As filed with the Securities and Exchange Commission on February 15, 2024.

File No.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10

GENERAL FORM FOR REGISTRATION OF SECURITIES

Pursuant to Section 12(b) or (g) of

the Securities Exchange Act of 1934

GE VERNOVA LLC*

(Exact name of registrant as specified in its charter)

Delaware 92-2646542

(State or other jurisdiction

of incorporation or organization)

(I.R.S. Employer

Identification No.)

58 Charles Street

Cambridge, Massachusetts 02141

(Address of principal executive office) (Zip Code)

(617) 674-7555

(Registrant’s telephone number)

Securities to be registered pursuant to Section 12(b) of the Act:

Title of each class

to be so registered

Name of each exchange

on which each class is to be registered

Common stock, par value $0.01 per share New York Stock Exchange

Securities to be registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated

filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated

filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the

Exchange Act.

Large accelerated filer ‘ Accelerated filer ‘

Non-accelerated filer È Smaller reporting company ‘

Emerging growth company ‘

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended

transition period for complying with any new or revised financial accounting standards provided pursuant to

Section 13(a) of the Exchange Act. ‘

* GE Vernova LLC will convert into a corporation and will be renamed GE Vernova Inc. prior to the

completion of the Spin-Off (as defined in Exhibit 99.1).

GE VERNOVA LLC

INFORMATION REQUIRED IN REGISTRATION STATEMENT

CROSS-REFERENCE SHEET BETWEEN INFORMATION STATEMENT

AND ITEMS OF FORM 10

This Registration Statement on Form 10 incorporates by reference information contained in the information

statement filed herewith as Exhibit 99.1 (the “Information Statement”).

Item 1. Business.

The information required by this item is contained under the sections of the Information Statement entitled

“Information Statement Summary,” “The Spin-Off,” “Management’s Discussion and Analysis of Financial

Condition and Results of Operations,” “Our Industry,” “Our Business,” “Certain Relationships and Related

Person Transactions,” and “Where You Can Find More Information.” Those sections are incorporated herein by

reference.

Item 1A. Risk Factors.

The information required by this item is contained under the sections of the Information Statement entitled “Risk

Factors” and “Cautionary Statement Concerning Forward-Looking Statements.” Those sections are incorporated

herein by reference.

Item 2. Financial Information.

The information required by this item is contained under the sections of the Information Statement entitled

“Capitalization,” “Unaudited Pro Forma Condensed Combined Financial Statements,” “Management’s

Discussion and Analysis of Financial Condition and Results of Operations,” and “Index to the Financial

Statements,” and the financial statements referenced therein. Those sections are incorporated herein by reference.

Item 3. Properties.

The information required by this item is contained under the section of the Information Statement entitled “Our

Business—Properties.” That section is incorporated herein by reference.

Item 4. Security Ownership of Certain Beneficial Owners and Management.

The information required by this item is contained under the section of the Information Statement entitled

“Security Ownership of Certain Beneficial Owners and Management.” That section is incorporated herein by

reference.

Item 5. Directors and Executive Officers.

The information required by this item is contained under the section of the Information Statement entitled

“Management.” That section is incorporated herein by reference.

Item 6. Executive Compensation.

The information required by this item is contained under the sections of the Information Statement entitled

“Director Compensation” and “Executive Compensation.” Those sections are incorporated herein by reference.

Item 7. Certain Relationships and Related Transactions, and Director Independence.

The information required by this item is contained under the sections of the Information Statement entitled

“Management” and “Certain Relationships and Related Person Transactions.” Those sections are incorporated

herein by reference.

Item 8. Legal Proceedings.

The information required by this item is contained under the sections of the Information Statement entitled “Our

Business—Legal Proceedings” and Note 20, “Commitments, Guarantees, Product Warranties, and Other Loss

Contingencies—Legal Matters” to the audited combined financial statements. Those sections are incorporated

herein by reference.

Item 9. Market Price of, and Dividends on, the Registrant’s Common Equity and Related Stockholder

Matters.

The information required by this item is contained under the sections of the Information Statement entitled

“Questions and Answers About GE’s Reasons for the Spin-Off,” “The Spin-Off,” “Dividend Policy,”

“Capitalization,” “Material U.S. Federal Income Tax Consequences of the Spin-Off,” and “Description of Our

Capital Stock.” Those sections are incorporated herein by reference.

Item 10. Recent Sales of Unregistered Securities.

The information required by this item is contained under the section of the Information Statement entitled

“Description of Our Capital Stock.” That section is incorporated herein by reference.

Item 11. Description of Registrant’s Securities to Be Registered.

The information required by this item is contained under the sections of the Information Statement entitled

“Questions and Answers About GE’s Reasons for the Spin-Off,” “The Spin-Off,” “Dividend Policy,” and

“Description of Our Capital Stock.” Those sections are incorporated herein by reference.

Item 12. Indemnification of Directors and Officers.

The information required by this item is contained under the section of the Information Statement entitled

“Description of Our Capital Stock—Limitation on Liability of Directors and Indemnification of Directors and

Officers.” That section is incorporated herein by reference.

Item 13. Financial Statements and Supplementary Data.

The information required by this item is contained under the sections of the Information Statement entitled

“Unaudited Pro Forma Condensed Combined Financial Statements,” “Index to the Financial Statements,” and the

financial statements referenced therein. Those sections are incorporated herein by reference.

Item 14. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure.

Not applicable.

Item 15. Financial Statements and Exhibits.

(a) Financial Statements

The information required by this item is contained under the sections of the Information Statement entitled

“Unaudited Pro Forma Condensed Combined Financial Statements,” “Index to the Financial Statements,” and the

financial statements referenced therein. Those sections are incorporated herein by reference.

(b) Exhibits

The following documents are filed as exhibits hereto:

Exhibit

Numbers Exhibit Description

2.1 Separation and Distribution Agreement, by and between General Electric Company and the

registrant.†

+

3.1 Form of Certificate of Incorporation of the registrant.*

3.2 Form of Bylaws of the registrant.*

10.1 Form of Transition Services Agreement, by and between General Electric Company and the

registrant.*

+

10.2 Form of Tax Matters Agreement, by and between General Electric Company and the registrant.†

+

*

10.3 Form of Employee Matters Agreement, by and between General Electric Company and the

registrant.*

10.4 Form of Trademark License Agreement, by and between General Electric Company and a subsidiary

of the registrant.*†

+

10.5 Form of Real Estate Matters Agreement, by and between General Electric Company and the

registrant.*

+

10.6 Form of Indemnification Agreement.*

10.7 Form of GE Vernova Long-Term Incentive Plan.

10.8 Form of GE Vernova Mirror 2022 Long-Term Incentive Plan.

10.9 Form of GE Vernova Mirror 2007 Long-Term Incentive Plan.

10.10 Form of GE Vernova Mirror 1990 Long-Term Incentive Plan.

10.11 Offer Letter with Kenneth Parks.*

10.12 Offer Letter with Rachel Gonzalez.†*

10.13 Offer Letter with Steven Baert.†*

10.14 Employment Agreement with Maví Zingoni.†*

10.16 GE Energy Supplementary Pension Plan.*

10.17 GE Energy Excess Benefits Plan.*

10.18 Amended GE Vernova Annual Executive Incentive Plan.

10.19 GE Vernova Restoration Plan.

10.20 GE Vernova U.S. Executive Severance Plan.

10.21 Framework Investment Agreement.†

+

21.1 Subsidiaries of the registrant.

99.1 Preliminary Information Statement.

99.2 Form of Notice of Internet Availability of Information Statement Materials.

* Previously filed.

