Personal and collective

protective equipment

market 2022

REPORT

WARSAW 2022

Personal and collective

protective equipment

market 2022

Protective equipment for upper

and lower limbs, protective

clothing for welders,

welding barriers

and acoustic panels in oces

REPORT

WARSAW 2022

This paper is published and based on the results of a research

task carried out within the scope of the fifth stage of the

National Programme “Improvement of safety and working

conditions” supported within the scope of state services by the

Ministry of Family and Social Policy.

Task no. 4.SP.24, entitled “Development of a diagnosis and

forecasting trends in the development of personal and collective

protective equipment market in Poland”.

The Central Institute for Labour Protection - National Research

Institute is the Programme’s main co-ordinator

Central Institute for Labour Protection - National Research Institute

ul. Czerniakowska 16, 00-701 Warszawa, phone: (22) 623 36 98, www.ciop.pl

Table of contents

4 Preface

6 Market survey of selected protective equipment

8 The object of the survey and the methodology used

11 Market analysis

12 Global protective equipment market

14 The market for protective equipment

in the European Union

16 Sectors of the use of personal protective equipment

and collective protective equipment and the workers

employed in hazardous conditions in Poland

17 Work accidents

19 Characteristics of suppliers

26 Competitiveness level in the supplier market

31 Recipient characteristics

34 Personal and collective protective equipment

distribution

38 Summary and conclusions

Preface

5

Market survey Market analysis SummaryForeword

Dear Sir and Madam,

We are pleased to present you with another report, which is the result of a survey

conducted on the personal and collective protective equipment market. The

purpose of this year’s survey on which this material was based was to characterise

the suppliers’ market of protective equipment for upper and lower limbs, protective

clothing for welders and selected collective protective equipment – welding barriers

and acoustic panels for oce rooms.

In an eort to ensure that workers in Poland are aware of hazards that can

dramatically change their lives, and that employers are provided with the right tools

and support in solving these problems, the Central Institute for Labour Protection

- National Research Institute conducts research and development as well as

dissemination activities related to occupational safety and health. It also strives

to respond to the needs of employees and employers by oering them modern

technical and organisational solutions as well as tools to support occupational safety

and health management, certification services, Internet resources and publications.

Particularly in the current situation, when personal protective equipment suppliers

are facing rising business costs and a possible decline in demand for the products

they oer, given also the high inflation, we hope that the following publication will

become a useful tool for them, providing information about the state of the industry

market and pointing out the factors strengthening it.

The conclusions of the report’s recommendations also indicate the importance

of large-scale educational activities promoting the proper selection and use of

personal protective equipment. It ultimately contributes to safer workplaces, but

also brings long-term economic benefits to employers. Therefore, we believe that

the following publication may become useful not only for suppliers of individual and

collective protective equipment, but also to some extent for other people present in

the labour market.

We would like to thank everyone who contributed to this report and invite you to

read it.

Wiktor M. Zawieska

Director CIOP-PIB

Market survey

of selected

protective

equipment

Personal and collective protective equipment market

7

The market survey of selected personal (PPE)

and collective (CPE) protective equipment

carried out in 2022 is a continuation of last

year’s project aimed at providing information

on the Polish market for suppliers and

recipients of this type of equipment.

Last year we published a report on the market survey of respiratory, eye, face,

head and hearing protection equipment, and due to the COVID-19 pandemic,

medical masks.

The subject of this year’s survey concerned the protection equipment for upper and

lower limbs and protective clothing. In order to ensure that the market diagnostics

and forecasts of this protective equipment are of interest and benefit to the entities

operating on that market (in particular manufacturers, distributors, importers and

also recipients of PPE), the survey takes into account only a number of product

groups, as universal as possible, due to their wide range of application or their

frequency of use. The survey also included selected CPE, which were subjected

to a separate analysis, therefore giving a broader context to the attempt to

characterise the PPE market. In the case of CPE, after consulting with specialists,

the most repetitive equipment available on the market was selected: acoustic

panels used in oce rooms and welding barriers (curtains, screens, partitions, etc.).

8

Foreword Market analysis SummaryMarket survey

The object of the survey

and the methodology used

The following PPE have been taken into account in the survey, specifying the

factors or the designation of the selected equipment:

• protective equipment for upper limbs (gloves to protect against mechanical

hazards, gloves to protect against chemicals),

• protective equipment for lower limbs (footwear to protect against falling

elements, footwear to protect against slipping),

• protective clothing (for welders).

The CPE taken into account in the survey included:

• acoustic panels (used in the oce working environment),

• welding barriers (curtains, partitions, screens, etc.).

The market survey of the above-mentioned protective equipment was carried out

using a methodological triangulation, which takes into account:

1. Analysis of secondary data (so-called desk research analysis), such as: data

published by Polish and European public statistics; information obtained

from business intelligence, market reports and information, oer price lists,

databases of business entities, and certifying and auditing authorities;

information available online, such as articles and web pages.

2. Quantitative surveys carried out using the mixed-mode CATI/CAWI technique

The quantitative survey was carried out on the Polish sample N = 201 of the

representatives of suppliers (manufacturers, importers, distributors and

authorised representatives) and of the recipients of the selected PPE and CPE,

selected in proportion to the number of entities in a given province. In addition,

at least one company employing more than 50 persons from each province

participated in the recipient survey.

Personal and collective protective equipment market

9

Table 1. Size of CATI/CAWI survey sample among the suppliers and recipients of

the selected personal and collective protective equipment

Source: ASM’s own study

Province

Size of the sample of recipients of

selected personal and collective protective equipment

Size of the sample

of suppliers of

selected personal

and collective

protective

equipment

Size of the company (number of employees)

Total

Up to 9 10-49 50-249 250 and more

Lower Silesia - 1 - 2

3

11

Kuyavian-Pomeranian - - 1 - 1 8

Lublin - - 3 - 3 5

Lubuskie - - 1 - 1 4

Łódź - - 2 2 4 10

Lesser Poland - - - 2 2 18

Mazovia - - 3 4 7 25

Opolskie - - 1 - 1 4

Subcarpathia - - 4 - 4 4

Podlesia - - - 1 1 3

Pomerania - 1 3 4 8 8

Silesia - - 2 1 3 20

Holy Cross Province 1 - 1 - 2 4

Warmia-Masuria - - - 2 2 4

Greater Poland - 1 2 2 5 16

West Pomerania - - 3 1 4 6

Total 1 3 26 21 51 150

10

Foreword Market analysis SummaryMarket survey

Recipients and suppliers were selected for the survey, taking into account the

division into PPE and CPE. The information was obtained from:

• N = 130 suppliers of selected PPE,

• N = 62 suppliers of selected CPE,

• N = 51 recipients of selected PPE,

• N = 18 recipients of selected CPE.

