UNITED STATES DISTRICT COURT

SOUTHERN DISTRICT OF NEW YORK

NESSA RISLEY, JAMES FREELAND, ROBERT

SCOTT, ANNIE VENESKY, ANDREW

CARDIS, and DEAN MEYERS, individually

and on behalf of all others similarly situated,

Plaintiffs,

v.

UNIVERSAL NAVIGATION INC. dba UNISWAP

LABS, UNISWAP FOUNDATION, HAYDEN Z.

ADAMS, PARADIGM OPERATIONS LP, AH

CAPITAL MANAGEMENT, L.L.C. dba

ANDREESSEN HOROWITZ, and UNION

SQUARE VENTURES, LLC,

Defendants.

No. 1:22-cv-2780-KPF

FIRST AMENDED CLASS ACTION COMPLAINT

Case 1:22-cv-02780-KPF Document 46 Filed 09/27/22 Page 1 of 171

ii

Table of Contents

NATURE OF THE CLAIMS ............................................................................................... 1

PARTIES .............................................................................................................................. 4

JURISDICTION AND VENUE ........................................................................................... 6

FACTUAL BACKGROUND .............................................................................................. 8

I. CRYPTO ASSETS AND SO-CALLED DEFI............................................................. 8

A. Ethereum ............................................................................................................. 10

B. ERC-20 Tokens ................................................................................................... 10

C. Initial Crypto Asset Offerings ............................................................................. 11

II. THE PROTOCOL ....................................................................................................... 12

A. “Decentralized” Exchanges Take Off, with

Uniswap Leading the Charge .............................................................................. 12

B. The Uniswap Interface ........................................................................................ 15

C. How the Protocol Works ..................................................................................... 19

III. UNISWAP’S OWNERSHIP STRUCTURE AND

CONTROL OF THE PROTOCOL ............................................................................. 26

A. Ownership of Uniswap ........................................................................................ 26

B. Paradigm, Andreesen, and USV Helped Develop and Upgrade the

Protocol Without Any Regard for Safeguards for Users of the Protocol ............ 28

C. Uniswap Has Unilateral Control Over the Protocol ............................................ 32

IV. UNISWAP ISSUED THE OWNER’S UNI TOKENS, WHICH ENABLES THEM

TO CONTROL THE PROTOCOL ............................................................................ 33

A. The UNI Token and Uniswap Governance ......................................................... 33

B. Andreessen Holds the Most UNI Tokens ............................................................ 36

C. Studies Conclude There is Centralized Control of DeFi Platforms .................... 37

D. The Uniswap Defense Fund ................................................................................ 39

V. DEFENDANTS CREATED AND CONTROL THE UNISWAP FOUNDATION .. 40

VI. THE OWNERS LIKELY PROVIDE MILLIONS OF DOLLARS IN

LIQDUITY TO THE LARGEST POOLS ON UNISWAP, WHICH

GENERATE MILLIONS OF DOLLARS IN FEES .................................................. 43

VII. UNISWAP ALLOWS THE ISSUANCE OF THOUSANDS

OF SCAM TOKENS .................................................................................................. 45

A. Scams Begin and Continue to Plague Uniswap .................................................. 45

Case 1:22-cv-02780-KPF Document 46 Filed 09/27/22 Page 2 of 171

iii

B. Uniswap Acknowledges but Continues to Allow Scams .................................... 47

VIII. THE PROTOCOL ALLOWS ISSUERS TO SCAM INVESTORS ......................... 50

A. EthereumMax ...................................................................................................... 51

1. The Rise and Fall of EMAX ..................................................................... 51

2. The EMAX Issuers Made a Fortune to the

Detriment of Investors in the Token ......................................................... 52

3. The EMAX Marketing Campaign ............................................................ 52

4. The EMAX Issuers’ Misrepresentations and Omissions .......................... 54

5. EMAX Is a Security .................................................................................. 55

B. Akita Inu (AKITA) .............................................................................................. 56

C. Olympus DAO (OHM) ........................................................................................ 60

D. Wise Token (WISE) ............................................................................................ 62

G. Bezoge Earth (BEZOGE) .................................................................................... 70

H. Matrix Samurai (MXS) ....................................................................................... 73

1. MXS Was a Scam Perpetrated in a Single Day ................................................... 73

2. MXS Is a Security ............................................................................................... 76

I. Alphawolf Finance (AWF) .................................................................................. 76

J. Rocket Bunny (BUNNY) .................................................................................... 78

K. BoomBaby.io (BOOMB) .................................................................................... 81

L. Saitama Token (SAITAMA) ............................................................................... 82

M. Dogelon Mars (ELON) ........................................................................................ 85

N. Kishu Inu (KISHU) ............................................................................................. 87

O. Starlink Token (STARL) ..................................................................................... 89

P. Smooth Love Potion (SLP) ................................................................................. 91

Q. FEGtoken (FEG) ................................................................................................. 94

R. Verasity (VERA) ................................................................................................. 96

T. HOGE.finance (HOGE) .................................................................................... 100

U. Sanshu Inu (SANSHU) ..................................................................................... 102

V. Shih Tzu (SHIH) ............................................................................................... 104

W. Jupiter Project (JUP) ......................................................................................... 106

X. Holo Project (HOT) ........................................................................................... 108

Y. Dent (DENT) ..................................................................................................... 111

Z. YFDAI Finance (YFDAI) ................................................................................. 113

Case 1:22-cv-02780-KPF Document 46 Filed 09/27/22 Page 3 of 171

iv

AA. Ares Protocol (ARES) ..................................................................................... 115

BB. HuskyToken (HUSKY) .................................................................................... 117

CC. Pundi X Labs (PUNDIX) ................................................................................. 119

DD. Kawakami Inu (KAWA) .................................................................................. 121

EE. Cyber Doge (CYBERD) .................................................................................... 123

FF. Lorde Edge (Edgelon) ....................................................................................... 125

JJ. Dogg Token (DOGG) ........................................................................................ 135

KK. Mine Token (MINE) ........................................................................................ 137

LL. ArchAngel (ARCHA) ........................................................................................ 140

MM. Stoner Doge Finance Project (STOGE) ......................................................... 142

IX. CLASS ALLEGATIONS ......................................................................................... 144

CAUSES OF ACTION .................................................................................................... 147

FIRST CAUSE OF ACTION .................................................................................. 147

Contracts With an Unregistered Exchange – Violation of Sections 5

and 29(b) of the ‘34 Act (Against all Defendants) ........................................... 147

SECOND CAUSE OF ACTION ............................................................................. 149

Unregistered Broker and Dealer – Violation of Sections 15(a)(1)

and 29(b) of the ‘34 Act (Against all Defendants) ............................................ 149

THIRD CAUSE OF ACTION................................................................................. 151

Control Person Liability - Violation of Section 20 of the ‘34 Ac

(Against Adams, Paradigm, Andreessen, and USV) ........................................ 151

FOURTH CAUSE OF ACTION Unregistered Offer and Sale of Securities –

Violation of Sections 5 and 12(a)(1) ................................................................. 152

of the ’33 Act (Against all Defendants) .................................................................. 152

FIFTH CAUSE OF ACTION Control Person Liability – Violation of

Sections 5 and 12(a)(1) of the ’33 Act

(Against Adams, Paradigm, Andreessen, and USV) ......................................... 154

SIXTH CAUSE OF ACTION

Unregistered Sale of Securities in Violation of I.C. § 30-14-509(b)

(Against all Defendants) .................................................................................... 154

SEVENTH CAUSE OF ACTION

Transacting Business as an Unregistered Broker-Dealer

in Violation of I.C. § 30-14-509(d) (Against all Defendants) ........................... 156

EIGHTH CAUSE OF ACTION

Control Person Liability I.C. § 30-14-509(g) (Against the Owners) ................ 157

Case 1:22-cv-02780-KPF Document 46 Filed 09/27/22 Page 4 of 171

v

NINTH CAUSE OF ACTION

Unregistered Offer and Sale of Securities

N.C. Gen. Stat. Ann. § 78A-56(a) (Against all Defendants) ............................. 159

TENTH CAUSE OF ACTION

Transacting Business as an Unregistered Dealer

N.C. Gen. Stat. Ann. § 78A-36 (Against all Defendants) ................................. 160

ELEVENTH CAUSE OF ACTION

Control Person Liability N.C. Gen. Stat. Ann. § 78A-56(c)

