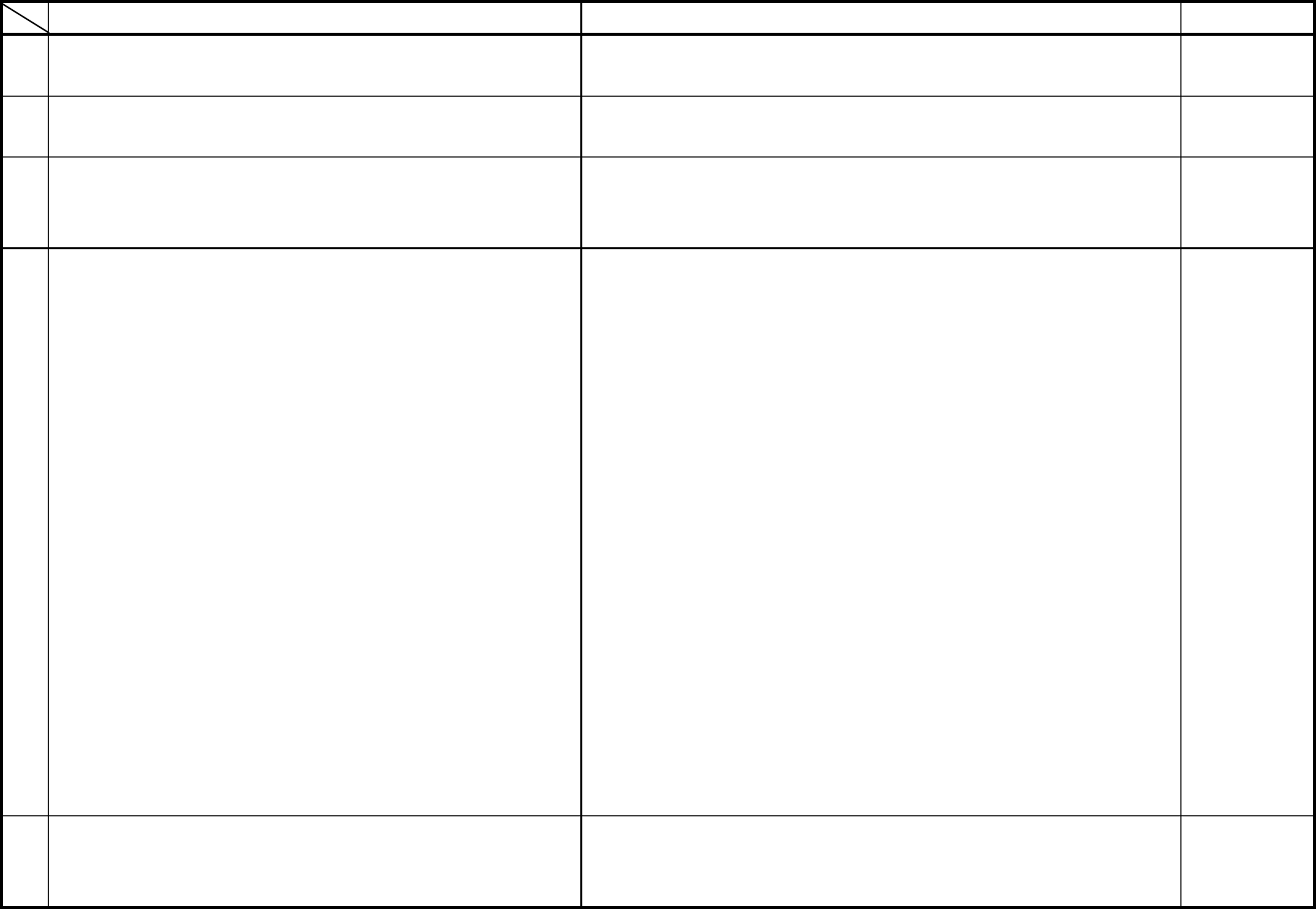

1

FERC Staff’s Responses to Discussion Questions from [email protected]v

List of Issue Groups

Business Rules ....................................................................................................................................................................... 2

Attachment Related Codes ................................................................................................................................................ 16

Tariff Record Related Codes ............................................................................................................................................. 22

Type of Filing Related Questions ..................................................................................................................................... 47

eTariff Viewer ......................................................................................................................................................................... 53

Company Registration......................................................................................................................................................... 62

Maintaining and Changing Tariff Data Bases ............................................................................................................... 63

2

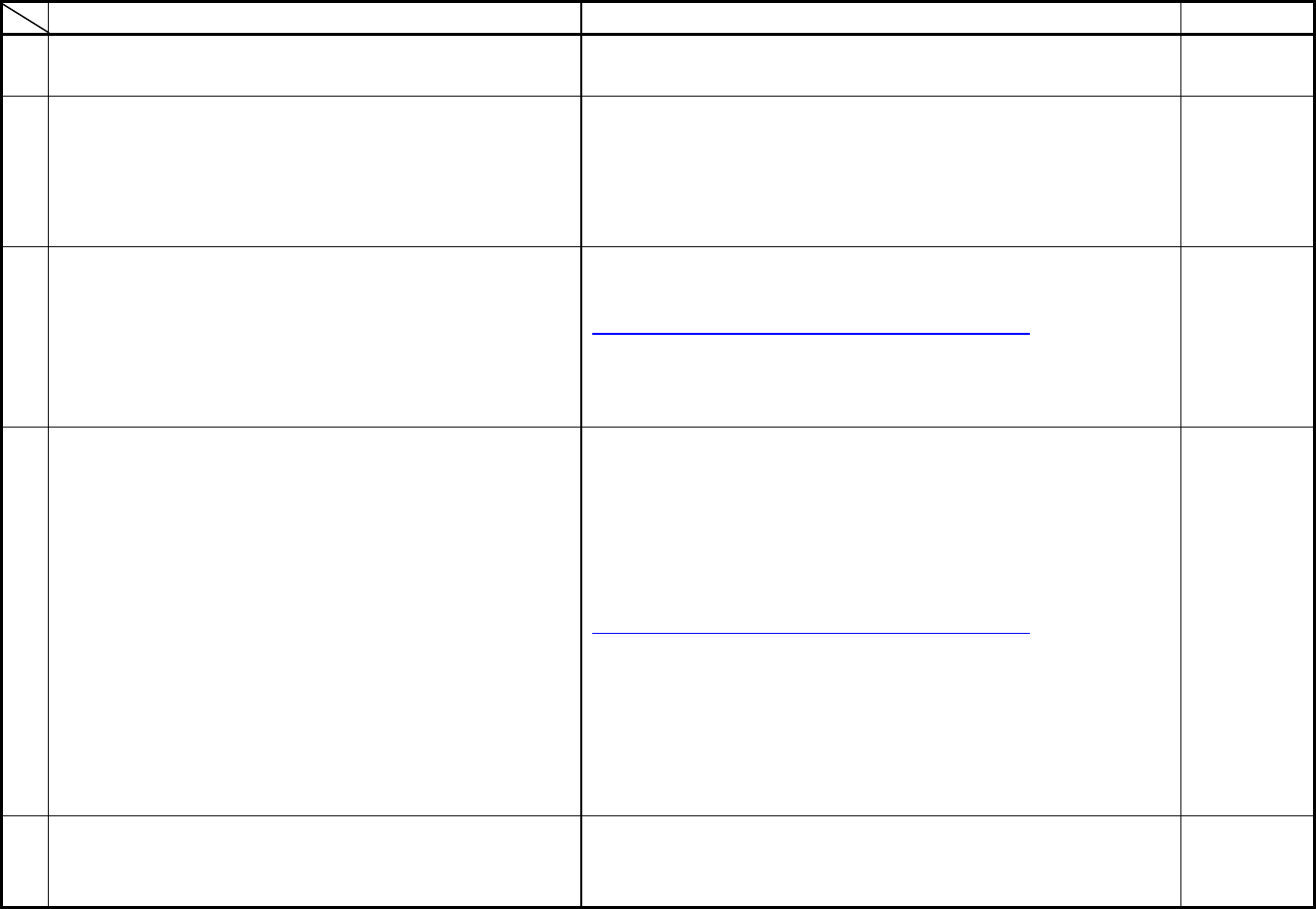

Business Rules

Question

Answer

Date

1

If a record change type of CHANGE is filed

in a filing for record id 1234 version 2.0.0

and then is subsequently withdrawn in a

later filing via a record change type of

WITHDRAW, can record id 1234 version

2.0.0 be filed again at some later date?

Upon processing the latter (WITHDRAW)

filing, is the earlier filed record physically

delete from FERC's eTariff database?

Neither the Filing Identifier (filing_id) number nor

the Tariff Record’s Record Version Number

(record_version_num) can be reused once the

filing has been accepted by the OSEC. Once the

OSEC has accepted a filing, the filing is an official

document with the Commission. A withdraw filing

initiates a set of FERC processes. Neither the

WITHDRAW filing type nor the WITHDRAW

Record Change Type results in the removal of the

tariff filing or the Tariff Record data being from the

FERC’s databases.

1/15/10

2

Under what circumstances will a filing

include tariff record versions that do not

contain tariff content?

• Withdrawal filings?

• Cancellation filings?

• Motion filings?

• Are there other filing types?