** To be filed by amendment.

† Certain portions of this exhibit have been redacted pursuant to Item 601(b)(2)(ii) and Item 601(b)(10)(iv) of

Regulation S-K, as applicable. The Company agrees to furnish supplementally an unredacted copy of the

exhibit to the Securities and Exchange Commission upon its request.

+ Certain schedules and exhibits to this agreement have been omitted pursuant to Item 601(b)(5) of

Regulation S-K. The Company agrees to furnish supplementally a copy of any omitted schedule or exhibit

to the Securities and Exchange Commission upon its request.

SIGNATURES

Pursuant to the requirements of Section 12 of the Securities Exchange Act of 1934, the registrant has duly caused

this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized.

GE VERNOVA LLC

By:

/s/ Robert M. Giglietti

Name: Robert M. Giglietti

Title: President & Treasurer

Date: February 15, 2024

, 2024

Dear GE Shareholders:

It has been just over two years since we announced our intention to form three independent investment-

grade industry-leading public companies. In early 2023, we successfully completed the spin-off of GE

HealthCare, and now, we are approaching the spin-off of GE Vernova and launch of GE Aerospace in the

beginning of the second quarter of 2024. Each of these companies are global leaders in vital industries,

continuing to become more important over time, and, notably, each will carry forward GE’s inimitable DNA

centered on innovation, customer focus, and humility.

Our teams have worked hard to prepare for life as independent companies and now are getting ready to

launch. As we’re already seeing take hold at GE HealthCare, as standalone companies, GE Vernova and GE

Aerospace will benefit from greater focus on their customers and increased capital allocation and strategic

flexibility to pursue high-quality growth in their specific industries. They are attracting broader and deeper

teams, boards, and investor bases that want to be a part of GE Aerospace and GE Vernova, each offering

missions with its own appeal. Both companies have made tremendous strides in creating lean cultures of

accountability, problem solving, and customer focus. Both companies also will have strong financial profiles and

investment-grade ratings that provide a foundation for targeted investments in growth and innovation.

The distribution to GE shareholders of shares of common stock of GE Vernova will provide current GE

shareholders with proportional ownership interest in GE Vernova. GE Vernova is uniquely positioned to

accelerate the energy transition and advance global sustainability. With an installed base of 7,000 gas

turbines–the world’s largest–and approximately 55,000 wind turbines, its technology helps generate

approximately 30% of the world’s electricity. GE Vernova provides solutions to customers to meet the strong

global demand to increase electrification and decarbonization levels by delivering critical energy transition

technologies and services. GE Vernova’s leadership team has extensive functional and industry expertise in

driving global sustainability, as well as a deep commitment to continuous improvement through lean. As a

standalone company, GE Vernova will build on its extraordinary track record of innovation, continuing to

develop and commercialize breakthrough technologies that enable the energy transition, while executing on its

strategy to grow profitably with strong free cash flow generation.

The GE Vernova distribution will be the form of a pro rata distribution to GE shareholders of all of the

outstanding shares of GE Vernova. The distribution is intended to be tax-free to GE shareholders for U.S. federal

income tax purposes. Shareholder approval is not required, and you do not need to take any action to receive

shares of GE Vernova to which you are entitled as a GE shareholder. You do not need to pay any consideration

or surrender or exchange your shares of GE common stock to participate in the spin-off.

Upon the spin-off of GE Vernova, GE shareholders as of the spin-off date also will continue to hold their

shares of GE, which will be listed on the NYSE under the ticker “GE” with the name “GE Aerospace”. GE

Aerospace’s sole focus will be executing its bold vision to invent the future of flight, lift people up, and bring

them home safely. With nearly 41,000 commercial engines at work in more than 70% of global airlines, and a

diverse portfolio of more than 26,000 defense engines, this exceptional franchise is a global aerospace leader.

And more than 70% of its revenue is derived from aftermarket services that not only have attractive economics,

but also keeps the team closer than ever to our customers. GE Aerospace will continue to generate significant

value for decades to come, leveraging the quality of its technology and product development plans, the energy

and collaboration of its team, and its positioning as the industry’s largest and youngest fleet.

I encourage you to read the attached Information Statement carefully, which is being provided to all holders

of GE shares as of the record date for the distribution of shares of GE Vernova common stock. The Information

Statement describes the separation in detail and contains important business and financial information about GE

Vernova.

Our futures are bright. As an independent company, GE Vernova will be even better positioned to accelerate

the energy transition and drive sustainability, focused on delivering disciplined revenue growth today while

innovating to create incremental value tomorrow. We thank you for your investment in GE.

Sincerely,

H. Lawrence Culp, Jr.

Chairman and CEO, GE

Chairman and CEO, GE Aerospace

, 2024

Dear Future GE Vernova Stockholders,

I am excited to welcome you as stockholders of GE Vernova, a purpose-built company developing, delivering

and servicing critical technologies that accelerate the energy transition. We create a more sustainable world,

enabling our customers to increase electrification and decarbonization levels, which improves the quality of life

of the communities and people our customers serve.

Communities around the world face significant challenges in maintaining a reliable, affordable and secure

electricity system, while also increasing access to electricity and reducing emissions. Demand for electricity is

expected to grow over 50% by 2040 given electrification of economies and as approximately 750 million people

lack electricity. Electricity generation from the power sector emits approximately 13 gigatons of CO

2

annually and

the entire power sector accounts for 40% of total global manmade CO

2

emissions. The increase in electricity

needed, along with the focus on decarbonization, will require generation capacity to almost double to 16,000 GW –

driving annual electricity related investment from just over $1.0 trillion to over $2.0 trillion.

GE Vernova delivers solutions to these challenges, through our significant scale and diversity of offerings that

serve the energy transition, building on more than 130 years of history as an industry leader. Many of the world’s

leading utilities, developers, governments and large industrial electricity users rely on our installed base to

generate approximately 30% of the world’s electricity – as well as to move this electricity reliably and

efficiently.

Our leadership in innovation will remain a key enabler for customers in their efforts to meet long-term

sustainability goals. We invest approximately $1 billion annually in R&D – and do so efficiently often with

partners or other third parties. These efforts drive critical breakthroughs across a range of technologies, such as

energy storage, hydrogen, carbon capture, small modular nuclear reactors, advanced wind turbines and electricity

software.

We achieved significantly better financial results in 2023 and will continue to improve profitability and cash

flow, as well as reduce risk, through better contracting on both the sale of new equipment and solutions we

provide. We also remain committed to our lean operating model to drive productivity, quality, and cost

improvements, which will bring margin expansion as well as the delivery of high quality products and services to

our customers. The GE Vernova Way, the principles we run our company on, prioritizes Safety, Quality,

Delivery and Cost (SQDC) – with safety coming first, for our employees, contractors, customers and other

stakeholders.

Growing demand from the multi-decade energy transition ahead along with our own cost and productivity efforts

will drive shareholder value. We will increase earnings and deliver stronger, more resilient cash flow, all while

enabling our customers to provide more reliable, affordable and sustainable electricity to the communities they

serve. Combating climate change and advancing sustainability remain global challenges, but also create

significant opportunities for GE Vernova, in supporting customer investments necessary to meet these

challenges. Our company is positioned for an attractive future – our leadership team and employees look forward

to sharing our success with you, our stockholders, and with the broader global community.

Scott L. Strazik

Chief Executive Officer

Information contained herein is subject to completion or amendment. A registration statement on Form 10 relating to these securities has been filed with the

Securities and Exchange Commission under the Securities Exchange Act of 1934, as amended.

Subject to Completion—Dated February 15, 2024

INFORMATION STATEMENT

GE Vernova LLC

Common Stock

(par value $0.01 per share)

We are sending you this Information Statement in connection with the spin-off (“Spin-Off”) by General Electric

Company (“GE”) of its wholly-owned subsidiary, GE Vernova LLC (together with its subsidiaries, “GE

Vernova,” the “Company,” “we,” “us,” or “our”), which holds GE’s renewable energy, power, and digital

businesses. GE Vernova LLC will convert into a corporation and will be renamed GE Vernova Inc. prior to the

completion of the Spin-Off.