(Against the Owners) ......................................................................................... 161

TWELFTH CAUSE OF ACTION

Aiding and Abetting Fraud (Against all Defendants) ....................................... 162

THIRTEENTH CAUSE OF ACTION

Aiding and Abetting Negligent Misrepresentation

(Against all Defendants) .................................................................................... 163

FOURTEENTH CAUSE OF ACTION

Unjust Enrichment (Against all Defendants) .................................................... 164

PRAYER FOR RELIEF .......................................................................................... 165

JURY TRIAL .......................................................................................................... 166

Case 1:22-cv-02780-KPF Document 46 Filed 09/27/22 Page 5 of 171

1

Plaintiffs Nessa Risley, James Freeland, Robert Scott, Annie Venesky, Andrew Cardis, and

Dean Meyers (collectively, the “Plaintiffs”), individually and on behalf of all others similarly

situated, as and for their first amended complaint against Defendants Universal Navigation Inc.

dba Uniswap Labs (“Uniswap”), the Uniswap Foundation, Hayden Z. Adams (“Adams”),

Paradigm Operations LP (“Paradigm”), AH Capital Management, L.L.C. dba Andreessen

Horowitz (“Andreessen”), and Union Square Ventures, LLC (“USV”) (Uniswap, the Uniswap

Foundation, Adams, Paradigm, Andreessen, and USV collectively referred to herein as

“Defendants”), allege on knowledge, information, and belief as follows:

NATURE OF THE CLAIMS

1. The Defendants created, own, and manage what they refer to as the “Uniswap

Protocol” (the “Protocol”), one of the largest crypto-asset exchanges in the world. This action

arises from their unlawful promotion, offer, and sale of unregistered securities on that exchange,

in the form of crypto “tokens” under federal and state law.

2. Uniswap has no barriers to entry for users looking to trade—or “swap”—crypto

tokens on the Protocol. Nor does Uniswap requires verification of an individual’s identity or

conduct any “know-your-customer” process. This combination has led to rampant fraud on the

Protocol.

3. Defendants are fully aware of the fraud perpetrated on the Protocol but have done

nothing to stop such activities, even though they could easily do so. Instead, Defendants maintain

a policy of willful blindness and encourage further fraudulent conduct by guaranteeing fees on all

trades to issuers of tokens on the Protocol (no matter how fraudulent). To date, Uniswap has

siphoned over $1 billion in fees from its users by allowing issuers of tokens to continue to profit

from their misconduct.

Case 1:22-cv-02780-KPF Document 46 Filed 09/27/22 Page 6 of 171

2

4. Uniswap has also enriched itself and the other Defendants through a fee structure

that they designed, created, and implemented on the Protocol. Unbeknownst to many users,

Uniswap collects fees for issuers on every transaction executed on the Protocol, generating vast

profits for Uniswap’s owners, who also act as issuers of tokens that are traded on the Protocol.

Uniswap has failed to disclose this fact and its attendant conflicts of interest in a transparent

manner. This is precisely the type of conduct that the securities laws, which Uniswap has

continually flouted, are designed to prevent.

5. From April 5, 2021 through the present (the “Class Period”), Defendants offered

and sold unregistered securities, including Alphawolf Finance, Bezoge, BoomBaby.io, Ethereum

Max, Matrix Samurai, Rocket Bunny, Akita, Archangel, Ares Protocol, Autz, Cyber Doge, Dent,

Dogg Token, Ethereum Chain Token, Ethereum Max, FEGtoken, Goku Inu, Hoge.finance,

HoloToken, Jupiter, Kawakami Inu, Kishu Inu, The Official Mine Token, Mononoke Inu, Pundi

X Token, Saitama, Sanshu Inu, Smooth Love Potion, StarLink, Stoner Doge, Vera, YfDai.finance,

Dogelon, HuskyToken, Lorde Edge, Shih Tzu, Wise Token, Lukso Token, Olympus Dao, and

Samsung Metaverse (collectively, the “Tokens”), throughout the United States on its Protocol,

without registering as a national securities exchange or as a broker-dealer, and without there being

any registration statements in effect for the Tokens it was selling, all in violation of applicable law.

All persons who purchased any Tokens on the Protocol during the Class Period and were harmed

thereby are referred to herein as the “Class.” Plaintiffs incorporate by reference the certifications

they filed in support of their motion for lead plaintiff, Dkt. Nos. 28-1–6.

6. Under guidelines promulgated by the Securities and Exchange Commission (the

“SEC”),

1

the Tokens are “investment contracts” and therefore “securities” under Section 2(a)(1)

1

“Framework For ‘Investment Contract’ Analysis of Digital Assets, available at https://www.sec.gov/files/dlt-

framework.pdf (last accessed September 19, 2022).

Case 1:22-cv-02780-KPF Document 46 Filed 09/27/22 Page 7 of 171

3

of the Securities Act of 1933 (the “’33 Act”) and Section 3(a)(10) of the Securities Exchange Act

of 1934 (the “’34 Act”). Thus, the issuers of these Tokens (the “Issuers”) were required to comply

with those and other laws by, specifically and without limitation, filing registration statements for

the Tokens. They failed to do so.

7. Uniswap was also required to register with the SEC as an exchange; which it did

not. After the launch of Uniswap’s own token, known as UNI, and implementation of Uniswap’s

governance, the Owners (defined below) were also required to register with the SEC as exchanges;

they failed to do so. As SEC Chairman Gary Gensler has made clear, “[n]ot liking a message isn’t

the same thing as not receiving it.”

8. Had the Tokens been registered as required, Plaintiffs and the Class would have

received necessary and meaningful disclosures that would have enabled them to reliably assess the

representations being made by the Issuers and the riskiness of their investments. Without these

disclosures, they were left to fend for themselves.

9. When the Issuers sought to sell the Tokens on the Protocol, Uniswap welcomed

them with open arms and collected millions of dollars in associated transaction fees. In doing so,

Uniswap failed to register as an exchange or broker-dealer, as it solicited, offered, and sold the

Tokens without filing any registration statements, in open violation of the federal securities laws.

10. Defendants have profited handsomely from this unlawful activity, as have the

Issuers to whom Uniswap paid hidden and exorbitant fees. Meanwhile, unsuspecting users on the

other side of these fraudulent transactions were left holding the bag.

11. Defendants Adams, Paradigm, Andreesen, and USV, (the “Owners”) separately or

together, aided and abetted the Issuers’ fraudulent activity by having control over the Protocol and

failing to enact measures that would have provided meaningful protection for the users of Uniswap.

Case 1:22-cv-02780-KPF Document 46 Filed 09/27/22 Page 8 of 171

4

12. Consequently, Uniswap and the Owners owe restitution and other relief to the

Class. Plaintiffs and the Class are entitled to damages for the amounts paid for the Tokens,

including all fees and charges collected by Uniswap, together with interest and attorneys’ fees and

costs, as well as other statutory and equitable relief.

PARTIES

13. Plaintiff Nessa Risley is an individual and a resident of North Carolina. Risley

purchased certain of the Tokens

2

on the Protocol beginning in May 2021. Risley first used the

Protocol in May 2021 and first learned about Uniswap around that time. Risley incurred

substantial losses on her transactions in connection with certain of the Tokens.

14. Plaintiff James Freeland is an individual and a resident of Idaho. Freeland

purchased certain of the Tokens

3

on the Protocol beginning in May 2021. Freeland first used the

Protocol in or around May 2021 and first learned about Uniswap around that time. Freeland

incurred substantial losses on his transactions in connection with certain of the Tokens.

15. Plaintiff Robert Scott is an individual and a resident of New York. Scott purchased

certain of the Tokens

4

on the Protocol beginning in May 2021. Scott first used the Protocol in or

around April 2021 and first learned about Uniswap around that time. Scott incurred substantial

losses on his transactions in connection with certain of the Tokens.

16. Plaintiff Annie Venesky is an individual and a resident of New York. Venesky

purchased Wise Token on the Protocol beginning in December 2020. Venesky first used the

2

Risley purchase the following Tokens: Alphawolf Finance, Bezoge, BoomBaby.io, Ethereum Max, Matrix

Samurai and Rocket Bunny.

