1Comunicación y Sociedad, 2021, e8037, pp. 1-34.

Content characterization of Latin

American lm productions on

Netix: a Bolivian perspective

Caracterización de las producciones

cinematográcas latinoamericanas en

Netix: perspectivas desde Bolivia

DOI: https://doi.org/10.32870/cys.v2021.8037

Javier aleJandro

rodríguez-CamaCho

1

https://orcid.org/0000-0003-4273-8452

andrés laguna-Tapia

2

https://orcid.org/0000-0002-9327-868X

Jens Bürger

3

https://orcid.org/0000-0001-8900-9666

vania landívar-Freire

4

https://orcid.org/0000-0002-6319-045X

We study international lm ows between Bolivia and Latin America to explore the

lack of Bolivian content on Netix and its limited presence in other svod platforms. We

characterize Netix originals, third-party content, and recent Bolivian lms, and develop

a thematic analysis of their synopsis and genre description, completed with the results

of a survey on the Bolivian consumption of streaming content. We identify common

patterns in Netix content and show how it differs from the more nationally minded

Bolivian cinematic tradition. Our results point to a homogenizing effect svod platforms

like Netix might have on lm productions.

Keywords: Netix, lm production, international lm distribution, Bolivia, content

analysis.

En este artículo estudiamos los ujos fílmicos entre Bolivia y Latinoamérica para explo-

rar la subrepresentación del país en Netix y su limitada presencia en otras plataformas

de streaming. Caracterizamos el contenido original y de terceros disponible en Netix y

películas bolivianas recientes, desarrollando un análisis temático basado en sus sinop-

sis y géneros cinematográcos, que se completa con resultados de una encuesta sobre

el consumo boliviano de streaming. Identicamos patrones comunes en el contenido de

Netix y mostramos sus diferencias con la producción boliviana, más alineada con una

tradición típica de un cine nacional. Los resultados sugieren un efecto homogeneizador

que podrían tener plataformas como Netix en la producción audiovisual local.

Palabras clave: Netix, producción cinematográca, distribución internacional, strea-

ming, Bolivia, análisis de contenido.

How to cite:

Rodríguez-Camacho, J. A., Laguna-Tapia ,A., Bürger, J. & Landívar-Freire, V.

(2021). Content characterization of Latin American lm productions on Netix: a

Bolivian perspective. Comunicación y Sociedad, e8037. https://doi.org/10.32870/

cys.v2021.8037

1

Ponticia Universidad Javeriana, Colombia.

2

Universidad Privada Boliviana, Bolivia.

3

Leuven.AI - KU Leuven Institute for AI, Belgium.

4

Universidad Privada Boliviana, Bolivia.

Submitted: 30/12/20. Accepted: 17/04/21. Published: 01/09/21.

2

J. A. Rodríguez-Camacho, A. Laguna-Tapia, J. Bürger, V. Landívar-Freire

inTroduCTion

The emergence and rapid spread of new digital technologies, at the end of

the 20

th

century, sparked a series of transformations in the consumption

habits of people around the globe. In the case of entertainment and

cultural goods,

5

the proliferation of domestic Internet connections,

personal computers, and digital video devices such as the dvd, led to

signicant changes both on their supply and demand. Research efforts

on the synergies and tensions between traditional business models in

the cultural industries, and those emerging with digital technologies,

began to appear in the mid-2000s. Eliashberg et al. (2006) were the rst

to put forth the idea that releasing a new movie on video-on-demand

(vod) or home video, before or at the same time as in cinemas, could

lead to higher revenues for the studios. Later studies would similarly

hold that digital technologies offered opportunities for optimization

in lm release strategies. For instance, in the channels, timing and

promotional strategies used (Calzada & Valletti, 2012; Cunningham

et al., 2010; Doyle, 2016; Hennig-Thurau et al., 2007); beginning to

outline the research agenda today focusing on digital lm distribution

worldwide.

6

Nonetheless, since these transformations tended to replicate

existing asymmetries in the entertainment industries, with the leading

companies established in the US, more recent works began to look

into international lm ows in the context of the Global South and the

cinematic traditions of developing countries (Albornoz & García Leiva,

2017a; Cornelio-Marí, 2020; Lobato, 2019; Lobato & Lotz, 2020). The

5

unesCo (2009) denes cultural goods as those “that convey ideas, symbols

and ways of life, i.e., books, magazines, multimedia products, software,

recordings, lms, videos, audio-visual programmes, crafts and fashion”. In

this study we consider cultural goods to be the larger category, thus using

that notation to refer to both artistic and entertainment goods.

6

Simultaneously, as pointed by Albornoz & García Leiva (2017a), there

is a growing concern among different social actors (

unesCo, the EU, to

mention a few), about the role of cultural industries in the very dynamic

and complex digital ecosystem and how to design and adopt promotion and

protection policies for them.

3

Content characterization of Latin American lm productions on Netix:...

present work attempts to contribute to these lines of research, analyzing

the effects of digital lm distribution through streaming platforms on

the internationalization of Bolivian audiovisual productions.

Netix, a company based in Los Angeles with a global presence

in over 190 countries, is the most emblematic of the new digital video

streaming platforms and, thus, of the disruptions they have provoked.

By late 2019, Netix had 167 million subscribers worldwide, with more

than 60% of them outside the US (Statista, 2019). Indeed, the company

has adopted an expansive global strategy, entering the Latin American

market in 2011, where it has experienced signicant growth, doubling

its subscriber base between 2017 and 2019 (Lee, 2019). Beyond this

globalized nature, researchers have noted that the best way to approach

its analysis is by looking at regional markets, since the company’s

catalog uctuates geographically (Lobato & Lotz, 2020). Some of these

changes are due to copyright issues, since part of the content Netix

distributes is not owned by the company. This led the company to

invest in proprietary content, spending over 17 billion dollars in 2020

(Spangler, 2020), with a growing focus on regional markets. In the case

of Latin America, Netix greenlighted 70 original regional productions

in recent years (De la Fuente, 2018). In this line, to understand what

are the characteristics of the content that Netix decides to acquire,

produce, and distribute for the Latin American market, and how

these decisions affect local lm production and consumption, are the

questions motivating our study.

Digital lm distribution has upended the traditional

internationalization dynamics in the industry. In the past, theater

chains and Tv rms (broadcast, cable, and pay-per-view) were the

main international exhibitors of entertainment media (Mirrlees, 2013),

with festivals and specialized circuits completing the channels used by

Latin American lm producers to distribute their work to regional

and global markets. In the past, Bolivian lmmakers had found some

success following such internationalization routes.

7

Yet, as of December,

7

Among the lms released since 2015 and restricted to top international lm

festival participation, Viejo calavera directed by Kiro Russo, won a Spe-

cial Mention (Filmmakers of the Present) was nominated to the Golden

4

J. A. Rodríguez-Camacho, A. Laguna-Tapia, J. Bürger, V. Landívar-Freire

2020, no Bolivian content is available on Netix. This is an intriguing

observation, given that streaming platforms have not only changed

how a local lm nds an international audience, but also the type of

content a local audience has access to, setting in motion a cycle that

can affect local lm industries beyond their participation on specic

platforms. With this in mind, we take focus on the Bolivian case for our

characterization of the content found on streaming platforms, outlining

a comparison with the Latin American lms available for Bolivian

audiences to stream on Netix, as well as those which reached the

Bolivian market through the traditional channels previously mentioned.

This article investigates the following research question: What

are the thematic and narrative characteristics of Latin American and

Bolivian lms distributed internationally on subscription video on

demand (svod) platforms such as Netix? We employ a mixed

quantitative and qualitative approach consisting of a characterization

of these lms, which we complete with primary information from users

of svod in Bolivia. Our goal is to bring light to the types of content

owing inside and outside specic countries and regions through

streaming platforms, with a focus on Bolivia, Latin America, and

Netix. The main contributions of this study are: 1) A thematic

and genre characterization of the content Netix produces as original

lms and the content it licenses from third parties in the Latin American

market; 2) A thematic and genre characterization of recently released

Leopard at the Locarno International Film Festival, and was nominated to

the Horizons Award at the San Sebastián International Film Festival. Simi-

larly, Eugenia, directed by Martín Boulocq, was nominated to the Best La-

tin-American Film award at the Mar del Plata Film Festival. International

Tv distribution has also been a channel successfully used by Bolivian pro-

ducers to reach international markets. For instance, European

Tv networks

such as

rai or rTve have broadcast Bolivian lms in the past. However,

given the data available and the apparent predominance of festivals as a

channel over

Tv or traditional theatre distribution, among Bolivian lms

released between 2015 and 2020, when examining the internationalization

channels these audiovisual products have used we focus exclusively on

streaming platforms and international lm festivals.

