FY 2023

ANALYSTS’ BRIEFING

April 16, 2024

P9.1

billion

60% GPM

GROSS PROFIT

P9.1

billion

60% GPM

GROSS PROFIT

P35.2

billion

TOTAL REVENUE

P35.2

billion

TOTAL REVENUE

P20.6

billion

59% margin

EBITDA

P20.6

billion

59% margin

EBITDA

P71.9

billion

RESERVATION

SALES

P71.9

billion

RESERVATION

SALES

P342.4

billion

TOTAL ASSETS

P342.4

billion

TOTAL ASSETS

P132.9

billion

TOTAL EQUITY

P132.9

billion

TOTAL EQUITY

0.84x

Net Debt to

Equity

0.84x

Net Debt to

Equity

FY23 AT A GLANCE

P10.3

billion

NET INCOME

P10.3

billion

NET INCOME

% Change

FY 2022FY 2023

IN PHP MILLIONS

18%29,82235,163

Total Revenues

19%12,79015,228

Real Estate

17%13,74216,021

Rental Income

31%1,6072,105

Mall admin, hotel operations &

miscellaneous income

7%1,6831,809

Interest Income

26%7,2479,116

Gross Profit (Residential)

56.7%

59.9%

Gross Margin

20%9,64711,596

Operating Expenses

21%17,00720,574

EBITDA (Consolidated)