Table 2. The number of suppliers and recipients of the quantitative survey

according to the individual products that are the subject of the survey

Source: ASM’s own study

3. Enhanced Individual Telephone Interviews (ITI)

The qualitative surveys consisted of a detailed, thorough conversation with the

respondent. ITI interviews were carried out to deepen the information acquired

during quantitative surveys. A total of 20 experts participated in qualitative

interviews (consisting of: representatives of suppliers of PPE and CPE, recipients

providing selected protective equipment in workplaces, OSH specialists,

representatives of market surveillance authorities and R&D environment).

Suppliers Recipients

Personal protective equipment 130 51

Gloves to protect against mechanical hazards 114 45

Gloves to protect against chemicals 103 40

Footwear to protect against falling elements 107 46

Footwear to protect against slipping 104 46

Protective clothing for welders 105 29

Collective protective equipment 62 18

Collective protective equipment 25 12

Welding barriers (curtains, screens, partitions) 44 11

11

Market analysis

Personal and collective protective equipment market

12

A. Personal protective equipment

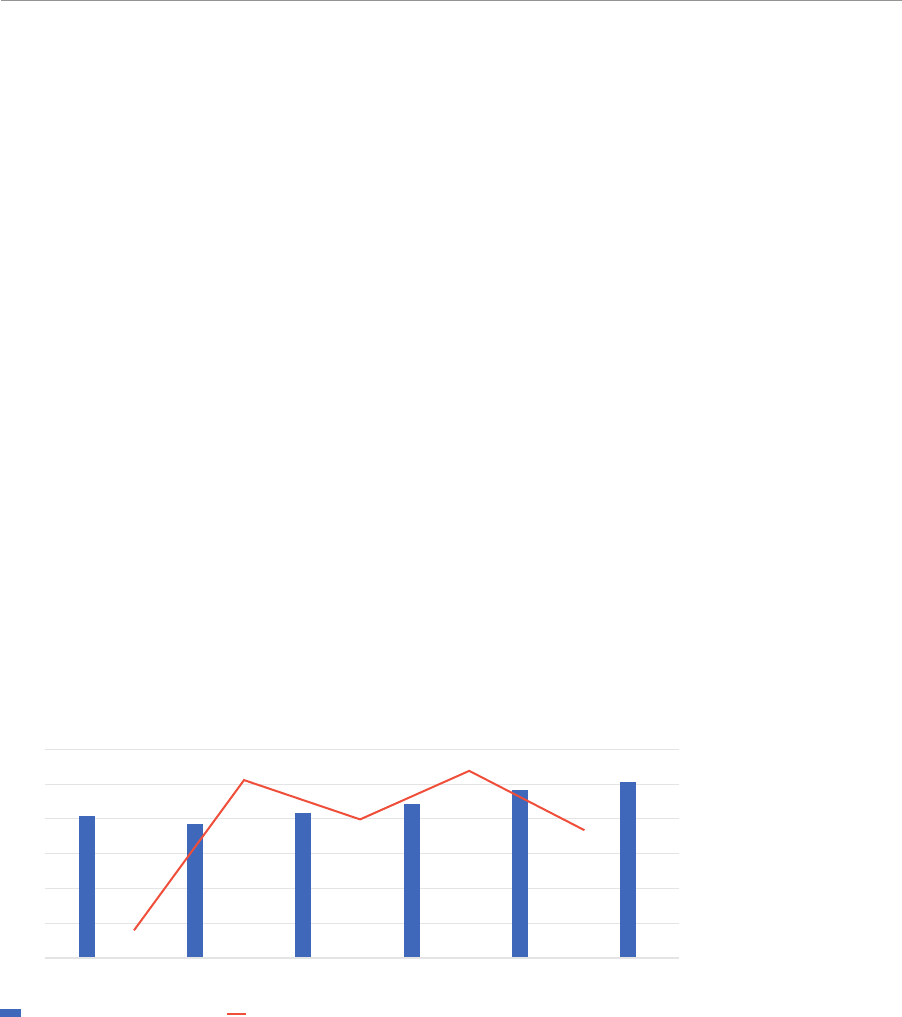

The global PPE market amounted to USD 52.43 billion in 2019. The forecasts

for the years 2020-2027 assume the market’s average annual increase of

7.4% (CAGR). According to these forecasts, in 2022, the PPE market value will

amount to USD 64.96 billion and will increase to USD 92.86 billion by 2027.

Figure 1. The global PPE market value in 2019-2027 (in USD billion)

* forecast

Source: ASM based on Statista data

According to the Grand View Research report

1

, the largest share of the revenues

of the global PPE market in 2020 (28%) corresponded to the hand protection

product segment. The hazards associated with harmful and hazardous chemicals,

contact with hot objects and protruding, sharp or rough elements are likely to

stimulate demand for safety gloves in the construction industry, food processing,

oil and gas, health care and metal manufacturing. The global market of industrial

safety gloves to protect against mechanical hazards amounted to USD 2 billion

in 2018

2

. According to the Global Market Insights report, the best development

forecasts for those product categories are found in several sectors/areas, such as:

mining, construction, automotive, assembly activities, heavy machine equipment

manufacturing, and industrial handling and packaging. The extractive industry has

a high demand for gloves due to the handling of heavy machinery and equipment.

1

Report from the analysis of the size, share and trends in the PPE market by product (respiratory protection, protective

clothing), by final use (healthcare, manufacturing), by region and segment forecasts, 2021-2028.

2

Global Market Insights Industrial Safety Gloves Market Size By Product (Mechanical/[Multi-Purpose, Cut Protection,

Oil Repellent, Specialized, Back Hand Impact Protection], Chemical & Liquid Protection/[Chemical Solutions, Single Use/

Disposable], Thermal/[Arc Flash], Special Protection), By Material (Nitrile Gloves, Natural Rubber Gloves, Vinyl Gloves,

Neoprene Gloves, Polyethylene Gloves), By Application (Automotive, Chemical, Machinery, Metal Fabrication, Oil & Gas,

Mining), Industry Analysis Report, Regional Outlook, Growth Potential, Price Trends, Competitive Market Share & Forecast,

2019-2025

100

90

80

70

60

50

40

30

20

10

0

52,43

56,31

60,48

64,96

69,78

74,94

80,49

86,46

92,86

2019 2020* 2021* 2022* 2023* 2024* 2025* 2026* 2027*

Global protective

equipment market

13

Foreword Market survey SummaryMarket analysis

Gloves to protect against mechanical hazards provide excellent protection against

cuts and injuries due to their resistance to cutting, piercing or abrasion. These

characteristics make these products desirable in the market. In the machinery and

equipment market alone, 2018 saw a demand of more than 750 million gloves to

protect against mechanical factors.