5

Content characterization of Latin American lm productions on Netix:...

Bolivian lms; 3) A comparison between Latin American and Bolivian

content available internationally on svod; 4) Insights on the effect

of Netix and international digital video distribution on national lm

production and consumption. We nd some common characteristics

between the content Netix licenses from third parties and Bolivian

lms available on svod, and an apparent trend towards homogeneity

in the thematic and narrative characteristics of Netix originals lms.

On the other hand, Bolivian lms showcase a strong focus on national

and historical themes; particularly those that are internationally

distributed outside of svod platforms (i.e., in lm festivals). Regarding

the effect on local audiences, the consumption of international content

distributed by Netix is vastly superior to Bolivian content available

on streaming platforms. Although this disproportionality may not be

surprising given the size of the Bolivian lm industry, when coupled

with the homogenizing trend observed in Netix’s content, it may have

implications on the types of content favored by local audiences and thus

potentially extend its effect to local lm production a well.

digiTal Film disTriBuTion, inTernaTionalizaTion, and iTs

eFFeCTs on The ConsumpTion and produCTion oF ConTenT

The last decade has seen the consolidation of new business models in

the lm industry, with distinct logics and priorities, sometimes at odds

with the traditionally prevailing ones (Clement et al., 2018; Hadida

et al., 2020; Jenner, 2018; Lobato, 2019; Lotz, 2014; Navarro Sierra,

2015). Among these, we nd the appearance and global expansion

of Subscription Video on Demand (svod) services like Netix,

Amazon Prime Video, Disney+, among many others. The extent of this

disruption has gone beyond lm distribution and exhibition, as svod

platforms realized that the control of the intellectual property they were

distributing was key to strengthening their strategic positions. The

content these platforms distribute comes from two sources: licensed

third-party content (lm and Tv productions created and owned by

different people or companies, who get paid royalties whenever a

distributor wants to include the content in their platform) or proprietary

content (in-house productions that do not involve signicant payments

beyond the production costs).

6

J. A. Rodríguez-Camacho, A. Laguna-Tapia, J. Bürger, V. Landívar-Freire

In recent years, svod companies have begun to acquire new content

or invest in their own productions. How these investment decisions are

made, and which content is produced and then distributed to which

markets is a question that has intrigued academics and practitioners.

Research on the relation between content and market metrics in the lm

industry is abundant. Indeed, there seem to be links between certain

content characteristics (series, sequels, book adaptations, actors and

directors involved) and its success. Kübler et al. (2020) developed

a framework for the valuation of the content available on digital

video subscription platforms, proposing to analyze: 1. Storytelling

characteristics and quality signals (length, format, genre, adaptation,

remake, etc.); 2. Monetary and artistic power (actors and directors

box-ofce records and audience awareness, awards and nominations,

etc.); and 3. Forward and reciprocal spill-overs (number of seasons and

episodes, recency, number of viewers, etc.).

To a large extent, our analysis builds on these criteria to develop a

characterization of the Latin American content distributed on Netix

(both licensed and proprietary) and of Bolivian lms produced

between 2015 and 2020. However, we also bring a focus to the effect

of internationalization on the content that is created and distributed by

svod platforms. Netix envisions itself as a “global business”, offering

local-language content in 70 of the 190 countries where it is present,

often expecting to turn these shows and lms into pan-regional hits

(Spangler, 2018). Hence, the characteristics of the content that might

at one time cater to country specic demands, but also possess the

potential to attract international markets, is one of the company’s main

concerns.

Several studies have approached this issue. For instance, Aguiar and

Waldfogel (2018) examine whether the internationalization of content is

unidirectional and/or may lead to the overrepresentation of US-content.

They nd that international theatrical distribution already favored US

productions, while in the case of Netix this bias is slightly diminished,

with many countries exporting content through the platform. However,

this analysis is limited to the quantitative aspects of such content.

8

An

8

Aside from the macro level of international lm distribution, facing exhi-

bition and consumer decisions, it is not yet clear how Netix’s algorithms

7

Content characterization of Latin American lm productions on Netix:...

approach based on numeric indicators alone may not reveal if the market

logic brought forward by Netix and international lm distribution on

svod is reshaping the content itself. It may be true that more lms

produced in countries with less developed lm industries are nding

international audiences through svod, but how are those productions

in terms of their format, themes, and narratives? Are they comparable

to content that nds international distribution elsewhere? And how do

they compare to the international content being imported?

These questions have been explored in the literature from different

perspectives and with diverse methodological strategies. One of the

main preoccupations of such studies has to do with diversity and

the situation of local lm industries that may struggle to compete

with the reach and nancial might of Netix, or simply get lost in the

middle of catalogs monopolized by foreign productions and largely

driven by algorithm-based recommender systems. Lobato (2018)

proposes several paths to analyze said catalog (cultural and linguistic

diversity, location strategy, imperialism, distribution practices for local

and foreign content), highlighting the increased complexity introduced

by recommendation systems and suggesting to complement catalog

examinations with evidence from the audiences (a strategy we follow).

Similar studies can be found for the cases of Australia (Cunningham

& Scarlata, 2020) and Mexico (Cornelio-Marí, 2020). The latter nds

that locally-created content offered on Netix has certain characteristics

that seem either to replicate or critique existing archetypes in

local tastes (for instance, melodramas such as Televisa’s telenovelas

and their ironic Netix counterpart La Casa de las Flores). The former

holds that regional Netix content may appear to struggle to grasp the

sensibilities of a local public, while established national producers can

more closely cater to it (i.e., audience and critical reviews of Stan’s

Australian original content were far superior to their Netix-produced

work when prioritizing some content and obscuring others. The company

has not revealed much about this, simply mentioning that their consumer-

centric approach bases those decisions on the user’s past choices and be-

haviors, and academic research on the topic is still emerging (see Siles &

Espinoza-Rojas, 2019).

8

J. A. Rodríguez-Camacho, A. Laguna-Tapia, J. Bürger, V. Landívar-Freire

regional counterparts). Subtler transnational dynamics are also at play

through translations and dubbing, as examined by Jenner (2018), or the

scheduling of releases.

9

Another concern surrounding international lm distribution through

svod relates to representational and diversity issues. Namely, the effect

it may have on what could be considered a “national cinema”, dened

as a lmic production that, as a corpus:

on the one hand... look[s] inward, reecting on the nation itself, on its past,

present and future, its cultural heritage, its indigenous traditions, its sense

of common identity and continuity. [And o]n the other hand... seems to look

out across its borders, asserting its difference from other national cinemas,

proclaiming its sense of otherness (Higson in Hjort & Mackenzie, 2000,

p. 67).

10

The digital disruption experienced in the lm industry has affected

national cinemas as well. Hersheld (2000) noted that the new

technologies of production, distribution and exhibition would allow

producers to focus on localized audiences, forgoing competition for

global markets, although tting into such models may cause narrative

and aesthetic conventions to be modied. He also suggested that

national cinemas are the product of the “complex operation of shifting

strategies and alliances of domestic and foreign policies, economic and

political ideologies, and social and cultural practices” (Hersheld, 2000,

p. 273). Hence, even if national cinemas would continue to exist away

9

Studies at the consumer level, from the perspective of recommendation

systems and choice, are still far less common. Perhaps McKenzie et al.

(2019), Siles et al. (2019) and Turner (2019), offer the insights most relevant

to our work.

10

We are aware of the complex and still-developing research on this

conceptualization. However, we are forced to leave such discussion outside

of the scope of this study, opting for a more pragmatic denition of national

cinemas, built on Higson (1989) and operationalized through the nationality

with which the lm has been indexed in international databases such as

imdB and Filmafnity. We expand on this in the methodological section.