To consummate the Spin-Off, GE will distribute all our common stock on a pro rata basis to the holders of GE

common stock (the “GE stockholders”). We expect that the distribution of our common stock will be tax-free to

holders of GE common stock for U.S. federal income tax purposes, except for cash that stockholders may receive

(if any) in lieu of fractional shares.

If you are a record holder of GE common stock as of the close of business on , 2024 which is the record

date for the Spin-Off, you will be entitled to receive share of our common stock for every

shares of GE common stock that you hold on that date. GE will distribute its shares of our common stock in

book-entry form, which means that we will not issue physical stock certificates. Equiniti Trust Company, LLC

(the “Distribution Agent”) will not distribute any fractional shares of our common stock.

The Spin-Off will be effective as of , New York City time, on , 2024. Immediately after the

Spin-Off becomes effective, we will be an independent, publicly traded company.

GE stockholders are not required to vote on or take any other action to approve the Spin-Off. We are not asking

you for a proxy, and request that you do not send us a proxy. GE stockholders will not be required to pay any

consideration for the shares of our common stock they receive in the Spin-Off, and they will not be required to

surrender or exchange their shares of GE common stock or take any other action in connection with the Spin-Off.

No trading market for our common stock currently exists. We expect, however, that a limited trading market for

our common stock, commonly known as a “when-issued” trading market, will develop as early as three days

prior to the distribution date, and we expect “regular-way” trading of our common stock will begin on the first

trading day after the distribution date. We have applied to list our common stock on the New York Stock

Exchange under the ticker symbol “GEV.”

In reviewing this Information Statement, you should carefully consider the matters

described in the section entitled “Risk Factors” beginning on page 24 of this Information

Statement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or

disapproved these securities or determined if this Information Statement is truthful or complete. Any

representation to the contrary is a criminal offense.

This Information Statement is not an offer to sell, or a solicitation of an offer to buy, any securities.

The date of this Information Statement is , 2024.

TABLE OF CONTENTS

Page

Trademarks and Copyrights ............................................................... ii

Industry, Ranking, and Market Data ........................................................ ii

Non-GAAP Financial Data ................................................................ ii

Questions and Answers About GE’S Reasons for the Spin-Off ................................... iv

Information Statement Summary ........................................................... 1

Risk Factors ........................................................................... 24

Cautionary Statement Concerning Forward-Looking Statements .................................. 60

The Spin-Off ........................................................................... 62

Dividend Policy ........................................................................ 68

Capitalization .......................................................................... 69

Unaudited Pro Forma Condensed Combined Financial Statements ................................. 70

Our Industry ........................................................................... 80

Our Business ........................................................................... 92

Management’s Discussion and Analysis of Financial Condition and Results of Operations ............. 128

Management ........................................................................... 155

Director Compensation ................................................................... 164

Executive Compensation ................................................................. 165

Security Ownership of Certain Beneficial Owners and Management ............................... 185

Certain Relationships and Related Person Transactions ......................................... 187

Material U.S. Federal Income Tax Consequences of the Spin-Off ................................. 195

Description of Our Capital Stock ........................................................... 199

Where You Can Find More Information ..................................................... 204

Index to Combined Financial Statements ..................................................... F-1

i

TRADEMARKS AND COPYRIGHTS

GE and the GE Monogram Logo are trademarks of the General Electric Company. Logos, trademarks, service

marks, trade names, and copyrights referred to in this Information Statement belong to us or are licensed for our

use. Solely for convenience, we refer to our intellectual property (“IP”) assets in this Information Statement

without the

™

,

®

, and

©

symbols, but such references are not intended to indicate that we will not assert, to the

fullest extent under applicable law, our rights to our intellectual property assets. Other logos, trademarks, service

marks, trade names, and copyrights referred to in this Information Statement are the property of their respective

owners.

INDUSTRY, RANKING, AND MARKET DATA

This Information Statement contains various historical and projected information concerning our industry, the

markets in which we participate, and our positions in these markets. Some of this information is from industry

publications and other third-party sources, and other information is from our own analysis of data received from

these third-party sources, our own internal data, and market research that our management team commissions for

our own evaluations and planning.

All of this information involves a variety of assumptions, limitations, and

methodologies and is inherently subject to uncertainties, and therefore you are cautioned not to give undue

weight to these estimates. All references to the information published by the IEA refer to information contained

in the International Energy Agency, World Energy Outlook 2023.

NON-GAAP FINANCIAL DATA

All financial information presented in this Information Statement is derived from the combined financial

statements of the Company included elsewhere in this Information Statement. All financial information presented

in this Information Statement has been prepared in U.S. Dollars in accordance with generally accepted

accounting principles in the United States of America (“U.S. GAAP”), except for the presentation of the

following non-GAAP financial measures: Organic Revenues, Organic Segment EBITDA, Adjusted EBITDA,

Adjusted EBITDA Margin, Adjusted Organic EBITDA, Adjusted Organic EBITDA Margin, Adjusted Net

Income, Adjusted Net Income Margin, and free cash flow.

We present Organic Revenues, Organic Segment EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin,

Adjusted Organic EBITDA, Adjusted Organic EBITDA Margin, Adjusted Net Income, Adjusted Net Income

Margin, and free cash flow in this Information Statement because we believe such measures provide investors

with additional information to measure our performance. Please refer to “Management’s Discussion and Analysis

of Financial Condition and Results of Operations—Non-GAAP Financial Measures” for an explanation on why

we use these non-GAAP financial measures, their definitions, and their limitations, and reconciliations to their

nearest U.S. GAAP financial measures.

Because of their limitations, these non-GAAP financial measures are not intended as alternatives to U.S. GAAP

financial measures as indicators of our operating performance and should not be considered as measures of cash

available to us to invest in the growth of our business or that will be available to us to meet our obligations. We

compensate for these limitations by using these non-GAAP financial measures along with other comparative

tools, together with U.S. GAAP financial measures, to assist in the evaluation of operating performance.

BASIS OF PRESENTATION

Unless otherwise indicated or the context otherwise requires, references in this Information Statement to:

(i) the “Company,” “GE Vernova,” “we,” “us,” and “our” refer to GE Vernova LLC (a newly formed

holding company) and its direct and indirect subsidiaries after giving effect to the Spin-Off. GE

ii

Vernova LLC will convert into a corporation and will be renamed GE Vernova Inc. prior to the

completion of the Spin-Off;

(ii) the “Board” or “our Board” refers to the board of directors of the Company;

(iii) the “bylaws” refers to our bylaws that will become effective as part of the Spin-Off, the form of which

is filed as an exhibit to our registration statement on Form 10 of which this Information Statement is a

part;

(iv) the “certificate of incorporation” refers to our certificate of incorporation that will become effective as

part of the Spin-Off, the form of which is filed as an exhibit to our registration statement on Form 10 of

which this Information Statement is a part;

(v) the “Spin-Off” refers to the transaction in which GE will distribute to its stockholders all of the shares

of our common stock;

(vi) the “Exchange” refers to the New York Stock Exchange;

(vii) “GE” refers to General Electric Company and its direct and indirect subsidiaries;

(viii) the “GE Board” refers to the board of directors of General Electric Company;

(ix) “stockholders” or “shareholders” refers to shareholders of General Electric Company or stockholders

of GE Vernova, depending on the context;

(x) the “Reorganization Transactions” refer to a series of internal reorganization transactions that GE will

undertake prior to, at, or after the Spin-Off, pursuant to which, among other transactions, GE Vernova

will hold, through its subsidiaries, GE’s renewable energy, power and digital businesses; and

(xi) the “GE Vernova business” refers to GE’s renewable energy, power, and digital businesses.

