Currency and Exchanges

guidelines for individuals

2024-08-05

Currency and Exchanges guidelines for individuals Disclaimer

2 of 35 19/2021

Financial Surveillance Department

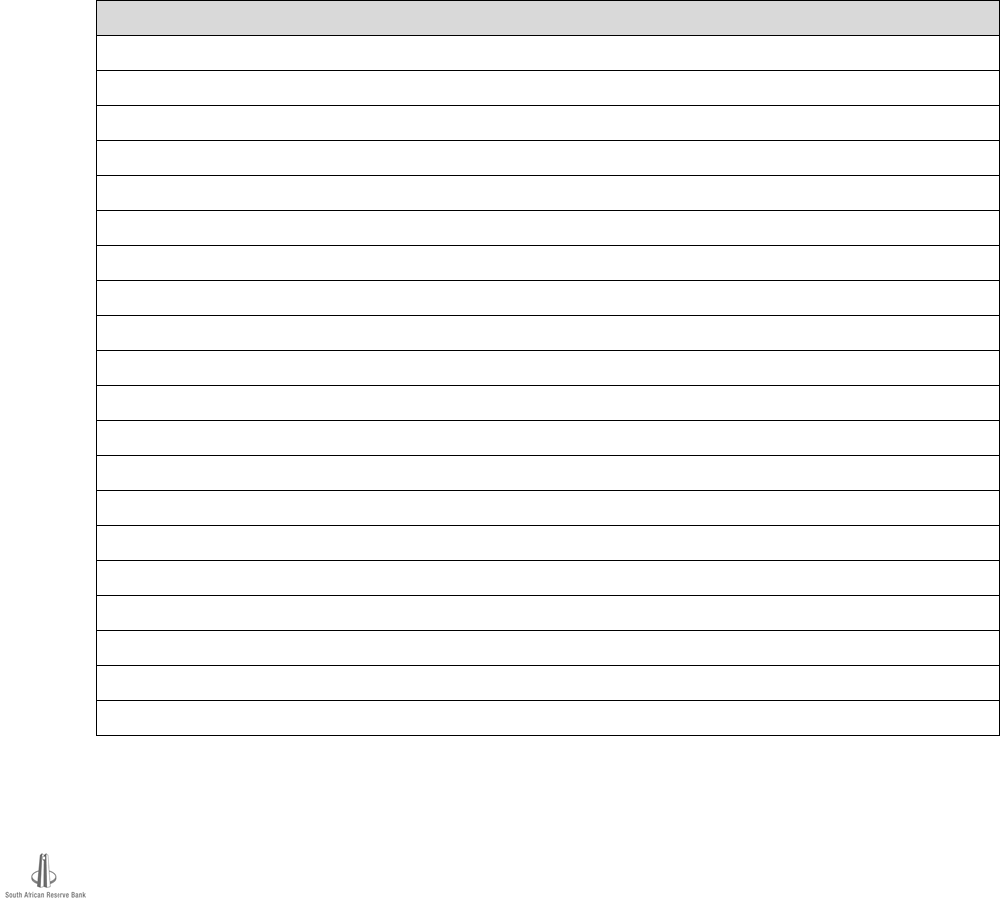

Version control sheet for the Currency and Exchanges guidelines for individuals

Version number

Issue date

Circular number

1.0

2016-07-29

7-2016

1.1

2016-11-03

9-2016

1.2

2017-01-03

2-2017

1.3

2017-03-01

7-2017

1.4

2017-08-25

10-2017

1.5

2017-08-30

11-2017

1.6

2017-11-17

13-2017

1.7

2018-02-02

2-2018

1.8

2018-05-07

8-2018

1.9

2018-05-28

10-2018

1.10

2018-06-22

11-2018

1.11

2018-08-02

12-2018

1.12

2018-09-03

14-2018

1.13

2018-10-11

15-2018

1.14

2018-10-31

16-2018

1.15

2019-02-08

2-2019

1.16

2019-02-08

3-2019

1.17

2019-03-05

4-2019

1.18

2019-03-05

5-2019

1.19

2019-04-18

7-2019 and 9-2019

1.20

2019-07-02

13-2019

1.21

2019-07-18

15-2019

1.22

2019-11-12

23-2019 and 24-2019

1.23

2020-06-10

4-2020

1.24

2020-07-10

5-2020

1.25

2020-08-13

6-2020

1.26

2020-10-02

11-2020

1.27

2020-10-08

12-2020

1.28

2020-10-14

13-2020

1.29

2020-12-14

19-2020

1.30

2021-01-04

1-2021

1.31

2021-01-29

2-2021

1.32

2021-02-19

4-2021

1.33

2021-02-26

6-2021

1.34

2021-05-21

8-2021, 9-2021, 10-2021

1.35

2021-05-21

11-2021

1.36

2021-05-25

12-2021

1.37

2021-06-15

13-2021, 14-2021, 15-2021

1.38

2021-06-29

16-2021

1.39

2021-07-08

17-2021

1.40

2021-07-30

18-2021

1.41

2021-08-20

19-2021

Currency and Exchanges guidelines for individuals Disclaimer

3 of 35 9/2024

Version number

Issue date

Circular number

1.42

2021-10-20

20-2021

1.43

2021-02-22

1-2022

1.44

2022-04-05

14-2022

1.45

2022-04-08

15-2022

1.46

2022-04-25

16-2022

1.47

2022-09-28

22-2022

1.48

2022-11-02

23-2022

1.49

2023-02-03

1-2023

1.50

2023-04-04

2-2023

1.51

2023-05-24

3-2023, 5-2023, 6-2023

1.52

2023-10-13

7-2023, 8-2023

1.53

2024-01-26

1-2024

1.54

2024-04-19

3-2024

1.55

2024-04-24

4-2024

1.56

2024-05-07

5-2024

1.57

2024-05-07

6-2024

1.58

2024-06-20

7-2024

1.59

2024-07-12

8-2024

1.60

2024-08-05

9-2024

Currency and Exchanges guidelines for individuals Disclaimer

4 of 35 20/2021

Disclaimer

The Currency and Exchanges guidelines for individuals (guidelines) are issued to

assist individuals and other interested parties by providing a general understanding of

the exchange control system in the Republic of South Africa. It does not have any

statutory force nor does it replace or supersede the Exchange Control Regulations

(Regulations) promulgated in terms of section 9 of the Currency and Exchanges Act,

1933 (Act No. 9 of 1933) or any permission, exemption or condition granted or attached

to certain transactions in terms of the Regulations.

The arrangements set out in the guidelines should in no manner be construed as

absolving individuals from their duties and obligations under any other law, including

but not limited to the Prevention of Organised Crime Act, 1998 (Act No. 121 of 1998),

the Financial Intelligence Centre Act, 2001 (Act No. 38 of 2001) and the Protection of

Constitutional Democracy against Terrorist and Related Activities Act, 2004

(Act No. 33 of 2004).

The Financial Surveillance Department of the South African Reserve Bank (Financial

Surveillance Department) views contraventions of the Exchange Control Regulations,

as well as any actions to circumvent the permissions and conditions contained in the

Currency and Exchanges Manual for Authorised Dealers in foreign exchange

(Authorised Dealer Manual) and the Currency and Exchanges Manual for Authorised

Dealers in foreign exchange with limited authority (ADLA Manual) in a serious light.

The Exchange Control Regulations, Orders and Rules, Authorised Dealer Manual and

the ADLA Manual are available on the South African Reserve Bank website:

www.resbank.co.za.

