PRAGMATIC INSTITUTE

|

2021 ANNUAL SURVEY

2020...

UNPRECEDENTED

|

INTRODUCTION

|

3

We are still seeing the

effects of COVID-19,

civil unrest and political

turmoil in all corners of

our society. But how

have these changes

affected us as product

leaders, managers and

marketers? That is one

of the key areas—along

with our regular research

on salaries, activities and

obstacles—we explore in

this year’s annual survey.

to the thousands of people who responded to this year’s

survey and the hundreds who agreed to further interviews.

Your continued passion for all things product inspires

us every year, particularly as we release our

20

th

annual

product management and product marketing survey.

Thank you...

PRAGMATIC INSTITUTE

|

2021 ANNUAL SURVEY

Proles of

Respondents to

This Year’s Survey

AgeGender

Location, location,

location

This year, we had respondents from

6 continents and 43 U.S. states.

|

RESPONDENT DEMOGRAPHICS

7

%

7

%

29

%

23

%

33

%

UNDER 30

30-39

40-49

50-59

60 or OVER

82

%

11

%

5

%

1

%

1

%

•

MALE — 58%

•

FEMALE — 41%

•

NON-BINARY — 1%

AMERICAS

EUROPE

ASIA

OCEANIA

AFRICA

United States

of America

Colorado ...................... 5%

Minnesota .................... 5%

Pennsylvania ............... 5%

Arizona ......................... 4%

Illinois ........................... 4%

New York ...................... 4%

Florida .......................... 3%

Virginia ......................... 3%

Washington .................. 3%

Wisco nsin .................... 3%

Michigan ...................... 2%

New Jersey .................. 2%

Ohio .............................. 2%

Oregon ......................... 2%

North Carolina ............. 2%

Utah .............................. 2%

Alabama ....................... 1%

Connecticut ................. 1%

Delaware ...................... 1%

Indiana ......................... 1%

Kansas ......................... 1%

Maryland ...................... 1%

Missouri ....................... 1%

Nebraska ..................... 1%

New Hampshire ........... 1%

Rhode Island ................ 1%

South Carolina ............. 1%

Tennessee ................... 1%

Idaho ......................... 0.4%

Maine ........................ 0.4%

Oklahoma ................. 0.4%

Iowa...........................0.3%

New Mexico ..............0.3%

South Dakota ............ 0.3%

West Virginia ............0.3%

District of Columbia ..0.1%

Louisiana ...................0.1%

Mississippi .................0.1%

13%

California

9%

Georgia

8%

Texas

7%

Massachusetts

|

5

PRAGMATIC INSTITUTE

|

2021 ANNUAL SURVEY

All Through

the Years

|

RESPONDENT DEMOGRAPHICS

We asked respondents

both the number of

years they’ve been in

the profession and

the number of years

they’ve been in their

current role.

|

7

While the average years in the profession did not shift greatly year-over-year, the average time in

the current role—

3.23 years—did. This is nearly a full year longer than we have seen over the past 20

years. This is most likely indicative of the limited number of individuals who elected to voluntarily shift

jobs during the unknowns of the pandemic. It is also a sign that the product profession will likely

experience high job migration rates this year, similar to those being experienced in other industries.

Years in the profession

30

%

23

%

18

%

12

%

17

%

0 – 4

5 – 9

10 – 14

15 – 19

20 or MORE

PRAGMATIC INSTITUTE

|

2021 ANNUAL SURVEY

Paths to

Product

|

RESPONDENT DEMOGRAPHICS

One of the things we most enjoy hearing about from our

respondents is what path they took to their product role.

The answers are as diverse as the respondents.

