National Mortgage Database (NMDB

®

)

Aggregate Mortgage Statistics

Data Dictionary and Technical Notes

June 28, 2024

1

Contents

NMDB® Aggregate Statistics Data Dictionary ............................................................................................... 2

NMDB

®

Mortgage Statistics Technical Notes ................................................................................................ 3

New Residential Mortgage Statistics ........................................................................................................ 4

Outstanding Residential Mortgage Statistics ............................................................................................ 5

Residential Mortgage Performance Statistics ........................................................................................... 5

Appendix A – Market Definitions .................................................................................................................. 8

Appendix B – New Residential Mortgage Statistics Series ......................................................................... 11

Appendix C – Outstanding Residential Mortgage Statistics Series ............................................................. 13

Appendix D – Residential Mortgage Performance Statistics Series ............................................................ 15

Residential Mortgage Performance Statistics, as of the End of the Quarter ......................................... 15

Residential Mortgage Performance Statistics Notes .............................................................................. 16

Additional Residential Mortgage Performance Statistics Concepts ....................................................... 17

Appendix E .................................................................................................................................................. 18

Names of Geography: National and Rural / Non-Rural .......................................................................... 18

Names of Geography: Census Regions, Census Divisions and States ..................................................... 18

Names and Codes of Geography: States ................................................................................................. 19

Names and Codes of Geography: 100 Metro Areas ............................................................................... 20

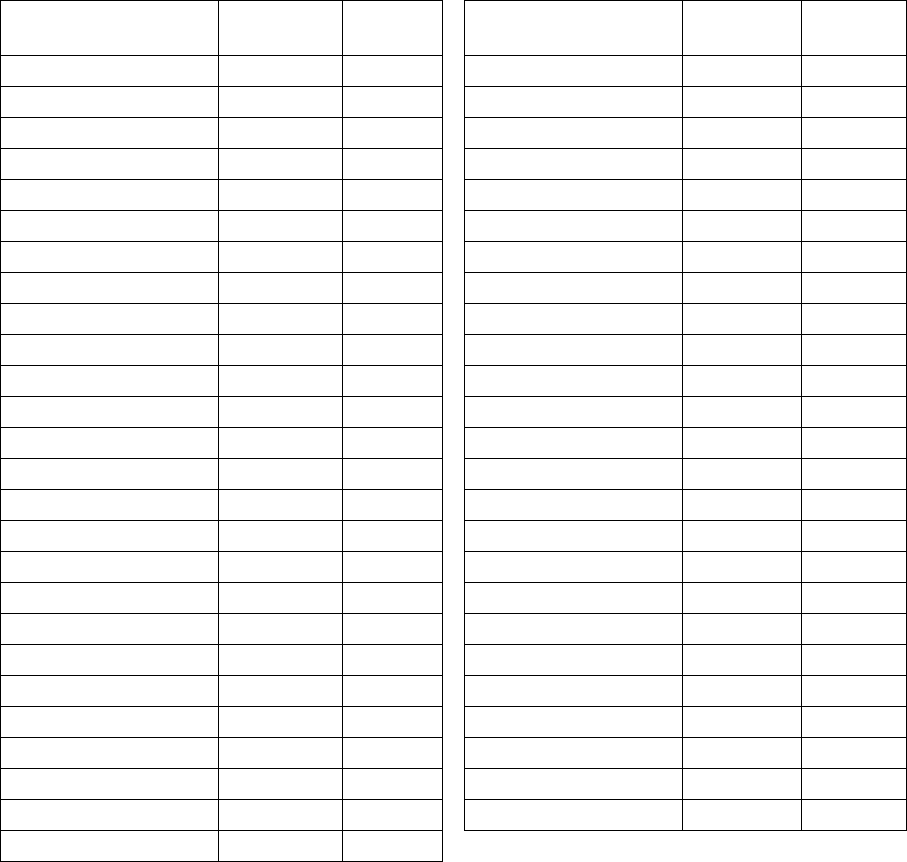

2

NMDB® Aggregate Statistics Data Dictionary

Field

Position

Field Name

Field Description

Max.

Length

Field

Type

Field Values or Examples

1

SOURCE

Data Source

4

String

NMDB

2

FREQUENCY

Frequency of the

Series

7

String

Annual

Quarterly

Monthly

3

SERIESID

Statistic Field

Identifier

19

String

New Residential Mortgages, see

Appendix B

Outstanding Mortgages, see

Appendix C

Performance Statistics, see

Appendix D

4

GEOLEVEL

Level of Geography

15

String

National

Rural/Non-Rural

Census Region

Census Division

State

Metro Area

5

GEOID

Geography

Identifier

5

String

See Appendix E

e.g.,

USA

RW

DNE

FL

23420

6

GEONAME

Name of

Geography

25

String

See Appendix E

e.g.,

United States

West

New England

Florida

Fresno, CA

7

MARKET

Mortgage Market,

Submarket

50

String

See Appendix A

e.g.,

All Mortgages

Enterprise Acquisitions (home

Purchase

Government (Refinance)

Other Conventional

(Continued)

3

Aggregate Statistics Data Dictionary (Cont.)

Field

Position

Field Name

Field Description

Max

Length

Field

Type

Field Values or Examples

8

PERIOD

Time Period: Year

Quarter or Month

6

String

e.g.,

2009

2009Q2

200906

9

YEAR

Year

4

Numeric

e.g., 2009

10

QUARTER

Quarter

1

Numeric

e.g., 2

11

MONTH

Month

2

String /

Numeric

e.g., 06 (includes leading zeros)

12

SUPPRESSED

Indicator for Value

Suppression

1

Numeric

1 = Suppressed

0 = Not Suppressed

13

VALUE1

Values Weighted

by Number of

Loans

10

Numeric

All Statistics/Aggregates are

weighted by the number of

mortgages at the end of the

quarter

14

VALUE2

Values Weighted

by Dollar Loan

Volume

(New Residential

Mortgage

Originations and

Outstanding

Mortgages Data

Only)

10

Numeric

Origination Statistics/Aggregates

are weighted by the value of

the origination loan amount

Outstanding Mortgage

Statistics/Aggregates are

weighted by the value of the

unpaid principal balance

(UPB) of the mortgage as of

the end of the quarter

NMDB

®

Mortgage Statistics Technical Notes

The NMDB

®

is a de-identified loan-level database of closed-end first-lien residential mortgages. It is

representative of the residential mortgage market as a whole; contains detailed, loan-level information on

the terms and performance of residential mortgages, as well as characteristics of the associated borrowers

and properties; and is continually updated. The core data in NMDB represent a statistically valid 1-in-20

random sample of all closed-end, first-lien mortgages active since January 1998 and reported to one of the

three national credit bureaus.

