PUBLIC

2017-08-24

SAP Revenue Accounting and Reporting

Content

1 SAP Revenue Accounting and Reporting.............................................9

2 What's New in Revenue Accounting and Reporting....................................10

2.1 Release 1.1................................................................... 10

Integration with SAP Billing and Revenue Innovation Management......................... 10

Enhancements in the Revenue Accounting Item Monitor.................................12

Processing of Return Orders.................................................... 13

Reconciliation of Revenue Accounting Items with Contracts..............................14

Enhancement of Account Determination............................................15

Planned Invoices for Billing Plans.................................................17

Archiving Revenue Accounting Contracts and Items....................................18

Determining Quantities and Amounts in Revenue Accounting.............................19

Migration by Package.........................................................20

Improvement in Closing Activities................................................ 22

Further Flexibility in Posting Process.............................................. 23

Prospective Change..........................................................25

Enhanced Reconciliation Functions...............................................26

2.2 Release 1.2...................................................................26

Integration with CRM......................................................... 27

Cancellation of Performance Obligation............................................29

Cost Recognition............................................................29

Enhanced CO Account Assignments.............................................. 30

Enhanced Capabilities for Contract Combination......................................31

Enhanced Conflict Handling in SAP Revenue Accounting................................32

Further Support for Disclosures..................................................33

Improvements in Contract Management............................................34

Improvements in Revenue Posting................................................34

Integration with Cost Object Controlling............................................36

Contract Change............................................................ 37

Transition to the new Revenue Standard............................................37

Free Selections in Mass Activities for RAI Transfer and Processing.........................39

2.3 Release 1.3...................................................................40

Aggregate General Ledger Postings by Debit/Credit Indicator............................40

Allow Different Currencies for Sales Order Items and Invoices.............................41

General Enhancements........................................................42

Check and Enhance Data Sources for Disclosures.....................................43

Exclude Billing Plan Items......................................................44

2

P U B LI C

SAP Revenue Accounting and Reporting

Content

Foreign Currency Handling According to IAS 21/ASC 830............................... 44

Inbound Processing: Exempt and Restore Revenue Accounting Items.......................46

Service Acceptance.......................................................... 47

Simplified Invoice Handling.....................................................48

Transfer Future Billing Data.....................................................48

3 Integration of Sender Components................................................50

3.1 SAP Sales and Distribution Integration with SAP Revenue Accounting and Reporting.............. 50

3.2 Integration with SAP Hybris Billing...................................................51

3.3 Integration with SAP CRM....................................................... 52

3.4 Integration of External Sender Components............................................53

4 Inbound Processing............................................................54

4.1 Basic Concepts of Inbound Processing...............................................54

Revenue Accounting Item......................................................54

Class for Revenue Accounting Items...............................................55

