What do Supplements Cover?

Medicare Supplements cover the same items Medicare Parts A and B cover. Medicare pays first and

pays most of your healthcare costs. Medicare Supplements pay second and help you pay your share

(co-pays/deductibles) of the bill. Supplements do not cover prescriptions. A separate Part D plan may

be needed for drug coverage.

Supplement plans are standardized, meaning regardless of the company selling a specific plan each

offers the same benefits. For example, a Plan G from one company will cover the exact same items or

services as a Plan G from all other companies. There are 10 standardized Medicare Supplement

Insurance plans, each offering a different level of coverage. These plans are shown on the back.

When can I get a Supplement?

Everyone has a once in a lifetime guaranteed opportunity to purchase a Medicare Supplement. This

guarantee happens when a person is 65 or older and first enrolls in Medicare Part B. You get six months

from the date your Part B starts to choose any supplement from any company. During these six months,

companies cannot turn you down due to your health. If you apply for a policy after your six month period

or if you are under 65, companies may refuse coverage because of health reasons.

How much do Supplements Cost?

The monthly premium for a supplement is based on your age, where you live, tobacco use, gender and

the coverage you select. A policy with less coverage (like a plan K) is typically less expensive than a

policy that offers more coverage (like a plan G). There is also a wide range between companies selling

the same policy. For example, a Plan G policy at age 65 ranges from $93 - $640 monthly, depending on

the company you choose and other variables.

What is a Medicare Supplement?

Medicare Supplement Insurance, or Medigap, is an insurance policy that

helps fill “gaps” in Original Medicare. Sold by private companies,

supplements work in conjunction with Medicare Part A and B, paying

some or all of a person’s remaining health care costs. Some policies may

also cover services that Original Medicare doesn’t cover, like medical care

when you travel outside the U.S.

How do I sign up for a Supplement?

Medicare Supplements are sold by private insurance companies. The Nebraska SHIP can provide

information on Supplement options, including monthly premiums. Once you have selected the

company you would like, contact the company directly or work with a local insurance agent to enroll.

Medicare Supplement Fact Sheet

For a personalized comparison, including available companies and monthly premiums,

please contact the Nebraska SHIP at 1-800-234-7119 or doi.ship@nebraska.gov.