1

A complete description of the NMDB is available in the NMDB Technical

Documentation at www.fhfa.gov/nmdbdata.

1

While the NMDB provides an excellent and comprehensive representation of mortgages for owner-occupied and

site-built homes, investor mortgages and mortgages for manufactured homes are not as well represented. This is

because mortgages taken out by non-persons are not reported to the credit bureaus by servicers and loans for

manufactured homes are not well-defined in the credit bureau reporting standards.

4

When the NMDB program began, an initial sample was drawn from all mortgage files outstanding at any

point from January 1998 through June 2012. Since then, the sample has been updated on a quarterly basis

with mortgages newly reported to Experian. Mortgages (and their borrowers) are tracked in NMDB from

at least one year prior to origination to one year after termination of the mortgage, whether that

termination is through prepayment, adverse termination, or maturity.

The sample used is large enough to support almost all types of statistically valid analyses but small

enough to manage logistically, thus dramatically reducing both contract and personnel costs. The

restriction of the NMDB frame to closed-end loans was made for two reasons. First, it mimics the

reporting requirements of the Home Mortgage Disclosure Act (HMDA) and second, it reflects the

practical fact that administrative data, which is a critical input for the NMDB data, is available for very

few open-ended loans.

To make core statistics available to the general public, FHFA is producing a series of aggregated data

files. These files contain statistics aggregated by year, quarter, and month. State level data are available in

the annual data files. Nationwide, Census Region and Census Division aggregates are available in all

three time dimension aggregations. The aggregated statistics are also provided for various submarkets in

addition to the single-family mortgage market as a whole. The defined submarkets are shown in Figure 1

and described in Appendix A. Information on the geographic areas included in the datasets is provided in

Appendix E.

Figure 1.

Mortgage Market

*

All Mortgages

Conforming Market

Jumbo Market

Government

**

/ Non-Conventional

Conventional Conforming Market

Enterprise Acquired

***

Other Conforming Market

Other Conventional Market

Conventional Market

*The NMDB includes mortgage originations from all 50 states and the District of Columbia. The NMDB is based on the first-lien, closed-end

mortgages reported to one of three major credit bureaus. The NMDB is a 5% sample and not a census of the mortgage universe.

**Government loans includes loans issued by the Federal Housing Administration (FHA), U.S. Department of Veterans Affairs (VA), and the

Rural Housing Rural Housing Service (RHS) of the U.S. Department of Agriculture (USDA).

***Enterprise acquired loans include loans acquired by either Fannie Mae or Freddie Mac.

Since the NMDB is based on a 5 percent sample, aggregated data in small cells are not statistically

reliable. Also, there may be privacy concerns when statistics are based on few observations. Therefore,

aggregated statistics are suppressed when they are based on fewer than 3 loans. Suppressed data are

indicated by the SUPPRESSED field.

New Residential Mortgage Statistics

New originations are mortgage loans that are initially funded, as determined by the account opening date.

They are categorized as home purchase (purchase money) mortgages or refinance mortgages. These

datasets include two analysis variables, VALUE1 and VALUE2. VALUE1 statistics are weighted based

on mortgage counts, where each sample mortgage represents 20 actual mortgages. VALUE2 statistics are

weighted by the origination loan amount of the mortgage.

Appendix B describes the set of aggregate statistics produced for new originations.

5

The following data sets providing aggregate statistics on new originations are available on the FHFA

website:

https://www.fhfa.gov/DataTools/Downloads/Pages/National-Mortgage-Database-Aggregate-

Data.aspx.

Nationwide and Census Areas:

nmdb-new-mortgage-statistics-national-census-areas-annual.csv

nmdb-new-mortgage-statistics-national-census-areas-quarterly.csv

nmdb-new-mortgage-statistics-national-census-areas-monthly.csv

State Level data:

nmdb-new-mortgage-statistics-states-annual.csv

All Geographic Delineations (large file):

nmdb-new-mortgage-statistics-all-annual.csv

Outstanding Residential Mortgage Statistics

Outstanding mortgage statistics are a stock measure of active mortgages taken at the end of each calendar

quarter when the NMDB is updated. Current active mortgages are equal to previous active mortgages

plus new originations less mortgages that are paid off or otherwise terminated. These datasets include two

analysis variables, VALUE1 and VALUE2. VALUE1 statistics are weighted based on mortgage counts,

where each sample mortgage represents 20 actual mortgages. VALUE2 statistics are weighted by the

amount of each mortgage’s unpaid principal balance (UPB) at the end of the indicated quarter.

Appendix C describes the set of aggregate statistics produced for outstanding mortgages.

The following data sets providing aggregate statistics on active mortgages are available on the FHFA

website:

https://www.fhfa.gov/DataTools/Downloads/Pages/National-Mortgage-Database-Aggregate-

Data.aspx.

Nationwide and Census Areas:

nmdb-outstanding-mortgage-statistics-national-census-areas-quarterly.csv

State Level data:

nmdb-outstanding-mortgage-statistics-state-quarterly.csv

All Geographic Delineations (large file):

nmdb-outstanding-mortgage-statistics-all-quarterly.csv

Residential Mortgage Performance Statistics

The NMDB data show three mutually exclusive performance categories: a) 30 or 60 days past due date, b)

90 to 180 days past due date, and c) in the process of foreclosure, bankruptcy, or deed-in-lieu. The data

reflect performance in the last month of each quarter. In addition, a new series has been added to provide

6

the forbearance rate beginning with the fourth quarter of 2019. Performance and forbearance rates are

calculated on only active loans starting the quarter after origination to the quarter before termination.