The Record Version Number

(record_version_num) is not used in any

automated fashion. It is not required for the Type

of Filing (filing_type) identified as a Motion,

Withdraw or Cancellation category. All other

categories of Type of Filing that require Tariff

Record Content Data require a Record Version

Number.

12/19/08

3

For which types of filings is an

associated_filing_id required in a filing?

Amendment? Compliance? Motion?

Withdraw? Report? Other?

The Baseline, Normal and Cancellation Type of

Filing categories do not require an Associated

Filing Identifier (associated_filing_id).

Compliance may require an Associated Filing

Identifier depending on the circumstance. All

other Type of Filing categories require an

Associated Filing Identifier.

12/19/08

5/25/10

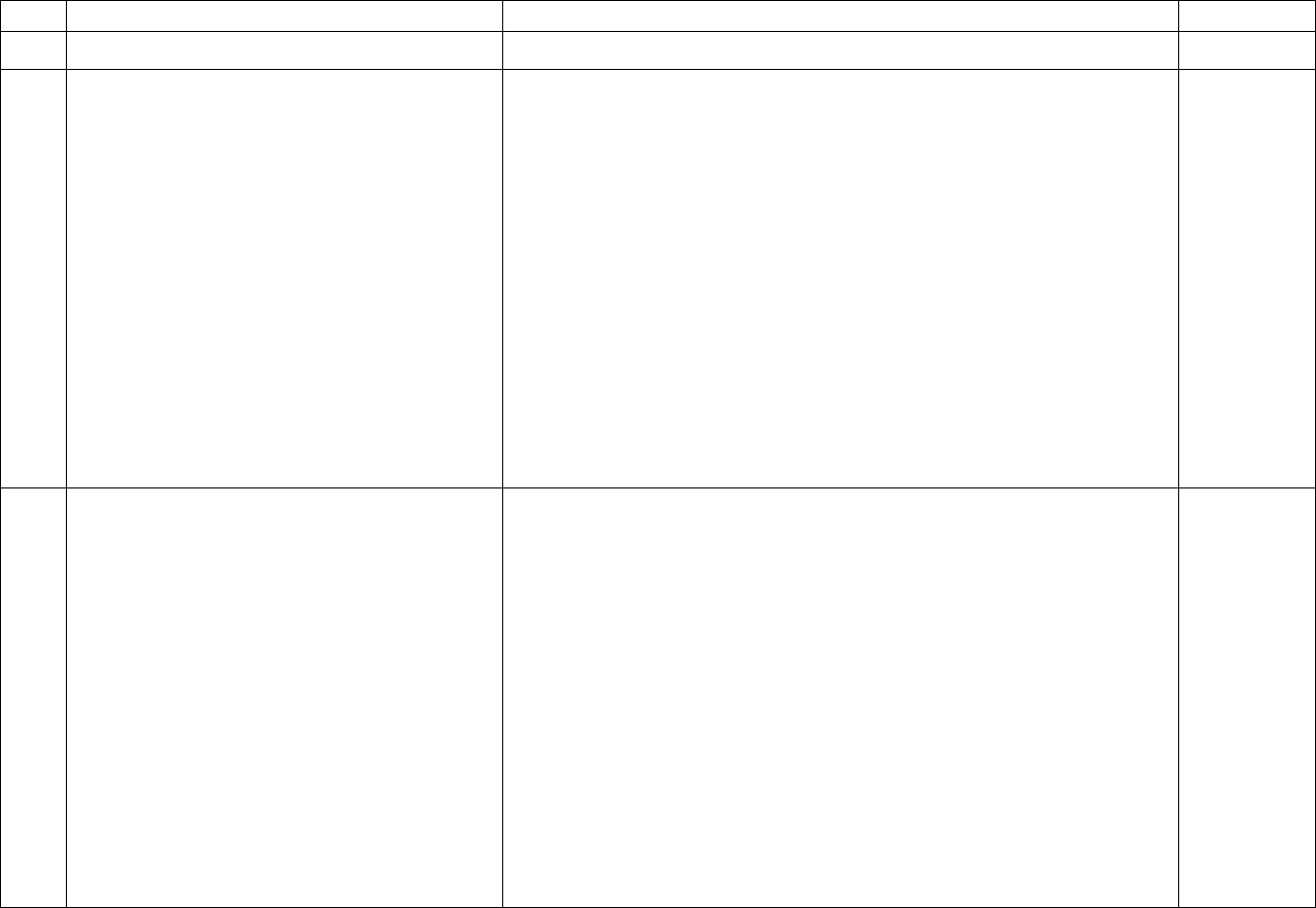

3

Question

Answer

Date

4

Which types of filings can BE the associated

filing for a filing being filed?

The Commission’s program specific regulations

and business rules specify which types of filings

may be associated with which filings. For

example, Withdraw and Amendment Type of

Filings can only be associated with tariff filings

that the Commission has not acted upon.

12/19/08

5/25/10

5

In the FERC documentation there are

references to automated actions

(amendment type filings, suspension

motions, status_change_timeout) to update

the status of filings and tariff records. Are

these things that happen automatically

within FERC’s tariff software? Are the

owners of the affected tariffs notified? Will

every tariff filing result in a FERC order?

The referenced Amendment and Motion Type of

Filing categories will in many cases automatically

update the status of filings. An amendment filing

for example will automatically change the filing

date for the proceeding (defined as all open tariff

filings within the root docket number set) after the

30

th

or 60

th

day which the Commission is required

to act. In some cases, the Commission may issue

a notice indicating that the filing has been made,

but no explicit notification of the status tariff filing

or tariff record change will be issued. The filer

needs to be aware of the regulatory implications

of its actions.

12/19/08

1/15/10

8/12/13

6

Currently, there is no way for software to

understand and enforce the quantity of each

type of attachment that may be placed into a

filing. For example, it wouldn’t make sense

for a filing to have two transmittal letters, but

it would make sense for a filing to have two

“Other Support not otherwise specified”

attachments. Is FERC willing to add a

column to the attachment-reference-

code.csv file that specifies whether multiple

Attachments are governed by the current

Secretary’s filing rules and in many cases,

multiple documents and filing types are used for

almost all types of documents. For example, a

transmittal letter may consist of a Word document

with an Excel spreadsheet as an appendix. Also,

confidential information with redacted and

unredacted copies may require the same

attachment type be used more than once. Thus,

designating which documents can be used

12/19/08

4

Question

Answer

Date

attachments of a particular type are allowed

in a filing?

multiple times is not worthwhile.

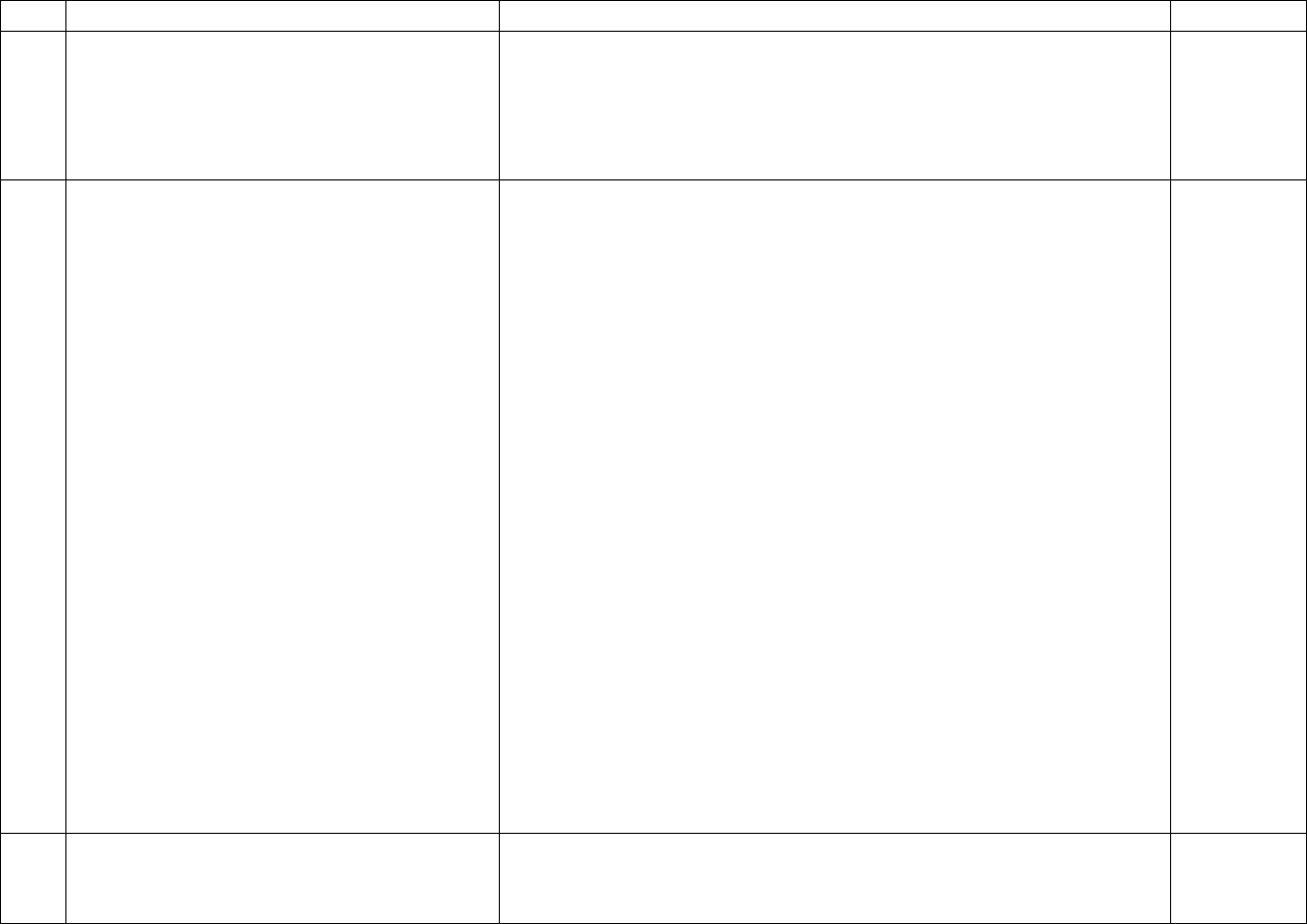

7

Can there be only one baseline filing

(new_type=Y) for a tariff/database?