---oOo---

Currency and Exchanges guidelines for individuals Table of contents

5 of 35 6/2023

Table of contents

Disclaimer ....................................................................................................................................... 4

Definitions ....................................................................................................................................... 6

1. Introduction ..................................................................................................................... 10

2. Authorised entities ........................................................................................................... 10

2.1 Authorised Dealers .......................................................................................................... 10

2.2 Authorised Dealer in foreign exchange with limited authority ........................................... 11

3. South African resident individuals ................................................................................... 12

3.1 Single discretionary allowance ........................................................................................ 13

3.2 Krugerrand coins ............................................................................................................. 13

3.3 Travel allowance ............................................................................................................. 13

3.4 Study allowances ............................................................................................................ 14

3.5 Residents temporarily abroad.......................................................................................... 15

3.6 Foreign capital allowance ................................................................................................ 16

3.7 Foreign currency holdings and other foreign assets held by resident individuals ............. 17

3.8 Intellectual property ......................................................................................................... 19

3.9 Import payments ............................................................................................................. 20

3.9.1 Import payments via credit and/or debit cards ................................................................. 20

3.9.2 Import payments via an Authorised Dealer in foreign exchange ...................................... 20

3.9.3 Philatelic imports and numismatic imports ....................................................................... 21

3.10 Miscellaneous commercial payments and receipts .......................................................... 21

3.11 Securities control............................................................................................................. 22

3.12 Legacies and distributions ............................................................................................... 22

3.12.1 Legacies and distributions from resident estates ............................................................. 22

3.12.2 Gifts and/or donations from non-residents ....................................................................... 23

3.12.3 Foreign inheritance and legacies from bona fide non-resident estate .............................. 23

3.12.4 Foreign inheritance and legacies from South African estates with foreign assets ............ 23

3.13 Export of goods ............................................................................................................... 24

3.14 Residents borrowing abroad ........................................................................................... 25

4. Private individuals who cease to be residents for tax purposes in South Africa ............... 27

5. Foreign nationals............................................................................................................. 29

6. Immigrants ...................................................................................................................... 31

7. The cross-border foreign exchange transaction reporting requirements .......................... 32

7.1 Integrated form ................................................................................................................ 33

8. Transactions with Common Monetary Area residents ..................................................... 34

8.1 Introduction ..................................................................................................................... 34

8.2 General ........................................................................................................................... 34

8.3 Travel .............................................................................................................................. 34

8.4 Export of motor vehicles .................................................................................................. 34

---oOo---

Currency and Exchanges guidelines for individuals Definitions

6 of 35 20/2021

Definitions

In the Currency and Exchanges guidelines for individuals, unless the context indicates

otherwise:

ADLA means an Authorised Dealer in foreign exchange with limited authority, including

Bureaux de Change, independent money transfer operators and value transfer service

providers, who are authorised by the Financial Surveillance Department to deal in foreign

exchange transactions as determined by the Financial Surveillance Department.

ADLA Manual means the Currency and Exchanges Manual for ADLAs issued by the

Financial Surveillance Department to ADLAs under the powers delegated by the Minister of

Finance. The ADLA Manual contains the permissions, conditions and limits applicable to

the transactions in foreign exchange that may be undertaken by ADLAs and/or on behalf of

their clients, as well as details of related administrative responsibilities.

Authorised Dealer means, in relation to any transaction in respect of gold, a person

authorised by the Treasury to deal in gold and, in relation to any transaction in respect of

foreign exchange, a person authorised by the Treasury to deal in foreign exchange.

Authorised Dealer Manual means the Currency and Exchanges Manual for Authorised

Dealers issued by the Financial Surveillance Department to Authorised Dealers under the

powers delegated by the Minister of Finance. The Authorised Dealer Manual contains the

permissions, conditions and limits applicable to the transactions in foreign exchange that

may be undertaken by Authorised Dealers and/or on behalf of their clients, as well as details

of related administrative responsibilities.

CMA means the Common Monetary Area, which consists of Lesotho, Namibia, South Africa

and eSwatini.

Cross-border foreign exchange transaction means the purchase or sale of foreign

exchange with or for Rand.

Customs means Customs and Excise, a division of the South African Revenue Service.

Financial assistance includes the lending of currency, the granting of credit, the taking up

of securities, the conclusion of a hire purchase or a lease, the financing of sales or stocks,

discounting, factoring, the guaranteeing of acceptance credits, the guaranteeing or

acceptance of any obligation, a suretyship, a buy-back and a leaseback, but excluding:

(i) the granting of credit by a seller in respect of any commercial transaction directly

involving the passing of ownership of the goods sold from seller to purchaser; and

(ii) the granting of credit solely in respect of the payment for services rendered.

Financial Surveillance Department means the Financial Surveillance Department of the

South African Reserve Bank (responsible for the administration of exchange control on

behalf of the Treasury).

Foreign bank account means a f oreign c urrency b a nk account conducted by

residents with a bank outside the CMA in terms of the provisions of the Authorised Dealer

Currency and Exchanges guidelines for individuals Definitions

7 of 35 20/2021

Manual or a specific authority granted by the Financial Surveillance Department.

Foreign currency means any currency other than currency that is legal tender in South

Africa, but excludes the currencies of Lesotho, Namibia and eSwatini. Foreign currency is

deemed to include any bill of exchange, letter of credit, money order, postal order,

promissory note, travellers’ cheque or any other instrument of foreign exchange.

Foreign currency account means an account conducted by residents (natural persons

and institutional investors only) and non-residents in the nostro-administration of

Authorised Dealers in terms of the provisions of the Authorised Dealer Manual or a specific

authority granted by the Financial Surveillance Department.

Foreign direct investment means the objective of obtaining a lasting interest by a resident

entity in one economy (direct investor) in an entity resident in an economy other than that of

the investor (direct investment enterprise). The lasting interest implies the existence of a long-

term relationship between the direct investor and the direct investment enterprise, and a

significant degree of influence on the management of the enterprise. A direct investment

enterprise is defined as ‘an incorporated or unincorporated enterprise in which a foreign

investor owns 10 per cent or more of the ordinary shares or voting power of an incorporated

enterprise or the equivalent of an unincorporated enterprise’.

Foreign nationals mean natural persons from countries outside the CMA who are

temporarily resident in South Africa, excluding those on holiday or business visits.

Gold as referred to in Regulations 2 and 5 includes all forms of gold other than wrought

gold, as well as ingots, amalgam, concentrates or salts of gold buttons and trade scrap.

Gold as referred to in Regulation 3 includes wrought gold and gold coins.

Immigrants mean natural persons who immigrated from countries outside the CMA with

the firm intention of taking up or who have taken up permanent residence in South Africa.

Integrated form means the electronic or paper format of a contract between an Authorised

Dealer or ADLA and its client resulting in a balance-of-payments reporting obligation. It

includes a declaration to the effect that the information provided is true and correct.

ITAC means International Trade Administration Commission of South Africa established in

terms of section 7 of the International Trade Administration Act, 2002 (Act No. 71 of 2002).

MRN means the Movement Reference Number issued by Customs once goods have been

cleared.

Non-resident means a person (i.e. a natural person or legal entity) whose normal place of

residence, domicile or registration is outside the CMA.

Non-resident Rand means Rand to or from a non-resident account that may be deemed, in

certain circumstances permissible elsewhere in the Authorised Dealer Manual, as an

acceptable payment mechanism in lieu of foreign currency. It should be noted that non-

resident Rand cannot in any manner be defined as foreign currency. It is purely Rand held

in a non-resident account or Rand received from a non-resident source.

Non-resident Rand account means the Rand account of a non-resident conducted in the

Currency and Exchanges Guidelines for Individuals

8 of 35 20/2021

books of an Authorised Dealer.

Passenger ticket means a ticket issued in respect of travel arrangements, inclusive of

electronically issued tickets (e-tickets).

Rand means the monetary unit of South Africa as defined in section 15 of the South African

Reserve Bank Act, 1989 (Act No. 90 of 1989).

Regulations mean the Exchange Control Regulations, 1961 as promulgated by

Government Notice R.1111 of 1961-12-01, as amended from time to time.

Related party means a party to a transaction that has a direct or indirect interest in the other

party and has the ability to control the other party or exercise significant influence over the

other party in making financial and operating decisions or both parties are under common

control. For the purpose of the Authorised Dealer Manual, this includes transactions between

parties that belong to the same group of companies such as parent, subsidiary, fellow

subsidiary and/or an associate company.

