The Impact of Originality in a

Transitioning Movie Industry

Jacob Graber-Lipperman

Dr. Kent Kimbrough, Faculty Advisor

Duke University

Durham, North Carolina

2019

2

Acknowledgements

Thank you to Dr. Kimbrough for offering incredible advice throughout the writing and

research of my thesis and for reviewing several of my drafts during the 2018-2019 academic

year. Without your help, I would have struggled mightily to finish this challenging task. You

made our honors seminar a welcoming place to run our ideas by both you and our classmates,

and with your guidance, the course was one of the most enjoyable classes I took during my time

at Duke. I will miss your unparalleled knowledge of Duke Basketball.

I’d like to thank my classmates during both the Fall and Spring semesters of the seminar

for workshopping my research and providing helpful input throughout the process. I’d also like

to thank Dr. Adam Rosen for taking time to meet with me and discuss the theory behind my

topic and several econometric techniques I utilized when approaching my analysis. Last, I’d like

to thank Thomas Howell and Tyee Pomerantz for aiding me in the data collection stage when I

faced an unexpected roadblock to complete my research. Their willingness to volunteer on a

moment’s notice helped make the completion of my thesis a much smoother endeavor.

One more special thank you goes out to my parents, who pushed me to complete a thesis

instead of coasting through senior year. You both always know how to motivate me, and I’m all

the wiser for having followed your advice.

3

Abstract

The paper explores the increasing success of non-original films distributed through

traditional theatrical releases, and asks whether new distributors, such as Netflix, may serve as

better platforms for original content. A dataset incorporating the top 100 highest-grossing films

at the domestic box office each year from 2000 to 2018 and a smaller subset including 81 titles

distributed by Netflix were utilized to investigate these issues. The results confirm non-original

theatrical releases have performed increasingly well over time, especially within the past four

years, while original theatrical releases have performed poorly, especially during this recent time

period. However, the research suggests the stark difference in performance observed for non-

original and original content in traditional distribution models may not appear for titles released

through the newer streaming platforms. This paper thus hopes to motivate future study into the

effect of streaming platforms on consumer purchasing behavior of films as new distribution

technology within the movie industry continues to proliferate.

1

JEL Classification: D1; D10; D19.

Keywords: Film Industry.

1

To contact the author, please email j[email protected]m. Jacob Graber-Lipperman will be working as a

consultant at Bates White Economic Consulting next year in Washington, DC.

4

I. The Changing Landscape of the American Entertainment Industry

The composition of the American film industry has changed dramatically since the days

of Jaws and Star Wars, the first Hollywood blockbusters. In 2018, 24 of the top 25 highest-

grossing films at the domestic box office fell under a broad category which will be called “non-

original” moving forward. For the purposes of the paper, this broad designation refers to movies

characterized as being franchise films (sequels, prequels, reboots, remakes, and cinematic

universe entries), cinematic adaptations (based on comic books, graphic novels, literature,

television shows, well-known historical events, and video games), or re-releases of older films.

Likewise, since the turn of the millennium, non-original films have increasingly dominated the

box office, replacing original films which once reached the top of the charts. In 2000, the number

of non-original films among the top 25 highest-grossing films was only 10. However, this figure

has climbed in recent years, surpassing 20 in 2014 and reaching a high of 24 this past year

(BoxOfficeMojo, 2019).

Fig 1. Share of non-original content among the top 25 highest-grossing films, 2000-2018

The trend of non-original fare comprising a larger portion of the highest-grossing

domestic films suggests studios are investing more in recognizable properties in order to

maximize the revenue of their projects at the US box office. This may be due to changing

consumer preferences, leading non-original films to represent the best return on investment for

movie studios. The increased penetration of new technologies, such as video-on-demand,

streaming services, and original content produced for online platforms, has also led to a change

5

in the way audiences can view entertainment content and may have altered the ways studios

consider assembling their portfolio of products.

Enter Netflix into the void of original popular content in American entertainment. The

streaming service’s arrival in the business of distributing “Netflix Originals” series and films

marks a new age in the entertainment industry.

2

The first season of Netflix’s first “original”

series, House of Cards, released in February of 2013. Although still a TV show, every single

episode of Season One released on the same day, allowing a viewing experience similar to

television in its length, but resembling cinema in the immediate availability of each episode.

Thus, the existence of the original series presents an interesting question of whether shows

“streamable” in this fashion represent competition for films. Since 2013, other subscription

services, such as Hulu and Amazon Prime, have similarly started to distribute their own series.

Beginning with the distribution of Beasts of No Nation in 2015, Netflix has also released

a wide range of “Netflix Original Films” available only through streaming on the platform

(Rodriguez, 2018).

3

This recent change should generate significant effects for the composition of

new films available for consumption in theaters and through unlimited on-demand services

moving forward. An even more recent development, Netflix announced in late October that it

would be releasing two art-house films, Roma and The Ballad of Buster Scruggs, to limited

theaters, followed shortly after by a streaming release online. The decision likely presents an

effort to ensure their projects compete during awards season, rather than an attempt to maximize

film revenue (Richwine, 2018). Regardless, through the production of original content and the

distribution of previously aired and released shows and movies, providers like Netflix are now

competing with the theater industry as an alternative source of entertainment for consumers.

Thus, this paper will attempt to answer one main question: why has originality decreased

in the traditional Hollywood studio system? The issue remains a pertinent question for content

producers moving forward, who will continue to look for ways to generate revenue through titles

which appeal to widespread audiences. In the case of Hollywood studios, perhaps non-original

content will remain the only viable investment for studios looking to profit off of their films.

Meanwhile, subscription-based providers, which do not need individual features to be successful,

2

In this case, “Netflix Originals” refers to content created by Netflix to be distributed for the first time online, rather

than on TV or in theaters, on their streaming platform.

3

The same idea applies for “Netflix Original” films that does for “Netflix Original” shows.

6

but rather need to offer a bundle of goods to entice a subscriber, may always fare better in the

space for original content.

To investigate this issue, the paper will attempt to see if a change in the success of

original content and non-original content has diverged as a result of the entry of new distribution

models for entertainment, such as the original series or the original film, into the industry. Due to

the recent introduction of original streaming content, the paper also hopes to motivate further

investigation into the field as original online-distributed projects increase in number and spread

across different sources.

The remainder of the paper will follow accordingly; Section II discusses the literature

surrounding consumer purchasing theory and how this may influence audience behavior when

selecting films to watch, as well as proposes two hypotheses which motivated the research;

Section III discusses how the yearly non-original film and box office share among top grossing

films has changed as a result of key innovations in online distribution; Section IV discusses how

the performance of individual non-original and original films has changed over time as a result

of these same innovations; and Section V discusses a method to compare between the relative

success of traditionally-distributed theatrical releases and online streaming-based films, as well

as how non-original versus original content performs in each of these two distribution models.

II. Originality and Transitioning Distribution Models

How does the acceleration of digital distribution of entertainment relate to a shift in

original content from movie studio releases to subscription-based providers? To begin with a

favorite quote within the movie industry, William Goldman once said, “[N]obody knows

anything” when referring to the inability of movie producers to predict whether their projects

will be successful (Waldfogel, 2017). Consequently, the trend towards a greater share of non-

original content in theatrical releases may represent a risk-averse approach by studios to achieve

success in the face of the uncertainty Goldman describes. But what is different about online

distribution that decreases the risk of releasing original content?