The second largest product segment is protective clothing, which consists of

clothing to protect against high temperature and flames, chemical-resistant

clothing, clean room clothing and clothing to protect against mechanical damage.

The high quality of these products has resulted in their increased use, which has

stimulated demand for them in dierent industries.

Safety footwear also represented a significant market share in the PPE

sales market. It is expected that during the forecast period, CAGR will reach

a level of 6.8% due to high demand for products. Increasing employers’

awareness about protecting workers from foot injuries caused by chainsaw

cuts, electric shock and midfoot impacts (caused by falling products or

materials) is likely to have a positive impact on segment development.

According to the Industrial Protective Footwear Market Research Report,

Analysis and Forecast

3

, the global industrial safety footwear market was valued

at USD 5.2 billion in 2021 and is expected to reach USD 6.9 billion by 2028. The

greatest demand for footwear to protect against falling elements is generated

by the manufacturing and construction sectors. According to Global Market

Insights

4

, the global industrial footwear market amounted to over USD 9 billion

in 2021. The demand for protective footwear has remained high in recent years,

mainly due to the increasing focus on reducing the number of victims of accidents

at work. An increasing number of workplace injuries will contribute to the growth

of this segment, which will generate revenues in excess of USD 3 billion by 2030.

Development prospects are also found in the agricultural segment. In 2021, this

segment achieved sales of more than 50 million pairs of safety footwear. It is

expected that by 2030 more than 57 million pairs will be sold.

B. Collective protective equipment

In the case of the global architectural acoustic panels market, according to the

Fortune Business Insights report, its size was valued at USD 7.37 billion in 2021.

This market is expected to increase from USD 7.55 billion in 2022 to USD 10.59

billion in 2029 showing a CAGR of 5%. In 2021, Europe held the second largest

share of the global market of acoustic panels for oce rooms due to both the

location of many international corporations that use the panels in oces to meet

stringent regulations, and standards of living in the region.

3

DataVagyanik

4

Industrial Safety Footwear Market Size By Product (Shoes/{By Material/[Leather (Construction, Oil & Gas, Transport, Mining,

Food, Pharmaceuticals, Agriculture, Fishery), Rubber (Construction, Oil & Gas, Transport, Mining, Food, Pharmaceuticals,

Agriculture, Fishery), PVC (Construction, Oil & Gas, Transport, Mining, Food, Pharmaceuticals, Agriculture, Fishery), PU

(Construction, Oil & Gas, Transport, Mining, Food, Pharmaceuticals, Agriculture, Fishery)]}, Boots/{By Material/[Leather

(Construction, Oil & Gas, Transport, Mining, Food, Pharmaceuticals, Agriculture, Fishery), Rubber (Construction, Oil & Gas,

Transport, Mining, Food, Pharmaceuticals, Agriculture, Fishery), PVC (Construction, Oil & Gas, Transport, Mining, Food,

Pharmaceuticals, Agriculture, Fishery), PU (Construction, Oil & Gas, Transport, Mining, Food, Pharmaceuticals, Agriculture,

Fishery)]}, Industry Analysis Report, Regional Outlook, Covid-19 Impact Analysis, Growth Potential, Price Trends, Competitive

Market Share & Forecast, 2022-2030

Personal and collective protective equipment market

14

The market for

protective equipment

in the European Union

In publicly available sources of information on PPE in the EU, there are no data on

protective clothing and therefore they are not included in the following subchapter.

The EU28 countries produce by far the most safety footwear. The manufacturing

increased from EUR 818,34 million in 2014 to EUR 1 billion in 2019. There has

therefore been an increase of 23.6% in five years. During the analysed period,

the highest increase in production value compared to the previous year occurred

in 2018 and 2016.

Figure 2. Manufacturing value of footwear with protective metal toe cap in EU28

between 2014 and 2019

Source: ASM based on Statista data

The production of safety gloves in EU28 is no longer significant. In 2014,

the manufacturing value of safety gloves in EU28 countries amounted to

EUR 37,76 million and despite an increase in the manufacturing value in the

following year, the next two years experienced a decrease in the production

volume of this type of PPE. The year 2018 resulted in a 54.3% increase in the

manufacturing of safety gloves, reaching a value of EUR 51,57 million. However,

already in 2019, the manufacturing value decreased to EUR 45,9 million

(an 11% decrease relative to 2018).

0

818

773

842

886

1011

2014 2015 2016 2017 2018 2019

year-over-year growth rate (in %)

200

400

600

800

1000

1200

9,5

970

5,3

9,0

4,2

value (in mln EUR)

-5,5

15

Foreword Market survey SummaryMarket analysis

Figure 3. The manufacturing value of safety gloves in EU28 between 2014

and 2019

Source: ASM based on Statista data

0

37.76

41.04

36.37

45.90

2014 2015 2016 2017 2018 2019

year-over-year growth rate (in %)

10

20

30

40

50

60

-8.1

51.57

-11.4

8.7

54.3

value (in mln EUR)

-11.0

33.42

Personal and collective protective equipment market

16

Sectors of the use of personal

protective equipment and

collective protective equipment

and the workers employed in

hazardous conditions in Poland

The recipients of PPE are all businesses in which workers are exposed to

bodily injury during their work. PPE and CPE are used in particular in the

following industries:

• production,

• construction,

• food industry (processing),

• mining,

• chemical and petroleum industry,

• healthcare and pharmaceutical industry,

• agriculture (the surveyed CPE does not apply here).

Polish employees are most vulnerable to working environment hazards. In

2021, almost 339,000 people were employed under such conditions. This

is 2.7% more than the year before and 7.1% more than in 2019. Noise was

the most frequent hazard in the working environment (more than 182,000

people were exposed to noise at the workplace in 2021, almost the same as

in the previous year and 2.2% less than in 2019).

In 2021, the number of employees exposed to mechanical factors related to

particularly hazardous machinery increased in comparison to 2020. There was an

annual increase of 14.1%.

At the same time, last year, an occupational risk assessment was carried

out in Polish businesses for 2.48 million employees, and for 68.6% of the job

positions, occupational risks were eliminated or reduced. PPE was used by

almost 1.3 million employees. The largest number of employees for whom,

in order to eliminate or reduce occupational risk, some form of personal

protective equipment was used in 2021, was in the provinces of Mazovia

(19.9%), Silesia (17.3%) and Greater Poland (9.8%).

17

Foreword Market survey SummaryMarket analysis

Work accidents

The demand for PPE and PPE depends on the number and intensity of risk factors,

but also on the awareness of company managers and workers themselves. As

a rule, the greatest demand is generated by sectors most frequently exposed to

accidents at work. According to data from the Central Statistical Oce (GUS),

11,111 people injured by accidents at work were reported in the first quarter of

2022, 2.0% more than in the first quarter of 2021. The number of injured people

per one thousand employees has also increased (the accident rate has increased

from 0.81 to 0.82).

