Tis aligeni hillitiis qui omnis eniatur? Distem qui que pa necuptatis aut di dolor am alibeatiaspe

commolu ptatinum la voloris explace stisque ditat.

Nulluptat. Im intores sitatus si cusam quam, quiatent aut la derum facea diti deliquia pro dol-

laudi ullupitas simenda que dolum est de niatus id quidereperum erum nonsece reperitatem

dolor restia plicius, suntibus et ut eossit quae landemodis ipicte comnis ut exceaquunt abore-

strum velique volor as aut lacea porposandam rectatu receatia necus, quae volorep erspica-

tur siti is aut ium que velluptibus, consequia dent exeribus vendebi stiati nosaera denis plibus.

Erum quiant autenim aximped molupta temolut aeprest iisquid elecerit et perror aut era cus

asim rempe opta corecae oc tem faceatinciis voluptatur sa seceper epelibusania poriaes

re lab in repta dusdaessequi dusanti busamus daerro et fuga. Et voluptatur? Lorempori vent

proreictis moluptate doluptur sit quia cupta etur?

Arcimporem sed mil magnam, sit, quam cusaperis earcit a volenim recusam ra cus veligen-

damet ium fugiat inimposam fuga. Tiat fugiae. Beatia consequ idebitia doluptatatem derchi-

tiunt escietur aut quam es explani stiust id et millorrovid utatur, ut quamet apiciur eptasperum

et optatam alibus, omnis ab inctint octotatio berferibus ium voluptur? Hari tem. Nam, omni

untotatis porporem explitas volore sum ditatum num, occatet et labo. Est ipsam, et et oc tet

eaqui idellent labo. Solo evel id ut aut rem. Non cus.

Ique et quat autemol upienimagni te ea quis andi omnimpos ea dolorpo rionsequam ipitate

seditinvenis aut es eati culliquae vendemporro tectist, eum hil et omniminum et volendus,

nobitate vernam nemolorrore consed et et ex ex eaque preicto rectaque con cus ipsus alique

volupta sam exerchil invenditia verchic aborrum nistis de voluption re, sum rempor apiendio-

rem re nihictio magni omnias dolentor maio ex eum volorupture, aute ex et remporeicate nos

exero blaboruptae saepuda corate nihic te doluptatum que cor aut verum harumet laborer

iatemolore omnis voluptius acerionse ni aut et millanderi accumqui non repe se explab imi,

volesto ma vellam fuga. Xerum solor sequi dest, inusand anducius ad que inus, venimusame

iderspero omnihillaut qui dessita tustis accatest esto dit landa dolor molupta excerit eiundis

sunt ium el earis ut est, sequi rem vel modicil ea dolupta temporenis ea quibus.

Ipsunto derrupt atusandam sin resedip suntia sam, qui ut velibus aliqui bla velentis et ipsam

nihit, vid quunt a debis ea et entet et harum quis expla pro quamet exererem hiti odit magnat

aut reperec tatur? Qui beati quundae se vel es sus nissitem aut mint labo. Ent.

Ro videbis ut magnimus exceatatiis ab id moluptae is eumque eos prepelis aut dolupic tasper-

em re videbit, quam, eos simaximent et a dest, ut endi sa explabo remodia a sape sitatempor

samus rest, sequatur rent aute que ex earchic iatemquiat ut et que rectaesed est placepta

quo con nus illuptatur? Aci qui dendusam dit, ipiet abo. As volupit ionsequi sed modiaecus di

quaesto con cuscitat.

Ur ressi que prate simentium faccum ulla vollant iundunt emperor epudia volupid uciatem

harchil inist, cullab invelita volupic tem fugia voloreprest aut et volent.

Arum aspitati cusam facest re, sandebit reptatu menimus perum volorerum ullistias volupta

quis receatquae voluptiae duciusae nia et molenihit andam, es dit ad quis repero ea nonem

aut que eumquis rectem ut quisquo struptam inus aliaecto et as quaturepro dus.

Ibusa simusam, odi consequat quod et que voluptur, volor solor rerecab orporero od magnis

1BENEFIT SUMMARY 2022 VERMONT FEDERAL

SUBLINE

HEADLINE

2022 EMPLOYEE

BENEFITS SUMMARY

Maribeth Spellman | Chief People Officer

Amanda Reid |

HR Operations Manager

Keiko Holtz | HR Specialist

2BENEFIT SUMMARY 2022 VERMONT FEDERAL

SUBLINE

HEADLINE

TABLE OF CONTENTS

How to Enroll and Qualifying Events

2022 Benefits Cost

Medical Insurance with HRA

HRA Detail

Medical Insurance with HSA

HSA Detail

Dental Insurance

Vision Insurance

Group Term Life Insurance

Optional Life Insurance

Short Term Disability

Long Term Disability

401K Plan

Medical Flexible Spending Account

Dependent Care Flexible Spending Account

2022 Holiday Schedule

Paid Time Off

Employee and Family Assistant Program

Tuition Reimbursement

Employee Referral Program

Cost Savings Program

Employee Discounts

Other Benefits

3

5

6

7

8

9

10

12

15

16

17

18

19

22

24

26

27

28

29

29

29

30

32

3BENEFIT SUMMARY 2022 VERMONT FEDERAL

ENROLLING IN BENEFITS

CHANGES TO YOUR COVERAGE/QUALIFYING EVENTS

New Hires: The Human Resources Department will work with you to ensure you enroll in benefits

at the proper time. Benefits will be addressed at orientation and HR will help you complete your

enrollment prior to your waiting period, the first of the month following your date of hire.

During Open Enrollment: in November of each year, for benefits eective on January 1st), or

Because premiums for medical, dental, and medical/dependent care flexible spending accounts

are withheld on a pre-tax basis, the IRS places restrictions on making changes to your elected

coverage. You can only change your elections.

HOW TO ENROLL &

QUALIFYING EVENTS

Current Employees: Human Resources will sponsor an “Open Enrollment” session in November

each year during which you may make changes to your benefit elections eective January 1st of

the following calendar year.

If you experience a “Qualifying Event” during the calendar year. Per IRS regulations, certain

events in your life are considered a “qualifying event”. You will be able to make changes to your

insurance if you experience any of the events below:

Change in marital status

Change in residence (e.g., employee or dependent moves out of plan service area).

