Garagepreneurs Internet Private Limited

CUSTOMER GRIEVANCE REDRESSAL

POLICY

1

Approval History

This document has been approved by Board of Directors on

1

08 September 2023

2

24 May 2024

3

10 June 2024

2

Contents

1. Background ........................................................................................................ 3

2. Key Definitions ................................................................................................... 3

3. Objectives ........................................................................................................... 4

4. Grievance Redressal Framework ......................................................................... 4

5. Maintenance of records ..................................................................................... 12

6. Reporting .......................................................................................................... 12

7. Review of the policy ........................................................................................... 12

3

1. Background

GaragePreneurs Internet Private Limited, (“the Company” or “slice”) is a fintech entity

incorporated under the Companies Act, 2013 in 2015 having its registered office in Bangalore. The

Company had recently applied to the Reserve Bank of India (“RBI”) seeking authorization to issue

Prepaid Payment Instruments (“PPI”) under the Master Directions on PPIs (“PPI Master

Directions”) issued by the RBI and has been granted approval by the RBI for setting up and

operating a payment system for PPI, thereby making the Company a Payment System Operator.

The Regulations mandate the Company to formulate and disclose a Customer Grievance Redressal

policy. Further, the Master Directions and Guidelines stipulate for the Company to appoint a Nodal

Grievance Redressal Officer.

Further, the Company through its mobile application “slice” offers its customers Unified Payments

Interface (UPI) based payment solutions. These activities fall under the purview of; NPCI guidelines

governing UPI (referred to as UPI Guidelines).

In view of the above, the Company has framed a consolidated Grievance Redressal Policy (“the

Policy”) with the approval of its Board of Directors (“Board”) as applicable for all the above-

mentioned activities. The Company has made this policy accessible to all the users on its mobile

app and website.

2. Key Definitions

For the purpose of this Policy, key definitions are as follows:

• “Customer” or “Complainant” or “User” - means an individual or entity – the end user

availing the services provided by the Company.

• “Grievance” or “Complaint” – refers to any correspondence that is comprehensive and

explicit in nature that conveys dissatisfaction with an inadequate level of service, inappropriate

conduct, or any act of omission or commission. However, messages intended to provide

feedback or provide explanation will not be regarded as complaints or grievances. Further, it

will also cover fraud incidence for UPI services.

• ‘Grievance Redressal Officer’ refers to an officer appointed by the PSP Bank, Issuing Bank

or RE who is responsible to overlook any grievance of the Customer for their respective product

(UPI and PPI)

• ‘Issuing Bank’ – refers to the respective bank of a customer where Customers maintain their

account and also issues UPI ID linked to the account.

• ‘Third Party Application Provider’ or ’TPAP’ – refers to the Company i.e., slice acting as

a service provider for PSP Bank while providing UPI services.

4

• ‘Nodal Officer’ refers to an officer appointed by the Company to handle the customer

complaints / grievances, the escalation matrix and turn-around-times for complaint

resolution.

• ‘Product’ – may refer to either one or all of the services offered by the Company. This

currently includes PPI and UPI.

• ‘PSP’ or ‘PSP bank’ or ‘Axis Bank’ - means Axis Bank Limited, a banking entity licensed

under the Banking Regulation Act, 1949 that is a member of the UPI ecosystem. Axis Bank

functions as a ‘Payment Service Provider’ (PSP) to the Company, for undertaking all UPI based

services.

3. Objectives

The primary objective of the Policy is to:

• Design a grievance redressal framework and implement it across Products offered by the

Company to provide its Customer with a seamless service and satisfaction;

• Ensure Customer protection;

• Ensure ease of access to the Customer by providing them with options of lodging a complaint

through various channels;

• Ensure transparency in grievance redressal by providing a defined Turn-Around-Time (TAT)

and ensuring timely resolution of customer complaints. Further, the Company will endeavour

to provide the Customer with transparent communication in case of the complaint not being

resolved within the prescribed timelines or if the complaint is not capable of being resolved;

• Ensure Customer satisfaction by providing a defined escalation matrix so that in the event that

a Customer is not satisfied with the given solution, they can escalate their complaint to higher

authorities who are responsible for the same; and

• Seek regular Customer feedback through complaints and endeavour to improve the Company’s

processes and products to match Customer demand and satisfaction;

4. Grievance Redressal Framework

The Company believes that it is their primary responsibility to focus on Customer service and

satisfaction. In its endeavour of providing its Customers with a seamless experience, the Company

has designed a comprehensive grievance redressal framework to address customer complaints. The

customers are provided multiple channels to lodge their complaints and these complaints are

resolved in a timebound manner, with also providing the Customer with a choice to escalate their

5

complaints. This section explores the grievance redressal framework applicable across different

products offered by the Company.