Reporting System means the electronic FinSurv Reporting System used to transmit data

to the Financial Surveillance Department in an agreed format.

Resident means any person (i.e. a natural person or legal entity) who has taken up

permanent residence, is domiciled or is registered in South Africa.

Resident temporarily abroad means any resident who has departed from South Africa to

any country outside the CMA with no intention of taking up permanent residence in another

country, but excluding those residents who are abroad on holiday or business travel.

Restricted Authorised Dealer means a person authorised by the Financial Surveillance

Department to deal in foreign exchange utilising a locally issued credit card for permissible

cross border transactions.

SADC means the Southern African Development Community consisting of Angola,

Botswana, Democratic Republic of the Congo, Lesotho, Madagascar, Malawi, Mauritius,

Mocambique, Namibia, Seychelles, South Africa, eSwatini, United Republic of Tanzania,

Zambia and Zimbabwe.

SARS means the South African Revenue Service.

SARS Customs Declaration comprises the following set of documents:

(a) SARS Customs Declaration form, which is the form used by Customs to verify

importers or exporters’ self-assessment of goods declared for a Customs procedure.

The customs procedure is defined by the Procedure Category Code (A to L) in

conjunction with the Customs Requested Procedure Code (RPC) on the declaration;

and

(b) SARS Customs Supporting documentation, which is the commercial documents

(e.g. suppliers invoice, regulatory permit, transport document, currency

Currency and Exchanges guidelines for individuals Definitions

9 of 35 20/2021

conversion/duty calculation worksheet) upon which the SARS Customs Declaration

Form is completed; and

(c) SARS Customs Status Notification, which is the response issued by Customs

(Electronic Data Interchange (EDI) Response Notification/Customs Release

Notification) specifying the status or decision of Customs in respect of goods

declared.

Single discretionary allowance means the R1 million allowance available to residents

(natural persons) 18 years and older per calendar year.

Securities include quoted stocks, shares, warrants, debentures and rights, as well as

unquoted shares in public companies, shares in private companies, Government, Municipal

and Public utility stocks, non-resident owned mortgage bonds and/or participations in

mortgage bonds and short-term debt instruments. The terms scrip and share certificates

include any temporary or substitute documents of title such as Letters of Allocation,

Warrants, Letters of Allotments, Orphan Certificates, Balance Receipts and any other

receipts for scrip.

South Africa means the Republic of South Africa.

Treasury means, in relation to any matter contemplated in the Regulations, the Minister of

Finance or an officer in National Treasury who, by virtue of the division of work in National

Treasury, deals with the matter on the authority of the Minister of Finance.

---oOo---

Currency and Exchanges guidelines for individuals Definitions

10 of 35 7/2024

1. Introduction

This document provides an overview of permissible foreign exchange related

transactions and the applicable requirements for individuals including private

individuals who have ceased to be residents for tax purposes in South Africa,

immigrants, foreign nationals and CMA residents when transacting with Authorised

Dealers or with ADLAs within the parameters of their respective appointment letters.

Enquiries must be directed to an Authorised Dealer or, where applicable, an ADLA.

Any request to the Financial Surveillance Department must be channelled through

an Authorised Dealer or ADLA. Full details applicable to the request must be provided

to the Authorised Dealer or ADLA who will place a comprehensive request before the

Financial Surveillance Department.

2. Authorised entities

2.1 Authorised Dealers

The offices in South Africa of the under mentioned banks are authorised to act, for

the purposes of the Exchange Control Regulations, as Authorised Dealers:

Name of entity - Authorised Dealer

ABSA Bank Limited

Access Bank (South Africa) Limited

Albaraka Bank Limited

Bank of China Johannesburg Branch

Bank of Communications Co. Limited Johannesburg Branch

Bank of Taiwan South Africa Branch

Bidvest Bank Limited

Capitec Bank Limited

China Construction Bank, Johannesburg Branch

Citibank, N.A., South Africa

Deutsche Bank AG, Johannesburg Branch

Discovery Bank Limited

FirstRand Bank Limited

Goldman Sachs International Bank, Johannesburg Branch

Habib Overseas Bank Limited

HBZ Bank Limited

HSBC Bank plc - Johannesburg Branch

Investec Bank Limited

JPMorgan Chase Bank (Johannesburg Branch)

Nedbank Limited

Currency and Exchanges guidelines for individuals Definitions

11 of 35 8/2024

Sasfin Bank Limited

Standard Chartered Bank – Johannesburg Branch

State Bank of India

The Standard Bank of South Africa Limited

Restricted Authorised Dealer

The office in South Africa of the under-mentioned bank is authorised to act, for the

purposes of the Regulations, as a Restricted Authorised Dealer in respect of

permissible credit card transactions per the quoted sections of the Currency and

Exchanges Manual for Authorised Dealers:

Name of entity – Restricted Authorised Dealer

African Bank Limited – Sections B.4(B) and B.16

Bank Zero Mutual Bank – Sections B.4(B) and B.16

Grindrod Bank Limited – Sections B.4(B) and B.16

Tyme Bank Limited – Sections B.4(B) and B.16

2.2 Authorised Dealer in foreign exchange with limited authority

The offices in South Africa of the entities listed hereunder are authorised to

act, for the purposes of the Regulations, as ADLAs. The ADLAs, dependent on their

category of appointment, are only authorised to conclude travel related transactions

and certain specified transactions under the single discretionary allowance:

Name of entity – ADLA

Category of

appointment

Border Forex (Pty) Limited

Two

Forex World (Pty) Limited

Two

Global Foreign Exchange (Pty) Limited

Two

Home Remitt (Pty) Limited

Two

Imali Express (Pty) Limited

Two

Inter Africa Bureau de Change (Pty) Limited

Two

Interchange RSA (Pty) Limited

Two

Master Currency (Pty) Limited

Two

Mukuru Africa (Pty) Limited

Two

NEC Money (Pty) Limited

Two

Sikhona Forex (Pty) Limited trading as Ria Money

Transfer

Two

Tourvest Financial Services (Pty) Limited trading as

Travelex

Two

Travel Forex (Pty) Limited trading as Travelex

Two

Access Forex (Pty) Limited

Three (MTO)

Currency and Exchanges Guidelines for Individuals

12 of 35 9/2024

Name of entity – ADLA

Category of

appointment

Clicksendnow (Pty) Limited

Three (MTO)

eZi Remit (Pty) Limited

Three (MTO)

Kawena Exchange (Pty) Limited

Three (VTSP)

Sasai Fintech (Pty) Limited

Three (MTO)

SendHome (Pty) Limited

Three (MTO)

Shop2Shop Money Transfer (Pty) Limited

Three (MTO)

Shoprite Money Transfers (Pty) Limited trading as

ShopriteSend

Three (MTO)

Teeenaar (Pty) Limited

Three (MTO)

Terra Payment Services South Africa (RF) (Pty) Limited

Three (MTO)

Tookiyo Trading (Pty) Limited

Three (MTO)

WorldRemit South Africa (Pty) Limited

Three (MTO)

Hello Paisa (Pty) Limited

Four

Mama Money (Pty) Limited

Four

Southeast Exchange Company (South Africa) (Pty)

Limited

Four

Category One : Travel related transactions only.

Category Two : Travel related transactions and certain prescribed single

discretionary allowance of R1 million per applicant within the

calendar year and offer money remittance services in

partnership with external money transfer operators.

Category Three: Independent money transfer operator or value transfer service

provider, facilitating transactions not exceeding R5 000 per

transaction per day within a limit of R25 000 per applicant per

calendar month.

Category Four : A combination of the services provided by Category Two and

Category Three ADLAs.

3. South African resident individuals

The foreign exchange restrictions on South African resident individuals have been

liberalised with the intention of reducing the administrative burden for individuals

undertaking foreign exchange transactions.