Certain percentages and other figures provided and used in this Information Statement may not add up to 100.0%

due to the rounding of individual components. In this Information Statement, we present estimated U.S. dollar

amounts for the industries in which we operate.

On November 9, 2021, GE announced its plans to form three independent, industry-leading, investment grade

public companies from (i) GE’s aviation business (“GE Aerospace”), (ii) GE’s healthcare business, GE

HealthCare Technologies Inc. (“GE HealthCare”), and (iii) GE’s energy business, GE Vernova. To accomplish

this, GE completed the tax-free spin-off of GE HealthCare on January 3, 2023 (the “GE HealthCare Spin-Off”)

and intends to execute the tax-free spin-off of GE Vernova in the beginning of the second quarter of 2024. This

Information Statement only relates to the Spin-Off of GE Vernova and does not apply to the GE HealthCare

Spin-Off.

In connection with the reverse stock split of GE’s shares of common stock effective on July 30, 2021, the holders

of GE share certificates were notified to surrender their GE share certificates in order to receive one post-split

share of GE common stock in exchange for eight pre-split shares of GE common stock. As of December 6, 2023,

approximately 158,264,159 GE shares of common stock continue to be held in certificated form. If you continue

to hold GE common stock in certificated form, you are encouraged to contact Equiniti Trust Company, LLC,

GE’s exchange agent for the reverse stock split, in order to exchange your GE share certificates representing

pre-split shares of GE common stock for (a) a statement indicating the number of newly issued shares of post-

split GE common stock held by you electronically in book-entry form together with a check for cash in lieu of

any fractional shares and any accrued dividends of GE paid prior to the date that you exchange your GE share

certificates, and (b) a statement indicating the number of newly issued shares of common stock of GE HealthCare

that you were entitled to receive in the GE HealthCare Spin-Off together with a check for cash in lieu of any

fractional shares and any accrued dividends of GE HealthCare paid prior to the date that you exchange your GE

share certificates. If you do not exchange your GE share certificates prior to the Spin-Off, you will also be

entitled to receive upon exchange of your GE share certificates a statement indicating the number of newly

iii

issued shares of our common stock in the Spin-Off together with cash in lieu of any fractional shares and any

accrued dividends of GE Vernova paid prior to the date you exchange your GE share certificates. However, you

will not receive any such shares of our common stock until you exchange your GE share certificates.

QUESTIONS AND ANSWERS ABOUT GE’S REASONS FOR THE SPIN-OFF

The following provides only a summary of certain information regarding GE’s reasons for the Spin-Off. You

should read this Information Statement in its entirety for a more detailed description of the matters described

below.

Q: What spin-offs has GE announced?

A: On November 9, 2021, GE announced its plan to form three independent, industry-leading, investment grade

public companies: (i) GE Aerospace, (ii) GE HealthCare, and (iii) GE’s energy business, GE Vernova. To

accomplish this, GE completed the GE HealthCare Spin-Off on January 3, 2023 and intends to execute the

tax-free spin-off of GE Vernova in the beginning of the second quarter of 2024. The separation of the three

businesses into stand-alone public companies is intended, among other things, to better position the management

of each business to focus and pursue opportunities for long-term growth and profitability unique to each

company’s business and to allow each business to more effectively implement its capital allocation strategies.

This Information Statement only relates to the spin-off of GE Vernova and does not apply to the previously

completed GE HealthCare Spin-Off.

Q: Why I am receiving this document?

A: GE is making this document available to you because you are a GE stockholder. If you are a holder of GE

common stock as of the close of business on the Record Date (as defined below), you will be entitled to receive a

distribution of share of our common stock for every shares of common stock of GE that you

hold on that date. This document will help you understand how the Spin-Off will result in your ownership of

shares in the Company and the operations of the Company as a stand-alone entity.

Q: What are the reasons for the Spin-Off?

A: The GE Board believes that the separation of the GE Vernova business from GE is in the best interests of GE

and its stockholders and for the success of the GE Vernova business for a number of reasons. See “The

Spin-Off—Reasons for the Spin-Off.”

Q: Why is our separation structured as a spin-off?

A: GE believes that a distribution of our shares that is tax-free to GE and its stockholders for U.S. federal income

tax purposes is the most efficient way to separate our business from GE.

Questions and Answers about the Spin-Off

The following provides only a summary of certain information regarding the Spin-Off. You should read this

Information Statement in its entirety for a more detailed description of the matters described below.

Q: What is the Spin-Off?

A: The Spin-Off is the method by which we will separate from GE. In the Spin-Off, GE will distribute to its

stockholders all of the outstanding shares of our common stock. Following the Spin-Off, we will be an

independent, publicly traded company.

iv

Q: Is the completion of the Spin-Off subject to the satisfaction or waiver of any conditions?

A: Yes, the completion of the Spin-Off is subject to the satisfaction, or the GE Board’s waiver, of certain

conditions. Any of these conditions may be waived by the GE Board to the extent such waiver is permitted by

law. In addition, GE may at any time until the Spin-Off decide to abandon the Spin-Off or modify or change the

terms of the Spin-Off. See “The Spin-Off—Conditions to the Spin-Off.” Alternatively, GE may waive any of the

conditions to the Spin-Off and proceed with the Spin-Off even if all such conditions have not been met. If GE

waives any such condition and the Spin-Off is completed, such waiver could have a material adverse effect on

GE’s and GE Vernova’s respective business, financial condition, or results of operations, the trading price of

GE’s common stock, or the ability of stockholders to sell their shares after the Spin-Off, including, without

limitation, as a result of illiquid trading due to the failure of our common stock to be accepted for listing or

litigation giving rise to any preliminary or permanent injunctions sought to prevent the consummation of the

Spin-Off. If GE elects to proceed with the Spin-Off notwithstanding that one or more of the conditions to the

Spin-Off has not been met, GE will evaluate the applicable facts and circumstances at that time and make such

additional disclosure and take such other actions as GE determines to be necessary or appropriate in accordance

with applicable law.

In particular, if GE waives the condition that GE will receive an opinion from each of Paul, Weiss, Rifkind,

Wharton & Garrison LLP and Ernst & Young LLP to the effect that the Spin-Off will qualify for non-recognition

of gain and loss under Section 355 and related provisions of the Code, then GE would notify its stockholders (1)

by filing an amendment to the Registration Statement on Form 10 of which this Information Statement forms a

part if the waiver occurs before the Registration Statement becomes effective or (2) by filing a Current Report on

Form 8-K if the waiver occurs after the Registration Statement becomes effective, as described in “The Spin-

Off—Conditions to the Spin-Off.” If GE waives that condition and then it is determined that the Spin-Off does

not qualify for non-recognition of gain and loss under Section 355 and related provisions of the Code, then in

addition to the potential material adverse effects described above, there could be material adverse tax

consequences to GE and its stockholders. See “Risk Factors—Risks Relating to the Spin-Off—The Spin-Off

could result in significant tax liability to GE and its stockholders if it is determined to be a taxable transaction”

and “Material U.S. Federal Income Tax Consequences of the Spin-Off.” GE does not currently intend to waive

this condition to the Spin-Off.

Q: Can GE cancel the Spin-Off even if all conditions have been met?

A: Yes. Until the Spin-Off has occurred, GE has the right to not effect the Spin-Off, even if all of the conditions

are satisfied. See the section entitled “The Spin-Off—Conditions to the Spin-Off.”

Q: Will the number of GE shares I own change as a result of the Spin-Off?

A: No, the number of shares of GE common stock you own will not change as a result of the Spin-Off.

