Financial Report

2021–2022

Yale University

Y

Y

Y

Y

Front cover (le column top to bottom, sweeping to right column top to bottom)

Dr. Brett King, Associate Professor of Dermatology. Photo: Dan Renzetti

A Yale School of Nursing student. Photo: Michael Marsland

A Yale School of Public Health student in front of the entrance to the school’s Laboratory for

Epidemiology & Public Health. Photo: Bradley E. Cli Photography

Graduates of the Yale School of Public Health’s Class of 2022 celebrate commencement. Photo:

James R. Anderson Photography

Dr. Akiko Iwasaki, center, instructing in her laboratory. Photo: Robert Lisak

A group of Graduate Entry Pre-Specialty in Nursing students at the Veterans Aairs Stand Down

event, where they provided health services and education. Photo: Dr. Jennifer McIntosh

Back cover (from top, moving counterclockwise)

Yale Sch0ol of Public Health students and faculty participating in the IRIS Run-Walk for Refugees

5K. Photo: Courtesy of Virginia Pitzer

A Yale School of Nursing nurse facilitates Covid-19 vaccine administration at Yale’s Lanman

Center. Photo: Dan Renzetti

Adam Kundishora, a 7th year chief neurological surgery resident at Yale New Haven Hospital

received his M.D. from Yale School of Medicine. Photo: Dr. Nanthiya Sujijantarat

Copyright ©2022 Yale University

Yale University Financial Report 2021–2022

1 Highlights

2 Message from the President

5 Message from the Senior Vice President for Operations and the Vice President for Finance

7 Financial Results

7 Overview

11 Operating Revenue

16 Physical Capital

18 Endowment

20 Management’s Responsibility for Financial Statements

21 Report of Independent Auditors

23 Consolidated Statements of Financial Position

24 Consolidated Statement of Activities

25 Consolidated Statements of Cash Flows

26 Notes to Consolidated Financial Statements

61 The President and Fellows of Yale University

61 The Ocers of Yale University

Highlights

Five-Year Financial Overview ($ in millions) 2022 2021 2020 2019 2018

Net Operating Results - Management View 167$ 276$ 125$ 87$ 91$

Financial Position Highlights:

Total assets 54,719$ 56,223$ 44,696$ 44,428$ 41,873$

Total liabilities 10,025 11,931 12,964 12,186 9,616

Total net assets 44,694$ 44,292$ 31,732$ 32,242$ 32,257$

Endowment:

Net investments, at fair value 41,122$ 41,913$ 30,957$ 30,295$ 29,445$

Total return on investments 0.8% 40.2% 6.8% 5.7% 12.3%

Spending from endowment 3.8% 5.0% 4.8% 4.6% 4.7%

Facilities:

Land, buildings and equipment, net

of accumulated depreciation 5,598$ 5,508$ 5,438$ 5,251$ 5,092$

Disbursements for building projects 378$ 380$ 437$ 447$ 367$

Debt 5,164$ 5,200$ 5,242$ 3,775$ 3,785$

Statement of Activities Highlights:

Operating revenues 4,810$ 4,579$ 4,247$ 4,105$ 3,817$

Operating expenses 4,540 4,201 4,044 3,835 3,627

Increase in net assets from operating activities 270$ 378$ 203$ 270$ 190$

Five-Year Enrollment Statistics 2022 2021 2020 2019 2018

First-Year Enrollment Class of: '25 '24 '23 '22 '21

First-Year applications 47,240 35,220 36,844 35,306 34,154

First-Year admitted 2,509 2,299 2,269 2,229 2,316

Admissions rate 5.3% 6.5% 6.2% 6.3% 6.8%

First-Year enrollment 1,786 1,264 1,550 1,573 1,579

Yield 71.2% 55.0% 68.3% 70.6% 69.3%

Total Enrollment:

Yale College 6,536 4,703 6,092 5,964 5,743

Graduate and professional schools 8,031 7,357 7,517 7,469 7,228

Total 14,567 12,060 13,609 13,433 12,971

Yale College Term Bill and Financial Aid:

Yale College term bill 77,750$ 74,900$ 72,100$ 69,430$ 66,900$

Average grant award for students receiving aid 59,944$ 58,340$ 59,205$ 57,633$ 53,703$

Fiscal Years

1

Message from the President

Dear Members of the Yale Community,

With the availability of vaccines, boosters, and more effective treatments for COVID-19, we have

emerged from the pandemic’s most severe stage and stepped closer to the end of this public health crisis.

As I reflect on the disruptions of recent years, I am grateful to every single one of you for your thoughtful

adherence to health guidelines, which has allowed us to ensure the continuity of Yale’s educational and

research mission, make great strides for the future of Yale, and advance our contributions to the world. As

you will see in this report, we have managed our financial resources with great care—and mobilized them

to great effect. It is a privilege, therefore, for me to present the 2021-2022 Financial Report, which

reflects the dedicated efforts of so many Yale faculty, staff, students, and alumni.

Since the beginning of the pandemic, we have placed the health and well-being of the Yale community, as

well as those surrounding it, at the center of our plans and actions. The careful stewardship of Yale’s

resources has allowed us to create and maintain a public health infrastructure comprised of a rigorous,

campus-based outreach program to identify linkages among confirmed cases of COVID-19; widespread

testing and isolation of positive cases; scientifically informed guidelines regarding the use of face masks,

social distancing, and other mitigation measures; and a robust vaccination program.

Although the pandemic has required much of our focus, it has not slowed our work to realize Yale’s

academic priorities in science and engineering; empirical, policy-relevant social science research; the arts

and humanities; and support for faculty and students. Launched in 2016, these priorities are calibrated to

prepare future leaders to serve all sectors of society and create knowledge that will benefit humanity and

improve life. I am pleased to offer a few highlights of our progress, which include this year’s landmark

investments in faculty growth, the development of faculty and staff research and scholarship, and support

for the next generation of leaders.

Recruiting and retaining an excellent, diverse faculty underpin every aspect of Yale’s academic strategy. In

February 2022, we announced landmark investments in the School of Engineering & Applied Science

(SEAS) and Faculty of Arts & Sciences (FAS) to add forty-five faculty positions. These expansions

complement the annual search activity in which we are already regularly engaged. Across FAS and SEAS,

we are recruiting more than 100 positions, some incremental and some recently vacated. This includes

searches for nearly thirty FAS ladder faculty positions across the humanities. In addition, FAS is actively

searching for more than thirty positions in the social sciences, of which a third are positions focused on

hiring faculty engaged in data-intensive social science. This will help Yale bolster its capacity for

interdisciplinary analysis across FAS and SEAS. Among FAS and SEAS STEM searches, some thirty-seven

openings are in support of the university’s science and engineering priorities, which will allow us to make

great headway in emerging fields.

As we welcome new scholars and investigators to campus, we are also focused on supporting faculty in

driving innovation in education, research, scholarship, and practice.

We launched Yale Ventures this past April to help faculty and students create solutions to local and global

problems. Yale Ventures combines several existing university groups that promote innovation and

entrepreneurship under one umbrella, with significant new investment. It is growing the ways the

2 Yale University Financial Report 2021-2022

university supports faculty and students through grant funding, mentoring, business training, and other

areas.

This fall, we officially celebrate the opening of the Humanities Quadrangle (HQ), Yale’s new home for

humanities faculty, students, and staff at 320 York Street. This spectacular building at the heart of

campus represents the centrality of the humanities to Yale as we develop new areas in teaching and

scholarship. Already, projects supported by the programming associated with HQ have encouraged

faculty to use the new space to leverage connections between their disciplines.