9

Content characterization of Latin American lm productions on Netix:...

from Digital video Subscription Platforms (dsps), their singularities

could not remain unaffected in a highly globalized industry. Moreover,

audience choices do not follow categorical local-global patterns, instead

operationalizing more complex and impermanent identity constructs

(Lobato, 2019). For instance, preferring international programming

for some things and national productions for others (e.g., Hollywood

dramas and local news). How much of viewer experience is determined

by supply is not obvious, which invites researchers to develop measures

of welfare that move from economic criteria to contemplate media

democratization and the fair representation of the diverse components

of a society (Albornoz & García Leiva, 2017b). We approach some of

these issues in the following sections.

meThods and maTerials

This work follows a three-step, two-sided, predominantly qualitative

methodology. Specically: 1) We develop a supply-side analysis of

lm production in Latin America; 2) Characterize these lms; and

3) Analyze the consumer side in Bolivia. Our study comprises the lms

released between 2015 and 2020 in the following categories: Netix

original Latin American lms, third-party Latin American lms, and

Bolivian lms released between 2015 and 2020 (available on svod

or not). The content we study on Netix was limited to the lms

available to stream in Bolivia by early December, 2020. In the case of

Bolivian productions, we cover all major releases in the six-year period,

irrespective of the distribution channels used.

For the analysis of the supply side, we rst compiled a systematic

list of the Latin American lms released within our period of study. A

database including each lm’s release date, title, run time, production

company, synopsis, genres, keywords, platforms where it is available,

festival participation, box ofce revenue, and audience rating, was

then developed with data gathered from Filmafnity. We chose this

movie recommendation website because of the language (Spanish)

and the comprehensive information it has for lms in the period and

region. Our database was completed with information from imdB,

The Numbers and Box Ofce Mojo, as well as the personal archives

10

J. A. Rodríguez-Camacho, A. Laguna-Tapia, J. Bürger, V. Landívar-Freire

of the research team and some Bolivian lm producers. We separated

Bolivian lms from those released in other Latin American countries

in the period. Our criteria for determining the nationality of a lm was

based on the country it was indexed with in Filmafnity. We hence

excluded international co-productions not based in a Latin American

country (for instance, Narcos, Street Food, El Vato or Third Mile) as

well as lms produced in Spain and Brazil. Series were also left out,

since there is no Bolivian serialized content to establish a comparison.

11

The next stage of the analysis consisted in a two-tier process of

characterization. First, we classify the lms based on their format,

production company, and country of origin. Next, we follow a

quantitative analysis of qualitative content methodology, in line with

Schreier (2012), with the goal of understanding each category in terms

of their themes and narrative. Schreier proposes to develop a frame for

content analysis (in general not just lm) in a “concept-driven way”,

which in our case is structured through the nationality and release

date, with other categories emerging from the data. We created tables

with those two categories as thread lines, then we processed the lms’

synopsis and genre tags using the software NVivo 12 and developed

word-frequency count tables, following an iterative process to exclude

grammatical connectors, adverbs, adjectives, and names. The resulting

tables are discussed in a hermeneutic interpretation of the narrative

characteristics they entail, contemplating the content valuation criteria

developed by Kübler et al. (2020). That is, the content under study is

taken to a framework including: length, genre, festival participation, and

audience ratings, to complete its analysis following the word counts.

11

Filmafnity does not reveal their criteria for indexing a lm with a specic

nationality. However, it is consistent with other platforms like

imdB, which

bases their decision on the source of funding (i.e., the country where the

production company is based on). We acknowledge the limitations of using

such simplifying heuristic and have decided to leave co-productions and

international shoots outside of our scope of analysis due to the distinct

dynamics intervening in those relations, which predate and go beyond

international lm distribution via

svod. Brazil is not included in our study

due to the size of the industry and because it is often considered a separate

market.

11

Content characterization of Latin American lm productions on Netix:...

On the side of the consumers, we gathered information on the usage

of Netix and other DSPs from 340 adult Bolivians, who voluntarily

and anonymously participated in a survey. This survey was developed

including questions about their viewing habits, the lms and series

they had seen in the past year (using lists with 10 randomly selected

titles for each category of analysis), the factors inuencing their

viewing decisions and relevant background data. We also controlled

for Covid-19 effects in the frequency of use and adoption of svod. We

followed a non-probabilistic convenience sampling method, which

we believe to be appropriate given the exploratory and descriptive

nature of the study. The survey was circulated during 20 days in

December 2020 and is available in Appendix N° 1.

12

resulTs: CharaCTerizaTion oF The

ConTenT and The Consumers

Participation and consumption habits in Bolivia: svod, Netix and

Latin American lms

Netix started offering their services in Bolivia in 2011, although it did

not gain widespread adoption until 2015 (Statista, 2020). To the best

of our knowledge, there is no data available on the number of users

the platform has in the country, nor on the entertainment consumption

habits of Bolivians in general. We obtained data on some of the

most relevant variables pertaining to these aspects using a survey, as

previously described.

13

The participants are evenly split between men and women, in line

with the demographic data for the country. There are slight sample

biases in terms of the age and educational attainment. A 28.3% of

the respondents are between 18 and 24 years old, which might lead

to the overrepresentation of this age group. This could come from

having distributed the survey among university students, although not

12

All appendices can be found online, following the link included in the con-

cluding sections.

13

The detailed demographic information of the participants is presented in

Appendix N° 2.

12

J. A. Rodríguez-Camacho, A. Laguna-Tapia, J. Bürger, V. Landívar-Freire

exclusively. A similar bias occurs in terms of the educational level of

the respondents. The survey was informally circulated in social media

by the researchers (WhatsApp, Facebook), which could have led to a

higher number of university-educated participants. Nevertheless, this

study did not follow a probabilistic or stratied sampling procedure

because we do not intend to present a comprehensive picture of the

Bolivian population, but to provide primary information on the use of

svod in the country.

Furthermore, even if the majority of the respondents may

come from a wealthier, urban, and highly-educated subset of the

population, such biases potentially reect other characteristics of

the participation in these services. In the case of the US, there is no

explicit relation between the educational level and the use of Netix

(Iqbal, 2020), even though people with higher degrees more often have

a svod subscription (Jay, 2020). The median age of Netix subscribers

in the US was lower when the streaming service was rst introduced

(today it is between 35 and 44), which could also be happening in

Bolivia, where the service market penetration is still in its early stages.

And although the subscriber base of Netix is evenly split across the

income brackets in the US, it has been argued that the market niche of

the service in developing countries could be closer to “cosmopolitan

upper classes” and those who can afford high-speed Internet connections

(Lobato, 2019), which might explain that 73.2% of our sample who is

a Netix subscriber has at least a Bachelor’s degree, while 37.5% of

those with vocational or technical training claim not to use any dsp. We

present a summary of the subscription and usage statistics below.

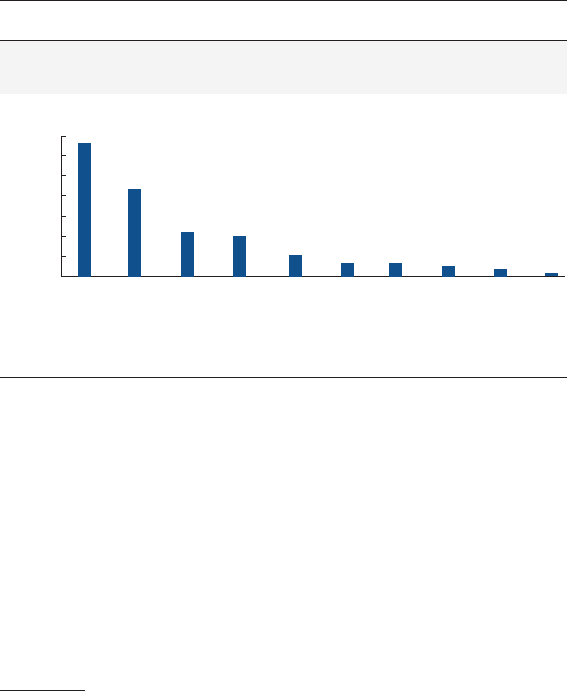

It is interesting that less than 1% of the survey participants do not

use any of the dsps presented to them.

