THE SMALL

B

USINESS BOOM

U

NDER THE

B

IDEN-HARRIS

ADMINISTRATION

APRIL 2022

THE

SMALL BUSINESS BOOM UNDER THE

BIDEN- HARRIS

ADMINISTRATION

i

Table of Contents

The Small Business Boom Under the Biden-Harris Administration .............................................. 1

Historic Levels of Business Creation .............................................................................................. 2

Small Businesses are Creating Jobs at the Highest Rate on Record ............................................... 3

A Day One Focus on Recovery and Growth .................................................................................. 4

Provided Millions of Americans with a Financial Lifeline Through the American Rescue Plan5

Reformed the PPP to Reach Small Businesses Left Out by the Previous Administration.......... 5

Delivered Billions in Targeted Small Business Relief Through the American Rescue Plan ...... 7

Reforming the COVID EIDL Program to Better Serve Businesses............................................ 8

Making it Easy for Small Businesses to Access Relief from the Restaurant Revitalization Fund

..................................................................................................................................................... 8

Supporting Small Businesses and Entrepreneurs During the Pandemic ......................................... 9

The Biden-Harris Administration Plan to Support Small Business Growth for Years to Come .. 11

Appendix ....................................................................................................................................... 20

THE

SMALL BUSINESS BOOM UNDER THE

BIDEN- HARRIS

ADMINISTRATION

1

The Small Business Boom Under the

Biden-Harris Administration

Through the American Rescue Plan and the equitable implementation of emergency relief

programs, President Biden and Vice President Harris fostered the strongest recovery for Main

Street on record. In 2021, Americans applied to start 5.4 million new businesses—more than 20

percent higher than any previous year on record.

The boom in new business creation has been particularly strong for entrepreneurs of color. In

2021, Hispanic Americans started new businesses at the fastest rate in more than a decade and 23

percent faster than pre-pandemic levels.

And, in the three-quarters of 2021, small businesses with fewer than 50 employees created 1.9

million jobs, the fastest start to small business job growth in any year on record.

This new White House report details the historic recovery for America’s small businesses and

demonstrates how the Biden-Harris agenda laid the foundation for this small business boom. By

focusing on combatting the pandemic, providing Americans with greater financial security, and

delivering more than $450 billion in emergency relief to small businesses, the Biden-Harris

Administration has helped create the conditions for unprecedented business and job creation.

The Biden-Harris strategy to rescue and revitalize Main Street contrasts sharply with the latest

tax plan from Republicans in Congress. The Congressional Republican proposal put forward by

Senator Rick Scott to impose a minimum tax on middle-class families would increase taxes on

small businesses across the country. In addition to detailing the historic economic progress the

Biden-Harris Administration has made to date, the Appendix includes a new state-by-state

analysis of the Congressional Republican tax plan. The analysis finds that this tax plan would

raise taxes on nearly half of small business owners (6.1 million people), including 82 percent of

small business owners making less than $50,000 per year. Under the Congressional Republicans’

plan, the typical small business owner would see their taxes increased by almost $1,200.

President Biden rejects Congressional Republicans’ plan to increase taxes on half of small

business owners. His four-pillar economic strategy for small businesses will lower costs and

level the playing field for families and small businesses. The plan is focused on:

1. Expanding access to capital,

2. Making historic investments in helping small businesses navigate available

resources,

3. Leveraging federal spending to support small businesses, and

4. Leveling the playing field for small business owners by reforming the tax code.

THE SMALL BUSINESS BOOM UNDER THE

BIDEN- HARRIS

ADMINISTRATION

2

Historic Levels of Business Creation

In 2021, Americans applied to start 5.4 million new businesses—more than 20 percent higher

than any previous year on record and more than two-thirds higher than the annual average of 3.2

million new businesses applications per year in the five years prior to the start of the pandemic.

Of these applications, roughly 1.8 million applications were for businesses that planned to hire

employees (“high-propensity applications”), an increase of more than 17% over the previous

annual record and more than 40% above the pre-pandemic average. Figure 1 below illustrates

the strong growth in new business applications in 2021 compared to pre-pandemic years.

Federal data also proves that this historic rise in new business applications is translating into

growth in the overall number of businesses.

An April 2022 analysis of the Quarterly Census of

Employment and Wages by the Economic Innovation Group found that the total number of

business establishments through the 3

rd

quarter of 2021 was 7 percent above pre-pandemic

levels. This study also found that 74 percent of all counties in the country had more business

establishments in the 3

rd

quarter of 2021 than before the pandemic. By contrast, only 44 percent

of counties had more establishments even five years after the Great Recession.

“…the

total number of business establishments through the 3rd quarter of

2021 was 7 percent above pre-pandemic levels.”

This boom in new businesses has been inclusive, as a number of studies show that new

entrepreneurship rates have increased the most among minorities. In May 2021,

a study by

Catherine Fazio, Jorge Guzman, Yupeng Lie, and Scott Stern analyzed state level business

0

1,000,000

2,000,000

3,000,000

4,000,000

5,000,000

6,000,000

Figure 1. National Business Applications

Applications High-Propensity Applications

Business applications, seasonally adjusted

Source: Business Formation Statistics

THE SMALL BUSINESS BOOM UNDER THE

BIDEN- HARRIS

ADMINISTRATION

3

registration records and found that startup formation in the wake of the COVID pandemic was

higher in areas with a higher proportion of Black residents and that this effect was magnified in

higher median income black neighborhoods. A March 2022

study from the Kauffman

Foundation found an increase in the rate of entrepreneurship amongst Blacks, Latinos, and

immigrants. The study also found that Hispanic Americans started new businesses at the fastest

rate in more than a decade and 23 percent faster than pre-pandemic levels. Hispanic Americans

were more likely to become new entrepreneurs in a given month than Americans of any or racial

or ethnic background.

“A March 2022 study from the Kauffman Foundation found an increase in

the rate of entrepreneurship amongst Blacks, Latinos, and immigrants. The

study also found that Hispanic Americans started new businesses at the

fastest rate in more than a decade and 23 percent faster than pre-pandemic

levels. Hispanic Americans were more likely to become new entrepreneurs in

a given month than Americans of any or racial or ethnic background.”

The record levels of Americans starting new businesses in 2021 is likely to enhance productivity

in the years to come. New entrants make a significant contribution to

overall productivity

growth, as entrants and young establishments are more productive than more established

companies or ones that go out of business. Research also suggests that young firms tend to have

higher labor productivity growth during their first 5-10 years. Higher productivity means that

the economy can produce – and consume – more goods and services for the same amount of

work, and is an important determinant of a country’s standard of living.