2

The NMDB Mortgage Performance Statistics show the payment past due status of a representative sample

of first lien closed-end mortgages as reported in consumers’ credit reports. Servicers and lenders

generally report loan payment status only once a month. However, past due status as legally reported to

the credit bureau is determined strictly by the number of calendar days that a payment is past due, e.g., 30,

60, 90, etc. For example, in a credit report, a missed April (first of the month) payment after a prompt

March payment does not appear as 30 days past due until May 2nd and thus will not be reflected in

servicer reports before that date. The CARES Act, passed March 28, 2020, presents another reporting

issue. Under the CARES Act, when forbearance is granted to current loans, they must be subsequently

reported as current regardless of whether or not payments are made. Finally, although most servicers

report loan performance monthly (about 97 percent) a small number do not. This can happen because

loans are in dispute, the servicer only reports on a quarterly basis, or for some seriously past due loans

there is no change in status. The NMDB statistics accommodate this issue with a “stale account rule”

similar to those embedded in credit scores. Monthly statistics reflect the most recent report status for a

loan within three months even when it is not reported in the current month. The most recent report within

24 months is used for mortgages 180 days or more past due and mortgages in the process of foreclosure,

bankruptcy, or deed-in-lieu.

These factors mean that the monthly NMDB statistics may not strictly align with other performance

metrics which determine past due status on a monthly basis, treat non-payments for loans under

forbearance differently or use different stale account rules. Historically, lenders have granted forbearance

to loans in areas hit by natural disasters. In the aftermath of Hurricane Katrina, for example, loans in

Louisiana showed no increase in delinquency despite the fact that many borrowers were not making

payments. Also, in rare cases, the foreclosure process can be drawn out longer than two years in states

with judicial foreclosure rules like New Jersey, Connecticut and Florida, and particularly during the

mortgage crisis. In these cases, the two-year stale account rule could actually reduce delinquency

measures.

Due to the time lag in the reporting of new mortgages to the credit bureaus (up to 6 months), performance

statistics reported in the latest two quarters should be treated as preliminary estimates that may be revised

in the future as the reporting gap closes. Generally, initial estimates of delinquency and forbearance are

higher than the revised numbers. During periods of higher-than-normal origination activity in the

mortgage market, the effect of the reporting lag could be more acute.

The following data sets providing aggregate statistics on mortgage performance are available on the

FHFA website:

https://www.fhfa.gov/DataTools/Downloads/Pages/National-Mortgage-Database-

Aggregate-Data.aspx (See Appendix B for descriptions of series elements and other definitions and

notes.)

Nationwide and Census Areas:

nmdb-performance-statistics-national-census-areas-quarterly.csv

2

Active loans are loans that are not closed or terminated for which there exists performance data. Termination

means the trade line is closed, whether through a mortgage refinance or the balance was otherwise paid off or

settled. The NMDB is based on a 5 percent nationally representative sample of first-lien, closed-end mortgages

reported to one of the three major credit bureaus. While the NMDB provides an excellent and comprehensive

representation of mortgages for owner-occupied and site-built homes, investor mortgages and mortgages for

manufactured homes are not as well represented because mortgages taken out by non-persons are not reported to the

credit bureaus and loans for manufactured homes are not well-defined in reporting to the credit bureaus.

7

State Level data:

nmdb-performance-statistics-state-quarterly.csv

Metro Area Level data:

nmdb-performance-statistics-metro-quarterly.csv

All Geographic Delineations (large file):

nmdb-performance-statistics-all-quarterly.csv

8

Appendix A

Market Definitions

CATEGORY

Market Definition

All Mortgages

All single-family mortgage originations from

NMDB. Coverage includes all 50 States and the

District of Columbia (5% sample of credit reports)

All Mortgages (Home Purchase)

Subset of All Mortgages, includes only home

purchase (purchase money) loan originations

All Mortgages (Refinance)

Subset of All Mortgages, includes only refinance

loan originations

Conventional Market

Subset of All Mortgages, includes all non-

government insured/guaranteed/direct loans

Conventional Market (Home Purchase)

Subset of Conventional Market, includes only

home purchase (purchase money) loan

originations

Conventional Market (Refinance)

Subset of Conventional Market, includes only

refinance loan originations

Conforming Market

Subset of All Mortgages, includes all loans at or

below the applicable FHFA conforming loan limit

(adjusted for number of units)**

Conforming Market (Home Purchase)

Subset of Conforming Market, includes only home

purchase (purchase money) loan originations

Conforming Market (Refinance)

Subset of Conforming Market, includes only

refinance loan originations

Conventional Conforming Market

Subset of All Mortgages, includes all non-

government insured/guaranteed/ direct loans at

or below the applicable conforming loan limit

(adjusted for number of units)

Conventional Conforming Market (Home

Purchase)

Subset of Conventional Conforming Market,

includes only home purchase (purchase money)

loan originations

Conventional Conforming Market (Refinance)

Subset of Conventional Conforming Market,

includes only refinance loan originations

(Continued)

9

Market Definitions (Continued)

CATEGORY

Market Definition

Enterprise Acquisitions

Subset of All Mortgages, includes all Enterprise

(i.e., Fannie Mae and Freddie Mac) acquired loans

(that are not guaranteed by a government agency)

Enterprise Acquisitions (Home Purchase)

Subset of Enterprise Acquisitions, includes only

home purchase (purchase money) loan

originations

Enterprise Acquisitions (Refinance)

Subset of Enterprise Acquisitions, includes only

refinance loan originations

Government / Non-Conventional

Subset of All Mortgages, includes all government

insured/guaranteed/direct loans

Government (Home Purchase)

Subset of Government / Non-Conventional,

includes only home purchase (purchase money)

loan originations

Government (Refinance)

Subset of Government / Non-Conventional,

includes only refinance loan originations

Other Conventional Market

Subset of All Mortgages, includes other

conventional loans after government

insured/guaranteed/direct loans and Enterprise

acquired loans are removed. Includes loans in the

Federal Home Loan Bank Acquired Member Assets

program, Credit Union, loans in private label

mortgage pools and other portfolio held loans.