14

Unsurprisingly, Netix is the

leading streaming service, with a 33.1% of users in the sample. The

closest competitor is Prime Video, with a third of the users that Netix

has in the sample. The third place goes to Disney+, which has positioned

itself in a comparatively short time. Specialized svod platforms

such as Retina Latina (Latin American lm) and Bolivia Cine (Bolivian

14

The survey included eight other options which are not presented in the

graph because they obtained less than 2% replies each.

13

Content characterization of Latin American lm productions on Netix:...

lm) are used by 2.1% and 2.7% of our sample.

15

Free dsps such as

YouTube and Twitch are also widely used (25.4% of the sample).

Based on the results of our survey we can characterize the

audiovisual content consumption of Bolivians, who regularly use dsps,

in the following summary.

16

1. Bolivian audiences overwhelmingly consume audiovisual content

at home.

14

2. Bolivian audiences largely decide what to watch once they enter

the platform.

15

Launched in February, 2020, Bolivia Cine is the rst Bolivian streaming

platform. Most of its catalog comprises Bolivian cinema, although it also

offers some Latin American content. As of December, 2020, it offers 79

movies (63 feature lms, including ction and documentaries, and 16 short

lms). The service is available worldwide, with copyright restrictions

(some lms are only available in Bolivia or Latin America). The platform

allows users to buy/download lms or rent them for a few days. Their short

lms are offered to stream for free.

16

A detailed examination of these results is included in Appendix N° 3.

17

To a certain extent, economic factors could be driving these numbers. On

average, the price of a cinema ticket in Bolivia is around 8

usd, with an urban

35.0

30.0

25.0

20.0

15.0

10.0

5.0

0.0

Users in the sample

33.10

21.70

11.20

10.00

5.40

3.70

3.40 2.70

2.10

0.90

Netflix YouTube Prime

Video

Disney+ HBO Go/

HBO Max

Apple

TV

Twitch Bolivia

Cine

Retina

Latina

Digital video subscription platforms available in Bolivia in December 2020

None

Figure 1

u

se oF digiTal video suBsCripTion plaTForms in The sample

Source: The authors.

14

J. A. Rodríguez-Camacho, A. Laguna-Tapia, J. Bürger, V. Landívar-Freire

3. Bolivian audiences decide what to watch based on recommendations

from friends and professional reviews.

4. Bolivian audiences seldom watch Bolivian lms.

5. Bolivian audiences seldom watch Latin American cinema.

6. Production or distribution by Netix is an important factor in the

decision of Bolivian audiences who watch Latin American cinema.

7. Bolivian audiences’ consumption of international lms and series

is inuenced by media and audience phenomena.

These patterns are broadly equivalent to what has been observed

at a global level or in regionalized audience studies (Iqbal, 2020; Jay,

2020; Jenner, 2018). Moreover, our results provide empirical support

for arguments theoretically put forth by Lobato (2019), among others,

highlighting the effects of Netix on the practices and participation

of streaming users. Nonetheless, economic, social, and technological

factors play important roles in the establishment and consolidation

of such consumption habits and practices, which calls for a nuanced

interpretation that should go beyond mere content analysis.

A characterization of svod and international audiovisual content:

Bolivian lm, Netix originals and Latin American cinema

We now turn our attention to the analysis of the supply side of svod in

Bolivia and Latin America. For this we use data we obtained for the lms

and series available on Netix in Bolivia (by early December, 2020),

released between January, 2015 and December, 2020. As described in

the methodological section, we characterize these following a two-

average monthly income of 465 usd in 2019, according to the National

Statistics Institute (

ine, 2019). A monthly Netix subscription in Bolivia

costs 7.99

usd, making it a rather cost-effective entertainment option for

families. The subscription prices of other DSPs are similar: Disney+ 5.99

usd, Amazon Prime 5.99 usd. Bolivia Cine, a svod platform specialized

on Bolivian lms, offers several pricing options: to buy a new release for

5.05

usd, to buy a “classic” lm for 2.89 usd, to rent a new release for 2.89

usd, and to rent a “classic” for 1.44 usd (all the prices and exchange rates

were valid for December, 2020).

15

Content characterization of Latin American lm productions on Netix:...

tier process. First, we classied the lms and series according to their

format, production/distribution company, and country of origin. Then,

we proceeded with a content-analysis methodology.

The categories we propose for the rst tier of the analysis are:

a. Format: Film, Tv series.

b. Production and/or distribution company: Third-party licensed

content, Netix owned content.

c. Country of origin: Bolivia, Other Latin American countries.

The data obtained for all the lms and series released between 2015

and 2020, indexed with a Latin American country of origin (including

Bolivia), and available to stream in Bolivia by December, 2020, was

classied as presented below.

TaBle 1

l

aTin ameriCan and Bolivian ConTenT released BeTween 2015

and 2020 availaBle To sTream in Bolivia By deCemBer 2020

Netix owned Third-party Bolivians Total

Tv series 55 19 0 74

Films 30 96 41 167

Total 85 115 41 241

Source: The authors.

It must be noted that none of the 41 Bolivian lms released in the

period are available on Netix, but on other platforms such as Bolivia

Cine, Prime Video or Vimeo on demand. From now on, for brevity,

whenever we say, “other platforms”, we mean any streaming service

available in Bolivia but Netix. Moreover, there are no Netix original

productions from Bolivia, or any Bolivian content available to stream

on the platform.

18

There are 23 other Bolivian lms, released between

18

It must be noted that there are Netix original shows and documentaries that

have been shot in Bolivia (Andes Mágicos, Street Food: Latin America), in

16

J. A. Rodríguez-Camacho, A. Laguna-Tapia, J. Bürger, V. Landívar-Freire

2015 and 2020, not available on any svod platform by December 2020.

This may be because these lms were previously on some platform but

not anymore or are subject to copyright issues that do not allow for

their digital distribution. What is certain is that a vast majority of them

(between 80 to 90%) were internationally premiered in lm festivals.

A summary table with the ten Bolivian lms included in the survey,

randomly selected from those premiered in the period, irrespective of

their streaming availability, can be found in Appendix N° 4.

Regarding the international content, it is worth mentioning that

a majority of the Latin American productions released on Netix in

this period corresponds to lm (70%). This content is still mostly

licensed from third parties, but only on a proportion of 4 to 3 in favor

of productions not owned by Netix. With that in mind, it is interesting

that 65% of Netix original content corresponds to series, while 83%

of the third-party content comprises lms. These ratios are consistent

with Netix’s global content strategy.

19

Indeed, the bias for serialized

content may align with the positive spill-overs in valuation from

repeated engagement suggested by Kübler et al. (2020).

As a result, we determine the following categories to carry on to the

content analysis stage:

• Netix original lms

• Third-party lms licensed by Netix

• Bolivian lms available on svod

• Bolivian lms not on svod

some cases with local crews, although these are left out of the study as

described in the methodological section because their indexing country, per

the production company, is the US and not Bolivia.

19

In the past decade, Netix’s lm catalog has decreased while its investment

in serialized content has continued to grow. Even if the proportion of

series in its catalogue is still around 28 or 33%, this rate was only 7% in

2010 (Clark, 2018; Jones, 2019). The estimation is that Netix now has

in its global catalogue 45% less movies and 400% more series than in 2010

(Cassillo & Schwindt, 2020). Based on our ndings we could argue that the

company’s global strategy follows similar patterns in its regional markets.

17

Content characterization of Latin American lm productions on Netix:...

The data for each of the lms was classied in these categories

before processing their synopses and genre information, to nd the

most frequently used words. This gives us an overview of the narratives,

themes and interests depicted in these lms and series. We present the

word frequency counts for each of the lm categories in Table 2.

The word clouds for each of the categories and the bar charts with

the top 20 most frequently used words are included in Appendix N° 7.

To avoid any interpretation bias stemming from translation, we kept the

words in Spanish, as originally gathered from Filmafnity. However,

we include a table with the English equivalences in Appendix N° 8.

Now, we analyze the themes and narratives of each category, based on

the results from the word frequency count.