3

Freeland purchased the following Tokens: Akita, Archangel, Ares Protocol, Autz, Cyber Doge, Dent, Dogg Token,

Ethereum Chain Token, Ethereum Max, FEGtoken, Goku Inu, Hoge.finance, HoloToken, Jupiter, Kawakami Inu,

Kishu Inu, The Official Mine Token, Mononoke Inu, Pundi X Token, Saitama, Sanshu Inu, Smooth Love Potion,

StarLink, Stoner Doge, Vera, and YfDai.finance.

4

Scott purchased the following Tokens: Dogelon, HuskyToken, Kishu Inu, Lorde Edge and Shih Tzu.

Case 1:22-cv-02780-KPF Document 46 Filed 09/27/22 Page 9 of 171

5

Protocol and first learned about Uniswap around that time. However, Venesky did not learn about

the substantial misrepresentations and issues with the Wise Token and problems with Uniswap

until several months later. Venesky incurred substantial losses on her transactions in connection

with the Wise Token.

17. Plaintiff Andrew Cardis is an individual and a resident of Australia. Cardis

purchased Lukso Token and Olympus Dao on the Protocol in November 2021. Cardis first used

the Protocol and first learned about Uniswap around that time. Cardis incurred substantial losses

on his transactions in connection with these two Tokens.

18. Plaintiff Dean Meyers is an individual and a resident of North Carolina. Meyers

purchased Samsung Metaverse on the Protocol in March 2022. Meyers first used the Protocol and

first learned about Uniswap around that time. Meyers incurred substantial losses on his

transactions in connection with Samsung Metaverse.

19. Defendant Uniswap is a Delaware business corporation duly registered with and

doing business in the State of New York, with a principal place of business in either Brooklyn, or

in New York, New York. According to Uniswap’s website, “[w]e are based out of SoHo in New

York.” In addition, Uniswap is currently looking to hire for several open positions in “New York

or Remote.”

20. Defendant Uniswap Foundation is a Delaware corporation. Upon information and

belief, the Uniswap Foundation has its principal place of business in New York City. Given their

overlapping control and common purpose, the Uniswap Foundation is an alter ego of Uniswap.

21. Defendant Adams is a citizen and resident of the State of New York, Kings County.

Adams is the inventor of the Protocol and Uniswap’s Chief Executive Officer, as well as an equity

owner of Uniswap. During the relevant period, Adams resided and worked in New York City.

Case 1:22-cv-02780-KPF Document 46 Filed 09/27/22 Page 10 of 171

6

Upon information and belief, Adams is a significant liquidity provider for tokens traded on the

Protocol and holds UNI tokens, giving him additional rights to control the Protocol.

22. Defendant Paradigm is a Delaware limited partnership with its principal place of

business in California. Paradigm is an equity owner of Uniswap. According to Uniswap, it raised

a seed round of funding from Paradigm to advance research and development of the Protocol and

other decentralized products on the Ethereum blockchain. Upon information and belief, Paradigm

is a significant liquidity provider for tokens traded on the Protocol and holds UNI tokens, giving

it additional rights to control the Protocol.

23. Defendant Andreessen is a Delaware limited liability company with its principal

place of business in California. Andreessen is an equity owner of Uniswap. According to

Uniswap, Andreesen led Uniswap’s Series A funding round, which was designed to add new

employees to Uniswap in the United States and to build a new version of the Protocol. Upon

information and belief, Andreesen is a significant liquidity provider for tokens traded on the

Protocol and holds UNI tokens, giving it additional rights to control the Protocol.

24. Defendant USV is a Delaware limited liability company with its principal place of

business at 915 Broadway, 19th Floor, New York, New York 10010. USV is an equity owner of

Uniswap. According to Uniswap, USV participated in Uniswap’s Series A funding round, which

was designed to add new employees to Uniswap in the United States and to build a new version

of the Protocol. Upon information and belief, USV is a significant liquidity provider for tokens

traded on the Protocol and holds UNI tokens, giving it additional rights to control the Protocol.

JURISDICTION AND VENUE

25. The Court has subject matter jurisdiction over this action pursuant to 28 U.S.C. §

1332(d)(2)(A) because the matter in controversy exceeds the value of $5,000,000, exclusive of

Case 1:22-cv-02780-KPF Document 46 Filed 09/27/22 Page 11 of 171

7

interests and costs, and is a class action in which a member of a class of plaintiffs is a citizen of a

different state from a defendant. The Court has subject matter jurisdiction over the ’33 Act and

’34 Act claims pursuant to 28 U.S.C. § 1331 and the state law claims pursuant to 28 U.S.C. § 1367.

26. This Court has personal jurisdiction over Uniswap as it maintains a place of

business in the State of New York, does significant business within the state and derives significant

profits thereby. Uniswap has operations and employees in New York City and Uniswap sold the

Tokens to persons in this district.

27. This Court has personal jurisdiction over the Uniswap Foundation as it maintains a

place of business in the State of New York and does significant business within the state and

derives significant profits thereby.

28. This Court has personal jurisdiction over Adams, a citizen and resident of the State

of New York. Upon information and belief, Adams resides in Kings County and works in both

Kings County and New York County.

29. This Court has personal jurisdiction over USV as it maintains a place of business

in the State of New York, does significant business within the state and derives significant profits

thereby. USV has operations and employees in New York County.

30. This Court has personal jurisdiction over Paradigm because it has engaged in

activities targeting New York relating to the subject matter of this action and giving rise to the

claims asserted herein. Upon information and belief, Paradigm regularly conducts substantial

business in the State of New York, systematically directs and/or targets its business at consumers

in New York and derives substantial revenue from business transactions in New York.

31. This Court has personal jurisdiction over Andreesen because it has engaged in

activities targeting New York relating to the subject matter of this action and giving rise to the

Case 1:22-cv-02780-KPF Document 46 Filed 09/27/22 Page 12 of 171

8

claims asserted herein. Upon information and belief, Andreesen regularly conducts substantial

business in the State of New York, systematically directs and/or targets its business at consumers

in New York and derives substantial revenue from business transactions in New York.

32. Venue is proper pursuant to 15 U.S.C. §§ 77v(a), 78aa(a), and 28 U.S.C. § 1391(b)

as this is a district where one or more Defendants is found or is an inhabitant or transacts business,

where the offer or sale of the unregistered securities took place, and where a significant portion of

the events that are the subject of the claims took place.

FACTUAL BACKGROUND

I. CRYPTO ASSETS AND SO-CALLED DEFI

33. A “cryptocurrency” or crypto asset is a digital asset designed to be a medium of

exchange or a store of value. Crypto assets use cryptography to secure and verify transactions, as

well as to control the creation of new units of a crypto asset.

34. Bitcoin, created in 2009, was the world’s first crypto asset, and remains the largest

and most popular today, with a market capitalization of over $350 billion. Since Bitcoin’s creation,

many other crypto assets have launched; collectively, crypto assets currently hold a market

capitalization of over $900 billion.

35. Every crypto asset is powered by a decentralized, open software or digital ledger

called a blockchain. Blockchains consist of “blocks” of data that can be traced all the way back to

the first-ever transaction on a network. Each blockchain is subject to different technical rules, but

they generally are all open source and rely on their communities to maintain and develop their

underlying code.

Case 1:22-cv-02780-KPF Document 46 Filed 09/27/22 Page 13 of 171

9

36. The most well-known crypto assets, such as Bitcoin and Ether, are obtained in one

of two ways. The first way is to expend resources to validate transactions on the blockchain in

exchange for a reward of newly minted tokens. This process is called “mining” or “validating.”

37. The second and more common way to obtain crypto assets is to acquire them from

someone else. This often involves using an online crypto asset exchange, which, like a traditional

stock exchange, matches buyers with sellers of assets.

38. In a traditional—or centralized—exchange, buyers and sellers are matched on a

one-to-one basis through orders. When the bid of a buyer matches the ask of a seller, a trade

occurs.

39. In contrast, so-called “decentralized” exchanges, such as the Protocol, do not use

traditional market orders to match buyers and sellers. Instead, they enable issuers to contribute a

pair of tokens to a pool where buyers can trade token “A” in exchange for token “B”. Often, in

this scenario, token B (e.g., a newly created token by the issuer) has no independent value but

token A does have value (e.g., ETH). Token B will derive its market price from the amount of

token A that is placed in the pool (i.e., the liquidity). As investors place more of their token A in

the pool, thereby increasing liquidity, in exchange for Token B, such transactions drive up the

price of Token B. Someone who places these token pairs in such a liquidity pool is known as a

“liquidity provider.”