Education

•

Doctorate degree – 4%

•

Master’s degree – 41%

•

Some master’s (degree not completed) – 7%

•

Bachelor’s degree – 40%

•

Associate degree – 3%

•

Some college (degree not completed) – 4%

•

High school – 1%

|

9

Other roles held in

their career

• Account Manager

• UX

• Customer Success

• Business Analyst

• Project Manager

• Technical Support

• Technical Writer

Number of professional

certications

15

%

61

%

23

%

69

%

41

%

22

%

13

%

32

%

21

%

3

%

25

%

20

%

33

%

0

Product Owner

Technical/Development

Product Marketing Manager

Outside Consultant

Trainer/Educator

Sales

Marketing Communications

Other (see below)

Product Manager

1 – 3

4 – 6

7 or MORE

PRAGMATIC INSTITUTE

|

2021 ANNUAL SURVEY

|

THE EFFECTS OF THE UNEXPECTED

The unexpected events of 2020 (COVID-19, natural disasters, civil

unrest and political turmoil) affected all of us on a personal level. Here,

we explore their effects on our products and our companies.

The Best

Laid Plans

How well did our January

product roadmaps and plans

hold up?

•

Held up completely – 9%

•

Held up moderately well – 61%

•

Complete rework – 25%

•

Not applicable – 5%

Where the shifts

occurred

Whether positive or negative, the

following activities were those most

affected by the unexpected events

of 2020.