“The record levels of Americans starting new businesses in 2021 is likely to

enhance productivity in the years to come.”

Small Businesses are Creating Jobs at the

Highest Rate on Record

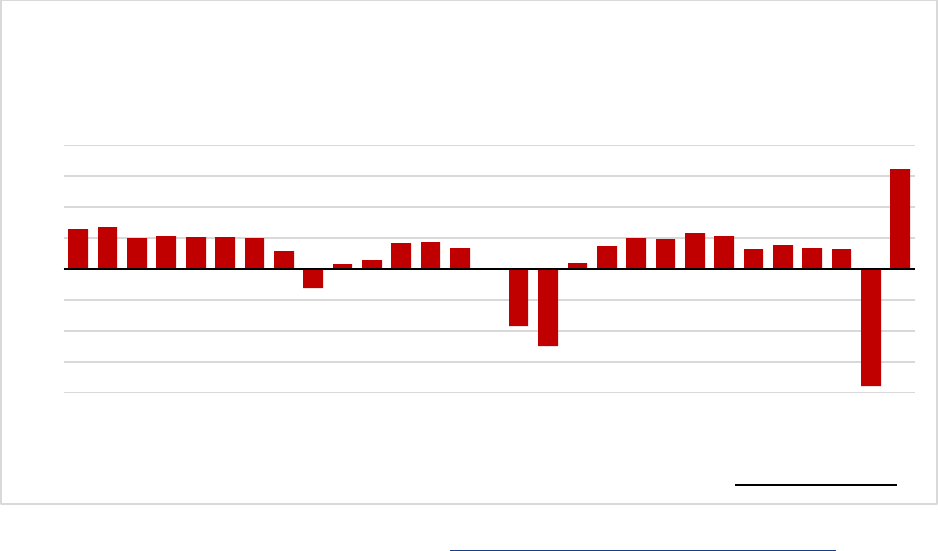

Under the Biden-Harris Administration, small businesses are creating jobs. In the first three

quarters of 2021, small businesses with less than 50 employees created 1.9 million jobs, the

fastest 9-month start to small business growth in any year on record. These 1.9 million jobs

represented 49% of net job growth across firms of all sizes over that period, the second highest

share on record.

THE SMALL BUSINESS BOOM UNDER THE

BIDEN- HARRIS

ADMINISTRATION

4

This is consistent with the January results of a leading survey of small business owners, which

found that the share of small businesses planning to create new jobs in the next three months was

higher than it ever was at any point during the previous Administration, and just 6 points below

the highest reading in the 48-year history of the survey set in August.

A Day One Focus on Recovery and Growth

This historic boom in entrepreneurship is no accident. By focusing on combatting the pandemic,

providing millions of Americans with financial security, and delivering hundreds of billions in

equitable emergency relief to small businesses, the Biden-Harris Administration helped create

the conditions for new business creation. When the Biden-Harris Administration first entered

office, small businesses faced major headwinds. Hundreds of thousands had closed over the

course of the pandemic, the unemployment rate was at 6.4%, and millions of workers remained

out of the workforce. Only two million Americans had received vaccines against COVID-19 and

the Federal government had no strategy to distribute them. While Congress had appropriated

billions in small business relief in 2020, mom-and-pop businesses and those owned by minorities

and women had too often been shut out of earlier relief efforts because of the prior

administration’s design and implementation of relief programs.

The Biden-Harris Administration took all of these challenges head on, passing the American

Rescue Plan, and reforming the two major small business relief programs: the Paycheck

Protection Program (PPP) and COVID Economic Injury Disaster Loan (EIDL) Program. These

actions helped preserve financial stability for millions of Americans and power historic rates of

economic growth and job creation, all of which have encouraged more and more Americans to

start businesses.

-800

-600

-400

-200

0

200

400

600

800

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021*

Figure 2. Average quarterly net change in private sector jobs at firms

with fewer than 50 employees.

Average quarterly net employment change, thousands, seasonally adjusted.

Notes and Sources: National Business Employment Dynamics (BLS), CEA. *Through Q3 of 2021

THE SMALL BUSINESS BOOM UNDER THE

BIDEN- HARRIS

ADMINISTRATION

5

Provided Millions of Americans with a Financial Lifeline

Through the American Rescue Plan

By betting on themselves to start their own business, entrepreneurs are also making a statement

about their optimism about the economy. Through the American Rescue Plan, the Biden-Harris

Administration created the conditions for an entrepreneur-driven recovery by expanding access

to COVID-19 vaccines and testing, preventing evictions and foreclosures, stabilizing the child

care industry and helping schools to safely reopen, protecting the financial stability of millions of

Americans, lifting historic numbers of children out of poverty, and protecting access to health

care. Even with the challenges posed by the Delta and Omicron variants, supports from the

American Rescue Plan helped power a historic and durable economic recovery that helped

prevent untold hardship and protect livelihoods.

Through the American Rescue Plan, the Biden-Harris Administration supported Americans

through the following:

R

EACHED MORE THAN 85% OF ALL AMERICANS WIT H $1,400 PER PERSON ECONOMIC

IMPACT PAYMENTS

THROUGH THE FIRST-EVER MONTHLY CHILD TAX CREDIT PAYMENTS, PROVIDED SUPPORT

TO THE FAMILIES OF MORE THAN

60 MILLION CHILDREN

CUT THE COST OF HEALTH INSURANCE PREMIUMS BY AN AVERAGE OF 50% FOR

14.5

MILLION AMERICANS

Studies by numerous economists

have found that these economic support programs have left

most Americans on a stronger financial footing, giving them the economic security they need to

consider starting a new business.

A May 2021 study of growth in Black entrepreneurship found

a link between Federal relief payments and new business license applications, strongly

suggesting that the supports contained in the American Rescue Plan were a key driver of the

nation’s boom in small business creation.