Individuals are permitted to conduct a foreign currency account with an Authorised

Dealer and/or a foreign bank account for the following purposes:

(a) for travel as authorised (see section 3.3 (h));

(b) foreign investment (see sections 3.1 and 3.6);

(c) legitimate foreign earned income (see section 3.6.4); and

Currency and Exchanges guidelines for individuals Definitions

13 of 35 8/2024

(d) foreign inheritance (see section 3.10).

The following dispensations listed hereunder are available to individuals:

3.1 Single discretionary allowance

3.1.1 A single discretionary allowance within a limit of R1 million per calendar year is

available to all South African residents who are 18 years and older, and in possession

of a valid green bar-coded South African identity document or smart identity

document card. This dispensation may be used for any legitimate purpose (including

for investment purposes abroad as well as the sending of gift parcels in lieu of cash

excluding gold and jewellery) at the discretion of the individual without any

documentary evidence having to be produced to the Authorised Dealer, except for

travel purposes outside the CMA, where certain prescribed documentation has to be

produced.

3.1.2 Foreign currency in the form of foreign notes may only be accorded by an Authorised

Dealer or ADLA for travel purposes.

3.1.3 Resident importers making import payments under this dispensation must have a

valid customs client number (CCN) issued by Customs. The registration code number

70707070 may be used only in cases where the value of goods imported is less than

R50 000 per consignment, subject to the limitation of three such consignments per

calendar year. The attention of importers is drawn to the requirement that the

consignment for which payment has been made from South Africa must be received

within four months from the date of payment. Should such consignment not be

received within the four month period, the importer must within 14 days of the expiry

of such period advise the Authorised Dealer through whom foreign currency was

purchased.

3.1.4 Individuals should note that when effecting payments for current account transactions

such payments may be made against the presentation to an Authorised Dealer of

documentary evidence in terms of subsection 3.7, while any other legitimate payment

may also be effected in terms of subsection 3.8 below. Such payments will not be

deducted from an individual’s single discretionary allowance limit of R1 million per

calendar year.

3.2 Krugerrand coins

In addition to the single discretionary allowance, residents may export Krugerrand

coins or the equivalent in fractional Krugerrand coins up to an amount of R30 000 as

gifts to non-residents, subject to the completion of the prescribed SARS Customs

Declaration.

3.3 Travel allowance

3.3.1 Individuals may also use the single discretionary allowance to avail of a travel

allowance through an Authorised Dealer or ADLA subject to the following conditions:

Currency and Exchanges guidelines for individuals Definitions

14 of 35 1/2022

(a) individuals, who are under the age of 18 years may not avail of a single

discretionary allowance as outlined in subsection 3.1 above, but may avail of

a travel allowance not exceeding an amount of R200 000 per calendar year;

(b) individuals may not avail of a travel allowance more than 60 days prior to their

departure and must present a valid passenger ticket when travelling by air,

bus, rail or ship;

(c) foreign currency may be availed of in foreign currency notes or traveller’s

cheques. The travel allowance may be transferred abroad to the traveller’s

own bank account and/or spouse accounts, but not to the account of a third

party. Minors travelling with parents, may have their travel allowances

transferred to their parents’ bank account abroad;

(d) bank credit and/or debit cards may also be used to avail up to 100 per cent of

the authorised prescribed or remaining allowance;

(e) in the event of any contravention of the provisions of the Regulations a

cardholder may be deprived of the use of all cards apart from being liable to

prosecution;

(f) any unused foreign currency must be resold within 30 days to an Authorised

Dealer or ADLA upon return to South Africa. However, business travellers

going abroad on recurring business trips, where the next business trip is to

commence within 90 days after returning from a previous business trip, any

unutilised foreign currency may be retained by the traveller for use during

subsequent business trips;

(g) up to R25 000 in Rand notes, per person, may be taken in addition to the travel

allowance, when proceeding on visits outside the CMA, to meet the travellers’

immediate needs on return to South Africa;

(h) a travel allowance may only be accorded by an Authorised Dealer or ADLA to

a travellers abroad, without returning to South Africa, provided that the annual

limit is not exceeded; and

(i) foreign currency may be purchased by foreign diplomats, accredited foreign

diplomatic staff as well as students with a valid student identity card from other

CMA member countries whilst in South Africa. CMA residents, in South Africa,

may be accorded foreign currency to cover unforeseen incidental costs whilst

in transit, subject to an Authorised Dealer or ADLA viewing a passenger ticket

confirming a destination outside the CMA.

3.4 Study allowances

3.4.1 Individuals proceeding abroad for study purposes may avail of the R1 million single

discretionary allowance. Spouses accompanying students also qualify for the

aforementioned facility.

Students may also export any household and personal effects, including jewellery

(but excluding motor vehicles), up to a value of R200 000 per student under cover of

Currency and Exchanges guidelines for individuals

15 of 35 1/2022

the prescribed SARS Customs Declaration.

In addition to the foregoing, Authorised Dealers may transfer directly to the institution

concerned the relative tuition and academic fees for the academic year, against

documentary evidence confirming the amount involved.

Students under the age of 18 years also qualify for a study allowance to pay for costs

associated with their studies abroad as well as a travel allowance of R200 000 per

calendar year.

To avail of this dispensation, residents must produce to an Authorised Dealer:

(a) documentary evidence from the institutions concerned confirming that the

student has been enrolled for a course for the period claimed; and

(b) evidence of the tuition and academic fees in the form of a letter or prospectus

from the institution to be attended.

3.4.2 Should a student require a continuation of the above-mentioned transfers during a

period following the initial 12 months, fresh documentary evidence complying with

the requirements of 3.4.1 (a) and (b) above must be submitted to an Authorised

Dealer.

3.5 Residents temporarily abroad

3.5.1 A resident proceeding abroad temporarily, may on departure and annually

thereafter, through an Authorised Dealer and/or ADLA, avail of the R1 million single

discretionary allowance and the R10 million foreign capital allowance without

returning to South Africa (see subsection 3.6 below). The green barcoded identity

document or Smart identity document card must be presented to an Authorised

Dealer prior to the resident travelling temporarily abroad. In addition, with regard to

the R10 million foreign capital allowance, a TCS PIN verifying the taxpayer’s tax

compliance status obtained via SARS eFiling must be presented to an Authorised

Dealer prior to effecting any transfers. Authorised Dealers must ensure that the

amount to be transferred does not exceed the amount approved by SARS.

Authorised Dealers should note that the TCS PIN can expire and should the

Authorised Dealers find that the TCS PIN has indeed expired, then the Authorised

Dealer must insist on a new TCS PIN verifying the taxpayer’s tax compliance status.

Where residents temporarily abroad make use of a general or special power of

attorney to facilitate future transfers, a certified copy of the valid green barcoded

identity document or Smart ID card must accompany the power of attorney.

The annual limit of the R1 million single discretionary allowance and the R10 million

foreign capital allowance dispensations may not be exceeded without prior Financial

Surveillance Department approval.

Residents temporarily abroad may use their local debit and/or credit cards whilst

temporarily abroad within the overall single discretionary allowance limit of R1 million

per applicant during a calendar year.

Currency and Exchanges guidelines for individuals

16 of 35 6/2023

3.5.2 Residents temporarily abroad may further receive pension and retirement annuity

income but no other foreign currency may be availed of without the specific approval

of the Financial Surveillance Department.

3.5.3 Any household and personal effects, motor vehicles, caravans, trailers,

motorcycles, stamps and coins (excluding coins that are legal tender in South Africa)

per family unit or single person, where the insurance value does not exceed

R1 million may be exported against the prescribed SARS Customs Declaration.

3.5.4 Farming implements, where the insurance value does not exceed R1 million, may

be exported, against the prescribed SARS Customs Declaration, by persons

proceeding into Africa for farming purposes.