Feel like you’ve been in more meetings since

the pandemic began? You have. There has

been a 30% increase in time spent in weekly

meetings vs. our last survey period

55

%

32

%

50

%

28

%

42

%

34

%

Re-prioritization of key features

Change in which marketing strategies

were most valuable

Change in which marketing channels

were most valuable

Adjustments to preferred market

research/customer feedback methods

Emergence of new target markets

Change in the target market’s demand

|

11

PRAGMATIC INSTITUTE

|

2021 ANNUAL SURVEY

|

THE EFFECTS OF THE UNEXPECTED

Effect on

Organizational

Growth

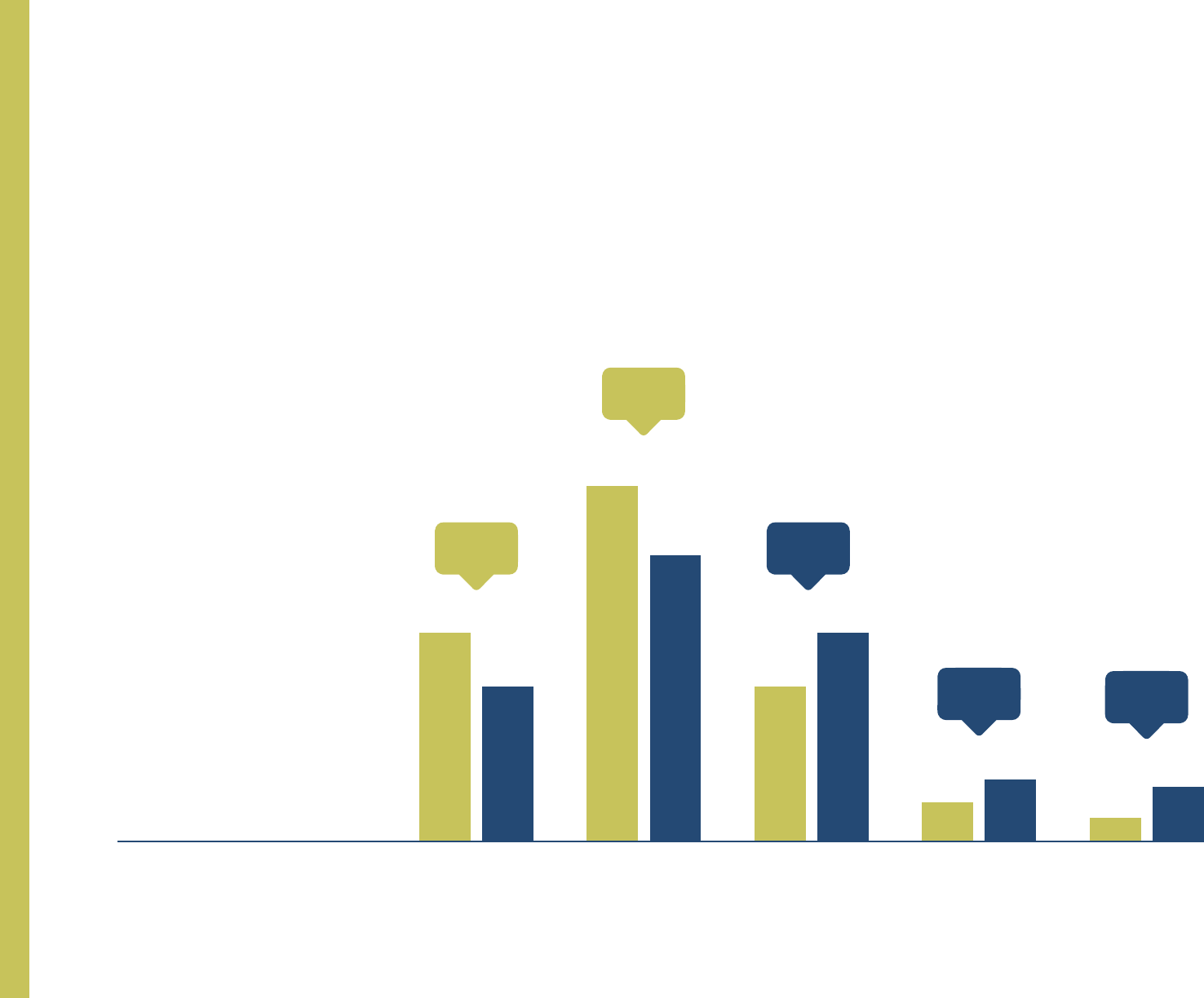

The growth trajectory

of the organizations our

respondents work at

were directly impacted

by the events of 2020.

High

growth

Medium

growth

Low

growth

Negative

growth

Flat

year-over-year

n

Going into 2020

n

At the end of 2020

20

%

27

%

37

%

45

%

27

%

20

%

7

%

3

%

9

%

5

%

-7

%

+7

%

+3

%

+4

%

-9

%

Effect on Department Growth

The bad news—departments and budgets shrank overall in 2020.

Size of department now vs. January 2020

The good news—52% of respondents stated that

there are currently openings within their department,

with nearly 20% saying they have ve or more current

open positions (that’s over 730 open positions).

Larger

27

%

Same

39

%

Smaller

34

%

|

13

PRAGMATIC INSTITUTE

|

2021 ANNUAL SURVEY

|

THE EFFECTS OF THE UNEXPECTED

Lasting

change?

Of all the changes

that occurred, which

do our respondents

expect to last?

Change in which marketing

strategies were most valuable

37

%

Change in the target

market’s demand

41

%

Re-prioritization of

key features

39

%

|

15

Change in which marketing

channels were most valuable

28

%

When we asked what they

hope (vs. expected) to have a

lasting change, the number

one answer was emergence

of new target markets.

?

Adjustments to preferred

market research/customer

feedback methods

23

%

Emergence of new

target markets

21

%

PRAGMATIC INSTITUTE

|

2021 ANNUAL SURVEY

|

THE EFFECTS OF THE UNEXPECTED

2020-2021

Bold Wins

&

Missed

Opportunities

(what we should have done, or done sooner)

|

17

PRAGMATIC INSTITUTE

|

2021 ANNUAL SURVEY

Free Offers

Respondents cited the successful use of free

trials and discounts to land new customers

and secure existing customers as a bold win.

Bold Wins

“ Provided NEW CAPABILITIES at

no cost and new capabilities for

extended free trial.”

“ OFFER FREE TAKE-OUT MODULE for a couple of months.

Many of the free modules have converted to paying modules.”

“ Offered a

FREE TRIAL OF OUR PRODUCT (add-on feature) to

our global customer base, which helped drive awareness

and conversions.”

|

19

|

18

“ Potential discounting/FREE

TRIAL for those impacted by

COVID pandemic.”

“ Aggressively change pricing strategy in favor of a land-and-

expand model.”

Missed Opportunities

PRAGMATIC INSTITUTE

|

2021 ANNUAL SURVEY

Bold Wins

Partnerships

COVID affected every industry. Those who

navigated successfully often cited the fact

they didn’t go it alone as the reason.