A simple explanation rests in varying consumer behavior for moviegoers purchasing

tickets and users of streaming services. Within consumer purchasing theory, familiarity is an

extremely important variable for determining behavior. Familiarity with a product encourages a

greater feeling of certainty that the consumer will be satisfied with the item and gain more utility

7

from their purchase. Certainty likewise motivates consumers to include the product in the set of

items they consider purchasing, therefore increasing the likelihood of purchase (Baker et al.,

1986). Yet this effect may be entirely felt by the consumer before the purchase. In an earlier

study, Berlyne (1970) proposed an opposing psychological effect, suggesting that the stimulus

created by experiencing an unfamiliar product provides greater impact on the receiver’s

satisfaction due to the irritation induced by repetition. Within the literature, this is referred to as

the “novelty effect.” However, this effect only arrives after, rather than before, the consumption

of a product.

The concepts of the familiarity and novelty effect can apply to the choice to consume a

film. For someone considering purchasing a theater ticket, the choice to consume allows for the

viewing of only one film. Once purchased, the moviegoer must live with their decision, even if

they decide they are not satisfied with the purchase of the film midway through viewing. Of

course, one could exit the theater before the end credits, but given the sunk cost of traveling to

the theater, this may represent an undesirable outcome. Thus, familiarity with a non-original

product, for example a Star Wars film, may increase feelings of certainty within the consumer

that they will enjoy the film. This concept is reflected in the literature. Dhar et al. (2012)

demonstrated sequel films earn more than parent or standalone films by increasing theater

attendance in the opening week of the project.

4

The willingness of moviegoers to immediately

consume sequels upon release suggests audiences prefer the familiarity of known titles.

On a Netflix-style platform, the ability to watch a range of unlimited movies after having

paid the initial fee encourages a different approach to selecting films for the consumer. From a

psychological standpoint, consumers may fear uncertainty less when choosing a product through

a subscription provider, knowing they can switch off the program with no marginal cost (aside

from their time spent watching) should it not fit their preferences. For this reason, Mark and Jay

Duplass, two filmmakers who produce movies for Netflix, suggest the unlimited content model

has garnered audiences for risky projects that weren’t “likely to come in the traditional movie

rental model” (Rodriguez, 2018). With this in mind, the anticipation of the novelty effect posited

by Berlyne (1970) may outweigh the benefits of familiarity discussed by Baker et al. (1986).

4

Parent films refers to those which spawned one or more sequels, such as the original Star Wars. Standalone films

refers to those which are not a part of a series or franchise.

8

To highlight the salience of the subscription model, look no further than the recent

popularity of MoviePass. The service, which originally allowed subscribers to purchase

unlimited movie tickets for a monthly fee, replicates the risk-dispersing aspects of Netflix in a

theater setting. For an industry which has seen little change in the way tickets have been

purchased over time, MoviePass represents an intriguing development to decrease the

significance of uncertainty on the consumer’s decision-making process.

From a supplier standpoint, the introduction of online distribution has similarly changed

the way producers decide to develop projects. The digitization of content has created what

Waldfogel (2017) describes as “the ‘long tail’ of niche products,” or projects which wouldn’t

have previously come to the market. The theory suggests that the reduction of costs to distribute

content through digital means makes producers likely to favor more obscure titles. When costs of

digital distribution are lower, everyone can create more products. Thus, finding a product that

falls within a specific niche, rather than resembling the growing majority of products available,

offers a path towards attracting revenue. In this case, original content may find a new path to the

market through subscription-based distributors.

The invention of HBO as a subscription-based service offers an illustrative example of

the concept. As defined by Spence (1976), market failure occurs within the television industry

when viewers’ willingness to pay for a program is higher than the program’s cost of production,

but the revenue to be gained from advertising to this base is lower than the cost of production.

For example, a small dedicated group of Firefly fans may have intensely loved the show, but the

network would be unwilling to air the show because advertisers would not have wanted to sell to

such a small audience. Were the show to be picked up by a subscription-based service, such as

HBO, the fans could pay the direct cost of subscription, which would be greater than the per-

viewer fee paid by advertisers, with the specific intention of watching Firefly. The subscription-

based model thus solves the market failure defined by Spence (1976).

Continuing with Netflix as an example of a subscription-based model, the service offers

up an “unlimited subscription bundle,” for which customers pay monthly fees for the right to

watch any of the television and movie offerings at their leisure (Hiller, 2017). Compared to the

traditional theater model, in which a product must intrigue a customer into purchasing the right

to watch a specific film, Netflix’s bundle must entice a customer to initially subscribe to its

content and remain a subscriber (2017). Thus, the subscription model transforms behavior in the

9

field. Since Netflix pays the licensers or producers of content a one-time fee, rather than a per-

use fee (as seen on platforms like Spotify, which pay artists per listen), the popularity of one

individual movie matters less than the popularity of a combination of films. Likewise, Netflix

may stand to benefit more from producing three $50 million original movies than one $150

million superhero blockbuster, even though the same logic would fail in the theatrical release

scenario.

Consequently, when examining how originality in film impacts the success of a film, this

paper will attempt to prove two hypotheses. First, over time, the positive impact of non-

originality on the financial success of content distributed through the traditional theater model

has increased. Dhar et al. (2012) found that between 1983 to 2008, sequel films generated an

increasingly higher first-week attendance (a figure which yields a strong effect on overall

profitability) than did non-sequel films. Likewise, this paper hopes to build upon the work of

Dhar et al. (2012) and attempt to see if significant increases in the “sequel effect,” expanded to

all non-original films, are identifiable since the recent advent of “Original” subscription-based

content.

The second hypothesis posits originality in content distributed through a subscription-

based service generates a larger positive (or less negative) effect on the success of the project

than originality does for content distributed through the traditional theater model. As discussed,

the dynamics of the subscription-based model yield greater incentives for consumers and

producers alike to pursue original content. However, due to the lack of revenue attached to

individual items distributed through the subscription model, identifying a metric for success

poses a difficult challenge.

III. Yearly Non-Original Film Share and Box Office Share Among Top Films

3.1: Outline

The research employs four different tests related to the two hypotheses discussed in the

previous section, all hoping to answer why originality in traditionally-released film has

decreased over time. This section includes the first two tests to explore the ideas set forth by the

first hypothesis—that non-original content has performed increasingly well at the box office in

comparison to original content in recent years. Test One and Two utilize market-level data

regarding non-original film share and box office share to explore this hypothesis.

10

For the initial test, the yearly non-original share of the highest-grossing films in the US is

regressed over several time indices for dates marking innovations in online distribution. A very

similar second test likewise regresses the yearly non-original share of box office revenue among

the highest-grossing films over the same time indices as the first test. These two tests attempt to

draw a connection between the arrival of online distribution and an increase in non-original

market share and box office share.

3.2: Data for Test One and Test Two

A wide range of data regarding movies distributed within the traditional model is

available to the public. TheNumbers reports up-to-date domestic box office revenues for films

based on studio reports (box office revenue does not include any aftermarket sales, such as rental

or DVD sales). All of the tests for this paper focus only on the domestic North American box

office. This removes factors such as staggered international release schedules and differing tastes

across markets from the experiment. Within the industry, reports about film revenue are regarded

as accurate.