The highest number of victims of accidents at work in the first part of the current

year was recorded in three sectors:

• industrial processing – 3,468 victims,

• trade, repair of motor vehicles – 1,425 victims,

• healthcare and social work – 1,195 victims.

Many individuals were also injured at work in the transport and warehouse

management sector (986) and in the construction industry (602). All the above-

mentioned industries will probably generate the greatest demand for PPE and CPE.

Map 1. Victims of accidents at work in Q1 2022

Source: ASM based on GUS data

318

534

430

300

713

1790

687

1399

583

723

426

501

1303

239

893

272

Personal and collective protective equipment market

18

The people injured the most by accidents at work are those injured as a result of

a collision with a fixed object (34.9%). Impacts by a moving object cause injuries

in 18.9% of cases. A total of 17.7% of accidents at work result from contact with

a sharp, coarse or rough object.

Figure 4. Victims of accidents at work in the first quarter of 2022 by events

causing injury (%)

Source: ASM based on GUS data

The most common cause of accidents at work is improper employee

behaviour (61.4%). Only 1.8% of accidents at work occur as a result of the employee

not using protective equipment.

Accidents at work occur most frequently when the employee is moving (40.3%).

Only 12% of injuries occur while performing work with manual tools and 8.8%

during machine operation. The most common injuries include those of upper

limbs (44.2%) and lower limbs (35.1%). It follows from these data that for PPE, arm

and leg protection equipment will generate the largest demand.

Figure 5. Victims of accidents at work by the location of the injury in the first

quarter of 2022

Source: ASM based on GUS data

0,1

34,9

18,9

17,7

7,7

14,7

2,7

3,3

contact with electrical current,

temperature, dangerous substances

and chemical solutions

drowning, burying, closing

collision with/impacting

a fixed object

impact by a moving object

contact with sharp, coarse,

rough object

experiencing aggression

from man or animal

trapped, crushed

physical or mental load

neck with cervical spine

whole body and its various parts

back, including spine

torso and internal organs

head

lower limbs

upper limbs

44.2%

35.1%

10.0%

3.6%

3.2%

2.6%

1.3%

19

Foreword Market survey SummaryMarket analysis

Characteristics of suppliers

The identification of entities involved in both the production and distribution of PPE

and CPE was not easy, as there is neither a section nor a dedicated department

for PPE and CPE on the Polish Classification of Activity (PCA) list. An additional

diculty was that only selected PPE and CPE had to be taken into account for

the analysis.

Suppliers of personal protective equipment

In the quantitative survey carried out among selected suppliers of PPE, 65.4% of

the entities were part of the distributor group and 16.9% of the manufacturers.

Respondents could only assign themselves to one of the groups that best

characterised the entity’s main activity. Among the manufacturers, only N = 1

declared that it has its own research department.

Figure 6. Structure of the surveyed suppliers of selected PPE (N = 130)

Source: ASM, CATI survey.

Among the surveyed suppliers of the selected PPE, small and medium-sized

enterprises with up to 49 employees were the dominant group (89.2%). A total of

7.7% of respondents employed 50-249 people, while 3.1% employed 250+ employees.

manufacturer

importer

authorised representative

distributor

65.4%

16.9%

11.5%

6.2%

Personal and collective protective equipment market

20

Table 3. Struktura dostawców wybranych ŚOI według wielkości przedsiębiorstwa

(N = 130)

Source: ASM, CATI survey

As many as 80.2% of the surveyed PPE suppliers have been active on the market for

more than 10 years. A total of 14.6% of respondents declared to have been active

on the market for over 30 years. Only one supplier has operated on the PPE market

for 1 year.

Figure 7. The PPE suppliers’ period of operation on the market (N = 130)

Source: ASM, CATI survey

A total of 97.7% of the surveyed suppliers are companies with only Polish capital.

Only 3 suppliers declared that the company holds foreign capital. Among them:

• N = 1 holds Danish capital,

• N = 1 holds US and Italian capital,

• N = 1 holds United Kingdom and French capital.

The vast majority of the surveyed suppliers diversify their PPE product

range. A total of 86.2% of suppliers have at least two types of PPE that are

subject to analysis. Then 63.8% of suppliers declared that they oer all types

of analysed PPE (gloves to protect against mechanical hazards, gloves to

protect against chemicals, footwear to protect against falling elements,

footwear to protect against slipping and protective clothing for welders).

Size of enterprise Share (%)

Up to 9 employees 66.9

10-49 employees 22.3

50-249 employees 7.7

250 and more employees 3.1

up to 10 years

11–20 years

25–30 years

31 years and more

19.2%

29.2%

36.9%

14.6%

21

Foreword Market survey SummaryMarket analysis

The largest number of PPE suppliers (87.7%) oer gloves to protect against

mechanical hazards, and the smallest (79.2%) oer gloves to protect against

chemicals. Every third supplier of PPE declared that it also oers CPE.

Figure 8. Selected PPE included in the PPE suppliers’ oering (N = 130)

Source: ASM, CATI survey

For most of the surveyed suppliers (59.2%), PPE accounts for more than

50% of the company’s total manufacturing/distribution oering. Businesses

conducting their activity in dierent areas have expanded their oering with

PPE, which is linked to an increased market demand for this product range.

It is also worth noting that for 22.3% of the surveyed suppliers, PPE are the only

products in their oering (100% share). Moreover, for 39.2% of the suppliers, PPE

represents at least 90% of the total oering.

Figure 9. Percentage of personal protective equipment in their suppliers’ oering

(N = 130)

Source: ASM, CATI survey

In addition to PPE, the suppliers include in their oering in particular: CPE, welding

equipment and materials, firefighting equipment, e.g. fire extinguishers.

gloves to protect against chemicals

footwear to protect against slipping

protective clothing for welders

footwear to protect against falling elements

gloves to protect against mechanical hazards

87.7%

82.3%

80.8%

80.0%

79.2%

to 25%

to 25%

51-75%

76% and more

48.5%

27.7%

13.1%

10.8%

Personal and collective protective equipment market

22

Table 4. Share of individual products in the personal protective equipment

oering (N = 130)

Source: ASM, CATI survey

In total, 41.5% of the surveyed suppliers are directing their oering to entities

throughout Poland and 20.8% to businesses both in Poland and abroad. Almost

every third PPE supplier operates only locally.

Figure 10. Entities to which the personal protective equipment suppliers direct their

oering (N = 130)

Source: ASM, CATI survey

The highest revenue for PPE suppliers is generated by large companies with more

than 250 employees. The revenue generated by the PPE suppliers is therefore

directly proportional to the size of the company’s workforce (the larger the

workforce, the higher the sales revenue).