We also have been making strides in addressing global challenges by bringing together the sciences,

engineering, arts, humanities, and social science. For example, every part of the university is working

together to combat climate change and biodiversity loss, and we have secured historic support for Yale’s

Planetary Solutions Project. Last year, we launched the Yale Center for Natural Carbon Capture and

continue to build new partnerships in pursuit of its ambitious research and educational efforts. In

January, we established the new multimillion-dollar Climate Impact Innovation Fund. This new fund

enables high-risk, high-reward faculty research projects involving collaborations across disciplines. In

early April, we announced the first round of seed grants to twenty-one faculty-led projects that involve

multidisciplinary research and demonstrate the depth and breadth of expertise and innovation at Yale.

Of course, our experiences with the pandemic and other public health crises, both past and present, make

salient the stark need for leadership in a variety of critical fields, including medicine, nursing, and public

health. In response, we are significantly investing in the Yale School of Public Health (YSPH) to help its

faculty and staff build on its historic strengths and respond even more effectively to worldwide public

health demands. Our investment will take the form of a $100 million contribution to YSPH’s endowment

to put it on solid financial footing and transition it into an independent school. Yale will also provide $50

million of endowment funds each to the Schools of Medicine, Nursing, and Public Health when each

school raises this amount in new endowment gifts.

In addition to the need for medical and scientific interventions around the world, we see the necessity for

solutions to violent conflict and political division. The launch of the Yale Jackson School of Global

Affairs—the university’s first new school since 1976—occurs at a time when division around the globe is

stronger than ever. The world has a pressing need for leadership in international affairs. The Yale Jackson

School is responding by fostering multidisciplinary scholarship to provide the intellectual foundation for

evidence-based policymaking. By convening world leaders and working collaboratively across fields, Yale

students and faculty will set the agenda in areas such as global health, political instability, and

cyberwarfare.

Yale’s initiatives allow the university to extend the frontier of knowledge and tackle the most critical

problems facing humanity. Yet none of our work would endure without new generations of scholars and

leaders to carry it forward. Therefore, we are focused on increasing financial aid across the university. Last

year, Yale enhanced its undergraduate financial aid packages for the fourth time in six years, and we will

do more. Yale has participated in a record number of targeted programs to expand our outreach to

prospective students with a variety of backgrounds, interests, and perspectives.

Yale’s careful financial stewardship and endowment spending practices are more necessary than ever. Our

policies insulate us from the economic fluctuations we anticipate ahead and allow us to push forward

boldly. Even during this period of uncertainty, for instance, we have introduced meaningful benefits for

faculty and staff, including new retirement incentives and an annual childcare subsidy program.

3

As you will see in the pages that follow, the exceptional circumstances we faced in 2021-2022 did not

limit the reach of our work or constrain our aspirations for the future. In fact, in some ways, they served

to focus our efforts on the areas of greatest need. I am deeply grateful for the way our community has

come together to take care of one another—and to care for our world.

Peter Salovey

President

Chris Argyris Professor of Psychology

4 Yale University Financial Report 2021-2022

Message from the Senior Vice President for Operations

and the Vice President for Finance

Financial Results

Yale finished the year ended June 30, 2022, with a surplus from operations on both a generally accepted

accounting principles (GAAP) and a Management View basis – the way Yale looks at financial information for

internal discussion and decision-making purposes (see page 6 for additional information). The university

generated a surplus from operations of $270 million on a GAAP basis and $167 million on a Management

View basis.

The university finished the year in a strong financial position, from both an operations and balance sheet

perspective, with $44.7 billion in net assets.

Revenues and Expenses

Operating revenues increased by 5.0% to $4.8 billion for the year. Yale’s largest source of income, spending

from the endowment, increased by 3.7% over the prior year to $1,568 million. The second largest source of

income, medical services, increased by 6.2% over the prior year to $1,327 million – a sustained rebound from

a decline in the early months of the pandemic. The third largest source of income, grants and contracts,

increased by 9.7% over the prior year to $962 million. Net tuition, room and board increased by 55.9% over

the prior year to $462 million since the vast majority of students who opted to defer admission or take leaves

of absence during the pandemic have now matriculated or rejoined the campus community.

Operating expenses grew by 8.1%. Salaries, wages, and benefits increased by 6% after lifting the hiring and

salary freezes instituted during the pandemic and providing enhanced employee benefits during the pandemic.

Other operating expenditures increased by 16.3%, impacted by several factors, including pandemic-related

expenses such as testing and personal protective equipment, the resumption of travel, and the resurgence of

on-campus and other activities. The significant rise of inflation this year applied pressure to costs of various

operations at the university, including notably increased food and energy prices.

Yale Endowment

The investment return for the Yale Endowment was 0.8% for the year. This result highlights the volatility of

investment returns from one year to the next, and the consequent importance of the Endowment Spending

Policy. The policy aims to maximize a stable flow of income to the budget while preserving the value of the

endowment in real terms to support future generations of students and scholars.

The university aims to spend 5.25% of the endowment’s value each year, which means the university needs an

endowment return of 8.25% to replenish this outlay (5.25% in spending plus long-term inflation of 3%) to

sustain this level of spending for future generations. The 2021-22 investment return was lower than that long-

term sustainable return, which might reasonably lead someone to conclude the budget for endowment income

needs to be reduced for the next year. In fact, the next budget year will see a healthy increase in spending on

teaching and research from the endowment because of the smoothing component of the Endowment Spending

Policy, explained in Footnote 1d of the financial statements. The smoothing component moderates the impact

of recent returns (high and low), which delivers on the goal of a stable flow of income to the budget, a vital

element for the successful operation of the university.

5

Fundraising and the For Humanity Campaign

October 2, 2021 marked the launch of the public phase of the For Humanity fundraising campaign to ensure

faculty and students at Yale have the support they need to tackle the most critical challenges facing humankind.

Guided by Yale’s mission to improve the world now and for future generations, and with a goal of raising $7

billion by June 2026, this campaign is the most ambitious fundraising effort in Yale’s history. The remarkable

generosity of Yale’s alumni and friends – including individuals, corporations, and foundations – provides

essential funding for student financial aid, investments in research, and every aspect of the university’s

operations, and this year finished with aggregate contributions of $614 million.

Capital Spending Highlights

Capital spending on facilities for this year totaled $378 million. Several major projects underway include the

comprehensive renovations to the Peabody Museum – which will feature a K-12 education center, a bright

central gallery to host year-round events, and a new outdoor courtyard for community gatherings – and Kline

Tower – which will feature open-plan three-story departmental clusters as the new home for the departments

of Astronomy, Mathematics, and Statistics and Data Science, as well as the new Kline Tower Institute (KTI)

for the Foundations of Data Science. A new building will house the Tobin Center for Economic Policy – which

will reduce the time from research to impact by enabling more policy-relevant research. In addition, with the

transformation of 100 College Street, it will soon house the departments of Neuroscience and Psychology

together with the new Wu Tsai Institute, whose goal is to understand human cognition.

Supporting the Yale Community

While the COVID-19 pandemic continued to have an impact on the university’s financial results during the

2021-22 financial year, it was significantly less pronounced than the previous two years. Despite three fiscal

years which have seen considerable impact on revenues and costs, Yale remains in a strong financial position,

and that will enable the university to continue to push forward with exciting investments to further strengthen

and advance our mission.

We are grateful for the extraordinary faculty, students, staff, alumni, and friends of the Yale community and

their efforts each day “to improve the world through outstanding research and scholarship, education,

preservation, and practice.”

Jack F. Callahan,

Jr. Stephen

C.

