CCH

®

ProSystem

fx

®

FixedAssets

User Guide

April 2017

Copyright 2000-2017, CCH Incorporated and its affiliates and licensors. All rights reserved. Material in this publication

may not be reproduced or transmitted, in any form or by any means, without prior written permission. Requests for that

permission should be directed to:

CCH Incorporated

20101 Hamilton Ave.

Suite 200

Torrance, CA 90502

The contents of this publication are believed to be accurate. However, responsibility cannot be assumed for the

information contained herein, and the consequences resulting from the use thereof. Material in this publication is subject

to change without notice.

This User Manual and the computer software it describes are designed to provide accurate and authoritative information

in regard to the subject matter covered. They are distributed with the understanding that the publisher is not engaged in

rendering legal, accounting, or other professional services. If legal advice or other expert assistance is required, the

services of a competent professional should be sought.

"CCH ProSystem fx Fixed Assets" is a registered trademark of CCH INCORPORATED.

“Windows” is a registered trademark of Microsoft Corporation.

All other brand, product, or company names are trademarks or registered trademarks of their respective owners.

Contents • iii

Chapter 1 - Introduction

1

Welcome to CCH®ProSystemfx® Fixed Assets

1

Highlights of CCH ProSystemfx Fixed Assets

1

Additional Resources

3

About the CCH ProSystemfx Fixed Assets User Guide

3

Conventions

4

Keyboard Shortcut Keys

4

Dialog Box Keys

4

Editing Keys

5

Cursor Movement Keys

5

CCH ProSystemfx Fixed Assets Keys

6

Menu Commands

7

Toolbar Buttons

8

CCH ProSystemfx Fixed Assets Toolbar

8

Standard Toolbar

9

Customizing the Standard Toolbar

11

Adding, Removing, and Reordering Buttons

11

Standard Toolbar Display Options

12

Docking the Toolbars

12

Using the Status Bar

12

Using Help

12

CCH ProSystemfx Fixed Assets support on the Web

13

Chapter 2 - Installing CCH ProSystemfx Fixed Assets

14

System Requirements

14

Permission Key

14

Installing CCH ProSystemfx Fixed Assets

14

Workstation Setup

16

Uninstalling CCH ProSystemfx Fixed Assets

17

Setting Preferences

17

Setting Up a Printer

20

Overview of Global Settings

20

Creating Global Settings for Amortization Code Sections

21

Creating Global Settings for Assets

22

Contents

Contents • iv

Default Property Types

24

Creating Global Settings for Books

25

Creating Global Settings for Categories

26

Creating Global Settings for Columns

26

Creating Global Settings for Filters

27

Creating Global Settings for GL Accum Depr/Amort Accounts

30

Creating Global Settings for GL Asset Accounts

30

Creating Global Settings for GL Depr/Amort Exp Accounts

31

Creating Global Settings for Locations

32

Creating Global Settings for Reports

32

Creating Global Settings for Report Sets

33

Creating Global Settings for User Defined Fields

34

Editing Global Settings

35

Renaming Global Settings

35

Copying Global Settings from an Alternate Location

36

Switching Between Local and Network Global Settings

37

Password Protecting Global Settings

37

Editing the Global Settings Password

37

Disabling Password Protection

38

Configuring Global Setting Update Options

38

Chapter 3 - Managing Clients

39

Creating a New Client

39

Applying Global Settings to a File

43

Setting Up Books

44

Book Setup and Section 179/Bonus Setup Default Settings

45

Section 179/Bonus Setup Defaults

48

Setting up Section 179/Bonus Data

48

Editing a Client's Book Setup

50

Resetting Book Defaults

51

Copying Books

51

Section 179 Business Rule

52

Disaster Zone Clean up Business Rule

53

Cellulosic Biomass Ethanol Business Rule

53

Contents

Contents • v

Recycling Business Rule

53

Section 168k and Disaster Zone Special Allowance Depreciation

Differences Business Rule

53

Specifying File Locations for Export and Report Print Files

54

Password Protecting a Client's File

54

Saving the Client File

55

Opening a Client File

56

Printing the Client List

57

Printing a Client List to a Printer

57

Printing a Client List to a PDFor Text File

58

Editing Client Properties

58

Changing the Client Type

59

Editing Fiscal Year Dates

61

Editing a Year

61

Adding a Year

61

Deleting a Year

62

Closing a Fiscal Year

62

Locking/Unlocking Fiscal Year Calculations

63

Amending Assets in a Locked Fiscal Year

63

Reversing a Closed Year

64

Deleting a Client File

65

Overview of Client File Management

65

CCH ProSystemfx Fixed Assets Files

65

Setting Up File Management Default Settings

66

Backing Up Client Data Files

67

Restoring Backup Data Files

68

Overview of Checking Files In/Out

69

Network Installation

69

Remote Check In/Out

69

Locking Files

69

Checking Files out from the Network to a Local Folder

70

Checking Files in to a Network from a Local Folder

70

Remotely Checking Files out from a Network

71

Remotely Checking Files in to a Network

72

Contents

Contents • vi

Abandoning a Checked-Out File

72

Saving a Client File to CCH ProSystemfx Engagement

73

Chapter 4 - Managing Assets

75

Overview of the Asset Detail Tab

75

Customizing Asset Detail Fields

76

Editing the Asset ID Field

76

Customizing Tax Schedule Links

77

Changing an Asset's Tax Link

77

Adding a New Entity

78

Editing an Entity

79

Deleting an Entity

79

Configuring the Asset Detail Picklist

80

Adding an Asset

82

Entering Asset Detail

82

Entering Depreciation Input

83

Navigating the Depreciation Detail Grid

83

Using the Depreciation Detail Grid

84

Type of Property

84

Additional Property Type (Optional)

85

Type of SUV(Optional)

85

Special Allowance Option

85

Cost or Other Basis (Optional)

86

Business Use Percent (Optional)

86

Method (Required)

87

Life (years, rate, or unit) (Required)

87

Convention

87

Sec. 179/Bonus (Optional)

88

Salvage Value (Optional)

88

ITC/Basis Adjustment (Optional)

88

Tax Preference/Section 168(e) Code (Optional)

88

Exchange Parent Current Depreciation

89

Prior Depreciation (Optional)

89

Special Allowance Depreciation (Optional)

89

Contents

Contents • vii

Current Depreciation (Optional)

89

Business Use Current Depreciation (Optional)

89

Total Depreciation (Optional)

89

Basis Reduction (Optional)