“ Shifted to partner channel strategy

as a method to SCALE RAPIDLY.”

“ A PIVOT TOWARD PARTNERSHIPS over in-house for items

that aren’t clear differentiators.”

“

TECHNOLOGY PARTNERSHIP with small, but rapidly

growing, hardware maker.”

|

21

“ Worked with strategic partners

to help organizations move to

WORK-FROM-HOME, securely.”

Missed Opportunities

PRAGMATIC INSTITUTE

|

2021 ANNUAL SURVEY

Bold Wins

Prioritization

“ IMPROVED PRIORITIZATION—

reducing what we are focused

on in order to drive speed.”

“ Maintained commitment to ONE MAJOR PROJECT on our

beginning roadmap—used remaining capacity to be responsive.”

“ Adjusted resources to

PRIORITIZE WHAT OUR MARKET

INDICATED

was now most important in the new landscape.”

Ruthless prioritization is often the difference

between success and failure. This is only

amplied in a time of crisis.

|

23

Missed Opportunities

“ KILLED projects.”

“ Sunset a product line that was not picking up

and focus the strategy.”

“Let go of what’s not working.”

PRAGMATIC INSTITUTE

|

2021 ANNUAL SURVEY

Bold Wins

Internal

Investment

One of the most varied areas of response was

around whether organizations increased or

decreased internal investments, and the areas

they focused on.

“Put PEOPLE BEFORE PROFIT.”

“ Able to FILL A COUPLE NEEDED POSITIONS in PM even

though company was on a hire freeze.”

“

CREATED MORE PROCESS around product management.”

|

25

Missed Opportunities

“ INVESTED MORE

in development.”

“ Should have started hiring sooner to get good candidates

that were laid off elsewhere.”

“ Took for granted how much information was communicated

in halls/drop-bys.”

PRAGMATIC INSTITUTE

|

2021 ANNUAL SURVEY

Bold Wins

Market

Focus

For some, COVID represented an opportunity

to pivot to large, untapped markets. But

the speed at which a company could pivot

was key.

“ New vertical markets for

ESSENTIAL JOBS.”

“ OFFERING NEW PRODUCTS and services aligned with a

suddenly sanitized and touchless world.”

“ Focused on new markets that were less affected by events.

DOUBLED DOWN ON SOME MARKETS forced into digital

transition by events.”

|

27

Missed Opportunities

“ Market/revenue

DIVERSIFICATION.”

“ We saw a surge in demand for certain nancing options

that was not foreseen. We should have done a better job

anticipating the impact.”

“ New features to support target audience now having to

work from home.”

PRAGMATIC INSTITUTE

|

2021 ANNUAL SURVEY

Bold Wins

Sales &

Marketing

Success in sales and marketing focused

on two areas: a strong focus on existing

customers and a smooth transition to

digital events.

“ Turned to 100% CLIENT

RETENTION FOCUS, nothing

new and shiny.”

“ SHIFTED BUDGETS from travel and tradeshows to

content and online ad spend.”

“ Shift the messaging from ‘look at us’ to

‘HERE’S HOW

WE’RE CONTRIBUTING’.”

|

29

Missed Opportunities

“ Focus on RETENTION

and LOYALTY.”

“Stayed closer to each client and redirected marketing strategies.”

“Monitor how users’ buying changed.”

PRAGMATIC INSTITUTE

|

2021 ANNUAL SURVEY

A Look at

Product

Teams Today

Department sizes ranged from one to 51, with an average size of 16.

|

PRODUCT TEAMS

For the rst time, the majority

of respondents—57%—

stated that product is its own

department, reporting to itself

or directly to the CEO.

A seat at

the table

|

31

Where do departments

report up?

How organizations measure

the success of product teams

Product teams are increasingly being measured on the

items closest to the company’s bottom line—on-time

releases that deliver revenue and satisfy customers.