The dataset assembled for Test One and Test Two includes the top 100 highest-grossing

films at the domestic box office every year from 2000 to 2018. Utilizing the turn of the

millennium as a starting point should be sufficient for the purposes of the research. During the

year 2000, the Dot-Com Boom of the mid-to-late 1990s was drawing to a close, and the

availability of alternate sources of entertainment (aside from television) began to emerge

thereafter. Thus, designing the experiment to encompass 2000 to 2018 should cover a time

period in which new technology was always present to influence consumer choices, which will

be reviewed in the next section.

Within the dataset, movies are categorized as being non-original utilizing a binary

variable. To help categorize films, TheNumbers features a database which breaks down content

utilizing source indices. The various indices (i.e. Books, Television, Comic Books) also includes

“Original Screenplay,” or scripts for a film not based on pre-existing material. This category

does, however, include sequels, since the script of some sequel films might not technically be

based on pre-existing content. Thus, films featured in the index were hardcoded within the

research to display a binary variable for sequel if they were an original screenplay for a non-

parent film (i.e. The Empire Strikes Back, not Star Wars) in a series. Any movie falling under

any of the non-original source categories receives a 1 for non-originality.

11

3.3: T1 - Impact of Online Distribution on Non-original Film Share Among Top Grossers

Procedure

The first test regresses the yearly share of non-original films among the top grossing

films in the domestic box office on time indices accounting for innovations in online distribution.

The timeframe between 2000 and 2018 provides over a decade of data points during which

innovations such as Netflix’s subscription streaming service (2007) and the introduction of

original series (2012, House of Cards) and original films (2015, Beasts of No Nation) emerged.

Within these time frames, a significant change in the market share of non-original films over

time could be expected. Consequently, the dates will remain important for investigation

throughout the remainder of the paper. Test One explores whether the number of non-original

films among the highest-grossing films each year between 2000 and 2018 has increased, as well

as if the rate has changed following the innovations in distribution methods mentioned above.

An equation for this procedure is provided below.

Fig 2. Regression equation for Test One.

is an indicator which starts at 0 in the year 2000, and increases by 1 every year

until 2018.

is a binary variable which is 1 if the year in question is between

2007 and 2011. An identical rule functions for the other two time-range variables for 2012 to

2014 and 2015 to 2018.

12

Results

T1 (top-left), T2 (top-right), T3 (bottom-left), T4 (bottom-right): Number of top grossing, non-original films

falling within four ranking brackets regressed on time indices. Standard errors displayed in parentheses. Coefficients

indicate number of films within rankings brackets that are non-original.

13

Discussion

Tables 1-4 analyze this question in two distinct ways, with Table 1, 2, 3, and 4 isolating

the effects of time on the non-original share among the top 25, top 26 to 50, top 51 to 75, and top

76 to 100 highest-grossing films, respectively. In the first regression (left column) in all tables,

the yearly number of non-original films among the top grossers is simply regressed on time, an

indicator variable which climbs by one each year. In the second regression in all tables, the

yearly non-original share is regressed on time and indicators for 3 time periods, indicating

whether the film released between 2007 to 2011, 2012 to 2014, and 2015 to 2018.

When analyzing the first regression, the yearly time variable generates a substantial

impact on non-original prevalence among top-grossers in Table 1. We can interpret this result as

saying the amount of non-original films is expected to rise by 0.354 films per year between 2000

and 2018 beginning with 14.9 films in 2000. While incremental each year, this represents a total

increase of over 6 films by 2018, a sizable amount for a set containing just 25 films. The

expectation of over 21 films being non-original in 2018 among the top 25 grossers approaches

but does not quite reach the actual amount of 24 observed.

Similary, the amount of non-original films within the top 26 to 50 grossers increases at

both a sizeable and statistically significant rate of 0.191 films per year, representing a total

expected increase of about 3.5 films by 2018. In Tables 3 and 4, however, the first regression

yields statistically insignificant results, as well as increasingly smaller effects which fall to zero

by the last table. Therefore, while offering nothing conclusive, especially given the small sample

size of this test, the first regression in Tables 1 through 4 illustrates the general increase in non-

originality over time among the highest rankings brackets (T1 and 2), and the absence of this

trend among the lower ranking brackets (T3 and 4).

Moving on to the second regression, the results proved drastically less statistically

significant. This is attributable to the low number of observations within each time period

bracket, which can be as low as 3. When interpreting these results, the number of non-original

films remains greatest in the higher of the four rankings brackets within almost all of the

respective time periods. Compared to the first regression, these results offer a slightly different

approach by showing the rate of increase is greater in later years, especially within the first two

tables. For example, utilizing the results for the second regression in Table 1, we would expect

the non-original share to be 14.92 films in 2000, 16.22 films in 2007, 18.18 in 2012, and 20.35 in

14

2015. Although a clear tendency towards large increases occuring in the latest time period

appears in Table 1 and Table 2, a lack of any recognizable pattern begins to emerge within the

results for Table 3 and Table 4. It is again imperative to stress the lack of statistical significance

present in these results, likely a result of the small sample size (19 yearly data points).

Test One illustrates some of the changes occurring within the film industry. The number

of non-original films is increasing, especially among the highest of the top-grossing brackets,

and especially within recent years. Intuitively, this makes sense; non-original films attract the

largest audiences, and thus occupy higher positions within the box office. Test Two follows up

the findings of Test One by asking how the financial incentives of releasing non-original content

is influencing the proliferation of non-original content among top-grossers at the US Box Office.

3.4: T2 - Impact of Online Distribution on Non-original Box Office Share Among Top Grossers

Procedure

An alternative approach which may offer more relevant findings focuses on the financial

success of non-original films, which incorporates both industry incentives and the magnitude of

financial success of the films at different rankings within the box office. Thus, while Test 2

follows a similar methodology to Test 1, the dependent variable is changed to the percentage of

the total box office of top grossers captured by the revenue of non-original films. For example, if

five of the ten highest-grossing films in 2000 were non-original films, and these five earned 5

million dollars, and in total the ten highest-grossing films earned 10 million dollars, the non-

original share of the box office in 2000 would be 50 percent. Like before, for the first and second

regressions in Tables 5-8, non-original revenue share is regressed on the yearly time index

variable and the binary variables for 2007-2011, 2012-2014, and 2015-2018.

An equation for this procedure is provided below.

Fig 3. Regression equation for Test Two.

The only variable different in the regression equation for Test Two is the dependent

variable, non-original box office share, which is expressed as a percentage rather than in absolute

15

numbers. Revenue for films has been adjusted to be in 2018 US dollars to prevent biases caused

by inflation within the data.

Results

T5 (top-left), T6 (top-right), T7 (bottom-left), T8 (bottom-right). Share of total domestic box office

by non-original content falling within four ranking brackets regressed on time indices. Standard errors

displayed in parentheses. Coefficients indicate non-original share of box office as a percentage within

rankings brackets.

16

Discussion

Within the first regression, the coefficients for the time index in Tables 5 through 7 offer

a significant result. Regression 1 in Table 5 shows to expect the non-original box office share to

increase by 1.4 percentage points each year from 2001 to 2018 among the top 25 films,

beginning with about 63 percent in 2000. Likewise, Tables 6 and 7 show to expect an increase of

about 0.8 percentage points each year for the next two rankings brackets beginning with 55

percent and 50 percent, respectively. This effect has dissappeared by Table 8. To contextualize

the rate of that growth, we’d expect the non-original box office share among the top 25 grossers

to be over 25 percentage points higher last year than it was at the turn of the milennium, and

about 14 percentage points higher for the next two rankings brackets over the same period. This

growing trend in the financial dominance of non-original content at the domestic box office

supports the paper’s hypothesis that a relationship exists between financial success and non-

originality among top-grossing movies which is increasing over time.