(Includes the jumbo mortgage market)

Other Conventional Market (Home Purchase)

Subset of Other Conventional Market, includes

only home purchase (purchase money) loan

originations

Other Conventional Market (Refinance)

Subset of Other Conventional Market, includes

only refinance loan originations

(Continued)

10

Market Definitions (Continued)

CATEGORY

Market Definition

Other Conforming Market

Subset of All Mortgages, other conventional

conforming loans after government

insured/guaranteed/direct loans, Enterprise

acquired loans and jumbo loans are removed.

Includes loans in the Federal Home Loan Bank

Acquired Member Assets program, Credit Union

and other portfolio held loans

Other Conforming Market (Home Purchase)

Subset of Other Conforming Market, includes only

home purchase (purchase money) loan

originations

Other Conforming Market (Refinance)

Subset of Other Conforming Market, includes only

refinance loan originations

Jumbo Market

Subset of All Mortgages, includes all loans above

the applicable FHFA conforming loan limit

(adjusted for number of units)

Jumbo Market (Home Purchase)

Subset of Jumbo Market, includes only home

purchase (purchase money) loan originations

Jumbo Market (Refinance)

Subset of Jumbo Market, includes only refinance

loan originations

*The NMDB is based on the first-lien, closed-end mortgages reported to one of three major credit bureaus. The

NMDB is a 5% sample and not a census of the mortgage universe.

** The conforming loan limit is the location determined maximum loan amount that can be acquired by Fannie

Mae or Freddie Mac.

11

Appendix B

Statistics for New Residential Mortgages

Series Descriptions SERIESID Notes

Number of Originations (1,000s) TOT_ORIG

VALUE1: 1,000s of originations

VALUE2: Millions of dollars ($)

Average Loan Amount (1,000 $) AVE_LOANAMT Rounded to nearest $1,000

Average Initial Required Loan Payment after Origination AVE_PAYMENT Rounded to nearest dollar ($)

Average Purchase Price or Appraised Value (1,000 $) AVE_PROPVAL Rounded to nearest $1,000

Average Contract Rate

AVE_INTRATE

Interest rate at time of origination

Percent Share Owner-Occupied Property PCT_OWNOCC

Share of originations where the property is

owner-occupied

Home

Purchase

Originations

Percent

Share

First-Time Homebuyer Loans* PCT_FTHB

Any of the borrowers is a first-time home

purchase

Repeat Homebuyer Loans PCT_REPEATHB

None of the borrowers is a first-time

homebuyer

All Home Purchase Loans PCT_HP Purpose of the loan is to purchase a home

Refinance

Originations

Percent

Share

Cashout Refinance Loans** PCT_CASHOUT

Purpose of the loan is to access equity

through a refinance

Rate and Term Refinance Loans PCT_OTH_REFI

None of the loans are cashout refinances

(purpose of the loan is to take advantage of

favorable rates and/or term through a

refinance)

All Refinance Loans PCT_REFI

Purpose of the loan is to refinance an existing

mortgage

Mortgage

Terms

Average Term to Maturity (Yrs.)

AVE_TERM

Term to maturity at time of origination

Percent

Share by

Term

Adjustable-Rate Mortgages PCT_ARM Adjustable-rate mortgage

15-Year Fixed Rate Mortgages PCT_TERM_FRM_15

Fixed rate mortgage where term to maturity is

less than or equal to 15 years

20- and 30-Year Fixed Rate

Mortgages

PCT_TERM_FRM_30

Fixed rate mortgage where term to maturity is

greater than 15 years

Back-End

Debt-to-

Income

Ratio

Average DTI AVE_DTI Average back-end debt-to-income ratio

Percent

Share by

DTI

Less Than or Equal To 36 PCT_DTI_LE36 Debt-to-income ratio at or below 36%

More than 36 To 43

PCT_DTI_3743

Debt-to-income ratio between 36.1 and 43%

Greater Than 43 PCT_DTI_GE44 Debt-to-income ratio above 43%

All

Borrowers'

Credit Score

Average Loan Credit Score AVE_VANTAGESCR

Average VantageScore® Version 3.0 of all

borrowers

Percent

Share of

Loans by

Borrowers'

Credit

Score***

Very Poor Credit PCT_VS_VERYPOOR Average borrower VantageScore is 300-499

Poor Credit PCT_VS_POOR Average borrower VantageScore is 500-600

Fair Credit

PCT_VS_FAIR

Average borrower VantageScore is 601-660

Good Credit PCT_VS_GOOD Average borrower VantageScore is 661-780

Excellent Credit PCT_VS_EXCELLENT Average borrower VantageScore is 781-850

Loan-to-

Value

Average

Loan-to-Value AVE_LTV Loan-to-value based on first lien mortgage

Combined Loan-to-Value AVE_CLTV

Loan-to-value based on first and

contemporaneous subordinate liens mortgage

Percent

Share by

CLTV

70.0% or Less PCT_CLTV_LE70

Combined Loan-to-value (CLTV) at or below

70%

70.1 - 80.0%

PCT_CLTV_7080

Combined Loan-to-value between 70 and 80%

80.1 - 90.0% PCT_CLTV_8090 Combined Loan-to-value between 80 and 90%

90.1 - 95.0% PCT_CLTV_9095 Combined Loan-to-value between 90 and 95%

95.1 - 97.0% PCT_CLTV_9597 Combined Loan-to-value between 95 and 97%

Greater Than 97.0% PCT_CLTV_GT97 Combined Loan-to-value greater than 97%

(Continued)

12

Statistics for New Residential Mortgages (Continued)