Yes. The Baseline Type of Filing category is a

special case used to establish a new Tariff

Identifier (tariff_id) for a company. Once the Tariff

Identifier has been established, then all

subsequent modifications to that tariff_id’s

database must be performed by one of the other

Type of Filing categories. For example, an

applicant may file in its Baseline Type of Filing

filing only one record_id: the first section of its

tariff. That would establish the Tariff Identifier.

Subsequently, and for the first time, the applicant

could file 1,000 record_ids that compose the rest

of the tariff and do not yet exist in the database.

This second filing must use a Type of Filing

category other than Baseline.

12/19/08

1/15/10

8

Under what circumstances can a filing of

refiled_type=Y be filed?

Many FERC programs’ regulations require

different business rules depending on whether a

tariff is filed with the Commission for the first time

(for example, a new company: refiled_type = N),

or is simply a restatement of what the

Commission has already reviewed and accepted

(refiled_type = Y).

12/19/08

9

Are there rules regarding the filing of root

tariff records (those without a parent) within

such a filing? Or are they treated the same

as tariff records that do have a parent?

A Tariff Identifier database can have multiple

parent (root) Tariff Record Identifiers (record_ids).

For example, Part 154 requires pipelines to

maintain Volume No. 1 for their open access

transportation and sales services, and a Volume

12/19/08

5

Question

Answer

Date

I suppose at the crux of this topic is the

difference in FERC’s eyes between a single

tariff/database that contains multiple root

tariff records VS multiple tariffs/databases

each of which containing a single root tariff

record.

No. 2 for their traditionally certificated services.

Both of these Volumes can be placed in a single

Tariff Identifier database under different parent

Tariff Record Identifiers.

10

How does the “Etariff Filing Rules Table”

PDF relate to the type-of-filing.csv? Are

these supposed to convey the same

information, the former in human readable

format and the latter in machine readable

format? When is the next time that these

resources will be updated with the latest

information?

The Etariff Filing Rules Table in PDF format is the

human readable format of the type-of-filing.csv

and att_ref_code.csv documents. The table and

related CSV files may be updated to reflect

business and regulatory changes.

12/19/08

3/6 /09

5/25/10

11

The Type of Filing list posted on FERC’s

web site contains a lot of information that

does not appear to be directly relevant to

the eTariff process (e.g. amendment type,

withdrawal type, refiled type). Why are these

included?

The Type of Filing data shows the business rules

eTariff applies to each and every Type of Filing

Code (filing_type) available to applicants. The

data provides information on how a tariff filing and

the attached Tariff Records are processed. The

information is provided to enhance applicants’

tariff filing and tariff maintenance software.

12/19/08

1/15/10

5/25/10

12

If Companies A, B and C have a joint rate

schedule, and Company A has agreed to be the

party responsible to maintain the rate schedule,

and Companies B and C have tariff records for

the rate schedule which incorporates by

reference Company A’s rate schedule, must

Companies B and C make a tariff filing to

modify their tariff records when Company A

No. However, Order No. 714 did not change

Companies B’s or C’s responsibilities for service and

supporting any changes to the joint rate schedule as

required by the statutes and Commission regulations.

3/6 /09

6

Question

Answer

Date

makes a tariff filing affecting the joint rate

schedule?

13

Companies A, B and C have a joint rate

schedule, and Company A has filed a proposed

change to that rate schedule. Companies B and

C wish to file additional material to the record to

support their parts of the proposed change. How

can they do this?

Companies B and C can file through eTariff utilizing a

REPORT filing type, such as FPA program’s Type of

Filing Code (filing_type) 150. When Companies B

and C make such a filing, they must use Company A’s

Company Identifier (company_id) and Filing Identifier

(filing_id) to ensure their material is properly routed to

Company A’s tariff filing proceeding.

3/6 /09

1/15/10

14

Companies A, B and C have a joint rate

schedule, and Company B wishes to make a

change to the joint rate schedule that only affects

them. Can Company B make the tariff filing?

The responsibilities of Companies A, B and C with

regard to filing and maintaining the joint rate schedule,

and responsibilities for satisfying all other statutory

and regulatory requirements related to proposed

changes and compliance, are a matter of the certificate

of concurrence agreement. If Companies A, B and C

wish to treat Company A’s joint rate schedule as a

shared rate schedule (see Order No. 714 at P 65-73),

the Tariff Filing XML schema will support such tariff

filings.

If Company B makes such a filing, it must use

Company A’s Company Identifier (company_id),

Tariff Identifier (tariff_id) and an appropriate Filing

Identifier (filing_id).

NOTE: Certificates of concurrences are NOT tariff

records. Certificates of concurrence are agreements

between the companies with tariffs defining who is

responsible for tariff maintenance, identifying the

3/6 /09

1/15/10

1/6/14

7

Question

Answer

Date

tariffs subject to the agreement, and memorializing any

limitations. Certificates of concurrence should only be

filed as a supporting document – NOT as a tariff

record.

15

Regarding the first two lines of the XML

Schema, can anything be removed, edited or

added to these lines without resulting in an

error?

No. The first two lines of the XML Schema must be

provided exactly as shown. If they are not provided

exactly as shown, the OSEC cannot process the filing

and it will be rejected.

1/15/10

16

My type of filing does not require all the data

elements provided in the XML Schema. May I

omit that row of information?

No. Every row of information for every sequence must

be provided, even if there is no information to convey.

If all the data elements are not provided exactly as

shown, the OSEC cannot process the filing and it will

be rejected.

1/15/10

17

What is the proper format for data elements that

are not populated?

Depending on the Type of Filing definition, different

data elements need not be populated. For example, a

BASELINE type of filing should not have an

associated_filing_id. However, the XML Schema

requires that all tariff filings provide that data element:

<xs:element name=”associated_filing_id”

type=”xs:integer” nillable=”true”/>

The tariff filing’s XML code for this data element should

appear as follows:

< associated_filing_id xsi:nil=”true” />

Please note the guidance provided at the XML Schema’s

note in the OSEC Implementation Guide with regard to

known issues for certain XML software tools.

1/15/10

18

If 0 (zero) is used to populated an XML Schema

No. Zero and null are different. Zero is read as

1/15/10

8

Question

Answer

Date

data element, will it be read by the

Commission’s software the same as “null”?

populating the data element. Null is read as not

populating the data element.

19

Can the order of the XML Schema’s data

elements be changed?

No. The data elements must be provided in the same

order as given in the XML Schema.

1/15/10

20

My filing had an ERROR and was rejected by

the OSEC. May I correct the filing, use the same

filing_id and resubmit it to the Commission?

Yes.

1/15/10

21

Can the clean tariff have headers and footers?

Yes. Order No. 714 removed the regulations that

required some program’s tariffs to include headers and

footers. Headers may be included in the tariff text, or

left as part of the RTF file’s page definition. However,

information in the headers or footers cannot be

contrary to any Commission finding, such as effective

date, or contrary to other meta data provided by the

company, such as section titles.

Headers that do not identify the proper tariff program

may also result in the Commission requiring the

applicant to refile the tariff records. The Commission

is responsible for five different tariff programs,

including two different electric and two different gas

tariff programs. “FERC Electric Tariff” and “FERC

Gas Tariff” are not adequate to identify the tariff

program. See 149 FERC ¶ 61,283, at P 89. If headers

are used, they should use the program identifiers

provided in the OSEC Implementation Guide.

6/25/10

1/6/14

22

Must the tariff or rate schedule have a table of

contents?

If the Commission’s regulations or order requires a

table of content for a tariff, rate schedule or any other

tariff document, it must be included.

6/25/10

9

Question

Answer

Date

23

Can a company continue use of the old

designation system?

Yes. However, if a company chooses to use its old

system, it still must abide by the general rule that the

designations must be unique so as not to create

confusion. See RP10-563-000.

6/25/10

24

Order No. 714 permits companies sharing joint

tariffs to incorporate a tariff by reference. Joint

tariffs are most common in the FPA program.

May other programs incorporate tariffs by

reference?

Yes, Order No. 714’s findings apply to all the tariff

programs, not just the Part 35 program.

6/25/10

25

As a non-designated party to a joint tariff, what

should be included on the tariff section

incorporating the designated filer’s tariff?