90

Adjusted Basis

90

Applying Section 179 Bonus Maximums at a Client Level

90

Apply the Maximum Section 179

91

Maximize all Section 179

91

Applying Section 179 Bonus Maximums at an Asset Level

92

Displaying a Calculation

92

Adding a Vehicle or Listed Property

93

Entering Home Office Input

94

Business Use of Home Information

94

Day Care Facilities

95

Business Use Percentage

95

Editing Property Tax Input Values

95

Entering State Use and State Use Amount Data

98

Projecting Asset Depreciation Data

98

Project Asset Depreciation for all Active Books

98

Project Asset Depreciation for a Specific Book

99

Editing an Asset

99

Duplicating an Asset

99

Clearing Current Depreciation Overrides

100

Locating an Asset

100

Using the Go To Asset Option

100

Using the Navigational Arrows and Keyboard Shortcuts

100

Adding Multiple Duplicates

101

Using Find and Replace

101

Customizing the Asset List View

102

Using the Asset List View

102

Customizing the Asset List View

102

Asset List Status Codes

103

Other Asset List Features

103

Contents

Contents • viii

Right-click Menu

103

To Select Consecutive Assets in the Asset List

103

To Select Non-consecutive Assets

103

To Select All Assets in the Asset List

103

Adding, Removing, and Rearranging Asset List Columns

104

Resizing Asset List Columns

105

Reapplying Default Asset List Column Settings

106

Overview of Using Filters

106

Creating a New Filter

106

Editing a Line in a Filter Formula

108

Removing a Line from a Filter Formula

109

Clearing a Filter's Entire Formula

109

Renaming a Filter

109

Deleting a Filter

110

Using the Calculator

110

Deleting Assets

110

Deleting a Single Asset

111

Deleting Multiple Assets

111

Transferring Assets between Files

111

Transferred Asset Status Codes

112

Copying Assets between Files

113

Splitting Assets

115

Undo Split

116

Tracking Assets

117

Selected Asset Information

117

Event Selection

117

Event Detail

117

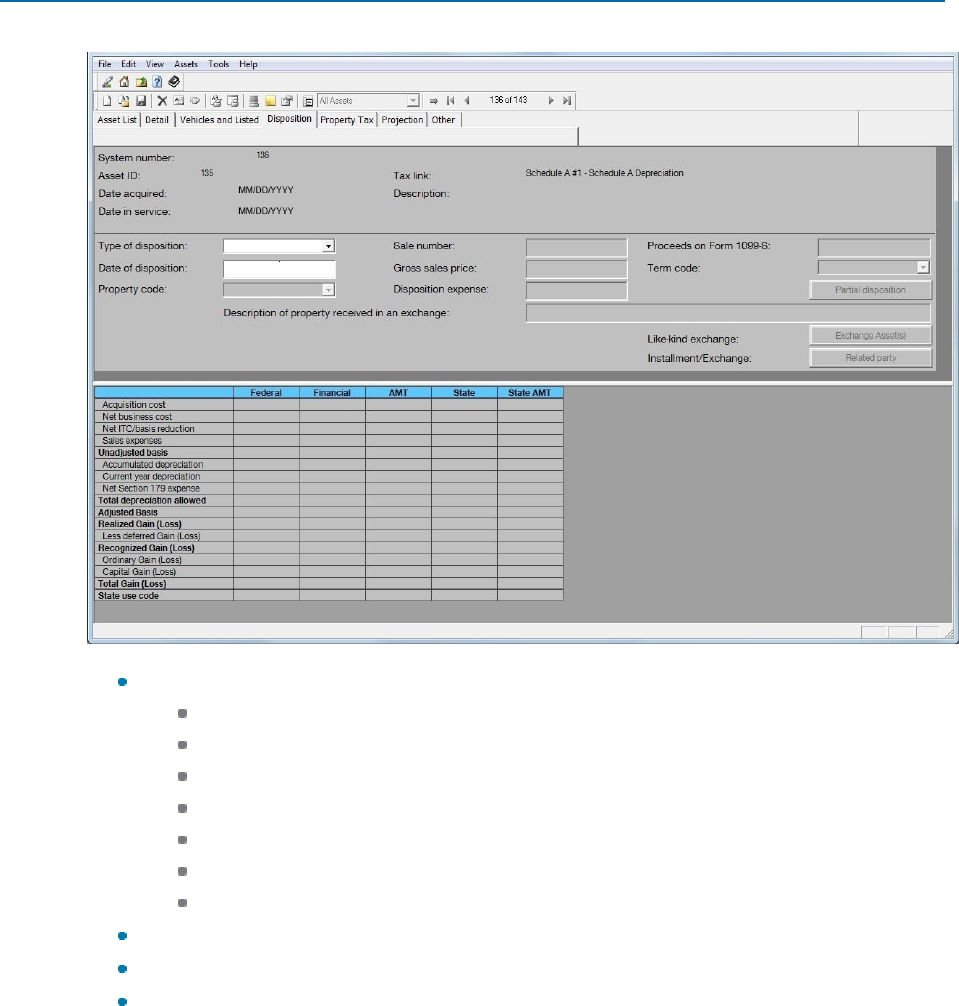

Chapter 5 - Managing Asset Disposition

119

Creating an Asset Disposition

119

Changing an Asset Disposition

119

Disposition Detail Input Fields

120

Related Party

121

Disposition Grid

123

Contents

Contents • ix

Disposing of an Asset Using Like-kind Exchange

123

Creating a Partial Disposition

125

Changing an Asset Disposition

127

Removing an Asset Disposition

127

Overview of Processing Group Dispositions

127

Grouping Assets for Disposition

128

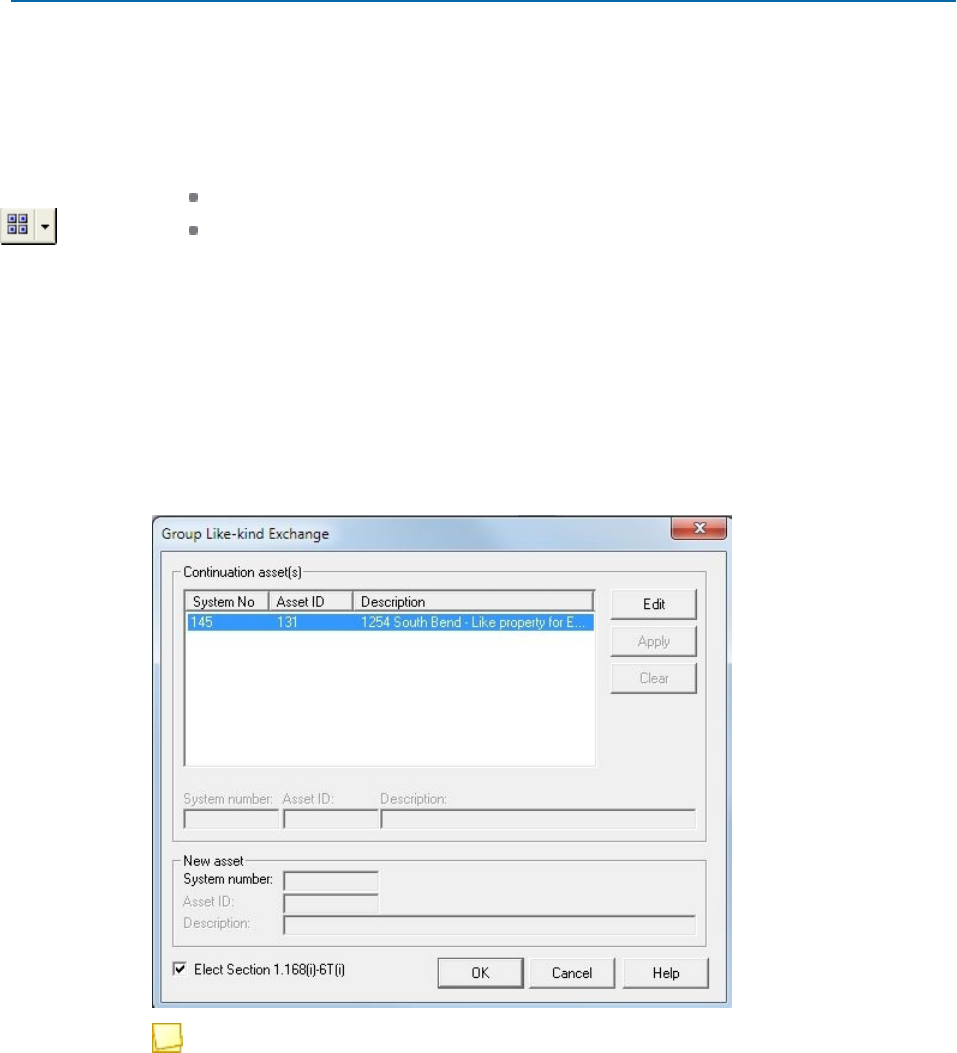

Creating a Group Disposition Using Like-Kind Exchange

129

Editing a Group Disposition

131

Deleting a Group Disposition

131

Allocating a Group Disposition

131

Adding/Removing Assets from the Group Disposition

133

Using the Disposition Tab

133

Adding/Removing Books

133

Report Changes

133

Creating Prior Year Dispositions

134

General Dispositions

134

Like-Kind Exchange (Exchange Assets)

134

Partial Disposition

134

Importing and Exporting Disposition Data

134

Creating Future Year Dispositions

135

General Dispositions

135

Like-Kind Exchange (Exchange Assets)

135

Partial Disposition

135

Importing and Exporting Disposition Data

135

Chapter 6 - Reporting Data

136

Selecting Reports

136

Printing Asset Detail

138

Customizing Report Properties

138

Applying Report Properties

138

Editing Report Properties

139

Prior Year Reports

149

Restricted Reports

150

Printing Reports

151

Contents

Contents • x

Previewing Reports

152

Printing to a PDF File

154

Saving Report Data to a File

154

Overview of Managing Report Sets

155

Creating a Report Set

155

Editing a Report Set

157

Deleting a Report Set

158

Printing a Report Set

159

Printing Government Forms

160

Exporting Reports to CCH ProSystemfx Engagement

161

Chapter 7 - Importing Data

163

Integrating CCH ProSystem fx Fixed Assets Data with CCH ProSystemfx

Tax and CCHGlobalfx Tax

163

Importing Assets for a Linked CCH ProSystemfx Tax or

CCHGlobalfxTaxClient

164

Importing Assets from a Non-Linked CCH ProSystemfx Tax or

CCHGlobalfx Tax Client

165

Overview of Importing Data into CCH ProSystemfx Tax and CCHGlobal fx

Tax

166

Importing Data into CCH ProSystemfx Tax and CCHGlobal fx Tax

167

Overview of Importing Data into CCH Access Tax

169

Importing Data into CCH Axcess Tax

170

Overview of Importing Data from Other FAM Products

172

Data to be Imported

172

Importing Data from Asset Keeper Pro

173

Asset Keeper Pro Conversion Issues

173

Importing Data from BNA

173

Importing Data from Fixed Assets CS

174

Fixed Assets CS Depreciation Solution Conversion Issues

174

Importing Data from Intuit® EasyACCT®

175

Importing Data from Sage® Fixed Assets (Sybase™)

175

Sage® Fixed Assets Conversion Issues

176

Importing Data from Sage® Fixed Assets Premier (SQL)

176

Sage® Fixed Assets Conversion Issues

177

Contents

Contents • xi

Overview of Importing Data from User-Defined Files

177

Importing Data from Excel® Spreadsheets

178

Importing Data from ASCII Character Delimited Files

179

Chapter 8 - Depreciation Computations

182

Accelerated Cost Recovery System (ACRS), Optional ACRS Straight Line

Method

182

Asset Life

182

Alternative Minimum Tax (AMT), Adjusted Current Earnings (ACE)

183

Modified Accelerated Cost Recovery System (MACRS), (ADS)

183

Section 168(k) Bonus Depreciation

184

New York Liberty Zone Provision

185

Bonus Depreciation for Disaster Zone Property

185

Bonus Depreciation for Cellulosic Biomass Ethanol Property

186

Bonus Depreciation for Reuse and Recycling Property

186

Asset Life

186

Averaging Convention

187

Depreciation Rate

187

MACRS Tables Method

188

MACRS Calculated Method

188

Pre-ACRS, Financial or Book Depreciation Methods

188

Declining Balance Method

188

Nonrecovery Straight Line Method

189

Sum of the Year's Digits Method

189

Units of Production Method

189

Alternative Minimum Tax (AMT), Adjusted Current Earnings (ACE)

189

Averaging Convention

189

Depreciation Methods Not Calculated

189

Depreciation in the Year of Disposition

190

MACRS, ADS Assets

190

ACRS Assets

190

Financial Depreciation Purposes

190

Like-Kind Exchanges

191

Like-Kind Exchange Computation

191

Contents

Contents • xii

Luxury Auto limits

192

Section 179 Expense

194

Section 179 Expense Computation

194

Alternative Minimum Tax (AMT), Adjusted Current Earnings (ACE)

196

Section 179 Recapture

196

Business Use 50 Percent or Less

196

Section 280F Recapture

197

Business Use 50 Percent or Less

197

Electric Auto Limitations

198

Luxury Auto Limitations

199

Empowerment Zone Property

201

New York Liberty Zone Property

202

Disaster Zone Property

202

Retail Motor Fuels Outlet Property

202

Tax Credits

202

Credit Summary

202

Contents

Chapter1

Chapter 1 - I ntr oducti on

Welcome to CCH

®

ProSystem

fx

®

Fixed Assets

CCH ProSystem

fx

Fixed Assets is a comprehensive software system that computes depreciation

using various methods. CCH ProSystem

fx

Fixed Assets provides reports, worksheets, and FASB-

compliant financial statements. In addition, fixed assets data can be transferred between CCH

®

ProSystem

fx

®

Tax and CCH ProSystem

fx

Fixed Assets, and CCH

®

Global

fx

Tax and CCH

ProSystem

fx

Fixed Assets. Fixed Assets data can also be imported into CCHAxcess™ Tax.