40. Liquidity is important for decentralized crypto asset exchanges. Uniswap, by virtue

of its close collaboration with Paradigm, Andreesen, and USV, is able to maintain ample liquidity

for various crypto assets. Because Uniswap generates fees on every transaction on its Protocol,

Uniswap’s liquidity providers are a major component of its business. According to Adams, “[i]n

2021, Uniswap LPs made $1.6b in revenue.”

Case 1:22-cv-02780-KPF Document 46 Filed 09/27/22 Page 14 of 171

10

A. Ethereum

41. The Ethereum blockchain launched in or around 2015. The token native to the

Ethereum blockchain is called “Ether” or “ETH”. Ether is the second largest crypto asset, with a

market capitalization at the time of this filing of more than $160 billion.

42. The Ethereum blockchain allows for the use of derivative “smart contracts.” Smart

contracts are self-executing, self-enforcing programs that write the terms of the agreement between

the buyer and seller directly into the program’s code.

B. ERC-20 Tokens

43. To standardize protocols for smart contracts, the Ethereum community utilizes

application standards for smart contracts called Ethereum Request for Comments (“ERCs”). ERCs

provide uniform transactions and efficient processes. The most common use of ERCs is to allow

for the creation of new crypto tokens.

44. ERC-20 is an application standard that allows for smart contract tokens to be

created on the Ethereum blockchain (“ERC-20 tokens”). ERC-20 tokens, also known as “alt

coins,” are considered “forks” of Ethereum. ERC-20 tokens are traded on the Ethereum

blockchain.

45. ERC-20 tokens are relatively simple and easy to deploy. Anyone with a basic

understanding of Ethereum, and not necessarily with any technical expertise, can create their own

ERC-20 token, which they can then market to investors. These issuers, known in the industry as

“developers” or “devs,” almost never register their new tokens as securities. In addition,

companies, like Uniswap, that run exchanges where these tokens are sold, rarely register with the

SEC, even though they are required to do so.

Case 1:22-cv-02780-KPF Document 46 Filed 09/27/22 Page 15 of 171

11

46. The oft-used phrase “Wild West” to describe the crypto asset market is particularly

apt as to ERC-20 tokens. Unsuspecting users do not appreciate that their investments could be

wiped out in an instant by a variety of schemes. Unfortunately, this has become a reality for many.

C. Initial Crypto Asset Offerings

47. Recently, and particularly in 2021, interest in crypto assets exploded. Looking to

capitalize on this enthusiasm, many companies and issuers sought to raise funds through “initial

coin offerings.” Nearly all these launches were issued using the ERC-20 protocol. Most of these

issuers chose not to register their securities offerings with the SEC and thereby failed to provide

investors critical information they would have otherwise received.

48. These issuers reached potential purchasers through social media sites, promoting

active and upcoming launches. Issuers would usually draft a whitepaper describing the project

and the terms of the launch. These whitepapers lacked elements that a registration statement filed

with the SEC would be required to contain, such as: (i) a “plain English” description of the

offering; (ii) a list of key risk factors; (iii) a description of important information and incentives

concerning management; (iv) warnings about relying on forward-looking statements; and (v) an

explanation of how the proceeds from the offering would be used. The whitepapers also lacked a

standardized format that investors could readily follow.

49. Gary Gensler, the Chairman of the SEC, has noted that “[w]e just don’t have

enough investor protection in crypto finance, issuance, trading, or lending. Frankly, at this time,

it’s more like the Wild West or the old world of ‘buyer beware’ that existed before the securities

laws were enacted. This asset class is rife with fraud, scams, and abuse in certain applications.”

50. On September 15, 2022, Chairman Gensler testified before the Senate Banking

Committee that “[o]f the nearly 10,000 tokens in the crypto market, I believe the vast majority are

Case 1:22-cv-02780-KPF Document 46 Filed 09/27/22 Page 16 of 171

12

securities. Offers and sales of these thousands of crypto security tokens are covered by the

securities laws, which require that these transactions be registered or made pursuant to an available

exemption.” Gensler continued: “Given that most crypto tokens are securities, it follows that many

crypto intermediaries – whether they call themselves centralized or decentralized (e.g., DeFi) – are

transacting in securities and have to register with the SEC in some capacity.” He went on to warn

of the potential for conflicts of interest when “exchange, broker-dealer, custodial functions, and

the like” are combined into the same legal entity.

II. THE PROTOCOL

A. “Decentralized” Exchanges Take Off, with Uniswap Leading the Charge

51. Hayden Adams first began working with Ethereum in 2017. As Adams tells it, he

had been recently laid off from his first job out of college and a friend encouraged him to learn to

write “smart contracts.” Adams asked, “[d]on’t I need to like know how to code?” to which his

friend responded, “[n]ot really, coding is easy. Nobody understands how to write smart contracts

yet anyway.” A little more than a year later, Adams and Uniswap launched the Protocol on

November 2, 2018.

52. Adams and colleagues at Uniswap created and developed both the Protocol and the

Interface (defined below). Uniswap facilitates trades of crypto assets, including the Tokens, by

operating the Interface, which allows users to access the Protocol, where crypto asset pools are

created and maintained. Uniswap promotes the Protocol as “one of the most widely-used platforms

on Ethereum.”

53. Shortly after its launch, Uniswap, through its Twitter handle, courted small

investors by claiming that its platform “is for many people”:

Case 1:22-cv-02780-KPF Document 46 Filed 09/27/22 Page 17 of 171

13

54. Throughout 2019, Uniswap remained a nascent exchange with a limited number of

users and trading volume. By the start of 2020, Uniswap started making inroads within the crypto

community but was still not a mainstream exchange at that point.

55. By mid-2020—as the Coronavirus pandemic kept people at home—amateur

investors flocked to retail investment platforms such as Robinhood. Shortly thereafter, the

“meme” craze began, with social-media users promoting the purchase of stocks based on factors

that were unrelated to business fundamentals. In one example of the “meme” craze, retail investors

coordinated their purchase of shares of the struggling GameStop Corp. and, in doing so, artificially

inflated its share price from $20 per share to near $500 at one point.

56. By the end of 2020, the “meme” craze spread to crypto assets, such as Dogecoin

(traded on Robinhood), resulting in sudden and substantial price increases. Amateur retail

investors, with little or no investment experience, purchased many of these promoted coins. By

Case 1:22-cv-02780-KPF Document 46 Filed 09/27/22 Page 18 of 171

14

that time, Uniswap, with robust financial and operational support provided by Andreesen,

Paradigm, and USV, was becoming more recognized within the crypto community, with its daily

volume exceeding $1 billion.

57. By late spring of 2021, Uniswap’s growth and name recognition had increased

dramatically as it was attracting scores of users who were new to crypto assets and/or Uniswap.

For example, Uniswap’s trading volume shot up to approximately $90 billion in May 2021, a

several hundred percent increase as compared to just a few months earlier:

58. Looking to capitalize on this investor enthusiasm and the power of the “meme”

craze, issuers launched thousands of new tokens on decentralized exchanges (“DEXs”), including

on the Protocol, many of which were priced at only fractions of a cent. As a result, by the middle

and end of 2021, tens of thousands of people began using the Protocol for the first time, many of

whom had likely not even heard of Uniswap before their first use of the Protocol.

59. Uniswap was particularly attractive to issuers because Uniswap did not impose any

listing fees on issuers or conduct any type of verification or background check, allowing the issuers

to operate in an unfettered and anonymous fashion.

Case 1:22-cv-02780-KPF Document 46 Filed 09/27/22 Page 19 of 171

15

60. The Protocol now averages approximately $1.5 billion per day in trading volume.

61. As of the filing of this First Amended Complaint, total trading volume on the

Protocol has surpassed $1.1 trillion, with over 111 million trades, and well over 50,000 token pairs

have been traded on the Protocol. In contrast, the two largest centralized exchanges, Binance and

Coinbase, allow users to trade approximately 1,450 and 500 tokens, respectively. Uniswap holds

itself out as the leading decentralized exchange with nearly 70% market share.

62. Defendants are fully aware that the overwhelming majority of all tokens traded on

the Protocol are scams and/or are fraudulent.

63. For its part, Uniswap collects fees on every transaction on the Protocol, and has the

right to (and likely does) allocate a portion of each fee to itself. To date, the total amount of fees

collected by Uniswap from its users has likely exceeded $2 billion.