33

%

12

%

15

%

28

%

3

%

64

%

22

%

10

%

12

%

44

%

0

%

16

%

2

%

27

%

1

%

30

%

12

%

16

%

8

%

Product Marketing

Product SalesMarketing

Customer Satisfaction or NPS Scores

Sales

Market Share

Development or Engineering/CIO/Technology

Competitive PositioningDirectly to the President/CEO/Managing Director

Number of Bugs Reported/Rework RequiredSupport

Lead PipelineServices or Training

Launch/Release Dates Are Hit

Other

Unknown or We Don’t Measure

Other

Product Management

Number of Releases in a Year

PRAGMATIC INSTITUTE

|

2021 ANNUAL SURVEY

Revenue & sources

|

PRODUCT TEAMS

2

%

9

%

4

%

24

%

14

%

16

%

21

%

8

%

2

%

Less Than $1 Million

$1 Million – $10 Million

> $10 Million – $50 Million

> $50 Million – $100 Million

> $100 Million – $1 Billion

> $1 Billion – $10 Billion

> $10 Billion – $100 Billion

Over $100 Billion

We Do Not Currently Generate Revenue

The

Companies

Served

Industry

Primarily

B2C

About equally

B2B and B2C

80

%

8

%

12

%

7

%

3

%

1

%

14

%

15

%

28

%

1

%

13

%

3

%

8

%

3

%

1

%

3

%

Agriculture and Food

Services

Construction

Education and

Educational Services

Financial Services

and Insurance

Healthcare

Manufacturing

Professional, Scientic

and Technical Services

Real Estate

Retail

Utilities

Wholesale

Direct-to-Consumers/

Households

Other

Primarily

B2B

Software Hardware

Hosted or

Cloud Services

Professional

Services or

Consulting

Types of products offered

80

%

27

%

52

%

55

%

49

%

18

%

18

%

15

%

Primary source of revenue

|

33

PRAGMATIC INSTITUTE

|

2021 ANNUAL SURVEY

|

PRODUCT TEAM ROLES

The Roles Of Product Team

Members Today

Role

54

%

35

%

13

%

INDIVIDUAL CONTRIBUTOR

DEPARTMENT HEAD

EXECUTIVE

Number of direct reports

•

1–5: 68%

•

6–10: 24%

•

11–15: 5%

•

16–20: 2%

•

21–25: 0%

•

More than 25: 1%

|

35

|

30

68

%

1

%

18

%

1

%

5

%

4

%

3

%

6 – 10

11 – 20

21 – 30

31 – 40

41 – 50

More than 50

5 or Less

Number of products

managed or worked on

9

The average respondent

works on or manages

nine products.

PRAGMATIC INSTITUTE

|

2021 ANNUAL SURVEY

members believe they should spend 53% of their time on strategic

activities, according to this survey. But only

8% of respondents

were able to focus at this level. Over half reported a gap of

25+

percentage points from their strategic goal.

Product team...

|

PRODUCT TEAM ROLES

|

37

Discovering new market opportunities for their organization

is an under-served activity, no matter who owns it. 69%

reported spending zero hours a month interviewing potential

customers, 66% spent zero hours on win/loss analysis

with evaluators, and 39% reported zero hours interviewing

customers. If we’re not nding the new opportunities, where

will they come from, and will they be market-driven?

PRAGMATIC INSTITUTE

|

2021 ANNUAL SURVEY

Who Owns What?

Understanding market problems

Performing win/loss analysis

Articulating distinctive competencies

Market denition, market sizing and segmentation

Dening product distribution strategy

Managing product portfolios

Creating and updating the business plan

Setting and maintaining pricing

Making buy, build or partner decisions

Tracking product protability

Performing technology assessment

Performing competitive analysis

Maintaining the roadmap

Managing innovation

Writing product requirements

Dening user personas

Dening use scenarios

Monitoring product milestones

Creating wireframes

Driving user testing

PRODUCT MARKETING

PRODUCT MANAGEMENT

34

%

36

%

13

%

16

%

29

%

7

%

23

%

14

%

13

%

48

%

33

%

22

%

6

%

5

%

60

%

BUSINESS

TECHNICAL

83

%

25

%

51

%

29

%

19

%

19

%

63

%

18

%

40

%

40

%

33

%

85

%

66

%

57

%

28

%

58

%

43

%

89

%

86

%

78

%

79

%

37

%

29

%

29

%

59

%

|

PRODUCT TEAM ROLES

|

39

19

12

7

hours articulating and

prioritizing product

requirements

hours planning and

communicating your

roadmap

hours analyzing

market segments

Time Spent Each Month On Key Activities

(Both product management and product marketing)

PRAGMATIC INSTITUTE

|

2021 ANNUAL SURVEY

|

PRODUCT TEAM ROLES

Who Owns What?