Reformed the PPP to Reach Small Businesses Left Out

by the Previous Administration

Within weeks of taking office, the White House and Small Business Administration (SBA)

announced a number of policy changes to target the PPP to the smallest businesses and to

companies that have been left behind in previous relief efforts. PPP’s initial round of roughly

$350 billion was depleted after two weeks in April 2020, raising concerns that women-and-

minority-owned businesses were unable to equitably access relief. A

Government

Accountability Office (GAO) analysis found that the first round of funding disproportionately

benefited larger businesses. The House Select Subcommittee on the Coronavirus Crisis found

that the prior Administration encouraged banks to limit their PPP lending to existing customers,

which ultimately excluded many minority- and women-owned businesses that did not have

existing banking relationships. Additionally, the subcommittee determined that, in 2020, the

SBA and Treasury failed to issue guidance prioritizing underserved markets, including minority-

and women-owned businesses.

THE SMALL BUSINESS BOOM UNDER THE

BIDEN- HARRIS

ADMINISTRATION

6

To address these issues, the Biden-Harris Administration implemented a number of reforms,

including the following:

• Instituted a 14-day period from February 24

th

through March 9

th

, 2021 during which only

businesses with fewer than 20 employees were able apply for relief through the Program.

This exclusive application period allowed lenders to focus on serving these smallest

businesses, which often needed additional time to navigate the paperwork entailed in

completion applications.

• Helped sole proprietors, independent contractors, and self-employed individuals that file a

Schedule C with their IRS 1040 tax forms receive more financial support by revising the

Program’s funding formula for these applicants. These types of businesses, which include

home repair contractors, beauticians, and small independent retailers, make up a significant

majority of all businesses. And our smallest businesses are the most diverse: businesses

without employees are 70 percent owned by women and people of color, compared to 30% of

businesses with employees. Yet many were structurally excluded from the PPP, or were

approved for as little as $1 because of how PPP loans were calculated. To address this

problem, in early March 2021 the Biden-Harris Administration implemented changes to the

PPP loan formula – with the support of more than 100 organizations, including the NAACP,

National Urban League, and the Center for Responsible Lending – to provide Schedule C

businesses with more relief, and established a $1 billion set aside for Schedule C applicants

without employees located in low- and moderate-income (LMI) areas.

• Consistent with a bipartisan bill, eliminated the restriction that prevented small business

owners with prior non-fraud felony convictions from obtaining relief through the

PPP. Before the Biden-Harris Administration took office, an applicant for the PPP was

ineligible if it was at least 20 percent owned by an individual who could not pass (1) a five-

year look-back for any felony involving fraud, bribery, embezzlement, or a false statement in

a loan application or an application for federal financial assistance; and (2) a one-year look-

back for any other felony. Due to disproportionately higher rates of incarceration for Blacks

and Latinos, this restriction served as one additional barrier for many minority-owned small

businesses. To expand access to PPP, the Biden-Harris Administration adopted bipartisan

reforms included in the PPP Second Chance Act, co-sponsored by Senators Ben Cardin (D-

MD), Rob Portman (R-OH), Cory Booker (D-NJ), and James Lankford (R-OK), to eliminate

the existing one-year look-back for non-fraud felonies unless the applicant or owner was

incarcerated at the time of the application.

• The Administration also worked to increase the amount of lending made through Community

Development Financial Institutions (CDFIs) and Minority Depository Institutions (MDIs).

These lenders have well-established histories making loans to minority-owned businesses

and, in recognition of this fact, Congress set a minimum target of $15 billion in the Economic

Aid Act of 2020 that authorized the final round of PPP. The Biden-Harris Administration

worked to exceed this target by partnering closely with lenders through regular calls to

ensure a regular flow of referrals to community financial institutions and minority depository

institutions.

THE SMALL BUSINESS BOOM UNDER THE

BIDEN- HARRIS

ADMINISTRATION

7

The latest data shows that these reforms had an impact on expanding access to PPP by small

businesses from underserved communities. According to a report by the independent GAO,

these reforms increased loan access for the smallest and minority-owned businesses that were too

often left out of earlier funding. A February 2022 study found that the PPP under the Biden-

Harris Administration provided more support to businesses located in minority communities than

the previous rounds under the Trump Administration, and specifically pointed to the reforms

announced in February 2021 as a contributing factor.

“A February 2022 study found that the PPP under the Biden-Harris

Administration provided more support to businesses located in minority

communities than the previous rounds under the Trump Administration and

specifically pointed to the reforms announced in February 2021.”

Delivered Billions in Targeted Small Business Relief

Through the American Rescue Plan

In addition to critical financial supports for families, the American Rescue Plan also included

targeted grant relief and tax credits for small businesses hit hard by the pandemic. These

supports helped businesses stay open and keep workers on payroll. Through the funding and

modifications provided in the American Rescue Plan, the Biden-Harris Administration:

• Delivered immediate relief to more than 100,000 hard-hit small restaurants and other

food and drinking establishments through emergency grants.

• Provided small grants to more than 600,000 of the hardest-hit small businesses through

the Targeted and Supplemental EIDL Advance programs.

• Sped relief to nearly 13,000 theaters, live venues and other entertainment and cultural

hubs, with more than 90% of grants going to operators with 50 or fewer employees.

• Provided billions in tax credits to small businesses to help them rehire and retain workers

by extending the Employee Retention Tax Credit and expanding eligibility to include

recent start-ups.

• Helped hundreds of thousands of businesses offer paid sick leave through the Paid Leave

Credit, making it easier for employees to get vaccinated, encouraging sick employees to

stay home, and keeping employees and customers safer.

The American Rescue Plan also provided states and localities with critical aid to help them tailor

their response to the public health emergency to address their communities’ most pressing needs,

including facilitating support for small businesses hard-hit by the pandemic. To date, hundreds of

states, localities, and tribes have invested more than $4 billion of State and Local Fiscal

Recovery Funds provided by the American Rescue Plan to help small businesses survive,

recover, and thrive. Fiscal Recovery Funds are supporting local small business relief efforts like

those in Lincoln, Nebraska to provide stabilizing mortgage and rental assistance to the small

businesses most impacted by the pandemic; or additional financial assistance to restaurants and

THE SMALL BUSINESS BOOM UNDER THE

BIDEN- HARRIS

ADMINISTRATION

8

small businesses as in Los Angeles, California; or to address gaps in the current business support

system that affect small businesses—especially historically underserved business entrepreneurs

who lack access to resources, technical assistance, or social support networks—like in Fort

Collins, Colorado.

Reforming the COVID EIDL Program to Better Serve

Businesses

In 2021, the Biden-Harris Administration strengthened the SBA’s COVID EIDL program, which

offered long-term, low-cost loans to small businesses and non-profits. The improvements

allowed more business to get greater and more flexible support from the program and consisted

of the following:

• Increasing the maximum loan amount from $150,000 upon taking office to $500,000 over

the summer of 2021 and to $2 million in September 2021. These funds can be used to

hire and retain employees, purchase inventory and equipment, and pay off higher-interest

debt.