B. The Uniswap Interface

64. Trading on the Protocol is conducted through Uniswap’s user interface (the

“Interface”). Uniswap controls and hosts the Interface on its webserver located in the United

States. All, or nearly all, investors that trade on the Protocol do so through the Interface. Plaintiffs

purchased the Tokens through the Interface.

65. To access the Interface, users must have what is referred to as a “crypto wallet” (a

“Wallet”). Wallets are computer applications (usually accessed through a smartphone) that

safeguard holders’ private keys, which allow them to send, receive, and access crypto assets. Some

of the most popular Wallets include Coinbase Wallet, Metamask, and Trust Wallet. Anyone with

a Wallet can access and use the Interface without any barriers or restrictions.

66. Users can access the Interface through a web browser, such as Google Chrome or

Safari, on their smart phone, tablet, or personal computer by navigating to app.uniswap.org or to

Case 1:22-cv-02780-KPF Document 46 Filed 09/27/22 Page 20 of 171

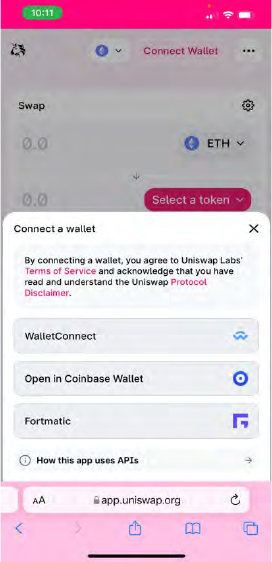

16

uniswap.org and clicking the “Launch App” icon, and then clicking “Connect Wallet” (the

“Browser Method”).

67. The far more common way for users to access the Interface is by using browsers

native to or imbedded in their Wallets to navigate to app.uniswap.org or to uniswap.org and

clicking “Launch App” (the “Wallet Method”). Plaintiffs Risley, Freeland and Meyers conducted

all of their transactions on the Protocol using the Wallet Method.

68. Once the Wallet has been connected, users are ready to “swap” tokens. A user must

first select the token she wishes to trade and the token she wishes to receive. The user can either

browse the Interface to find the token or may search by token name, symbol, or token address.

69. From there, users can trade by selecting the two tokens they would like to swap,

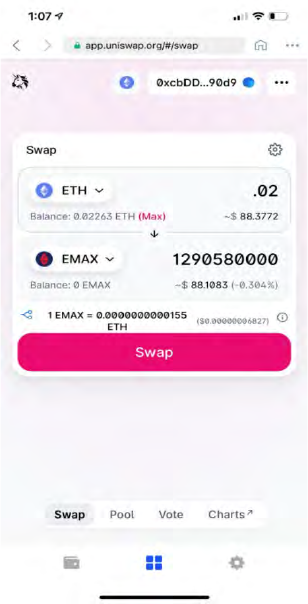

specifying the amount, and then clicking the button “Swap”:

Case 1:22-cv-02780-KPF Document 46 Filed 09/27/22 Page 21 of 171

17

70. Typically, before proceeding with the “Swap,” a user must set their “slippage

tolerance.” Slippage tolerance refers to the amount of price fluctuation the user will tolerate

between the time the user confirms the swap and the time the transaction is completed. If the price

changes more than is allowed by the slippage tolerance before the transaction is completed, the

proposed swap will not go through. With extremely volatile tokens, the slippage tolerance usually

needs to be set more than 10% or even 20% to ensure the completion of a transaction.

71. The first time that a user trades a token with the Protocol, she needs to “approve”

the token. By “approving” a token, according to Uniswap, “[t]his gives the Uniswap Protocol

permission to swap that token from your wallet.”

5

72. Users of the Interface who desire to be liquidity providers may also create or

contribute to liquidity pools.

73. Prior to the filing of this action, users who accessed the Interface through the Wallet

Method were never presented with any terms of service, any disclaimers, any disclosures, or any

information whatsoever about the Protocol.

74. On or about April 23, 2021, Uniswap posted terms of service (the “Terms of

Service”) of the Interface on a page of its website that is not readily accessible from the website’s

home page. Uniswap subsequently updated the Terms of Service on or about October 25, 2021.

6

At some point after April 23, 2021, Uniswap began prompting users accessing the Interface

through the Browser Method with the following when they click “Connect a wallet”:

5

See https://support.uniswap.org/hc/en-us/articles/8120520483085 (last accessed September 19, 2022).

6

See https://uniswap.org/terms-of-service (last accessed September 19, 2022).

Case 1:22-cv-02780-KPF Document 46 Filed 09/27/22 Page 22 of 171

18

The prompt includes links to webpages for Uniswap’s “Terms of Service” and “Protocol

Disclaimer.” However, a user (using the Browser Method) does not need to click on the links or

check any boxes to connect her Wallet to the Interface.

75. Only a small portion of users access the Interface through the Browser Method.

Most users access the Interface through the Wallet Method, and such users have never been

presented with—let alone had the opportunity to review and agree to—the Terms of Service and

the Protocol Disclaimer. In any event, the Terms of Service and Protocol Disclaimer are legally

unenforceable.

76. In addition to being unenforceable and unseen by the vast majority of Uniswap’s

users, the Terms of Service contain numerous and significant material misrepresentations. For

example, the Terms of Service state that “we [Uniswap] do not broker trading orders on your

behalf nor do we collect or earn fees from your trades on the Protocol. We also do not facilitate

the execution or settlement of your trades, which occur entirely on the publicly distributed

Case 1:22-cv-02780-KPF Document 46 Filed 09/27/22 Page 23 of 171

19

Ethereum blockchain.” These statements are patently false. Uniswap collects fees (and can keep

a portion of those fees for itself) and undoubtedly acts as the broker, facilitator, and seller in

connection with all trades on the Protocol, including, without limitation, through its ownership and

operation of the Interface.

C. How the Protocol Works

77. Uniswap deployed the original version of the Protocol (“v1”) on Ethereum Mainnet

(or the main public Ethereum blockchain) on November 2, 2018. Uniswap launched the second

version of the Protocol (“v2”) in May 2020. In the whitepaper for v2 (the “v2 Whitepaper”),

Uniswap claims that v2 has “several new highly desirable features. Most significantly, it enables

the creation of arbitrary ERC20/ERC20 pairs, rather than supporting only pairs between ERC20

and ETH.”

78. According to Uniswap, the Protocol operates through an “Automated Market

Maker” or “AMM,” which Uniswap claims replaces the buy and sell orders in an order book

market with a liquidity pool of two assets, both valued relative to each other. As one asset is traded

for the other, the relative prices of the two assets shift, and a new market rate for both is determined.

Thus, buyers and sellers do not trade with each other directly but instead do so with Uniswap

through liquidity pools Uniswap creates and maintains. The following diagram, from Uniswap’s

website, demonstrates how v2 of the Protocol works:

Case 1:22-cv-02780-KPF Document 46 Filed 09/27/22 Page 24 of 171

20

79. In other words, the issuers and/or liquidity providers deposit two tokens of equal

value into a “Uniswap Pool,” which is what Uniswap calls it. In the diagram above, Token A often

represents ETH

7

and Token B represents the ERC-20 token that the issuer wants to introduce to

investors. In return, Uniswap “mints” and issues unique tokens (“Liquidity Tokens,” referred to

as “Pool Tokens” in the diagram above) to the liquidity providers as follows: “Whenever liquidity

is deposited into a pool, unique tokens known as liquidity tokens are minted and sent to the

provider’s address. These tokens represent a given liquidity provider’s contribution to a pool. The

proportion of the pool’s liquidity provided determines the number of liquidity tokens the provider

receives.” According to Uniswap, “[a]s liquidity tokens are themselves tradable assets, liquidity

providers may sell, transfer, or otherwise use their liquidity tokens in any way they see fit.”

80. Uniswap controls and maintains the liquidity pools by, among other things, (i)

holding liquidity provider funds and newly created tokens in Uniswap’s proprietary “core

contracts,” (ii) using routers that Uniswap controls to process all transactions executed by issuers

7

In actuality, as more fully discussed below, when an issuer creates a new token and pairs it with ETH, the ETH is

“wrapped” by Uniswap, which turns the ETH into WETH. In addition, when users of the Interface trade their ETH

for the ERC-20 token, their ETH is wrapped.