CCH ProSystem

fx

Fixed Assets gives you access to the CCH ProSystem

fx

Technical Support team.

Highlights of CCH ProSystem

fx

Fixed Assets

The following list highlights some of the CCH ProSystem

fx

Fixed Assets features. Details can be

found in this guide and in Help.

Automatic Computations. Simultaneously computes and maintains asset depreciation using

different methods of depreciation for different basis.

CCH ProSystem

fx

Fixed Assets also calculates depreciation for short tax years, special

allowance depreciation, and section 179 depreciation. Gain or loss on asset disposition and ITC

basis adjustments are also automatically calculated.

Automatically calculates prior year depreciation.

Calculations can be overridden. Override CCH ProSystem

fx

Fixed Assets' computed

depreciation amounts, when necessary.

Multiple Depreciation Books. Provides five depreciation books (Federal, Financial, AMT,

ACE, and State), plus three user-defined books.

Asset Disposition. Computes gains and losses on the disposition of an asset. CCH

ProSystem

fx

Fixed Assets can create a group disposition and print Government Disposition

Form 4797.

Financial Statements and Reports. Produces FASB-compliant financial statements and a

variety of reports such as depreciation expense, depreciation expense comparison, projection,

journal entry, variance, and net book value.

Chapter 1 - Introduction • 1

INTRODUCTION

Report Presentation. Reports can be filtered to specify which assets and books to include.

Report Customization. The font, font style and size, and column widths of reports can be

customized. Reports can be printed to a file for export to another program.

Fileable Forms. Produces Government Forms 4562 and 4797.

Annual Cost Summary report. Shows cost totals for each category type for the current and

preceding years to assist in preparing property tax returns.

Simplified Data Entry. Provides asset detail for all books in a grid display as well as

instantaneous compilation for an asset.

Predefined lists of asset types make it easy to add assets. In addition, you can create picklists

for other items such as Location, Category, and General Ledger Account Numbers that can be

used for all assets within a company.

Similar assets can be entered using the Duplicate Asset feature.

Custom Property types. Create and/or modify property types specific to your needs. Enter or

modify the estimated market value, sales tax rate, and sales tax amount of an asset on the

Property Tax

tab.

Autoflow Feature. Fills the cost of other open books with an entry in the federal cost.

GAAP rules for Like-kind Exchanges. GAAP rules can be applied for Like-kind Exchanges in

the Financial book.

Import Capabilities. Imports asset data from CCH ProSystem

fx

Tax, Microsoft

®

Excel

®

, or

CSV files.

Integration with Tax System. Totals only or detailed asset data can be imported into a CCH

ProSystem

fx

Tax return.

Integration with CCH

®

Global

®

Tax System. Totals only or detailed asset data can be

imported into a CCH Global

fx

Tax return.

Depreciation Computations.

Mid-quarter Convention. For assets acquired during the current year, you have the

option of having CCH ProSystem

fx

Fixed Assets determine if the mid-quarter

convention applies, or forcing the mid-quarter or half-year convention. This is done on

the client level when specifying Book Setup.

Adjusted Current Earnings (ACE).

Earnings and Profits (E&P).

Tables and Formulas.

Prior Depreciation.

Section 179 - Total Cost of Property.

AMT Calculation. For personal property acquired after 12/31/1998, AMT and the 150%

election under MACRS are calculated over regular MACRS lives instead of Alternative

Depreciation System lives.

Luxury Autos Limits.

Notes. Provides an 80-character note field for each asset as well as a note field that applies to

the client.

Chapter 1 - Introduction • 2

Additional Resources

Release Information. For information on the latest features in the current release of CCH

ProSystem

fx

Fixed Assets, select Help > Release Info.

User Guide. Select Help > CCH ProSystem

fx

Fixed Assets support on the Web >

Product Home Page > Guides to access the product guides from the CCH Support website.

About the CCH ProSystem

fx

Fixed Assets User Guide

This guide includes the following chapters:

Chapter 1, Introduction, gives an overview of CCH ProSystem

fx

Fixed Assets and explains

the CCH ProSystem

fx

Fixed Assets toolbars and system help features.

Chapter 2, Installing CCH ProSystem

fx

Fixed Assets, gives step-by-step instructions for

installing CCH ProSystem

fx

Fixed Assets on a network server or a standalone computer. It also

discusses setting system preferences.

Chapter 3, Managing Clients, explains how to add, view, and edit client properties. This

chapter also includes information on managing and deleting client files.

Chapter 4, Managing Assets, explains how to add, duplicate, view, edit, filter, and delete

assets. It also discusses how to view asset projections.

Chapter 5, Managing Asset Disposition, explains how to enter an individual or group asset

disposition, view a disposition, change a disposition, and remove a disposition.

Chapter 6, Reporting Data, explains how to define, preview, and print CCH ProSystem

fx

Fixed Assets reports.

Chapter 7, Importing Data, explains how to import clients from CCH ProSystem

fx

Tax and

CCHGlobal

fx

Tax, popular fixed assets applications, and various file types. This chapter also

discusses importing CCH ProSystem

fx

Fixed Assets data into CCH ProSystem

fx

Tax,

CCHGlobal

fx

Tax, and CCHAxcess Tax.

Chapter 8, Depreciation Computations, is a reference for depreciation computations. The

Table of Contents gives a complete list of the topics in this chapter.

Use the guide's table of contents to quickly locate information.

Chapter 1 - Introduction • 3

Conventions

To help you locate and interpret information, this guide uses consistent visual cues and a few

standard text formats as follows:

To clarify the paths to menu functions, the path is shown in parentheses below heading titles:

(File > Client Properties > Basic Information).

Specific actions you should make appear in bold lettering, for example: Select Client

Properties from the menu.

Italics are used to reference titles of chapters and sections in the guide, sections of a screen,

dialogs, tabs, and fields. Here are some examples of this convention:

The

Group Disposition List

dialog displays.

Enter a date in the

Date of Disposition

field.

Chapters and section names will have a hyperlink to that page in the guide, for example,

Allocating a Group Disposition

on page131.

A message beginning with Note, Tip, or Warning contains important additional information

about the preceding text.

Function keys are shown in bold lettering, for example: Press F5 to locate an asset.

Keyboard Shortcut Keys

CCH ProSystem

fx

Fixed Assets assumes you are familiar with Windows

®

operating systems and

that you are using a mouse with Windows

®

. However, for your convenience, the keyboard shortcuts

available within CCH ProSystem

fx

Fixed Assets are listed below.