ThemaTiC and narraTive analysis oF neTFlix original Films

In Table 2 we can see that the most frequently used words in the

synopsis and genre description for these lms are: “familias” (families),

“comedia” (comedy), “drama”, “documental” (documentary), “carrera”

(career), “hombre” (man), “grupo” (group), and “historia” (story). In

terms of the genre, those three are the most prevalent in Netix global

catalogue as well: 41% of its content are documentaries, while 21% of

the ction feature-length productions are dramas and 16% comedies

(Follows, 2017). This is also consistent with the demand, since 16.23%

of our sample claims to most often watch dramas, 15.98% comedies,

and 14.42% documentaries. Family comedies such as La boda de la

abuela were watched by 6.73% of our sample. Family-centric plots are

also common in melodramas, one of the recurrent subgenres of Netix

original content, as noted by Cornelio-Marí (2020). On the other hand,

while “historia” could both signal a narrative approach to storytelling,

over more observational or experimental forms, it could also be a term

related to period-pieces and documentaries, such as La Noche de 12

años or Roma.

20

It should not go without mentioning that these lms

are ostensibly male-centric narratives, as evidenced by “hombre” (man)

20

La boda de la abuela (Dir. Javier Colinas, Mexico, 2019), La noche de 12

años (Dir. Álvaro Brechner, Uruguay, 2018), Roma (Dir. Alfonso Cuarón,

Mexico, 2018).

18

J. A. Rodríguez-Camacho, A. Laguna-Tapia, J. Bürger, V. Landívar-Freire

TaBle 2

w

ord FrequenCy CounT For The synopses oF laTin ameriCan and Bolivian Films release BeTween 2015 and

2020

availaBle To sTream in Bolivia By deCemBer 2020

Netix Original Films Third-party Films Bolivian lms on svod Bolivian lms not on svod

Families 2.36% Comedy 4.03% Story 2.91% Drama 1.60%

Comedy 1.81% Drama 2.66% Bolivia 2.61% Bolivia 1.37%

Drama 1.81% Family 2.32% Documentary 2.30% Documentary 1.37%

Documentary 1.63% Documentary 2.05% Drama 1.99% Moment 1.37%

Career 1.27% Story 1.64% Family 1.23% Police ofcers 1.14%

Man 1.09% Father 1.37% World 1.23% Story 1.14%

Group 0.91% Friends 1.16% Father 1.23% Man 0.92%

Story 0.91% Woman 1.16% City 1.07% Wife 0.92%

Unexpected 0.91% Romance 1.16% Bolivian 0.92% Stays 0.92%

Together 0.91% Young 1.02% War 0.92% Friendship 0.69%

Source: The authors.

19

Content characterization of Latin American lm productions on Netix:...

being the sixth most frequent word. Moreover, not only is “mujer”

(woman) missing in the count; when it appears, it is in gendered roles

(“madre” (mother), “abuela” (grandmother), “esposa” (wife) or as

“chica” (girl), failing to put women on the same level with “hombre”

(man).

Thematic and narrative analysis of third-party lms available on Netix

In Table 2 we can see that the most frequently used words in the

synopsis and genre description for these lms are: “comedia” (comedy),

“drama”, “familia” (family), “documental”, “historia” (story), “padre”

(father), “amigos” (friends), “mujer” (woman), and “romance”. Hence,

generally speaking, we can say that the lms Netix licenses from other

Latin American production companies are in the same genres as those it

produces. Some differences appear from the side of romantic comedies

and narratives about couples, as indicated by the words “romance” and

the appearance of “mujer”, which is often found in the context of a

relationship in these synopses (see Gloria or Lo más sencillo es

complicarlo todo). Narratives about travel and others aimed at young

adults and their groups of friends, like those found in Una especie de

familia, El otro hermano, Yo, adolescente and Mi mejor amigo, mark

a difference with respect to original content, too.

21

Mexico remains

the largest producer of content with 31.25%, followed by Argentina

(18.75%) and Colombia (18.75%). However, other regions are more

evenly represented in the catalog. For a comparison, in the case of

original Netix lms, Argentina and Colombia, respectively, amount to

26.7% and 7%, to Mexico’s 55%. Moreover, third-party licensed lms

come from 10 different countries, whereas Netix produced original

lms only in six of them.

Thematic and narrative analysis of Bolivian lms available

on streaming platforms

21

Gloria (Dir. Sebastián Lelio, Chile, 2013), Lo más sencillo es complicarlo

todo (Dir. René Bueno, Mexico, 2018), Una especie de familia (Dir. Diego

Lerman, Argentina, 2017), El otro hermano (Dir. Adrián Caetano, Argen-

tina, 2017), Yo, adolescente (Dir. Lucas Santa Ana, Argentina, 2020), Mi

mejor amigo (Dir. Martin Deus, Argentina, 2018).

20

J. A. Rodríguez-Camacho, A. Laguna-Tapia, J. Bürger, V. Landívar-Freire

To graphically illustrate the themes and narratives of Bolivian lms, we

next present the word clouds obtained from the frequency count of their

synopses and genre descriptions.

In Table 2 and the word cloud in Figure 2 we can see that the most

frequently used words in the synopsis and genre description for these

lms are: “historia” (story), “Bolivia”, “documental” (documentary),

“drama”, “familia” (family), “mundo” (world), “padre” (father),

“ciudad” (city). The predominant genres in this case are documentaries

and dramas, which aligns with Netix and third-party produced

content. However, only four out of 41 Bolivian lms in this category

are comedies. This might owe to the difference in each platform’s

user prole; comedies are less frequently found in Mubi or Curiosity

Stream, to cite two examples. The platforms where Bolivian lms

are most often available to stream internationally are Bolivia Cine (a

specialized platform where 90% of Bolivian lms available on svod

Figure 2

s

ynopsis and genre word

Cloud For Bolivian Films

released in 2015-2020

and availaBle To sTream

inTernaTionally

Source: The authors with data from

Filmafnity (2020).

Figure 3

s

ynopsis and genre

word

Cloud For

Bolivian Films released in

2015-2020

noT availaBle on svod

Source: The authors with data from

Filmafnity (2020).

21

Content characterization of Latin American lm productions on Netix:...

are present), Prime Video (28%), Filmin (21%), as well as Vimeo on

Demand, and Mowies.

It is worth noting that “ciudad’’ (city) signals the predominance of

urban narratives among these lms, which is somewhat unexpected in

a cinematic tradition where the stereotype of indigenous themes has

been its international calling card since the 1950s. That said, this would

nevertheless seem to be a lm production that still caters to a national

audience, if we are to consider the frequency of the word “Bolivia” a

valid indicator. We can estimate that at least 57% of these lms deal with

historical or social themes of interest to Bolivians, thus requiring certain

familiarity with the broader context of the country, unlike the comedies

or romantic stories available on Netix. This thematic prevalence might

be an effect of the heritage of Third Cinema in Bolivia, since one of its

leading lights was Jorge Sanjinés, a lmmaker who remains active today

and whose work still has an outsized inuence in Bolivian cinema.

22

Thematic and narrative analysis of Bolivian lms not available on svod

In Table 2 and the word cloud in Figure 3 we can see that the most

frequently used words in the synopsis and genre description for

these lms are: “drama”, “Bolivia”, “documental” (documentary),

“momento” (moment), “policías” (police ofcers), “historia” (story),

“hombre” (man), “esposa” (wife). In general, these are not dissimilar

from the most repeated words in the synopsis and genre description

of Bolivian lms available on streaming platforms. The two main

genres are still dramas and documentaries, although the proportion of

comedies is higher in this case (24% to a 9.8% in the case of Bolivian

lms on svod). The family component is no longer present, which

may signal a shift from melodramas to thrillers. Indeed, there are crime

dramas (26%) and horror lms (13%) in this category, which were not

22

Third Cinema was a 1960s and 1970s movement led by lmmakers from

the so-called developing countries, whose intention was to create lms that

dealt with the post-colonial nature of their national experiences, moving

away from Hollywood and cinema-as-entertainment views to become po-

liticized and often position itself as a revolutionary tool. See Solanas &

Gettino (1970) for a more precise introduction to the concept.