Q: Will the Spin-Off affect the trading price of my GE common stock?

A: GE believes that our separation from GE offers its stockholders the greatest long-term value. There can be no

assurance that, following the Spin-Off, the combined trading prices of the GE common stock and our common

stock will equal or exceed what the trading price of GE common stock would have been in the absence of the

Spin-Off. It is possible that after the Spin-Off, our and GE’s combined equity value will be less than GE’s equity

value before the Spin-Off. We expect the trading price of GE’s shares of common stock will be lower than

immediately prior to the Spin-Off, as they will no longer reflect the value of the GE Vernova business.

Q: What will I receive in the Spin-Off in respect of my GE common stock?

A: As a holder of GE common stock, you will receive a distribution of share of our common stock for

every shares of GE common stock you hold on the Record Date. The Distribution Agent will distribute

v

only whole shares of our common stock in the Spin-Off. See “The Spin-Off—Treatment of Fractional Shares”

for more information on the treatment of the fractional share you might otherwise be entitled to receive in the

Spin-Off. Your proportionate interest in GE will not change as a result of the Spin-Off. For a more detailed

description, see “The Spin-Off.”

Q: What is being distributed in the Spin-Off?

A: GE will distribute approximately shares of our common stock in the Spin-Off, based on the

approximately shares of GE common stock outstanding as of , 2024. The actual number of

shares of our common stock that GE will distribute will depend on the total number of shares of GE common

stock outstanding on the Record Date. The shares of our common stock that GE distributes will constitute all of

the issued and outstanding shares of our common stock immediately prior to the Spin-Off. For more information

on the shares being distributed in the Spin-Off, see “Description of Our Capital Stock—Common Stock.”

Q: What do I have to do to participate in the Spin-Off?

A: All holders of GE’s common stock as of the Record Date will participate in the Spin-Off. You are not required

to take any action in order to participate, but we urge you to read this Information Statement carefully. Holders of

GE common stock on the Record Date will not need to pay any cash or deliver any other consideration, including

any shares of GE common stock, in order to receive shares of our common stock in the Spin-Off. In addition, no

stockholder approval of the Spin-Off is required. We are not asking you for a vote and request that you do not

send us a proxy card.

Q: What will happen if I continue to hold GE share certificates?

A: If you hold GE share certificates that have not been converted into book-entry form, you will still be entitled

to receive shares of our common stock in the Spin-Off although you will not receive such shares until you

exchange your GE share certificates. In connection with the reverse stock split of GE’s shares of common stock

effective on July 30, 2021, the holders of GE share certificates were notified to surrender their GE share

certificates in order to receive one post-split share of GE common stock in exchange for eight pre-split shares of

GE common stock. As of December 6, 2023, approximately 158,264,159 GE shares of common stock continue to

be held in certificated form. If you continue to hold GE common stock in certificated form, you are encouraged

to contact Equiniti Trust Company, LLC, GE’s exchange agent for the reverse stock split, in order to exchange

your GE share certificates representing pre-split shares of GE common stock for (a) a statement indicating the

number of newly issued shares of post-split GE common stock held by you electronically in book-entry form

together with a check for cash in lieu of any fractional shares and any accrued dividends of GE paid prior to the

date that you exchange your GE share certificates, and (b) a statement indicating the number of newly issued

shares of common stock of GE HealthCare that you were entitled to receive in the GE HealthCare Spin-Off

together with a check for cash in lieu of any fractional shares and any accrued dividends of GE HealthCare paid

prior to the date that you exchange your GE share certificates. If you do not exchange your GE share certificates

prior to the Spin-Off, you will also be entitled to receive upon exchange of your GE share certificates a statement

indicating the number of newly issued shares of our common stock in the Spin-Off together with cash in lieu of

any fractional shares and any accrued dividends of GE Vernova paid prior to the date you exchange your GE

share certificates. However, you will not receive any such shares of our common stock until you exchange your

GE share certificates.

Q: What is the record date for the Spin-Off?

A: GE will determine record ownership as of the close of business on , 2024, which we refer to as the

“Record Date.”

vi

Q: When will the Spin-Off occur?

A: The Spin-Off will be effective as of , New York City time, on , 2024, which time and date

we refer to as the “Distribution Date.”

Q: How will GE distribute shares of our common stock?

A: On the Distribution Date, GE will release the shares of our common stock to the Distribution Agent to

distribute to GE stockholders. The whole shares of our common stock will be credited in book-entry accounts for

GE stockholders entitled to receive the shares in the Spin-Off. If you own GE common stock as of the close of

business on the Record Date, and you retain your entitlement to receive the shares of our common stock through

the Distribution Date, the shares of our common stock that you are entitled to receive in the Spin-Off will be

issued to your account as follows:

Registered stockholders: If you own your shares of GE common stock directly, either in book-entry form through

an account at GE’s transfer agent (Equiniti Trust Company, LLC) and/or if you hold paper stock certificates, you

are a registered stockholder. In this case, the Distribution Agent will credit the whole shares of our common

stock you receive in the Spin-Off by way of direct registration in book-entry form to a new account with our

transfer agent. Registration in book- entry form refers to a method of recording share ownership where no

physical stock certificates are issued to stockholders, as will be the case in the Spin-Off. You will be able to

access information regarding your book-entry account for shares of our common stock at

www.shareowneronline.com by calling 1-888-999-0031.

“Street name” or beneficial stockholders: If you own your shares of GE common stock beneficially through a

bank, broker, or other nominee, the bank, broker, or other nominee holds the shares in “street name” and records

your ownership on its books. In this case, your bank, broker, or other nominee will credit your account with the

whole shares of our common stock that you receive in the Spin-Off on or shortly after the Distribution Date. We

encourage you to contact your bank, broker, or other nominee if you have any questions concerning the

mechanics of having shares held in “street name.”

See “The Spin-Off—When and How You Will Receive Our Shares” for a more detailed explanation.

Q: If I sell my shares of GE common stock on or before the Distribution Date, will I still be entitled to

receive shares of our common stock in the Spin-Off?

A: If you sell your shares of GE common stock before the Record Date, you will not be entitled to receive shares

of our common stock in the Spin-Off. If you hold shares of GE common stock on the Record Date and decide to

sell them on or before the Distribution Date, you may have the ability to choose to sell your GE common stock

with or without your entitlement to receive our common stock in the Spin-Off. You should discuss the available

options in this regard with your bank, broker, or other nominee. See “The Spin-Off—Trading Prior to the

Distribution Date.”

Q: How will fractional shares be treated in the Spin-Off?

A: The Distribution Agent will not distribute any fractional shares of our common stock in connection with the

Spin-Off. Instead, the Distribution Agent will aggregate all fractional shares into whole shares and sell the whole

shares in the open market at prevailing market prices on behalf of GE stockholders entitled to receive a fractional

share. The Distribution Agent will then distribute the aggregate cash proceeds of the sales, net of brokerage fees,

transfer taxes and other costs, pro rata to these holders (net of any required withholding for taxes applicable to

each holder). See “The Spin-Off—Treatment of Fractional Shares” for a more detailed explanation of the

treatment of fractional shares. The receipt of cash in lieu of fractional shares generally will be taxable to the

recipient GE stockholders for U.S. federal income tax purposes as described in the section entitled “Material U.S.

vii

Federal Income Tax Consequences of the Spin-Off.” The Distribution Agent will, in its sole discretion, without

any influence by GE or us, determine when, how, through which broker-dealer and at what price to sell the whole

shares of our common stock. The Distribution Agent is not, and any broker-dealer used by the Distribution Agent

will not be, an affiliate of either GE or us.

Q: What are the U.S. federal income tax consequences to me of the Spin-Off?