3.6 Foreign capital allowance

3.6.1 A foreign capital allowance may be availed of through an Authorised Dealer, which

may be transferred to a foreign currency account with a local Authorised Dealer or

invested abroad, within a limit of R10 million per calendar year per individual, subject

to a TCS PIN verifying the taxpayer’s tax compliance status and green bar-coded

South African identity document or Smart identity document card and is 18 years

and older.

3.6.2 The funds to be transferred must be converted to foreign currency by an Authorised

Dealer.

3.6.3 The Financial Surveillance Department will consider applications by private

individuals via an Authorised Dealer to invest in different asset classes offshore in

addition to the abovementioned allowance. Private individuals wishing to avail of

this dispensation must first approach SARS to obtain a TCS PIN verifying their tax

compliance status report, which must accompany their application to the Financial

Surveillance Department for consideration.

3.6.4 Private individuals may, as part of their single discretionary allowance and/or foreign

capital allowance, export multi-listed domestic securities to a foreign securities

register in a jurisdiction where such securities are listed, subject to tax compliance

and reporting to the Financial Surveillance Department via a Central Securities

Depository Participant, in conjunction with an Authorised Dealer.

3.6.5 Private individuals may only fund online international trading accounts at registered

brokers in terms of the single discretionary and/or foreign capital allowance, i.e. the

Authorised Dealer concerned must convert the Rand into foreign currency and

transfer such funds via the banking system as an Electronic Funds Transfer to a

foreign bank account or the funds can be deposited in a foreign currency account at

an Authorised Dealer. No South African debit, credit and virtual card may, however,

be used to fund a foreign currency account at an Authorised Dealer or a bank

abroad, nor may international trading accounts of private individuals be funded using

South African credit, debit and virtual card transfers. Online international trading

accounts, inter alia include trading global currencies against each other, trading a

contract for difference, trading in foreign stocks, trading commodities including

crypto currencies and/or trading foreign indices using an online trading platform of

the broker concerned.

Currency and Exchanges guidelines for individuals

17 of 35 6/2023

3.7 Foreign currency holdings and other foreign assets held by resident

individuals

3.7.1 Foreign currency holdings

Individuals and foreign nationals who are holders of foreign currencies outside South

Africa must, unless exempted elsewhere in terms of the provisions of this document,

offer to sell their holdings to an Authorised Dealer within 30 days from the date of

becoming entitled thereto.

A serious view will be taken by the Financial Surveillance Department of any

unauthorised retention of foreign currency balances, whether with foreign banks,

overseas principals, agents or shippers.

3.7.2 Funding structure

Individuals may raise loans abroad to finance the acquisition of foreign assets without

recourse to South Africa. Only authorised foreign assets may be used as collateral

in this instance and under no circumstances may local guarantees or suretyships be

issued or may South African assets be encumbered.

Individuals are allowed to participate in offshore share incentive or share option

schemes, provided that such participation is financed under the R10 million foreign

capital allowance and/or the R1 million single discretionary allowance.

Individuals are allowed to take up new shares in foreign companies that have

accrued by way of rights on existing holdings of shares, provided that transfers in

payment thereof are dealt with in terms of the R10 million foreign capital allowance

and/or the R1 million single discretionary allowance.

3.7.3 Income earned abroad and foreign capital introduced

Income earned abroad on or after 1997-07-01 may be retained abroad. It should be

noted that income earned abroad and own foreign capital introduced (excluding

export proceeds, sale proceeds from the sale of South African assets and capital

repatriated on which the 5 per cent levy has been paid in terms of the Exchange

Control Amnesty and Amendment of Taxation Laws Act, 2003 (Act No. 12 of 2003)

into South Africa from the above-mentioned date by individuals resident in South

Africa, may be re-transferred abroad (excluding any growth on the funds introduced).

Documentary evidence confirming that the income and/or capital had previously been

converted to Rand must be furnished to the Authorised Dealer concerned and only

the Rand equivalent of any amount repatriated is eligible for re-transfer abroad.

In cases where income is earned abroad as a result of services rendered by

individuals normally resident in South Africa, such individuals should be physically

abroad whilst rendering these services, in order to qualify for the aforementioned

dispensation.

Currency and Exchanges guidelines for individuals

18 of 35 6/2023

3.7.4 Disposal of legal foreign assets

Individuals may with effect from 2022-02-23 dispose of their authorised foreign

assets to other individuals, subject to local tax disclosure and compliance by the

relevant parties.

It should be noted that where the authorised foreign asset is sold to a private

individual with recourse to South Africa, the transfers in payment thereof must be

dealt with in terms of the R10 million foreign capital allowance and/or the R1 million

single discretionary allowance.

Any sale of the authorised foreign assets to private individuals where payment will

take place locally in Rands resulting in no cross-border flow of funds other than

change of ownership, such transactions must be referred to the Financial

Surveillance Department and will also be subject to local tax disclosure as well as

compliance by the relevant parties.

Contraventions that occurred before 2022-02-23 must still be regularised with the

Financial Surveillance Department.

3.7.5 Donations of legal foreign assets

Individuals may with effect from 2022-02-23 donate authorised foreign assets to

other private individuals, subject to local tax disclosure and compliance by the

relevant parties.

The donations may also be retained abroad, subject to local tax disclosure and

compliance by the relevant private individuals.

Contraventions that occurred before 2022-02-23 must still be regularised with the

Financial Surveillance Department.

3.7.6 Lending of legal foreign assets

Individuals may with effect from 2022-02-23 lend authorised foreign assets to

residents, including trusts, subject to local tax disclosure and compliance by the

relevant parties.

Where the authorised foreign assets are lent to other residents for use abroad, such

transactions must take place without any recourse to South Africa. Any

arrangements to repay such foreign commitments from South Africa and/or for

repayments to take place locally in Rands, such transactions must be referred to the

Financial Surveillance Department.

Where the authorised foreign assets are lent to other residents for use locally, the

matter must be referred to an Authorised Dealer.

Contraventions that occurred before 2022-02-23 must still be regularised with the

Financial Surveillance Department.

Currency and Exchanges guidelines for individuals

19 of 35 6/2023

3.7.7 Reinvestment into South Africa (“loop structures”)

Resident individuals with authorised foreign assets may invest in South Africa,

provided that where South African assets are acquired through an offshore structure

(loop structure), the investment is reported to an Authorised Dealer as and when the

transaction(s) is finalised as well as the submission of an annual progress report to

the Financial Surveillance Department via an Authorised Dealer. The aforementioned

party also has to view an independent auditor’s written confirmation or suitable

documentary evidence verifying that such transaction(s) are concluded on an arm’s

length basis, for a fair and market related price.

Upon completion of the aforementioned transaction, the Authorised Dealer must

submit a report to the Financial Surveillance Department which should, inter alia,

include the name(s) of the South African affiliated foreign investor(s), a description

of the assets to be acquired (including inward foreign loans, the acquisition of shares

and the acquisition of property), the name of the South African target investment

company, if applicable and the date of the acquisition as well as the actual foreign

currency amount introduced including a transaction reference number.

Existing unauthorised loop structures (i.e. created by individuals prior to 2021-01-01)

and/or unauthorised loop structures where the 40 per cent shareholding threshold

was exceeded, must still be regularised with the Financial Surveillance Department.

3.8 Intellectual property

The transfer of South African owned intellectual property by way of sale, assignment

or cession and/or the waiver of rights in favour of non-residents in whatever form,

directly or indirectly, is not allowed without the prior written approval of the Financial

Surveillance Department.

South African residents may, however, sell, transfer and assign intellectual property

to unrelated non-resident parties at an arm’s length and a fair and market related

price, provided they present to Authorised Dealers the sale, transfer or assignment

agreement and an auditor’s letter or intellectual property valuation certificate

confirming the basis for calculating the sale price. The dispensation excludes sale

and lease back agreements.

All inward funds emanating from such transactions must be repatriated to South

Africa within a period of 30 days from the date of becoming entitled thereto.