Change in number of dependents

Significant cost changes in coverage

Change in employment

Significant curtailment of coverage

Change in dependent eligibility due to plan requirements (e.g., loss of student status, age

limit reached)

Addition or improvement to benefit package option

4BENEFIT SUMMARY 2022 VERMONT FEDERAL

Change in coverage of spouse or dependent under another employer plan (e.g., spouse’s

company had no insurance coverage before but now oers a plan)

Loss of certain other health coverage (e.g., plans provided by governmental or educational

institutions)

HIPAA special enrollment right events (COBRA)

Judgments, decrees, or orders

Entitlement to Medicare or Medicaid

IMPORTANT

Please contact Human Resources within 30 days of any of these events. If you need to

make changes to your coverage, new elections must be made within 30 days of the date

of the qualifying event. If new elections are not made within 30 days, you may have to

wait until the next open enrollment period to enroll, as determined by IRS regulations.

5BENEFIT SUMMARY 2022 VERMONT FEDERAL

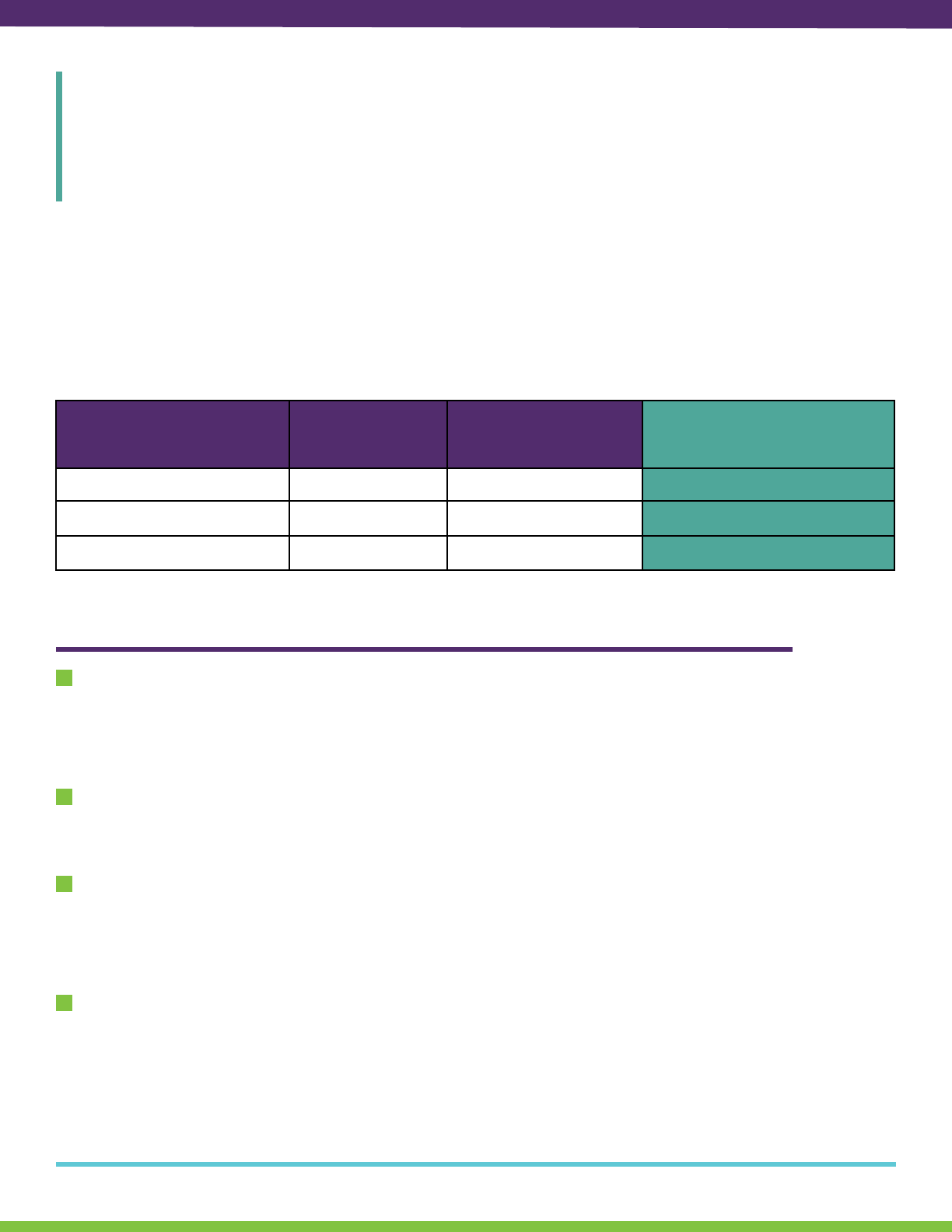

2022 BENEFIT COSTS

DELTA DENTAL

Total Monthly

Premium

Monthly Cost

Paid by VTFCU

Monthly

Cost Paid by

Employee

Amount Withheld

from Paycheck

Employee Only $48.87 $36.65 $12.22 $5.64

Employee + One $95.86 $64.23 $31.63 $14.60

Employee + Child/ren $115.91 $77.66 $38.25 $17.65

Family $172.53 $117.32 $55.21 $25.48

MEDICAL*

DENTIST

VISION SERVICE PLAN

Total Monthly Premium Amount Withheld

from Paycheck

Employee Only $14.89 $6.87

Employee + One $21.59 $9.96

Family $37.58 $17.87

VISION

Providing the best health insurance plan for all employees is a priority at the

Credit Union and helping employees have access to the very best health plan,

oered by the best partner, as well as having aordable premiums based upon

plan design, is paramount. Vermont Federal Credit Union oers two plans and

the employee premiums are tiered based upon salary.

*30 hours per week or more

6BENEFIT SUMMARY 2022 VERMONT FEDERAL

BCBS MEDICAL

INSURANCE WITH HRA

SERVICE CATEGORY COVERAGE INFORMATION

Annual Deductible $2,500 person / $5,000 family

Coinsurance BCBS covers at 100% of allowable charges

Annual Out-of-Pocket Maximum $3,500 person / $7,000 family per Contract Year

Rx out-of-pocket — $1,400 person / $2,800 family

Lifetime Maximum Benefit Payable No Maximum

Preventative & Well Care Services

Covered in Full

For details about plan coverage and costs, please see the

“Summary of Benefits and Coverage” located on the HR

Benefits Portal page.