But does this relationship change due to the key innovations introduced over time?

Again, the second regression does not yield statistically significant results. It’s important to note

many of these results are not robust given the small sample size. Like when the regression

equations were carried through in Test One, the results of the second regression show a familiar

trend; the financial impact of non-originality on the domestic box office is growing over time,

and carries the highest influence in the higher rankings brackets before dissapearing in the lowest

bracket. Adjusted for the length of the time periods, the rate of growth of non-original box office

share is fastest during the last time period among the 2 highest rankings brackets, showing that

the financial success of non-original content is increasing in recent years.

Given the lack of statistical significance in the second regression, not much—if

anything—can be concluded from Test One or Test Two. What the tests do exhibit is the

importance of the last time period, 2015 to 2018, in proving the validity of Hypothesis One. The

yearly statistics utilized in the first two experiments may offer a high-level picture of the trends

occuring in the movie industry. But with only 19 data points to choose from—the yearly number

of top grossers and the yearly box office share—the analysis is subject to variations which can

exist in such a small sample size. To expand the scope of the investigation, Test Three analyzes

the individual financial success of each film based on its characterisitics, including non-

originality, in order to confirm a shift is occuring during this final time period.

17

IV. Individual Film Revenue as a Function of Non-originality

4.1: Outline

This section includes Test Three, which will further explore the ideas set forth in the Test

Two by investigating the financial success of the individual films among the yearly top 100

highest-grossing films, rather than focusing on trends from an industry-level perspective. For this

test, the real revenue of a film is regressed on a number of characteristics, including non-

originality, release month, critical rating, genre, and film profile, to analyze how the source

material of a film impacts the financial success of the project. The time indices will also be

included to assess how these effects have changed over time.

4.2: Data for Test Three

Test Three utilizes an expanded version of the dataset for Test One and Test Two. Like

the first dataset, this dataset features the top 100 highest-grossing films for each year between

2000 and 2018 categorized by their source type and having an overall binary variable for non-

originality. Again, this dataset also includes indicator variables for time and binary variables for

whether a film falls within a specific time bracket (2007 to 2011, 2012 to 2014, and 2015 to

2018) to represent innovations in online distribution. However, Test Three analyzes the films on

an individual level, so information regarding the film’s profile, genre, critical rating, release

month, and MPAA rating are included in the data to provide appropriate control variables.

A movie’s budget offers an indication of the size of a project’s “profile,” or how well-

known it is among consumers prior to release. Thus, budget data could serve as an important

control when comparing between projects with disparate profiles, such as Star Wars and Creed,

which are both non-original projects. In the case of Star Wars, Disney is willing to invest a

budget in the hundreds of millions because of the large scale fanbase for the property. Although

still popular, MGM knows the Creed franchise has less fans than its intergalactic counterpart,

and thus won’t invest as much towards the film’s budget. While TheNumbers features a database

of budgets, it also includes a warning that budget data is often kept secret or manipulated by

studio executives. Additionally, the number of budgets available within these indices proves a

limiting factor for using budget as a control variable. Therefore, budget was not used in the test.

To compensate for the lack of a control variable for film profile, the number of critical

reviews can be used as an alternative indicator, similar to how Duan et al. (2008) employed user

18

ratings as a proxy for sales. Film critics work for publishers who want to feature movie reviews

which their audience will be interested to read. With this logic, more critical reviews of a larger

scale film, like Star Wars, will appear in the buildup to the film’s release compared to a mid-tier

project like Creed. For reference, the two most recent films in both franchises, The Last Jedi and

Creed II, have 414 and 208 critic reviews posted on Rotten Tomatoes, respectively. Thus, the

quantity of critical reviews for a project on Rotten Tomatoes will serve as a control variable for a

film’s profile prior to its release. Profile as a control variable is also important for distinguishing

original content which may have an external factor lending it more visibility to the public. The

presence of a famous director at the helm, such as James Cameron, makes a film a huge property,

despite its lack of attachment to any pre-existing material.

TheNumbers includes several other indices which helped provide the control variables

necessary to isolate the originality factor within the research. TheNumbers includes genre

indices, which incorporates 11 different film genres. Like film profile, genre can be used to

control for the fact that audiences are interested in different types of projects. An action movie

such as The Fast and the Furious appeals to a larger movie-going crowd than does a dramatic

movie like Moonlight. Other control variables, such as release date, MPAA rating, and critical

ratings, are readily available within the indices on TheNumbers and Rotten Tomatoes. With the

availability of ratings through the internet, audiences can see how much critics liked a movie,

which is an important influence on their decisions to go see a film. Likewise, Rotten Tomatoes

critical score (percent approval) is included as a control variable in the dataset. A binary variable

for each month of the year provides an important control given films experience more success in

various seasons, such as during summer or the holidays. Last, the MPAA rating (i.e. G, PG, PG-

13, R, etc.) is included as a control to account for the different size and ages of audiences who

may attend a film based on its MPAA rating.

4.3: T3 - Box Office Revenue of an Individual Film Based on Non-originality

Procedure

Unlike the first two tests, Test Three regresses the revenue of an individual film

(originating from the dataset of the top 100 grossing films each year between 2000 and 2018) on

the non-originality variable to assess how source material affects financial success. Thus, non-

originality as a binary independent variable (1 for non-original) is added to the experiment, and

19

the dependent variable is the real domestic box office revenue of the film (in millions of 2018

US dollars). Additionally, the real revenue is regressed on interaction terms which indicate

whether a non-original film released during one of the specified time periods—2007 to 2011,

2012 to 2014, and 2015 to 2018—representing the key innovations in online distribution (i.e.

Netflix’s online streaming, the release of Netflix Original shows, and the release of Netflix

Original Movies). 1900 films are included in the analysis.

An equation for this procedure is provided.

Fig 4. Regression equation for Test Three.

Real Revenue is expressed in millions of US dollars. Non-Original

i

, Time

i

, and the

controls for the three time period brackets follow the same rules as in Section III. An interaction

term for the time brackets is also included (i.e. a non-original film from 2016 will receive a 1 for

Non-Original

i

, X2015.2018

i

, and Un2015.2018

i

). RTScore

i

and RTNumRevs

i

are continuous

control variables representing a film’s Rotten Tomatoes critical score (percentage of critics who

enjoyed the film) and the number of critical ratings. There are 6 MPAA ratings, 11 genres, and

12 release month binary variables that are 1 if the film falls within those categories.

20

Results

T9: Real revenue regressed on non-originality and time indicators. Coefficients signify millions of USD.

X variables (i.e. X2007.2011) indicate original films released between the specified dates, while Un

(Un2007.2011) variables are interaction terms for non-original films released between the specified dates.

The last regression includes all relevant control variables (many were not presented in the table due to

lack of significance).

21

Discussion

Due to its greater sample size, Test Three yielded the most robust results thus far.