Dening marketing plans

Measuring the ROI of marketing programs

Building customer retention plans

Launch planning

Buyer personas

Success stories

Thought leadership

Lead generation

Customer’s buying process

Driving user testing

Providing sales channel training

Creating customer-facing sales collateral

Creating internal sales tools

Creating presentations and demos

Going on sales calls

Stang seminar and trade show events

Answering sales questions

35

%

40

%

34

%

58

%

29

%

22

%

48

%

12

%

7

%

8

%

16

%

53

%

15

%

26

%

34

%

6

%

23

%

69

%

44

%

38

%

29

%

84

%

70

%

63

%

72

%

47

%

72

%

61

%

77

%

80

%

83

%

33

%

50

%

47

%

PRODUCT MARKETING

PRODUCT MANAGEMENT

GO-TO-MARKET

SALES READINESS

Time Spent Each Month On Other Activities

27

6

6

hours managing

email

hours creating sales

collateral

hours in launch

preparation

(Both product management and product marketing)

|

41

PRAGMATIC INSTITUTE

|

2021 ANNUAL SURVEY

SPOTLIGHT: THE

EVOLUTION

OF PRODUCT

MARKETING

|

PRODUCT MARKETING FOCUS

we’ve witnessed (and—we hope—partially helped

shape) a dramatic evolution of the role of

product marketing. It is no longer overlooked

but seen as a key strategic player and leader in

many of today’s companies. And nowhere is that

truer than in high-growth organizations.

Over the last 7 years...

10

years in

product marketing

vs. 13.4 general population

58

%

master’s degree

or higher

vs. 52% general population

3

years in current

marketing role

vs. 3.76 general population

8

products

managed

vs. 11.7 or other product marketers

Prole of a

Product Marketing

Manager

in

High-Growth

Revenue Orgs

|

43

PRAGMATIC INSTITUTE

|

2021 ANNUAL SURVEY

THERE

ARE:

For Every 1

Product Marketing

Professional in the

Organization

|

PRODUCT MARKETING FOCUS

2

product

managers

2

marketing

communications

people

of product marketers at

high-growth companies

reside in the marketing

department; just

9% have

product marketing as a

separate group.

Average

department size is 13.

23

sales

people

4

sales

engineers

marketing

communications

people

48

%

|

45

PRAGMATIC INSTITUTE

|

2021 ANNUAL SURVEY

|

PRODUCT MARKETING FOCUS

32% of product marketers

set and maintain pricing

and packaging—this is

more than double what we

saw just 5 years ago.

Key Responsibilities

of Product Marketing at

High-Growth Companies

Understanding

customer’s buying

process

86%

Buyer

personas

86%

Thought

leadership

86%

Dening user

personas

70%

Ownership of these activities are 10+ pts higher

in

high-growth companies than others:

|

47

Where They Are Spending Their Time

Sales enablement vs. marcom support

We’ve noted a shift in the primary focus of product marketing from marketing communications support to

sales enablement. This shift is more notable within high-growth organizations.

This shift has also culminated in a fairly notable shift in compensation. Those primarily focused on product

marketing reported total compensation packages

13% higher than those in product management. This was

across all company growth rates.