South African residents may license intellectual property to non-resident parties at

an arm’s length and a fair and market related price for the term of the agreement,

provided that they present Authorised Dealers with the licence agreement and an

auditor’s letter confirming the basis for calculating the royalty or licence fee.

All royalties and/or fees emanating from such transactions must be repatriated to

South Africa within a period of 30 days from the date of becoming entitled thereto.

The sale, transfer, assignment and/or licensing of intellectual property is subject to

appropriate tax treatment.

Currency and Exchanges guidelines for individuals

20 of 35 11/2021

3.9 Import payments

Payments effected under this section require the presentation of documentation and

will not be deducted from the single discretionary allowance limit of R1 million per

calendar year.

3.9.1 Import payments via credit and/or debit cards

Individuals with locally issued credit and/or debit cards are permitted to make foreign

currency payments for small transactions (e.g. imports over the Internet) by means

of such credit and/or debit cards. Payments are limited to R50 000 per transaction.

Cardholders will, however, not be absolved from ad valorem excise and custom

duties or from complying with the requirements imposed by Customs.

Any singular transaction exceeding R50 000 may not be split to circumvent the limit

applicable to this dispensation.

3.9.2 Import payments via an Authorised Dealer in foreign exchange

Individuals may purchase foreign currency for payment of imports via an Authorised

Dealer.

Where an import permit is required, residents must ensure that a covering import

permit issued by ITAC is obtained.

All applications for the importation of gold must be referred to the South African

Diamond and Precious Metals Regulator in terms of the Precious Metals Act, 2005

(Act No. 37 of 2005).

Payments for imports must be made against the following documentation:

(a) commercial invoices issued by the supplier;

(b) any one of the transport documents as prescribed by the International

Chamber of Commerce Uniform Customs and Practice for Documentary

Credits (UCP 600) and its supplement for electronic presentation, the eUCP,

evidencing transport of the relative goods to South Africa; or

Foreign currency payments for imports into South Africa may be effected on

any shipment and/or delivery term where the freight is included in the cost of

the goods being imported.

(c) Freight Forwarders Certificate of Receipt or Freight Forwarders Certificate of

Transport; or

(d) consignee’s copy of the prescribed SARS Customs Declaration.

In lieu of the documents referred to in points (b) and (c) above, arrival notifications

issued by shipping companies may be tendered.

All documentation must be retained by the resident for a period of at least five years.

Currency and Exchanges guidelines for individuals

21 of 35 11/2021

Since Botswana is a member of the Custom Union, imports from Botswana may be

paid for against the commercial invoice issued by the supplier and the consignee’s

copy of the prescribed SARS Customs Declaration.

Where goods for which payment has been made from South Africa have not been or

will not be consigned to South Africa within four months of the date of payment, the

importer must within 14 days of the expiry of such period advise the Authorised

Dealer through whom foreign currency was purchased of this fact.

In cases where an importer fails to provide import documentation or to report the

non-receipt of goods within the above-mentioned four month period to the Authorised

Dealer concerned, such Authorised Dealer may cease providing foreign currency to

the importer until the matter has been satisfactorily resolved. Any non-compliance

will be reported to the Financial Surveillance Department who may issue an

instruction to all Authorised Dealers that no foreign currency may be provided to such

importer until the matter has been satisfactorily resolved.

Individuals who wish to hedge their import commitments must approach their

Authorised Dealer in this regard.

3.9.3 Philatelic imports and numismatic imports

Residents must approach their Authorised Dealers who may grant foreign currency

in payment of import for numismatic (excluding South African gold coins minted in

1962 and thereafter) and philatelic purposes. The Authorised Dealer will furnish

applicants with a letter of authority for submission to the appropriate government

department.

The government department concerned will endorse, on the face of the letter, the

value of each parcel received in South Africa during the relative period. When this

authority has been fully used or on the date of its expiry, the relative letter of

authority must be returned to the Authorised Dealer concerned before a new letter

in respect of any subsequent period is issued.

Matters relating to the importation of medals, medallions, pendants and other similar

non-currency articles must be referred to ITAC.

3.10 Miscellaneous commercial payments and receipts

3.10.1 Payments effected under this section require the presentation of documentation

and will not be deducted from the single discretionary allowance limit of R1 million

per calendar year.

3.10.2 Miscellaneous commercial payments inclusive of associated costs to non-residents

may be effected via an Authorised Dealer in respect of legitimate foreign obligations.

3.10.3 The following conditions are also applicable:

(a) foreign currency payments may also be made in advance against documentary

evidence, e.g. an invoice or agreement;

Currency and Exchanges guidelines for individuals

22 of 35 11/2021

(b) residents may approach their Authorised Dealer to issue guarantees on their

behalf in favour of non-residents with the exception of guarantees for capital

transactions and currency transfer guarantees, which need to be referred via

an Authorised Dealer to the Financial Surveillance Department. Authorised

Dealers may also, where applicable, approve the extension of the

aforementioned guarantees;

(c) residents may not participate in lotteries organised abroad, as such

participation contravenes the Lotteries Act, 1997 (Act No. 57 of 1997).

Furthermore, in terms of the National Gambling Act, 2004 (Act No. 7 of 2004),

as amended by the National Gambling Amendment Act, 2008 (Act No. 10 of

2008), residents may not participate in any gambling activities not authorised

in terms of the afore-mentioned Act;

(d) South African securities may be exported by residents for sale abroad only

through an Authorised Dealer and the sale proceeds must be repatriated to

South Africa;

(e) residents may only purchase securities abroad within the R10 million foreign

capital allowance, within the single discretionary allowance limit of R1 million

per calendar year, or through the use of exempted foreign assets. All other

applications for purchases of securities abroad must be referred by the

Authorised Dealer to the Financial Surveillance Department; and

(f) residents must sell to Authorised Dealers within 30 days all foreign bank notes

received from non-residents as payment for legitimate transactions, e.g.

services rendered, gratuities, tips or gifts.

3.11 Securities control

Residents may not act as a nominee for a non-resident purchasing shares or

securities in South Africa, unless permission has been obtained via an Authorised

Dealer from the Financial Surveillance Department.

Residents of the CMA who deal in securities may not register an address outside

the CMA without obtaining the specific prior written approval of the Financial

Surveillance Department, via an Authorised Dealer. The applications to the Financial

Surveillance Department must contain full and precise details of the request.

Residents may under no circumstances have local dividends on South African

registered shares paid outside the CMA without specific prior written approval from

the Financial Surveillance Department.

Individuals can invest without restriction in locally managed investment products that

have foreign exposures, such as collective investment schemes and long-term

insurance policies.

3.12 Legacies and distributions

3.12.1 Legacies and distributions from resident estates

Currency and Exchanges guidelines for individuals

23 of 35 6/2023

Cash bequests and the cash proceeds of legacies and distributions from resident

estates due to non-resident private individuals, non-resident entities and/or trusts

may be remitted abroad, provided that the Liquidation and Distribution Account

bearing a Master of the High Court reference number is available. In cases where

the total assets of the resident estate is less than R250 000, cash bequests and the

cash proceeds of legacies due to non-resident private individuals, non-resident

entities and/or trusts may be remitted abroad, provided that the Last Will and

Testament and Letter of Executorship or Authority are available.

In all cases where such an estate holds authorised foreign assets, distribution of

the foreign assets may be effected to non-residents, provided that all foreign

administrative and related costs have been met from the foreign portion of the

estate.

Other assets inherited by non-residents may be exported under cover of the

required SARS Customs Declaration provided that such articles are bequeathed to

the beneficiaries in terms of the deceased’s will or otherwise in terms of the

Liquidation and Distribution Account bearing a Master of the High Court reference

number.

Capital distributions from local testamentary trusts due to non-residents may be

remitted abroad, provided that the trustees resolution confirming the capital

distribution and the Last Will and Testament confirming that the beneficiary is

entitled to such capital distribution are available.