Without any time-related controls, the first regression indicates we should expect an original film

to gross about $86.8 million at the box office, while we would expect that figure to climb by

$35.1 million if the film were non-original. On an economic level, this is an extremely

significant result. Simply distributing a movie that is non-original will increase the expected

profits of the product by over 40 percent within this regression. The coefficient for non-

originality is significant at the one percent level, demonstrating a strong relationship between a

film’s source material and its financial success. The second regression, which incorporates a time

index similar to that in the first two experiments, shows the time coefficient is not significant,

even at the 10 percent level. Thus, non-originality, and not time is explaining the difference in

revenues. This result makes logical sense given revenues are inflation-adjusted.

The third regression, however, offers more insight into the recent financial advantage

non-original films have enjoyed at the box office. This equation shows we should expect original

films released between 2000 and 2006 to gross $92.4 million, with that number rising by $24.5

million if the film were non-original (significant at the 1 percent level) during the time period.

An additional statistically significant change in the film’s financial success based on source

material occurs for films released between 2015 and 2018; original films stand to make $25.5

million dollars less than they would have between 2000 and 2006, while non-original films stand

to make $38.9 million dollars more. In sum, a non-original film released between 2015 and 2018

stands to earn about $62.4 million dollars more than an original film released during the same

time period, an economically significant increase of 93 percent. Even when compared to a non-

original film from 2000, the expected increase in real revenue for a non-original film released

between 2015 and 2018 stands at 10 percent.

While the creation of films released solely through online streaming platforms in 2015

marks an important innovation in the film industry, it does not signify that this specific date is

the cause of this shift. However, it does appear that the divergence truly emerges around this

point in time. Similar to Test One and Two, in which the 2015 time period offered the most

sizable results, a notable difference arises in box office trends surrounding this date, particularly

for non-original content.

22

When controlling for other variables which might have an impact on a film’s financial

success in the fourth regression, the marginal effect of non-originality in the 2000 to 2006 time

period shrinks to $10 million—still an increase of almost 20 percent—with a significance just

outside the 10 percent level. The coefficients for time period, however, remain high in the final

two time periods. This signifies an original film released between 2015 and 2018 is expected to

earn $51.6 million less than an original film released between 2000 and 2006 (controlling for the

other variables), an effect significant at the 0.001 percent level and a notably sizable impact. The

financial success of individual original films is expected to decrease by over 100 percent during

the final time period, demonstrating a rapid transition in which originality harms the financial

success of films much more in recent years.

Interestingly, the interaction term for non-originality during this time period does not

offer significant results. This might suggest that while original films suffer, the gains

experienced by non-original films are captured instead by the other control variables. Among

non-original films, a prevalence for franchise films exists, which could lead expected economic

performance to be represented by the control variables often associated with these types of films.

These may include PG-13 MPAA ratings, early summer or holiday release dates, and the action

or adventure genre. This idea will be explored in the subsequent sub-section. Regardless, to

improve the robustness of the experiment and arrive at significant results for the interaction term

for non-originality, this paper recommends the introduction of an appropriate instrumental

variable to the regression for future experiments. This would eliminate the endogeneity present

in the equation.

It is important to note certain control variables, including the ones mentioned above,

yield an enormous economic effect on the financial success of a film, oftentimes to a greater

extent than the variables accounting for the time period. Adventure films, for example, are

expected to yield $61.8 million more in revenue than the baseline film, while films released in

May are expected to yield $39.2 more in revenue. Both of these factors are significant at the

0.001 percent level.

Rotten Tomatoes scores also pose a subtle financial effect for films of disparate critical

quality. For example, a film receiving a 0 percent score on the website is expected to earn $25.4

million less than a film receiving a 100 percent score. For the film with the median Rotten

Tomatoes Score, 53 percent, the regression shows to expect the revenue to be $5.8 million

23

dollars more than the film with the score at the 25 percent quartile (30 percent), and $5.8 million

dollars less than the film with the score at the 75 percent quartile (76 percent). Since Rotten

Tomatoes can only vary by 100, the relative effect of Rotten Tomatoes scores remains small

when compared to other controls, despite its statistical significance.

Film profile, however, can pose a much greater economic effect. For every 100 more

reviews a film received on Rotten Tomatoes, the revenue is expected to climb $61.9 million.

Since the amount of reviews within the dataset can vary by several hundred in number, this

yields perhaps the most significant increase in financial success. To illustrate, Avatar, which

received 303 reviews, is expected to earn $175.2 million more than Fireproof , which received

20 reviews (holding all other controls constant). Avatar, possessing a greater name recognition

due to having James Cameron as director, obviously received a lot of attention, giving it a higher

profile and helping it garner more financial success than most original films. Films falling within

the middle two quartiles of film profile should expect less, but still sizable, deviation due to this

variable. The 25

th

and 75

th

percentile are only separated by 92 reviews (123 to 215), meaning

film profile accounts for a $56.9 million increase between these two quartiles.

Critical review count remains an imperfect measure of how to assess the profile of a film

due to its crossing-over in many instances with the originality category. Additionally, given the

proliferation of multimedia news outlets, modern films have more reviews available on Rotten

Tomatoes than older films in the dataset. Avatar, regardless of being the highest grossing

international film of all time, has over 100 less reviews than last year’s Black Panther. Likewise,

when holding all other controls constant, profile is not the most effective variable to analyze in

isolation.

24

Revenue by Source Content

T10: Real Revenue in millions of 2018 USD regressed on each category for non-originality, yearly indicators,

interaction terms, and relevant control variables. Coefficients are in millions of 2018 USD. Table is one single column

but presented side by side due to its length.

In the fourth regression of Table 9, the coefficients for non-originality and the interaction

terms for time period and non-originality lost their statistical significance. As briefly discussed,

other control variables potentially associated with non-originality, like MPAA rating, genre, or

release month, may have influenced the lack of significance and captured the impact of non-

originality. To explore this possibility, the films included in the dataset were also categorized by

their specific source content, rather than just an overall binary variable for non-originality. These

sources included books, comic books, TV shows, remakes, plays, spin-offs, video games,

historical events, re-releases, and sequels.

25

When real revenue is regressed on these categorical variables, unsurprisingly, films

derived from comic books or sequel films are expected to earn the most at the box office. As

mentioned before, many of these films are high-budget superhero or franchise films, which rank

among some of the most successful titles today. It is therefore unsurprising that Table 10 shows

comic book movies should be expected to gross $29.3 million more than the baseline original

film, while sequel films should be expected to gross $60.5 million more. Both are statistically

significant results. Meanwhile, the coefficients for MPAA rating, release month, and genre all

shrink in magnitude compared to those in Table 9, showing these control variables were earlier

capturing some of the effect of these specific categories of non-originality. Thus, these results

offer a probable explanation for the drop in size and statistical significance for the final

interaction term in the fourth regression of Table 9, given much of the expected earnings of a

project is tied up in the type of non-originality, rather than just non-originality itself.

When accounting for these controls in the fourth regression, the effect of originality on

the individual success of the top 100 highest-grossing films at the domestic box office remains

pertinent. Likewise, Test Three supports the ideas of the paper; non-original films released

through the traditional distribution model have seen a rise in financial success during the most

recent time period, even when accounting for other factors which determine how well a film will

sell in theaters. However, a test implementing a better instrument to eliminate endogeneity

among the independent variables should be utilized to arrive at a more robust conclusion

regarding the interaction between time period and non-originality.