Case 1:22-cv-02780-KPF Document 46 Filed 09/27/22 Page 25 of 171

21

and users of the Protocol, and (iii) issuing Liquidity Tokens when a pool is created, without which,

pools on the Protocol would not function.

81. According to the v2 Whitepaper, “Uniswap v1 is an on-chain system of smart

contracts on the Ethereum blockchain” and “Uniswap v2 is a new implementation based on the

same formula.” The “whitepaper describes the mechanics of Uniswap v2’s ‘core’ contracts

including the pair contract that stores liquidity providers’ funds—and the factory contract used to

instantiate pair contracts.” See id at 6 (“One design priority for Uniswap v2 is to minimize the

surface area and complexity of the core pair contract—the contract that stores liquidity providers’

assets.”). When a trade is executed, “the seller sends the asset to the core contract before calling

the swap function. Then, the contract measures how much of the asset it has received, by

comparing the last recorded balance to its current balance.” Uniswap acknowledges that this

process “will require calling the pair contract through a ‘router’ contract that computes the trade

or deposit amount and transfers funds to the pair contract.” These smart contracts are in the

exclusive control of Uniswap and/or the Owners.

82. In addition, when an issuer creates a new token and pairs it with ETH, the ETH is

“wrapped” by Uniswap, turning the ETH into WETH. When users of the Interface swap their

ETH for an ERC-20 token, Uniswap wraps their ETH. In each instance, the ETH is wrapped

through Uniswap’s routers and in a separate transaction before the initial transaction is completed.

According to CoinMarketCap, “[w]rapped tokens, like WETH or Wrapped Bitcoin, are tokenized

versions of cryptocurrencies that are pegged to the value of the original coin and can be unwrapped

at any point…. The mechanism of such coins is similar to that of stablecoins. Stablecoins are

essentially ‘wrapped USD’ in the sense that dollar-pegged stablecoins can be redeemed for FIAT

dollars at any point.”

Case 1:22-cv-02780-KPF Document 46 Filed 09/27/22 Page 26 of 171

22

83. According to the v2 whitepaper, Uniswap needs to wrap a user’s ETH when used

to trade on the Protocol:

Since Uniswap v2 supports arbitrary ERC-20 pairs, it now no

longer makes sense to support unwrapped ETH. Adding such

support would double the size of the core codebase, and risks

fragmentation of liquidity between ETH and WETH pairs.

Native ETH needs to be wrapped into WETH before it can be

traded on Uniswap v2.

84. Nearly all users of the Interface trade with ETH and not WETH, and thus, each of

their trades requires the use of multiple Uniswap routers and transactions to execute.

85. As a result of the foregoing, Uniswap undoubtedly holds and controls tokens

through the use of their smart contracts and as they travel through Uniswap’s routers, which are

located and/or created in the United States. Thus, when a user swaps one token for another token,

she interacts with and obtains such token directly from Uniswap and the pool it controls.

86. According to Uniswap, the launch price of a new ERC-20 token is determined

pursuant to a “constant product” formula, expressed as x * y = k, where x and y represent the

respective amounts of the two tokens in the liquidity pool. The total liquidity in the pool is

represented in the equation by k, which Uniswap claims always remains constant. The following

diagram demonstrates how the price of the ERC-20 token fluctuates:

Case 1:22-cv-02780-KPF Document 46 Filed 09/27/22 Page 27 of 171

23

87. In short (and intuitively), the price of a token is a function of the number of tokens

investors have purchased. Put another way, a purchase of a token causes the price to rise, and a

sale of a token causes the price to fall. The formula only captures a snapshot in time. After each

trade in a pool occurs, the formula is rerun in order to rebalance the equation. Thus, Uniswap’s

reference to its formula as a “constant product formula” is misleading.

88. Typically, issuers launch new ERC-20 tokens on the Protocol by placing (i) an

extremely large (often more than a trillion or quadrillion) amount of the new tokens in the pool,

and (ii) a small amount of ETH, often worth less than $100,000. As a result, the initial price of

the newly launched tokens is usually fractions of a penny. Given their very low prices and high

supply, these tokens are highly unstable and susceptible to wild and rapid price swings; however,

none of this is meaningfully disclosed by Uniswap (or the other Defendants) to Uniswap users.

89. Additionally, there are no barriers or restrictions to anyone issuing a new token on

the Protocol. Uniswap boasts that “anyone can become a liquidity provider” on the Protocol. In

fact, the identity of most of the issuers on the Protocol is not disclosed to investors (or even

Uniswap).

Case 1:22-cv-02780-KPF Document 46 Filed 09/27/22 Page 28 of 171

24

90. Uniswap’s initial decision—countenanced by the other Defendants through their

control of the Protocol—to allow complete anonymity, coupled with the lack of any listing fees or

requirements, has created and fostered an ideal environment for fraudulent conduct. Uniswap and

the other Defendants are aware of this reality; the trouble is they choose to profit from its

continuance.

91. Since at least the implementation of v2, Uniswap has charged fees (“User Fees”) to

users of the Protocol. For v2, Uniswap charged User Fees in the amount of 30 basis points on each

trade, with issuers guaranteed to receive 25 basis points (5/6ths of the fee), and Uniswap reserving

the right to receive 5 basis points (1/5th of the fee). The addition of Uniswap’s 5-basis point fee

was new to v2 and not a feature of v1. Uniswap does not disclose these fees to users of the Protocol

in a transparent manner.

92. Uniswap distributes the User Fee to issuers through additional Liquidity Tokens

that Uniswap issues to them: “Whenever a trade occurs, a 0.3% fee is charged to the transaction

sender. This fee is distributed pro-rata to all LPs in the pool upon completion of the trade. To

retrieve the underlying liquidity, plus any fees accrued, liquidity providers must ‘burn’ their

liquidity tokens, effectively exchanging them for their portion of the liquidity pool, plus the

proportional fee allocation.” See also v2 Whitepaper at 5 (noting that “accumulated fees are

collected only when liquidity is deposited or withdrawn. The contract computes the accumulated

fees, and mints new liquidity tokens to the fee beneficiary, immediately before any tokens are

minted or burned.”). Given that liquidity providers can only realize the gains they make through

the User Fees by “burning” their Liquidity Tokens, thereby draining the liquidity from the liquidity

pools, Uniswap and the other Defendants have incentivized liquidity providers to engage in

behavior that will cause token values to decline to the detriment of investors.

Case 1:22-cv-02780-KPF Document 46 Filed 09/27/22 Page 29 of 171

25

93. The fact that Uniswap can decide whether to take its share of the User Fee is

notable. In addition to being part of the ownership of Uniswap, upon information and belief,

Andreesen, Paradigm, and USV are market makers on the Protocol, using it to trade large quantities

of valuable tokens, for which they garner substantial fees as liquidity providers. It is not in their

interests for Uniswap to retain its contractually guaranteed share of the User Fees.

94. In addition to the User Fees, the liquidity providers often impose a “tax” on trades

(“Trade Taxes”), which typically range from 2% to 10% and can be imposed on both sales and

purchases or only upon sales. The taxed tokens are typically (i) “burned”, i.e., removed

permanently from the total treasury of the token; (ii) redistributed on a pro-rata basis to the existing

holders; and/or (iii) redistributed to issuers. The Trade Taxes are purportedly to prevent price

manipulation and to discourage investors from selling their tokens. Uniswap does not disclose to

users of the Interface whether Trade Taxes are imposed on the token they are purchasing or selling.

In most cases, a user will only be able to determine the amount of Trade Tax in connection with a

transaction by analyzing the Ethereum blockchain after Uniswap completes such transaction.

95. Upon information and belief, Uniswap charges other undisclosed fees to users of

the Interface in addition to the User Fees and Trade Taxes. The total of such fees, given the trading

volume, is likely substantial and to determine the actual amount, one would have to analyze

thousands, if not millions, of transactions on the Ethereum blockchain.

96. In May 2021, Uniswap launched the third version of the Protocol (“v3”), which

operates in a manner substantially similar to v2, but has additional features. According to

Uniswap, “v3 is based on the same constant product reserves curve as earlier versions but offers

several significant new features,” including “Flexible Fees,” “Protocol Fee Governance,” and

“Concentrated Liquidity.” With v3, Uniswap now charges User Fees pursuant to tiers. By default,

Case 1:22-cv-02780-KPF Document 46 Filed 09/27/22 Page 30 of 171

26

there are three tiers, which correspond to User Fees in the amount of 5, 30, or 100 basis points

respectively. Nonetheless, many issuers continue to use v2.