Figure 11. Recipients generating the highest revenue for personal protective

equipment suppliers (N = 130)

Source: ASM, CATI survey

Individual personal protective equipment Share (%)

Gloves to protect against mechanical hazards 14.24

Gloves to protect against chemicals 7.53

Footwear to protect against falling elements 14.45

Footwear to protect against slipping 13.98

Protective clothing for welders 7.40

Other PPE products 42.40

TOTAL 100

to entities from several provinces

entities across the entirety of Poland and foreign entities

exclusively local entities

entities across the entirety of Poland

41.5%

30.8%

20.8%

6.9%

micro-companies (up to 9 persons)

small companies (10-49 people)

medium companies (50-249 people)

large companies (over 250 people)

24.6%

23.1%

20.0%

7.7%

individuals

5.4%

dicult to say

19.2%

23

Foreword Market survey SummaryMarket analysis

PPE suppliers were asked to assess their financial situation. As much as

86.9% of them agreed that their product prices will increase in 2023. Large

increases in business costs are a large problem for 73.1% of respondents.

In the next 3 years, sales growth is expected by nearly every fourth

PPE supplier.

Suppliers of selected collective protective

equipment

In the quantitative survey carried out among selected suppliers of CPE, 53.2% of

the entities were part of the distributor group, and 29.0% of the manufacturers.

Respondents could only assign themselves to one of the groups that best

characterised the entity’s main activity. N = 4 of manufacturers declared that

they have their own research department.

Figure 12. Structure of the surveyed suppliers of selected collective protection

equipment (N = 62)

Source: ASM, CATI survey

Among the surveyed suppliers of the selected CPE, small and medium-sized

enterprises with up to 49 employees were the dominant group (83.9%). A total

of 16.1% of respondents employed 50 and more.

The vast majority (98.4%) of the surveyed companies have operated on the CPE

market for at least 5 years, with none of the companies operating for less than

1 year. As many as 77.4% of the surveyed CPE suppliers have been active on the

market for more than 10 years. Almost every third respondent has operated

for 21-30 years.

53.2%

manufacturer

importer

authorised representative

distributor

29.0%

6.5%

11.3%

Personal and collective protective equipment market

24

Figure 13. The collective protective equipment suppliers’ period of operation on

the market (N = 62)

Source: ASM, CATI survey

As many as 98.4% of the surveyed CPE suppliers are companies with only Polish

capital. Only one respondent declared that the company holds foreign capital

(British and French).

Only 11.3% of the suppliers declared that they oer all the analysed CPE

(acoustic panels in oce rooms, welding barriers). Most oer only one of the

analysed CPE products.

The largest CPE suppliers (71.0%) oer welding barriers. As many as 68.9% of the

CPE suppliers also oer PPE.

For the vast majority of the surveyed suppliers (85.5%), CPE represents up to

25% of the company’s total production/distribution oer. It is worth noting

that more than half of the respondents (51.6%) declared that CPE represents

up to 5% of the company’s total oering.

Figure 14. Percentage of collective protective equipment in their suppliers’

oering (N = 62)

Source: ASM, CATI survey

up to 10 years

11–20 years

11–20 years

31 years and more

32.3%

33.9%

22.6%

11.3%

76 % i więcej

51-75%

26-50%

do 25 %

85.5%

9.7%

0%

4.8%

25

Foreword Market survey SummaryMarket analysis

Apart from CPE, their suppliers oer in particular: PPE, welding equipment and

materials, furniture.

The suppliers were asked what percentage the selected products have

in their CPE oering. Only 9.55% of the total CPE oering consists of

analysed products.

Table 5. Share of individual products in the collective protective equipment

(N = 62)

Source: ASM, CATI survey

A total of 50.0% of the surveyed suppliers direct their oering to entities across

the entirety of Poland, and 29.0% to both businesses in Poland and abroad. Only

12.9% of CPE suppliers operate locally.

Figure 15. Entities to which the collective protective equipment suppliers direct

their oering (N = 62)

Source: ASM, CATI survey

The highest revenue for CPE suppliers is generated by large companies with

more than 250 employees. Close to every fourth respondent encountered

diculties when trying to indicate which consumers generate the highest

revenue for the company.

Individual collective protective equipment Share (in)

Acoustic panels in oce rooms 6.60

Welding barriers 2.95

Other CPE products 90.45

TOTAL 100

to entities from several provinces

exclusively local entities

entities across the entirety of Poland and foreign entities

entities across the entirety of Poland

50.0%

29.0%

12.9%

8.1%

Personal and collective protective equipment market

26

Competitiveness level in the

supplier market

Personal protective equipment

The vast majority of the surveyed PPE suppliers declared that competition on

the PPE market was strong or very strong. There are many small and very small

manufacturers and distributors, but there are also several larger players with well-

established positions and significant market shares.

In the opinion of the surveyed PPE recipients, competitive advantages may also

include issues such as the provision of non-standard orders, or the fact that the

manufacturer’s/distributor’s representative arrives at their company and advises

which specific products will be appropriate, measures the workers in order to select

the appropriate size of PPE, etc. Also, solutions such as B2B platforms that facilitate

placing orders are an additional advantage for suppliers in the opinion of the

PPE recipients.

From the point of view of PPE recipients, companies providing solutions in this area

also compete on the breadth of their product range. Some suppliers are authorised

dealers of one manufacturer and oer only its products, while other distributors

oer products from many dierent manufacturers.

The surveyed suppliers indicated that there are eight major competitors on the

PPE market (average). In total, 18.5% of respondents declared that the number of

key competitors did not exceed three, and more than every fourth one could not

indicate a specific number.

Companies, both manufacturers and distributors, present on the Polish PPE market are

mainly competing with prices, quality, innovative solutions and product availability.

Level of servicing, handling of complaints and customer care are also important,

i.e. everything that the manufacturer or distributor oers besides the PPE itself, such

as scanning feet to support the proper selection of protective equipment or workplace

audits to select the right solutions.

The importance of product availability arises from COVID-19 pandemic constraints,

which, although they are no longer in place in most countries or are being applied to

a more limited degree, continue to aect supply chain disruptions, both in terms of

components and raw materials for manufacturers and finished products in the context of

distributors. Some companies have protected themselves by increasing their inventory,

but typically they are stockpiled for existing customers, and handling additional orders

could be a problem.

27

Foreword Market survey SummaryMarket analysis

Figure 16. Number of major competitors on the personal protective equipment

market according to the suppliers (N = 130)

Source: ASM, CATI survey

In particular, large manufacturers have unquestionable competitive advantages,

as they have their own factories and can control the entire manufacturing process.