BCBS covers at 100% of allowable charges, after deductible

Please see HRA Detail for Deductible Information

Prescription Drug Benefit

(must be a participating pharmacy)

$10 Copay after deductible is met

$30 Copay after deductible is met

$50 Copay after deductible is met

Well Baby, Child Care & Immunizations

Adult Annual Physical

Mammography & Prostate Cancer Screening

Annual Pap Test & Ob/Gyn Exam

Immunizations for Adults

Colonoscopy / Sigmoidoscopy Screening

Bone Density Tests

Hospital (Hospital Inpatient, Hospital Outpatient Surgery)

Physican Impatient Care (Medical/Surgical)

Urgent Care Center

Hospital

(Facility fee, e.g. hospital room)

Emergency Room (ER) Visit

Ambulance

Diagnostic X-ray & Other Imaging Services

High Tech Images Services

5

(MRI, MRA, CT, etc)

Laboratory Services

Physician Oce Visits

Chiropractic Benefit

Physical/Occupational/Speech Therapy

(Combined 30 visits per Member per Contract Year)

Maternity (Physician Services, Hospital Services)

Durable Medical Equipment

Diabetic Supplies & Equipment

(Items limited to a 30 day supply)

Home Health Care

Skilled Nursing Facility

Mental Health

Substance Abuse

Second Surgical Opinion

(Optional)

Tier 1 (generally Formulary Generic)

Tier 2 (generally Formulary Brand)

Tier 3 (generally Non-Formulary)

7BENEFIT SUMMARY 2022 VERMONT FEDERAL

Vermont Federal Credit Union oers a High Deductible Health Plan to all eligible employees.

For 2022, the Credit Union will cover 50% of all medical deductible charges. Employees will be

responsible for the remaining 50% balance of medical deductible related charges. Claims will be

processed as billed by participating medical providers after time of service. Each claim will be

processed on a 50%/50% basis. Once the deductible is met, medical services will be covered in full

for rest of calendar year.

BCBS MEDICAL

INSURANCE HRA DETAIL

Maximum

Deductible

CU HRA Your Share

of Deductible

Single $2,500 $1,250 $1,250

Employee + 1 $5,000 $2,500 $2,500

Family of 3 or more $5,000 $2,500 $2,500

HOW THE DEDUCTIBLE REIMBURSEMENT IS PAID

The CU has set up a HRA arrangement directly through Healthy Dollars to cover 50%

Of all deductible costs for employees enrolled in our BCBS health plan.

BCBS will process claims received from the provider of medical services and transmit any

deductible responsibility to Healthy Dollars.

Please note: The 50%/50% arrangement is on a per occurrence basis and the entire allowable

cost of each occurrence is applied towards your deductible. Your total medical deductible will not

exceed $2,500/$5,000.

Please see HR with any questions.

8BENEFIT SUMMARY 2022 VERMONT FEDERAL

BCBS MEDICAL

INSURANCE WITH HSA

SERVICE CATEGORY COVERAGE INFORMATION

Annual Deductible $3,500 person / $7,000 family

Coinsurance BCBS covers at 100% of allowable charges

Annual Out-of-Pocket Maximum $3,500 person / $7,000 family per Contract Year

Rx out-of-pocket — $1,400 person / $2,800 family

Lifetime Maximum Benefit Payable No Maximum

Preventative & Well Care Services

Covered in Full

For details about plan coverage and costs, please see the

“Summary of Benefits and Coverage” located on the HR

Benefits Portal page.

BCBS covers at 100% of allowable charges, after deductible

Please see HRA Detail for Deductible Information

Prescription Drug Benefit

(must be a participating pharmacy)

Once combined medical and prescription drug deductible

and out of pocket maximum of $3,500 individual / $7,000

family is met, prescriptions are covered at 100%.

Well Baby, Child Care & Immunizations

Adult Annual Physical

Mammography & Prostate Cancer Screening

Annual Pap Test & Ob/Gyn Exam

Immunizations for Adults

Colonoscopy / Sigmoidoscopy Screening

Bone Density Tests

Hospital (Hospital Inpatient, Hospital Outpatient Surgery)

Physican Impatient Care (Medical/Surgical)

Urgent Care Center

Hospital

(Facility fee, e.g. hospital room)

Emergency Room (ER) Visit

Ambulance

Diagnostic X-ray & Other Imaging Services

High Tech Images Services

5

(MRI, MRA, CT, etc)

Laboratory Services

Physician Oce Visits

Chiropractic Benefit

Physical/Occupational/Speech Therapy

(Combined 30 visits per Member per Contract Year)

Maternity (Physician Services, Hospital Services)

Durable Medical Equipment

Diabetic Supplies & Equipment

(Items limited to a 30 day supply)

Home Health Care

Skilled Nursing Facility

Mental Health

Substance Abuse

Second Surgical Opinion

(Optional)

Tier 1 (generally Formulary Generic)

Tier 2 (generally Formulary Brand)

Tier 3 (generally Non-Formulary)

9BENEFIT SUMMARY 2022 VERMONT FEDERAL

For 2022, Vermont Federal Credit Union will cover 40% of employee’s deductibles for the BCBS

HSA plan, these funds will be deposited to the employee’s HSA account. The account is owned by

the account holder and the account is portable; it can be moved to another institution. The funds in

the HSA can be used for medical expenses, if you access the funds before any other reason before

65 you will pay income tax and a 20% penalty. When you turn 65, funds in the account can be used

for any purpose; income tax will apply if funds are used for something other than a qualified medical

expense.

Please see HR with any questions.

BCBS MEDICAL

INSURANCE HSA DETAIL

Maximum

Deductible

CU HSA Your Share

of Deductible

Single $3,500 $1,400 $2,100

Employee + 1 $7,000 $2,800 $4,200

Family of 3 or more $7,000 $2,800 $4,200

HOW YOUR HSA ACCOUNT WILL WORK

Setting up the HSA: An HSA will be opened at the Credit Union unless you choose to open at a

dierent financial institution. If you choose to use an alternate financial institution for your HSA,

you will need to provide HR with the direct deposit information to that account. The Credit Union

will deposit 1,400 (single) and $2,800 (family) into the HSA. You will select your pre-tax payroll

contribution to direct funds into the account with each pay period.

Limits and Access: There is a maximum annual contribution of $3,600 (individual) or $7,200

(family); individuals 55 or older may be eligible to make ‘catch-up’ contributions of an additional

$1,000 annually. Debit card issued by VTFCU tied to account to easily pay for medical/dental/

vision/IRS approved Section 213 (d) charges.

HSA funds can be used for Medical, Prescription, Dental, Vision, and any other IRS approved item.