Generally, the non-designated tariff section should

have an informative section title, the name of the

designated party, tariff and, as necessary, section title,

and any other information or limitations applicable to

the tariff and non-designated party. See

Portland

General Electric Company for an example of a

designated party filing, and Puget Sound Energy, Inc.

for an example of a non-designated filing, especially

the accepted tariff record.

6/25/10

10/11/13

26

Company A’s paper version of the OATT was

maintain and filed with the Commission under a

Service Company B designation. That OATT

will now be in another Company C’s tariff. Can

Company A’s Order No. 714 baseline tariff

filing incorporate Company C’s OATT by

reference?

This is similar to a Joint tariff situation. Yes, Company

A can provide a single tariff record incorporating

Company C’s OATT by reference in the baseline

filing. The Transmittal Letter of Company A must

clearly explain that Company C will be the location of

the OATT in place of what used to be Service

Company B’s tariff, and confirm that no other

significant changes are in the baselined Company C

incorporated tariff.

6/25/10

27

Company A’s paper rate schedule is identical to

Company B’s paper rate schedule. Can

If the rate schedules are clearly marked as a joint tariff

and are identical in all respects, Company A can

6/25/10

10/11/13

10

Question

Answer

Date

Company A incorporate Company B’s rate

schedule as part of its Order No. 714 compliance

filing?

incorporate Company B’s rate schedule provided the

appropriate letters of concurrence are provided. The

Transmittal Letter must clearly state the nature of the

incorporation by reference. See also answers to Qu. 12

and 14 above.

If Company A’s incorporation by reference is limited

or conditional, any proposals by either Company A or

B to change the incorporated rate schedule imply that

the rate schedules, or their application, are not

identical. In that case, Company A needs to make a

Normal/Statutory filing with its proposal for the

incorporated by reference rate schedule.

28

In a contested proceeding before an ALJ, the

parties wish to file a settlement with the ALJ.

Can eTariff be used to file the Settlement?

eTariff must be used to file Settlements. Parties should

follow the instructions of the ALJ. Public, Procedures

Governing Rule 602 Settlement Filings (Oct. 13, 2017)

(Accession Number 20171013-3043).

Any Settlement that claims to have real tariff records

as part of the Settlement and those tariff records are not

filed through eTariff must be followed up with an

eTariff Compliance filing to enter the tariff records into

the eTariff data base.

6/25/10

4/11/19

29

A Settlement contains tariff records. Can eTariff

be used to file the Settlement?

Any filing that contains real tariff records must be filed

in eTariff.

Any Settlement with real or pro forma tariff records

must be filed in eTariff. Further, pro forma Tariff

Records must be filed as Tariff Records using Record

6/25/10

4/11/19

11

Question

Answer

Date

Change Type Pro Forma. Blackstone Wind Farm,

LLC, 167 FERC ¶ 61,004, at P 5 (2019).

30

A Settlement contains tariff records and provides

that the agreed upon tariff records will go into

effect upon Commission approval. What date

should be used to populate the Tariff Record

Proposed Effective Date?

When an applicant does not know or have a proposed

effective date, the Tariff Record Proposed Effective

Date should be populated with 12/31/9998. Note

special case when establishing a new Tariff Identifier:

Tariff Record Related Codes, Qu. 32.

6/25/10

10/4/2011

31

The ISO has, under one of its tariffs, tariff

documents of its members. As the eTariff XML

schema only contains the Company Identifier of

the owner of the Tariff Identifier, how can the

other party to the shared tariff be made a co-

applicant to the proceeding?

eFiling provides functionality to add co-applicants to

an eTariff filing. eFiling’s instructions are located at

https://ferconline.ferc.gov/efiling-help.asp.

1/27/2011

32

My Transmittal Letter requested that several

names be added to the Commission maintained

service list in my proceeding. However, only the

name on the service list is the one associated

with the Company Profile. Why are the names

in the Transmittal Letter not on the service list?

Since Order No. 703, eFiled material is not read by

staff to transcribe names to the Commission service

list. Populating the Commission’s service list is

performed by the applicant as part of the eFiling

process. eFiling’s instructions on how to add names to

the Commission’s service list are located at

https://ferconline.ferc.gov/efiling-help.asp. If a party

wishes to add more names to the Commission’s service

list, they may do so by using the electronic

Documentless Intervention function. Those

instructions are available at

https://ferconline.ferc.gov/efiling-

help.asp#intervention.

1/27/2011

33

I ZIPped my XML tariff filing using Apple’s OS

X’s embedded compression software. However,

upon making the filing with the Commission, I

Apple’s OS X’s embedded compression software is

known to include a sub-folder and a file in that sub

folder that is usually hidden from OS X users. The

4/18/11

12

Question

Answer

Date

received and error message that the eTariff Zip

file contains more that one file. I looked at the

file and I do not see anything other than the

XML file. What is happening?

subfolder contains another file with the identical name

as the file at the parent level, but whose content is

different. eFiling screens ZIP files to ensure that only

one file is included, and that the file is an XML file.

The subfolder is considered by eFiling as a second file.

eTariff filers should not use compression software that

uses proprietary formats.

34

I made a Normal/Statutory filing in the NGA

Gas program. I entered “Y” in the

Suspension Motion data element. The

Transmittal Letter stated that the pipeline

was motioning into effect the tariff record if

the Commission suspended the tariff record.

The Commission suspended the tariff record

for more than one day. Why does the

Public Viewer show the tariff record as

Suspended after the end of the suspension

period?

The Suspension Motion data element is only to

reflect the NGA pipeline’s motion proposal in the

event of minimal suspension consistent with the

filing requirements of section 154.7(a)(9) of the

Commission’s regulations. A Transmittal Letter

statement that the pipeline motions tariff records

suspended for more than the minimal period does

not comport with the Commission’s electronic tariff

filing requirements to place suspended tariff

records into effect. If the tariff records were:

1. suspended for more than the minimal

period,

2. for which the Suspended Motion data

element was populated with “N”, or

3. the Commission rejected the pipeline’s

minimal suspension motion into effect,

neither a Suspension Motion data element

populated with “Y” nor a statement in the

Transmittal Letter is adequate to place the

suspended tariff records into effect.

If the NGA pipeline wishes to motion into effect

11/13/13

1/6/14

13

Question

Answer

Date

tariff records that remain in Suspended status, it

must do so pursuant to section 154.206 of the

Commission’s regulations. Such filings require a

TOFC 610 Motion category filing with a proposed

effective date for each record equal to or later

than the end of the suspension period. Motion

filings cannot propose a retroactive effective date.

Motions filings can be made any time after the

tariff record is suspended and before the end of

the Commission’s suspension period or later

effective date as proposed by the pipeline in its

TOFC 610 Motion filing.

See 149 FERC ¶ 61,123,

at P 30.

35

I need access to the eTariff XML file that

was filed with the Commission. Can I

request a copy of that file from the

Commission?

The Commission does not retain a copy of the

eTariff XML file once the data within the file has

been extracted.

5/12/16

36

I, as an eTariff filing agent, made an eTariff

filing. However, I forgot to select the co-

applicants of the filing. How do I correct this

mistake and add co-applicants to the

proceeding?

eLibrary and the Commission’s Notices are

dependent upon eTariff filing agents properly

identifing all co-applicants as part of the eFiling

process. If co-applicants are not properly

identified in the eFiling process, they will not

appear as co-applicants in eLibrary, the Notice

and, possibly, the Commission order.

To add co-applicants to an Open eTariff

proceeding, prepare a new eTariff filing under the

same CID as the one initially used. Select a Type

of Filing category of AMENDMENT or

5/12/16

14

Question

Answer

Date

COMPLIANCE as appropriate for the Associated

Filing Identifier. File as a normal eTariff filing

through eFiling, this time selecting the appropriate

co-applicants.

NOTE 1: Type of Filing category AMENDMENT

eTariff filings must have at least one Tariff

Record. Type of Filing category COMPLIANCE

eTariff filings do not have to have a Tariff Record.

Both type of filings will receive a new sub-docket.

NOTE 2: The eTariff filing agent must also be

listed as an eTariff filing agent in each co-

applicant’s CID profile. If the agent is not listed in

a company’s CID, eFiling will not list that company

for the agent to select as a co-applicant.

37

The company wishes to file a

NORMAL/STATUTORY filing without a

Tariff Record and still achieve a statutory

action date. Is that possible?

No. Order No. 714-A provides that applicants

may only make tariff filings designated as a

statutory filing through eTariff. Designating a tariff

filing as a statutory filing is accomplished through

the applicant choosing a NORMAL/STATUTORY

or AMENDMENT Type of Filing Code appropriate

for the program. Statutory action dates are a

function of the date of filing and the Tariff

Record’s Tariff Record Proposed Effective

Date(s). A Tariff Record’s Tariff Record Proposed

Effective Date metadata is part of a proposed

Tariff Record. If there is no Tariff Record, the will

be no Tariff Record Proposed Effective Date and

5/12/16

15

Question

Answer

Date

a statutory action date cannot be calculated.

16

Attachment Related Codes

Question

Answer

Date

1

Is FERC willing to add the valid file

extensions for each type of file identified in

the attachment-content-type.csv file? This

would enable software to automatically

identify the attachment type based on the

file's extension. In the event that the file

extension is not unique to an attachment

type, software could present users with a

short list of file types from which they could

choose.

The extension information is now provided in the

att_content_type_code.csv file.