The Company has defined a multi-level Escalation matrix to ensure that a Complainant is able to

appeal and escalate their grievance to a higher level. The degree of escalation varies according to

the product offered by the Company. Level 1 and Level 2 of escalation are applicable to the Products

offered by the Company.

Additionally, the Turn-Around-Time (TAT) for addressing grievances has been explicitly defined

by the Company in accordance with relevant guidelines. The Company has designed its grievance

redressal process to ensure a smooth and timely resolution of Customer complaints.

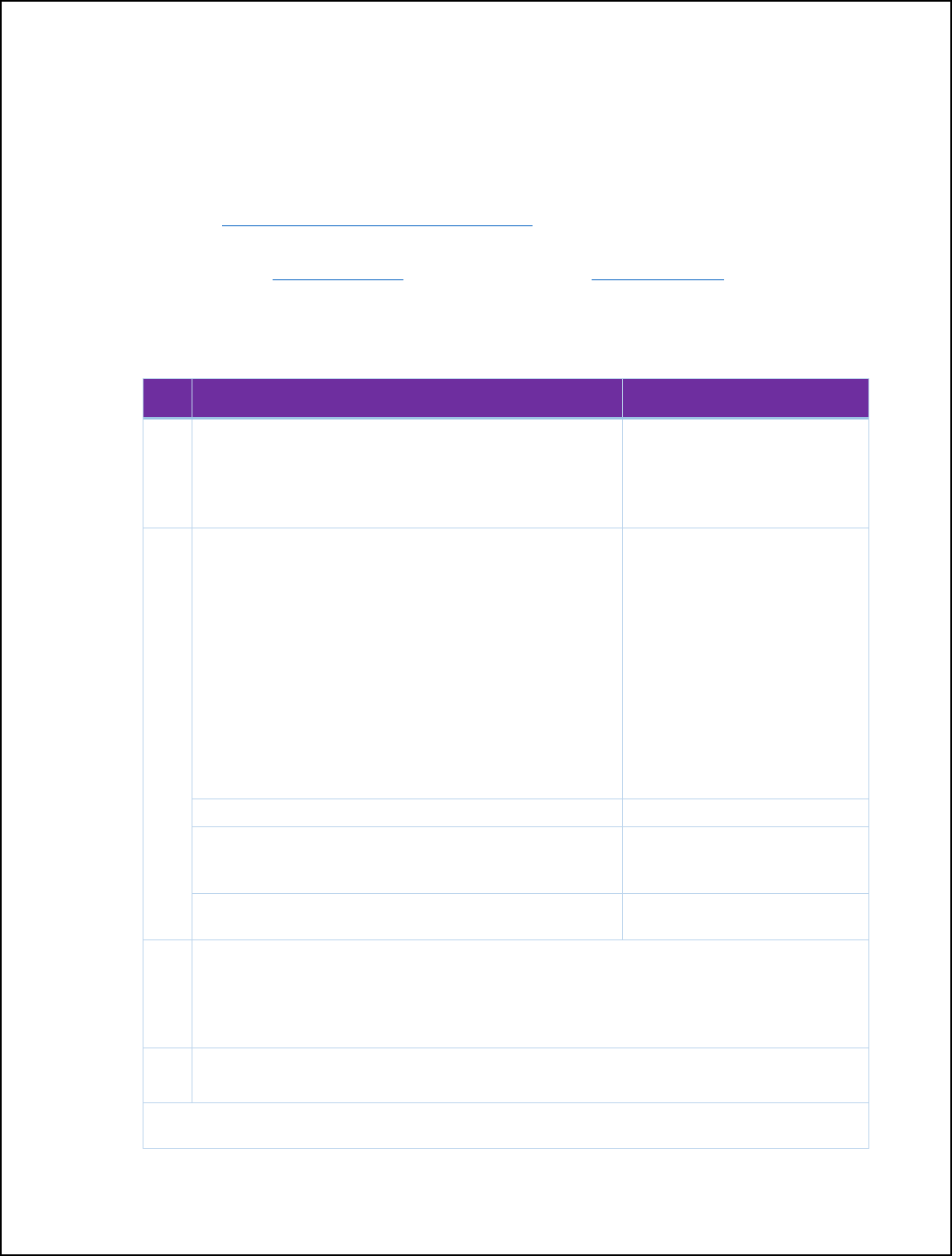

The following table provides a snapshot of the escalation matrix and the TAT vis-à-vis the various

products offered by the Company.