22

J. A. Rodríguez-Camacho, A. Laguna-Tapia, J. Bürger, V. Landívar-Freire

as prevalent in the case of Bolivian lms available on svod. Something

similar occurs with “historia” and “momento”, which could indicate

a retrospective, ethnological or observational approach in these lms,

interested in capturing slices of social life (moments, per the word used

in the sinopsis). For example, one can see that about 20% of the Bolivian

documentaries are heterodox registers irting with the conventions of

non-ction, such as Cómo matar a tu presidente or Procrastinación,

supporting this intuition. As discussed in the previous section, this is

a character present in older lms in the Bolivian cinematic tradition

as well. Moreover, here, the frequent use of Bolivia in the synopses

would seem to reiterate the domestic-market and/or national-cinema

affectations of these lms.

disCussion, limiTaTions and ConCluding remarKs

Factors affecting the internationalization of Bolivian lms, diversity

and representation in svod platforms, local markets and national ci-

nemas

There are multiple factors involved in lack of Bolivian content on

Netix, namely the bargaining dynamics in a sector where Netix and

other distributors hold signicant (quasi-oligopolistic) power, as well as

the smallness of Bolivia as a market and industry, product characteristics

could still be a factor worth analyzing. Indeed, we use the data from

content analysis and the characterization of Latin American and

Bolivian lm to argue the effects on audiences and production coming

from Netix’s outsized role as an international distributor with

localized content and presence. And while it is still early to observe

entrenched effects, some evidence may appear in the narrative and

thematic characterizations developed in previous sections. Ultimately,

we comment on how diversity may be affected, and if the characteristics

of the lms and series being created for svod may inuence what could

be called “national cinemas”, through our content analysis and demand

data.

We rst compare the word frequency counts to nd insights on the

thematic similarities and differences between each type of content, as

presented in Figure 4.

23

Content characterization of Latin American lm productions on Netix:...

Netflix Originals

Third-party

Bolivian SVOD

Bolivian not SVOD

4.50

4.00

3.50

3.00

2.50

2.00

1.50

1.00

0.50

0.00

Drama

Comedy

Documentary

Family

Story

Father

Woman

World

Friends

Man

Percentage of repetition in

the top 300 words

Basing our comparison on the word frequencies presented in Figure

4, we can say that, on the thematic level, Bolivian lms appear to have

more in common with Latin American lms that are not originally

produced by Netix. Although documentaries are a common genre to

the three types of content, comedies, family stories and melodramas

seem to be more prevalent among Netix original lms. Historical

narratives are salient in the three types of content; however, the

national specicity of the Bolivian case is different than the Mexican

or Argentinian ones, for these countries have a greater level of cultural

inuence in the continent. Namely, Bolivia lacks gures as salient

as Maradona, Luis Miguel or Pablo Escobar, who have featured in

Netix’s original content.

The size of the Bolivian market is also a factor potentially driving

the underrepresentation of Bolivian content on Netix. The country has

a relatively small population, even before considering the segment that

may be able to access Netix’s service. Bolivia also lacks a support

ecosystem for its lm industry, with private and public participants,

educational institutions, and a clear normative framework (even

in matters as elemental as the enforcement of copyright law). This

can certainly hinder the development of an international market for

Bolivian lms, affecting their supply and the local demand for content.

Figure 4

T

en mosT FrequenT words in The synopsis and genre oF Films in

The analysis CaTegories

Source: The authors.

24

J. A. Rodríguez-Camacho, A. Laguna-Tapia, J. Bürger, V. Landívar-Freire

Moreover, that seems to be a problem common to several countries

in Latin America with smaller markets and industries, like Ecuador

or Honduras, both absent in Netix’s catalog. However, population

alone or a country’s relative wealth may not be a sufcient indicator

to predict inclusion either, for Chile, Paraguay, and Perú are also

underrepresented in Netix’s catalog. Then, if the protability of a

national market, nor the quality and characteristics of its products,

can explain their exclusion, the matter could potentially be ingrained

at the strategic level. Indeed, African, Asian, and European countries

are similarly left out of Netix’s regional catalogs. Netix would seem

to favor internationalization strategies where they license some local

content, or shoot in regional locations, to attract users who they plan

on keeping with American content. This contrasts with other svod

providers’ strategies, like Amazon Prime Video, a company that bets on

specic national markets and develops content more tailored to these,

for that approach generates positive externalities for other business

units under their corporate banner.

Nevertheless, we do not abandon content analysis entirely, even if it

explains the exclusion of national lms only partially. We are interested

in understanding the characteristics of Netflix’s original audiovisual

products to analyze how the transformations in the supply can affect local

audiences and, eventually, the content they demand from their national

producers. With that goal, we built a content valuation table following

some of the criteria put forth by Kübler at al. (2020), using data from the

surveyed sample and Filmafnity, which we present below.

The genres we present in Table 3 are the most commonly found on

Netix, based on our content analysis. We can see that comedies are less

frequent in Bolivian lms than their Netix counterparts. The average

length of Bolivian lms is also shorter, which could be an effect of the

numerous documentary features produced in the period with run times

between 40 and 70 minutes.

23

The audience share of Bolivian lms in

23

Some examples, included in our data set, are: Compañía (2019, 60 min.), Mar

negro (2018, 61 min.), En el murmullo del viento (2018, 61 min.), Cómo ma-

tar a tu presidente (2018, 60 min.), Días de circo (2018, 65 min.), El rey negro

(2017, 68 min.), Fuera de campo (2017, 60 min.), Nana (2016, 65 min.), and

La última navidad de Julius (2015, 48 min.).

25

Content characterization of Latin American lm productions on Netix:...

TaBle 3

C

onTenT valuaTion For laTin ameriCan and Bolivian Films released BeTween 2015 and 2020, availaBle on

svod

Genres Average Length Festival

Participation

Average Audience

Rating

Average Viewers in the

Sample

Netix Documentary 17% 92 minutes 30% 5.8 8.90%

Drama 50% (1. 02) (10. 3)

Comedy 34%

Third-party Documentary 20% 92 minutes 80% 6.7 6.75%

Drama 40% (1. 03) (4. 8)

Comedy 40%

Bolivian Documentary 20% 84 minutes 100% 5.8 6.90%

Drama 70% (0. 3) (4. 4)

Comedy 10%

Source: The authors.

26

J. A. Rodríguez-Camacho, A. Laguna-Tapia, J. Bürger, V. Landívar-Freire

our sample is marginally higher than the one for Latin American lms

not produced by Netix. It is also interesting to see that the average

audience rating for Bolivian lms and for Netix originals are equal,

with a greater variability in the case of Netix. The literature shows

that user and expert reviews are a good quality signal for lms (Basuroy

et al. 2003; Hennig-Thurau & Houston, 2019). Then, we could say that

a difference in the perceived quality of Bolivian lms is not one of the

reasons behind its low representation in Netix’s catalog. However, this

quantitative approach may fail to consider other differences (thematic

disparities stemming from idiosyncratic sensibilities, humor that

plays on regional stereotypes and local idioms, etc.) and admittedly

draws from a sample that due to its proximity to lm researchers and

producers could have particular valuations for the works created by

national artists.

Moving now to the potential impact of Netix and international

digital video distribution, in light of the evidence we have found, it

cannot be said that Bolivian lm production has been affected as

a “national cinema”. If we consider the prevalence of Bolivian and/

or historical narratives in the content analysis, following Higson’s

denition (1989) this is still a lm production that gazes inward to

analyze its present and past, while reasserting its otherness in relation

to other countries. Nonetheless, we cannot generalize these ndings to

the rest of Latin America or even those with smaller lm industries,

for Bolivian movies are not available on Netix nor are there Bolivian-

produced Netix originals, which limits what we can say about the

effect of Netix on other countries’ “national cinemas”. However,

we can provide some insights on this direction, considering that the

concentration of Netix original content around certain themes and

narratives (family comedies, melodramas, TV-style documentaries), as

evidenced in the word-frequency charts of Appendix N° 7, could imply

that there is less diversity in its catalog than in third-party licensed

content or Bolivian lms. A country-specic comparison like the one

carried out here for Bolivia and its content inside and outside svod

platforms may offer additional insights for other Latin American cases.