12/19/08

1/15/10

2

The "Record Content Type Code" file

(record-content-type-code.csv) provides a

"security_level" column but no

"record_content_type_code" column. The

"security_level" column should be changed

to "record_content_type_code," right?

This error has been corrected.

12/19/08

3

Concerning the various software packages

used for Attachments: how best can the

acceptable software versions be

determined? If software versions are too

new will this create problems in the upload

of the electronic tariff package?

The Secretary of the Commission determines

which electronic document formats may be

electronically filed with the Commission. OSEC

posts this information on the

www.ferc.gov web

site, and OSEC is delegated the responsibility of

maintaining the Attachment Content Type Codes

(att_content_type_code).

12/19/08

4

The Attachment Reference Code list posted

on FERC’s site contains a cross-reference

to Filing Type. Will this list be normalized

The Attachment Reference Codes for Transmittal

Letter, Tariff, Marked Tariff and Other have been

normalized across Types of Filings as of

12/19/08

1/15/10

17

Question

Answer

Date

across Filing Types?

12/7/2009.

5

RTF was chosen as one of the “standards”.

Was SGML (Standard Generalized Markup

Language) considered?

RTF was one of two Record Binary Data

(record_binary_data) versions of software

recommended to the Commission by NAESB and

accepted by Order No. 714. As noted by Order

No. 714, the standards are the result of a

consensus after a long process starting in 2001.

12/19/08

6

Since Office 2007/Word 2007 supports

many more features than RTF, is there any

guideline on how to translate these features

to RTF?

Microsoft provides compatibility documentation for

various versions of Word 2007 with RTF entitled Rich

Text Format (RTF) Specification.

There are no OSEC guidelines at this time. Each

company needs to asses the use of its word processing

capabilities with respect to creation of RTF files. Our

guidance would be that tariff provisions should not use

complex formats. A reasonable test is to view the

document after it has been saved in RTF in an

alternative software reader than what was used to create

the RTF, such as WordPad.

12/19/08

5/25/10

8/12/13

7

A Word 2007 DOCX saved as a RTF may

expand tremendously. There may be a problem

with size of files once translated to RTF from

DOCX. E.g. I saved a 10mb DOCX as a RTF

and it became 243 MB. However zipping that

same file it became 23 MB while the DOCX

zipped yielded 8MB (a resulting 3x difference).

Each company needs to asses the use of its word

processing capabilities with respect to creation of RTF

files. Our guidance would be that tariff provisions

should not use complex formats. There is a 10MB limit

to the Record Binary Data (record_binary_data). Tariff

creation software should be chosen and configured to

conform to the technological limits of RTF and the

OSEC Implementation Guide.

See also the response to Question 12 below.

12/19/08

4/18/11

18

Question

Answer

Date

8

A map/line drawing/diagram greatly increased

the size of the RTF versions of the Record

Binary Data file. What are the alternatives

means of creating this data?

Maps/line drawings/diagrams in JPG format can

significantly increase the RTF file size. Try converting

from JPG to GIF format, and saving in grey scale. An

alternative is to file the Maps/line drawings/diagrams as

a separate tariff section in PDF format.

See also the response to Question 12 below.

5/25/10

4/18/11

9

My eTariff filing was rejected by the

Commission as it failed to include a Clean

Tariff. However, the att_ref_code.csv table

indicates that a Clean Tariff is not required.

Why was my filing rejected?

Order No. 714 did not change the documentation

requirements for a complete tariff filing. The

convention for eTariff filings permits the Clean Tariff

to be part of the Transmittal Letter or attached as a

separate document. The flexibility eTariff provides

users to satisfy the attachment requirement does not

change the requirement that the documentation must be

provided.

Note that the OSEC and the Commission have the

ability to change the eTariff attachment filing

requirements to mandate the attachment of a separate

Clean Tariff document as a means of ensuring the

regulatory requirement is satisfied.

5/25/10

10

My formula rates tariff sheets are creating large

tariff sections when converted into RTF files.

What can I do?

Many formula rate paper tariff sheets were constructed

by printing directly from the spreadsheet software or

copying spreadsheets into a word processor and saving

in the native file format before printing.

RTF is capable of receiving some forms of embedded

objects and rendering tables. However RTF is not as

efficient as native file formats for tables and styles.

6/10/10

4/18/11

19

Question

Answer

Date

When converting formula rate tariff sheets to RTF,

review the tariff sheets to ensure that the existing tariff

sheets are compliant with the minimum font size

required by the Commission’s regulations (10 point

font: sec. 385.2003(a)(4) (10)).

Review whether a table structure is required, or whether

columns or tabs will suffice.

Review whether tables contain unnecessary rows or

columns.

Consider converting the formula rate into a plain-text

format to remove most table and style codes. For

example, Excel provides Save As|MS –DOS text

format. For an example of this technique for rendering

large rate designs, see

http://www.ferc.gov/industries/gas/gen-info/rate-

filings/rate_fnl.pdf.

See also the response to Question 12 below.

11

Can I leave active hyper-links in my tariff

sections?

No. Leaving hyper-links in a tariff creates a security

risk for both FERC and site that the link is directed.

6/10/10

12

My Microsoft Word file has graphics in it, and

RTF conversion file size is large. Can I set

some default in Word to reduce the file size?

Yes. However, it should only be done with great

caution and some companies may limit access to the

necessary files to IT support personnel only. The

Microsoft information and instructions are located here:

http://support.microsoft.com/kb/224663

4/18/11

20

Question

Answer

Date

13

How can I improve the attachment descriptions

that appear in eLibrary?

eLibrary prominently displays the hyperlinked

Attachment Document File Name as the lead item,

followed by the Attachment Description. As a result,

many applicants believe that the Attachment Document

File Name is the attachment’s description. However, it

is not. Further, many applicants who try to name their

attachment file names with complete descriptions

quickly run into the 60-character limit for the

Attachment Document File Name data element. The

effective available Attachment Document File Name

character limit is really about 55, as the remaining

characters must be reserved for the extension (“dot” and

the extension characters).

eLibrary’s description of the attachment follows the

hyperlinked Attachment Document File Name.

Applicants should use the Attachment Description to

pass the attachment’s description to eLibrary. The

Attachment Description data element has an 80

character limit. Many applicants do not change their

software’s default Attachment Description of “Other”,

and thereby miss an opportunity to provide eLibrary

and the public a more informative description of the

attachment’s content.

5/25/11

14

I made a mistake and did not identify a

document as Privileged/CEII in the Attachment

Security Code. What should I do to correct this

mistake?

All documents that are part of an eTariff filing are, upon

acceptance by OSEC as a tariff filing, automatically and

immediately uploaded into eLibrary and made part of

the public record with the security status provided by

the Applicant. FERC is not responsible for detecting

1/6/14

21

Question

Answer

Date

and correcting filer errors.

Applicants cannot change the security status of a

document once in the public record through an eTariff

filing. When such an error occurs:

1. The Applicant should email

FERCOnLineSupp[email protected]

. The email should

identify the Applicant, docket number, date of filing

and accession number of the specific document at

issue, and request FERC staff to change the status of

the document to either privileged or CEII, as

appropriate.

2. The Applicant is responsible for correcting their

filing. The Applicant should modify their filing

using the appropriate TOFC to ensure the proper set

of documents are before the Commission and the

public consistent with 18 C.F.R. 388.112 (2014).

This regulation requires:

a. A redacted pubic version of the document

b. An unredacted non-public version of the

document, and

c. A proposed form of protective agreement.

Alternatively, instead of modifying the filing, the

Applicant may Withdraw the filing and start over. Note

that Withdraw of a tariff filing does not remove the

filing or any of its documents from eLibrary or change

the security status of any document.

22

Tariff Record Related Codes

Question

Answer

Date

1

Discuss "PRO FORMA" record

change type relative to version

numbers. It seems that "PRO

FORMA" tariff records will "use up"

a version. Could PRO FORMA

tariff record versions use version

numbers in the 1000’s, for example,

so that they do not collide with the

natural progression of version

numbers? Are there any tariff

record filing rules that are relaxed

for records filed with a "PRO

FORMA" change type?

Order No. 714 gave applicants some discretion in

creating Record Version Number (record_version_num)

entries, and the application of such discretion to Pro

Forma Tariff Records would be reasonable. As

applicants usually file Pro Forma tariff sections as part of

a request for a full review of the proposed tariff changes,

all the Tariff Record Content Data should be filed for

each Pro Forma Tariff Record.

12/19/08

2

Tariff Record Proposed Effective

Date: this XML field is marked as

required in the "OSEC

Implementation Guide," however, it

wouldn't be needed for a withdrawal

filing, for example. Is this right?

Aside from withdrawal filings, are

there other types of filings for which

Tariff Record Proposed Effective

Date would not be required?

Currently, there is no Withdraw category Type of Filing

Code (filing_type) that requires a Tariff Record Proposed

Effective Date (proposed_effective_date) to implement

the Commission’s regulatory business rules. However,

that may not be the case in the future.

12/19/08

3

When filing a tariff record with

multiple options, do all tariff records

in the filing have to have the same

number of options? For example, if

The Commission’s normal business practice, and

adopted in the OSEC Implementation Guide, is to accept

one option in its entirety, reject the others, and require a

compliance filing to include proposals in other options

12/19/08

23

Question

Answer

Date

tariff record #12 was being filed with

option codes "A" and "B," would

tariff record #23 also need to be

filed as an option "A" and an option

"B" even if only one version of

record #23 was desired?

where accepted. Given this business practice,

applicants proposing different Option Code sets may

choose to file complete sets to reduce the likelihood of a

subsequent compliance filing or the number of Tariff

Records that must be included in a subsequent

compliance filing.