S. No.

Escalation level

Description

TAT

Product(s)

1.

Level 1 –

Customer Service

Agent

Lodging a grievance

via the channels

mentioned in (4.2).

Acknowledgment of

receipt of grievance

within 48 hours;

PPI and UPI

Written reply / resolution

within 5 working days of

lodging the grievance.

2.

Level 2

Appealing to the

The Customer Service

PPI and UPI

Customer Service

Manager

/

Head

must

Manager / Head of

respond and address the

the Company.

complaint within 5

working days of the

complainant lodging the

grievance.

3.

Level 3

Escalating to the

Nodal Officer /

Grievance Redressal

Officer, as

applicable.

A)

Escalating a

10 working days

PPI

complaint to the

Nodal Officer

B)

Escalating the

T+1 days of registering

UPI

grievance to the PSP

the complaint

bank (Axis Bank)

6

S. No.

Escalation level

Description

TAT

Product(s)

4.

UPI Level 4

Escalating the

grievance to the

Customer’s

respective bank

(issuing bank)

Issuing bank to respond

within T+1 days of

lodging the complaint.

UPI

5.

UPI Level 5

Escalating the

grievance to NPCI

-

7.

RBI Ombudsman

A Customer may

approach the RBI

Ombudsman on

their CMS portal

after exhausting all

levels of escalation.

-

PPI and UPI

4.1 Channels of Lodging a Complaint

The Company provides a Customer with an option of 3 channels to lodge their grievance. These

channels for Level 1 are mentioned below.

S.

No

Channel

Process

1.

slice mobile app

Help and Support (slice app>Profile>help and

support>raising a ticket)

2.

Email

help@sliceit.com

3.

Helpline Number

+918048329999

4.2 Grievance Redressal Process

A Customer can lodge a complaint / grievance via any of the three channels provided by the

Company which include the slice app, a dedicated Customer grievance Email Id and via a phone

call (the three channels are mentioned in detail in Section 4.1).

While raising a complaint, a Complainant must also provide the following information:

i.

Customer’s complete name;

ii.

Customer’s complete correspondence address;

iii.

Phone number;

iv.

Email address;

v.

Details of the complaint.

7

Post registering a complaint, the Complainant will receive an acknowledgement from the Company

within 48 hours of making the complaint.

Escalation Matrix

• Level 1 – Customer Service Agent (PPI and UPI)

Any complaints raised by the Complainant will be first handled at this level. The Company will send

a written reply / resolution to the complainant within 5 working days of lodging the complaint. The

Complainant will receive the communication on their registered Email Id. The nature and time

taken for the reply will depend on the Complainant’s grievance i.e., whether the customer service

team is able to resolve the complaint, else they will communicate their inability to do so within the

specified time frame.

• Level 2 – Customer Service Manager / Head (PPI and UPI)

If the Complainant is not satisfied with the response received from the Customer Service (in Level

1), they can escalate their grievance to this Level 2 via email custom[email protected]. The

Customer Service Manager / Head will ensure to resolve the and respond within 5 working days of

receiving the complaint.

• Level 3 – Nodal Officer / Grievance Redressal Officer as applicable

A) Level3 – Nodal Officer for PPI product

If the Complainant is not satisfied with the response received from the customer service in Level 2,

they can escalate their grievance to level 3 by appealing to the Nodal Officer of the Company.

The Complainant may contact the Nodal Officer at the details mentioned below. The Officer must

respond within 10 workings days of receiving the complaint.