A: GE has received a private letter ruling from the Internal Revenue Service (the “IRS”) to the effect that, among

other things, the Spin-Off, will qualify as a transaction that is tax-free for U.S. federal income tax purposes under

Sections 355 and 368(a)(1)(D) of the Internal Revenue Code of 1986, as amended (the “Code”). Completion of

the Spin-Off is conditioned on GE’s receipt of a separate written opinion from each of Paul, Weiss, Rifkind,

Wharton & Garrison LLP and Ernst & Young, LLP to the effect that the Spin-Off will qualify for

non-recognition of gain and loss under Section 355 and related provisions of the Code. It is expected that the

Spin-Off will qualify as a transaction that is tax-free to GE and GE stockholders, for U.S. federal income tax

purposes, under Sections 368(a)(1)(D) and 355 of the Code, and thus no gain or loss will be recognized by, or be

includible in the income of a U.S. Holder (as defined in “Material U.S. Federal Income Tax Consequences of the

Spin-Off”) as a result of the Spin-Off, except with respect to any cash (if any) received by GE stockholders in

lieu of fractional shares. After the Spin-Off, GE stockholders will allocate their basis in their GE common stock

held immediately before the Spin-Off between their GE common stock and our common stock in proportion to

their relative fair market values on the date of Spin-Off. GE may also waive the tax opinions as a condition to the

completion of the Spin-Off. GE does not currently intend to waive this condition to the obligation to complete

the Spin-Off. If GE were to waive this condition, it would communicate such waiver to GE stockholders in a

manner as described in “The Spin-Off—Conditions to the Spin-Off.” See “Material U.S. Federal Income Tax

Consequences of the Spin-Off” for more information regarding the potential tax consequences to you of the

Spin-Off. You should consult your tax advisor as to the particular tax consequences of the Spin-Off to you.

Q: What will the Company’s relationship be with GE following the Spin-Off?

A: In connection with the Spin-Off, we and GE will enter into a Separation and Distribution Agreement (as

defined herein) and will enter into various other agreements, including a Transition Services Agreement, a Tax

Matters Agreement, an Employee Matters Agreement, an Intellectual Property Cross License Agreement, a

Trademark License Agreement, and a Real Estate Matters Agreement (each, as defined herein). These

agreements will provide a framework for our relationship with GE after the Spin-Off and provide for the

allocation between us and GE of GE’s assets, employees, liabilities, and obligations (including its property,

employee benefits, environmental liabilities, and tax liabilities) attributable to periods prior to, at, and after our

Spin-Off from GE. For additional information regarding the Separation and Distribution Agreement and other

transaction agreements, see “Risk Factors—Risks Relating to the Spin-Off.”

Q: Who will manage the Company after the Spin-Off?

A: Led by Scott Strazik, who will be our Chief Executive Officer after the Spin-Off, our executive management

team possesses deep knowledge of, and extensive experience in, our industries. Our executive management team

has been closely involved in key strategic decisions with respect to the Company and in establishing a vision for

the future of the Company. See “Management.”

Q: What will govern my rights as a GE Vernova stockholder?

A: Your rights as a GE Vernova stockholder will be governed by Delaware law, as well as our amended and

restated certificate of incorporation and our amended and restated bylaws. At the time of the Spin-Off, we expect

that there will be no material differences in stockholder rights between the existing GE common stock and GE

Vernova common stock other than (i) your ability for five years after the Spin-Off to elect only a particular class

viii

of our Board subject to election in any given year (versus the ability to elect GE’s entire board of directors each

year), (ii) the stockholder vote required to remove a director will be the affirmative vote of at least a majority of

the voting power of our outstanding common stock (versus GE’s majority of the votes cast standard), (iii) our

stockholders will be able to remove directors with or without cause following the period during which the Board

is classified (versus GE’s stockholders being able to remove directors only for cause at any time), (iv) the

heightened voting threshold to call a special meeting of 25% of the holders of outstanding shares of our common

stock (versus GE’s 10% threshold), (v) the advance notification window for stockholder proposals and

nominations, which is between 90 and 120 days prior to the first anniversary of the prior year’s annual meeting

(versus GE’s advance notification window of between 120 and 150 days prior to the first anniversary of the

mailing of the previous year’s proxy materials), and (vi) the exclusive forum provisions in our amended and

restated certificate of incorporation, which provide that Delaware courts will be the exclusive forum for any

shareholder derivative action and for certain other types of claims brought against us, and that the federal district

courts of the United States will be the exclusive forum for any claims arising under the Securities Act (versus no

such provision in GE’s organizational documents). For additional details regarding GE Vernova common stock

and GE Vernova stockholder rights, see “Description of Our Capital Stock” and “Risk Factors – Risks Relating

to Our Common Stock and the Securities Market.”

Q: Do I have appraisal rights in connection with the Spin-Off?

A: No. Holders of GE common stock are not entitled to appraisal rights in connection with the Spin-Off.

Q: Where can I get more information?

A: If you have any questions relating to the mechanics of the Spin-Off, you should contact the Distribution Agent

at:

Equiniti Trust Company, LLC

Attn: Account Management Team

1110 Centre Pointe Curve, Suite 101

Mendota Heights, Minnesota 55120-4101

Before the Spin-Off, if you have any questions relating to the Spin-Off, you should contact GE at:

GE Investor Relations

One Financial Center, Suite 3700

Boston, Massachusetts 02111

After the Spin-Off, if you have any questions relating to GE Vernova, you should contact GE Vernova at:

GE Vernova LLC

58 Charles Street

Cambridge, Massachusetts 02141

Attention: Investor Relations

Questions and Answers about GE Vernova

The following provides only a summary of certain information regarding GE Vernova. You should read this

Information Statement in its entirety for a more detailed description of the matters described below.

Q: Do we intend to pay cash dividends?

A: Once the Spin-Off is effective, we will determine the optimal allocation of capital to achieve the company’s

strategy and deliver competitive returns to our stockholders, including whether to pay cash dividends to our

ix

stockholders. The timing, declaration, amount, and payment of future dividends to stockholders, if any, will fall

within the discretion of our Board. Among the items we will consider when establishing a dividend policy will be

the capital needs of our business and opportunities to retain future earnings for use in the operation of our

business and to fund future growth. See “Dividend Policy.”

Q: How will our common stock trade?

A: We have applied to list our common stock on the New York Stock Exchange under the ticker symbol “GEV.”

Currently, there is no public market for our common stock. We anticipate that trading in our common stock will

begin on a “when-issued” basis as early as three days prior to the Distribution Date and will continue up to and

including the Distribution Date. “When-issued” trading in the context of a spin-off refers to a sale or purchase

made conditionally on or before the Distribution Date because the securities of the spun-off entity have not yet

been distributed. “When-issued” trades generally settle within two trading days after the Distribution Date. On

the first trading day following the Distribution Date, any “when-issued” trading of our common stock will end

and “regular-way” trading will begin. Regular-way trading refers to trading after the security has been distributed

and typically involves a trade that settles on the second full trading day following the date of the trade. See “The

Spin-Off—Trading Prior to the Distribution Date.” We cannot predict the trading prices for our common stock

before, on, or after the Distribution Date.

Q: Who is the transfer agent and registrar for our common stock?

A: Equiniti Trust Company, LLC is the transfer agent and registrar for our common stock.

Q: Are there risks associated with owning shares of our common stock?

A: Yes, there are substantial risks associated with owning shares of our common stock. Accordingly, you should

read carefully the information set forth under the section entitled “Risk Factors” in this Information Statement.

x

INFORMATION STATEMENT SUMMARY

The following summary contains selected information about us and about the Spin-Off. It does not contain all of

the information that is important to you. You should review this Information Statement in its entirety, including

matters set forth under “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and

Results of Operations,” and the combined financial statements and the notes thereto included elsewhere in this

Information Statement. Some of the statements in the following summary constitute forward-looking statements.