Murphy

Senior

Vice President for Operations and Vice President for Finance and

Chief Operating Officer

Chi

ef Financial Officer

6 Yale University Financial Report 2021-2022

Financial Results

Overview

Yale University (“Yale” or the “university”) manages its operations to achieve long-term financial

equilibrium. It is committed to sustaining both the programs and the capital assets (endowment and

facilities) supporting those programs over multiple generations. Endowment allocation, Yale’s largest

source of revenue, is allocated to the operating budget based on a spending policy that preserves the

endowment asset values for future generations, while providing a robust revenue stream for current

programs. Similarly, Yale’s operating budget provides the major portion of the funds needed, through the

capital replacement charge (“CRC”), to replenish the capital base necessary to ensure that buildings are

maintained to support current and future programs.

The consolidated statement of activities in the audited financial statements is presented in

accordance with accounting principles generally accepted in the United States of America (“GAAP”).

GAAP generally recognizes revenue when earned and expenses when incurred. The Management View,

used for internal decision-making, is focused more on resources available and used in the fiscal period

presented. Some of the more significant differences between the two views are as follows:

The Management View does not include certain revenue that will not be received within the next

fiscal year, such as pledged contribution revenue.

The Management View recognizes capital maintenance through a CRC and recognizes equipment

purchases as expensed in the year acquired versus the historical cost depreciation expensed in the

consolidated statement of activities.

The Management View includes the realized gains and losses on interest rate swaps used to

manage exposure to interest rate fluctuations. GAAP requires these realized gains and losses to be

presented net of related unrealized gains and losses.

The Management View presents the expenses related to the defined benefit plans differently as

compared to GAAP.

The GAAP financial statements do not present fund balance transfers between the operating,

physical, and financial categories as the Management View does.

The Management View presentation, along with a summary of the differences between the university’s

net operating results from the Management View to the GAAP View, is presented on the following page.

7

Yale University Operating Results – Management View

for the years ended June 30, 2022 and 2021 ($ in thousands)

June 30, 2022 June 30, 2021

Revenues:

Tuition, room and board - gross 878,158$ 650,331$

Tuition discoun

t

(432,288) (357,036)

Tuition, room and board - net 445,870 293,295

Grants and contract income 962,088 876,936

Medical services income 1,373,968 1,293,680

Contributions 235,631 201,229

E

ndowment income 1,567,656 1,511,831

Investment and other income 291,267 366,789

Total external income 4,876,480 4,543,760

Expenses:

Faculty salaries 1,182,151 1,078,617

All other salaries 1,020,752 963,966

E

mployee benefits 767,888 698,987

Total salaries and benefits 2,970,791 2,741,570

Stipends and fellowships 123,115 110,157

Non-salary expenses 1,130,790 962,729

Interest, CRC and other amortization 426,382 408,440

Total expenses 4,651,078 4,222,896

Transfers (58,902) (44,972)

TOTAL NET OPERATING RESULTS (MANAGEMENT VIEW)

166,500 275,892

Summary of differences between the Management View

and GAAP presentation of net operating results:

Operating pledge activity

(2,788)

46,768

E

xpenses related to long-term liabilities

(6,834)

(81,264)

Capital funding, depreciation and disposals (6,910) (30,934)

Lease activity 2,157 2,157

Interest rate swaps

58,792

55,344

Deferred investment income

-

64,627

Funding transfers

58,902

44,972

INCREASE IN NET ASSETS FROM OPERATIONS PER

THE CONSOLIDATED STATEMENT

OF ACTIVITIES (GAAP VIEW)

269,819$ 377,562$

8 Yale University Financial Report 2021-2022

Fiscal Year 2022 Management View Results

The university budget structure is managed through 49 separate budget units that are combined into five

categories for reporting purposes.

The following table summarizes Management View operating revenue by source in fiscal year 2022.

School of Medicine

The largest unit is the School of Medicine, representing 49% of university total operating revenue. The

School of Medicine engages in research, teaching, and clinical practice. Revenues for patient care services,

net of contractual adjustments, are primarily based on negotiated contracts with managed care companies

(29%), BlueCross BlueShield (30%), Medicare (22%), Medicaid (9%), and commercial insurance and

others (10%). Additionally, approximately 38% of the School of Medicine’s medical services income in

2022 represents revenue recognized as a result of the university’s affiliation with Yale-New Haven

Hospital (the “Hospital”). Yale Medicine (“YM”) is one of the largest academic multi-specialty practices

in the country and the largest in Connecticut. As of June 30, 2022, YM included 1,580 full-time and 182

part-time physicians providing services in over 100 specialty and subspecialty areas organized into 21

departments, engaging in research, and participating in teaching approximately 1,412 total students

(excluding Ph.D. students) and 916 residents. The School of Medicine performs significant research for

federal and state governments, foundations, and corporate entities. Research funded by the federal

government represents 81% of total research performed at the School of Medicine, with the National

Institutes of Health (“NIH”) providing 91% of that funding. The university has established policies and

procedures to manage and monitor compliance with these important agreements. School of Public Health

revenues are included in the figures reported for the School of Medicine.

9

Faculty of Arts and Sciences

The Faculty of Arts and Sciences includes Yale’s undergraduate and graduate programs in the arts and

sciences. During the 2021-2022 academic year, 6,536 undergraduate students were enrolled at Yale

College. The undergraduate population is a diverse group attracted from across the United States and

from many foreign countries. Foreign students account for approximately 10% of the undergraduate

population. Yale College is dedicated to providing undergraduates with a liberal arts education that

fosters intellectual curiosity, independent thinking, and leadership abilities. Students learn to think

critically and independently and to write, reason, and communicate clearly in preparation for a spectrum

of careers and vocations. During the 2021-2022 academic year, 3,309 students were pursuing their

studies at the Graduate School of Arts and Sciences. Yale Graduate School of Arts and Sciences considers

learning to teach to be an integral part of doctoral education and incorporates training and teaching

opportunities into every program. Throughout the unique program of study crafted by graduate students

and their faculty advisers, the university provides support that allows Ph.D. students to focus on their

scholarship, successfully complete their degrees, and pursue rewarding careers.

Professional Schools

The Professional Schools category includes the Divinity School, the Law School, the School of Art, the

School of Music, the School of the Environment, the School of Nursing, the David Geffen School of

Drama, the School of Architecture, and the School of Management. During the 2021-2022 academic

year, 3,499 students were pursuing their studies at one of Yale’s professional schools.

Institutes/Collections and Other

Institutes and Collections includes the libraries, museums and galleries, and large institutes with

significant programmatic and financial activity across multiple academic units. First-hand encounters

with Yale’s collections are an integral part of teaching and learning across the university, helping students

forge creative connections and inspiring tomorrow’s leaders. The Other category includes Athletics and

various administrative and support units.

The university ended the year with a surplus from operations of $167 million on the Management View

basis. Operating revenues increased 7% and operating expenses, excluding transfers, increased 10%

compared to 2021. Net tuition, room, and board grew significantly due to increased enrollment from

matriculating students who had deferred admission or taken leaves of absence during the pandemic.

Grant and contract income, as well as medical services income, were higher than the prior year due to

research and clinical activities continuing to increase post-pandemic. Expenses grew faster than revenue

due to increased activity on campus after the acute phase of the pandemic as well as inflation.

10 Yale University Financial Report 2021-2022

Fiscal Year 2022 GAAP Results

Operating Revenue

The university derives its operating revenue from the following sources: tuition, room and board (net of

certain scholarships and fellowships), grant and contract income, medical services income, allocation of

endowment spending from financial capital, contributions, investment income, and other income.