Comparison to Non

High-Growth Orgs

Hours per

Month

ActivitIes

Interviewing customers 5.37 17%

Analyzing market segments 9.52 7%

Objective investment analysis of potential market opportunities 8.3 13%

Researching and documenting the buying process 8 12%

Dening plans and budgets for selling products to new customers 4.46

-13%

Dening plans and budgets for ensuring customer loyalty 3.63 -16%

Measuring and tuning product marketing plans to ensure alignment of corporate goals 13.88 68%

Ensuring all departments are prepared for external product launch 9.42 31%

Identifying customer referrals and references 2.38

-5%

Creating sales collateral 21.17 90%

Creating sales tools for your sales channel 11.88 66%

Creating or delivering sales channel training programs 4.46 15%

Producing standard product presentations and demo scripts 8.21 32%

PRAGMATIC INSTITUTE

|

2021 ANNUAL SURVEY

Partners

For

Success

companies are those that have discovered

how to leverage and combine the power of

data, design and product. How does your

company compare to the industry averages

in these key partnerships?

The most innovative...

|

THE DATA, DESIGN AND PRODUCT INTERSECTION

|

49

PRODUCT

DATADESIGN

PRAGMATIC INSTITUTE

|

2021 ANNUAL SURVEY

SPOTLIGHT: DATA

& PRODUCT

|

PRODUCT AND DATA

The importance of being data-driven is clearly felt by our respondents: when asked how necessary it will

be for product teams to be trained in data-driven decision making in the next three years,

54% said it would

be an important differentiator, while

39% believe it will be mandatory to be hired or retain their position.

While

92% of total respondents agreed or strongly agreed when asked to rate themselves on the statement

“I am data-driven in my approach to work,” they also acknowledged the struggles they face to be data-

driven. Chief among them were concerns around data living in multiple systems (making it hard to draw

conclusions) and the desire to be data-driven but lacking access to the data they need, leading to a lack of

condence in predictions being made (23%, 23% and 17% respectively).

Only 25% of respondents said

that big data has changed the

way they perform their role

to date. But the impact of it

on their futures was weighing

heavy on their minds.

Data as a differentiator was also something they

were thinking about at the product level. We asked

respondents how their companies compare to the

competition in terms of the use of big data.

40

%

32

%

16

%

12

%

Competitors are about equal to us

Competitors are behind us

I have no idea

Competitors are ahead of us

|

51

is a powerful tool to add to

strategic discussions, but 10%

of respondents feel that even

having that data fails to convince

stakeholders. Attempting to

get that data from dedicated

teams can also be a struggle,

with 10% of respondents feeling

that the responses they get

back from their data teams

don’t answer the questions

they attempted to ask.

Data...

PRAGMATIC INSTITUTE

|

2021 ANNUAL SURVEY

So, where is being data-driven most

powerful for today’s product teams?

We asked respondents to select three

activities that would benet most from

a data-driven approach. The responses

clearly favor strategic thinking and

positioning in the market:

Market problems

12

%

Product roadmap

10

%

Business plan

5

%

Pricing

8

%

Win/loss

5

%

|

PRODUCT AND DATA

|

53

PRAGMATIC INSTITUTE

|

2021 ANNUAL SURVEY

SPOTLIGHT: DESIGN

& PRODUCT

|

PRODUCT AND DESIGN

90% of our annual survey respondents have a visual

interface to their product. With

44% of respondents

actively collaborating with a design resource through-

out the design process and

38% providing feedback

on design iterations someone else generates, that

interface is clearly a collaborative effort between

product and design resources.

•

I actively collaborate with a design resource

throughout the process – 44%

•

I am uninvolved with the design – 7%

•

I create the design myself – 4%

•

I provide feedback on design iterations

someone else generates – 38%

•

I provide requirements but am not otherwise

involved in the design – 7%

|

55

is vital but not without its struggles. When we asked product managers what challenges they

personally faced around design,

15% faced challenges making the transition from problem to

be solved (the what) with execution of a solution (the how);

14% felt a misalignment with their

design teams on what the customer really needed out of a solution; while

13% struggled in

clearly dening what responsibilities were owned by which role.

While many respondents talked about partnering

with designers, there were still questions about

responsibilities and roles.

29% of product managers

stated that they owned creating wireframes, and

37%

stated they owned driving user testing.