Combined with the results of the first two tests, which isolated the years between 2015

and 2018 as a potential time period in which this shift occurred, it is entirely plausible that the

innovations in online distribution of entertainment content have altered consumer preferences

and generated the increasing success of non-original films. This could have occurred due to the

gradual integration of innovations like online streaming (introduced by Netflix in 2007) or

Original shows (2012) into the mainstream, the recent entrance of Original streaming films

(2015), a combination of all three innovations, or a different external factor. Thus, the success of

non-original versus original content in the online distribution model will be explored further in

Section V to further investigate why originality has decreased in the traditional film industry.

26

V. Test Within the Non-Traditional Distribution Model

5.1: Outline

While Tests One, Two, and Three all investigated the first hypothesis, Test Four explores

the second hypothesis: non-originality of subscription-based streaming content yields a smaller

effect on the success of the project than does non-originality for content distributed through the

traditional theater model. This section of the paper moves beyond current research and hopes to

begin a conversation about how the types of content which will appear in the future through the

different distribution models will continue to evolve. Test Four incorporates a different dataset

utilizing electronic word of mouth in place of revenue to compare between streaming-based and

traditional content.

5.2: Theory

One of the main issues in examining the success of original content in the subscription-

based setting is the lack of a revenue stream directly related to the product. When a consumer

pays for HBO, they may only be watching Game of Thrones. Yet their monthly fee doesn’t

directly represent revenue for the one program, but rather the whole platform. Even more

difficult to analyze is the lack of viewing statistics for the streaming-based subscription services,

like Netflix and Hulu (HBO does release “ratings” similar to a traditional TV channel when a

film debuts on the premium channel). Although third party estimates of “ratings” for original

shows and movies, such as Stranger Things and Bright, do exist, Netflix’s own Chief Content

Officer has publicly stated the estimates are inaccurate (Koblin, 2017). For streaming services,

viewing numbers represent extremely valuable proprietary data, offering insight into the type of

programming which customers will enjoy, and are thus unavailable in a precise form.

Analyzing electronic word of mouth (eWOM) as a substitute for actual revenue or

viewing statistics may offer an alternative path to assess the relative success of subscription-

based content. In the literature regarding word of mouth (WOM), or interpersonal

communication, researchers have always considered WOM an important factor for consumers

when choosing whether to purchase a product. Katz and Lazarsfeld (1955) showed WOM was

the single most important source of influence for consumers choosing between household items,

and Slack (1999) asserted people choose to visit a new website because of a personal

recommendation 57 percent of the time. However, studies of the impact of WOM on sales stalled

27

due to the difficulties associated with recording all verbal conversation. In response, Godes and

Mayzlin (2004) proposed the study of eWOM, or online discussion of a product. On the internet,

communications are more easily recorded and traceable, solving the problem associated with a

lack of records for conversations.

Interestingly enough, two influential papers for eWOM, Godes and Mayzlin (2004) and

Duan et al. (2008) both utilized the movie industry as a topic for their research, since the industry

had always received significant academic attention for studying the effects of WOM. Godes and

Mayzlin (2004) concluded their data suggested the greater the volume of eWOM for a film, the

higher impact of the buzz on future sales. However, the nature of eWOM as an endogenous

variable in generating sales remains important to note in this setting. Duan et al. (2008) discuss

the “positive feedback mechanism” of eWOM, noting that eWOM “is not only a driving force in

consumer purchase, but also an outcome of retail sales.” Thus, when considering eWOM as a

measure of success for a product, it is important to consider it as an endogenous variable while

performing regression analysis. Godes and Mayzlin (2004) acknowledge the time-dependent

nature of eWOM, stating although overall eWOM may generate higher aggregate sales, “high

[e]WOM today does not necessarily mean higher sales tomorrow. It may just mean that the firm

had high sales yesterday.”

To reflect this element, Duan et al. (2008) measured eWOM on a daily basis, stressing

the importance of the short interval. With relation to the movie industry, the study first regressed

the volume of eWOM on Box Office revenue, and subsequently revenue on eWOM. Through

their research, they found that daily postings of user reviews displayed a strong positive

correlation with the daily gross of a film. However, they also discovered that a lag in eWOM,

such as user reviews posted on day t-1 or day t-2, demonstrated a weaker correlation with the

daily gross of the film on day t (2008). Thus, by including lagging terms, the study was better

able to pinpoint causality between eWOM one day and sales that same day. When developing a

relationship regarding eWOM, employing measures from different time periods can be important

for removing endogeneity.

In the years since the discussion of eWOM began, the proliferation of social media also

provides a new vehicle for eWOM. While the dispersion of user reviews represented the only

eWOM factor in the experiments discussed earlier, the sharing of reactions to a film via social

media presents an alternative variable to analyze. Despite hesitations about the uncertainty of

28

models utilized to predict the impact of social media buzz on box office revenue, Lehrer and Xie

(2016) propose that social media can be utilized to improve box office predictions. While their

approach utilized eWOM valence, or the overall sentiment of the post, the ability to collectively

measure the feelings of social media posts about a product has posed problems in experiments

(Godes & Mayzlin, 2008). Analyzing the overall sentiment of eWOM towards a single title can

prove time-consuming and inaccurate, while also limiting the ability of researchers to develop

large datasets. Likewise, the research for this paper will instead focus on eWOM volume, and not

valence, as a measure of film success.

While the concerns of Godes and Mayzlin (2008) towards eWOM valence rest in the

difficulties of estimating the effects of positive versus negative eWOM, this paper will use

search hits as a source of eWOM volume neutral in its valence. While a Google search, for

example, does not constitute interpersonal communication, it does demonstrate an awareness of a

consumer towards the existence of a product. To demonstrate, Wu and Brynjolffson (2015)

developed a model by which search frequencies of housing prices in various markets were

utilized to predict future housing prices. Furthermore, the authors claimed their model beat the

National Association of Realtor’s predictions for the period by 23 percent (2015). Although not

applicable in every industry, in the case of Netflix, Piper Jaffray analysts have posited Google

Trends as an indicator of general trends in subscription growth, citing a 4 percent error in the use

of tracking Google hits of Netflix for predicting growth of subscribers (Wolff-Mann, 2018).

To summarize the importance of WOM, and more specifically, eWOM, to the research,

the prevalence of data related to buzz about a product will serve as a substitute for revenue and

viewership data of subscription-based streaming services. An analysis of eWOM utilizing more

traditional sources of interpersonal communication, such as volume of critical or user reviews of

films, or newer sources, such as volume of mentions over social media, or proxies for eWOM,

such as Google search volume, can provide a method for comparing the relative success of

content across the two different distribution models.

5.3: Data for Test Four

The dataset features both traditionally-distributed and streaming-based content. The

eWOM for each of the yearly 100 highest-grossing films at the domestic box office released after

June of 2014 (over a full calendar year before the release of Beasts of No Nation, the first Netflix

Orginal film) until the end of 2018 is incorporated into the new dataset, as well as the eWOM for

29

every Original film released by Netflix from October of 2015 (release date of Beasts of No

Nation) to April of 2019. eWOM is collected using the Google Trends web app. The Google

Trends poses issues, since it only records eWOM of different search terms relative to an index,

rather than giving an absolute number of search hits for a given time period. Additionally, the

app only allows for five entries at a time. Thus, the approximately 450 traditional movies and 90

Netflix Original films released during the specified time periods were input five at a time before

being re-indexed to the last film in the previous set.