Regarding the channels these lms use to nd their international

audiences, it is telling that all Bolivian releases included in the audience

27

Content characterization of Latin American lm productions on Netix:...

survey participated in at least one international lm festival. Only

30% of Netix original lms participated in them, while 80% of the

third-party content it licenses did. This could be a signal that Latin

American production companies use festivals and their adjacent lm

markets to reach distributors such as Netix. However, the fact that no

Bolivian lms are available on Netix hampers this reasoning, linking

back to the conjecture of strategic motives behind the absences. The

exclusivity of these channels can be a factor in the diversity of Netix’s

catalog, too. Not all lm productions can go to festivals nor do Netix

acquisition agents attend all festivals, which themselves have particular

programming policies and criteria. International lm distribution is far

from being a competitive market where simply matching standards and

cultivating audience tastes can guarantee participation. This is a line of

research that deserves exploration, involving themes such as the cultural

selectivity of programmers and the industrial logics of Hollywood and

other institutions (Crofts, 1993).

On the side of domestic distribution, the programming choices of the

dsps are not trivial. Over 75% of our sample claim not to have decided

what to watch before they access the streaming platform. Furthermore,

Latin American lms available on Netix were more frequently watched

by our sample than those not available on svod. This sounds obvious

but carries implications for the diversity of the content being offered

to the audiences, particularly when the global trends point towards

a consolidation of dsps over theatrical distribution. Digitization had

already accelerated these processes, prompting policymakers to search

for “ways to defend and incentivize, through policy and public-private

partnerships” (Albornoz & García Leiva, 2017a), inclusivity and

diversity in the cultural industries. This to make sure that the content

involves “differences, variety, balance and disparity in terms of values,

identities and aesthetics... reecting the multiple groups living in

a society” (Albornoz & García Leiva, 2017b, pp. 31-32), allowing

citizens not only to access and choose from them, but also to create,

distribute and share these contents. National quotas and incentives to

production have proven successful in increasing the participation of

certain countries in svod platforms’ catalogs, but to be successful such

policies need to bank on their national lm industry being ready to

28

J. A. Rodríguez-Camacho, A. Laguna-Tapia, J. Bürger, V. Landívar-Freire

step up and ll the demand, a process where understanding the content

characteristics favored by Netix, as proposed by our study, can be

advantageous.

limiTaTions

This study is framed by the uctuating and localized nature of Netix’s

catalog. To be precise, the information on the lms and series available

on the platform only reects the case of Bolivia in early December,

2020. New content is being added on a regular basis, some other is

removed, and even regional markets face copyright limitations to

international distribution. This limitation has been noted in previous

works and calls for the creation of a global network of scholars to

collaborate in transnational analyses of the content. Our work takes a

rst step in that direction.

Another limitation comes from the sizes of the regional and national

subsets of the catalog. There are more lms from the whole of Latin

America than from any single country, which makes comparisons

difcult. One could pick equal-sized samples from each subset, but

the trade-off there would be with the analytical power of quantitative

analyses of qualitative content, for there would not be enough data to

reach information saturation.

Similarly, there are no Bolivian lms on Netix as of December,

2020, which requires us to pool Bolivian releases from other svod

platforms to establish a comparison. Given the descriptive, exploratory

nature of this work, we consider this to be an adequate proxy.

Furthermore, several of the third-party owned lms available on

Netix could also be streamed in other platforms in the past (or even

right now) in the country. Consequently, Bolivian lms as a whole are

proportionally overrepresented in our sample, in relation to the actual

size of the Bolivian lm industry. Dealing with these asymmetries

demands a nuanced approach, considering the relative size of the

Bolivian lm industry in terms of the production and consumption of

content, before leading to more robust conclusions.

29

Content characterization of Latin American lm productions on Netix:...

ConCluding remarKs

One of the aims of this work was to offer some key elements to understand

the challenges that internationalization and digital distribution bring

for small lm industries. Our results align with the emerging literature

on this subject, nding that the presence of Netix and other svod

platforms is reshaping entertainment consumption. Namely, that Netix

has become the main channel for Bolivian audiences to access Latin

American lms, as well as a broader catalog of content. On the side

of production, we nd that Bolivian lms possess some characteristics

such as a focus on national and historical themes, regional humor in their

comedies, and non-traditional approaches to their documentaries, that

distinguish them both from regional Netix original lms and licensed

Latin American content. Some of these disparities could explain why

there are no Bolivian lms or series on Netix to date.

According to our ndings, Bolivian audiences are following the

global trends, consuming audiovisual content primarily from home,

often restricting their choices to what is available on the streaming

platforms they already subscribe to (even if it is not entirely clear

how much of a role recommendation systems play). Considering these

behaviors and what our non-probabilistic sample reports, we can say

that these audiences watch few Latin American or Bolivian lms. When

they do, they more often watch those that benet from the audience

and media buzz Netix original productions can afford (La casa de las

ores, Roma) or older third-party content licensed by Netix (Yo soy

Betty, la fea). The proportion of consumers who watch a Latin American

lms on Netix is higher than that of those who watch in other channels

(movie theaters, festivals). Hence, not being on Netix could handicap

the capacity of nding international audiences for a Latin American or

Bolivian lm.

Although we look at the 2015-2020 period, our work does not

propose a longitudinal study. Hence, we are unable to discuss

transformations in the content, narratives or genres of Latin American

audiovisual products potentially due to the inuence of Netix.

Nonetheless, even if their catalog seems to be diverse, with a

representation of many Latin American countries, our analysis shows

30

J. A. Rodríguez-Camacho, A. Laguna-Tapia, J. Bürger, V. Landívar-Freire

that these products t a quite specic prole, with a predominance of

classical genres (drama, comedy, documentaries), structures (mainly

narrative content, often serialized) and themes (family or male-centric

stories, urban narratives). The concerns this raises in terms of diversity

are not unfounded. Future works may bring attention to how “national

cinemas” and local cinematic specicities can survive and nd their

own spaces in highly homogenized and globalized markets.

appendiCes

All the appendices are online-only and can be found here.

aCKnowledgmenTs

This st udy would not have been possible without the kind

contributions of Imagen Docs (Mary Carmen Molina, Sergio Zapata)

and the Laboratorio de Comunicación Transmedia of Universidad

Privada Boliviana (Luis Brun), who helped us distribute the survey,

Ariel Soto, Álvaro Olmos (Bolivia Cine) and Juan Pablo Milán, who

provided us information on the Bolivian lms released in the period, and

Pamela Córdova who supplied us with data on the Bolivian economy.

The nal version of this paper benetted from the generous comments

of two anonymous reviewers and the editors.

Bibliographic references

Aguiar, L. & Waldfogel, J. (2018). Netix: global hegemon or facili-

tator of frictionless digital trade? Journal of Cultural Economics,

42(3), 419-445. https://doi.org/10.1007/s10824-017-9315-z

Albornoz, L. A. & García Leiva, M. T. (2017a). El audiovisual en la era

digital. Ediciones Cátedra.

Albornoz, L. A. & García Leiva, M. T. (2017b). Diversidad e industrias

audiovisuales: El desafío cultural del siglo XXI. Fondo de Cultura

Económica.

Basuroy, S., Chatterjee, S. & Ravid, S. A. (2003). How critical are criti-

cal reviews? The box ofce effects of lm critics, star power, and

budgets. Journal of Marketing, 67(4), 103-117. https://doi.org/10.1

509%2Fjmkg.67.4.103.18692

31

Content characterization of Latin American lm productions on Netix:...

Calzada, J. & Valletti, T. M. (2012). Intertemporal movie distribu-

tion: Versioning when customers can buy both versions. Marketing

Science, 31(4), 649-667. https://doi.org/10.1287/mksc.1120.0716

Cassillo, J. & Schwindt, O. (2020). Netix Has 45% Fewer Movies

(and 400% More TV Shows) Than it Did in 2010. TV Revolution.

https://tvrev.com/netix-has-45-fewer-movies-and-400-more-tv-

shows-than-it-did-in-2010/

Clark, T. (2018). Netix movie catalogue has gone down since 2010.