Net Tuition, Room and Board

Net tuition, room and board totaled $462 million in fiscal year 2022, an increase of 56% from 2021, and

represented 10% of the university’s total operating revenue. Gross tuition, room and board totaled $878

million in 2022, an increase of 35% from 2021 which totaled $650 million. Of this amount, $771

million represents tuition, a 25% increase over 2021 and $107 million represents revenue from room

and board, which increased over 200% from 2021. These increases are primarily due to an increase in

enrollment as the university returns to a pre-pandemic learning model, a return of students who deferred

their studies in 2021 to 2022, and increased enrollment related to the two new residential colleges. In

accordance with GAAP, student income is presented net of certain scholarships and fellowships, which

totaled $416 million and $354 million for 2022 and 2021, respectively, representing an 18% increase in

2022. Scholarships and fellowships as a percentage of gross tuition, room and board were 47% and 54%

for 2022 and 2021, respectively. These amounts fluctuate based on the needs of enrolled students.

Tuition for students enrolled in Yale College was $59,950, and room and board was $17,800,

bringing the total term bill to $77,750 for the 2021-2022 academic year. The increase in the Yale

College term bill was 4% over the 2020-2021 academic year.

The university maintains a policy of offering Yale College admission to qualified applicants

without regard to family financial circumstances. This “need-blind” admission policy is supported with a

commitment to meet the full demonstrated financial need of all students throughout their undergraduate

years.

During the 2021-2022 academic year, 54% of Yale College undergraduates received financial

aid. In the Graduate School of Arts and Sciences, 99% received financial aid in the form of tuition

discounts, stipends, and health insurance. In the professional schools, 83% received financial aid. In all,

74% of total eligible university students enrolled received some form of university-administered student

aid in the form of scholarships, loans, or a combination of both scholarships and loans.

Grant and Contract Income

Grant and contract income totaled $962 million in fiscal year 2022, an increase of 10% from 2021, and

represented 20% of the university’s total operating revenue. The Yale School of Medicine, which recorded

82% of the university’s grant and contract income in fiscal year 2022, reported an increase of 10% for

2022, while the remaining university units increased by 8%.

Revenue recognized on grants and contracts from the federal government was $743 million, or

77% of 2022 grant and contract income, supporting Yale’s research and training programs. Included in

the $743 million is Department of Health and Human Services (“DHHS”) funding of $561 million,

primarily through the NIH, an increase of 11% compared to the prior year. The university also receives

significant research funding from the National Science Foundation, the Department of Energy, and

11

student aid awards from the Department of Education. Non-federal sources, which include foundations,

voluntary health agencies, corporations, and the State of Connecticut, provided an additional $219

million in funding for research, training, clinical, and other sponsored agreements during 2022.

In addition to the reimbursement of direct costs charged to sponsored awards, sponsoring

agencies reimburse the university for a portion of its facilities and administrative costs, which include

costs related to research laboratory space, facilities, and utilities, as well as administrative and support

costs incurred for sponsored activities. These reimbursements for facility and administrative costs

amounted to $245 million in 2022 and $230 million in 2021. Recovery of facility and administrative

costs associated with federally sponsored awards is recorded at rates negotiated with DHHS, the

university’s cognizant agency. Yale’s current rate agreement is effective through June 30, 2023, and the

base year for the university’s next facilities and administrative calculation is fiscal year 2022.

Medical Services Income

Medical services income totaled $1.3 billion in fiscal year 2022, an increase of 6% from 2021, and

represented 28% of the university’s operating revenue. The largest portion of this revenue stream is

derived from medical services provided by YM. The Hospital continued to invest in YM in fiscal year

2022 with support increasing by 9% to a total of $492 million for clinical services, investment in faculty

recruitment, and new clinical programs. In addition, positive discussions continue around increased

support from the Hospital for physician compensation and program development.

Medical services income generated by YM increased by $70 million over 2021, or 6%. Patient

care income, which accounts for 54% of medical services income, was up $22 million or 3%. Both

ambulatory and surgical volumes experienced growth in fiscal year 2022, despite a temporary dampening

to clinical practice volumes in early January 2022 related to reduced surgical procedures that resulted

from a recent wave of COVID-19. Other contributors to the clinical growth include the partnering of Yale

New Haven Health System (“YNHHS”) affiliates with YM to continue practice expansion outside of New

Haven County and deepen the relationship with YNHHS delivery network hospitals (Greenwich,

Bridgeport, Lawrence + Memorial, and Westerly Hospitals).

12 Yale University Financial Report 2021-2022

Contributions

Donations from individuals, corporations, and foundations represent a vitally important source of

revenue for the university. Gifts to the university provide necessary funding for current operations, for

long-term investments in the university’s physical infrastructure, and, in the case of gifts to the

endowment, provide permanent resources for core activities for future generations. Gifts of $233 million

in 2022 and $247 million in 2021, made by donors to support the operations of the university, are

reflected as contribution revenue in the operating section of the consolidated statement of activities,

whereas gifts to the university’s endowment and for building, construction, and renovation are reflected

as contribution revenue in the non-operating section of the consolidated statement of activities. In

aggregate, contributions included in the university consolidated financial statements total $614 million in

2022 compared to $946 million in 2021, which was a record-breaking year.

Certain gifts commonly reported in fundraising results are not recognized as contributions in the

university’s consolidated financial statements. For example, “in-kind” gifts such as works of art and books

that will be maintained as part of the university’s collections are not recognized as financial transactions in

the consolidated financial statements. Grants from private, non-governmental sources (i.e., corporations

and foundations) reported as gifts for fundraising purposes are included in the consolidated statement of

activities as grant and contract income.

Allocation of Endowment Spending

Each year a portion of the endowment’s market value is allocated to support operational activity. This

important source of revenue represents 33% of total operating revenue in fiscal year 2022, and is the

largest source of operating revenue for the university. The level of spending is computed in accordance

with an endowment spending policy that has the effect of smoothing year-to-year market value swings.

Endowment investment returns allocated to operating activities increased by 4% in 2022 to $1.6 billion.

Additional information on Yale’s endowment spending policy is provided in the endowment section of

this report and in the Notes to Consolidated Financial Statements.

13

Other Investment Income

Other investment income includes interest, dividends, and gains on non-endowment investments.

Other Income

Other income primarily includes publications income, income from executive education and other non-

degree granting programs, royalty income, admissions revenue relating to athletic events and drama

productions, parking revenue, special event and seminar fees, and application and enrollment fees.

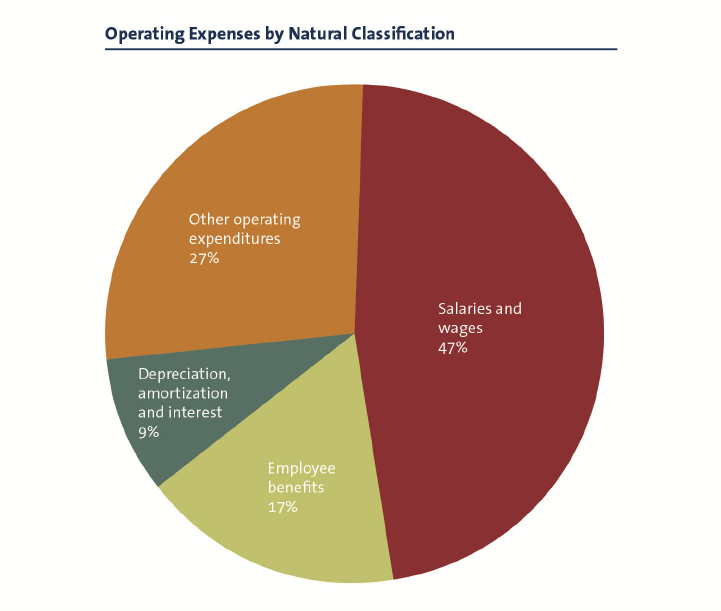

Operating Expenses

Operating expenses totaled $4.5 billion for 2022, representing an 8% increase over 2021. With 5,086

faculty, 1,501 postdoctoral and postgraduate associates, 5,168 managerial and professional staff

(“M&P”), and 5,160 clerical, technical, service, and maintenance personnel, personnel costs are the single

largest component (63%) of the university’s total operating expenses (counts represent headcount as of

fall 2021).