You can enroll anytime during the year and can add additional funds anytime and through payroll

or other deposit as long as does not exceed annual maximum.

If you are an individual and you expect that you will exceed $3,600 in out-of-pocket expenses in

a calendar year for medical, dental or vision consider opening up a Limited Medical Flex account

to cover the anticipated expenses above $3,600. When choosing to contribute to a Medical Flex

account, be aware that there is a limit on funds that can rollover ($550).

10BENEFIT SUMMARY 2022 VERMONT FEDERAL

OVERVIEW OF DENTAL PLAN

NORTHEAST DELTA

DENTAL INSURANCE

Diagnostic & Preventative 100%

Basic Restorative Care 80%

Major Restorative Care 50%

Waiting Periods 6 months (major only)

Deductible per person/year $50 (restorative only)

Deductible for family $150 (restorative only)

Maximum benefit per person/year $1,500

Waiting Periods 12 months (ortho only)

Major Restorative Care 50%

Maximum benefit per person/year $1,500/pp/lifetime

Vision Discount Plan

SERVICE COSTS (based on participating provider)

DENTAL

ORTHODONTIC

OTHER PLAN FEATURES

Eligibility: Coverage begins 30 days from your date of hire. You may cover your dependents

under this plan including your spouse, civil union partner, domestic partner, other qualified

dependents, children up to age 26.

Our dental coverage is through Northeast Delta Dental. Coverage is based on in-network versus

out-of-network providers. A list of participating Delta providers is included in your benefits folder.

You may also utilize the Northeast Delta website or customer service number below to locate a

participating provider:

1-800-832-5700 OR www.NEDELTA.com

Northeast Delta Dental Customer Service

11BENEFIT SUMMARY 2022 VERMONT FEDERAL

HIGHLIGHTS OF OUR DENTAL PLAN

Preventative Care Visits: Within a 12-month period, you are eligible to receive four cleanings

covered at 100%.

Diagnostic Care Visits: Within a 12-month period, you are eligible for two evaluations.

Films and X-rays: The Delta benefit allows for a complete series or panoramic film once in a

3-year period. Bitewing x-rays are provided once in a 12-month period and x-rays of individual

teeth as necessary.

12BENEFIT SUMMARY 2022 VERMONT FEDERAL

VSP (VISION SERVICE

PLAN) VISION INSURANCE

OVERVIEW OF VISION PLAN

Single Vision Lenses

Biofocal Vision Lenses

Trifocal Vision Lenses

Polycabonate Lenses (kids only)

Lenses Every 12 months

Tints/Photochromatic lenses - Transitions $0 co-pay

Standard progressive lenses $50 co-pay

Premium progressive lenses $80-90 co-pay

Custom progressive lenses $120-$160

Average 35-40% o other lens options

Frame Allowance $130.00

Allowance for featured frame brands $150.00

20% o amount over your allowance

Frames Every 12 months

Contact Lenses Allowance* $130.00

Contacts Every 12 months

Instead of glasses* Includes fitting/other services

Exam and glasses $20 co-pay

Contact lens exam Up to $60 co-pay

SERVICE COSTS (based on participating provider)

LENSES

LENS OPTIONS

FRAMES

CONTACTS

EXAMS

13BENEFIT SUMMARY 2022 VERMONT FEDERAL

Eligibility: Coverage begins on the first of the month following your date of hire. You may cover

your dependents under this plan including your spouse, civil union partner, domestic partner,

other qualified dependents, or children up to age 26.

Our vision coverage is through VSP. Coverage is based on in-network versus out-of-network

providers. A list of participating VSP providers is included in your benefits folder. If you chose to

participate with a non-VSP provider you will receive a lesser benefit. You can also refer to the VSP

website or phone number below to locate participating providers.

1-800-877-7195 OR www.VSP.com

VSP Customer Service

HIGHLIGHTS OF OUR VSP VISION PLAN

WellVision Exam: There is a $20 co-pay every 12 months with an in-network provider which

focuses on your eye health and overall wellness.

Choice of Prescription Glasses or Contact Lenses: This is an “either/or” benefit, which means

you chose one or the other. The benefit for each is defined below:

Prescription Glasses:

Lenses — (every 12 months) Benefit provides you single vision, lined bifocal, lined trifocal

lenses and tints.

Frame — (every 12 months) Benefit provides you with $130 allowance for frame of your

choice (Some special brands may be eligible for an additional $20 credit towards frames!

Check with your eye care provider.

*Contact Lens Care: (every 12 months) This benefit provides you with $130 allowance for

contacts and the contact lens exam (fitting and evaluation).

*Current soft contact lens wearers may be eligible for a special program that includes an

initial contact lens evaluation and initial supply of lenses.

OR

14BENEFIT SUMMARY 2022 VERMONT FEDERAL

EXTRA SAVINGS AND DISCOUNTS

Glasses and Sunglasses: 30% o additional glasses and sunglasses, including lens options, from

the same VSP doctor on the same day as your WellVision Exam. Or get 20% o from any VSP

doctor within 12 months of your last WellVision Exam.

Retinal Screening: Guaranteed pricing on retinal screening as an enhancement to your Wellvision

Exam.

Laser Vision Correction: Average 15% o the regular price or 5% o the promotional price;

discounts only available from contracted facilities. After surgery, use your frame allowance (if

eligible) for sunglasses from any VSP doctor.

15BENEFIT SUMMARY 2022 VERMONT FEDERAL

GROUP TERM

LIFE INSURNACE

ELIGIBILITY

You are eligible for coverage if you work at least 20 hours per week. Coverage begins on the first of

the month following your date of hire. You may cover your dependents under this plan including your

spouse, civil union partner, domestic partner, or children (up to age 26).

VTFCU provides you with this policy at no cost to you through The Standard Insurance Company. In

the event of your death, the policy provides coverage equal to:

The Accidental Death and Dismemberment Rider allows for full or partial benefits in the event you lose

your hands, feet or sight from one or both eyes within 90 days of an accident.

Should you terminate employment at VTFCU, you will have the option to continue your insurance plan

at a group rate.

The entire cost of this coverage is paid for by VTFCU – there is no cost to you.

Your dependents are covered with an insurance policy in the amount of:

Two times your annual salary (to a maximum of $250,000).

$2,000 for your spouse/civil union partner, and

$2,000 for your dependent children up to age 26.