Dialog Box Keys

Shortcut Function

Page Up or Page Down Scrolls up or down a list box, one window at a time

Alt + Down Arrow,

or F4

Opens a selected drop-down list

Alt +Up Arrow,

or F4

Closes a selected drop-down list

Spacebar Toggles between selecting and clearing a check box

Shift + Up Arrow,

Shift + Down Arrow,

Shift + Right Arrow,

or Shift + Left Arrow

Extends the selection in a text box one character at a

time

Chapter 1 - Introduction • 4

Shortcut Function

Shift + Page Up

Extends the selection to the first character in a text

box

Shift + Page Down

Extends the selection to the last character in a text

box

Enter

Executes a command button or chooses the selected

item in a list box and executes the command

Esc,

or Alt +F4

Closes a dialog box without completing the command

Editing Keys

Shortcut Function

Ctrl + C

Makes a copy of the selected text and places it on the

Clipboard

Ctrl +V Inserts text from the Clipboard to the active window

Ctrl +X

Deletes the selected text and places it on the

Clipboard

Ctrl +Z Reverses the previous editing operation

Cursor Movement Keys

Shortcut Function

Up Arrow Moves up one line

Down Arrow Moves down one line

Right Arrow Moves right one character

Left Arrow Moves left one character

Ctrl + Right Arrow Moves right one word

Ctrl + Left Arrow Moves left one word

Home Moves to the beginning of the line

Chapter 1 - Introduction • 5

Shortcut Function

End Moves to the end of the line

CCH ProSystem

fx

Fixed Assets Keys

Shortcut Function

Ctrl + A Selects Asset List or input field data

Ctrl + D Deletes an asset

Ctrl + F Finds a value and replaces it with another value

Ctrl + G Finds the next occurrence of a specified value

Ctrl + N Creates a new client

Ctrl +O Opens a client

Alt +F4 Closes a client

Ctrl + R Displays client properties

Ctrl +S Saves content without closing the client file

Ctrl + T Adds an asset

Ctrl +U Duplicates an asset

F5 Goes to a specific asset

F6

Toggles between the upper and lower sections of the

Detail

and

Disposition

tabs

Alt +Home Moves to the first asset

Alt + End Moves to the last asset

Alt + Page Up,

or Alt + Up Arrow

Moves to the previous asset

Alt + Page Down,

or Alt + Down Arrow

Moves to the next asset

Chapter 1 - Introduction • 6

Menu Commands

Shortcut Menu Commands

Ctrl + T Assets > Add

Ctrl + D Assets > Delete

Ctrl + U Assets > Duplicate

Alt + Home Assets > First

Alt + End Assets > Last

Alt + Page Down Assets > Next

Alt + Page Up Assets > Previous

Ctrl + C Edit > Copy

Ctrl + X Edit > Cut

Del Edit > Delete

F5 Edit > Go To

Ctrl + V Edit > Paste

Ctrl + A Edit > Select All

Ctrl + F Edit > Find and Replace

Ctrl + Z Edit > Undo

Ctrl + R File > Client Properties

Alt + F4 File > Close

Ctrl + N File > New …

Ctrl + O File > Open …

Ctrl + S File > Save

Chapter 1 - Introduction • 7

Navigation

Keyboard Shortcuts Navigation Shortcuts

or Alt + Home

First

Selects the first asset

or Alt + Page Up

Previous

Selects the previous asset

or Alt + Page

Down

Next

Selects the next asset

or Alt + End

Last

Selects the last asset

Go To

Asset

Locates an asset by system number or company asset

ID

Toolbar Buttons

CCH ProSystem

fx

Fixed Assets provides two toolbars for quick access to frequently used functions.

The CCH ProSystem

fx

Fixed Assets toolbar consists of system-defined icons. The Standard toolbar

can be customized to display user-defined icons. The toolbars can be turned on or off, and

customized from the View menu. Use the following commands to set your toolbar preferences:

View > Toolbars > All. Toggles both the CCH ProSystem

fx

Fixed Assets toolbar and the

Standard toolbar on or off.

View > Toolbars > Fixed Assets. Toggles the CCH ProSystem

fx

Fixed Assets toolbar on or

off.

View > Toolbars > Standard. Toggles the Standard toolbar on or off.

View > Toolbars > Customize. Allows you to customize the Standard toolbar icons.

CCH ProSystem

fx

Fixed Assets Toolbar

New Client. Ctrl + N. Creates a new client file. If another client is open,

you are prompted to save changes before creating a new client.

Open Client. Ctrl + O. Opens an existing client file. If another client is

open, you are prompted to save changes before opening another client.

Save Client. Ctrl + S. Saves the active client file.

Delete Asset. Ctrl + D. Deletes the selected asset or assets.

Chapter 1 - Introduction • 8

Add Asset. Ctrl + T. Adds a new asset.

Duplicate Asset. Ctrl + U. Creates a duplicate of the selected asset.

Print Asset Detail. Prints an asset detail report including depreciation

detail for the asset selected on the Asset List or displayed in the

Detail

tab.

Print Reports. Displays a list of reports that can be printed.

Display Calculation. Displays the calculation for the current year

depreciation.

Open Client Notes. Opens the client's note.

Open Client Properties. Ctrl + R. Opens the

Client Properties

dialog

allowing you to change client detail, setup books, etc.

Filters. Displays the

Filter List

dialog from which you can add filters or

edit existing ones.

Filter List. Displays available filters that can be applied to the Asset List.

This drop-down list is only available on the Asset List window.

Go To Asset. F5. Enables you to locate an asset by system number or

company asset ID.

First, Previous. Alt + Home, Alt + Page Up. Moves to the first asset or

previous asset.

Next, Last. Alt + Page Down, Alt + End. Moves to the next asset or last

asset.

Standard Toolbar

The Standard toolbar can be customized to include the following icons:

New Client. Ctrl + N. Creates a new client file. If another client is open, you are prompted to

save changes before creating a new client.

Open Client. Ctrl + O. Opens an existing client file. If another client is open, you are prompted

to save changes before opening another client.

About. Displays the current version information and current licensing for CCH ProSystem

fx

Fixed Assets.

Close Client. Alt + F4. Closes a client file.

Customize Toolbar. Allows you to add, remove, and organize buttons on the Standard

toolbar.

Exit. Closes CCH ProSystem

fx

Fixed Assets.

Chapter 1 - Introduction • 9

Import from Tax. Allows you to import asset data for CCH ProSystem

fx

Tax and

CCHGlobal

fx

Tax clients.

Import Various File Types. Allows you to import asset data from a selection of fixed assets

management applications, Excel

®

files, and comma separated value files.

Export to Engagement Menu. Displays a drop-down list of export functions that includes

Export Reports and Provide Engagement User Info.

Copy Assets. Allows you to copy assets between client data files.

Transfer Assets. Allows you to transfer assets between client data files.

Print Menu. Displays a drop-down list of print functions, which includes Reports, Asset

Detail, and Forms.

Edit Menu. Displays a drop-down list of editing functions that includes Undo, Cut, Copy (Ctrl

+ C), Paste, Delete, and Select All (Ctrl + A).

Find Menu. Displays a drop-down list of search functions that includes Find and Replace (Ctrl

+ F), and Find Next (Ctrl + G).

Multiple Duplicate. Allows you to specify the number of times to duplicate a selected asset.

Split Asset. Divides a single asset into multiple assets.

Undo Split. Combines split assets into the single originating asset.

Section 179 Allocation. Allows you to set the section 179 amounts on all eligible current-year

assets from the Asset List.

File Management Menu. Displays a drop-down list of functions to manage a client file that

includes Setup, Backup, Restore, Check-in, and Check-out.

Global Settings Menu. Displays a drop-down list to select and setup CCH ProSystem

fx

Fixed Assets Global Settings.

Books. Allows you to activate Financial, AMT, ACE, State, and define three additional books.

Copy Books. Allows you to copy books that are active in the current year to any book that is

available. AMT and ACE are only available to copy if the originating book is Federal, AMT or

ACE.

Columns. Allows you to add, remove, or rearrange columns for display in the Asset List.

Fields. Allows you to edit Asset Detail field definitions.

Lock/Unlock Calculation. Allows you to lock or unlock any active year.

Disposition Menu. Displays a drop-down list of disposition functions that includes Remove

Disposition and Group Disposition.

Chapter 1 - Introduction • 10

Preferences. Allows you to set user preferences for certain print, display, export, currency

rounding, data entry, and Global Settings update functions.

Configure Security. Allows you to password protect a client file.

Calculator. Displays the calculator program.

Close Year End. Allows you to close the current year and open the next year.

Remove Overrides. Removes the current depreciation overrides for all assets in the client

file.

Reverse Closed Year. Allows you to roll back to the prior year.

Help Topics. Alt + F1. Displays the CCH ProSystem

fx

Fixed Assets Help program.

Release Info. Displays release information, feature, and system requirements for the installed

version.

CCH ProSystem

fx

on the Web. Displays the list of CCH ProSystem

fx

Fixed Assets Web

links.

Help for Current Field. F1. Displays field-level help for the selected field.

Tutorial. Launches the tutorial program.

Amend Asset. Allows you to amend a locked asset.

Customizing the Standard Toolbar

(View > Toolbars > Customize)

The CCH ProSystem

fx

Fixed Assets Standard toolbar can be customized using the following

functions:

Add, remove, and reorder buttons.

Insert one or more separators to organize buttons.

Restore previous toolbar settings.

Show or hide button labels.

Display small or large icon images.

Adding, Removing, and Reordering Buttons

To display the

Customize Toolbar - Standard Toolbar

dialog, do one of the following:

Select View > Toolbars > Customize.

Click Customize Toolbar on the toolbar.

Chapter 1 - Introduction • 11

The

Customize Toolbar - Standard Toolbar

dialog provides the following functions:

Add an item to the toolbar. Select a button or separator from

Available toolbar buttons

and

click Add, drag it to

Current toolbar buttons

, or double-click the item to add it.

Remove an item from the toolbar. Select a button or separator from the

Current toolbar

buttons

and click Remove, drag it to

Available toolbar buttons

, or double-click the item to

remove it.

Reorder a toolbar item. Select the item to be moved in

Current toolbar buttons

and click

Move Up or Move Down. You can also drag an item to a new position.

Reset the toolbar. Click to restore the toolbar to its setting prior to opening the dialog.

Standard Toolbar Display Options

The

Customize Toolbar - Standard Toolbar

dialog provides a

Text Options

drop-down list to modify

the appearance of the Standard Toolbar. You can choose to show button labels below each icon, to

the right of each icon, or to display icons without text labels.

Docking the Toolbars

By default, the toolbars are docked at the top of the screen below the menu bar. You can move them

to another toolbar position or to another position on the CCH ProSystem

fx

Fixed Assets window. To

move a toolbar, click a Separator (the vertical line on the left side of each toolbar) and drag it to any

position.

Using the Status Bar

The status bar, located at the bottom of the window, displays messages advising what process is

being performed. It also displays descriptions of selected menu options, field tips, and toolbar

buttons. To toggle the status bar on/off, select View > Status Bar.

Using Help

To access Help, you can use any of the following methods:

Select Help > Help Topics, press Alt + F1, or click Help topics on the toolbar to access help

on all topics.

Select Help > Help for Current Field, press F1, or click Help for Current Field on the toolbar

for field-specific help.

Select Help > Tutorial or click Tutorial on the toolbar to access the tutorial program for CCH

ProSystem

fx

Fixed Assets.

Select Help > CCH ProSystem

fx

Fixed Assets support on the Web > Product Home

Page > Guides to access the product guides from the CCH Support website.