Distributions as a result of the renunciation of a beneficiary’s right to capital of a

testamentary trust must be referred via an Authorised Dealer to the Financial

Surveillance Department.

3.12.2 Gifts and/or donations from non-residents

Individuals may, with effect from 2022-02-23, receive and retain abroad monetary

and other legitimate gifts and donations received from a non-resident source without

having to declare it to an Authorised Dealer, subject to local tax disclosure and

compliance. These dispensations shall not apply retrospectively and any

contravention before 2022-02-23 must still be regularised with the Financial

Surveillance Department.

3.12.3 Foreign inheritance and legacies from bona fide non-resident estate

Individuals are not required to declare to their Authorised Dealer inheritances or

legacies from bona fide foreign estates that accrued after 1998-03-17 and may retain

the capital and any income generated thereon abroad.

3.12.4 Foreign inheritance and legacies from South African estates with foreign assets

Individuals may without reference to the Financial Surveillance Department retain

foreign assets inherited from a South African estate, subject to local tax disclosure

and compliance.

Currency and Exchanges guidelines for individuals

24 of 35 6/2023

Where it is disclosed to the Financial Surveillance Department that the foreign

assets inherited were held by the deceased in a manner contrary to the provisions

of the Regulations, an application for regularisation of such assets must be

submitted via an Authorised Dealer to the Financial Surveillance Department.

If approved, the retention of such assets abroad may be subject to the payment of a

levy.

Foreign assets inherited and which were held abroad by the resident beneficiary not

in compliance with the provisions of the Regulations, must apply for regularisation

via an Authorised Dealer to the Financial Surveillance Department.

3.13 Export of goods

3.13.1 Individuals exporting goods must comply with the following conditions:

(a) complete a SARS Customs Declaration;

(b) sell goods exported within a reasonable time, but no later than six months from

the date of shipment;

(c) receive the full foreign currency proceeds in South Africa not later than six

months from the date of shipment;

(d) receive payment in foreign currency or Rand from a Rand from a Non-resident

Rand account in the name of the non-resident and/or Rand from a vostro

account held in the books of the Authorised Dealer;

(e) offer for sale to an Authorised Dealer the full foreign currency proceeds within

30 days after becoming entitled thereto; and

(f) report in writing to an Authorised Dealer the non-receipt of the full foreign

currency proceeds, within the prescribed period, as well as the failure to sell

the goods exported within six months from the date of shipment.

3.13.2 All motor vehicles exported for sale abroad must have an export permit issued in

terms of the International Trade Administration Act, 2002 (Act No. 71 of 2002).

In respect of the temporary export of motor vehicles to all countries outside the CMA,

residents must complete the prescribed SARS Customs Declaration and such vehicle

must be returned to South Africa within a period of six months.

3.13.3 All temporary exports of items or goods such as personal effects and jewellery to

countries outside the CMA, for which no payment is to be received in South Africa,

must where required, be supported by the prescribed SARS Customs Declaration.

These goods or replacement items must be returned to South Africa within a period

of six months.

Should the insurance value of the above-mentioned goods taken by the traveller

exceed R200 000, the prior written approval of the Financial Surveillance Department

must be obtained.

Currency and Exchanges guidelines for individuals

25 of 35 11/2021

Requests to export any items or goods, with an insurance value in excess of R50 000,

for which no payment will be received and where the items exported will not be

returned to South Africa, must be referred to the Financial Surveillance Department.

3.13.4 Residents who wish to hedge their exchange rate or currency risk must approach

their Authorised Dealer in this regard.

3.14 Residents borrowing abroad

3.14.1 Resident individuals must approach their Authorised Dealer to obtain approval to

avail of inward foreign loans and foreign trade finance facilities from any non-resident

and such loans must be recorded via the Loan Reporting System by the Authorised

Dealer concerned.

3.14.2 All applications for inward foreign loans and foreign trade finance facilities must, inter

alia, contain the following information which must be furnished to the Authorised

Dealer:

(a) full names of the local borrower;

(b) identity number or temporary resident permit number or registration number of

the borrower;

(c) full names of the foreign lender;

(d) domicile of the foreign lender;

(e) relationship between the foreign lender and the borrower;

(f) denomination of the loan;

(g) currency and amount of principal sum;

(h) interest rate and margin;

(i) purpose of the loan;

(j) details of the type of security required, if any;

(k) tenor. In instances where a loan will be repaid at a fixed future date, the date

on which the loan will be repaid must be provided and, where a loan will be

repaid in instalments, the date of the first instalment should be provided as well

as the interval of the instalments, e.g. monthly/quarterly intervals;

(l) copy of the loan agreement, if available/applicable;

(m) full details of early repayment options, as well as currency switch options, if

any;

Currency and Exchanges guidelines for individuals

26 of 35 6/2023

(n) in the case of foreign trade finance facilities, written confirmation from the

borrower to the effect that the relative import or export transaction is not being

financed elsewhere; and

(o) detail of any commitment fees, raising fees and/or any other administration

fees payable by the borrower.

3.14.3 The following minimum requirements must be met for the loan to be approved by the

Authorised Dealer:

(a) the tenor of each loan must be at least one month;

(b) the interest rate in respect of third party foreign denominated loans may not

exceed the base lending rate plus 3 per cent or, in the case of shareholders’

loans, the base lending rate as determined by commercial banks in the country

of denomination;

(c) the interest rate in respect of Rand denominated loans may not exceed the

base rate, i.e. prime rate, plus 5 per cent on third party loans or the base rate,

in the case of shareholders' loans;

(d) the fixed interest rate linked to the base rate, if applicable, may not exceed the

interest rate mentioned in (b) or (c) above. In this regard, approved inward

foreign loans should always be adjusted accordingly in line with the set criteria;

(e) the loan funds to be introduced may not represent or be sourced from a South

African resident’s foreign capital allowance, foreign earnings retained abroad,

funds for which amnesty had been granted in terms of the Exchange Control

Amnesty and Amendment of Taxation Laws Act, 2003 (Act No. 12 of 2003),

funds regularised under the Exchange Control Voluntary Disclosure

Programme and/or foreign inheritances;

(f) the loan funds may not be invested in foreign sinking funds;

(g) no upfront payment of commitment fees, raising fees and/or any other

administration fees are payable by the borrower;

(h) the above-mentioned fees may be paid from South Africa once the loan funds

have been received and converted into Rand locally, provided that such fees

do not exceed 5 per cent of the principal sum; and

(i) early repayments may be effected offshore, provided that the relevant loans

are fully drawn down, reported correctly on the Loan Reporting System and

that there are no anomalies on the Loan Reporting System.

If the above-mentioned requirements cannot be met, a suitable application must be

submitted via an Authorised Dealer to the Financial Surveillance Department.

Currency and Exchanges guidelines for individuals

27 of 35 11/2021

4. Private individuals who cease to be residents for tax purposes in South Africa

4.1 The concept of emigration as recognised by the Financial Surveillance Department

has now been phased out with effect from 2021-03-01.

4.2 The distinction between South African resident assets and non-resident assets

remains extant.

4.3 Authorised Dealers may allow the transfer of assets abroad, provided a private

individual:

(a) has ceased to be a resident for tax purposes in South Africa;

(b) has obtained a TCS in respect of “emigration” from SARS; and

(c) is tax compliant upon verification of the TCS.

4.4 In addition to (4.3) above, private individuals may in the same calendar year that they

ceased to be residents transfer via an Authorised Dealer up to R1 million as a travel

allowance, without the requirement to obtain a TCS PIN letter. This is a once-off

dispensation and cannot be used in subsequent calendar years. Private individuals

ceasing to be residents for tax purposes only qualify for the aforementioned travel

allowance, and may not avail of any unutilised portion of the single discretionary

allowance available to residents.