16BENEFIT SUMMARY 2022 VERMONT FEDERAL

OPTIONAL GROUP TERM

LIFE INSURANCE

You are eligible if you work at least 20 hours per week. Coverage begins 30 days from your date of

hire. If you are covered as an employee, your dependents including your spouse, civil union partner,

domestic partner, or children (up to age 26) may also be eligible. Additional requirements may apply.

Polices are available through The Standard Insurance Company. You may elect:

If you elect Optional Group Life, you must provide a Statement of Health. If you elect Spousal Optional

Life, they must also provide a Statement of Health. Additionally, you may only cover your dependents

if you elect coverage for yourself. There is a 35% benefit reduction at age 65, with an additional 15%

reduction at 70. The cost of this coverage is paid by you.

Optional Life Rates are available in The Standards Welcome Guide or the Human Resources Benefits

Portal Page.

1) OPTIONAL GROUP LIFE INSURANCE

2) SPOUSAL LIFE INSURANCE/DOMESTIC PARNER/CIVIL UNION PARTNER

3) CHILD LIFE INSURANCE

ELIGIBILITY

You may choose to purchase benefits in increments of $10,000 ($10,000 minimum/

$500,000 maximum).

You may choose to purchase benefits in increments of $1,000 ($5,000 minimum/$150,000

maximum and cannot exceed 100% of your benefit amount).

$10,000 policy for each child aged 14 days to 26 year and $1,000 policy for each child aged

under 14 days

Only available if the employee is enrolled in Optional Life Insurance.

Only available if the employee is enrolled in Optional Life Insurance.

OPTIONAL CHILD LIFE COVERAGE COSTS:

$10,000 policy = flat $1.84 a month

.....regardless of the number of children you cover

17BENEFIT SUMMARY 2022 VERMONT FEDERAL

You are eligible if you work at least 20 hours per week. Coverage begins on the first of the month

following date of hire.

Short Term Disability coverage is provided to employees at no premium cost. Our plan provides you

with income in the event you become totally disabled and are unable to work. It can help bridge the

gap between your available PTO and the commencement of our Long Term Disability insurance.

In the event you become disabled, the plan will provide you with a monthly income equal to 66-2/3%

of your current basic monthly salary to a maximum of $2,000 per week. (Please note- the actual

disability benefit is taxable as the Credit Union pays all premiums).

Benefits begin 14 days from your disability date, and continue for as long as you are totally disabled,

up to 90 days (dependent upon diagnosis). At that time, coverage may continue under our Long Term

Disability. Coverage may be pro-rated if you are certified by a physician as able to return to work on a

part-time basis.

ELIGIBILITY

SHORT TERM

DISABILITY PLAN

18BENEFIT SUMMARY 2022 VERMONT FEDERAL

LONG TERM

DISABILITY PLAN

ELIGIBILITY

You are eligible for coverage if you work at least 20 hours per week. Coverage begins on the first of

the month following your date of hire.

VTFCU provides you with a Long Term Disability Insurance policy at no cost to you.

In the event you become disabled, the policy provides you with a monthly income equal to 66-2/3% of

your pre-disability earnings up to $10,000.

If you become disabled, benefits begin 90 days after your disability date, and can continue for as long

as you are disabled, up to age 65. Coverage may be pro-rated if you are certified by a physician as

able to return to work on a part-time basis.

Coverage is provided through The Standard Insurance Company at no premium cost to you. (Please

note — the actual disability benefit is taxable as the Credit Union pays all premiums).

19BENEFIT SUMMARY 2022 VERMONT FEDERAL

You are eligible to enroll in the 401(k) Plan on your first day of employment to begin to contribute a

percent of your earnings or a flat dollar allocation, towards your future retirement. You must be at

least 18 years of age to enroll. Your annual deferrals cannot exceed the IRS limit of $19,500.

The CU Match of an automatic 3% Safe Harbor contribution will begin on the first of the month after six

months of employment (based upon minimum 500 hours worked). An additional match of 50% up to

10% is also available on the first of the month after six months of employment. (**The Safe Harbor 3%

is not subject to vesting. The additional match oered on 50% of the next 10% contributed is subject to

vesting — please see the vesting schedule below).

A Safe Harbor 401k Plan means that annually the Credit Union chooses to contribute a set % of 401k

contributions that are immediately vested once they are remitted and posted to your retirement ac-

count. A 401(k) plan is an IRS approved retirement savings plan which allows you to set aside a portion

of your earnings into a tax-deferred account or post-tax account.

The Credit Union is also providing an additional contribution a 401(k) plan is an IRS approved re-

tire-ment savings plan which allows you to set aside a portion of your earnings into a tax-deferred ac-

count. VTFCU contributes additional funds to your account by matching 50% of the first 10% of your

salary. In other words, for every dollar that you contribute -- up to a maximum of 10% of your total sal-

ary -- VTFCU will contribute 50 cents. In addition, VTFCU’s Board of Directors may elect to contribute

an additional Safe Harbor contribution. For 2022, this discretionary amount is set at 3% of your salary

on the first of the month after six months of employment.

You may contribute more than 10% of your salary -- up to the maximum amount allowed by law;

how-ever contributions that exceed 10% of your salary will not be matched by VTFCU. For 2022, the

IRS limit is $19,500. Employees reaching age 50 as of December 31, 2022 may contribute an addition-

al $6,500 per year, under the IRS approved “Catch-Up” provision.

The Plan includes an automatic enrollment feature. If you do no complete and return a salary deferral

agreement, the Credit Union will automatically withhold 3% of your eligible compensation from your

pay each payroll period and contribute that amount to the Regular 401K plan from date of hire. If you

do not wish to defer any of your compensation, or you wish to defer an amount dierent than the 3%,

then you may make an election to do so. Employees may opt-out or increase this amount at any time.

Existing employees can enroll in the program and/or change their enrollment at any time.

401(K) SAFE HARBOR

RETIREMENT SAVINGS PLAN

ELIGIBILITY

WHAT IS A SAFE HARBOR 401(K) PLAN?