• Extending the deferment window to 30 months, ensuring that small businesses could get

through the pandemic without having to worry about making payments.

• Making it easier for eligible small businesses with multiple locations in hard-hit sectors

like restaurants, hotels, and gyms to access relief.

• To ensure that taxpayer dollars are used to support businesses that truly need help, SBA

implemented new practices to subject loans above $500,000 to additional scrutiny.

• The Administration has also worked closely with the oversight community on EIDL and

other SBA programs to put into place new standards, additional safeguards, and other

preventative measures to ensure program integrity. The SBA Inspector General testified

in January 2022 that “SBA is more prepared now than they've ever been in terms of the

control environment that is currently in place from a risk perspective” and that the

“programs have more integrity in them right now than they did at the onset” of the

pandemic.

Making it Easy for Small Businesses to Access Relief from

the Restaurant Revitalization Fund

The American Rescue Plan included several features to ensure historically underserved small

businesses would be able to access aid, including the creation of an initial funding prioritization

period for Restaurant Revitalization Fund applications from historically underserved business

owners and women- and veteran-owned small businesses. The American Rescue Plan also

included a set-aside to ensure funds would reach small businesses with less than $500,000 in

gross receipts. But the Administration also took several additional steps to ensure access to

needed relief for the smallest of small businesses who needed the assistance most. This included

the creation of additional funding set-asides for very small businesses including those with

THE SMALL BUSINESS BOOM UNDER THE

BIDEN- HARRIS

ADMINISTRATION

9

annual gross receipts below $50,000. In addition to the set asides, the SBA conducted hundreds

of outreach events and provided key information in multiple languages, as well as engaging in a

first-of-its-kind technology initiative to partner with point of sale providers, such as Clover, NCR

Corporation, Square, and Toast to make it easy for thousands of restaurant owners to accelerate

their Restaurant Revitalization Fund application submission process working directly with their

point-of-sale service providers. As a result of these efforts, nearly two-thirds of available funds

reached businesses owned by women, veterans, and economically and socially disadvantaged

individuals.

Supporting Small Businesses and

Entrepreneurs During the Pandemic

Overall, the Biden-Harris Administration in 2021 provided historic levels of support to small

businesses and entrepreneurs.

$450+ BILLION IN EMERGENCY RELIEF VIA SBA

TO MORE THAN 6 MILLION SMALL BUSINESSES

2021 Biden-Harris PPP Reforms Made an Impact—Compared to the Previous

Administration’s PPP Round

67% – Increase in Loans to Businesses in Low to Moderate Income Communities

35% – Increase in Loans to Businesses with Less than 20 Employees

40% – Increase in Loans to Rural Small Businesses

$42K – Average Loan in 2021, Down from $101K Under Previous Administration

NEARLY 6X – Number of Loans Made by Community Financial Institutions Increased to 1.4M,

Up from 241K Under President Trump

THE SMALL BUSINESS BOOM UNDER THE

BIDEN- HARRIS

ADMINISTRATION

10

Through the Restaurant Revitalization Fund, the Biden-Harris SBA was able to:

Provide more than 100,000 businesses with grants averaging $283,000

Support restaurant owners in all 50 states, Washington DC, and territories

Deliver $18 BILLION in relief to underserved populations, including:

Women-Owned businesses: $7.5 BILLION

Veteran-Owned businesses: $1 BILLION

Social and Economically Disadvantaged Individual-Owned businesses: $6.7 BILLION

Businesses Owned by Representatives of Multiple Underserved Populations: $2.8 BILLION

Through the COVID Economic Injury Disaster Loan program, the Biden-Harris SBA has

offered low interest, long-term loans with no payments due for 30 months.

Key numbers:

$155 BILLION to approximately 820,000 small businesses since taking office

95% of borrowers have less than 20 employees

Roughly ONE-T HIRD were located in LMI areas

56% of loans were $50K or less

$95K – average loan size over life of the program

THE SMALL BUSINESS BOOM UNDER THE

BIDEN- HARRIS

ADMINISTRATION

11

The Biden-Harris Administration Plan

to Support Small Business Growth for

Years to Come

The Biden-Harris Administration has made historic progress to date, and remains committed to

helping America’s new small businesses grow and create jobs. The Administration’s economic

agenda is focused on lowering costs and leveling the playing field for families and small

businesses, with the goal of extending the entrepreneurship boom under President Biden

continues for years to come.

Our strategy to support small businesses is focused on four pillars:

1. Expanding access to capital by offering more than $300 billion in loans and equity

investments through the end of the decade;

2. Making historic investments in programs that help entrepreneurs find the resources

they need;

3. Leveraging Federal procurement, infrastructure spending, and research and

development to direct hundreds of billions in government contracts to small

businesses; and

4. Leveling the playing field for small business owners by reforming the tax code.

1. Expanding Access to Capital by Offering More than $300 Billion in Loans

and Equity Investments Through the End of the Decade

Small businesses need capital in order to start up and grow. The early days of the pandemic

revealed stark differences in access to capital, with too many mom and pops and minority-owned

businesses lacking the established banking relationships to access the previous Administration’s

version of PPP. As the country’s economic recovery accelerated in 2021, small businesses

experienced more challenges in accessing traditional, non-emergency capital than they faced

prior to the pandemic. In a recent survey of small businesses with employees

, the Federal

Reserve found that 36% of firms sought traditional financing in 2021 compared to 43% in 2019.

When small businesses did obtain lending, they were much likelier to receive less than they

sought, with only 30% of businesses in 2021 reporting they receive the full amount of financing

requested compared to 51% in 2019.

The Biden-Harris Administration will expand access to low-cost loans and investment capital

through the following initiatives:

• Leveraging tens of billions of dollars in loans and equity investments in partnership

with States, Territories, and Tribes to increase access to capital for small businesses.