Personnel costs were $2.9 billion in 2022, a 6% increase over 2021. Faculty salary expenses

increased 10% which is partly attributable to an increased headcount to support growth in clinical

activities. Staff salaries and wages increased 4% from 2021 to 2022, largely due to the lifting of the salary

freezes implemented during the pandemic. The cost of providing employee benefits, including various

pension, post-retirement health, and insurance plans in addition to Social Security and other statutory

benefits, totaled $760 million for 2022, an increase of 3% from 2021.

Depreciation, amortization, and interest expense remained relatively flat from 2021.

Other operating expenses, including services, materials and supplies, and other expenses,

increased 16% from 2021, primarily due to an increase in non-salary expenses in most schools and units,

driven by increased activity on campus and increases in general expenses due to inflation.

14 Yale University Financial Report 2021-2022

Yale reports its operating expenses by natural classification in the consolidated statement of activities and

discloses these operating expenses across functional classification in the Notes to Consolidated Financial

Statements in accordance with GAAP.

The university spent 69% of its operating resources on programmatic support, 24% on patient care and

other related services, and 7% on administration and other institutional support.

15

Physical Capital

Capital spending on facilities in fiscal year 2022 totaled $378 million. This represents a decrease of less

than 1% from the 2021 spending level.

The Yale School of Medicine (“YSM”) accounted for approximately 21% of the university’s 2022 capital

expenditures. Investments were made to support a new YSM laboratory and dry research space at 100

College Street, including the renovation and expansion of the existing Yale Animal Resources Center

vivarium, and a new centralized research support facility at 750 West Campus Drive. 100 College Street

will also be home to the Wu Tsai Institute and faculty from across campus, including the Departments of

Psychology and Neuroscience. The remaining expenditures are related to other programmatic

renovations, clinical expansion and upgrades, and capital maintenance projects throughout the school.

Nineteen percent of the university’s capital spending was invested in the sciences on the central

campus. Work progressed on the comprehensive renovation of Kline Tower, Yale’s tallest building. This

renovation will prepare Kline to become the new home for the departments of Astronomy, Mathematics,

and Statistics and Data Science, as well as the new Kline Tower Institute (“KTI”) for the Foundations of

Data Science. Construction began in January 2021 and is scheduled to complete in summer 2023.

Investments were also made to support various building code upgrades, and for renovations to support

programmatic needs throughout the sciences.

Fourteen percent of the university’s capital spending was invested in a comprehensive renovation

and addition to the Yale Peabody Museum of Natural History (the “Museum”). The renovated Museum

will feature a new K-12 Education Center with dedicated classrooms for local schoolchildren, a light-filled

Central Gallery designed to host outreach events year-round, and a new outdoor courtyard space for

community gatherings. In all, the Museum’s total gallery space will expand by over 50%. Construction

began in October 2020 and is scheduled to complete in March 2023. The Museum’s galleries are

scheduled to reopen in 2024.

Eleven percent of the university’s capital spending went to capital maintenance renovations to

interior and exterior building elements on residential colleges that were vacant during the summer

months (Trumbull, Branford, and Saybrook), and to the completion of the Yale Schwarzman Center, a

16 Yale University Financial Report 2021-2022

university-wide center for student life and the arts. The university also invested 10% of its capital

spending in the social sciences.

The university’s renovation and building plans were funded by a combination of gifts, debt, and

the operating budget. The university continues to rely heavily on the extraordinary generosity of its

alumni and friends. Gifts for facilities in 2022 totaled $112 million, which includes gifts to support the

comprehensive renovation of the Museum and construction on the Economics Building that will house

the Tobin Center for Economic Policy.

A major source of funding for the capital program is debt provided through the Connecticut Health and

Facilities Authority (“CHEFA”), which allows the university to borrow at tax-exempt rates. This funding

source is critical to keep the cost of funding at low levels, which allows the university to maximize the use

of its resources and further advance the fulfillment of its mission of teaching and research. The university

continues to receive the highest bond ratings available: AAA from Standard and Poor’s Global Rating and

Aaa from Moody’s Investors Service.

Recognizing the critical importance of maintaining its physical capital over many generations, the

university allocates funds directly from the operating budget to a capital maintenance account. The annual

equilibrium funding target for internal purposes is an estimate of the amount needed to maintain Yale’s

facilities in good condition on a consistent basis, thus avoiding deferred maintenance. While not an exact

science, an estimate of the full capital replacement equilibrium level for 2022 is $295 million. In 2022,

most of this amount was funded with operating funds and capital gifts.

17

Endowment

The endowment provides the largest source of support for the academic programs of the university. To

balance current and future needs, Yale employs investment and spending policies designed to preserve

endowment asset values while providing a substantial flow of income to the operating budget. At June 30,

2022, net assets in the endowment totaled approximately $41.4 billion, after the allocation of

endowment spending of $1.6 billion to the operating budget during the year.

Investment Performance

For the fiscal year ended June 30, 2022, the endowment earned a 0.8% investment return. During the

past decade, the endowment earned an annualized 12.0% return, which added $20.6 billion of value

relative to a composite passive benchmark and $13.0 billion relative to the mean return of a broad

universe of colleges and universities.

Endowment Spending

The endowment spending policy, which allocates endowment earnings to operations, balances the

competing objectives of providing a stable flow of income to the operating budget and protecting the real

value of the endowment over time. The spending policy manages the trade-off between these two

objectives by using a long-term targeted spending rate combined with a smoothing rule, which adjusts

spending in any given year gradually in response to changes in endowment market value.

The targeted spending rate approved by the Yale Corporation currently stands at 5.25%.

According to the smoothing rule, endowment spending in a given year sums to 80% of the previous year’s

spending and 20% of the targeted long-term spending rate applied to the market value at the start of the

prior year. The spending amount determined by the formula is adjusted for inflation and an allowance for

taxes and constrained so that the calculated rate is at least 4.0%, and not more than 6.5%, of the

18 Yale University Financial Report 2021-2022

endowment’s inflation-adjusted market value at the start of the prior year. The smoothing rule and the

diversified nature of the endowment mitigate the impact of short-term market volatility on the flow of

funds to support Yale’s operations.

The majority of endowment spending is allocated across multiple purposes, including financial

aid and professorships, based on donor restrictions or internal designations by the university.

Endowment spending that is neither restricted nor designated provides additional support for budgetary

priorities, including purposes to carry out the university’s mission.

Asset Allocation

Asset allocation proves critical to successful endowment performance. Yale’s asset allocation policy

combines tested theory and informed market judgment to balance investment risks with the desire for

high returns.

Both the need to provide resources for current operations and the desire to preserve the

purchasing power of assets dictate investing for high returns, which leads the endowment to be weighted

toward equity. In addition, the endowment’s vulnerability to inflation directs the university away from

fixed income and toward equity instruments. Hence, about 92% of the endowment is invested in assets

expected to produce equity-like returns, through domestic and international securities, real assets, and

private equity.

Endowment Summary

Yale continues to rely on the principles of equity orientation and diversification. These principles guide

Yale’s investment strategy, as equity orientation makes sense for investors with long time horizons and

diversification allows the construction of portfolios with superior risk and return characteristics. The

university’s equity-oriented, well-diversified portfolio positions the endowment for long-term investment

success.