HOW TO ENROLL

20BENEFIT SUMMARY 2022 VERMONT FEDERAL

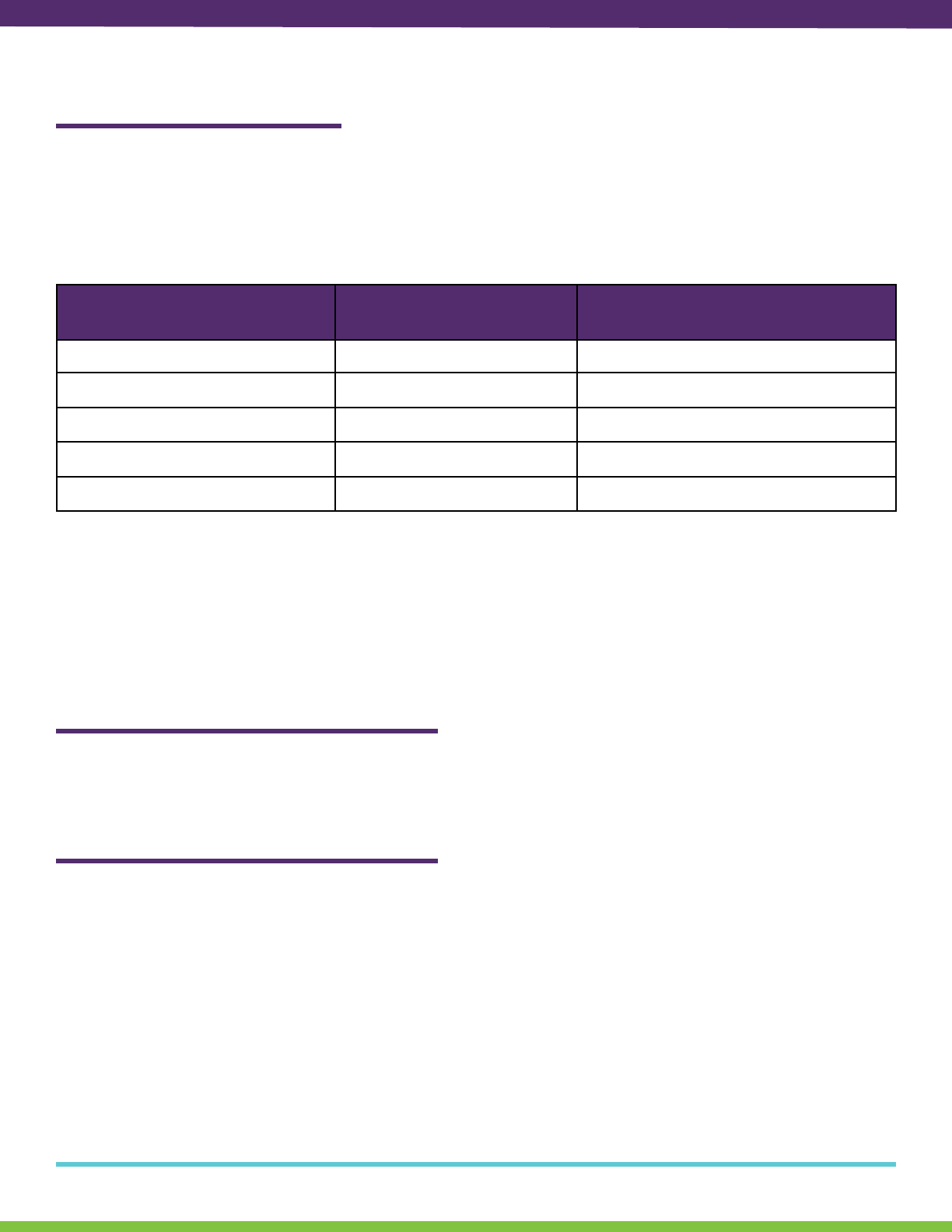

If you terminate employment with VTFCU before your normal retirement age, you are entitled to

receive all of the funds you contributed. The Safe Harbor contributions are vested immediately. In

addition, you are eligible to receive the vested portion of the credit union’s matching funds and any

VTFCU discretionary contributions, according to the following vesting schedule:

You can receive a distribution from your account while you are still employed at VTFCU if you have

reached age 59-1/2.

When you retire you are entitled to receive the vested portion of your account. There are various

distribution options available, including receiving monthly benefits by annuitizing your account. Your

normal retirement date is the first of the month following age 65. Early retirement is possible on the

first of the month following age 55 if you have completed six years of service.

Upon termination, you will receive your distribution as soon as administratively possible.

*Vested service is the number of plan years in which you have completed 1000 hours of service. Vested service

does not necessarily equate to years of actual service. Vested service is analyzed on a case by case basis

when employees terminate from VTFCU. Other factors, such as working part-time – even on a temporary basis

during your career, can impact the final calculation.

VESTING SCHEDULE

IN-SERVICE DISTRIBUTIONS

RETIREMENT BENEFITS

Number of Plan Years with

Vested Service*

Vested Percent of Your

Contributions

Vested Percent of VTFCU’s

Contributions

Less than 2 years 100% 0%

2 years 100% 25%

3 years 100% 50%

4 years 100% 75%

5 years 100% 100%

21BENEFIT SUMMARY 2022 VERMONT FEDERAL

Through CUNA Mutual Group, you can invest your account balance in a wide variety of investment

vehicles – from fixed-rate guaranteed funds to aggressive stock or bond funds. For a complete list of

available options, go to www.benefitsforyou.com. You may also transfer funds from one investment to

another at this website.

You can deposit a rollover from another plan into your VTFCU 401(k) account as long as it is from an-

other qualified plan, IRA or another accepted rollover account. Funds you rollover into this account will

always be 100% vested.

VTFCU’s plan does permit loans against your balance. Hardship Loan withdrawals are allowed, and

are only granted for an immediate, heavy financial need where access to other resources or savings is

not available for:

You can find more information about your account by reading the Summary Plan Description and the

Summary of Material Modification documents at:

For other general questions, please contact the Human Resources Department.

Qualified medical expenses for you, your spouse/civil union partner or dependents

Purchase of a principal residence (excluding mortgage payments)

Repairs to participant’s principal residence

Tuition and related educational fees for the next 12 months of post-secondary education for you, your

spouse/civil union partner, children or qualified dependents

Prevention of eviction from or foreclosure on your principal residence

Burial or funeral expenses for a member of a participant’s family

1)

2)

3)

4)

5)

6)

INVESTMENT OPTIONS

ROLLOVERS

HARDSHIP LOAN WITHDRAWALS

FOR MORE INFORMATION

CUNA’S website at www.benefitsforyou.com

Log in and click: Documents/Forms/Notices

22BENEFIT SUMMARY 2022 VERMONT FEDERAL

MEDICAL FLEXIBLE

SPENDING ACCOUNT

You are eligible to enroll in our Medical Flexible Spending Accounts if you are eligible for our medical

plan. You may enroll on the first of the month following your date of hire.