5

Unfortunately, due to the lengthy process involved with collecting and processing data in

this manner, more films from earlier time periods were not able to be added to the set. Likewise,

the research does not contain an intertemporal comparison to see how the effects of non-

originality have changed over time as part of Test 4. Additionally, many films had to be removed

from the set because of issues singling out the eWOM of film titles which may be common

search terms.

6

Many one-word film titles, such as Lucy, generated noise unassociated with the

release of the film due to other searches which may have been for alternative queries (i.e. the

show I Love Lucy, the character Lucy from Peanuts, or the actress Lucy Liu). While this does

introduce a possible error into the data, there is no clear directional bias due to the random nature

of film titles relating to common phrases. Potential biases could stem from franchise films

holding longer, more specific titles which would rarely be eliminated, favoring larger films in the

dataset. After removing problematic search terms, the data-set features 341 traditional and 81

streaming-based titles.

7

Additional errors arise due to the time periods available in the Google Trends app. Given

the length of time analyzed in the paper, the indices provided in the results for each set only

5

For example, if five films were entered into the Google Trends app, the next set would feature the fifth film as the

new first entry. In this manner, the trends can re-indexed every four films to allow for comparisons between each

set. A Google Trends API package is available in R which could allow for more efficient bulk-entry and processing

of film titles than the by-hand method utilized in the paper. The research presented here decided not to use this

package due to time constraints of writing a suitable program. Additionally, the program is often blocked by Google

if too many users on one Wi-Fi network run too many terms through the API. For future students, this may pose

issues. Alternative collection methods are recommended.

6

The app does sometimes allow to search for a movie instead of a term, but this option is not available for every

title, thus leading to the dropping of troublesome titles for which this option was unavailable.

7

Bird Box, released by Netflix in December of 2018, was also removed from the dataset due to its large outlier

status for the Week 2 index. Its eWOM index for Week 2 was eight times greater than the next closest Netflix title,

which significantly skewed the non-originality term in Table 13. One could argue the popularity of the film had

more to do with its viral status, including a popular internet meme called the “Bird Box Challenge,” than the

popularity of its source material, the original novel. This type of popularity does not fit with the research and was

removed accordingly.

30

measured how frequently searched a term was over the course of a week. Thus, the data contains

a weekly index for the week beginning on the Sunday before the release of the film, as well as a

second weekly index for the week beginning on the Sunday after the release of the film. This

does not allow for the same precise daily analysis utilized by Duan et al. (2008). For films which

may have released on different days, this may introduce an error given the differing amounts of

time before and after a film was released within the indices for the first and second week. For

traditionally-distributed films, wide releases usually occur on Thursday nights, with some

irregularity. For Netflix projects, however, the release day is more erratic. While this does

introduce noise into the data, there is again no obvious directional bias due to the consistent

release dates of theatrical films and the random release dates of Netflix films.

For future research utilizing eWOM as a means of comparison between the traditional

and streaming-based distribution models, the use of a more precise data-collecting tool is

recommended. The incorporation of daily lagging terms will allow for greater specificity and

better ensure the elimination of endogeneity. Additionally, as Netflix and other streaming

services expand their portfolios of online films, the sample size of an accompanying dataset can

be expanded to allow for a more robust future investigation.

Like Test Three, the films are categorized by source material, with a collective non-

original binary variable and indicators for each type of source. The control variables from Test

Three (critical rating, film profile, genre, and release month) aside from MPAA rating (not

available for every Netflix title) are carried over as well.

5.4: T4 - Impact of Non-originality on eWOM for Both Distribution Models

Procedure

The fourth test regressed eWOM for films on an interaction term for distribution model

and originality, while controlling for a range of variables carried over from Test Three. The

analysis utilized the collective volume of google searches for the weeks beginning on the

Sundays before and after the release of the individual film, which will be called Week 1 and

Week 2.

While imperfect, this does capture the buzz around a film during the first and second

week of its release. Analyzing only the start of a film’s run can be a more efficient method than

incorporating the entirety of the film’s stay in the box office. The importance of the opening

31

weekend time frame is stressed by Dhar et al. (2012), due to the fact that non-original content

often shifts audience demand towards the opening-weekend of a film. While this does not ensure

better “legs,” or audience retention within the industry, front-loaded films enjoy the highest

profitability by amassing most of their revenue immediately. Thus, this research included an

opening week and a second week and will be run with both the Week 1 and Week 2 index as

dependent variables.

An equation for the procedure is provided below.

Fig 5. Regression equation for Test Four.

Similar to before, Non-Original

i

is a binary variable which will be 1 for non-original

content and 0 for original content. Likewise, Theater

i

is a binary variable which will be 1 for

content distributed through theaters and 0 for content distributed through online streaming. This

remains an extremely important control, since it will eliminate the effect of different audience

size and behavior for films released in theaters versus on a Netflix or Hulu without other control

variables. For example, despite the popularity of both properties, Star Wars may appeal to a

broader audience than Stranger Things due to the visibility of theater releases. The third beta will

be associated with an interaction term for Non-Original

i

and Theater

i

.

Thus, this third beta will only impact non-original films distributed in theaters. The

eWOM for non-original films released in theaters will experience the effects of β

1

+ β

2

+ β

3

.

eWOM for original films released in theaters will experience the effects of β

2

. eWOM for non-

original films released through streaming services will experience the effects of β

1

. eWOM for

original films released through streaming services will experience none of the effects of the first

three betas.

A similar group of controls to those present in Test Three will also be necessary for the

experiment. Controlling for year is important given the short time frame during which streaming-

based original series and films have been available, meaning the first years of these innovations

could experience different effects on eWOM than in later years as consumers became

accustomed to the new developments. Like Experiment 2, the analysis for Experiment 3 will also

32

control for profile, critical ratings, genre, and release month (MPAA was unavailable on Netflix

during the time period of the research).

How does eWOM translate to sales?

Within the dataset, the indices for eWOM during Week 1 and 2 are 83.8 and 83.6 percent

correlated with the total real revenue of the film, respectively. This provides an initial indication

that eWOM from the two opening weeks can serve as a reliable proxy for total sales. The two

indices themselves are 94.7 percent correlated, leading both indices to be almost equally

correlated with revenue. Both indices are less correlated with opening weekend gross, with only

81.7 and 78.6 percent correlation for eWOM during Week 1 and 2 and opening weekend

revenue, respectively. This drop may be due to moviegoers demonstrating interest in a film by

searching it online or reading reviews during Week 1 or 2 but planning to see it at a later date. In

this case, their interest would only affect the total revenue, rather than the opening weekend

revenue. Thus, Test 4 will consider total box office as sales.

A simple regression of real revenue on both indices for Week 1 and Week 2 can show an

approximate marginal effect of eWOM on sales. For each additional unit increase in the index

for Week 1, real revenue is expected to increase by $16.8 million dollars. Likewise, if the second

index was instead used to predict sales, for each additional

unit increase in the index for Week 2, real revenue is

expected to increase $12.4 million. To contextualize this

difference, Avengers: Infinity War is four units higher than

Jurassic World on the index for Week 1, and five units

higher on the index for Week 2. This would translate into

expecting Infinity War to earn about $58 million or $60

million more than Jurassic World, depending on the index

used, over its entire box office run. While this estimation

does not properly reflect the differences in financial success

between these two specific films, this example does

demonstrate the sizable expected financial effect of unit

changes in eWOM within the regression.

T11: Real Revenue in millions of USD

regressed on the two weekly indices

for eWOM. Coefficients represent

millions of 2018 USD.