Series Descriptions

SERIES

Notes

Percent Market Share

Government PCT_GOVERNMENT

Government insured/guaranteed/direct

loans

Enterprise PCT_ENTERPRISE

Non-government loans acquired by an

enterprise

Other Conforming (Portfolio) PCT_OTHERCONFORMING

Non-government, non-enterprise

conforming loans

Jumbo Market PCT_NONCONFORMING Loans above the conforming loan limit

Percent Share of Loans by

All Borrowers’ Race

All White alone PCT_WHT All borrowers are White

All Black or African American

alone

PCT_BLK All borrowers are Black or African American

All Asian alone

PCT_ASN

All borrowers are only Asian

All Native Hawaiian and Other

Pacific Islander alone

PCT_HPI

All borrowers are Hawaiian or Pacific

Islander

All American Indian and Alaska

Native alone

PCT_AMI

All borrowers are American Indian or Alaska

Native

Multiple races PCT_MIX

(a) One or more borrowers reported more

than once race, or (b) where each borrower

reported one race, but the borrowers were

from different races

Percent Share of Loans by

All Borrowers’ Ethnicity

All Hispanic or Latino PCT_HIS

All borrowers are Hispanic or Latino

(including single borrower) who may be or

any race

At least one Hispanic or Latino PCT_HSP

One borrower is Hispanic or Latino (among

two or more borrowers) who may be of any

race

All White alone, not Hispanic or

Latino

PCT_WNH

All borrowers are White and not Hispanic or

Latino

Multiple races or race other

than White, not Hispanic or

Latino

PCT_MNH

All borrowers are not Hispanic or Latino and

(a) one or more borrowers reported more

than once race, or (b) where each borrower

reported one race, but all the borrowers

were of race other than White

All

Borrowers'

Ages

Average Age

AVE_AGE_BORROWER

Average age of all borrowers

Percent

Share of

Loans by

Age

Less Than 25 PCT_AGE_LT25 Average borrower age is less than 25

25 to 34 PCT_AGE_2534 Average borrower age is 25 to 34

35 to 44 PCT_AGE_3544 Average borrower age is 35 to 44

45 to 54

PCT_AGE_4554

Average borrower age is 45 to 54

55 to 64 PCT_AGE_5564 Average borrower age is 55 to 64

At Least 65 PCT_AGE_GE65 Average borrower age is at least 65

Percent Share by Number

of Borrowers and Gender

Single Borrower - Male PCT_MALEBOR One borrower and that borrower is male

Single Borrower - Female

PCT_FEMALEBOR

One borrower and that borrower is female

Two Borrowers PCT_TWOBOR Two borrowers

More Than Two Borrowers PCT_MULTIBOR More than two borrowers

*First-time homebuyer is determined by reviewing the credit data of every borrower for prior mortgages. When no prior mortgage is found

for the borrower, that borrower is defined as a first-time homebuyer. If any borrower associated with a loan is a first-time homebuyer, that

loan is defined as a first-time homebuyer loan.

**Cashout refinance is defined as when the new first lien amount plus any second lien amounts is more than five percent above the

previous first and second liens’ Unpaid Principal Balance (UPB), at the time of the refinance, added together.

***https://www.experian.com/blogs/ask-experian/credit-education/score-basics/what-is-a-good-credit-score

13

Appendix C

Statistics for Residential Mortgages Active as of the End of the Quarter

Series Descriptions SERIESID Notes

Outstanding (Active) Loans TOT_LOANS

VALUE1: 1,000s of mortgages

VALUE2: Billions of dollars ($)

Percent Share of Loans by Geography PCT_LOANS

Number of outstanding loans in the

geography divided by total Nationwide

outstanding loans

Origination Loan Volume ($ Bil.) TOT_LOANAMT

Total Loan Volume at Origination (billions

of dollars ($), VALUE1 only)

Median Monthly Payment MED_PAYMENT

Median principal, interest and escrow

(where applicable) payment for the month

ending the quarter (VALUE1 only)

Average Monthly Payment AVE_PAYMENT

Average principal, interest and escrow

(where applicable) payment for the month

ending the quarter (VALUE1 only)

Mark-to-Market

Loan-to-Value*

Average

AVE_MTMLTV

Average mark-to-market loan-to-value*

Percent Share by

LTV

Less Than or Equal to

60%

PCT_MTMLTV_LE60

Mark-to-market loan-to-value (LTV) at or

below 60%

60.1 - 70.0% PCT_MTMLTV_61_70

Mark-to-market loan-to-value between 60

and 70%

70.1 - 80.0% PCT_MTMLTV_71_80

Mark-to-market loan-to-value between 70

and 80%

80.1 - 90.0% PCT_MTMLTV_81_90

Mark-to-market loan-to-value between 80

and 90%

90.1 - 100% PCT_MTMLTV_91_100

Mark-to-market loan-to-value between 90

and 100%

Greater Than 100% PCT_MTMLTV_GT100

Mark-to-market loan-to-value greater

than 100%

Contract Interest

Rate at

Origination

Average AVE_INTRATE

Average interest rate at time of

origination

Percent Share by

Interest Rate

Less Than 3% PCT_INTRATE_LT_3

Contract interest rate below 3 percent

3.00 – 3.99% PCT_INTRATE_3_4

Contract interest rate between 3 and 4

percent

4.00 – 4.99% PCT_INTRATE_4_5

Contract interest rate between 4 and 5

percent

5.00 – 5.99% PCT_INTRATE_5_6

Contract interest rate between 5 and 6

percent

Greater Than or Equal to

6%

PCT_INTRATE_GE_6

Contract interest rate at or greater than 6

percent

Mortgage Term

Adjustable Rate

Mortgages

Originated Less Than or

Equal to 4 Years Ago

PCT_TERM_ARM_1_4

Adjustable Rate Mortgages (ARMs) that

were originated within the prior 4 years

Originated More than 4

Years Ago

PCT_TERM_ARM_5PL

Adjustable Rate Mortgages (ARMs) that

were originated more than 4 years ago

Fixed Rate

Mortgages

Term of 15 Year or Less PCT_TERM_FRM_15

Fixed Rate Mortgages (FRMs) with a term

less than or equal to 15 years (primarily 15

year mortgages)

Term of More than 15

Years

PCT_TERM_FRM_30

Fixed Rate Mortgages (FRMs) with a term

of more than 15 years (primarily 20 and 30

year mortgages)

(Continued)

14

Statistics for Residential Mortgages Active as of the End of the Quarter (Continued)