Business Insider. https://www.businessinsider.com/netix-movie-

catalog-size-has-gone-down-since-2010-2018-2

Clement, M., Otten, C., Seifert, R., Kleinen, O., Houston, M. B., Kar-

niouchina, E. V. & Heller, C. (2018). IDEA FORUM: the impact

of subscription-based video on demand on traditional distributors’

value chains and business models. Journal of Media Economics,

31(1-2), 50-67. https://doi.org/10.1080/08997764.2020.1796687

Cornelio-Marí, E. M. (2020). Mexican Melodrama in the Age of Netf-

lix: Algorithms for Cultural Proximity. Comunicación y Sociedad,

e7481. https://doi.org/10.32870/cys.v2020.7481

Crofts, S. (1993). Reconceptualizing national cinema/s. Quar-

terly Review of Film & Video, 14(3), 49-67. https://doi.

org/10.1080/10509209309361406

Cunningham, S. & Scarlata, A. (2020). New forms of internationalisation?

The impact of Netix in Australia. Media International Australia,

177(1), 149-164. https://doi.org/10.1177%2F1329878X20941173

Cunningham, S., Silver, J. & McDonnell, J. (2010). Rates of change:

Online distribution as disruptive technology in the lm industry.

Media International Australia, 136(1), 119-132. https://doi.org/10

.1177%2F1329878X1013600114

De la Fuente, A. M. (2018). Netix ramps up Colombian production.

Variety. https://variety.com/2018/tv/global/netix-colombian-pro-

duction-six-new-series-1202976981/

Doyle, G. (2016). Digitization and changing windowing strate-

gies in the television industry: Negotiating new windows on

the world. Television & New Media, 17(7), 629-645. https://doi.

org/10.1177%2F1527476416641194

32

J. A. Rodríguez-Camacho, A. Laguna-Tapia, J. Bürger, V. Landívar-Freire

Eliashberg, J., Elberse, A. & Leenders, M. A. (2006). The motion pic-

ture industry: Critical issues in practice, current research, and new

research directions. Marketing Science, 25(6), 638-661. https://doi.

org/10.1287/mksc.1050.0177

Follows, S. (2017). The numbers behind Netix Original movies and TV

shows. https://stephenfollows.com/netix-original-movies-shows/

Hadida, A. L., Lampel, J., Walls, W. D. & Joshi, A. (2020). Hollywood

studio lmmaking in the age of Netix: a tale of two institutional lo-

gics. Journal of Cultural Economics, 1-26. https://doi.org/10.1007/

s10824-020-09379-z

Hennig-Thurau, T., Henning, V., Sattler, H., Eggers, F. & Houston, M.

B. (2007). The last picture show? Timing and order of movie dis-

tribution channels. Journal of Marketing, 71(4), 63-83. https://doi.

org/10.1509%2Fjmkg.71.4.063

Hennig-Thurau, T. & Houston, M. B. (2019). Entertainment Science.

Springer Books.

Hennig-Thurau, T., Malthouse, E. C., Friege, C., Gensler, S., Lobschat,

L., Rangaswamy, A. & Skiera, B. (2010). The impact of new media

on customer relationships. Journal of Service Research, 13(3), 311-

330. https://doi.org/10.1177%2F1094670510375460

Hersheld, J. (2000). Mexico. In G. Kindem (Ed.), The International

Movie Industry (pp. 273-291). SIU Press.

Higson, A. (1989). The concept of national cinema. Screen, 30(4), 36-

47. https://doi.org/10.1093/screen/30.4.36

Hjort, M., Mackenzie, S. & Fulford, M. (2000). Cinema and nation.

Psychology Press.

Instituto Nacional de Estadística-ine. (2019). Bolivia: Ingreso prome-

dio mensual en la ocupación principal, según características ocupa-

cionales, 2011-2019. Encuesta Nacional de Hogares. https://www.

ine.gob.bo/index.php/estadisticas-economicas/encuestas-de-hoga-

res-ingresos/

Iqbal, M. (2020). Netix Revenue and Usage Statistics. Business of

Apps. https://www. businessofapps.com/data/netix-statistics/

Jay, A. (2020). Number of Netix subscribers in 2020: Growth, Reve-

nue and Usage. Finances Online. https://nancesonline.com/num-

ber-of-netix-subscribers/

33

Content characterization of Latin American lm productions on Netix:...

Jenner, M. (2018). Netix and the Re-invention of Television. Springer.

Jones, A. (2019). Netix now has more TV shows and fewer movies

than 5 years ago. Cinema Blend. https://www.cinemablend.com/

television/2486360/netix-now-has-more-tv-shows-but-fewer-mo-

vies-than-5-years-ago-smart-trend

Kübler, R., Seifert, R. & Kandziora, M. (2020). Content valuation strat-

egies for digital subscription platforms. Journal of Cultural Eco-

nomics, 45, 295-326. https://doi.org/10.1007/s10824-020-09391-3

Lee, E. (2019). Netix Looks Abroad as Growth Slows in the U. S. The

New York Times. https://www.nytimes.com/2019/12/16/business/

media/netix-us-subs-slowing-down-international-subs-growing.

html

Lobato, R. (2018). Rethinking international TV ows research in the

age of Netix. Television & New Media, 19(3), 241-256. https://doi.

org/10.1177%2F1527476417708245

Lobato, R. (2019). Netix nations: The geography of digital distribu-

tion. NYU Press.

Lobato, R. & Lotz, A. D. (2020). Imagining Global Video: The Challen-

ge of Netix. JCMS: Journal of Cinema and Media Studies, 59(3),

132-136. https://doi.org/10.1353/cj.2020.0034

Lotz, A. D. (2014). The television will be revolutionized. NYU Press.

McKenzie, J., Crosby, P., Cox, J. & Collins, A. (2019). Experimen-

tal evidence on demand for “on-demand” entertainment. Journal

of Economic Behavior & Organization, 161, 98-113. https://doi.

org/10.1016/j.jebo.2019.03.017

Mesa, C. (2018). Historia del cine boliviano 1897-2017. Plural Edi-

tores.

Mirrlees, T. (2013). Global entertainment media: Between cultural im-

perialism and cultural globalization. Routledge.

Navarro Sierra, N. (2015). Del patio de butacas a los nuevos espacios

del cine: Sistemas online de distribución cinematográca. Comu-

nicación y Sociedad, 24, 187-214. https://doi.org/10.32870/cys.

v0i24.2527

Schreier, M. (2012). Qualitative content analysis in practice. Sage pub-

lications.

Siles, I., Espinoza-Rojas, J., Naranjo, A. & Tristán, M. F. (2019). The

mutual domestication of users and algorithmic recommendations

34

J. A. Rodríguez-Camacho, A. Laguna-Tapia, J. Bürger, V. Landívar-Freire

on Netix. Communication, Culture & Critique, 12(4), 499-518.

https://doi.org/10.1093/ccc/tcz025

Solanas, F. & Getino, O. (1970). Toward a third cinema. Cineaste, 4(3),

1-10.

Spangler, T. (2018). Netix content boss Ted Sarandos downplays

looming threat from Disney, WarnerMedia. Variety. https://variety.

com/2018/digital/news/netix-ted-sarandos-threat-disney-warner-

media-streaming-1203078374/

Spangler, T. (2020). Netix Projected to Spend More Than $17 Bi-

llion on Content in 2020. Variety. https://variety.com/2018/

digital/news/netix-ted-sarandos-threat-disney-warnermedia-strea-

ming-1203078374/

Statista. (2019). Number of Netix paying subscribers from 2011 to

2019, by type. https://www. statista.com/statistics/258321/number-

of-netix-subscribers-by-type/

Statista. (2020) Latin America: number of Netix subscribers 2020.

https://www.statista.com/statistics/324452/latin-america-netflix-

subscribers/

Turner, G. (2019). Approaching the cultures of use: Netix, disruption

and the audience. Critical Studies in Television, 14(2), 222-232.

https://doi.org/10.1177%2F1749602019834554

unesCo. (2009). The 2009 unesCo Framework for Cultural Statistics

(FCS). http://uis.unesco.org/sites/default/files/documents/unesco-

framework-for-cultural-statistics-2009-en_0.pdf