See “Cautionary Statement Concerning Forward-Looking Statements.”

Introduction

GE Vernova is a global leader in the electric power industry, with products and services that generate, transfer,

orchestrate, convert, and store electricity. We design, manufacture, deliver, and service technologies to create a

more reliable and sustainable electric power system, enabling electrification and decarbonization, underpinning

the progress and prosperity of the communities we serve. We are a purpose-built company, uniquely positioned

with a scope and scale of solutions to accelerate the energy transition, while servicing and growing our installed

base and strengthening our own profitability and shareholder returns. We have a strong history of innovation

which is a key strength enabling us to meet our customers’ needs.

The breadth of our portfolio also enables us to provide an extensive range of technologies and integrated

solutions to help advance our customers’ sustainability goals. Our installed base generates approximately 30% of

the world’s electricity. We support our customers’ specific efforts to electrify their economies, meet demand

growth, improve reliability and resiliency, and navigate the energy transition through limiting and reducing

emissions. The portfolio of equipment and services that we deliver is diversified across technology types and is

adaptable based on electric power market conditions and demand.

We blend GE’s culture of innovation and technological excellence with our focus to drive electrification and

decarbonization through our cultural foundation—known as the GE Vernova Way—which guides everything we

do. The principles of the GE Vernova Way are Innovation, Customers, Lean, One Team, and Accountable. These

principles define how we work and create value for our people, customers, shareholders, and the planet. We drive

Innovation in everything we do, serve our Customers with pride and focus, and operate with a Lean mindset,

focusing on safety, quality, delivery, and cost, across our operations. We act as One Team with inclusivity,

authenticity, and diversity allowing us to win together, and are Accountable both individually and collectively to

deliver on our purpose and commitments. These principles are embedded throughout the organization through our

monthly operating reviews, employee training programs, internal communications, and in how we measure

performance. We see the GE Vernova Way as a potential differentiator, as this helps ensure we deliver effective,

measurable, and sustainably successful outcomes for our customers, employees, and other stakeholders.

Within GE Vernova, we have aligned our businesses, and report our financial results across three operating

segments:

•Our Power segment includes the design, manufacture, and servicing of gas, nuclear, hydro, and steam

technologies, providing a critical foundation of dispatchable, flexible, stable, and reliable power. This segment

delivers predictable and growing, long-term earnings and free cash flow from servicing our vast installed base

and from growing this installed base with new equipment and services. For example, we maintain the largest

installed base of gas turbines globally of 886 installed GW and 2,206 GW total across our Gas Power, Nuclear

Power, Hydro Power, and Steam Power businesses within this segment.

• Our Wind segment includes our wind generation technologies, inclusive of onshore and offshore wind

turbines and blades. This segment benefits from secular demand tailwinds for zero-carbon power generation.

1

We are pivoting our Onshore Wind strategy to focus on fewer markets, where we believe we have built and

maintain competitive advantages, fewer product offerings, and increased productivity efforts, all to drive

long-term profitable growth. We maintain an installed base of 117 GW of Onshore Wind and 1 GW of

Offshore Wind turbines for zero-carbon power generation.

•Our Electrification segment includes grid solutions, power conversion, solar and storage solutions, which we

collectively refer to as Electrification Systems, and digital technologies, which we refer to as Electrification

Software, required for the transmission, distribution, conversion, storage, and orchestration of electricity from

point of generation to point of consumption. This segment benefits from a growing need for grid infrastructure,

modernization, and reliability, as well as from the demand for new products, solutions, and services.

Investment in these technologies will be critical to enabling the energy transition by connecting renewables to

the grid, electrifying other carbon-intense sectors, and preserving grid resilience and reliability.

Sources of revenue for GE Vernova in 2023 were approximately split equally between the sale of products and

services. About 65% of GE Vernova’s total RPO (remaining performance obligation, a measure of backlog) of

$116 billion at the end of 2023, or $75 billion, was for services, with a significant portion committed under

long-term contractual arrangements, providing us with enhanced levels of predictability and visibility into

services revenue for years to come. Services are typically sold directly to our customers, either through long-term

contractual service agreements or as individual transactions at time of service.

Services include the maintenance, replacement of spare parts, repairs, upgrades, and software subscriptions

throughout the operating life of our products globally. To lead in services, we invest in inspection and repair

technologies, monitoring and diagnostics capability, and plant upgrade offerings to improve the performance and

operation of our installed base.

Products include the design, manufacture, and delivery of a wide range of power generating, grid hardware and

software, power conversion, and energy storage products. We sell our products directly to customers or through

engineering, procurement, and construction firms, where we can be either a sub-supplier or a consortium partner.

Our scope of supply can range from products alone to extended plant or project development scope, which can

include plant-level guarantees and/or GE Vernova having turn-key responsibilities, often shared with partners,

for project development. GE Vernova has manufacturing, assembly, and component production capabilities in

over 100 plants across 27 countries.

We are well-positioned to benefit from extended growth in the demand for our products and services as emerging

economies focus on electrification and mature economies on further electrification and decarbonization. We expect

to drive profitable growth through cost reductions, improved quality, better contracting, and higher productivity

levels — all as demand accelerates. We expect to generate cash flow, fund incremental growth opportunities and

increase flexibility to drive future capital allocation while maintaining investment grade ratings.

Our Industry and Business

Electricity is critical to economic progress and prosperity as well as to improve the quality of life. The International

Energy Agency (the “IEA”) expects demand for electricity generation in 2040 to grow by more than 55% from

2022 levels with the natural gas, hydro, wind, nuclear, solar and storage energy sub-sectors playing a key role. This

growing demand for electricity generation is driven by multiple factors. Approximately 750 million people globally

lack access to electricity, and many more who do have access experience frequent, extended outages that disrupt

their lives, impact their safety and security, and challenge their economic growth. Electricity use is also increasing

as an alternative to fossil fuels for whole industries or sectors, such as transportation, which are currently pursuing

increased electrification as a means to decarbonize. The future electric power system must meet this demand growth

2

while incorporating new and diverse sources, preserving or improving system reliability, affordability, and

sustainability. Electric power sector emissions account for approximately 40% of all human-made carbon dioxide

(“CO

2

”) emissions in the world today and without a change to the current energy mix, global growth in demand for

electricity generation would increase CO

2

emissions by more than 7 billion tons annually by 2040.

GE Vernova innovates and invests across our broad portfolio of technologies to help our customers meet growing

demand for electricity generation and reduce the carbon intensity of power grids and electricity supply, while

maintaining or improving system reliability, affordability, and sustainability. Today, approximately 30% of the

world’s electricity is generated using GE Vernova’s installed base of technologies. We intend to grow profitably

through the sale of equipment needed to electrify and to decarbonize power systems, as well as by servicing this

installed base for decades to come. We will continue to support customer efforts to limit or reduce emissions, and

we expect to continue reducing the carbon intensity of our installed base – all while increasing the resiliency of

the grid and achieving the goals of our customers, investors, and employees.

We deliver products and services that generate, transfer, orchestrate, convert, and store electricity. Our products

and solutions generate electricity from various forms of energy or fuels, including wind, hydro, solar, nuclear,

natural gas, and steam. We have offerings that transfer and orchestrate electricity reliably, safely, and securely

from generation sources to consumers, over various electricity grids or systems – using grid-related software,

hardware, automation, and controls. We develop and deliver technologies that convert electricity across grid

systems, such as from alternating to direct current (AC to DC) or vice versa (DC to AC); from one voltage level

or frequency to another; and into other forms of energy including mechanical, thermal, and chemical. We also

develop and deliver solutions that enable customers to store electricity for use to meet peak demand, through

products such as pumped hydro and integrated battery energy storage systems.