III. UNISWAP’S OWNERSHIP STRUCTURE AND CONTROL OF THE

PROTOCOL

A. Ownership of Uniswap

97. Uniswap has at all times, together with the other Defendants and/or individually,

maintained complete control over the Protocol and the Interface. Uniswap created and maintained

the Protocol and the Interface in the United States, and it hosts them both on their own servers in

the United States. In a series of tweets on July 24, 2021, Adams acknowledged that

“http://app.uniswap.org = Uniswap Labs owned domain” and that “[d]ecentralization doesn’t

mean Uniswap Labs lets you do whatever you want on its website. It means you don’t need a

single interface instance to access the protocol.”

98. Uniswap is structured and run as a for-profit business, with the Interface, the

Protocol and UNI as its primary assets. In September 2021, shortly after it was announced that

the SEC was investigating Uniswap, Chairman Gensler warned that decentralized finance projects,

or “DeFi”, are under increased scrutiny: “[t]here’s still a core group of folks that are not only

writing the software, like the open-source software, but they often have governance and fees.

There’s some incentive structure for those promoters and sponsors in the middle of this.”

8

Uniswap has a governance structure, collects fees, and has created and enabled an incentive

structure for issuers and liquidity providers (including Andreesen, Paradigm, and USV) at all

relevant times.

8

“Crypto’s ‘DeFi’ Projects Aren’t Immune to Regulation, SEC’s Gensler Says,” available at:

https://www.wsj.com/articles/cryptos-defi-projects-arent-immune-to-regulation-secs-gensler-says-11629365401#

(last accessed September 19, 2022).

Case 1:22-cv-02780-KPF Document 46 Filed 09/27/22 Page 31 of 171

27

99. On or about April 12, 2019, Uniswap issued $1.825 million worth of equity shares

in the company to two investors: Adams and Paradigm. Uniswap filed a Form D with the SEC

reporting this offering. The terms of any agreement between Adams and Paradigm, on the one

hand, and Uniswap, on the other hand, are not publicly available. Thus, it is unclear at this time

what rights Adams and Paradigm received in connection with the equity acquisition, or how they

acquired the same.

100. On or about June 6, 2020, Uniswap issued an additional $11 million in equity shares

and options or warrants in the company to multiple investors. Uniswap filed a Form D with the

SEC reporting this offering. In a related press release, Uniswap stated that the funding was “led

by” Andreessen. Funding was also provided by other Defendants, including Paradigm and USV,

in exchange for an ownership stake in Uniswap. Upon information and belief, the terms of any

agreement between Andreesen or USV, on the one hand, and Uniswap, on the other hand, are not

publicly available. Thus, it is unclear at this time what rights Andresen and USV received in

connection with the equity acquisition, or how they acquired the same.

101. Adams, Andreesen, Paradigm, and USV control a significant amount of UNI

tokens, thus giving them the ability to control the Protocol, either individually and/or collectively.

Upon information and belief, as liquidity providers, they have contributed millions of dollars’

worth of tokens to liquidity pools on the Protocol, thus enriching themselves to the tune of millions

of dollars in User Fees.

102. Upon information and belief, Adams, Andreesen, Paradigm and USV (through their

equity ownership or otherwise) were incentivized to (and did) steer Uniswap to create v2 and v3,

which allowed the pairing of unique ERC-20 tokens, so that they could fund large liquidity pools

and generate millions of dollars in fees for themselves. In v1, an ERC-20 token could only be

Case 1:22-cv-02780-KPF Document 46 Filed 09/27/22 Page 32 of 171

28

paired with ETH and not another ERC-20, which limited the ability of issuers and liquidity

providers to yield endless fees.

B. Paradigm, Andreesen, and USV Helped Develop and Upgrade the Protocol

Without Any Regard for Safeguards for Users of the Protocol

103. Paradigm is a crypto asset hedge fund and Andreesen and USV are venture capital

firms. However, they are not merely passive investors in Uniswap; they were and remain

intimately involved with the operations of Uniswap, including but not limited to the development

of the Protocol.

104. On February 11, 2021, in a series of tweets, Adams specifically named Andreesen,

Paradigm, and USV and acknowledged that they “have been incredibly value additive.” Adams

listed the many ways in which they had added value, including: “Advising, sourcing candidates,

conducting interviews, making introductions, writing smart contracts, writing whitepapers,

reading/explaining other peoples papers/smart contracts, historical analytics, letting me sleep on

their couch, proof reading blogposts, insider info…content creation, breakthrough Uniswap-

related math research, playing HALO 3, educating regulators and institutions, product design

feedback, and a whole lot more…Not to mention providing millions in funding during the depths

of a bear market”:

Case 1:22-cv-02780-KPF Document 46 Filed 09/27/22 Page 33 of 171

29

105. Adams acknowledged that “we would not be where we are today without our

investors.”

106. Although Adams spotlighted Andreesen, Paradigm, and USV, he did not specify

what each of them did specifically (or continue to do). The terms of their investments are not

publicly available information. However, the available public information shows significant

contributions to the development and expansion of Uniswap and the Protocol.

Case 1:22-cv-02780-KPF Document 46 Filed 09/27/22 Page 34 of 171

30

107. Dan Robinson, Head of Research at Paradigm, was instrumental in the development

of both v2 and v3, which he discussed in detail in an interview with the website The Defiant.

9

Moreover, Robinson and several of his Paradigm colleagues promoted Paradigm’s role in

upgrading the Protocol on Twitter.

108. On May 18, 2021, Paradigm published an article authored by Robinson on its

website, entitled “Liquidity Mining on Uniswap v3.”

10

In the article, Robinson touts in technical

detail how improvements in v3 will benefit liquidity providers. On June 7, 2021, Paradigm

published another article authored by Robinson on its website, entitled “Uniswap v3: The

Universal AMM.”

11

In the article, Robinson describes in technical detail how the AMM on v3

works. Robinson and Paradigm have such intimate knowledge of the Protocol because they co-

created it with Adams.

109. On July 16, 2021, Matt Huang, co-founder of Paradigm, issued a press release on

Paradigm’s website, entitled “Expanding our Research Team.”

12

In the release, Huang stated that

Paradigm assembled a “Research team” led by Dan Robinson. Huang further acknowledged that

the research team “work[ed] closely with our investment team and our portfolio on projects like

Uniswap v3.” In a tweet announcing the press release, Huang stated “[o]ur Research team at

@paradigm started three years ago as an experiment, but it’s become a key part of our firm and

the crypto community.” Huang’s tweet suggests that Paradigm was intimately involved with

Adams in co-creating the first version of the Protocol, v1, which launched less than three years

before Huang made that statement.

9

“‘V3 is Winding Back a Bit of the Uniswap Revolution; It’s Going to be Very Influential:’ Dan Robinson,”

available at https://newsletter.thedefiant.io/p/v3-is-winding-back-a-bit-of-the-uniswap (last accessed September 19,

2022).

10

See https://www.paradigm.xyz/2021/05/liquidity-mining-on-uniswap-v3 (last accessed September 19, 2022).

11

See https://www.paradigm.xyz/2021/06/uniswap-v3-the-universal-amm (last accessed September 17, 2022).

12

See www.paradigm.xyz/2021/07/expanding-our-research-team (last accessed September 17, 2022).

Case 1:22-cv-02780-KPF Document 46 Filed 09/27/22 Page 35 of 171

31

110. On July 28, 2021, Dave White, a “Research Partner” at Paradigm, tweeted “I've

been working on a new type of automated market maker with @danrobinson and

@haydenzadams.” White stated “[t]he Time-Weighted Average Market Maker, or TWAMM

(pronounced “tee-wham”), helps traders on Ethereum efficiently execute large orders.” He also

included a link to a “paper” on Paradigm’s website describing TWAMM.

13

Dave White, Dan

Robinson and Hayden Adams are all listed as authors. In the conclusion, White writes, “[i]f you

are interested in working on this or similar problems, you can email [email protected] or DM

me on Twitter, or reach out to Uniswap Labs at [email protected].”

111. Paradigm also co-drafted the whitepapers for v2 and v3 with Adams and other

Uniswap employees. Robinson is listed as a co-author of those whitepapers.