19

Management’s Responsibility for Financial Statements

Management of the university is responsible for the integrity and reliability of the consolidated financial

statements. Management represents that, with respect to the university’s financial information, the

consolidated financial statements in this annual report have been prepared in conformity with

accounting principles generally accepted in the United States of America (“GAAP”).

The accompanying consolidated financial statements have been audited by the university’s

independent auditors, PricewaterhouseCoopers LLP. Their audit opinion, on the following page,

expresses an informed judgment as to whether the consolidated financial statements, considered in their

entirety, present fairly, in conformity with GAAP, the consolidated financial position and changes in net

assets and cash flows.

The university maintains a system of internal controls over financial reporting, which is designed to

provide a reasonable assurance to the university’s management and the Yale Corporation (the

"Corporation”) regarding the preparation of reliable published financial statements. Such controls

are maintained by the establishment and communication of accounting and financial policies and

procedures, by the selection and training of qualified personnel, and by an internal audit program

designed to identify internal control weaknesses in order to permit management to

take appropriate corrective action on a timely basis. There are, however, inherent limitations in the

effectiveness of any system of internal control, including the possibility of human error and the

circumvention of controls. Accordingly, even an effective internal control system can provide only

reasonable assurance with respect to financial statement preparation. Furthermore, the

effectiveness of the internal control system can change with circumstances.

The Corporation, through its Audit Committee comprised of members not employed by the

university, are responsible for engaging the independent auditors and meeting with management, internal

auditors, and the independent auditors to independently assess whether each is carrying out its

responsibilities. Both the internal auditors and the independent auditors have full and free access to the

Audit Committee.

Stephen C. Murphy Shannon N. Smith

Vice President for Finance and University Controller

Chief Financial Officer

20 Yale University Financial Report 2021-2022

PricewaterhouseCoopers LLP, 101 Seaport Boulevard, Boston, MA 02210

T: (617) 530 5000, F: (617) 530 5001, www.pwc.com/us

Report of Independent Auditors

To the President and Fellows of Yale University

Opinion

We have audited the accompanying consolidated financial statements of Yale University and its

subsidiaries (the “University”), which comprise the consolidated statements of financial position as of

June 30, 2022 and 2021, and the related consolidated statements of activities for the year ended June 30,

2022, and of cash flows for the years ended June 30, 2022 and 2021, including the related notes

(collectively referred to as the “consolidated financial statements”).

In our opinion, the accompanying consolidated financial statements present fairly, in all material respects,

the financial position of the University and its subsidiaries as of June 30, 2022 and 2021, the changes in

its net assets for the year ended June 30, 2022 and its cash flows for the years ended June 30, 2022 and

2021 in accordance with accounting principles generally accepted in the United States of America.

Basis for Opinion

We conducted our audit in accordance with auditing standards generally accepted in the United States of

America (US GAAS). Our responsibilities under those standards are further described in the Auditors’

Responsibilities for the Audit of the Consolidated Financial Statements section of our report. We are

required to be independent of the University and to meet our other ethical responsibilities, in accordance

with the relevant ethical requirements relating to our audits. We believe that the audit evidence we have

obtained is sufficient and appropriate to provide a basis for our audit opinion.

Other Matter

We previously audited the consolidated statement of financial position as of June 30, 2021 and the related

consolidated statements of activities and of cash flows for the year then ended (the statement of activities

is not presented herein), and in our report dated October 25, 2021, we expressed an unmodified opinion

on those consolidated financial statements. In our opinion, the information set forth in the accompanying

summarized financial information for the year ended June 30, 2021 is consistent, in all material respects,

with the audited consolidated financial statements from which it has been derived.

Responsibilities of Management for the Consolidated Financial Statements

Management is responsible for the preparation and fair presentation of the consolidated financial

statements in accordance with accounting principles generally accepted in the United States of America,

and for the design, implementation, and maintenance of internal control relevant to the preparation and

fair presentation of consolidated financial statements that are free from material misstatement, whether

due to fraud or error.

In preparing the financial statements, management is required to evaluate whether there are conditions or

events, considered in the aggregate, that raise substantial doubt about the University’s ability to continue

as a going concern for one year after the date the financial statements are issued.

21

Auditors’ Responsibilities for the Audit of the Consolidated Financial Statements

Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are

free from material misstatement, whether due to fraud or error, and to issue an auditors’ report that

includes our opinion. Reasonable assurance is a high level of assurance but is not absolute assurance and

therefore is not a guarantee that an audit conducted in accordance with US GAAS will always detect a

material misstatement when it exists. The risk of not detecting a material misstatement resulting from

fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional

omissions, misrepresentations, or the override of internal control. Misstatements are considered material

if there is a substantial likelihood that, individually or in the aggregate, they would influence the judgment

made by a reasonable user based on the financial statements.

In performing an audit in accordance with US GAAS, we:

● Exercise professional judgment and maintain professional skepticism throughout the audit.

● Identify and assess the risks of material misstatement of the consolidated financial statements,

whether due to fraud or error, and design and perform audit procedures responsive to those risks.

Such procedures include examining, on a test basis, evidence regarding the amounts and

disclosures in the consolidated financial statements.

● Obtain an understanding of internal control relevant to the University audit in order to design

audit procedures that are appropriate in the circumstances, but not for the purpose of expressing

an opinion on the effectiveness of the University’s internal control. Accordingly, no such opinion is

expressed.

● Evaluate the appropriateness of accounting policies used and the reasonableness of significant

accounting estimates made by management, as well as evaluating the overall presentation of the

consolidated financial statements.

● Conclude whether, in our judgment, there are conditions or events, considered in the aggregate,

that raise substantial doubt about the University’s ability to continue as a going concern for a

reasonable period of time.

We are required to communicate with those charged with governance regarding, among other matters, the

planned scope and timing of the audit, significant audit findings, and certain internal control-related

matters that we identified during the audit.

Other Information

Management is responsible for the other information included in the annual report. The other information

comprises the Yale University Financial Report 2021-2022, but does not include the consolidated financial

statements and our auditor’s report thereon. Our opinion on the consolidated financial statements does

not cover the other information, and we do not express an opinion or any form of assurance thereon.

In connection with our audit of the consolidated financial statements, our responsibility is to read the

other information and consider whether a material inconsistency exists between the other information and

the consolidated financial statements or the other information otherwise appears to be materially

misstated. If, based on the work performed, we conclude that an uncorrected material misstatement of the

other information exists, we are required to describe it in our report.

Boston, Massachusetts

October 21, 2022

22 Yale University Financial Report 2021-2022

Yale University Consolidated Statements of Financial Position

as of June 30, 2022 and June 30, 2021 ($ in thousands

)

2022 2021

Assets:

Cash and cash equivalents $ 712,614 $ 772,593

Accounts receivable, net 405,683 397,974

Contributions receivable, net 1,020,493 1,197,417

Notes receivable 89,912 96,509

Investments, at fair value 46,472,072 47,830,139

Right of use assets 179,645 182,694

Other assets 240,814 238,088

Land, buildings and equipment, net of accumulated depreciation 5,598,069 5,507,845

Total assets $ 54,719,302 $ 56,223,259

Liabilities:

Accounts payable and accrued liabilities $ 615,340 $ 631,093

Advances under grants and contracts and other deposits 194,594 174,478

Lease liabilities 253,081 254,428

Other liabilities 1,368,728 1,957,123

Liabilities under split-interest agreements 130,816 149,105

Bonds and notes payable 5,164,430 5,199,573

Liabilities associated with investments 2,298,288 3,565,475

Total liabilities $ 10,025,277 $ 11,931,275

Net Assets:

Net assets without donor restrictions: Yale University $ 8,592,595 $ 7,652,769

Net assets without donor restrictions: non-controlling interests 1,621 779

Total net assets without donor restrictions 8,594,216 7,653,548

Net assets with donor restrictions 36,099,809 36,638,436

Total net assets $ 44,694,025 $ 44,291,984

Total liabilities and net assets $ 54,719,302 $ 56,223,259

The accompanying notes are an integral part of these consolidated financial statements.