4.5 In addition, household and personal effects up to an amount of R1 million per family

unit may be exported under a SARS Customs Declaration form within the same

calendar year that the individual ceases to be a resident for tax purposes provided

such assets have been declared on the relevant forms. Transactions of this nature

will be treated similar to cash. For amounts in excess of R1 million, the provisions of

(4.6) and (4.7) below will apply.

4.6 In addition to the transfers mentioned in (4.5) above, Authorised Dealers may allow

the transfer of up to a total amount of R10 million per calendar year per private

individual who ceases to be a resident for tax purposes in South Africa and is 18

years and older, provided that the individual is tax compliant and submits the

applicable TCS Application for verification.

4.7 South African non-tax residents who transfer more than R10 million offshore are

subject, initially to a more stringent verification process by SARS; as well as a

subsequent approval process from the Financial Surveillance Department. Such

transfers will trigger a risk management test that will, inter alia, include verification of

the tax status and the source of funds, as well as risk assess the private individual in

terms of the anti-money laundering and countering terror financing requirements, as

prescribed in the Financial Intelligence Centre Act, 2001 (Act No. 38 of 2001).

4.8 With regard to (4.7) above, it is imperative that the application to the Financial

Surveillance Department is accompanied by, inter alia, a TCS PIN letter that will

contain the tax number and TCS PIN to verify the taxpayer’s tax compliance status

and amount requested to be transferred.

Currency and Exchanges guidelines for individuals

28 of 35 6/2023

4.9 Any requests for further transfers of remaining assets will be subject to a TCS

application in respect of Foreign Investment Allowance (FIA) irrespective of the date

of emigration, i.e. prior or after 2021-03-01.

4.10 The externalisation of listed and unlisted domestic securities by individuals who

cease to be residents for tax purposes will be treated similar to cash, which will form

part of the foreign capital allowance and is also subject to the TCS process at SARS.

4.11 In respect of the withdrawal of retirement funds (lump sum benefits from pension

preservation, provident preservation and retirement annuity funds) when South

African residents cease to be residents for tax purposes in South Africa, payment of

lump sum benefits to such individuals shall only be allowed by Authorised Dealers if

the individual member has remained non-tax resident for at least three consecutive

years. The requirements stated in (4.6) and (4.7) above will apply.

4.12 All assets that were previously blocked as per a specific directive that was given by

the Financial Surveillance Department in terms of the provisions of Exchange Control

Regulation 4(2), may be dealt with as follows:

(a) In respect of income and capital distributions from inter vivos trusts, such

distributions may be transferred abroad, subject to the TCS process being

completed by the private individual and/or beneficiaries of the trust. For any

transfers above R10 million, the requirements of (4.7) above will apply.

(b) With regard to pre-inheritance gifts, such funds may be transferred abroad,

subject to the TCS process being completed by the resident donor. For any

transfers above R10 million, the requirements of (4.7) above will apply.

4.13 Applications by private individuals who cease to be residents for tax purposes and

who are no longer active on the SARS registered database and receive an

inheritance or life insurance policy (excluding lump sum benefits from pension

preservation, provident preservation, retirement annuity funds and annuities from

insurers) up to R10 million, will not be required to apply to SARS for a Manual Letter

of Compliance - Transfer of funds. For applications above R10 million, applicants are

required to obtain a Manual Letter of Compliance - Transfer of funds, from SARS.

4.14 On a once-off basis, the remaining cash balances not exceeding R100 000 in total

of private individuals who have ceased to be residents for tax purposes, may be

remitted offshore without reference to the SARS.

4.15 With regard to the gathering of statistical information on the assets and liabilities

declared by South African residents who cease to be residents for tax purposes, the

Financial Surveillance Department will rely on information collected by SARS via

the SARS TCR01 form.

4.16 In terms of the TCS system, a TCS PIN letter will be issued to the South African

residents who cease to be residents for tax purposes that will contain the tax

number. Authorised Dealers must use the TCS PIN to verify the applicant’s tax

compliance status via SARS eFiling prior to effecting any transfers. Authorised

Dealers must ensure that the amount to be transferred does not exceed the amount

approved by SARS. Authorised Dealers should note that the TCS PIN can expire

Currency and Exchanges guidelines for individuals

29 of 35 11/2021

and should the Authorised Dealers find that the TCS PIN has indeed expired, the

Authorised Dealers must request that the taxpayer must submit a new TCS

application to SARS to be issued with a TCS PIN.

4.17 Income due to private individuals who ceased to be residents for tax purposes in

South Africa may be transferred offshore, provided the Authorised Dealers ensure

that the amounts to be transferred are legitimately due to private individuals who

ceased to be residents for tax purposes in South Africa, ensure that suitable

arrangements are made to meet all local liabilities and verify a TCS of good

standing at least once a year to confirm that the private individual who ceased to be

resident for tax purposes in South Africa is tax compliant in respect of the transfer of

income referred below. With regard to (g) and (h) below, a TCS of good standing is

required at least once a year on applications up to R10 million and a tax compliance

status request – TCS FIA is required for above R10 million applications.

(a) interest and profit;

(b) dividends: Authorised Dealers may allow the transfer of dividends, profit

and/or income distributions from quoted companies, non-quoted companies

and other entities in proportion of percentage shareholding and/or ownership.

Authorised Dealers may not allow the transfer from South Africa of any

income earned outside South Africa, unless such funds represent the profits

of wholly-owned subsidiaries or of branches of South African registered

companies previously transferred to South Africa;

(c) income distributions from close corporations;

(d) directors’ fees or members’ fees;

(e) pension payments paid by registered funds only;

(f) cash bonuses on insurance policies;

(g) income received from a trust created in terms of a last will and testament;

(h) income received from an inter vivos trust;

(i) rentals on fixed property including rental pool agreements, provided that

rentals are substantiated by the production of a copy of the rental or rental

pool agreement;

(j) annuity payments;

(k) refunds paid by SARS, provided that Authorised Dealers are satisfied that the

beneficiaries are permanently resident outside the CMA; and

(l) salaries and/or fees payable in respect of services rendered.

5. Foreign nationals

5.1 On taking up temporary residence in South Africa, foreign nationals (except those

Currency and Exchanges guidelines for individuals

30 of 35 11/2021

who are purely in South Africa on a temporary visit) are required, on arrival, to declare

in writing to an Authorised Dealer:

(a) whether they are in possession of foreign assets and, if so, give an undertaking

to the effect that they will not place such foreign assets at the disposal of a third

party normally resident in South Africa; and

(b) that they have not applied for similar facilities through another Authorised

Dealer.

5.2 On receipt of such completed declarations and undertakings, foreign nationals may:

(a) conduct their banking on a resident basis;

(b) dispose of or otherwise invest their foreign assets, including foreign cash funds

held by them, subsequent accruals, as well as foreign income, without

interference from the Financial Surveillance Department;

(c) conduct Non-resident Rand accounts or foreign currency accounts in the books

of an Authorised Dealer; and

(aa) transfer abroad funds accumulated during their stay in South Africa

provided that the source from which they have acquired such funds can

be substantiated; and

(bb) the value of such funds is reasonable in relation to their income generating

activities in South Africa during the period.

(d) retransfer abroad capital which has been introduced into South Africa, provided

the individual can substantiate the original introduction of such funds.

(e) retransfer abroad household and personal effects, including motor vehicles,

provided that the items have been purchased with funds which would have been

transferable and/or the items have been imported into South Africa. The

individual must be able to substantiate the importation of any goods by

presenting documentary evidence to an Authorised Dealer. These effects may

be transferred abroad under cover of the required SARS Customs Declaration

5.3 The above provision excludes single transactions up to an amount of R3 000 per

transaction per day within a limit of R10 000 per applicant per calendar month. While

the personal banking of foreign nationals temporarily resident in South Africa may be

conducted on a resident basis, any interest held by such individuals in local entities

(i.e. legal persons) will be deemed as non-resident for the purposes of local financial

assistance.

5.4 On presentation of documentary evidence to an Authorised Dealer, foreign nationals