Chapter 1 - Introduction • 12

CCH ProSystem

fx

Fixed Assets support on the Web

The Customer Support Web site can be accessed by selecting Help > CCH ProSystem

fx

Fixed

Assets support on the Web > Product Home Page or by clicking CCH ProSystem

fx

on the

Web on the toolbar.

The CCH ProSystem

fx

Fixed Assets support on the Web menu options open your Internet Web

browser and take you to the selected area of the Customer Support Web site:

Product Home Page. View information (e.g., FAQs, System Requirements, Hot Topics)

related to the product.

Browse our Knowledge Base. Browse articles by topic to find solutions that our tax and

support team have compiled.

Contact Support. Contact us with your general comments and questions, check the status of

support and enhancement requests, view firm information change requests, find Web site

administration information, and more.

Start a Remote Support Session. Start a support session with a support representative.

My Account. Log in or register to manage your account, receive copies of your invoices, check

the status of your order, and more.

Product Guides. Access product user guides for helpful information on features.

Chapter 1 - Introduction • 13

Chapter2

Chapter 2 - I nst all i ng CCH P roSyst em

fx

F ixed Assets

Before beginning the installation, you should exit all Windows

®

programs. If this is a first-time

installation, have your permission files ready or, if you will be downloading the permission files from

the Internet, have your SSO login information ready. See

Permission Key

below for more

information.

Notes:

If this is a network installation, all users must exit the CCH ProSystem

fx

program and all CCH

ProSystem

fx

applications.

If you are using Citrix

®

, you must install CCH ProSystem

fx

Fixed Assets at the server PC as an

administrator and run the installation using Add/Remove Programs in Control Panel. This

ensures that INI and DLL program files are properly installed in the system directories.

System Requirements

You can access the CCH ProSystem

fx

Fixed Assets system requirements on the CCH Support

website.

Permission Key

A permission key is necessary for your first installation of CCH ProSystem

fx

Fixed Assets and for the

installation of the initial CCH ProSystem

fx

Fixed Assets release each year. For subsequent

installations, the install program reads permission information from your hard drive or network server.

Permission keys are downloaded from our web site. For instructions, please see our Knowledge Base

article: https://support.cch.com/kb/solution.aspx/kb159

Installing CCH ProSystem

fx

Fixed Assets

Do the following to install CCH ProSystem

fx

Fixed Assets to a standalone PC or network server:

1.

If you are installing directly from the downloaded install files, then please follow the instructions

provided in the release notes.

Chapter 2 - Installing CCH ProSystemfx Fixed Assets • 14

INSTALLING CCH PROSYSTEM FX FIXED

ASSETS

2. Select Start > Run.

3. Type ?:\Setup (where ? represents the location of the install files) and click OK.

Note: If necessary, click Browse to find your install files and select Setup.exe.

After CCH ProSystem

fx

Fixed Assets Setup prepares for the installation, the

Permission File

dialog displays.

4.

Select one of the following methods to install the permission key:

Internet download. Downloads the permission key from the Internet. If you are

installing for the first time, this option is selected by default.

If you use this method, you must enter your customer account number.

Use previously installed permission key. Not available for the first installation.

Permission key disk drive path. Select this option to use your permission files. Enter

the drive location where the permission key is located or click Browse to locate the drive.

5.

Do one of the following:

If you selected

Internet download

, enter your CCH ProSystem

fx

user ID and password

on the CCH ProSystem

fx

Login screen, and click Login to begin downloading your

permission key. The permission key is downloaded from the Web site and the installation

proceeds to the next step automatically.

If you selected a different option on the

Permission File

dialog, click Next to continue to

the Welcome screen.

6. Click Next on the Welcome screen to display the

Type of Installation

dialog.

7.

Select one of the following options:

Network Install. Installs CCH ProSystem

fx

Fixed Assets to a common network drive

for access by other networked workstations. Users from other workstations must run

Setup.exe from the network drive/directory where CCH ProSystem

fx

Fixed Assets is

installed. See the following section,

Workstation Setup

, for information.

Standalone Install. Installs CCH ProSystem

fx

Fixed Assets to your computer and

creates a program group with an icon to access CCH ProSystem

fx

Fixed Assets.

8. Click Next to continue.

9.

Select the destination location for the program files. You can accept the default location,

C:\FixedAst, or click Browse to select a different location.

Note: If a message advises there is insufficient space on the selected drive, you must

select a different drive or exit the installation and allow for additional space on the

destination drive.

10. Click Next to continue.

11.

Select the destination location for the client data. You can accept the default location,

C:\FixedAst\UserData, or click Browse and select a different location to store the client data

files.

12. Click Next to continue.

Chapter 2 - Installing CCH ProSystemfx Fixed Assets • 15

13.

Select the features you want to install.

Tutorial. Installs the tutorial for CCH ProSystem

fx

Fixed Assets.

Sample Clients. Installs sample client data for your reference.

14. Click Next to continue.

15. Select a program folder for the CCH ProSystem

fx

Fixed Assets icons. You can accept the

default, enter a new folder name, or select another existing folder.

16. Click Next to continue.

17. Click Install to begin the installation.

18.

When the install is complete, you are prompted to restart your computer. Make a selection and

click Finish.

Note: You can select to do this now or later, but the computer must be restarted to update

certain system files before running CCH ProSystem

fx

Fixed Assets.

Workstation Setup

Complete the following steps to give a workstation access to a network installation of Fixed Assets:

1. Select Start > Run.

2. Enter the directory path of the CCH ProSystem

fx

Fixed Assets workstation setup program,

?:\FixedAst\Setup.exe (where ? represents the network drive). Use Browse, if needed, to

locate the path. Click OK.

3. Click Next on the Welcome screen to display the

Type of Installation

dialog.

4. Select Workstation Setup and click Next.

5.

Select a location for your work folder where your backup files will be stored. Accept the default

location or click Browse to select a different location. The work folder should be on a local drive.

Click Next to continue.

6. Select a program folder for the CCH ProSystem

fx

Fixed Assets icons. You can accept the

default, enter a new folder name, or select another existing folder. Click Next to continue.

7. Click Install to begin the installation.

8.

When the install is complete, you are prompted to restart your computer. Make a selection and

click Finish.

Note: You can select to do this now or later, but the computer must be restarted to update

certain system files before running CCH ProSystem

fx

Fixed Assets.

Chapter 2 - Installing CCH ProSystemfx Fixed Assets • 16

Uninstalling CCH ProSystem

fx

Fixed Assets

To uninstall CCH ProSystem

fx

Fixed Assets, complete the following steps:

1. From the Start menu, select Control Panel > Programs and Features.

2. On the

Install/Uninstall

tab, select CCH ProSystem

fx

Fixed Assets from the list of installed

software and click Add/Remove. If you are uninstalling a local installation, skip to step 4.

3.

Do one of the following:

To uninstall the entire network installation, choose Uninstall Network.

To remove the local program group, icons, and registry entries, choose Uninstall

Workstation.

4. A confirmation dialog displays. Click Yes to begin the uninstall program.

5. Click Finish.

Notes:

You may be prompted to restart your computer. You can choose to restart now or later, but the

computer must be restarted to completely remove CCH ProSystem

fx

Fixed Assets program

files.

The uninstall program does not remove client data files or custom Global Settings.

Setting Preferences

(Tools > Preferences)

The CCH ProSystem

fx

Fixed Assets user preferences allow you to do the following:

Control what assets display and the way the Asset List displays.

Control what assets print in reports.

Specify how currency values are rounded on a per file basis.

Carry an existing asset's tax link, sales tax rate, and settings to new assets.

Automatically allocate a portion of gain/loss to assets involved in group dispositions.

Control when you upgrade Global Settings.

Chapter 2 - Installing CCH ProSystemfx Fixed Assets • 17

To set display, print, and new asset preferences, do the following:

1. To display the

Preferences

dialog, do one of the following:

Select Tools > Preferences.

Click Preferences on the toolbar.

2. In the

Display options

section, check one or both of the following boxes:

Display prior year disposed assets. Display assets with prior year disposition dates.

When the option is not checked, assets with disposition dates prior to the current year

are removed from the Asset List.

Display fully depreciated assets. Display fully depreciated assets. When the option is

not checked, assets with no current depreciation, no adjusted basis, and placed in

service prior to the current year are removed from the Asset List.

3. Choose a grid style from the

Asset List style

drop-down list in the

Display options

section.

Display all lines

Display vertical lines only

Chapter 2 - Installing CCH ProSystemfx Fixed Assets • 18

Alternating shaded lines

No lines

4. In the

Print and export options

section, check any or all of the following options:

Print prior year disposed assets. Include assets with disposition dates prior to the

current year in printed reports or printed asset detail.

Print fully depreciated assets. Include all fully depreciated assets in printed reports or

printed asset detail.

Prepare Form 4562 even if not required to be filed. Preview and print Form 4562

whether or not it is required to be filed.

Create single PDF file for multiple report selection. Creates a single PDF file with

bookmarks for multiple reports. When this option is not selected, the system processes a

PDF file for each report.

Note: You can also print a group of reports to a single PDF on a case-by-case basis

by selecting the

Print to single PDF

option on the

Print

dialog.

5. In the

Currency rounding

section, choose whether to round currency values to the nearest dollar

or penny on a per file basis.

Warning! If you change your

Currency rounding

preference from penny to dollar, the

pennies will not recalculate if you change the option back.

6. In the

Data entry

section, select one or both of the following boxes:

Use previous tax link for new asset. New assets assume the same tax link as the

preceding asset in the Asset List.

Use previous asset's sales tax rate. New assets adopt the sales tax rate entered on

the previous asset.