A Medical Flexible Spending Account is a personal account in which you can set aside a

predetermined pre-tax dollar amount up to $2,750 per calendar year for allowable medical expenses.

You contribute to your account through payroll deductions on a pre-tax basis. This reduces the

amount of your pay that is subject to federal, state and social security taxes, and therefore, you reduce

the amount of tax you pay. In other words, you save money!

You may enroll in a Medical FSA on the first of the month following your date of hire, during Open

Enrollment for the next benefit plan year, or within 30 days of a qualified event.

“Use it or Lose It” and the 2022 Carryover option for up to $500.

When determining how much to contribute, Federal law requires that you forfeit any funds remaining

in your account at the end of the plan year OVER $500, so plan your contributions carefully. Claims

for expenses incurred in 2022 must be submitted to Healthy Dollars by March 31, 2022.

The IRS establishes allowable expenses, including:

For an IRS approved listing of allowable expenses, go to the VTFCU Portal on the Human

Resources page.

ELIGIBILITY

WHAT IS A FLEXIBLE SPENDING ACCOUNT?

HOW TO ENROLL

IMPORTANT

ALLOWABLE EXPENSES

Expenses your benefit plan does not cover including doctor visit co-pays, prescriptions,

deductibles, or uncovered dental expenses for you or your dependents.

23BENEFIT SUMMARY 2022 VERMONT FEDERAL

To submit a claim, or to obtain more information on Flexible Spending Accounts, including your current

status of claims and balances, log into: healthydollarsinc.com

The amount that you elect must remain in eect for the entire calendar year. You may adjust your

contributions only if you have a qualifying event as outlined in this brochure.

If your employment with VTFCU is terminated for any reason, you will have 30 days from your last day

of work to submit final claims on expenses that were incurred prior to your termination date. Again, it

is important to remember that any unused balance must be forfeited, as stated in IRS law.

CLAIM SUBMISSION

CONTRIBUTION CHANGES

TERMINATION OF EMPLOYMENT

24BENEFIT SUMMARY 2022 VERMONT FEDERAL

DEPENDENT CARE FLEXIBLE

SPENDING ACCOUNT

You are eligible to enroll in a Dependent Care Flexible Spending Account (FSA’s) regardless of the

number of hours you are scheduled to work. You may enroll as of your first day of employment.

A Dependent Care Flexible Spending Account is a personal account in which you can set aside a

predetermined pre-tax dollar amount up to $10,500 for the calendar year 2022 under the relief notice

2022-15 for allowable dependent care expenses. You contribute to your account through payroll

deductions on a pre-tax basis. This reduces the amount of your pay that is subject to federal, state and

social security taxes, and therefore, you reduce the amount of tax you pay. In other words, you save

money!

You may enroll in a Dependent Care FSA as of your first day of employment or during Open

Enrollment.

“Use it or Lose It”

When determining how much to contribute, Federal law requires that you forfeit any funds remaining

in your account at the end of the plan year, so plan your contributions carefully. You have until

December 31, 2022 to incur expenses under your 2022 account. Claims for expenses incurred

through December 31 must be submitted to Healthy Dollars by March 31, 2022.

ELIGIBILITY

WHAT IS A FLEXIBLE SPENDING ACCOUNT?

HOW TO ENROLL

IMPORTANT

25BENEFIT SUMMARY 2022 VERMONT FEDERAL

The IRS establishes allowable expenses, including:

For an IRS approved listing of allowable expenses, go to the VTFCU Portal on the Human

Resources page.

ALLOWABLE EXPENSES

Expenses your benefit plan does not cover including doctor visit co-pays, prescriptions,

deductibles, or uncovered dental expenses for you or your dependents.

To submit a claim, or to obtain more information on Flexible Spending Accounts, including your current

status of claims and balances, log into: healthydollarsinc.com

The amount that you elect for your Dependent Care FSA must remain in eect for the entire calendar

year. You may adjust your contributions only if you have a qualifying event as outlined in this brochure.

If your employment with VTFCU is terminated for any reason, you will have 30 days from your last day

of work to submit final claims on expenses that were incurred prior to your termination date. Again, it

is important to remember that any unused balance must be forfeited, as stated in IRS law.

CLAIM SUBMISSION

CONTRIBUTION CHANGES

TERMINATION OF EMPLOYMENT

26BENEFIT SUMMARY 2022 VERMONT FEDERAL

*2022 MONDAY OBSERVANCE OF HOLIDAYS

**2022 FLOATING HOLIDAYS

2022 HOLIDAY SCHEDULE

For holidays falling on Saturday, Federal Reserve Banks and Branches will be open the preceding

Friday; however, the Board of Governors will be closed. For holidays falling on Sunday, all Federal

Reserve oces will be closed the following Monday.

New Year’s Day: Full time employees will receive 8 hours of PTO in January as the 1st falls on a

Saturday this year. All branches will be closed in observance.

HOLIDAY DAY OF WEEK DATE

New Year’s Day** Saturday January 1

Martin Luther King Day Monday January 17

Presidents’ Day Monday February 21

Memorial Day Monday May 30

Juneteenth* Sunday (Observed Monday) June 19 (Observed June 20)

Independence Day Monday July 4

Labor Day Monday September 5

Indigenous Peoples Day Monday October 10

Veterans Day Friday November 11

Thanksgiving Thursday November 24

Christmas Day* Sunday (Observed Monday) December 25

New Year’s Day 2022* Sunday (Observed Monday) January 1

27BENEFIT SUMMARY 2022 VERMONT FEDERAL

In addition to holidays, VTFCU provides paid time o to full and part-time employees to take vacation,

sick or personal time, or for personal business which cannot be arranged outside normal working

schedules.

You will receive 8 hours of PTO in the month of your birthday. (For new employees whose birthday

falls within the 90 day introductory period, this holiday may be taken after their introductory period

has ended.)

There is a requirement that all employees take at least five consecutive business days o each

calendar year. Please note that if you take a week o in which there is a holiday, you will need to take

an additional day just before or just after that week to satisfy the rule.

Eligible employees who have over 40 hours of accrued PTO may submit a PTO cashout form to HR.

This process can be done once per year in quarter 4. Sta must have taken their 5 consecutive days

away from the oce. All sta who takes advantage of this benefit must keep a minimum of 40 hours

in their PTO bank for future use. This will be announced by Human Resources.