23

Yale University Consolidated Statement of Activities

for the year ended June 30, 2022 with summarized comparative totals for the year ended June 30, 2021 ($ in thousands)

Without Dono

r

With Dono

r

Restrictions Restrictions 2022 2021

Operatin

g

Revenues and releases:

Net tuition, room and boar

d

$ 461,513 $ - $ 461,513 $ 295,972

Grant and contract income, primarily fo

r

research and trainin

g

962,088 - 962,088 876,936

Medical services incom

e

1,327,268 - 1,327,268 1,250,086

Contributions 18,457 214,125 232,582 247,471

Allocation of endowment spending from

financial capita

l

449,993 1,118,449 1,568,442 1,512,601

Other investment income 59,158 10,573 69,731 163,076

Other incom

e

188,447 48 188,495 232,963

Total revenues 3,466,924 1,343,195 4,810,119 4,579,105

Net assets released from restriction

s

1,173,387 (1,173,387) - -

Total revenues and releases 4,640,311$ 169,808$ 4,810,119$ 4,579,105$

Expenses:

Salaries and wages 2,114,898$ -$ 2,114,898$ 1,971,143$

Employee benefit

s

759,791 - 759,791 741,114

Depreciation, amortization and interes

t

407,795 - 407,795 407,673

Other operating expenditure

s

1,257,816 - 1,257,816 1,081,613

Total expenses 4,540,300 - 4,540,300 4,201,543

Increase in net assets from operating activitie

s

100,011 169,808 269,819 377,562

Non-operatin

g

Contributions 1,625 379,910 381,535 698,720

Total endowment retur

n

50,332 215,548 265,880 12,052,824

Allocation of endowment spending to operations (278,461) (1,289,981) (1,568,442) (1,512,601)

Other investment incom

e

501,102 755 501,857 433,841

Change in funding status of defined benefit plan

s

503,181 - 503,181 671,287

Other increases (decreases) 46,941 428 47,369 (60,849)

Net assets released from restriction

s

15,095 (15,095) - -

Increase in net assets from non-operating activitie

s

839,815 (708,435) 131,380 12,283,222

Total increase in net assets - Yale Universit

y

939,826 (538,627) 401,199 12,660,784

Change in non-controlling interests 842 - 842 (100,754)

Total increase (decrease) in net assets 940,668 (538,627) 402,041 12,560,030

Net assets, beginning of year 7,653,548 36,638,436 44,291,984 31,731,954

Net assets, end of year $ 8,594,216 $ 36,099,809 $ 44,694,025 $ 44,291,984

The accompanying notes are an integral part of these consolidated financial statements.

24 Yale University Financial Report 2021-2022

2022 2021

Operating activities:

Change in net assets 402,041

$ 12,560,030$

Adjustments to reconcile change in net assets to net cash

used in operating activities:

Depreciation and amortization 340,039

332,458

Realized and unrealized gain on other investments (512,958) (459,059)

Net endowment investment loss (gain) 106,046 (11,888,742)

Change in non-controlling interests (842) 100,754

Change in funding status of defined benefit plans (503,181) (671,287)

Non-operating contributions (381,535) (698,720)

Contributed securities (118,421) (212,670)

Proceeds from sale of donated securities 44,640 38,273

Other adjustments (9,898) 74,980

Changes in assets and liabilities that (use) provide cash:

Accounts receivable (7,709) (33,122)

Contributions receivable 3,962 (46,276)

Other operating assets (1,435) (7,355)

Accounts payable and accrued expenses (191,042) 224,342

Advances under grants and contracts and other deposits 20,116 (9,899)

Other liabilities 94,516 170,986

Net cash used in operating activities (715,661) (525,307)

Investing activities:

Student loans repaid 12,021 13,461

Student loans granted (5,578) (5,611)

Purchases related to capitalized software costs and other assets (26,560) (47,426)

Proceeds from sales and maturities of investments 10,593,403 15,468,766

Purchases of investments (10,189,985)

(15,174,268)

Purchases of land, buildings and equipment (424,953) (381,017)

Net cash used in investing activities (41,652) (126,095)

Financing activities:

Proceeds from restricted contributions 554,497

406,029

Proceeds from sale of contributed securities restricted for endowment 73,781 174,397

Con

tributions received for split-interest agreements 9,027

4,434

Payments made under split-interest agreements (15,840) (17,345)

Re

payments of long-term debt (16,489) (50,966)

Repayments to the Federal government for student loans (2,858)

(3,128)

Net cash provided by financing activities 602,118 513,421

Net decrease in cash and cash equivalents (155,195) (137,981)

C

ash and cash equivalents, beginning of year 931,177

1,069,158

Cash and cash equivalents, end of year 775,982$ 931,177$

Yale University Consolidated Statements of Cash Flows

for the years ended June 30, 2022 and 2021 ($ in thousands)

The accompanying notes are an integral part of these consolidated financial statements.

25

Yale University

Notes to Consolidated Financial Statements

1. Significant Accounting Policies

a. General

Yale University ("Yale” or the “university") is a private, not-for-profit institution of higher education

located in New Haven, Connecticut. The university is governed by the Yale Corporation (the

“Corporation”), a body comprised of the President, ten appointed Successor Trustees, six elected Alumni

Fellows, and the Governor and Lieutenant Governor of Connecticut, who are board members ex officio.

The university provides educational services primarily to students and trainees at the

undergraduate, graduate and postdoctoral levels, and performs research, training and other services

under grants, contracts and other similar agreements with agencies of the federal government and other

sponsoring organizations. The university's academic organization includes Yale College, the Graduate

School of Arts and Sciences, twelve professional schools and a variety of research institutions and

museums. The largest professional school is the Yale School of Medicine, which conducts medical

services in support of its teaching and research missions.

b. Basis of Presentation

The consolidated financial statements of the university include the accounts of academic and

administrative departments of the university, and affiliated organizations which are required to be

consolidated under the applicable accounting guidance.

The university measures aggregate net assets and net asset activity based on the absence or

existence of donor-imposed restrictions. Net assets are reported as without donor restrictions and with

donor restrictions and serve as the foundation of the accompanying consolidated financial statements.

Brief definitions of the two net asset classes are presented below:

Net Assets Without Donor Restrictions - Net assets derived from tuition and other institutional resources

that are not subject to explicit donor-imposed restrictions. Net assets without donor restrictions also

include board-designated funds functioning as endowment.

Net Assets With Donor Restrictions - Net assets that are subject to explicit donor-imposed restrictions on

the expenditure of contributions, including those given to be maintained in perpetuity; income and gains

on contributed assets subject to donor-imposed restrictions not yet appropriated for spending by the

Corporation and student loan funds. In addition, net assets with donor restrictions include restricted

contributions from donors classified as funds functioning as endowment. Restrictions include support of

specific schools or departments of the university, for professorships, research, faculty support,

scholarships and fellowships, library and art museums, building construction and other purposes. When

time and purpose restrictions expire, net assets with donor restrictions are reclassified to net assets

without donor restrictions.

26 Yale University Financial Report 2021-2022

Measure of Operations - The university's measure of operations as presented in the consolidated statement

of activities includes revenue from tuition (net of certain scholarships and fellowships) and fees, grants

and contracts, medical services, contributions for operating programs, other investment income, the

allocation of endowment spending for operations and other income. Operating expenses are reported on

the consolidated statement of activities by natural classification.