The advantage is also held by those companies that have a wide range of products

covering all PPE. However, Polish and European manufacturers present on the

Polish PPE market still have to face a high share of imported products, e.g. from

China, which are significantly cheaper but worse in quality.

Dierences between companies located in Poland can be observed. Often

those with foreign capital transfer OSH requirements from their main

oces abroad, and therefore pay more attention to better quality products.

Conversely, companies with Polish capital often only look for the price of

a single purchase of safety gloves or footwear.

During the enhanced ITI interviews, the PPE suppliers were asked about the most

important players on the market, which are shown by the graphics below. These

are manufacturers and distributors who, according to the PPE suppliers, are the

most important businesses in the industry.

Graphic 1. Top distributors of personal protective equipment according to the

suppliers (N = 6)

Source: ASM, ITI survey

18.5%

22.3%

23.1%

8.5%

27.7%

1-3 competitors

4-9 competitors

10-15 competitors

16 and more competitors

dicult to say

Personal and collective protective equipment market

28

The PPE suppliers emphasised that although there are few Polish

manufacturers, those who are present on the market have a strong, well-

established position and are known among the recipients.

According to one of the PPE suppliers, Polish glove manufacturers mainly supply

ordinary, knitted or crocheted products, while the coated ones, which protect

against chemicals, originate mainly from foreign manufacturers. Polish companies

manufacturing PPE, that were mentioned by the suppliers include: Strzelce

Opolskie (JS Gloves), Prortor, Demar, PW Krystian.

Graphic 2. The most important manufacturers of PPE in the opinion of the

personal protective equipment suppliers (N = 6)

Source: ASM, ITI survey

Competition on the PPE market is very strong. It is therefore worth paying attention

to the factors that determine the selection of the PPE supplier. In the opinion of the

PPE recipients, the price of the product is the most important. In the opinion of the

recipients, there are many PPE suppliers and, for example, in the case of gloves,

they have a very diverse product range in terms of price, ranging from PLN 1.5 to

gloves that even cost PLN 150. However, the problem is finding good quality

products at an aordable price. There are far fewer suppliers of protective clothing

for welders. As underlined by one of the recipients, there are few suppliers on the

Polish market who oer good quality protective clothing.

Product certification and the availability of products for immediate delivery are

also important for the PPE recipients. Among the ‘other’ responses, the respondents

indicated the quality of the product and brand loyalty. Only 7.8% of the recipients

indicated that the PPE products are selected through a tender. Large numbers of

suppliers always participate in these tenders. Companies also test products. During

these tests, the employees receive the products of the individual manufacturers for

a certain period of time and determine which ones they find best for their work.

Contracts are signed on this basis.

29

Foreword Market survey SummaryMarket analysis

„The test period lasts three months. During this time, we have over

200 models of gloves to test from nearly forty companies. Our

purchasing department sends our specification of requirements

to our bidders database, and then those companies, if they can

oer a product that we are looking for, submit an ocial oer and

test samples.”

Collective protective equipment

Competition in the CPE market is less intense than in the PPE market. However,

most CPE suppliers assess the competition level as high or very high.

The surveyed suppliers indicated that there are six major competitors (average)

on the CPE market. In total, 24.2% of respondents declared that the number of key

competitors does not exceed three. It is worth noting that 22.6% of the surveyed

suppliers could not indicate the number of key competitors on the CPE market.

Figure 17. Number of major competitors on the collective protective equipment

market according to the suppliers (N = 62)

Source: ASM, CATI survey

In the Polish CPE market, in the opinion of the suppliers, there are mainly

distributors of foreign brands. This is especially visible in the case of welding

barriers. However, when it comes to acoustic panels for oce rooms, there are

several Polish manufacturers, e.g. Bejot. According to the suppliers, this market is

filled with a large number of competing companies and is rather fragmented. The

most important players among the CPE manufacturers and distributors, according

to their suppliers, are presented in the graph below.

1-3 competitors

4-9 competitors

10 and more competitors

dicult to say

22.6%

22.6%

24.2%

30.6%

Personal and collective protective equipment market

30

Graph 3. The most important suppliers of the selected collective protection

equipment in the opinion of the suppliers (N = 4)

Source: ASM, ITI survey

The companies dealing with CPE in Poland compete primarily with prices and

the colour range on oer, e.g. for welding barriers. The speed of delivery is also

important, as well as (for acoustic panels for oce rooms) acoustic parameters

and certificates. In Poland, in the opinion of suppliers, CPE certificates are

unnecessary, so their possession may be a competitive advantage.

The technical requirements for CPE products are clearly defined by regulations and

must be met by the manufacturers, so this is not an aspect that enables a company

to gain a competitive advantage in the market. However, in the opinion of suppliers,

innovation in terms of consuming less materials while maintaining the necessary

parameters on a given surface may provide an advantage over competition.

Although competition on the CPE market is assessed by suppliers as less than

on the PPE market, it still remains at a high level. It is therefore necessary to pay

attention to the factors that determine the selection of the CPE supplier. The most

important for the CPE recipients is the product certificate (88.9%), and only then its

price (77.8%). Products that are available for immediate delivery is also important.

Most important acoustic panel suppliers

Most important welding barrier suppliers

31

Foreword Market survey SummaryMarket analysis

Recipients of selected personal

protective equipment

The vast majority of the surveyed PPE recipients are active in a widely defined

manufacturing sector, which is a part of section ‘C’ in the PCA list. A total of 7.8% of

respondents were representatives of the construction sector.

Figure 18. Sector in which personal protective equipment recipients operate

(N = 51)

Source: ASM, CATI/CAWI survey

Among the surveyed recipients of the selected PPE, medium-sized and

large businesses with more than 50 employees dominated (92.2%). Only

5.9% of respondents employed 10-49 people, while 2.0% employed up to

9 employees.

The surveyed recipients use a range of PPE. Respondents most often source

lower (96.1%) and upper (92.2%) limb protection equipment. Eye and face

protection equipment (88.2%) and hearing protection equipment (86.3%) are also

very important. The surveyed suppliers use respiratory protection equipment

least frequently. However, the percentage of surveyed entities applying this

precautionary measure is still high (72.5%).

Wykres 19. Personal protective equipment used by their recipients (N = 51)

Source: ASM, CATI/CAWI survey

automotive

pharmaceutical

construction

manufacturing

86.3%

7.8%

3.9%

2.0%

protective clothing

protective equipment for hearing

protective equipment for eyes and face

protective equipment for upper limbs (arms)

protective equipment for lower limbs (legs)

96.1%

92.2%

88.2%

86.3%

82.4%

protective equipment for respiratory system

protective equipment for head

76.5%

72.5%

Recipient characteristics

Personal and collective protective equipment market

32

Taking into account the selected PPE, the recipients most often source footwear to

protect against falling elements (90.2%) and footwear to protect against slipping

(90.2%). More often, respondents use gloves to protect against mechanical hazards

than against chemicals. A total of 56.9% of the PPE recipients also use protective

clothing for welders.