Through the American Rescue Plan, the Treasury Department is working with all states

and territories and more than a hundred Tribal governments on standing up small

THE SMALL BUSINESS BOOM UNDER THE

BIDEN- HARRIS

ADMINISTRATION

12

business lending and investment programs as part of the American Rescue Plan's State

Small Business Credit Initiative (SSBCI). This investment will catalyze tens of billions

in public and private capital to support low-cost loans, microloans for our smallest

businesses, and venture capital focused on small businesses, including for businesses

owned by socially and economically disadvantaged individuals. As of early Spring 2022,

jurisdictions have proposed over 70 equity investment programs and over 130 small

business credit support programs that would leverage SSBCI. By this summer, the first

wave of programs will launch, unlocking billions of dollars in new lending and

investment capital for tens of thousands of small businesses in big cities and small towns

all across America.

• Improve SBA’s traditional loan programs by expanding access to provide more than

$250 billion in financing to more than 500,000 small businesses by the end of the

decade. The SBA’s traditional 7a, 504, and microloan programs are in more demand than

ever before, collectively reaching a record high loan volume in Fiscal Year 2021

by

providing $44.8 billion through more than 61,000 loans. In recognition of this demand,

Congress increased the lending ceiling for 504 loans by Certified Development

Companies (CDCs) by $3.5 billion to $11 billion total in the Consolidated Appropriations

Act for 2022 and the President’s Budget for Fiscal Year 2023 would increase the ceiling

for the 7a loan guarantee program by $5 billion to $35 billion overall. To ensure easier

access to these programs, SBA will modernize its online Lender Match tool to allow

improved match making and a simpler experience for both the borrower and lender. SBA

will also reduce barriers for entrepreneurs with criminal backgrounds, so that individuals

who have spent time in the criminal justice system are able to access critical small

business loans to start up, grow, and create jobs. The SBA will also expand access to

flexible capital for small manufacturers and improve access to low-cost small loans to the

smallest businesses.

• Increase access to capital through the Small Business Investment Company (SBIC)

Program and drive more than $50 billion in public and private investment by the end of

the decade. For more than 60 years, the SBIC Program has enabled access to long-term

financing for American small businesses. In Fiscal Year 2021, the SBA committed

$4 billion alongside private sector investors to private equity and private credit funds

licensed as SBICs. This led to $7.1 billion in financing to support more than 1,000 small

businesses across the country. Yet outdated regulations have led to the SBIC Program

supporting predominantly long-term debt and not equity investment. This has resulted in

limited support by SBICs for main street and innovation economy new businesses

founded by underrepresented small business owners. SBA is reviewing current SBIC

program rules to identify potential reforms that would drive more capital into sectors and

small businesses undercapitalized by private sector investors.

• Strengthen community lenders by investing capital and deepening partnerships. CDFIs

are on the frontlines of the battle to close the racial wealth gap, providing historically

underserved and often low-income communities access to credit, capital, and financial

support to grow businesses, increase affordable housing, and reinforce healthy

neighborhood development. To help community lenders fulfill their mission, the Biden-

Harris Administration has taken steps to expand and improve the SBA's Community

Advantage loan guarantee programs. SBA will also increase

the number of CDFIs that

participate in Lender Match by 20% by September 30, 2023. Treasury’s Emergency

THE SMALL BUSINESS BOOM UNDER THE

BIDEN- HARRIS

ADMINISTRATION

13

Capital Investment Program (ECIP) is also investing approximately $8.74 billion through

CDFIs and MDIs. Treasury anticipates that small business lending will make up a

significant portion of the increase in lending from institutions that receive ECIP

investments. Treasury's CDFI Fund routinely makes funding available to CDFIs that

provide capital and technical support to small businesses and the $1.25 billion CDFI

Rapid Response Program, deployed in June of 2021, is already having impact in the

market.

• Provide new sources of capital to support small and medium sized manufacturers.

During President Biden’s first year in office, manufacturing as a share of U.S. Gross

Domestic Product returned to pre-pandemic levels, companies have announced major

new investments in American manufacturing, and the economy added 367,000

manufacturing jobs – the most in nearly 30 years. Supporting small manufacturers is

critical to maintaining this momentum, which is why the Biden-Harris Administration

will implement a number of new credit initiatives through the Department of Treasury,

SBA, and the Export-Import Bank (EXIM) in the coming year. As part of the American

Rescue Plan’s SSBCI initiative, the Treasury Department will convene state, local,

territorial, and Tribal governments this Spring to share ideas and highlight best practices,

building to a roundtable of elected officials and other stakeholders later this year to

highlight accomplishments. SBA will also promote and prioritize licenses for SBICs

committed to providing capital to domestic small business manufacturers. SBIC fund

managers have financed over $14 billion in manufacturing-related businesses over the

last decade, representing 24 percent of total dollars invested through the program during

that period and making the program a good source of potential investment going forward.

And EXIM has launched a new Make More in America

initiative to provide loans and

loan guarantees to support manufacturers seeking to export to foreign markets.

• Investing $1 billion to catalyze regional economic growth across the country. The

Commerce Department Economic Development Administration’s (EDA) $1 billion Build

Back Better Regional Challenge (BBBRC) program is a critical American Rescue Plan

initiative that aims to boost economic recovery from the pandemic and rebuild American

communities, including those grappling with decades of disinvestment. The BBBRC will

support community-led plans to develop and strengthen regional industry clusters across

the country, all while embracing equitable economic growth, creating good-paying jobs,

and enhancing U.S. global competitiveness. In December, EDA announced 60 Phase 1

finalists – each a coalition of partnering entities such as state and local government,

Tribes, labor unions, institutes of higher education, and philanthropy – that proposed

projects that will develop or scale regional industry sectors, develop and train the

workforce of today, and build resilient economies. Each finalist was awarded

approximately $500,000 to further develop their proposed projects and strengthen their

regional growth clusters in advance of submitting a Phase 2 application. These grants will

help the finalists take their projects to the next level in preparation for the Phase 2

deadline and also serve as critical long-term coordination and planning resources to

diversify and strengthen America’s regional economies.