4

Under eTariff, when filing a new version of a given tariff record, in addition to the content of the record

being updated, the organization of tariff can also be changed. Specifically, the "Tariff Record Collation

Value" and the "Tariff Record Parent Identifier" can also be changed. I present here an example filing

scenario followed by some questions.

Scenario

Given the following tariff records which represent only a portion of the overall tariff:

#17 v0.0.0 General Terms & Conditions

|

+---#1120 v3.0.0 Gas Quality

Record id 17 is the "General Terms & Conditions" section. Record id 1120 is the "Gas Quality" section,

which has some history as it is on version 3.0.0. Record 1120 is a child of record 17.

Filing scenario: Two new sections are being added: "Rate Guarantees" and "Issue Resolution Response".

Like "Gas Quality," these sections speak to "Pipeline Performance." As such, a new section called

"Pipeline Performance" will also be added. Its parent will be "General Terms & Conditions" (record 17).

"Gas Quality," "Rate Guarantees," and "Issue Resolution Response" will all be children of "Pipeline

Performance". Therefore, the new structure of the tariff will be as follows:

#17 v0.0.0 General Terms & Conditions

|

+---#???? v?.?.? Pipeline Performance

|

24

Question

Answer

Date

+---#???? v?.?.? Gas Quality

|

+---#9217 v0.0.0 Rate Guarantees

|

+---#9218 v0.0.0 Issue Resolution Response

There are 3 ways to file these changes to the tariff that all have roughly the same results. They are

presented below:

(1) File 3 new records for "Pipeline Performance," "Rate Guarantees," and "Issue Resolution." File "Gas

Quality" as v4.0.0. of record id 1120 and change its parent to be the "Pipeline Performance" record.

(2) File v4.0.0 of record id 1120 changing it over to be the "Pipeline Performance" record, which obviates

the need to change its parent. In addition, file 3 new records for "Gas Quality," "Rate Guarantees," and

"Issue Resolution."

(3) Cancel record id 1120. In addition, file 4 new records for "Pipeline Performance," "Gas Quality," "Rate

Guarantees," and "Issue Resolution."

4a

For industry members: How often

does such a filing scenario occur?

Some of this data is available from the Commission’s

FASTR data, available at

http://www.ferc.gov/industries/gas/gen-

info/fastr/htmlall/index.asp

. Every Volume No. 1 with a

revision above “Original” constitutes a reorganized tariff.

Adding sections to existing tariffs most frequently is

associated with the Commission imposing new tariff

requirements.

12/19/08

4b

For FERC: What is the preferred

filing method (1, 2, or 3) for such a

filing?

All the proposed filing methods require the use of a Tariff

Record Collation Value (collation_value) to organize the

Tariff Records in the proposed fashion. Filing method 1

is preferred: retain the use of Tariff Record No. 1120,

and relocate its position in the tariff through a new Tariff

Record Collation Value. This method preserves the

history of Tariff Record No. 1120.

12/19/08

25

Question

Answer

Date

5

How are the energy companies to

use the parent relationship in a

sheet-based tariff to meet the

needs of the eTariff process and

FERC's eTariff Viewer?

At NAESB’s public web site is a Draft Implementation

Guide 01/25/08 (Redline)

(

http://www.naesb.org/pdf3/etariff012308a2.doc). It has

an extensive set of Use Case Descriptions starting at

approximately page 44. The Use Cases show

examples of how to use the Tariff Record Identifier

(record_id) and Tariff Record Parent Identifier

(record_parent_id) that will be used by the FERC’s

eTariff Viewer to show the structure of the Tariff Records

in the Table of Contents pane.

12/19/08

10/8/10

6

Should the Title Sheet of Volume X

be the parent and all the tariff

sheets in Volume X be its children?

This suggestion would work. See response to Business

Rules, Question No. 9.

12/19/08

7

Would this solution cause problems

in generating the Table of

Contents?

No.

12/19/08

8

These questions all relate to filings having associated filings and tariff records having associated tariff

records.

8a

When a filing has an associated

filing, is it necessarily true that

every tariff record contained within

will be associated with the same

filing?

The Associated Filing Identifier (associated_filing_id) is

the Filing Identifier (filing_id) for the previous Tariff Filing

to which the subject Tariff Filing or Tariff Record

pertains. The Filing Data’s Associated Filing Identifier

does not necessarily determine the appropriate Tariff

Record Content Data’s Associated Filing Identifier. See

8(d) for examples.

12/19/08

8b

When a tariff record being filed is

associated with a previously filed

tariff record, the Associated Filing

Identifier, Associated Record

Identifier, and Associated Option

True. However, if a set of several tariff records with the

same Tariff Record Identifier and Option Code are in the

associated tariff filing, the action will be against the

whole Tariff Record Identifier set.

12/19/08

8/12/13

26

Question

Answer

Date

Code work together to uniquely

identify the associated record.

True?

8c

When a tariff record being filed is

associated with a previously filed

tariff record, must the filing within

which it is being filed also be

associated with a previously filed

filing? Must they be the same

filing?

No.

12/19/08

8d

Can you provide an example where

the Associated Fling ID at the Filing

level would differ from the

Associated Filing ID at the Tariff

record level?

Example A: A COMPLIANCE Type of Filing that

CHANGEs Tariff Records from a NORMAL Type of

Filing category filing (e.g., RP01-234-000) and Tariff

Records from two subsequent and associated

AMENDMENT Type of Filing category filings (RP01-234-

001 and RP01-234-002).

Example B: A Compliance Type of Filing that CHANGEs

a Tariff Record from a NORMAL Associated Filing,

which would have the association data, and introduces a

NEW Tariff Record, which would have no association

data.

Example C: A Motion Type of Filing that moves into

effect suspended Tariff Records from a NORMAL and its

AMENDMENT Tariff Filings.

12/19/08

8e

Could there be multiple Associated

Filing IDs at the Tariff record level?

Multiple Tariff Records can have different Associated

Filing IDs, but any given Tariff Record Identifier can have

no more than one Associated Filing ID.

12/19/08

9

Under what circumstances will a

The MOTION, WITHDRAW and CANCELLATION Type

12/19/08

27

Question

Answer

Date

filing include tariff records that do

not contain tariff content such that

fields record_content_type_code,

record_binary_data, and

record_plain_text will be blank.

>Withdrawal filings?

>Cancellation filings?

>Motion filings?

Are there other filing types?

of Filing categories (filing_type) do not require content

for the record_content_type_code, record_binary_data,

and record_plain_text fields. Further, regardless of the

Type of Filing, Tariff Records with a Record Change

Type (record_change_type) populated with CANCEL or

WITHDRAW do not require content for the

record_content_type_code, record_binary_data, and

record_plain_text fields.

In addition, no tariff text may be required for some tariff

organization. For example, a parent record may only

have text in the Record Content Description and/or Tariff

Record Title.

10/8/10

10

Could record binary data in .rtf

format contain a page break? For

instance, because there appears to

be no limitation of content on a tariff

sheet, one could presumably have

the content run over to the next

sheet but continue to name that

Sheet No. 200, thus one would

need to have a break to make it

work.

Yes. The eTariff software system will not be altering any

of the binary content of the tariff record. If the material is

retrieved as an rtf file, then the page break codes should

show up as they were entered. However, in a web page

viewer, or any other conversion to other formats, page

breaks may or may not be recognized.

12/19/08

11

Consider the following scenario:

(A) An eTariff record is filed with

FERC.

(B) FERC accepts the changes

subject to conditions.

(C) The record is filed again in a

compliance filing (like today's

Yes, the Record Effective Priority Order (priority_order)

is required: Tariff status is largely controlled by dates

(think of the statutory clock and notice periods as

examples). The problem becomes what happens for the

same tariff record of a single date with multiple tariff

record changes hitting on the same date?

1) Two tariff record changes: In this scenario, which is

3/6 /09

28

Question

Answer

Date

Substitute tariff sheets) with the

same effective date as in (A) above.

Is it necessary that the two filed

records (in (A) and (C) above) have

different Record Effective Priority

Order values?

the same as in the question for date 1/1/2020, the

“substitute” record is likely to take precedence over the

“original” record, and the objective is to show as

“effective” the substitute record for the whole day.

Section Revision Priority Order Disposition Tariff Record

Status

Section 156 6.0.0 500 Minimal Suspension Superceded

Section 156 6.1.0 520 Accepted Effective

2) But scenario 1) is simplistic, and there are often

more complex issues. Suppose the example below for a

given date 1/1/2020:

Section Revision Priority Order Disposition Tariff Record

Status

Section 156 6.0.0 500 Minimal Suspension Superceded

Section 156 7.0.0 600 Accepted Effective

If a change in the tariff record text was required to

v6.0.0, but not 7.0.0, then the compliance filing would

be:

Section Revision Priority Order Disposition Tariff Record

Status

Section 156 6.0.0 500 Minimal Suspension Superceded

Section 156 6.1.0 520 Accepted Superceded

Section 156 7.0.0 600 Accepted Effective

If a change in the tariff record text was required to

v6.0.0, and if affected the tariff text of 7.0.0, then the

compliance filing would be:

Section Revision Priority Order Disposition Tariff Record

Status

Section 156 6.0.0 500 Minimal Suspension Superceded

29

Question

Answer

Date

Section 156 7.0.0 600 Accepted Superceded

Section 156 7.1.0 620 Accepted Effective

12

What are the status conditions for

Natural Gas Act (natural gas

pipeline) tariff records?