Table 6. Selected personal protective equipment used by their recipients

(N = 51)

Źródło: ASM, badanie CATI/CAWI.

In the opinion of the suppliers, the PPE recipients and therefore the end-

users are very often not aware that better safety gloves or footwear exist on

the market. Yet, even if they have such knowledge, they are usually not the

decision makers for the PPE purchased by the business. However, they are

able to best assess the quality and functionality of PPE, and their opinion is

the most important for manufacturers.

In the opinion of the PPE suppliers, recipients and end-users lack work safety

awareness. Decision makers for the purchase of PPE in Polish businesses are still

largely guided by the cost of this purchase – so cheaper gloves or footwear are

often selected, including those originating from China, for example. OSH specialists

and decision makers are not always aware of the benefits of purchasing better

quality and more expensive personal protection equipment, and how this translates

into a reduction in costs related to accidents at work.

Selected personal protective equipment % of users

Gloves to protect against mechanical hazards 88.2

Gloves to protect against chemicals 78.4

Footwear to protect against falling elements 90.2

Footwear to protect against falling elements 90.2

Protective clothing for welders 56.9

Recipients of selected collective

protective equipment

The vast majority of the surveyed CPE recipients operate in a widely defined

manufacturing sector (83.3%). In total, 16.7% of respondents were representatives of

the construction sector.

Figure 20. Sector in which collective protective equipment recipients operate

(N = 18)

Source: ASM, CATI/CAWI survey

Among the surveyed recipients of the selected CPE, medium-sized and large

businesses with more than 50 employees dominated (88.9%). Only 5.6% of

respondents employed 10-49 people, while 5.6% employed up to 9 employees.

The CPE recipients most commonly source acoustic panels for oce rooms (66.7%)

and welding barriers (61.1%), which results from the selection of respondents (only

respondents who are recipients of these products were eligible for the survey).

Among the subsequent CPE used in companies, the surveyed entities indicated

ventilation systems (55.6%), lightning protection systems (38.9%), handrails and

working platforms (38.9%).

Figure 21. Collective protective equipment used by their recipients (N = 18)

Source: ASM, CATI/CAWI survey

In the opinion of the suppliers, CPE recipients do not look for innovative

solutions because most of them only want to comply with regulatory

requirements. As a general rule, they do not source these products for their

own needs, but are rather interested in them out of necessity.

construction

manufacturing

83.3%

16.7%

handrails and working platforms

lightning protection system

ventilation

welding barriers (curtains, screens, partitions)

acoustic panels in oce rooms

66.7%

61.1%

55.6%

38.9%

acoustic panels used in the industrial rooms

38.9%

27.8%

fall arest nets

working and protective scaolding.

other

22.2%

16.7%

5.6%

33

Foreword Market survey SummaryMarket analysis

Recipients of selected collective

protective equipment

The vast majority of the surveyed CPE recipients operate in a widely defined

manufacturing sector (83.3%). In total, 16.7% of respondents were representatives of

the construction sector.

Figure 20. Sector in which collective protective equipment recipients operate

(N = 18)

Source: ASM, CATI/CAWI survey

Among the surveyed recipients of the selected CPE, medium-sized and large

businesses with more than 50 employees dominated (88.9%). Only 5.6% of

respondents employed 10-49 people, while 5.6% employed up to 9 employees.

The CPE recipients most commonly source acoustic panels for oce rooms (66.7%)

and welding barriers (61.1%), which results from the selection of respondents (only

respondents who are recipients of these products were eligible for the survey).

Among the subsequent CPE used in companies, the surveyed entities indicated

ventilation systems (55.6%), lightning protection systems (38.9%), handrails and

working platforms (38.9%).

Figure 21. Collective protective equipment used by their recipients (N = 18)

Source: ASM, CATI/CAWI survey

In the opinion of the suppliers, CPE recipients do not look for innovative

solutions because most of them only want to comply with regulatory

requirements. As a general rule, they do not source these products for their

own needs, but are rather interested in them out of necessity.

construction

manufacturing

83.3%

16.7%

handrails and working platforms

lightning protection system

ventilation

welding barriers (curtains, screens, partitions)

acoustic panels in oce rooms

66.7%

61.1%

55.6%

38.9%

acoustic panels used in the industrial rooms

38.9%

27.8%

fall arest nets

working and protective scaolding.

other

22.2%

16.7%

5.6%

Personal and collective protective equipment market

34

Personal protective equipment

The surveyed suppliers diversify sales of PPE to dierent sectors. The main

recipients of PPE are mainly the manufacturing and construction sectors. In total,

57.7% of suppliers deliver PPE to the automotive sector and 55.4% to the food sector.

Figure 22. Sectors to which the personal protective equipment suppliers’ oer is

addressed (N = 130)

Source: ASM, CATI survey

The sale of PPE by distributors takes place in two ways:

• directly to the end-user,

• sales to other trading companies which then distribute products to end-users.

Graphic 4. Distribution of the personal protective equipment distributors

Source: ASM, ITI survey

transport

food

automotive

construction

manufacturing

80.0%

77.7%

57.7%

55.4%

chemical and petroleum

52.3%

48.5%

health care

pharmaceutical

other

43.1%

42.3%

6.2%

DISTRIBUTOR

TRADE COMPANY

END-CUSTOMER

END-CUSTOMER

Personal and collective protective

equipment distribution

35

Foreword Market survey SummaryMarket analysis

PPE manufacturers typically sell their products to distributors, who then sell them to

end-users, i.e. workplaces. Sometimes, the manufacturer has several key end-users

who buy PPE directly from the manufacturer, bypassing the distributor.

Where the producer is an international conglomerate, the distribution is somewhat

dierent. PPE from manufacturing facilities is distributed to branches in each

country and only then domestic subsidiaries distribute the products to their

distributors and end-users.

Graphic 5. Distribution of personal protective equipment manufacturers

Source: ASM, ITI survey

Figure 23. Personal protective equipment distribution channels used by their

suppliers (N = 130)

Source: ASM, CATI survey

The development of online sales is all the more important because the vast

majority of recipients are making purchases online. A total of 64.7% of the PPE

recipients combine oine purchases with online purchases, and 11.8% make only

online purchases (N = 51).