THE SMALL BUSINESS BOOM UNDER THE

BIDEN- HARRIS

ADMINISTRATION

14

2. Making it Easier than Ever for Aspiring and Established Entrepreneurs to

Access Federal Small Business Programs

Many small businesses, especially those from underrepresented communities, lack the access to

technical expertise, accountants, and lawyers employed by better resourced businesses. The

Biden-Harris Administration will help level the playing field by making historic investments in

providing Main Street small businesses with the additional support they need to access federal,

state, and local programs that can help them start up and grow. These investments include:

• Establishing the $100 million Community Navigator program at SBA and

strengthening other technical assistance programs. Funded as part of the American

Rescue Plan, the Community Navigator Pilot Program launched last year and is

deploying trusted and culturally competent community service providers to close

resource gaps for small businesses—in urban and rural America—with a priority focus on

those businesses owned by veterans, women and socially and economically

disadvantaged individuals. Through this pilot program, SBA is partnering with 51

grantee organizations that will work with over 400 local community groups in all 50

states and Puerto Rico to connect America's small businesses to federal, state, and local

resources so they can recover and thrive. This new program builds upon SBA’s

nationwide network of over 1,300 Resource Partners that offer technical assistance to

small businesses. SBA also recently launched the

Small Business Digital Alliance, a

public-private partnership to offer small businesses with critical tech resources to start

and expand their e-commerce business, with an eye toward scaling for success.

• Strengthening the Minority Business Development Agency (MBDA). Latino and Black

Americans are roughly 30 percent of the U.S. population; yet they own less than 10

percent of small businesses with employees. For more than 50 years, the only federal

agency solely dedicated to the growth and global competitiveness of minority business

enterprises has been operating with limited resources and without permanent

authorization from Congress. The Bipartisan Infrastructure Law made MBDA

permanent, elevated its Director to Under Secretary of Commerce, and gave the agency

more tools and authorities to support underserved businesses. The President’s FY2023

budget request would more than double the funding for the under resourced agency.

These actions will enable MBDA to create and expand programs to address the economic

challenges facing underserved communities, expand minority business ownership, and

shrink longstanding inequities in wealth and opportunity.

• Providing technical assistance to help businesses access Treasury’s SSBCI program. In

establishing the SSBCI program, which will catalyze tens of billions of dollars in public

and private dollars to support loans and investments in small businesses, the American

Rescue Plan included a historic investment to provide technical support to these

businesses. The focus of these dollars will be on ensuring that the smallest businesses

and those owned by socially and economically disadvantaged individuals are able to

access legal, accounting, and financial advisory services when applying for SSBCI

capital programs or other state or federal small business programs. Treasury has

announced that it is making available $200 million of these funds to states, territories and

THE SMALL BUSINESS BOOM UNDER THE

BIDEN- HARRIS

ADMINISTRATION

15

Tribal Governments for their technical assistance efforts and $100 million to be

implemented by the MBDA.

• Expanding Resources and Programming for Women-Owned Small Businesses.

Women represent one of fastest growing entrepreneurial segments in the country and

were among the hardest hit by the COVID-19 pandemic. Under the Biden-Harris

Administration the SBA has invested $22.4 million in establishing the largest Women’s

Business Center (WBC) network in the agency’s history and expanding the network to

every state in the U.S., Washington, DC and Puerto Rico. In total the SBA WBC

footprint has expanded to 141 centers providing counseling and technical assistance

services to nearly 100,000 women entrepreneurs annually. Over the last year, SBA has

doubled the number of WBCs at HBCUs, established two new centers in Puerto Rico,

and increased funding by 41% to $31 million to further meet the demands of women

entrepreneurs.

• Support for Native American-Owned Small Businesses through the pandemic.

American Indian, Alaska Native and Native Hawaiian owned businesses play crucial

roles in their respective communities and many of these communities were devastated by

the pandemic. The Biden-Harris Administration and the SBA invested an unprecedented

level to help these businesses recover from the pandemic. In 2021 the SBA helped

provide $2.28 billion in Paycheck Protection Program Loans to American Indian, Alaska

Native and Native Hawaiian businesses. These PPP loans supported 7,513 Native

American-owned businesses. Additionally, in 2021 the SBA helped provide $303 million

in emergency assistance for eligible restaurants, bars, and other qualifying businesses

impacted by COVID-19 through the Restaurant Revitalization Fund. Native American-

Owned Small Businesses will continue to be a core priority moving forward. Through

the Community Navigator program established by the American Rescue Plan, the SBA

has created 30 new partnerships with Native American-focused and led organizations that

will help connect Native American-owned businesses to the resources they need to grow

and succeed.

3. Leveraging Federal Procurement, Infrastructure Spending, and Research

and Development Funding to Support Small Businesses

Budgets reflect values, and the Biden-Harris Administration is committed to ensuring that

Federal spending is used to create opportunities for the nation’s small businesses. Over the next

few years, the Administration will be working to ensure that the Federal government’s historic

investments to revitalize the nation’s infrastructure and annual spending on goods, services, and

research and development helps support small business growth.

The Biden-Harris Administration will:

• Leverage the Bipartisan Infrastructure Law to strengthen Main Street businesses. The

Bipartisan Infrastructure Law will equip Main Street entrepreneurs with the tools and

resources they need to innovate, create good-paying jobs, and provide the essential goods

and services our communities need. The Biden-Harris Administration’s implementation

of the law will:

THE SMALL BUSINESS BOOM UNDER THE

BIDEN- HARRIS

ADMINISTRATION

16

o Reduce small business shipping delays by upgrading our nation’s transportation

infrastructure. Decades of declining public investment has left our roads, bridges,

rail, and transit systems in poor condition, with a trillion-dollar backlog of needed

repairs. Prior to the pandemic, nearly two-thirds of small business owners

considered local roads and bridges average, poor, or very poor quality and more

than half of small business owners said infrastructure investments are crucial to

the success of their business. The Bipartisan Infrastructure Law will invest $621

billion in transportation infrastructure and resilience to help small businesses

obtain the inputs they need and deliver goods and services to consumers across

America and around the world.

o Help small businesses hire new employees and reach new customers by providing

universal broadband. Broadband internet is necessary for Americans to do their

jobs and increasingly important for small business owners all across America.

Yet, by one definition, more than 30 million Americans live in areas where there

is no broadband infrastructure that provides minimally acceptable speeds. Even

before the pandemic, 7 in 10 small business owners felt it was important for

Congress to fund broadband projects. The Bipartisan Infrastructure Law will

invest $65 billion in broadband access, affordability, and equity; helping ensure

that every American has access to reliable high-speed internet and creating new

opportunities for small businesses nationwide.

o Expand access to tens of billions of dollars’ worth of federal, state, and local

government contracts, including more than $37 billion through the U.S.

Department of Transportation (DOT). For too long, America’s small businesses

have struggled to compete for and win government contracts. The Bipartisan

Infrastructure Law includes a historic procurement effort designed to support

small businesses and tackle long standing inequities in the contracting system.