GE VERNOVA TECHNOLOGIES

ACROSS THE ELECTRIC POWER INDUSTRY

TransferGenerate Orchestrate Convert Store

DC

AC

H

2

O

GE Vernova’s products, services, and pipeline of investments in leading edge technologies help utility,

commercial, and industrial customers avoid, reduce, or capture greenhouse gas emissions produced when

generating electricity. Use of carbon-free generation technologies like wind, solar, hydro, and nuclear helps

avoid greenhouse gas emissions. Power plant efficiency upgrades and the increasing use of lower carbon-intense

fuels like hydrogen in gas turbines can help our customers reduce their greenhouse gas emissions compared to

their current state. We also develop integrated solutions that capture carbon for use or sequestration, rather than

releasing carbon into the atmosphere and contributing to climate change.

The global electric power industry landscape is subject to volatility driven by quickly changing economic

outlooks, increasing geopolitical tensions, and energy policy uncertainty. Renewables growth may also be

impacted by transmission capacity constraints, site permitting, and electrical interconnection delays, project

constraints driven by reduction in available land and/or increased land costs, growing importance of biodiversity

protection, and security of supply concerns on critical minerals. The broader wind industry is further challenged

with fleet quality and reliability issues, with the offshore wind industry recently facing high project execution

risks and limited profitability at current price levels.

3

In addition to these industry pressures, some of our business units experienced operating losses in the recent past

attributed to a variety of challenges, including fleet quality issues, pricing, execution challenges on complex

projects, a lack of commercial underwriting terms that protect for inflationary pressures, and not enough

standardization of products. Each of the business units facing these challenges has made significant progress on

their paths towards profitability over the past several quarters. Strengthened operational rigor and commercial

discipline together with actions to reduce structural and operating costs—by leveraging lean business practices—

are contributing to the turnaround and improvement seen in several of these businesses over the last few periods.

GE Vernova maintains a global reach and scale necessary to lead the energy transition to an electrified and

decarbonized future, with approximately 80,000 employees, including our field services associates, and a local

presence in more than 100 countries. We derived approximately 71% of our 2023 revenues from OECD

countries—and geographically 47% of our revenue from the Americas, 25% from Europe, 16% from Asia and

12% from the Middle East & Africa. We deliver products and services into large, growing segments tied to the

energy transition and we estimate the addressable market we serve was approximately $265 billion in 2022.

Overall, industry experts conservatively anticipate spending in the power and end-use sectors will increase from

$1.4 trillion per year in recent years to more than $2.4 trillion per year in the 2030s. We serve the world’s largest

utilities – many of whom serve the OECD or developed markets – that today focus heavily on decarbonization

efforts.

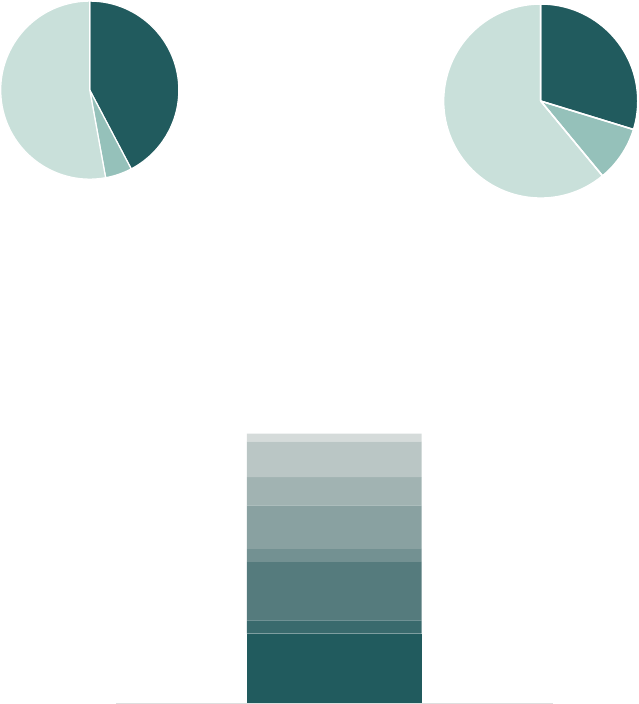

Addressable Market by Segment*

Power

$110B

Wind

$80B

Electrification

$75B

2023 GE Vernova Revenue by Segment

Power

$17.4B

16% of addressable

market

Wind

$9.8B

12% of addressable

market

Electrification

$6.4B

9% of addressable

market

*Based on Addressable Market analysis conducted in 2022

Excludes $0.4B eliminations

2023 GE Vernova Revenue by Geography

Rest of Americas

$3.2B

Europe

$8.4B

U.S.

$12.5B

Asia

$5.3B

Middle East

and Africa

$3.9B

2023 GE Vernova Revenue

OECD vs. Non-OECD Countries

OECD

$23.7B

Non-OECD

$9.5B

Globally, the IEA estimates the world will need 55% more generation of electricity in 2040 than it did in 2022

and that electricity levels required to reach economy-wide net zero emissions would need to more than double

from 2022 levels, which will drive a shift in generation technology mix, improved resilience and security of

power grids, and modernization / digitalization of the existing infrastructure.

4

Carbon-free generation technologies including wind, solar, hydro, and nuclear are expected to account for nearly

90% of new capacity addition orders over the next ten years, with a balance of many generation sources likely required

to navigate the energy transition towards a more sustainable power sector while preserving system reliability and

affordability. Wind and solar combined accounted for 12% of all electricity generated in the world in 2022. By 2030

many experts expect this figure will reach approximately 25%, and in scenarios that achieve net zero emissions may

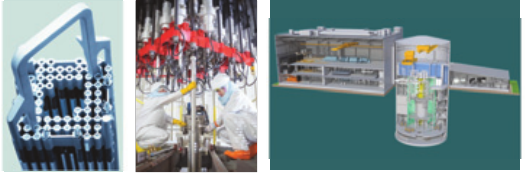

reach 70% percent by 2050. Nuclear power generation is expected to grow, with small modular nuclear reactor

(“SMR”) technology expected to be operative by 2030, assuming a critical role in the sector. Hydro power offers

emission-free power output and we expect it will play an important role in the evolving energy mix. Besides benefiting

from increasing customer demand for wind equipment and the need to service this equipment, we also expect to

support customers through service of their existing nuclear and hydro plants and sales of incremental new units.

Natural gas power plants will continue to play a vital role in the energy transition through the provision of

dependable, dispatchable, and flexible power, helping to address the intermittency of renewable energy sources.

Approximately 22% of the world’s electricity in 2022 was generated using natural gas. We expect to continue

servicing our large existing and growing our installed base of gas turbines. In the coming years, we expect to

expand this business to accelerate decarbonization by retrofitting gas turbines to use hydrogen and/or adopting them

for use in carbon capture systems.

As we serve these markets, GE Vernova will continue to build on a rich heritage of technology leadership and

innovation, with more than 140 years of experience dating back to Thomas Edison’s first commercial power

plant in the United States (1882). We continue to be an innovation leader, with approximately 36,000 patents and

patent applications filed in approximately 60 countries. Other significant innovations developed by us include:

• the world’s first licensed nuclear power plant (1957),

• the world’s first F-class gas turbine (1990),

• wind blades for the world’s first offshore wind farm (1991),

• the world’s first mobile (trailer-mounted) aeroderivative gas turbine for power generation (1996),

• the world’s first wind turbines with low-voltage-ride-through capability (2003),

• multiple world records for most efficient gas combined cycle plant (2016), and

• North America’s first commercial award for a small modular nuclear reactor (2022).

Investment Highlights

GE Vernova is an industry leader creating a more reliable and sustainable electric power system by

providing a breadth of products and services necessary to increase electrification and decarbonization. We