That collaboration...

PRAGMATIC INSTITUTE

|

2021 ANNUAL SURVEY

|

COMPENSATING THESE CRITICAL ROLES

Our annual compensation reports are used by leading rms

and individuals around the world for planning and negotiation.

To continually improve the precision of the data we collect,

we slightly altered the way these questions were asked. This

caused an overall increase in compensation reported. This is

reective of the way the data was collected, not a sizable shift

in compensation within the industry.

PRAGMATIC INSTITUTE

|

2021 ANNUAL SURVEY

|

57

Below is a look at the way product roles are compensated

and the key factors affecting pay rates.

United States of America

Salary Bonus

Connecticut

California

Massachusetts

North Carolina

Georgia

Ohio

Illinois

Virginia

Pennsylvania

Michigan

Colorado

Washington

Texas

Oregon

New York

Indiana

Florida

Minnesota

Wisconsin

Utah

Arizona

$174,000

$169,527

$163,831

$156,000

$153,929

$146,000

$145,000

$144,700

$141,875

$140,000

$138,947

$136,757

$135,217

$134,000

$132,500

$130,000

$127,556

$126,875

$121,111

$121,000

$113,333

$16,056

$8,949

$7, 356

$5,107

$8,653

$8,100

$5,481

$6,289

$8,886

$4,167

$9,141

$10,119

$3,055

$9,192

$2,914

$8,700

$7,600

$5,591

$4,333

$5,188

$2,463

U.S.A.

$6,626

$143,291

•

Salary

•

Bonus

Canada

$4,157

$112,847

U.K.

$4,429

$97,906

Germany

$10,615

$106,250

India

$1,654

$53,400

Ireland

$12,278

$131,429

150

140

130

120

110

100

90

80

70

60

50

40

30

20

10

PRAGMATIC INSTITUTE

|

2021 ANNUAL SURVEY

|

COMPENSATING THESE CRITICAL ROLES

Key Factors Affecting

Compensation

Gender

Males earn an

average of 13% more

|

59

Main Area

of Focus

The wider the areas of

responsibility, the higher

the compensation

$15k

Education

Those with a Master’s

earn $15k higher than

the average, while the

highest bonuses went to

those with Doctorates

$146,879

Creating and executing go-to-market strategies

for products (working with sales and marketing,

channel support, etc.)

$129,500

Deciding what should go in products (gathering

requirements from the market, prioritizing, working

with development, etc.)

$153,464

Each of the above about equally

PRAGMATIC INSTITUTE

|

2021 ANNUAL SURVEY

Practical, actionable training

that delivers immediate impact.

That’s Pragmatic Institute.

BUILD

Align product and development teams

to build remarkable products.

DATA

Harness the power of data to impact

business decisions and accelerate growth.

FOUNDATIONS

Implement a proven, practical

blueprint for being market driven.

MARKET

Focus your team on the marketing

strategies that deliver results.

FOCUS

Use market data to identify and

present the right product strategies.

LAUNCH

Elevate your team’s product

and marketing launches.

DESIGN

Create intuitive product experiences

that exceed user expectations.

PRICE

Set the right price for each

product in each market.

Pragmatic Institute is the

transformational

partner for

today’s businesses, providing

immediate impact through

actionable and practical training.

We focus on building expertise

and collaboration within and

across data, design and product

teams. This allows organizations

to accelerate innovation, grow

revenue, improve customer

satisfaction and drive success.

Our courses are taught by industry

experts with decades of hands-

on experience, and include a

complete ecosystem of training,

resources and community. This

focus on dynamic instruction and

continued learning has delivered

impactful education to over

200,000 alumni worldwide.

But we don’t just do training—we

provide proven methodologies,

adaptable resources, battle-

tested strategies and world-class

support. In fact, thousands of

companies around the world—

from startups to Fortune 500—

rely on our models to drive

their business and power their

strategies.

If you’re ready to empower your

teams to create truly innovative

solutions for your market, visit

PragmaticInstitute.com or call

480-515-1411.

|

61

pragmaticinstitute.com