Among other things, the legislation directs DOT to work to ensure that more than

$37 billion in infrastructure contracts are awarded to disadvantaged business

enterprises, representing at least 10 percent of the funding appropriated to the

Federal Highway Administration, Federal Transit Administration, and National

Highway Traffic Safety Administration. The Bipartisan Infrastructure Law will

put Main Street to work rebuilding the nation’s roads and bridges, eliminating the

nation's lead service lines and pipes, deploying broadband, and installing

thousands of miles of new and resilient transmission lines.

• Increase access to billions of dollars in federal spending for small businesses. The

federal government is the largest consumer in the world each year, spending more than

$650 billion in goods and services, while spending roughly $160 billion in research and

development. The Biden-Harris Administration will ensure that small businesses

participate in these expenditures by:

o Increasing the share of federal procurement dollars that go to small

disadvantaged businesses (SDB)s by 50% by 2025. In June 2021, President Biden

committed to grow the share of federal contract dollars spent using SDBs from

the nearly 10% it has reached in recent years to 15% by Fiscal Year 2025 – a 50%

increase. Last year, the Biden-Harris Administration announced its strategy

to

THE SMALL BUSINESS BOOM UNDER THE

BIDEN- HARRIS

ADMINISTRATION

17

achieve this goal, including a series of reforms to reduce barriers to entry,

increase incentives for the acquisition workforce, and improve transparency.

o Expanding through the President’s 2023 Budget access to Federal research and

development investment to drive more than $50 billion in funding to

innovative small businesses through the end of the decade. Each year, the Small

Business Innovation Research (SBIR) and Small Business Technology Transfer

(STTR) programs provide competitive, merit-based opportunities, for innovative,

US-based small businesses and startups to pursue high-potential scientific,

technological and research endeavors with a focus on commercialization. In

Fiscal Year 2021, 11 participating Federal agencies invested more than $4 billion

through the SBIR/STTR programs in approximately 4,000

innovative companies. Over the past 40 years, SBIR/STTR investments have

played a critical role in the early life and success of significant technologies and

firms like Qualcomm, iRobot, Sonicare, and 23andMe. Today, SBIR/STTR

enables projects addressing critical needs for innovation in support of our national

defense, including technologies to autonomously protect our borders using

artificial intelligence and to train fighter pilots utilizing augmented reality to

enhance defense preparedness and warfighter safety. The Department of Defense

has found that for every $1 invested in the SBIR and STTR programs there has

been

a $22 return to the American economy. Yet underserved small business

owners building innovative companies have historically participated in these

programs at low rates. The Biden-Harris Administration will improve access for

underrepresented small business owners to SBIR and STTR funding by

strengthening outreach and enhancing technical and business assistance

available to these businesses.

o Establishing an SBA Office of Manufacturing Initiatives designed to help small

manufacturers access contracting opportunities. Manufacturing is the fourth

largest employer among small businesses, comprises the largest share of U.S.

exports, contributes significantly to the supply chain in many industries and plays

a uniquely historic role in the economic health of communities across the country.

However, the small manufacturers are under-represented within federal

procurement receiving only 15% of manufacturing contracts from federal

agencies; moreover, women and people of color are significantly under-

represented as small business owners in the manufacturing sector compared to all

sectors. Announced by President Biden in July 2021 and funded in the President’s

2023 Budget, this SBA office will advance policies that expand opportunities for

small manufacturers to compete for a greater share of federal contracts and by

developing supports to help small makers to automate, improve processes, expand

capacity, export, diversify supply chains, and develop human capital strategies.

4. Leveling the Playing Field for Small Business Owners by Reforming the

Tax Code

While Main Street is roaring back, many small businesses struggle to grow and compete globally

due to a tax code that disproportionately benefits multinational corporations. The Biden-Harris

THE SMALL BUSINESS BOOM UNDER THE

BIDEN- HARRIS

ADMINISTRATION

18

Administration’s agenda would give tax relief to millions of entrepreneurs, and crack down on

the unfair tax schemes that give big corporations a leg up.

According to a White House analysis, the President’s Agenda would deliver tax cuts to more

than 3.9 million entrepreneurs and only raise taxes on those making over $400,000. That means

97 percent of small business owners would not face any income tax increases, and, in fact,

millions would be getting tax cuts.

When it comes to big corporations, the President’s plan makes sure that they no longer have an

advantage over Mainstreet Businesses by being able to engage in sophisticated tax games.

The current tax system unfairly prioritizes large multinational corporations over Main Street

American small businesses. In 2018, married couples making about $150,000 working at their

own small business paid over 20 percent of their income in federal income and self-employment

taxes. By contrast, U.S. multinational corporations paid less than 10 percent in corporate income

taxes on U.S. profits.

For this reason, the Biden-Harris Administration supports a 15 percent corporate minimum tax

here and around the world to ensure that no large profitable corporation gets away with paying

$0 in taxes and reversing the massive 2017 Republican tax cuts, by increasing the corporate tax

rate to 28 percent.

By contrast, Congressional Republicans not only oppose making big corporations pay their fair

share, they have also proposed

hiking taxes on middle-class families and small business owners,

which would result in a tax increase for half of small business owners, including 82 percent of

those making less than $50,000 per year. Under this Republican plan, the typical small business

would see their taxes increase by roughly $1,200.

“…Congressional Republicans not only oppose making big corporations pay

their fair share, they have also proposed hiking taxes on middle-class families

and small business owners, which would result in a tax increase for half of

small business owners, including 82 percent of those making less than

$50,000 per year. Under this Republican plan, the typical small business

would see their taxes increase by roughly $1,200.”

Specifically, the Administration will:

• Level the playing field and raise revenue that will help pay for new programs for Main

Street. Nearly three-quarters of small businesses say the current tax system favors big

businesses over small businesses and that their business is harmed when big corporations

use loopholes to avoid taxes. About two-thirds of small business support increasing taxes

on corporations. The Biden-Harris Administration is calling on Congress to raise the

corporate income tax rate to 28 percent; strengthen the global minimum tax for large

multinational corporations; enact a 15 percent minimum tax on book income of large,

THE SMALL BUSINESS BOOM UNDER THE

BIDEN- HARRIS

ADMINISTRATION

19

highly profitable corporations; eliminate incentives for large corporations to offshore

profits and jobs; and ramp up enforcement to address tax avoidance among large

corporations. These proposals will make the tax code fairer while protecting millions of

small businesses from tax increases. For example, President Biden’s proposal to restore

the corporate tax rate halfway back to its pre-2018 level would not affect any small

businesses that file taxes as a passthrough entity (LLCs, S-corps, and sole

proprietorships). That’s nearly every small business in America.