Status conditions vary over time and in accordance with

a variety of statutory, regulatory and business rules. The

combination of the meta data required by the XML

schema and the business rules permit at least the

following tariff record status conditions:

Pending

Accepted

Effective

Suspended

Superceded

Rejected

Withdrawn

Overtaken by events

Pro Forma

3/6 /09

13

What are the status conditions for

Federal Power Act (public utility)

tariff records?

Status conditions vary over time and in accordance with

a variety of statutory, regulatory and business rules. The

combination of the meta data required by the XML

schema and the business rules permit at least the

following tariff record status conditions:

Pending

Pending (Tolled)

Accepted

Effective

Suspended

Superceded

Rejected

Withdrawn

Overtaken by events

3/6/09

30

Question

Answer

Date

Pro Forma

14

What are the status conditions for

Interstate Commerce Act (oil

pipeline) tariff records?

Status conditions vary over time and in accordance with

a variety of statutory, regulatory and business rules. The

combination of the meta data required by the XML

schema and the business rules permit at least the

following tariff record status conditions:

Conditionally Accepted

Conditionally Effective

Accepted

Effective

Suspended

Superceded

Rejected

Withdrawn

Overtaken by events

Pro Forma

3/6 /09

15

What are the status conditions for

Part 284 program (NGPA intrastate

and NGA Hinshaw gas pipelines)

tariff records?

Status conditions vary over time and in accordance with

a variety of statutory, regulatory and business rules. The

combination of the meta data required by the XML

schema and the business rules permit at least the

following tariff record status conditions:

Conditionally Accepted

Conditionally Effective

Pending (Tolled)

Accepted

Effective

Superceded

Rejected

Withdrawn

Overtaken by events

3/6 /09

11/13/13

31

Question

Answer

Date

Pro Forma

16

What are the status conditions for

Power Administration tariff records?

Status conditions vary over time and in accordance with

a variety of statutory, regulatory and business rules. The

combination of the meta data required by the XML

schema and the business rules permit at least the

following tariff record status conditions:

Conditionally Accepted

Conditionally Effective

Accepted

Effective

Superceded

Rejected

Withdrawn

Overtaken by events

Pro forma

3/6 /09

17

What is the tariff record status

condition of “Overtaken by events”?

The tariff record status condition of “Overtaken by

events” indicates the disposition of a tariff record whose

status before the Commission is moot because it has

been overtaken by some other filing. Currently, if an

applicant files a correction to an initial filing’s tariff record

or a correction to a compliance filing’s tariff record, the

applicant should indicate that the underlying record is

withdrawn. If it fails to do so, the Commission should

reject the tariff record as moot.

In eTariff, AMENDMENTS to a NORMAL/STATUTORY

or another AMENDMENT, or COMPLIANCE to a

COMPLIANCE Type of Filing should target the

underlying tariff record utilizing the associated date

elements: Associated Filing Identifier, Associated

3/6 /09

1/15/10

5/25/10

1/27/11

32

Question

Answer

Date

Record Identifier and Associated Option Code. Upon

OSEC acceptance of the later tariff filing, the associated

tariff record’s status will convert to “Overtaken by events”

without further action by the applicant or the

Commission.

18

What is the FPA and NGPA

programs’ tariff record status

condition of “Pending (tolled)”?

The “Pending (tolled)” status condition indicates that the

Commission has issued an order finding a

NORMAL/STATUTORY or AMENDED FPA or NGPA

program type of filing (a filing type for which there is a

statutory or regulatory time the Commission must act)

tariff filing deficient (FPA and NGPA programs) or

protested (NGPA program) and cannot be processed

within the time-line. The statutory or regulatory time for

the Commission to act is no longer applicable. The tariff

filing and tariff records will remain in this status until (a)

an AMENDMENT type of filing is filed, which will reset

the filing date for the statutory or regulatory clock to the

date of the AMENDMENT filing; (b) the Commission

rules upon the tariff record; or (c) the filing is withdrawn.

Note that in the NGPA program, the optional procedures

of 284.123(g) provide for regulatory tolling (without

Commission order) of the tariff records in the event the

filing remains protested by the 60

th

day from the date of

filing, and the tolling status may be removed by

regulation (without Commission order) if the protest is

withdrawn within the reconciliation period.

3/6 /09

1/15/10

5/25/10

11/13/13

19

What is the difference between the

tariff record status conditions of

“Accepted” and “Effective”?

The tariff record status condition of “Accepted” indicates

that the tariff record has been accepted by the

Commission or pursuant to some other statutory or

3/6 /09

33

Question

Answer

Date

business rule, and may become effective some date in

the future. The tariff record status condition of

“Effective” indicates that the tariff record has been

Accepted and is in effect.

20

What is the tariff record status

condition of “Conditionally

Accepted”?

Certain programs’ statutory, regulatory or business rules

permit a tariff record to become effective before

Commission action is required. Conditionally Accepted

indicates a tariff record change is proposed to be

effective on a specified future date.

3/6 /09

21

What is the tariff record status

condition of “Conditionally

Effective”?

Certain programs’ statutory, regulatory or business rules

permit a tariff record to become effective before

Commission action is required. The tariff record status

condition of “Conditionally Effective” indicates that the

tariff record is effective, but that final Commission action

is still pending.

3/6 /09

22

NGA section 7 certificate filings

commonly contain “Pro Forma” tariff

records. Are NGA section 7

certificate filings’ “Pro Forma” tariff

records required to be filed utilizing

eTariff.

Not at this time. If the Commission decides to require

NGA section 7 certificate filings to be filed utilizing the

eTariff gateway of eFiling, that requirement will be the

subject of a separate Notice and/or rulemaking.

All NGA section 4 compliance filings to Commission

orders on NGA section 7 certificate filings must utilized

eTariff. These compliance filings may contain Pro

Forma, New or Changed tariff records.

3/6 /09

23

If a Conditionally Accepted or

Conditionally Effective tariff record

is Suspended or Rejected, must the

applicant refile the tariff record that

was formerly effective?

No. The status of the tariff record that was superceded

by the Conditionally Accepted or Conditionally Effective

tariff record will revert to tariff record status of Effective.

3/6 /09

24

Can the Associated Filing Identifier

No. The Associated Filing Identifier

3/6 /09

34

Question

Answer

Date

(associated_filing_id) reference a

Filing Identifier (filing_id) other than

the filer’s?

(associated_filing_id) must reference only Filing

Identifiers (filing_id) made by the filer as identified by the

Company Identifier (company_id).

25

Can the Associated Record

Identifier (associated_record_id)

reference a Tariff Record Identifier

(record_id) of another Company

Identifier (company_id) or Tariff

Identifier (tariff_id)?

No. The Associated Record Identifier

(associated_record_id) must reference only a Tariff

Record Identifier (record_id) that exists in the Tariff

Filing’s Tariff Identifier (tariff_id) for the of the Tariff

Filing’s Company Identifier (company_id).

3/6 /09

26

In a situation of multiple option sets

– Options A, B and C, and a new

Tariff Record Identifier (record_id)

is being created, what should the

different option sets’ Record

Change Type

(record_change_type) contain?

There must be at least one Record Change Type

(record_change_type) of NEW in the first option the

proposed new Tariff Record Identifier (record_id)

appears. Thereafter and within the tariff filing’s option

sets, Tariff Record Identifier (record_id) of either NEW or

CHANGE are acceptable. Acceptable examples for a

new Tariff Record Identifier (record_id) of “1234”:

Example 1:

Option Record Change Type

A NEW

B CHANGE

C CHANGE

Example 2:

Option Record Change Type

A NEW

B NEW

C CHANGE

Example 3:

5/25/10

35

Question

Answer

Date

Option Record Change Type

A null

B NEW

C CHANGE

27

For tariff records with a Record

Change Type

(record_change_type) of PRO

FORMA, must the Option Code

(option_code) be populated?

Yes. There can be multiple PRO FORMA option sets.

However, PRO FORMA option sets should avoid Option

Code (option_code) “A”, as that code designates the

applicant’s primary real (as opposed to pro forma) tariff

change proposal.

5/25/10

28

I found a mistake in a tariff record in

a tariff filing that is still pending

before the Commission. How do I

correct the tariff record?

If the pending tariff filing is a Normal/Statutory filing, then

file an Amendment category type of filing; or if the

pending tariff filing is a Compliance filing, then file a

Compliance category type of filing. The corrected tariff

records should contain all the associated tariff record

information (associated_filing_id, associated_record_id,

and associated_option_code) to properly target the

incorrect tariff record. Providing the associated tariff

record information informs the Commission that the

targeted tariff record is replaced. The Commission will

reflect the targeted tariff record’s status as OBE

(Overtaken By Events).