Use previous asset’s settings for new asset. New assets adopt the following details

from the previous asset's settings:

Date Acquired

Date in Service

Category

Location

Type of Property

Additional Property Type

Special Allowance Option

Business Use Percentage

Method

Life

Convention

Tax Preference/Section 168(e) Code

Chapter 2 - Installing CCH ProSystemfx Fixed Assets • 19

7. Select Always allocate portion of gain/loss to each asset to automatically allocate

gain/loss amounts to individual assets involved in group dispositions. Each asset involved in a

group disposition will display allocated gain/loss amounts on the

Disposition

tab.

Note: Selecting this option will not automatically allocate gain/loss amounts to assets

involved in existing group dispositions.

8. See

Configuring Global Setting Update Options

on page38 to determine how updated Global

Settings are applied to client files.

9. Click OK.

Setting Up a Printer

(File > Printer Setup)

Use Printer Setup to change the printer destination for your reports.

1. Select File > Printer Setup.

2. Select a printer from the

Name

drop-down list.

Note: To change printer configurations, click Properties.

3. Click OK to save your changes and exit this dialog.

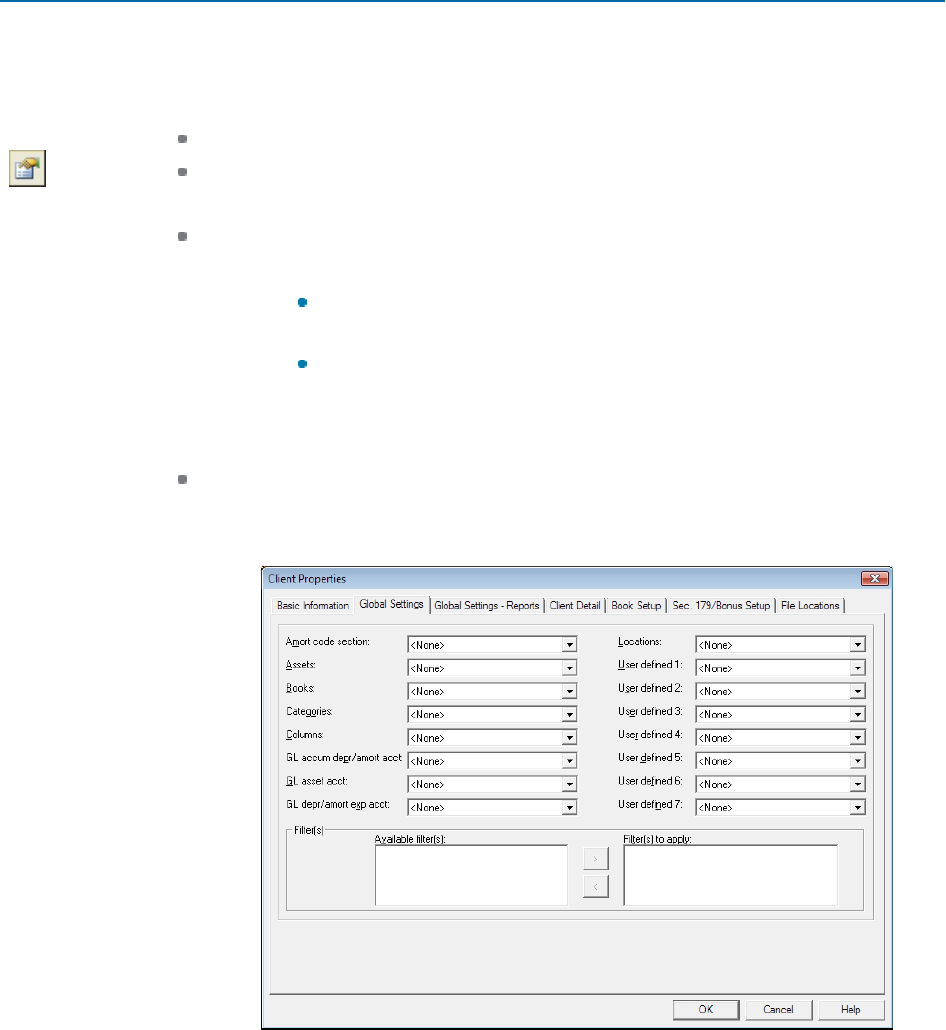

Overview of Global Settings

(Tools > Global Settings)

Global settings can be customized as default values for a variety of CCH ProSystem

fx

Fixed Assets

components. Apply global settings to reduce the time it takes to create new assets and reports for a

client, and to ensure consistency in the application of certain program and depreciation calculation

settings.

1.

To select a Global Setting option, do the following:

Select Tools > Global Settings.

Click Global Settings Menu on the toolbar.

2.

Select one of the following options:

Amortization Code Sections GL Asset Accounts

Assets GL Depr/Amort Exp Accts

Books Locations

Categories Reports

Chapter 2 - Installing CCH ProSystemfx Fixed Assets • 20

Columns Report Sets

Filters Security

GL Accum Depr/Amort Accts User Defined

See

Setting Preferences

on page17 for instructions on determining how changes to Global Settings

should be applied to existing client files.

Note: An individual using a remote installation of CCH ProSystem

fx

Fixed Assets can configure

the system to use Global Settings from a network installation or copy settings from an alternate

location into a local setup.

Creating Global Settings for Amortization Code Sections

(Tools > Global Settings > Amortization Code Section)

To create a Global Setting for Amortization Code Sections, do the following:

1. To display the

Global Settings - Amortization code section

dialog, do one of the following:

Select Tools > Global Settings > Amortization Code Section.

Click Global Settings Menu and select Amortization Code Section.

2. Click New. The

Global Settings - Amortization code section

dialog displays and lists

amortization codes.

3. Edit the name or enter a new name in the

Global setting

field.

4. If desired, enter descriptive text in the

Field tip

field to display in the left area of the status bar.

5.

Do any of the following:

To move the position of an item in the picklist, select an item and click Move Up or

Move Down.

To delete items from the picklist, select an item and select Delete.

To clear the entire picklist, select Clear list.

Select Restore to restore the system-provided picklist.

To list the items alphabetically, check the Sort list alphabetically box.

To add an item to the picklist, enter a new item in the

Edit item

field and click Add.

To change an item, highlight an existing item. The selected item displays in the

Edit

item

field. Make changes to the item in the

Edit item

field. Click Apply to update the

picklist or Clear field to abandon your changes.

6. Click OK to save your changes and exit this dialog.

7. Click Close.

Chapter 2 - Installing CCH ProSystemfx Fixed Assets • 21

Creating Global Settings for Assets

(Tools > Global Settings > Assets)

Use the following procedure to create customized method, life defaults, and whether to allow Section

179 for existing property types (for example, Auto or Personal). These new defaults can be applied to

Federal and other books (for example, Financial and AMT). You can also create customized property

types.

Use this procedure to create Global Settings:

1. To display the

Global Settings - Assets

dialog, do one of the following:

Select Tools > Global Settings > Assets.

Click Global Settings Menu and select Assets.

2. Click New. The

Global Settings - Assets

dialog displays a list of property types.

3. Edit the default name in the

Global setting name

field.

4.

You can do the following:

Edit the method, life values, and whether to allow Section 179 for one or more of the

default property types.

The values available in the

Method

field for selection are dependent on the start and end

dates. The values in the

Life

field are determined by the selected method.

Chapter 2 - Installing CCH ProSystemfx Fixed Assets • 22

Once Global Settings for Assets are applied to a client's file, changes made to default

method and life values are applied to existing assets.

a.

Click the tab for the book you want to change and highlight a property type.

b. Click Edit and make changes to the default method, life values, and whether to

allow Section 179.

c. Click Apply to update the values for the selected property type or click Clear to

abandon your changes and exit Edit mode.

d. If you change the method value on the

Federal

tab, you may be prompted to

apply your changes to other books where the modifications are relevant. Click

Yes to apply the changes to the other books. Click No to only apply the changes

to the Federal book.

Note: If Global Settings for assets has methods or lives different from the

Federal

tab, the setting for

Compute Basis As...

in File > Client Properties > Book Setup

must be changed to None. Otherwise, the book will follow Federal.

Create a customized property type.

CCH ProSystem

fx

Fixed Assets includes more than two dozen default property types,

see

Default Property Types

on the facing page. You also have the option to create

customized property types.

The

Long Name

,

Abbreviated Name

, and

Code

fields are required fields.

a. Click New on the

Global Settings List - Assets

dialog. The

New Property Type

dialog displays.

b. Enter a name for the property type in the

Long Name

field.

Information entered in the

Long Name

and

Code

fields displays in the picklist of

the

Type of Property

field in the depreciation detail section of the

Detail

tab. The

field allows 40 characters.

c. Enter an abbreviated name for the property type in the

Abbreviated Name

field.

The abbreviated name displays in the

Type of Property

field after a customized

property type has been selected. The code value also displays in reports.

d. Enter a code for the new property type in the

Code

field.

The code is appended to the long name in the

Type of Property

drop-down list

and may also be used in the reports. The field allows four characters.

e. Enter a start date for the new property type in the

Start Date

field.

f. Enter an end date for the new property type in the

End Date

field. Your new

property type displays in the

Type of Property

drop-down list on the

Detail

tab

when the Date in service is in this date range. The new property type will remain

in the list until it has an end date that has expired.

g. Click OK to save your changes and exit this dialog. The

Global Settings - Assets

dialog displays in edit mode.

h. Select a depreciation method from the

Method

drop-down list.

Chapter 2 - Installing CCH ProSystemfx Fixed Assets • 23

i. Select or enter a default value in the

Life

field.

j. Select whether to allow Section 179 for the new property type in the

Allow

Sec179

field.

k. Click Apply to update the values for the new property type or Clear to abandon

your changes and exit edit mode.

Assign default property type.

When adding new assets, you have the option of selecting the default property type that

will display in the

Type of Property

field on the

Detail

tab.