• Give a tax cut to 3.9 million small business owners. Because of the American Rescue

Plan, millions of middle-class families – including small business owners – are receiving

well deserved tax cuts through the Child Tax Credit, the Earned Income Tax Credit,

Affordable Care Act Premium Tax Credits, and the Child and Dependent Care Tax

Credit. The Administration is proposing extending that tax relief because he believes that

middle-class families and Main Street entrepreneurs already pay enough in taxes.

Extending these provisions would cut taxes for 3.9 million small business owners, giving

them the financial security and peace of mind they need to grow their business.

• Protect 6 million small business owners from Congressional Republicans’ Main Street

Minimum Tax plan. In 2017, Congressional Republicans passed a tax package that

prioritized big corporations over Main Street small businesses. Now, they are calling

for

middle-class Americans – including small business owners – to pay more than $100

billion more in taxes each year. According to a new analysis from the White House, the

Congressional Republicans’ Main Street Minimum Tax would increase taxes on 6.1

million small business owners. The typical small business owner affected by this plan

would have to pay more than $1,000 more in taxes each year. Main Street already pays

plenty in federal, state, and local taxes, with some small business owners paying twice

the rate as big corporations. President Biden opposes Congressional Republicans’ new

Main Street Minimum Tax and remains committed to protecting all Americans earning

less than $400,000 per year from tax increases.

THE SMALL BUSINESS BOOM UNDER THE

BIDEN- HARRIS

ADMINISTRATION

20

Appendix

In February, Florida Senator Rick Scott released an 11-point plan to “Rescue America” that

noted, “All Americans should pay some income tax to have skin in the game, even if a small

amount. Currently over half of Americans pay no income tax.” While Senator Scott did not

specify how his plan would work, independent analysts have interpreted this plan as creating a

minimum tax of $100 for unmarried filers and $200 for couples filing jointly, regardless income

level. This would effectively eliminate the refundable portion of tax credits such as the Child Tax

Credit and the Earned Income Tax Credit, while reducing the value of the standard deduction for

low- and middle-income households.

While institutions like the Urban-Brookings Tax Policy Center estimate that as much as 97

percent of the tax burden of Scott’s plan would fall on those making less than $100,000, there

have been no in-depth analyses of the impact on small business owners.

The following table presents the results of a new Biden-Harris Administration analysis of how

Senator Scott’s proposal would affect small business owners. The analysis defines small business

owners as individuals whose active income or loss from small business represents at least 25

percent of their Adjusted Gross Income; all passive income and losses are disregarded. Small

businesses include businesses filing as S-corporations, partnerships, and on individual income

tax return Form 1040 Schedules C, E and F, but do not include C-corporations, RICS, and

REITs. The small business threshold is set at $5 million of income or deductions.

The analysis finds that Senator Scott’s proposal would increase taxes for 49.7 percent of small

business owners (6.1 million tax units). Among small business owners earning less than $50,000

per year, 81.6 percent (5.6 million tax units) would see their taxes increase. The median annual

tax increase for small businesses whose taxes would increase under Senator Rick Scott’s plan is

$1,200.

THE SMALL BUSINESS BOOM UNDER THE

BIDEN- HARRIS

ADMINISTRATION

21

Table A. State-by-State Estimates of Congressional Republicans' Middle-Class Minimum Tax Proposal

Percentage of Small Business Owners with a Tax Increase and Average Tax Increase, by State

State

Small Business Ow ners

Small Business Owners Earning Less than $50,000

Share with Tax Increase

Median Tax Increase

Share with Tax Increase

Median Tax Increase

AK

38.6%

$1,600

79.0%

$1,000

AL

58.0%

$2,400

83.6%

$2,000

AR

61.6%

$1,800

84.9%

$1,700

AZ

55.1%

$1,600

83.7%

$1,200

CA

49.0%

$1,600

83.1%

$1,200

CO

47.0%

$1,200

81.2%

$700

CT

42.6%

$900

80.4%

$600

DC

35.4%

$1,100

78.1%

$800

DE

48.3%

$1,200

78.7%

$700

FL

56.8%

$1,400

82.6%

$900

GA

58.3%

$2,000

84.8%

$1,700

HI

49.8%

$700

81.1%

$500

IA

50.6%

$900

79.3%

$600

ID

59.6%

$1,200

84.1%

$700

IL

48.9%

$1,600

82.1%

$1,200

IN

56.3%

$1,200

82.1%

$700

KS

53.5%

$900

81.8%

$600

KY

59.4%

$1,700

82.8%

$1,300

LA

55.5%

$2,300

83.5%

$2,000

MA

41.4%

$700

79.2%

$500

MD

42.7%

$1,400

78.7%

$1,000

ME

55.1%

$900

80.5%

$600

MI

55.4%

$800

82.5%

$600

MN

46.4%

$700

79.0%

$500

MO

56.6%

$1,100

82.8%

$700

MS

62.5%

$2,800

84.2%

$2,800

MT

58.6%

$600

82.0%

$400

NC

56.3%

$1,800

83.1%

$1,600

ND

49.9%

$600

81.6%

$400

NE

52.6%

$900

81.0%

$600

NH

38.5%

$1,500

74.3%

$600

NJ

43.5%

$1,400

81.9%

$800

NM

60.0%

$1,300

84.6%

$900

NV

55.3%

$1,700

80.8%

$1,200

NY

49.3%

$1,400

82.7%

$1,000

OH

52.2%

$1,500

79.2%

$900

OK

58.1%

$1,600

84.4%

$1,200

OR

53.2%

$800

80.9%

$600

PA

50.8%

$800

80.4%

$600

RI

48.9%

$1,100

79.9%

$700

SC

57.2%

$1,800

82.8%

$1,600

SD

55.3%

$700

80.4%

$500

TN

56.5%

$1,800

81.9%

$1,600

TX

54.3%

$2,500

83.7%

$2,200

UT

52.0%

$1,800

82.4%

$1,400

VA

45.8%

$1,700

80.6%

$1,300

VT

53.5%

$500

81.6%

$300

WA

44.6%

$1,300

78.9%

$700

WI

51.7%

$700

79.8%

$500

WV

62.0%

$1,500

83.7%

$900

WY

54.3%

$700

81.7%

$400