57.9%

58.5%

EBITDA Margin

9%5,2185,686

Interest & Financing Charges

39%7,39310,292

Net Income

Income Statement

Residential Segment

In Php Billion

+9.7% FY23 vs FY22

+10.0% 4Q23 vs 4Q22

17.1

18.9

4Q22 4Q23

+10.0%

65.5

71.9

FY22 FY23

+9.7%

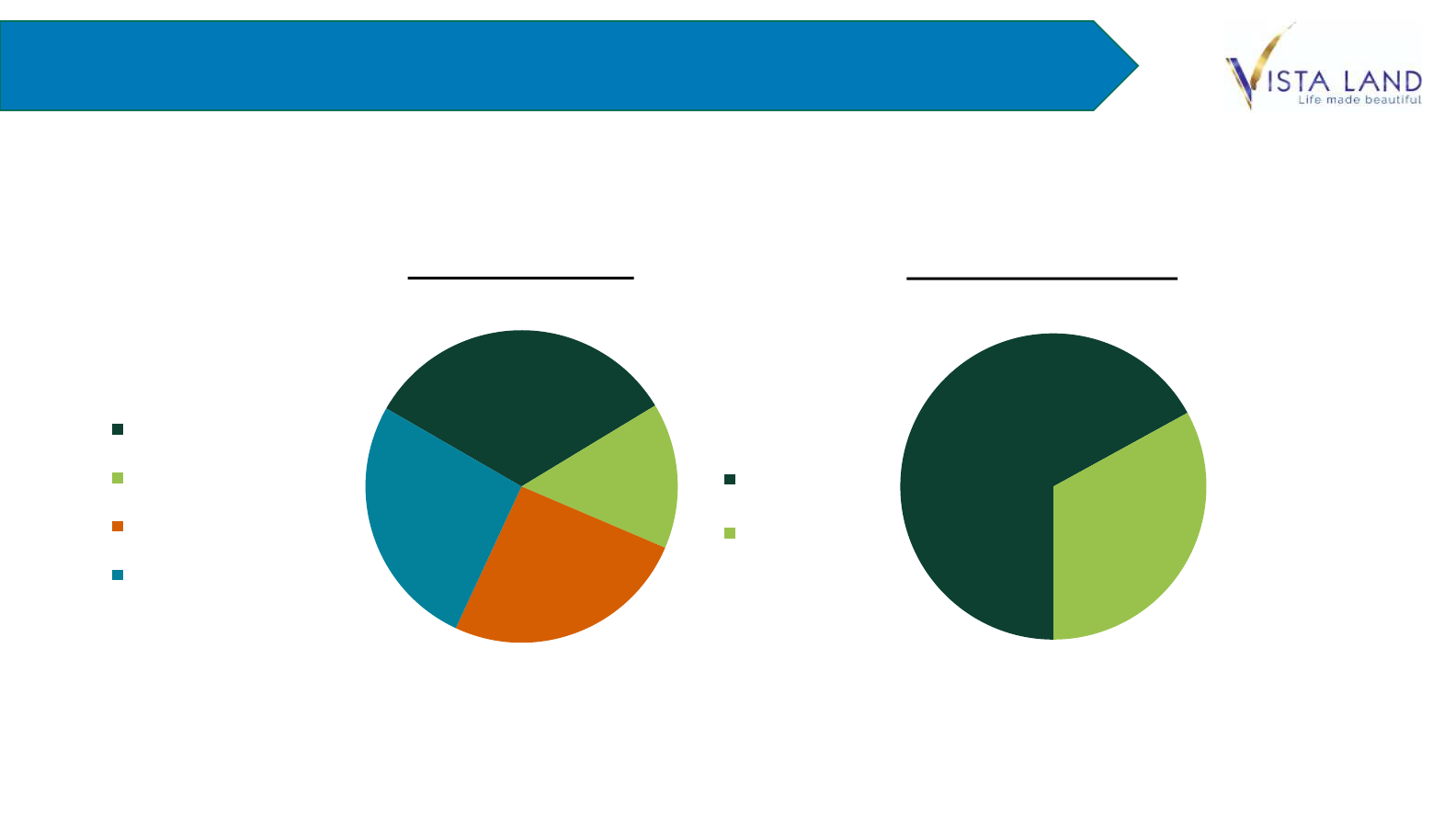

Real Estate Revenue Contribution

30%

40%

6%

4%

21%

22%

44%

11%

4%

20%

CAMELLA

COMMUNITIES

PHILIPPINES

COMMUNITIES

PHILIPPINES

BRITTANY

CROWN ASIA

VISTA RESIDENCES

BRITTANY

CROWN ASIA

VISTA RESIDENCES

FY 2023 FY 2022

CAMELLA

• Camella brand accounts for 69% and 66% for 2023 and 2022 respectively

• Mid to high end brands Crown Asia and Brittany contributes around 10% combined

• Vista Residences our subsidiary for vertical developments account for 21% of the total

Commercial Space Summary

We have a total of

105

commercial

assets composed of

7

offices

42

malls

56

commercial

centers

%GROSS FLOOR AREA (GFA) in sqm

871,384,148

MALLS & RETAIL

STORES

13226,227

OFFICE

1001,610,375

As of December 31, 2023

Leasing Statistics

4Q233Q232Q231Q234Q223Q222Q221Q224Q21KEY STATS

100%100%100%100%100%100%100%100%100%Operating GFA

87%87%87%87%87%86%86%86%84%Occupancy – system

wide

86%86%86%86%86%85%85%85%83%Malls

92%92%92%92%92%92%92%92%92%Office

%pre-COVID level

100%100%100%100%95-100%92-100%80-90%75-85%70-80%

Foot traffic

Financial Condition

% Change31-Dec-202231-Dec-2023

IN PHP MILLIONS

(33%)47,17731,484

Cash and Investments

12%74,40183,403

Total receivables

19%53,53463,771

Real Estate Inventories

5%118,344124,656

Investment Properties

6%322,214342,401

Total Assets

2%158,395161,332

Interest Bearing Loans

6%198,564209,540

Total Liabilities

7%123,650132,862

Equity

Gearing Ratio

% Change31-Dec-2231-Dec-23

IN PHP MILLIONS

2%158,395161,331

Total Interest Bearing Debt*

(12%)56,61749,909

Cash and Investments

9%101,778111,423

Net Debt

7%123,650132,862

Equity

1.28x1.21x

Debt to Equity

0.82x0.84x

Net Debt to Equity

*excludes receivables sold (with recourse) to banks classified as Loans Payable

Debt Profile

33%

15%

26%

26%

Bank Loans

Retail Peso Bond

Corporate Note

USD Bonds

Funding Sources

Debt Maturity Profile

67%

33%

Long Term

Short Term

Landbank

% ageTOTAL LAND AREA* (in HAs)

85%2,422.31Owned

15%411.20

Share in Joint

Ventures

100%2,833.51TOTAL

*Mega Manila – Metro Manila and the

neighbouring provinces of Cavite, Laguna, Rizal,

Batangas and Bulacan

*includes 192.46 hectares of STR’s landbank

61

%

Provincial

39

%

Mega Manila*

LAND BANK LOCATION

Project Launches

As of December 31, 2023, we have

launched 34 projects with an

estimated value of about

₱50.7B

2

Brittany

3

Camella

11

Communities Philippines

14

Vista Estate

3

Vista Residences

1

Crown Asia

Capital Expenditure

20.0

19.2

7.3

7.2

0.7

0.7

FY23E FY23A

Construction Land Development Land Acquisition

FY23EFY23APER ACTIVITY

20.019.2

CONSTRUCTION

7.37.2

LAND DEVELOPMENT

0.70.7

LAND ACQUISITION

28.027.1

TOTAL (bn)

FY23EFY23APER TYPE

4.33.5

CAPEX

23.723.6

WORKING CAPITAL

28.027.1

TOTAL (bn)

Spent ₱27.1B as of Dec 31, 2023

(97% of 2023 CAPEX budget)

Note: May not add up due to rounding issues

In Php Billion

28.0 27.1

2023

Strategy

Maximize

Optimize

Vista Estate

More Upscale,

Vertical,

Commercial

Projects

Key Message

RESOURCES

Key Message

18

Coffee Projects

were built in 2023

14

Vista Estates

project for 2023

26

Vista Estates

across the country to date

P7.7 billion

Combined project value of

Brittany and Crown Asia

(high-end development)

Vista Estate

More Upscale,

Vertical,

Commercial

Projects

15%

Of the total launched project value

What’s in store for the year (teaser)

Launch more Vista Estates

in 2024

Unveiling of resort-type development

(Boracay and Palawan)

High-end developments in

Metro Manila

Launch condominium projects beside

existing malls to increase mall GFA

Thank you!

Except for historical financial and operating data and

other information in respect of historical matters, the

statements contained herein are “forward-looking

statements”. Any such forward-looking statement is

not a guarantee of future performance and involves a

number of known and unknown risks, uncertainties and

other factors that could cause the actual performance,

financial condition or results of operation of Vista Land

& Lifescapes, Inc. and its subsidiaries to be materially

different from any future performance, financial

condition or results of operation implied by such

forward-looking statement.

For Corporate

Disclosures

Vista Land Website

https://www.vistaland.com.ph/