The default property type displays on all book tabs, but can only be set on the

Federal

tab.

a.

Highlight a property type in the list.

b. Click Set as Default. The property type selected now displays an asterisk (*)

denoting that it is the default property type. It is also the first in the

Property Type

list.

5. Click OK to save your changes and exit this dialog.

6. Click Close.

Default Property Types

CCH ProSystem

fx

Fixed Assets includes the following default property types:

Personal Investment Res Rental

Amort Leasehold RRB

Auto NonRes Software

Auto-Elec Other Start Up

Auto-No Lmt Qual Lease SUV

Foreign Real Tax-Exempt

Fuels Outlet Real-Farm Truck/Van

IDC Real LIH Utility

Improvement Reforestation Water Utility

Chapter 2 - Installing CCH ProSystemfx Fixed Assets • 24

Creating Global Settings for Books

(Tools > Global Settings > Books)

To create a Global Setting for books, do the following:

1. To display the

Global Settings List- Books

dialog, do one of the following:

Select Tools > Global Settings > Books.

Click Global Settings Menu and select Books.

2. Select the client type the Global Setting is to be configured for and click New.

The

Global Settings - Books

dialog displays.

3. Edit the name in the

Global settings name

field as needed.

4. Configure the book settings as needed. See

Setting Up Books

on page44 for configuration

details.

5. Click OK to save your changes and exit this dialog.

6. Click Close.

Chapter 2 - Installing CCH ProSystemfx Fixed Assets • 25

Creating Global Settings for Categories

(Tools > Global Settings > Categories)

To create a Global Setting for categories, do the following:

1. To display the

Global Settings List - Category

dialog, do one of the following:

Select Tools > Global Settings > Categories.

Click Global Settings Menu and select Categories.

2. Click New. The

Global Settings - Category

dialog displays.

3. Edit or enter a new name in the

Global setting

field.

4. If desired, enter descriptive text in the

Field tip

field to be displayed in the left area of the status

bar.

5.

Do any of the following:

To move the position of a category in the picklist, select a category and click Move Up or

Move Down.

To delete categories from the picklist, select a category and select Delete.

To clear the entire picklist, select Clear list.

To list the categories alphabetically, select Sort list alphabetically.

To add a new category to the picklist, enter a new category in the

Edit item

field and

click Add.

To change an item, highlight an existing category. The selected category displays in the

Edit item

field. Make changes to the category in the

Edit item

field. Click Apply to

update the picklist or Clear field to abandon your changes.

6. Click OK to save your changes and exit this dialog.

7. Click Close.

Creating Global Settings for Columns

(Tools > Global Settings > Columns)

To create a Global Setting for the columns displayed on the

Asset List

tab, do the following:

1. To display the

Global Settings - Columns

dialog, do one of the following:

Select Tools > Global Settings > Columns.

Click Global Settings Menu and select Columns.

2. Click New. The dialog displays.

3. Edit or enter a new name in the

Global setting name

field.

4. Select a type of book (for example, Disposition, Federal, etc.) from the

Column Category

drop-

down list according to the type of detail you want to display.

Chapter 2 - Installing CCH ProSystemfx Fixed Assets • 26

5.

Change the columns configurations as needed.

Add columns. Select one or more columns from the

Available columns

list and click

the right arrow. You can also double-click or drag columns to add them to the

Columns

selected for display

list.

Remove columns. Select one or more items from the

Columns selected for display

list and click the left arrow. You can also double-click or drag columns to move them to

the

Available columns

list.

Change the order of columns. Select a column in the

Columns selected for display

list. Click Move Up or Move Down.

Restore defaults. Click Apply Default to return the

Columns selected for display

to

the original system-default list.

6.

Repeat steps 4 and 5 until columns for all desired categories are selected. A maximum of 26

columns may be selected for the Asset List view.

7. Click OK.

8. Click Close.

Note: When column selections are made to an active book and the book is then deactivated, any

saved column selections are retained. The data is cleared and the columns become blank.

Creating Global Settings for Filters

(Tools > Global Settings > Filters)

To create a Global Setting for a filter that can be applied to selected files, do the following:

1. To display the

Global Settings List - Filters

dialog, do one of the following:

Select Tools > Global Settings > Filters.

Click Global Settings Menu and select Filters.

Chapter 2 - Installing CCH ProSystemfx Fixed Assets • 27

2. Click New. The

Filter Editor

dialog displays.

3. Edit the name or enter a new name in the

Filter Name

field.

4.

Create the first line of the condition that will control which assets are affected by this filter. The

elements that can be used to define a filter include the following:

Parenthesis. Use the left and right parentheses to connect multiple expressions.

Field name. Use the drop-down list to select the general or detail field to be used. Fields

are listed alphabetically with detail fields listed first and general fields listed last.

From book. This field becomes available if the field name you choose is a detail field.

Select the book from the drop-down list. You also have the option of applying the search

conditions to any or all of the available books. Selecting Any returns results if one or

more books match the search criteria. If All is selected, each book must meet the applied

search condition to return a result.

Condition. Use the drop-down list to select the search operators to use in the formula.

There are eight system-defined operands.

= Equal

<> Not Equal

> Greater Than

>= Greater Than or Equal

< Less Than

<= Less Than or Equal

Chapter 2 - Installing CCH ProSystemfx Fixed Assets • 28

P Present

NP Not Present

Value. The choices available depend on the field name you chose. The following entries

are possible.

Picklist. If the field has a picklist associated with it (e.g., Category field), the

picklist displays in the Value field.

Date field. If the field is a date field, the date entered must match the

mm/dd/yyyy date format.

Numeric amount. If the field is a numeric field, enter a numeric value in the

format to be used.

5.

When you have completed the line, you can do one of the following:

Click Add to List to insert the filter into the bottom section of the window. If this is not

the first line, it is added to the end of the formula list.

Highlight an existing line. Click Insert to add the line directly above the highlighted line.

Highlight an existing line. Click Replace to delete the existing line and replace it with the

newly defined formula.

6.

You can continue adding filters to the formula list. To connect two consecutive lines, use the

And or Or connector by choosing a radio button in the

Connect with previous

section.

7.

You can also manipulate the filter lines by using one of the following buttons:

Modify. Highlight a line in the formula and click Modify. You can change any of the

elements that define the line. Click Replace to exchange the existing line with the

modified line. You can also click Add to List or Insert to add a new line to the list while

leaving the existing line unchanged.

Delete. Highlight a line in the formula list and click Delete. You are asked to confirm

that you want to delete the line.

Clear All. Clicking this button deletes all defined formula lines.

8. Click OK when you are finished.

9. Click Close.

Chapter 2 - Installing CCH ProSystemfx Fixed Assets • 29

Creating Global Settings for GL Accum Depr/Amort Accounts

(Tools > Global Settings > GL Accum Depr/Amort Acct)

To create a Global Setting for GL Accum Depr/Amort Accounts, do the following:

1. To display the

Global Settings List - GL accum. depr./amort. accts.

dialog, do one of the

following:

Select Tools > Global Settings > GL Accum Depr/Amort Acct.

Click Global Settings Menu and select GLAccum Depr/Amort Acct.

2. Click New. The

Global Settings - GL accum. depr./amort. acct.

dialog displays.

3. Edit or enter a new name in the

Global setting

field.

4. If desired, enter descriptive text in the

Field tip

field to be displayed in the left area of the status

bar.

5.

Do any of the following:

To move the position of an item in the picklist, select an item and click Move Up or

Move Down.

To delete items from the picklist, select an item and select Delete.

To clear the entire picklist, select Clear list.

To list the items alphabetically, check the Sort list alphabetically box.

To add an item to the picklist, enter a new item in the

Edit item

field and click Add.

To change an item, highlight or double-click an existing item. The selected item displays

in the

Edit item

field. Make changes to the item in the

Edit item

field. Click Apply to

update the picklist or Clear field to abandon your changes.

6. Click OK to save your changes and exit this dialog.

7. Click Close.

Creating Global Settings for GL Asset Accounts

(Tools > Global Settings > GL Asset Account)

To create a Global Setting for GL Asset Accounts, do the following:

1. To display the

Global Settings List - GL asset accounts

dialog, do one of the following:

Select Tools > Global Settings > GL Asset Account.

Click Global Settings Menu and select GLAsset Account.

2. Click New. The

Global Settings - GL asset account

dialog displays.

3. Edit or enter a new name in the

Global setting

field.

4. If desired, enter descriptive text in the

Field tip

field to be displayed in the left area of the status

bar.

Chapter 2 - Installing CCH ProSystemfx Fixed Assets • 30

5.

Do any of the following:

To move the position of an item in the picklist, select an item and click Move Up or

Move Down.

To delete items from the picklist, select an item and select Delete.

To clear the entire picklist, select Clear list.

To list the items alphabetically, check the Sort list alphabetically box.

To add an item to the picklist, enter a new item in the

Edit item

field and click Add.

To change an item, highlight or double-click an existing item. The selected item displays

in the

Edit item

field. Make changes to the item in the

Edit item

field. Click Apply to

update the picklist or Clear field to abandon your changes.

6. Click OK to save your changes and exit this dialog.

7. Click Close.

Creating Global Settings for GL Depr/Amort Exp Accounts

(Tools > Global Settings > GL Depr Amort Exp Acct)

To create a Global Setting for GL Depr/Amort Exp Accounts, do the following:

1. To display the

Global Settings List - GL depr./amort. exp. accts.

dialog, do one of the

following:

Select Tools > Global Settings > GL Depr Amort Exp Acct.

Click Global Settings Menu and select GLDepr/Amort Exp Acct.

2. Click New. The

Global Settings - GL depr./amort. exp. acct.

dialog displays.