MANUFACTURER

DISTRIBUTOR

MANUFACTURING

PLANT

BRANCH IN

A GIVENCOUNTRY

DISTRIBUTOR

The rapid development of new technologies and the change of purchasing processes force

suppliers to develop sales channels. In total, 59.2% of the surveyed suppliers declared that

they employ both stationary and online sales. However, more than every third supplier

uses only stationary sales channels. The share of traditional sales will decrease over

the years. In fact, suppliers in their plans take into account the development of dierent

sales platforms, thereby planning innovation in the field of distribution strategy.

only stationary sales

only online sales

stationary and online sales

36.9%

3.8%

59.2%

Personal and collective protective equipment market

36

Collective protective equipment

The surveyed suppliers diversify their CPE sales to dierent sectors. The main

recipients of CPE are mainly the manufacturing and construction sectors.

A total of 38.7% of suppliers supply CPE to the automotive, chemical and

petroleum sectors. Among the responses ‘other’, a broadly defined service sector

has emerged.

Figure 24. Sectors to which the collective protective equipment suppliers direct

their oering (N = 62)

Source: ASM, CATI survey

Graphic 6. Distribution of the collective protective equipment distributors

Source: ASM, ITI survey

The distribution of CPE manufacturers is identical to that of PPE manufacturers.

food

chemical and petroleum

automotive

construction

manufacturing

71.0%

54.8%

38.7%

38.7%

transport

37.1%

33.9%

health care

pharmaceutical

other

30.6%

25.8%

19.4%

DISTRIBUTOR

TRADE COMPANY

END-CUSTOMER

END-CUSTOMER

37

Foreword Market survey SummaryMarket analysis

Graphic 7. Distribution of the collective protective equipment manufacturers

Source: ASM, ITI survey

The change of purchasing processes forces suppliers to develop sales channels.

In total, 64.5% of the surveyed CPE suppliers declared that they employ both

stationary and online sales. Only 29.0% of suppliers use only traditional sales

channels as part of the distribution strategy.

Figure 25. Collective protective equipment distribution channels used by their CPE

suppliers (N = 62)

Source: ASM, CATI survey

In what concerns CPE purchases, the recipients are accustomed to traditional

purchases. In total, 44.4% of the surveyed recipients use this channel only. Every

other CPE recipient combines oine purchases with online purchases, and only

5.6% make online purchases (N = 18).

END-CUSTOMER

BRANCH IN

A GIVENCOUNTRY

DISTRIBUTOR END-CUSTOMER

MANUFACTURER

64.5%

29.0%

6.5%

only stationary sales

only online sales

stationary and online sales

Summary and

conclusions

Personal and collective protective equipment market

39

PPE and CPE are necessary to ensure that

employees are safe during their work.

Therefore, the demand for selected protective equipment is mainly influenced by

the type of work performed and the risks with which it is associated. Factors such as

better technical support and increased awareness of the price/performance ratio

of products are expected to encourage the production of own-brand products. The

increasing contractual production of PPE designed according to the specifications

of distributors, mainly in the developed economies of North America and Western

Europe, has a significant impact on the increased demand for products.

In the case of protective clothing, end-users consider several factors when

purchasing, such as the material used and the coating it has, the barrier properties

of the seams and other features such as fastenings. Continuous innovation, such as

the development of lighter and convenient industrial protection equipment using

high-quality fabrics, is expected to have a positive impact on the growth of the

market.

Demand for protective equipment that combines safety with better aesthetics and

technological innovations can contribute to market growth.

The market of textiles for the production of protective clothing is changing

dynamically, there is an increasing number of innovative solutions, and companies

are increasingly open to benefiting from technological innovations.

Protective clothing should be light, convenient, safe and compliant with the current

standards. In particular, they must (which is important for specialist clothing), be

tailored to the specific expectations of the recipient and examined in detail in this

respect. Entry into the market of such a range as, for example, textile fabrics used

for the production of inflammable overalls, is preceded by numerous laboratory

tests and performance tests.

40

Foreword Market survey Market analysis Summary

The development of innovation on the market is partly determined by ecological

requirements. For example, millions of gloves reach the landfill every year. In

response, new companies have emerged who have introduced biodegradable,

disposable nitrile gloves. Manufacturers of PPE may, apart from switching to

biodegradable materials, also reduce their energy footprint by designing new

machinery and modifying existing machinery in order to reduce their energy

demand.

The analysis of the information collected during the market survey of the

selected PPE and CPE allowed for the preparation of the following conclusions/

recommendations:

• Further eorts are needed to increase the awareness of people involved in

ensuring the safety of workers – the use of personal protective equipment

should not only be a legal requirement;

• the use of good gloves and higher-quality safety footwear translates into long-

term savings and better protection of workers;

• it is essential to properly train OSH specialists and to disseminate knowledge in

the medical environment on the role played by CPE and PPE;

• greater advice on the selection of PPE and CPE in the workplace should be

encouraged and promoted;

• the selection of PPE should be targeted at the individual needs of the recipients

– safety gloves or footwear should be selected for specific hazards;

• regular training on the use and selection of OSH products at end-user level is

recommended; it is good practice for suppliers to organise this type of training

at their regular recipients;

• the employers should be made aware that the selection of PPE and CPE should

be made by an OSH specialist who has the necessary knowledge;

• it is worth placing more emphasis in marketing activities on the promotion of

new innovative solutions for PPE and CPE, since consumers, when asked about

innovative products on the market, often indicate that they are not familiar with

such products;

• from the point of view of manufacturers, it is necessary to invest in research and

development activities;

• the new legislation should be amended swiftly as new technologies emerge

(e.g. the conversion of traditional welding into laser welding, in which case there

are still insucient provisions for CPE);

• suppliers should invest in online sales platforms because the online sales

channel is most frequently selected by the recipients of PPE and CPE;

• cooperation on the PPE and CPE market should include manufacturers,

scientific and research units, market surveillance authorities and OSH services.

Personal and collective protective equipment market

41

Information on

• environmental factors aecting the behaviour of suppliers and recipients,

• market entry barriers and key elements of the supply chain,

• market innovation potential,

• market price factors,

• factors aecting the demand for selected PPE and CPE,

• export and import,

• the current and future market situation,

see the document entitled

‘Personal and collective protective equipment market 2022. Supplement to the

Report’, available at a charge

Details concerning the purchase of the supplement and the free electronic version of

the publication ‘Personal and collective protective equipment market 2022. Report’

is available at

https://www.ciop.pl_raport-badanierynku-srodkiochrony

The material was prepared on the basis of a market survey of the suppliers and recipients of

selected personal and collective protective equipment carried out by ASM – Centrum Badań

i Analiz Rynku Sp. z o.o. at the request of the Central Institute for Labour Protection – National

Research Institute.

Personal and collective

protective equipment market

REPORT 2022

ISBN 978-83-7373-382-4

www.ciop.pl