Contact details of the Nodal Officer:

Name

Swetha S

Address

Indiqube Ashford Park View, First Floor, Municipal No.9, 80 Feet Rd,

Industrial Layout, Koramangala 3rd block, Ward No 68, Bengaluru -

560034, Karnataka

Email id

swetha.s@sliceit.com

Contact Number

+91 80 4552 3323

B)- Level 3 – Payment Service Provider (PSP) for UPI

In accordance with National Payments Corporation of India (NPCI) guidelines, an end Customer

availing UPI services offered by the Company is provided with a five-step escalation matrix to raise

their grievance.

8

The Guidelines mandate the Company (a TPAP) to undertake the first step grievance redressal via

its app or call or Email. This initial grievance redressal is the responsibility of the TPAP which has

been covered across Level 1 (Customer Service Agent) and Level 2 (Customer Service

Manager/Head) of this policy.

Further as per the NPCI Guidelines, the Company has provided its customers with 2 additional

levels of grievance escalation.

If the complainant is not satisfied by the solution provided by Level 2 – Customer Service Manager

/ Head, they may escalate their grievance by appealing to the PSP Bank. As the Company has

collaborated with Axis Bank to provide UPI services to its customers, the Complainant may lodge a

complaint via any of the channels provided by Axis Bank on this link -

https://www.axisbank.com/contact-us/grievance-redressal/retail-banking-grievance-redressal .

As per the NPCI guidelines, the PSP must respond within T+1 days to the grievance registered by

the complainant.

• Level 4 – Issuing bank only for UPI

A Complainant who is not satisfied with the grievance redressal offered by the PSP may approach

the issuing bank i.e., the bank at which the complainants maintain their account connected to the

slice app. The concerned bank must respond to the query within T+1 days to the grievance

registered by the complainant.

• Level 5 – NPCI only for UPI

Further, if the Complainant is still not satisfied with the grievance addressal undertaken by Axis

Bank (PSP), they may approach the NPCI for escalating their grievance. The Complainant may

approach the NPCI via its website – https://www.npci.org.in/what-we-do/upi/dispute-redressal-

mechanism to register their grievance escalation.

4.3 The RBI Ombudsman

A Complainant may approach the RBI Ombudsman (under the Reserve Bank – Integrated

Ombudsman Scheme, 2021) after exhausting all grievance redressal measures offered by the

Company (as mentioned in section 4.2 above). The complainant can lodge their grievance on the

‘Complaint Management System’ (CMS) portal of the RBI.

Note:

i.

A Customer availing PPI services may approach the RBI Ombudsman if they remain

unsatisfied with the grievance redressal solution provided by the Company in Level 3 of the

escalation matrix.

9

ii.

In accordance with NPCI Guidelines, a Customer availing UPI services may approach the

RBI Ombudsman only in the order of escalation i.e., if they are not satisfied with the

grievance redressal solution provided by NPCI.

4.4 Customer Compensation and TAT for failed transactions

The Company has a defined Customer compensation and TAT process for failed transactions for its

PPI and UPI products. This process is in accordance with RBI’s “Harmonisation of Turn Around

Time (TAT) and Customer compensation for failed transactions using authorised Payment

Systems, 2019”. The following table details the said process:

(Note: Here, T refers to the day of transaction and refers to the calendar date; R refers to the day

on which the reversal is concluded.)

S.

No.

Product

Description

Timeline for

auto-reversal

Compensation

payable

1.

PPI (On-Us

transaction)

Beneficiary’s PPI

not credited.

Reversal affected in

Remitter’s account

within T+1 days.

INR 100/- per day if

delay is beyond T+1

dayy.

PPI debited but

transaction

confirmation not

received at

merchant location.

2

UPI

Account debited but

If unable to credit

INR 100/- per day if

the beneficiary

the beneficiary

delay is beyond T+1

account is not

account, auto

days.

credited (transfer of

Reversal (R) by the

funds)

beneficiary bank

latest on T+1 day.

Account debited but

Auto-reversal

INR 100/- per day if

transaction

within T+5 days.

delay is beyond T+5

confirmation not

days.

received at

merchant location

(payment

4.5 Reporting of Un-authorised PPI transactions and liability of the Customer

10

It is the Customer’s liability to report any unauthorised electronic payment transaction to the PPI

issuer (the Company). The Company has endeavoured to provide all its customers availing PPI

services a 24x7 facility to lodge complaints relating to unauthorized transactions.