Series Descriptions

SERIESID

Notes

Credit Score at

Current

Quarter**

Average AVE_VANTAGESCR

Average VantageScore® Version 3.0 of all

borrowers

Percent Share of

Loans by

Borrowers' Credit

Score

Very Poor Credit PCT_VS_VERYPOOR

Average borrower VantageScore is 300-

499

Poor Credit PCT_VS_POOR

Average borrower VantageScore is 500-

600

Fair Credit PCT_VS_FAIR

Average borrower VantageScore is 601-

660

Good Credit PCT_VS_GOOD

Average borrower VantageScore is 661-

780

Excellent Credit PCT_VS_EXCELLENT

Average borrower VantageScore is 781-

850

Age of Mortgage

Loan

Average (Months) AVE_AGE_LOAN

Average number of months since loan

was originated

Percent Share by

Age

Less Than or Equal to 4

Years

PCT_TENURE_1_4

Share of outstanding loans that were

originated within 4 years

4.01 – 7.00 Years PCT_TENURE_5_7

Share of outstanding loans that were

originated 4.01 – 7.00 years ago

7.01 – 10.00 Years PCT_TENURE_8_10

Share of outstanding loans that were

originated 7.01 – 10.00 years ago

Greater Than 10 Years PCT_TENURE_11PL

Share of outstanding loans that were

originated more than 10 years ago

Percent Market Share

Government PCT_G0VERNMENT

Government insured/guaranteed/direct

loans

Enterprise PCT_ENTERPRISE

Non-government loans acquired by an

Enterprise

Other Conventional PCT_OTHER

Non-government, non-enterprise loans,

includes jumbo market

*Mark-to-market loan-to-value = current unpaid principal balance / ((origination property value / origination HPI) X current HPI)

**https://www.experian.com/blogs/ask-experian/credit-education/score-basics/what-is-a-good-credit-score

15

Appendix D

Residential Mortgage Performance Statistics, as of the End of the Quarter

Series Descriptions

SERIESID

Notes

Percent 30 or 60 Days

Past Due Date

PD3060

Number of active loans at least 30 or 60 days past due

date (subject to the stale account rule) at the end of the

quarter, divided by all active loans at the end of the

quarter.

Percent 90 to 180 Days

Past Due Date

PD90180

Number of active loans at active least 90, 120, 150 or

180 days past due data (subject to the stale account

rule) at the end of the quarter, divided by all active loans

at the end of the quarter.

Percent in the Process

of Foreclosure,

Bankruptcy, or Deed in

Lieu

FBD

Number of active loans in the process of foreclosure,

bankruptcy or deed in lieu (subject to the stale account

rule) at the end of the quarter, divided by all active loans

at the end of the quarter.

Percent in Forbearance

FBR

Number of active loans indicated as being in forbearance

at the end of the quarter, divided by all active loans at

the end of the quarter.

16

Residential Mortgage Performance Statistics Notes

Notes

Descriptions

Active Loans

Mortgage loans that are not closed or terminated for which there

exists performance data.

Loans Recently Originated

It may take months for newly originated loans to appear in the credit

history. Even though the performance classification is missing, these

loans are treated as current until a valid performance code is found

and are included in the denominator.

Timing of Reported Loan

Performance

Application of Metro2® credit bureau reporting guidelines can affect

the timing of the reporting of loan performance status, particularly for

those servicers that report at the end of a calendar month.

Credit History Suppression

Credit history of an individual is suppressed when the individual

disputes his or her credit report. Credit histories of individuals affected

by federally declared natural disasters are also suppressed in the

affected regions and time periods.

Credit Purge Seven Years

After Default

Per Fair Credit Reporting Act (FCRA) rules, credit history of a loan is

purged seven years after the loan first goes into default. To create the

historical NMDB, two credit bureau archives were used: the first

archive was obtained at the end of December 2005, and the second

archive was obtained six and half years later at the end of June 2012.

Reconciliation of the two archives was done carefully. However, as a

result of the FCRA rules, a number of loans that were in a state of past

due at the end of 2005 had been purged from the credit bureau data in

the June 2012 archive. Through a limited matching of loan records to

intermediate archives, the dissolution of many of these loans were

resolved. However, NMDB has some undercounting of seriously past

due loans from 2006 to 2012, but the undercounting diminishes the

closer the time period is to the end of 2012.

17

Additional Residential Mortgage Performance Statistics Concepts

Concept

Definition

Days Past Due

The percent days past due in the Table tab reflect what a person sees

when they request a credit report. The days past due follow the Metro

2® credit bureau reporting guidelines, such that loans are classified as

current or past due 29 or fewer days; 30 to 59 days past due; 60 to 89

days past due; 90 to 119 days past due; 120 to 149 days past due; 150

to 179 days past due; and 180 or more days past due. For more

information on alternative measures of mortgage performance, see

National Mortgage Database Technical Report 1.2

, October 30, 2017.

Stale Account Rule

For loan performance and forbearance status beginning 2012, a three-

month stale account rule is used, i.e., if a quarter-ending performance

code is missing, the stale account rule requires looking back month by

month up to two months until an actual performance code is recorded

and that performance code is applied to the current month. For loan

performance prior to 2012, a six-month stale account rule is used.

Additionally, a 24-month rule is applied to loans that are 180 or more

days past due or in the process of foreclosure, bankruptcy, or deed in

lieu.

Reporting Lag and Rapidly

Changing Mortgage

Volumes

Due to the time lag in the reporting of new mortgages to the credit

bureaus (up to 6 months), performance statistics reported in the latest

two quarters should be treated as preliminary estimates that may be

revised in the future as the reporting gap closes. Generally initial

estimates of delinquency are higher than the revised numbers. During

periods of higher-than-normal origination activity in the mortgage

market, the effect of the reporting lag could be more acute.

18

Appendix E

Names of Geography: National and Rural / Non-Rural

Area

Description

United States

50 States and the District of Columbia

United States, Rural Area

Includes all census tracts defined as rural by FHFA's Duty to Serve

regulation.

3

United States, Non-Rural

Area

Includes all other census tracts—i.e., those that are not classified as rural

by FHFA’s Duty to Serve regulation.