The university’s non-operating activity within the consolidated statement of activities includes

contributions to the university’s endowment and for building construction and renovation, investment

returns and other activities related to endowment, and long-term benefit plan obligation funding

changes.

Liquidity - The university’s financial assets available within one year of the date of the consolidated

statement of financial position for general expenditure as of June 30 are as follows, in thousands of

dollars:

2022 2021

Total assets, at year end 54,719,302$ 56,223,259$

Less nonfinancial assets:

Land, buildings and equipment, net of accumulated depreciation 5,598,069 5,507,845

Other assets 240,814 238,088

Right of use assets 179,645 182,694

Financial assets, at year end 48,700,774 50,294,632

Less those unavailable for general expenditure within one year due to contractual

or donor-imposed restrictions:

Restricted by donor with time or purpose restrictions 914,040 1,095,679

Subject to appropriation and satisfaction of donor restrictions

including board-designated endowments 43,255,859 44,779,408

Other long-term notes receivable 89,912 96,509

Financial assets available to meet cash needs for general expenditures within one year 4,440,963$ 4,323,036$

The university has $4,441.0 million of financial assets that are available within one year of the date of

the 2022 consolidated statement of financial position to meet cash needs for general expenditure

consisting of cash of $712.6 million, accounts receivable of $405.7 million, contributions receivable of

$106.5 million, and short-term investments of $3,216.2 million. In addition to these available financial

assets, a significant portion of the university’s annual expenditures will be funded by current year

operating revenues including tuition, grant and contract income and medical services income. The

university has a policy to structure its financial assets to be available as its general expenditures,

liabilities, and other obligations come due. As part of its liquidity management, the university invests

cash in excess of daily requirements in various short-term investments, including U.S. government

instruments.

Additionally, the university has board-designated funds of $7,189.6 million. Although the university

does not intend to spend from this endowment, other than amounts appropriated for general

expenditure as part of its annual budget approval and appropriation process, amounts from its board-

designated funds could be made available if necessary. However, both the board-designated funds and

27

donor-restricted endowments contain investments with lock-up provisions that would reduce the total

investments that could be made available, as described in Note 2.

c. Cash and Cash Equivalents

Cash and cash equivalents are recorded at cost, which approximates fair value due to their short-term

nature and include institutional money market funds and similar temporary investments with maturities

of three months or less at the time of purchase. Cash and short-term investments awaiting investment in

the long-term investment pool are reported as investments and totaled $1,556.3 million and $1,187.9

million at June 30, 2022 and 2021, respectively. Short-term investments included in the long-term

investment pool which may otherwise qualify as cash equivalents under the university’s policy are

accounted for as investments by policy and are accordingly not included within these cash disclosures.

Supplemental disclosures of cash flow information include the following, in thousands of dollars:

2022 2021

Cash paid during the year for interest

166,862$ 170,086$

Noncash investing activities:

Land, buildings and equipment purchases

payable to vendor

46,148$ 53,568$

The following table summarizes supplemental cash flow information related to leases for the year ended

June 30, in thousands of dollars:

2022 2021

Cash paid for amounts included in measurement of liabilities:

Operating cash flows from financing leases

7,719$ 7,730$

Operating cash flows from operating leases

9,798 10,422

Financing cash flows from financing leases

6,691 4,783

Non-cash lease related items:

ROU assets obtained in exchange for new financing liabilities

-$ 41,561$

ROU assets obtained in exchange for new operating liabilities

20,572 3,178

The following table provides a reconciliation of amounts reported within the consolidated statements of

financial position that sum to the total of the amount shown in the consolidated statement of cash flows

for the years ended June 30, in thousands of dollars.

2022 2021

Cash and cash equivalents

712,614$ 772,593$

Cash included in Investments, at fair value

63,368 158,584

Total cash and cash equivalents shown in the

consolidated statements of cash flows

775,982$ 931,177$

28 Yale University Financial Report 2021-2022

d. Investments

Fair Value - The university's investments are recorded in the consolidated financial statements at fair

value.

Fair value is a market-based measurement based on assumptions that market participants would use in

pricing an asset or liability. As a basis for considering assumptions, a three-tier fair value hierarchy has

been established which categorizes the inputs used in measuring fair value. The hierarchy of inputs used

to measure fair value and the primary methodologies used by the university to measure fair value

include:

Level 1 – Quoted prices for identical assets and liabilities in active markets. Market price data

is generally obtained from relevant exchange or dealer markets.

Level 2 – Inputs, other than the quoted prices in active markets, that are observable either

directly or indirectly, such as quoted prices for similar assets or liabilities, quoted prices in

markets that are not active, or other inputs that are observable.

Level 3 – Unobservable inputs for which there is little or no market data, requiring the

university to develop its own assumptions.

Assets and liabilities measured at fair value are determined based on the following valuation techniques:

Market approach – Prices and other relevant information generated by market transactions

involving identical or comparable assets or liabilities; and/or

Income approach – Techniques to convert future amounts to a single present amount based

on market expectations, including present value techniques and option-pricing models.

The fair value of publicly traded fixed income and equity securities is based upon quoted market prices

and exchange rates, if applicable. The fair value of direct real estate investments is determined from

periodic valuations prepared by independent appraisers.

Investments are exposed to various risks, such as interest rate, market and credit risks. Due to the level of

risk associated with certain investments, it is at least reasonably possible that changes in the values of

investments will occur in the near term and that such changes could materially affect the amounts

reported in the university’s consolidated financial statements.

Derivatives - Derivative financial instruments in the investment portfolio include interest rate swaps

which are recorded at fair value with the resulting gain or loss recognized in the consolidated statement

of activities.

Resell and Repurchase Agreements - Cash paid relating to resell agreements is generally collateralized by

federal agency and foreign debt securities. The university takes possession of the underlying collateral

and monitors the value of the underlying collateral to the amount due under the agreement. Cash

received under repurchase agreements is collateralized by investments in asset-backed securities,

corporate debt, federal agency debt, and foreign debt securities. Collateral fair value is monitored to the

amounts due under the agreements.

29

Management Fees - The university records the cost of managing its endowment portfolio as a decrease in

non-operating activity as a component of total endowment return within the applicable net asset class in

the consolidated statement of activities. Management fees consist of the internal costs of the university’s

Investments Office (the “Investments Office”), outside custodian fees, and fees for external investment

managers and general partners.

Total Return - The university invests its endowment portfolio and allocates the related earnings for

expenditure in accordance with the total return concept. A distribution of endowment return that is

independent of the cash yield and appreciation of investments earned during the year is provided for

program support. The university has adopted a current endowment spending policy in accordance with

the Uniform Prudent Management of Institutional Funds Act (“UPMIFA”) as adopted in the State of

Connecticut, designed specifically to stabilize annual spending levels and to preserve the real value of the

endowment portfolio over time. The spending policy attempts to achieve these two objectives by using a

long-term targeted spending rate combined with a smoothing rule, which adjusts spending gradually to

changes in the endowment’s fair value. An administrative charge is assessed against the funds when

distributed.

To the extent that a donor-restricted endowment fund falls below its historic dollar value a

deficit would exist, and it would be reported as a reduction of net assets with donor restrictions.

Spending from an endowment fund in a deficit position would continue under the spending policy so

long as the fund’s value is more than 70% of its historical dollar value. At June 30, 2022, there were

174 endowment funds in a deficit position totaling $5.1 million in aggregate, the fair value of which

totaled $214.1 million with a corresponding historic dollar value of $219.2 million. There were no

endowment funds in a deficit position at June 30, 2021.

The university uses a long-term targeted spending rate of 5.25%. The spending amount is

calculated using 80% of the previous year’s spending and 20% of the targeted long-term spending rate