112. v2 and v3 were unilaterally developed and rolled out without input from users or

via any governance proposals, solely for the benefit of some portion of the Owners.

113. In his tweets on February 11, 2021, Adams confirmed that the Owners attempted

“to educate regulators.” In fact, the Owners have actively sought to prevent regulatory oversight

of the crypto asset industry—including the activities that occur on the Protocol. Specifically, in

2018, Andreesen and USV jointly met with the SEC and argued that crypto tokens do not constitute

securities (that would otherwise be subject to regulation), speciously claiming that they only

function to access blockchain-based services and networks.

114. Andreesen has advocated against crypto regulation since it has been an investor in

Uniswap, as referenced by Adams’ tweet. For example, on or about April 18, 2022, Andreessen

sent a letter to the SEC advocating against a proposed rule, “[a]ssuming that the Proposal does

13

See https://paradigm.xyz/2021/07/twamm/ (last accessed September 17, 2022).

Case 1:22-cv-02780-KPF Document 46 Filed 09/27/22 Page 36 of 171

32

reach DeFi systems, it would have significant and adverse consequences for these systems and

web3 as a whole.”

115. The Owners’ participation in the creation of the UNI token with governance rights

and making themselves a preferred class of token holders (discussed below) belies any self-serving

representations that tokens are not subject to regulation. Small investors continue to suffer from

the fraudulent conduct that is endemic to the Protocol, while Defendants continue to encourage

them to trade the same tokens that they deny are securities.

116. It is also clear that Defendants sought to monetize the Protocol to the detriment of

everyday users. Indeed, in April 2021, Paradigm acknowledged that inexperienced users of DEXs,

like the Protocol, are constantly taken advantage of: “Every day, thousands of people use a

decentralized exchange (DEX) for the first time. However, the idiosyncrasies of a public

blockchain routinely catch newcomers off-guard, even those familiar with trading on more

traditional venues. As a result, traders bleed money to arbitrageurs and frontrunners, leading to

worse-than-necessary execution.”

14

Nonetheless, Defendants do not meaningfully warn such

users of the Protocol or implement simple safeguards to protect them.

C. Uniswap Has Unilateral Control Over the Protocol

117. According to Adams, Uniswap was named by Vitalik Buterin, a co-founder of

Ethereum. Adams had initially wanted to call it Unipeg—a mixture between a Unicorn and a

Pegasus. Uniswap proved a more apt name, as Uniswap maintains final and unilateral control

over all business on the Interface, and with the other Defendants, controls the Protocol.

118. For example, despite claiming that the Protocol is decentralized, Uniswap has

unilaterally delisted tokens from its Interface on multiple occasions.

14

See https://research.paradigm.xyz/amm-price-impact (last accessed September 19, 2022).

Case 1:22-cv-02780-KPF Document 46 Filed 09/27/22 Page 37 of 171

33

119. In July 2021, in response to regulatory pressure, Uniswap unilaterally delisted over

100 tokens from its Interface.

120. On another well-publicized occasion, the launch of a new token caused an error in

the protocol’s data aggregator. In response, Uniswap unilaterally removed the token from the

Interface.

121. Uniswap also controls the Protocol through a software license. Uniswap views the

Protocol as its intellectual property, and v3 is explicitly subject to a “business source license” from

Uniswap and/or the Owners. The license limits use of the v3 source code under terms and

conditions that Uniswap can unilaterally change at any time.

IV. UNISWAP ISSUED THE OWNER’S UNI TOKENS, WHICH ENABLES THEM

TO CONTROL THE PROTOCOL

A. The UNI Token and Uniswap Governance

122. On or about September 16, 2020, Uniswap issued its own token, UNI. UNI can be

purchased on the Protocol.

123. According to Uniswap, UNI holders would be granted “immediate ownership” of,

inter alia, Uniswap governance (the “Governance”) and the UNI community treasury.

124. Previously, the company’s official Twitter account joked, in response to the

admitted “schilling” by a close friend of Adams, that “[i]f we had any tokens we would totally

give you some.” Sure enough, after launching UNI, Uniswap allocated 40% of the total supply

of UNI to “team members and future employees, investors and advisors” to be distributed over a

four-year period, as follows:

• 21.266% to team members and future employees with 4-year vesting [212,660,000

UNI];

• 18.044% to investors with 4-year vesting [180,440,000 UNI]; and

• 0.69% to advisors with 4-year vesting [6,900,000 UNI].

Case 1:22-cv-02780-KPF Document 46 Filed 09/27/22 Page 38 of 171

34

125. Most of this group is made up of Adams (and other employees of Uniswap),

Andreesen, Paradigm, and USV, who received or are set to receive millions of UNI. UNI launched

at approximately $3 per token and doubled in price within a day and eventually reached an all-

time high of approximately $45 per token. Thus, by launching UNI, the Defendants enriched

themselves to the tune of millions of dollars.

126. Uniswap claims that the remaining 60% of UNI tokens are for the “Uniswap

community members,” a group which it does not define. It appears that only 15% of UNI was

initially allocated to such “community members,” and approximately one third of this amount (5%

of UNI) was allocated to “historical liquidity providers,” which include the Defendants. Uniswap

states that the remaining 10% was “split evenly across all 251,534 historical user addresses.”

127. Of the remaining 45% of UNI, Uniswap stated that the “governance treasury will

retain 43% [430,000,000] . . . to distribute on an ongoing basis through contributor grants,

community initiatives, liquidity mining, and other programs.” Further, “governance can vote to

allocate UNI towards grants, strategic partnerships, governance initiatives, additional liquidity

mining pools, and other programs.” In other words, whoever controls Uniswap’s Governance can

allocate the remaining UNI tokens as they see fit.

128. In summary, Defendants directly received the vast majority of the 40% of UNI

earmarked for “team members, investors, and advisors” as well as some or most of another 5% of

UNI earmarked for “historical liquidity providers,” and indirectly retain and control another 43%

of UNI through governance of Uniswap. Thus, Defendants directly or indirectly control as much

as 88% of UNI, while only the remaining 12% of UNI is held by smaller users.

129. This discrepancy in UNI ownership and control is further amplified by the

governance rules of Uniswap. Under the Governance, ownership of at least one percent of the

Case 1:22-cv-02780-KPF Document 46 Filed 09/27/22 Page 39 of 171

35

total UNI supply is required to submit a governance proposal, and four percent is required to vote

“yes” to reach quorum. Under these parameters and given the allocation of UNI, the Owners have

a disproportionate amount of power and effectively control Uniswap’s governance—and by

extension the Protocol.

130. Thus, Uniswap’s assertion that UNI is a governance token allowing holders to vote

on changes to the Protocol and how to allocate funds in the governance treasury is demonstrably

false and misleading.

131. As set forth herein, UNI is a “security” under the standards promulgated by the

SEC and the Supreme Court. Nevertheless, Uniswap failed to register UNI with the SEC as

required by the federal securities laws. That this particular security trades on an exchange that is

owned and operated by the same people who are simultaneously the issuers, owners, and

controllers of the security—and who also obtain fees from transactions in the security—speaks to

the lawless environment created by Defendants.

132. Upon information and belief, UNI was issued to support Defendants’ ongoing

efforts to develop newer and better versions of its Protocol, while enriching Defendants and

consolidating their control over the Protocol through the Governance, which was created to enable

the Owners to control the Protocol. According to Uniswap, the Protocol is “owned and governed

by UNI token holders.”

133. Moreover, Uniswap actively promotes both UNI and the Protocol to prospective

investors on social media, podcasts, websites, and other media. Through such promotion, Uniswap

have misleadingly touted the exchange as a decentralized market with no central operator or

administrator, contrasting it with markets that are “designed to take fees.” However, Uniswap

does charge fees to users of the Protocol, which directly benefits Defendants. Uniswap has also

Case 1:22-cv-02780-KPF Document 46 Filed 09/27/22 Page 40 of 171

36

made false and/or misleading statements about UNI, the Protocol, as well as Uniswap’s business

and governance.

134. The Owners, individually and/or collectively, hold enough UNI tokens to

completely control the Governance, and therefore, the Protocol.

135. The top 100 holders of UNI tokens hold 80% of all UNI tokens currently in supply.

The Owners are each likely top 10 holders of UNI tokens.

136. In addition, even though there are over 300,000 UNI token holders, many of them