Names of Geography: Census Regions, Census Divisions and States

Census

Region

Census

Division

States

Northeast

New England

Maine, New Hampshire, Vermont, Massachusetts, Rhode Island,

Connecticut

Middle Atlantic

New York, New Jersey, Pennsylvania

Midwest

East North Central

Ohio, Indiana, Illinois, Michigan, Wisconsin

West North

Central

Minnesota, Iowa, Missouri, North Dakota, South Dakota, Nebraska,

Kansas

South

South Atlantic

Delaware, Maryland, District of Columbia, Virginia, West Virginia,

North Carolina, South Carolina, Georgia, Florida

East South Central

Kentucky, Tennessee, Alabama, Mississippi

West South

Central

Arkansas, Louisiana, Oklahoma, Texas

West

Mountain

Montana, Idaho, Wyoming, Colorado, New Mexico, Arizona, Utah,

Nevada

Pacific

Washington, Oregon, California, Alaska, Hawaii

3

This includes: (1) a census tract outside of a metropolitan statistical area, as designated by the Office of

Management and Budget; or (2) a census tract in a metropolitan statistical area, as designated by the Office of

Management and Budget, that is outside of the metropolitan statistical area's Urbanized Areas as designated by the

U.S. Department of Agriculture's Rural-Urban Commuting Area Code #1, and outside of tracts with a housing

density of over 64 housing units per square mile for USDA's RUCA Code #2. Effective July 1, 2023, amendments

to the Duty to Serve regulation modify the definition of "rural area" to include all "colonia census tracts" that would

not otherwise satisfy the definition. Refer to:

https://www.fhfa.gov/DataTools/Downloads/Pages/Duty-to-Serve-

Eligibility-Data.aspx

19

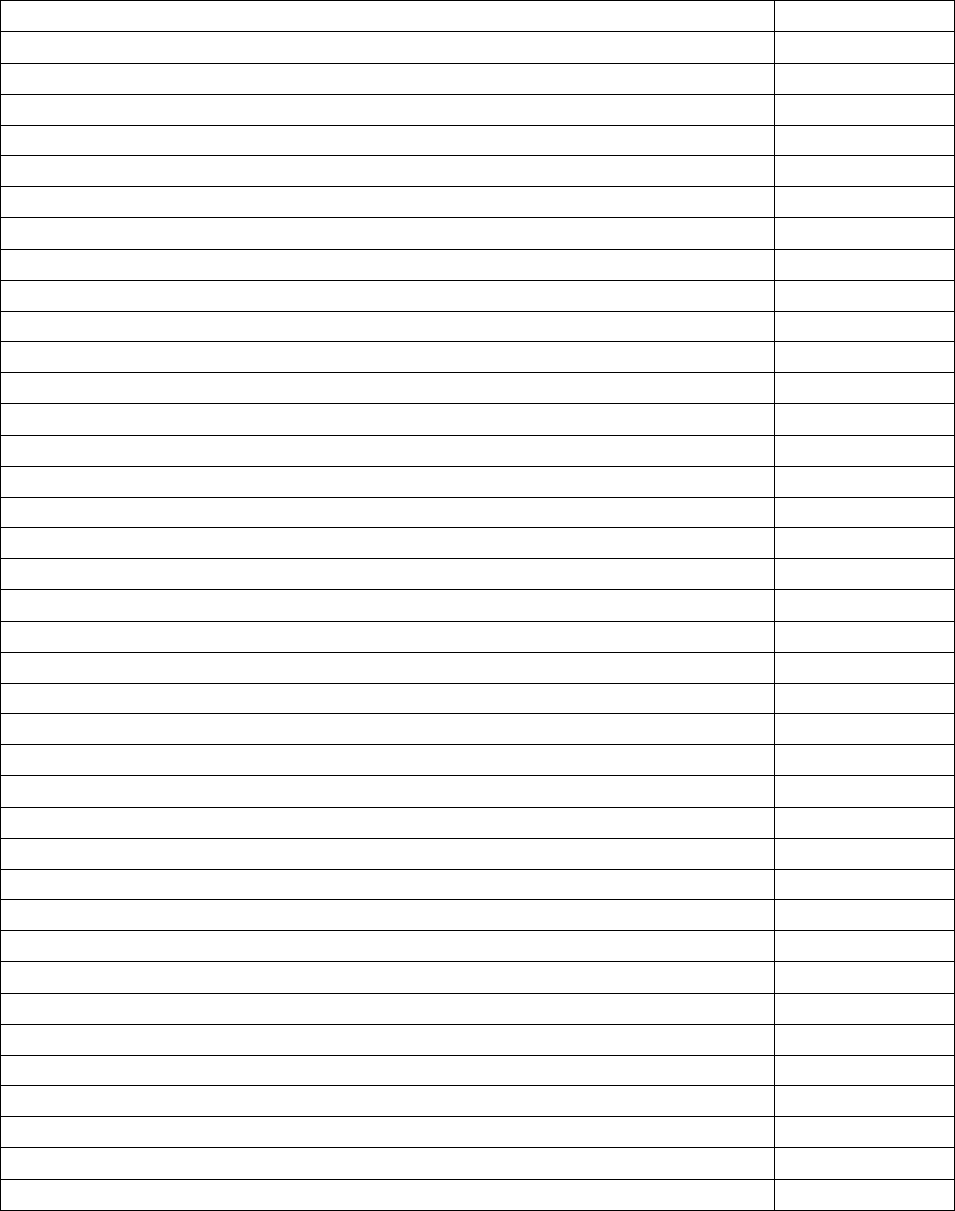

Names and Codes of Geography: States

State Name

Postal

Code

FIPS

Code

State Name

Postal

Code

FIPS

Code

Alabama

AL

01

Montana

MT

30

Alaska

AK

02

Nebraska

NE

31

Arizona

AZ

04

Nevada

NV

32

Arkansas

AR

05

New Hampshire

NH

33

California

CA

06

New Jersey

NJ

34

Colorado

CO

08

New Mexico

NM

35

Connecticut

CT

09

New York

NY

36

Delaware

DE

10

North Carolina

NC

37

District of Columbia

DC

11

North Dakota

ND

38

Florida

FL

12

Ohio

OH

39

Georgia

GA

13

Oklahoma

OK

40

Hawaii

HI

15

Oregon

OR

41

Idaho

ID

16

Pennsylvania

PA

42

Illinois

IL

17

Rhode Island

RI

44

Indiana

IN

18

South Carolina

SC

45

Iowa

IA

19

South Dakota

SD

46

Kansas

KS

20

Tennessee

TN

47

Kentucky

KY

21

Texas

TX

48

Louisiana

LA

22

Utah

UT

49

Maine

ME

23

Vermont

VT

50

Maryland

MD

24

Virginia

VA

51

Massachusetts

MA

25

Washington

WA

53

Michigan

MI

26

West Virginia

WV

54

Minnesota

MN

27

Wisconsin

WI

55

Mississippi

MS

28

Wyoming

WY

56

Missouri

MO

29

20

Names and Codes of Geography: 100 Metro Areas

Metro Area

MSA Code

Akron, OH

10420

Albany-Schenectady-Troy, NY

10580

Albuquerque, NM

10740

Allentown-Bethlehem-Easton, PA-NJ

10900

Anaheim-Santa Ana-Irvine, CA (MSAD)

11244

Atlanta-Sandy Springs-Alpharetta, GA

12060

Austin-Round Rock-Georgetown, TX

12420

Bakersfield, CA

12540

Baltimore-Columbia-Towson, MD

12580

Baton Rouge, LA

12940

Birmingham-Hoover, AL

13820

Boise City, ID

14260

Boston, MA (MSAD)

14454

Bridgeport-Stamford-Norwalk, CT

14860

Buffalo-Cheektowaga, NY

15380

Cambridge-Newton-Framingham, MA (MSAD)

15764

Camden, NJ (MSAD)

15804

Cape Coral-Fort Myers, FL

15980

Charleston-North Charleston, SC

16700

Charlotte-Concord-Gastonia, NC-SC

16740

Chicago-Naperville-Evanston, IL (MSAD)

16984

Cincinnati, OH-KY-IN

17140

Cleveland-Elyria, OH

17460

Colorado Springs, CO

17820

Columbia, SC

17900

Columbus, OH

18140

Dallas-Plano-Irving, TX (MSAD)

19124

Dayton-Kettering, OH

19430

Denver-Aurora-Lakewood, CO

19740

Detroit-Dearborn-Livonia, MI (MSAD)

19804

El Paso, TX

21340

Elgin, IL (MSAD)

20994

Fort Lauderdale-Pompano Beach-Sunrise, FL (MSAD)

22744

Fort Worth-Arlington-Grapevine, TX (MSAD)

23104

Frederick-Gaithersburg-Rockville, MD (MSAD)

23224

Fresno, CA

23420

Gary, IN (MSAD)

23844

(Continued)

21

Names and Codes of Geography: 100 Metro Areas (Continued)

Metro Area

MSA Code

Grand Rapids-Kentwood, MI

24340

Greensboro-High Point, NC

24660

Greenville-Anderson, SC

24860

Hartford-East Hartford-Middletown, CT

25540

Houston-The Woodlands-Sugar Land, TX

26420

Indianapolis-Carmel-Anderson, IN

26900

Jacksonville, FL

27260

Kansas City, MO-KS

28140

Knoxville, TN

28940

Lake County-Kenosha County, IL-WI (MSAD)

29404

Las Vegas-Henderson-Paradise, NV

29820

Little Rock-North Little Rock-Conway, AR

30780

Los Angeles-Long Beach-Glendale, CA (MSAD)

31084

Louisville/Jefferson County, KY-IN

31140

Memphis, TN-MS-AR

32820

Miami-Miami Beach-Kendall, FL (MSAD)

33124

Milwaukee-Waukesha, WI

33340

Minneapolis-St. Paul-Bloomington, MN-WI

33460

Montgomery County-Bucks County-Chester County, PA (MSAD)

33874

Nashville-Davidson--Murfreesboro--Franklin, TN

34980

Nassau County-Suffolk County, NY (MSAD)

35004

New Haven-Milford, CT

35300

New Orleans-Metairie, LA

35380

New York-Jersey City-White Plains, NY-NJ (MSAD)

35614

Newark, NJ-PA (MSAD)

35084

North Port-Sarasota-Bradenton, FL

35840

Oakland-Berkeley-Livermore, CA (MSAD)

36084

Oklahoma City, OK

36420

Omaha-Council Bluffs, NE-IA

36540

Orlando-Kissimmee-Sanford, FL

36740

Oxnard-Thousand Oaks-Ventura, CA

37100

Philadelphia, PA (MSAD)

37964

Phoenix-Mesa-Chandler, AZ

38060

Pittsburgh, PA

38300

Portland-Vancouver-Hillsboro, OR-WA

38900

Providence-Warwick, RI-MA

39300

Raleigh-Cary, NC

39580

Richmond, VA

40060

(Continued)

22

Names and Codes of Geography: 100 Metro Areas (Continued)

Metro Area

MSA Code

Riverside-San Bernardino-Ontario, CA

40140

Rochester, NY

40380

Sacramento-Roseville-Folsom, CA

40900

Salt Lake City, UT

41620

San Antonio-New Braunfels, TX

41700

San Diego-Chula Vista-Carlsbad, CA

41740

San Francisco-San Mateo-Redwood City, CA (MSAD)

41884

San Jose-Sunnyvale-Santa Clara, CA

41940

Seattle-Bellevue-Kent, WA (MSAD)

42644

St. Louis, MO-IL

41180

Stockton, CA

44700

Syracuse, NY

45060

Tacoma-Lakewood, WA (MSAD)

45104

Tampa-St. Petersburg-Clearwater, FL

45300

Tucson, AZ

46060

Tulsa, OK

46140

Urban Honolulu, HI

46520

Virginia Beach-Norfolk-Newport News, VA-NC

47260

Warren-Troy-Farmington Hills, MI (MSAD)

47664

Washington-Arlington-Alexandria, DC-VA-MD-WV (MSAD)

47894

West Palm Beach-Boca Raton-Boynton Beach, FL (MSAD)

48424

Wichita, KS

48620

Wilmington, DE-MD-NJ (MSAD)

48864

Winston-Salem, NC

49180

Worcester, MA-CT

49340