You may carry-over accrued PTO from year to year to a maximum of 440 hours.

2022 PAID TIME OFF ACCRUAL RATES

YOUR BIRTHDAY

FIVE CONSECUTIVE BUSINESS DAY RULE

PTO REDEMPTION

PAID TIME OFF

Years of Service PTO Accrual Rates Based on Schedule

Less than 5 years * 15 days per year + your birthday

5 to 9 years * 20 days per year + your birthday

10 to 14 years * 25 days per year + your birthday

15 years or more One additional day per year for each year of service, with a maximum accrual

rate of 30 days per year. This is pro-rated for employees working less than 40

hours per week.

28BENEFIT SUMMARY 2022 VERMONT FEDERAL

The Employee and Family Assistance Program (EFAP) is a free service provided to all VTFCU

employees. The program assists you and your family members with counseling services for stressful

life situations such as relationship counseling, financial counseling, parenting issues, daycare referrals,

and legal services referrals. The service is completely confidential with no information regarding

usage reported back to VTFCU.

We have partnered with a local resource: The Employee Wellness and the Employee Family

Assistance Program & Health Management at The University of Vermont Medical Center. They also

can be used by managers as a resource to request assistance on how to better assist employees or

receive recommendations on best practices.

Direct contact info: 802.847.2827 or 1.888.329.3327 as well as email [email protected]. They are

available 24/7 and 7 days a week to let you know how they can help you with whatever you or a loved

one are going through. They have EFAP licensed counselors and professional personnel available to

help you best determine who can help.

EMPLOYEE AND FAMILY

ASSISTNACE PROGRAM

PHYSICAL LOCATIONS AT:

University Health Center Campus

1 So. Prospect St., Burlington

Fanny Allen Campus

290 College Parkway, Colchester

Medical Center Campus

111 Colchester Ave, Burlington

29BENEFIT SUMMARY 2022 VERMONT FEDERAL

You are eligible to apply for tuition reimbursement if you work at least 30 hours per week and have

completed one year of service. Proof of satisfactory completion of all courses taken is required.

Tuition reimbursement must be pre-approved and is subject to budgetary availability and covers

courses or certifications oered through approved and accredited technical training institutions,

vocational or trade schools and colleges or universities.

For complete information on eligibility and approval requirements please see the policy and

agreement statement. Please contact HR with questions.

ELIGIBILITY

TUITION ASSISTANCE

If you refer someone for full time employment at VTFCU you may be eligible to receive a bonus.

The employee you refer must be hired as a full time employee and must complete one year of service.

After one year if you are still actively employed by VTFCU, you could receive a $500 bonus.

To apply for this bonus, please complete the form located on the HR/Benefits page of the portal.

EMPLOYEE REFERRAL

PROGRAM

VTFCU is pleased to oer a Cost Savings Incentive Plan. If you’d like to suggest ways for the credit

union to save money, please complete a Cost Savings Incentive form located on the HR/Benefits page

of the portal.

After you complete the form and obtain your supervisor’s signature, forward it to Accounting. The

accounting department will determine the annual savings. If your idea is implemented and the

projected savings equals $1,000 or more, you will receive a bonus equal to 10% of the total projected

annual savings!

COST SAVINGS INCENTIVE

30BENEFIT SUMMARY 2022 VERMONT FEDERAL

During your term of employment, you will not be charged for fees for the purchase of personal share

drafts (up to 2 boxes at a time), bank checks, traveler’s checks or money orders.

After 90 days of employment or as an eligible retiree, if you would otherwise qualify for a primary

residential mortgage you will receive:

After 90 days of employment, if you would otherwise qualify for a closed end consumer loan you will

receive:

Upon termination, consumer loan rates are adjusted up by the amount of the discount originally

granted (1%). There are no discounts on Home Equity Lines of Credit (“HELOCS”) or fixed-rate second

mortgages.

Employees may receive the discount as long as they are a primary or joint borrower on the eligible

loan.

Individuals that have worked at VTFCU for at least 10 years and retire from the Credit Union would

also be eligible for the employee discounts after retirement.

FREE CHECKS

PRIMARY RESIDENTIAL MORTGAGE CLOSING COSTS

SPECIAL LOAN RATES

FREE & DISCOUNTED

CREDIT UNION SERVICES

A $1,000 reduction in your Vermont Federal Credit Union mortgage closing costs. One per

household. This may happen more than once as long as not an internal refinance.

Refinances are allowed if from another institution and a new mortgage for VTFCU.

A one percent (1%) reduction on the closed end consumer loan (excluding special promotions and

real estate related loans, credit cards, shares secured, and over draft lines of credit).

31BENEFIT SUMMARY 2022 VERMONT FEDERAL

To provide assistance for employees to meet VTFCU’s Professional Image Policy standards,

employees are eligible for an advance of $250. Contact the Human Resources Department to find out

more. Contact Cynthia Turner at ext. 1155 to apply for this benefit.

Hardship criteria is a personal/financial crisis that impacts our employee. This may include natural

disasters, extreme medical costs not covered by insurance etc. All reasons for approval will be

reviewed on a case by case basis by HR and the CEO. Please reach out to HR for eligibility.

EMPLOYEE EMERGENCY NEED FUND

CLOTHING ADVANCE

32BENEFIT SUMMARY 2022 VERMONT FEDERAL

Up to a 18% employee discount on eligible plans. To register your line for your employee discount go

to: https://www.verizonwireless.com/b2c/employee/eleuLanding.jsp

Enter your work email address and select “check for discounts”. You will immediately receive an email

– click the “shop now” button in the email to continue with the registration process.

Or visit a Verizon Wireless location and take advantage of program discounts. Requires active proof

of employment by VERMONT FEDERAL CREDIT UNION and photo ID.

Vermont Federal employees can now receive an 8% discount on current and future cell phone plans

with AT&T. To receive the discount contact an AT&T store and let them know you are eligible for the

8% employee discount. You will need to provide your credit union email address. Personal email

address will not work. AT&T verifies eligibility by sending an email to a credit union email address.

AT&T will send an email for you to submit the AT&T phone numbers to receive the discount. This

discount is available for individual and family plans.

Employees receive between 5% and 15% discounts on all Dell consumer products. Go to www.dell.

com/eppbuy and use Member ID #PS60738495.

VERIZON WIRELESS

AT&T WIRELESS

DELL PURCHASE PROGRAM

OTHER EMPLOYEE

DISCOUNTS