3. Edit or enter a new name in the

Global setting

field.

4. If desired, enter descriptive text in the

Field tip

field to be displayed in the left area of the status

bar.

5.

Do any of the following:

To move the position of an item in the picklist, select an item and click Move Up or

Move Down.

To delete items from the picklist, select an item and select Delete.

To clear the entire picklist, select Clear list.

To list the items alphabetically, check the Sort list alphabetically box.

To add an item to the picklist, enter a new item in the

Edit item

field and click Add.

To change an item, highlight or double-click an existing item. The selected item displays

in the

Edit item

field. Make changes to the item in the

Edit item

field. Click Apply to

update the picklist or Clear field to abandon your changes.

6. Click OK to save your changes and exit this dialog.

7. Click Close.

Chapter 2 - Installing CCH ProSystemfx Fixed Assets • 31

Creating Global Settings for Locations

(Tools > Global Settings > Locations)

To create a Global Setting for Locations, do the following:

1. To display the

Global Settings List - Locations

dialog, do one of the following:

Select Tools > Global Settings > Locations.

Click Global Settings Menu and select Locations.

2. Click New. The

Global Settings - Location

dialog displays.

3. Edit or enter a new name in the

Global setting

field.

4. If desired, enter descriptive text in the

Field tip

field to be displayed in the left area of the status

bar.

5.

Do any of the following:

To move the position of a location in the picklist, select a location and click Move Up or

Move Down.

To delete locations from the picklist, select a location and select Delete.

To clear the entire picklist, select Clear list.

To list the locations alphabetically, check the Sort list alphabetically box.

To add a location to the picklist, enter a new location in the

Edit item

field and click Add.

To change an item, highlight or double-click an existing location. The selected location

displays in the

Edit item

field. Make changes to the location in the

Edit item

field. Click

Apply to update the picklist or Clear field to abandon your changes.

6. Click OK to save your changes and exit this dialog.

7. Click Close.

Creating Global Settings for Reports

(Tools > Global Settings > Reports)

Report properties cannot be customized for Form 4797.

To create a Global Setting for reports or forms, do the following:

1. To display the

Global Settings List - Reports

dialog, do one of the following:

Select Tools > Global Settings > Reports.

Click Global Settings Menu and select Reports.

2. Click New. The

Global Settings - Reports

dialog displays.

3. Edit the contents of the

Global setting name

field as needed.

Chapter 2 - Installing CCH ProSystemfx Fixed Assets • 32

4.

Do one or more of the following as needed:

To modify a report's settings, select a report from the

Reports list

and click Properties.

Make the needed configurations and click OK.

To set the report formatting options, click Set Reporting Format. Make the necessary

changes and click OK.

To modify settings for Form 4562, select the form in the

Forms list

and click Form

Properties. Make the needed configurations and click OK.

5. Click OK on the

Global Settings - Reports

dialog to save settings.

6. Click Close.

Creating Global Settings for Report Sets

(Tools > Global Settings > Report Sets)

Book overrides do not apply to certain reports.

To create a Global Setting for report sets, do the following:

1. To display the

Global Settings List - Report Sets

dialog, do one of the following:

Select Tools > Global Settings > Report Sets.

Click Global Settings Menu and select Report Sets.

2. Click New to display the

Edit Report Set

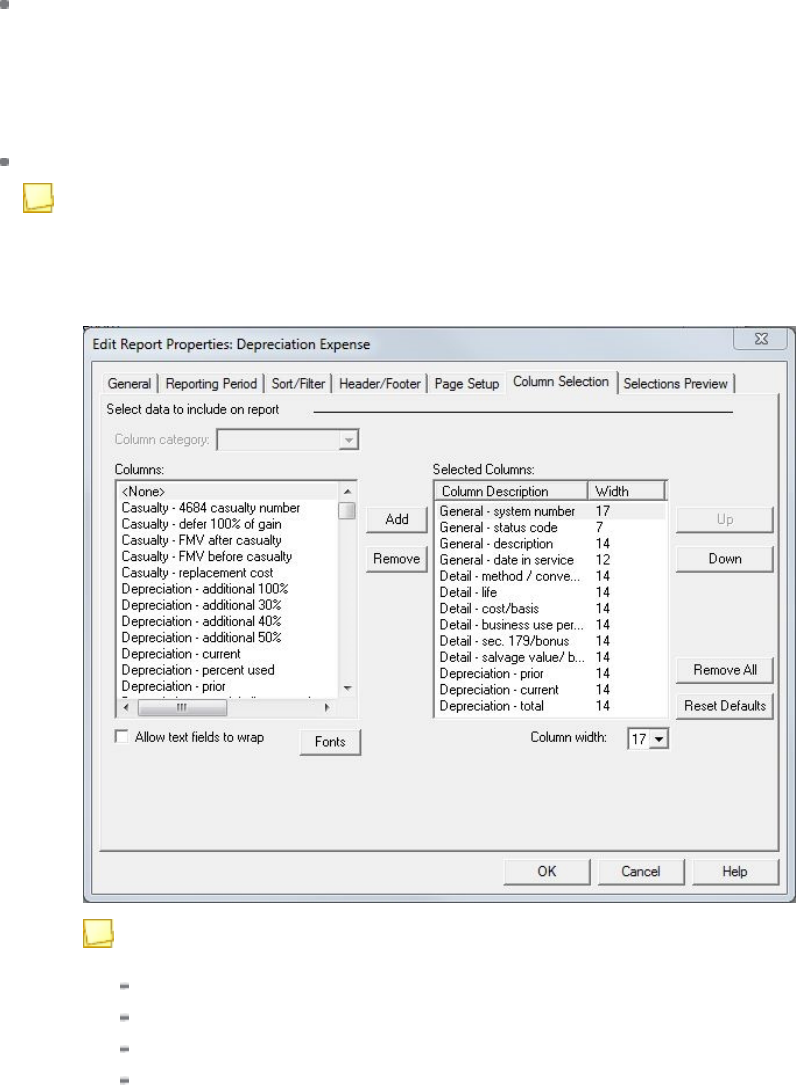

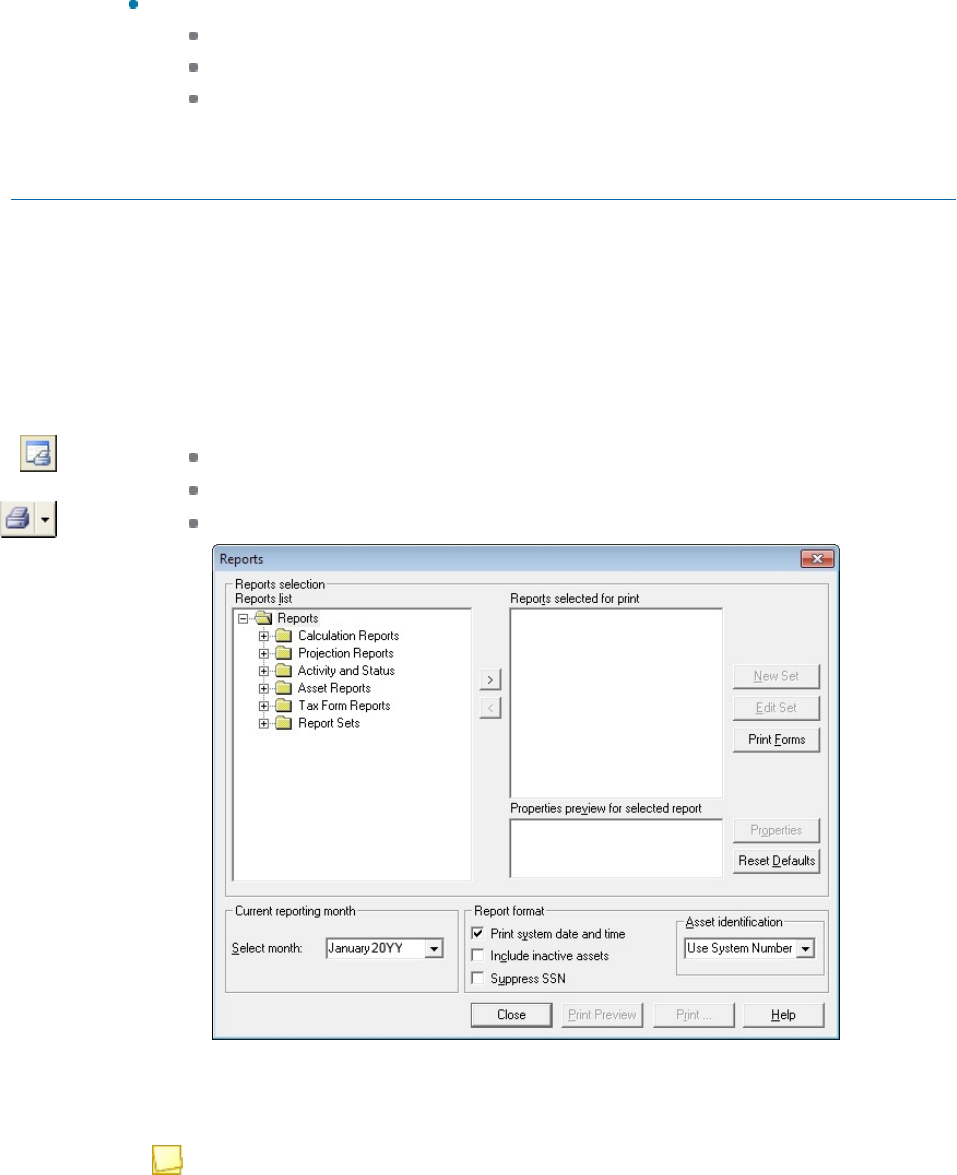

dialog.