OUT01173

10/23

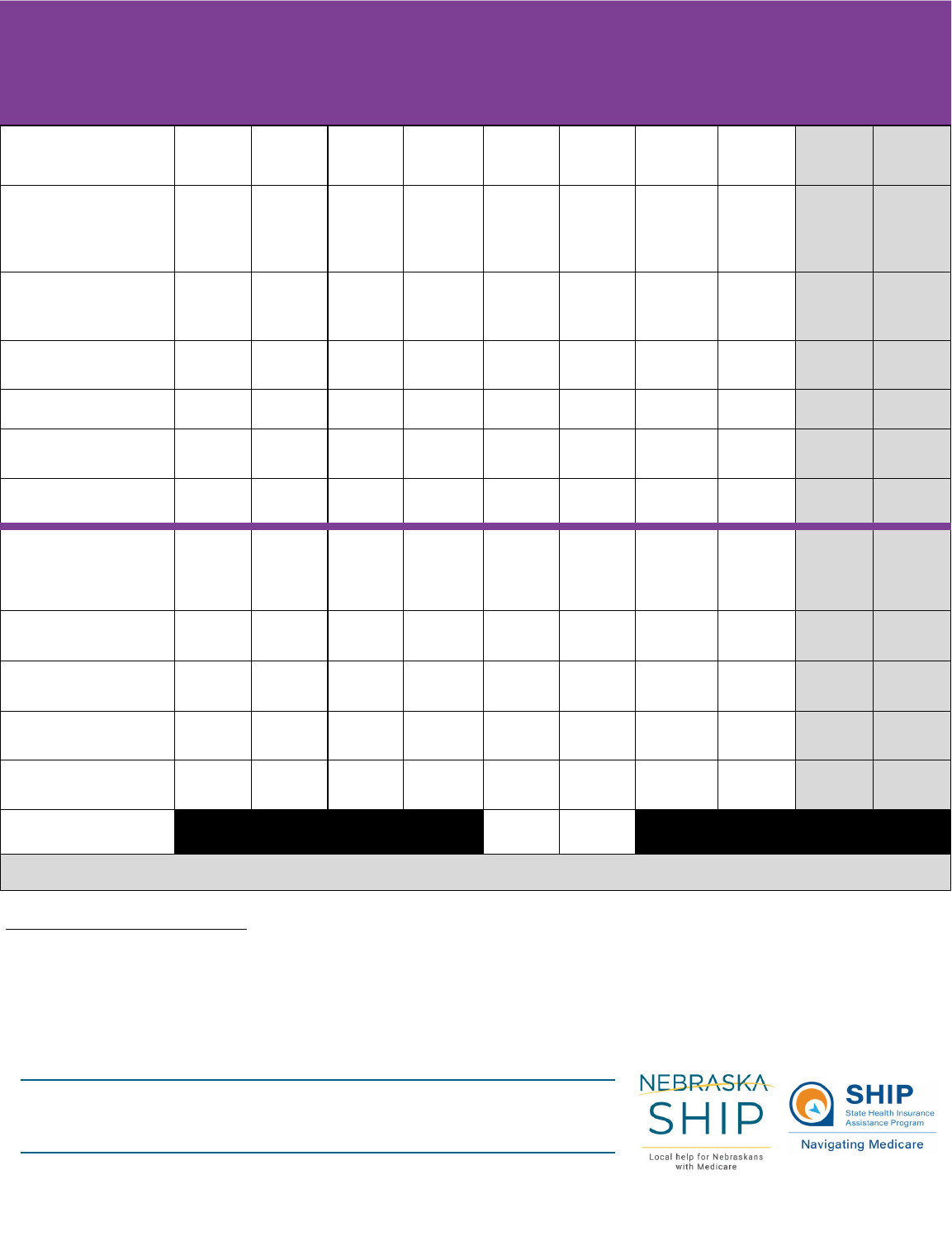

*High Deductible Option —High deductible policies offers the same coverage as a Plan F or Plan G policy

once an annual deductible has been met ($2,800 deductible in 2024). Prior to meeting the deductible, you

are responsible for the costs listed on the left side of the above chart. These costs will go towards the

annual deductible.

¹

Plan N pays 100% Part B coinsurance except $20 copay for office visits and $50 copay for ER visits.

BENEFITS PLAN

A

PLAN

B

PLAN

D

PLAN

G*

PLAN

K

PLAN

L

PLAN

M

PLAN

N

PLAN

C

PLAN

F*

Part A Hospital

Coinsurance,

days 61-90

($408 per day)

Hospital Lifetime

Reserve, days 91-

150 ($816 per day)

365 More Hospital

Days-100%

Parts A and B Blood

50% 75%

Part B Medical

Coinsurance (20%)

50% 75%

¹

Part A Hospice

Coinsurance

50% 75%

Skilled Nursing

Facility Coinsurance,

days 21-100

($204 each day)

50% 75%

Part A Hospital

Deductible ($1,632)

50% 75% 50%

Part B Medical

Deductible ($240)

Part B Excess

Charges (15%)

Foreign Travel

Emergency

Out-of-Pocket Limit

$7,060 $3,530

2024 Medicare Supplement Options

Plan C and Plan F are only available to individuals eligible for Medicare prior to 1/1/2020.

This project was supported, in part by grant number 90SAPG0078, from the U.S. Administration for Community Living,

Department of Health and Human Services, Washington, D.C. 20201.

Neither the SHIP nor the Nebraska Department of Insurance endorses any specific agent, company, product or plan of insurance.

1-800-234-7119 - www.doi.nebraska.gov/ship

Each Medicare Supplement Plan offers a specific list of benefits. Since plans are standardized, premium

comparison and special conditions are important to consider when choosing a policy that is right for you.