6/10/10

29

I found a mistake in tariff record 123

in a tariff filing that is still pending

before the Commission. Tariff

record 123 had several child

records with Record Change Type

NEW. I filed a single tariff record

consisting of (a) a correction to tariff

record 123 with a Record Change

Type WITHDRAW to withdraw the

Any proposal to withdraw or OBE a pending tariff record

with pending child records, regardless of whether the

child records are in the proceeding or another

proceeding, will be deemed either withdrawn or OBE,

as there is no longer a parent record for the child records

to attach. All tariff records must have a parent to provide

the tariff with structure and continuity. Tariff records

cannot “float” in a tariff, and must be “anchored.”

6/25/10

36

Question

Answer

Date

record or (b) an associated tariff

record 567 with tariff record 123 to

OBE tariff record 123. Now all the

child records with Record Change

Type NEW to tariff record 123 are

no longer visible in the Public Tariff

Viewer and appear to have been

either (a) withdrawn or (b) OBE.

What happened?

Another analog to visualize the situation: imagine a NEW

section to an outline, and the section has several sub-

sections. If the highest level of the section is removed,

all the subsections will be removed at the same time.

30

My filing was rejected by the

Commission as it failed an eTariff

validation test. I corrected the

error. However, the filing was

rejected again as it failed another

test not previously identified. How

can this happen?

Many of the Secretary’s validation tests are complex,

requiring use of several data elements from the XML file

and comparing to several other data elements in the

Commission’s eTariff data base. If the expected data

from the XML filing are not available or unexpected, the

validation test results will find that there was an error and

reject the filing. The complex validation tests will not

run. Once the filing has been refiled with the previously

noted errors corrected, then the complex tests can run.

The result of those complex tests can be other error

messages and rejection of the filing. It is always a good

idea to first test your XML filing in the Sandbox to ensure

the filing will pass all validation tests.

1/27/2011

31

I tried to upload my test tariff filing

into the Sandbox, but I received an

error message that the site is

unavailable, that I do not have

rights to the site, or nothing

happens. What is wrong with your

Sandbox site?

In most instances the problem is with the user’s internet

browser’s security settings with regard to access to and

use of an FTP site. Either use your browser’s HELP

feature to research the appropriate settings or discuss

your requirement to access the Sandbox’s FTP site with

your IT personnel.

Frequently, browser settings permitting access to the

5/25/11

37

Question

Answer

Date

Sandbox are lost when browsers are upgraded. If you

formerly had access to the Commission’s Sandbox but

have lost access, check your FTP security settings.

32

A new company is creating a new

tariff, but does not know when it will

go into service. What Tariff Record

Proposed Effective Dates should

the Baseline filing contain?

Baseline tariff filings with “to be determined” proposed

effective dates of 12/31/9998 need to include at least

one tariff record with a Tariff Record Proposed Effective

Date in the near future – date of filing is acceptable. The

reason is that the earliest Tariff Record Proposed

Effective Date in a Baseline filing becomes the

establishment date for the Tariff Identifier. No Tariff

Record can have an effective date that predates the

Tariff Identifier’s establishment date. Therefore, if a

Tariff Identifier has an establishment date of 12/31/9998,

once the company goes into service and informs the

Commission of its in-service date, it will not be able to

provide a Tariff Record Proposed Effective Date earlier

than 12/31/9998. The company will have to file a

Cancellation of the Tariff Identifier with the 12/31/9998

establishment date and file a new Baseline filing to

create a new Tariff Identifier with the in-service date.

10/4/11

33

The company needs to make a

Normal/Statutory, Amendment or

Compliance filing that requires several

tariff records to reflect intermediate

changes; or, the company wishes to

propose several different changes to a

tariff record, each change with a

different prospective effective date.

How can this be done?

There are two methods to make tariff filings that involve a set

of tariff records with the same Tariff Record Identifier.

Assume an example were one tariff record needs 4 versions.

Method 1: This method requires 4 tariff filings, each tariff

filing containing one tariff record. Do NOT associate at the

Tariff Record Content Data Level, as that will result in the

target tariff record or record set becoming OBE if that record

or record set is in a Pending, Tolled, Conditionally Accepted

or Conditionally Effective status.

2/3/14

38

Question

Answer

Date

Method 2: Multiple tariff records with the same Tariff

Identifier and multiple Tariff Record Proposed Effective Dates

(a Tariff Record ID set) can be filed in a single tariff filing.

All the proposed tariff records with the same Tariff Identifier

must have the same Option Code. However, each tariff record

must have a different Record Effective Priority Order. Do

NOT associate at the Tariff Record Content Data Level, as

that will result in the target tariff record or record set

becoming OBE if that record is in a Pending, Tolled,

Conditionally Accepted or Conditionally Effective status.

Example:

Tariff Record ID Priority Order Option Code P. Eff. Date Ass. Tariff Record

1589 1085 A 1/8/10 Null

1589 1258 A 2/8/10 Null

1589 1565 A 3/8/10 Null

1589 1566 A 3/8/10 Null

Under Method 2, make sure the Record Effective Priority

Order is valid for each Tariff Record Proposed Effective Date.

Method 1 is the best method for those who have limited

experience with eTariff and/or whose eTariff software does

not validate associations at the Tariff Record Content Data

Level.

Method 1 also will establish different statutory effective

dates (in the example above, 3 different dates), while

Method 2 will establish a statutory date based on earliest

proposed effective date.

34

I made a filing following Method 2

If the tariff records in the subject tariff filing are Pending,

2/3/14

39

Question

Answer

Date

describe in Qu. 33 above, with a Tariff

Record ID set containing 4 tariff

records. One of those records has a

mistake that needs to be corrected.

How can I correct that record?

Tolled, Conditionally Accepted or Conditionally Effective,

then an Amendment or Compliance filing (as appropriate)

may be filed to correct the tariff record. However, the whole

Tariff Record ID set of 4 tariff records must be refiled.

Remember to increment the Record Effective Priority Order.

With at least one of the tariff records in the tariff record set,

associate at the Tariff Record Content Data Level. This

association at the Tariff Record Content Data Level will OBE

ALL the proposed tariff records in the set in the targeted tariff

filing.

35

I made a filing following Method 2

describe in Qu. 33 above, with a Tariff

Record ID set containing 4 tariff

records. Why is it not possible to

correct only select records in the Tariff

Record ID set?

eTariff’s XML Schema Version 1 does not provide enough

data elements to correctly target a single tariff record in a

Tariff Record ID set.

For example, Filing Identifier 687 proposed and has pending:

Tariff Record ID Priority Order Option Code P. Eff. Date

1589 1085 A 1/8/10

1589 1258 A 2/8/10

1589 1565 A 3/8/10

1589 1566 A 3/8/10

If Line 3 (Tariff Record ID 1589, Priority Order 1565, Option

Code A with a Tariff Record Proposed Effective Date of

3/8/10) is in error, the eTariff XML schema, at the associated

Tariff Record Content Data Level, only request data elements

the Tariff Record ID and the Option Code. These are not

enough data to select the proper tariff record in the Tariff ID

set that is in error.

36

I made a Normal/Statutory or

Compliance filing following Method 2

describe in Qu. 33 above. What other

Any Type of Filing Code or Record Change Type that requires

providing associated tariff record data at the Tariff Record

Content Data Level should be treated with extreme caution.

2/3/14

40

Question

Answer

Date

limitations are there to the use Tariff

Record ID sets?

Normal/Statutory filings may be revised using Amendment

category Type of Filing Codes, and Compliance Statutory

filings may be revised using Compliance category Type of

Filing Codes. See Qu. 34 above.

Record Change Type Withdraw that targets any tariff record

within a filing’s Tariff Record ID set will withdraw the

complete Tariff Record ID set.

37

I made a tariff filing with a Tariff

Record ID set that the Commission

suspended. How do I move the

suspended tariff records into effect or

change their effective dates?

The Motion category of Type of Filing Codes is used to

motion tariff records into effect and/or change their effective

date, as permitted by Commission regulation. Motion filings

can only be directed to tariff records that are in Suspended

status.

The use of a Motion filing targeting a suspended Tariff Record

ID set will result in all the tariff records in the Tariff Record

ID set going into effect on the same date (see Qu. 35). If

multiple tariff records with different Tariff Record Proposed

Effective Date in a Tariff Record ID set are provided in the

Motion filing, the actual Effective date that will appear in the

Commission’s records is unpredictable.

The proper method to change the date of Suspended tariff

records in a Tariff Record ID set is to file a Compliance (FPA

Program) or Normal/Statutory (Oil Program) filing that

contain a new Tariff Record ID set with the new Tariff Record

Proposed Effective Dates. Such filings in the FPA and Oil

Programs should state in the Transmittal Letter that the

Commission should act before the automatic end of the

2/3/14

41

Question

Answer

Date

suspension period when Suspended tariff records

automatically change status to Effective.

38

My filing was rejected because of

OSEC Validation Rule 80: A tariff

record's Record Effective Priority

Order in the filing duplicates an

effective or pending Record Effective

Priority Order. Which records need to

be checked to eliminate this error?

The most common reason eTariff filings are rejected by the

Secretary is OSEC Validation Rule 80. The Secretary’s

rejection email provides the Tariff Record Identifier that

caused the error to assist filers in identifying and correcting

the problem. Each Tariff Record Identifier’s Record Effective

Priority Order in a proposed tariff filing should be checked

two ways:

1. If there are multiple identical Tariff Record Identifiers in