A Customer may lodge a complaint against unauthorised transaction by visiting the Company’s

website ( https://www.sliceit.com/beware-of-fraud ) or its app and fill the required details.

Additionally, a Customer may lodge their complaint via the Company’s helpline number for

reporting fraud - +91 80483 29999 or email the grievance to [email protected]. The following table

represents a Customer’s liability basis the nature of unauthorised transaction and the time taken

by the customer to report such transactions since the longer they take to notify the Company, higher

will be the risk of loss to the Customer or the Company.

S.

No.

Particulars

Maximum Liability of

Customer

(a)

Contributory fraud / negligence / deficiency on the part

of the Company, including PPI-MTS issuer (irrespective

of whether or not the transaction is reported by the

customer)

Zero

(b)

Third party breach where the deficiency lies neither

with the Company nor with the Customer but lies

elsewhere in the system, and the Customer notifies the

Company regarding the unauthorised payment

transaction.

The per transaction Customer liability in such cases will

depend on the number of days lapsed between the

receipt of transaction communication by the customer

from the Company and the reporting of unauthorised

transaction by the Customer to the Company -

i. Within three days#

Zero

ii. Within four to seven days#

Transaction value or INR

10,000/- per transaction,

whichever is lower

iii. Beyond seven days#

The Company to decide on a

case-to-case basis.

(c)

In cases where the loss is due to negligence by a Customer, such as where they have shared

the payment credentials, the Customer will bear the entire loss until they report the

unauthorised transaction to the Company. Any loss occurring after the reporting of the

unauthorised transaction shall be borne by the Company.

(d)

The Company may also, at its discretion, decide to waive off any Customer liability in case

of unauthorised electronic payment transactions even in cases of Customer negligence.

# The number of days mentioned above shall be counted excluding the date of

receiving the communication from the PPI issuer.

11

Additionally, the Company will endeavour to facilitate notional credit of the transaction value or

INR 10,000, whichever is lower, into a shadow account within 10 days of the receipt of the

Customer’s grievance, irrespective of settlement of insurance claim, if any.

Further, as per the PPI Master Directions, the Company will resolve the grievance within 90 days

of receiving the grievance and establish the liability of the Customer, if any. If the Company is not

able to either resolve the grievance or establish any customer liability within 90 days of receiving

the grievance, then the Company will compensate the Customer as per the norms laid out in the

table above.

4.6 Customer awareness

In order to promote customer awareness and to educate the Customers on safe and secure use of

digital payments using PPI, the Company will:

• disseminate information on secure electronic payment practices through multi-lingual

campaigns via either of the channels such as website, mobile app, SMS, email etc. This

information will cover:

o customers' rights and obligations,

o emphasize the importance of not disclosing sensitive information such as User ID,

password, PIN, card number, CVV, OTP, etc.

o importance of not swapping SIM cards or opening links received in emails or

messages etc.

• communicate to its customers to keep updated their mobile number/ email id etc. registered

with the Company to receive SMS alerts for all their payment transactions conducted using

PPI. Subject to system capabilities, the Company may in future also use alternate channels

such as email or in-app notifications etc. to send transaction alerts.

• provide multiple channels for reporting unauthorized electronic payments transactions,

including SMS, email, website, mobile app, etc.

12

5. Maintenance of records

In accordance with applicable regulations, the Company shall save and retain any records relating

to complaints it has received, especially the following:

•

Mobile no. of the Complainant;

•

Nature of complaints received;

•

Status;

•

Resolution provided; and

•

Compensation awarded, if any.

6. Reporting

The Company will immediately notify the RBI of any breach of security or leakage of confidential

information pertaining to Customers. Further, the Company also on a quarterly basis will submit

the PPI Customer Grievance Report to the RBI as prescribed in Annexure 6 of the PPI Master

Directions.

The Company will endeavour to report any fraud, cyber-attack or suspicious transaction to NPCI

fraud risk team at frau[email protected] on a daily basis.

Further, the Board or any committee of the Board on a periodic basis be apprised on the

•

number of customer liability cases handled by the Company.

•

the aggregate value involved in such cases and

•

action taken on such cases.

7. Review of the policy

The Policy will be reviewed at least once a year, or sooner if there are any changes affecting the

Company's business operations or changes in the regulatory framework. Any such policy changes

will be approved by the Board and communicated to all relevant departments.