33

Results of Primary Test Four Regression

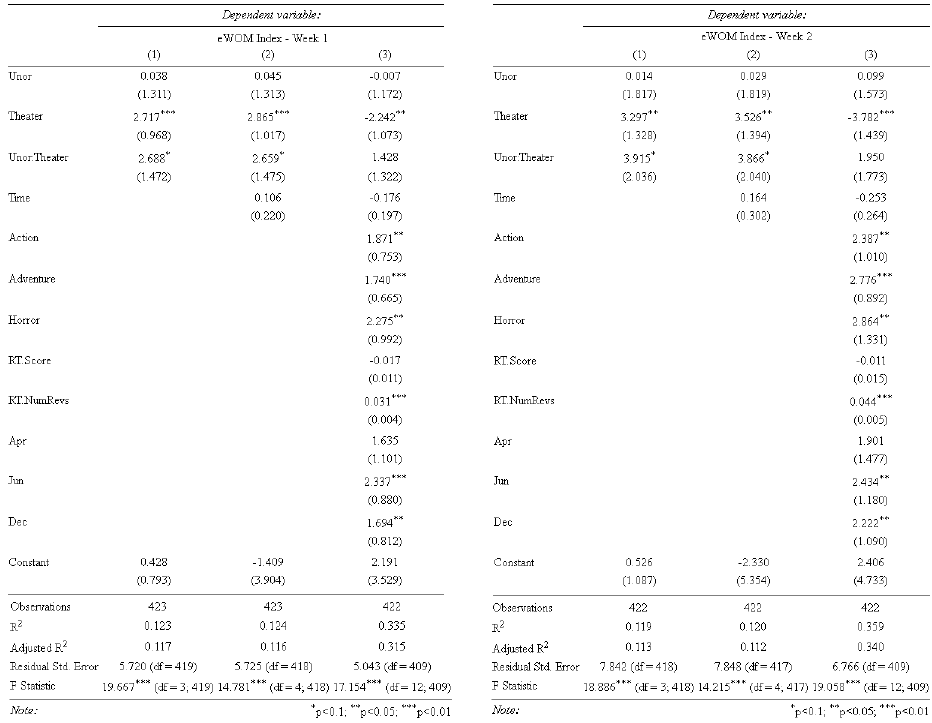

T12 (Left) and T13 (Right): In both cases, the eWOM index for Week 1 (left) and Week 2 (right) is regressed on

binary variables for originality and distribution model, as well as control variables similar to those used in Test

Three. Coefficients are of the magnitude of the unitless indices.

Discussion

In both the first and second regression of T12 and T13, the impact of the traditional film

release on the eWOM of the film immediately stands out. For both original and non-original

films, the eWOM is expected to rise by sizable and statistically significant amounts. For

example, a film’s Week 1 eWOM is expected to increase by 2.717 points if released through a

theater, and an additional 2.688 points if it is also non-original. A similar trend is evident for

Week 2 eWOM, with expected increases of 3.297 if released in theaters and an additional 3.915

if the film is non-original. When also controlling for time in the second regression, no

statistically significant trend emerges (similar to the results in Test Three). Without the control

34

variable for film profile, which is only featured in the third regression in both tables, this result

seems plausible. Most of the Netflix Original films receive less attention than movies which

were among the highest-grossing films at the domestic box office and would thus generate less

eWOM than their traditional counterparts.

With the inclusion of all relevant control variables (non-relevant controls have already

been removed) in the third regression of T12 and T13, the coefficient for Theater

i

(β

2

) reverses

its sign while maintaining its statistical significance. This shows that while holding the profile of

a film constant, there is a negative effect felt by original films released in theaters that is not

cancelled out by any potential positive increase from the coefficient for non-originality (β

1

) or

the interaction term (β

3

). To compare between original and non-original theatrical films, there is

a potential for original films to generate β

1

+ β

3

less eWOM than non-original films. eWOM is

expected to be 2.24 and 3.782 points lower in Weeks 1 and 2, respectively, for theatrical films

compared to Netflix films holding originality constant. To contextualize this in financial terms

using the regressions in the previous subsection, this would lead to an approximate decrease of

$37.6 million and $46.3 million in revenue based on the eWOM regressions for Week 1 and

Week 2, a strong economic effect.

In similar fashion to Test Three, the coefficient for the interaction term (β

3

) in the third

regression in both T12 and T13, representing non-original films released in theaters, shows a

sizable positive but statistically insignificant expected increase in eWOM. Like the interaction

term between non-originality and time period discussed earlier in Test Three, the lack of

significance may indicate other control variables better capture the impact of non-originality. To

reiterate, summer and holiday season releases, as well as the action and adventure genre, are

often present for superhero or franchise films, which may capture the effect of non-originality

more than the binary variable does alone. Including an instrumental variable, similar to one

which could be used within Test Three, is recommended for future tests replicating Test Four to

eliminate this problem.

Looking at the effects only felt by streaming-based content, non-original films released

through streaming services are expected to see no increase in eWOM relative to original films in

both T12 and T13. The absence of a significant or sizable coefficient (β

1

) over this term works to

partially support the second hypothesis—that non-original content does not enjoy the same

35

competitive advantage in the new online streaming space—by showing there is no difference in

eWOM between original and non-original Netflix titles.

Thus, acknowledging the lack of significance for β

1

and β

3

, a conservative interpretation

of the data suggests films released in theaters, holding all other variables constant, perform worse

than do Netflix releases. However, like the discussion in Test 3, the effects which could be

represented by β

3

are likely captured by other control variables—specifically the action and

adventure genres, summer and holiday releases, and large profiles—due to the frequent cross-

over between non-originality and these variables. If the sizable effect of β

3

was acknowledged,

despite its lack of significance, non-original theatrical releases would receive 1.428 and 1.950

greater eWOM in Weeks 1 and 2, respectively, than original films. On the other hand, as

established earlier, β

1

is neither sizable nor significant. Thus, the marginal effect felt by non-

original versus original theatrical releases, β

1

+ β

3

, would be greater than the marginal effect felt

by non-original versus original Netflix release, β

1

. This scenario, although imperfect, presents the

strongest case for the validity of the paper’s second hypothesis—that a disparity exists between

the relative success of non-original and original films in theaters which is absent from Netflix.

Test Four requires further investigation and expansion in order to properly validate the

second hypothesis. Acquiring more data points by utilizing more films, both released in theaters

and across Netflix and other distributors entering the space, will quickly raise the statistical

significance of many of the variables. Additionally, the employment of a more efficient tool to

collect the eWOM of the various individual films will allow for the elimination of biases related

to common phrase titles and total weekly eWOM counts, as well as provide a better method for

reducing endogeneity due to eWOM’s status as both preceding and following sales. With a

stronger experimental design and the release of more streaming-based films, the question of

whether original content can succeed relatively more on online-streaming platforms can be

answered more precisely in the future.

VI. Conclusion

The research present in this paper set out to prove two hypotheses; first, the success of

non-original content has increased, especially in recent years, within the traditional distribution

model; second, original content would fare better compared to non-original content in the new

streaming platform space relative to its success in the traditional distribution model. The results

offered in Tests One, Two, and Three strongly support the first hypothesis, while Test Four

36

suggests the potential validity of the second hypothesis. Likewise, the results of this paper

provide several implications for the future of filmmaking.

For movie studio executives deciding how to assemble their portfolio of theatrical