4.2 Configuration of Revenue Accounting Item Classes...................................... 55

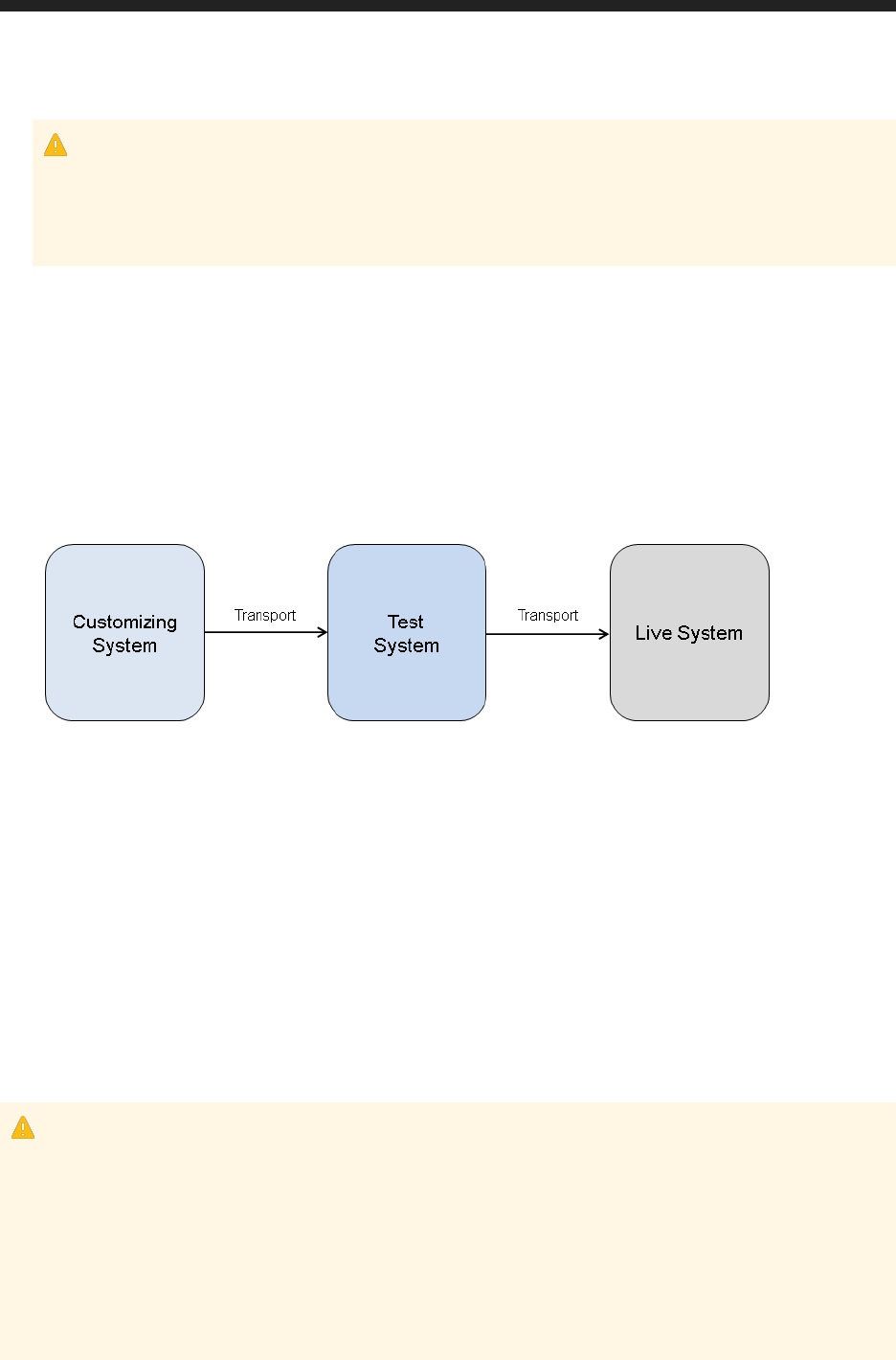

System Landscape...........................................................57

Interfaces for Revenue Accounting Item Classes......................................58

Customer Fields in Revenue Accounting Item Classes..................................58

Interface Generation..........................................................59

4.3 Adding Accounts to Revenue Accounting Items......................................... 61

4.4 Changing of Raw Data and Error Handling.............................................62

4.5 Transfer of Revenue Accounting Items to Processable Status...............................63

4.6 Processing Revenue Accounting Items...............................................64

BRFplus Functions Executed During Processing......................................65

Determining Quantities and Amounts..............................................70

Generating Planned Invoices....................................................70

Processing of Order Items with Predecessor Items.....................................71

4.7 Displaying Revenue Accounting Items................................................72

4.8 Reconciliation of Revenue Accounting Items with Sender Component Data......................74

4.9 Reconciliation of Revenue Accounting Items with Contracts................................ 75

4.10 BRFplus Simplified User Interface...................................................75

5 Contract Management..........................................................77

5.1 Performance Obligations.........................................................77

Linked Performance Obligations................................................. 77

Performance Obligation Hierarchies...............................................78

Manual Performance Obligations.................................................79

Deletion of Performance Obligations..............................................80

Cancellation of Performance Obligations........................................... 82

Negative Performance Obligations................................................84

SAP Revenue Accounting and Reporting

Content

P U B LI C 3

5.2 Revenue Accounting Contracts.....................................................86

Creating a Contract.......................................................... 86

Changes to Contracts.........................................................86

Combination of Revenue Accounting Contracts.......................................94

Searching for and Displaying a Contract............................................97

Revenue Schedule...........................................................98

Pending Review Worklists..................................................... 102

5.3 Operational Documents.........................................................106

5.4 Rights of Return...............................................................106

5.5 Cost Recognition..............................................................108

Examples for Cost Recognition..................................................109

Contract Acquisition Cost......................................................114

5.6 Support of Multiple Accounting Principles............................................ 120

5.7 Status Management............................................................121

5.8 Support of Multiple Currencies....................................................124

Define Relevant Currency Type..................................................125

Fixed Exchange Rate Method...................................................126

Actual Exchange Rate Method..................................................129

5.9 Reprocessing.................................................................131

6 Price Allocation..............................................................132

6.1 Price Determination............................................................132

Condition Exclusion List.......................................................132

Contractual Price........................................................... 132

6.2 Standalone Selling Price-Weighted Allocation..........................................133

6.3 Standalone Selling Price Tolerances................................................ 134

6.4 Residual Price Allocation.........................................................135

6.5 Performance Obligations Excluded from Allocation......................................138

6.6 Customized Allocation..........................................................139

6.7 Allocation Effect...............................................................139

6.8 Price Allocation for Structured Performance Obligations..................................140

7 Contract Change.............................................................143

7.1 Invoicing....................................................................144

7.2 Change of Estimates........................................................... 146

7.3 Contract Modification...........................................................148

Applying a Prospective Change................................................. 149

Retrospective Changes.......................................................154

Mixed Changes.............................................................156

7.4 Attributes Change from Inception Date.............................................. 158

7.5 Determination of Contract Change Type............................................. 158

8 Fulfillment of Performance Obligations............................................160

4

P U B LI C

SAP Revenue Accounting and Reporting

Content

8.1 Event-Based Fulfillment.........................................................160

8.2 Time-Based Fulfillment..........................................................160

Spreading.................................................................161

Duration of Fulfillment........................................................165

8.3 Fulfillment by Percentage of Completion............................................. 167

8.4 Manual Fulfillment.............................................................169

8.5 Compound Structure Fulfillment...................................................173

Distribution from High-Level Performance Obligation..................................173

Minimum Fulfilment Percentage from Low-Level Performance Obligation....................175

Distribution Method Takes Priority over the Minimum Fulfillment Percentage.................177

9 Invoicing...................................................................180

9.1 Simplified Invoice Handling.......................................................180

10 Integration with Cost Object Controlling...........................................186

11 Revenue Posting.............................................................189

11.1 Revenue Posting in Three Steps................................................... 193

11.2 Transfer Revenue..............................................................195

11.3 Calculation and Distribution of Contract Liability/Asset or Unbilled Receivable/Deferred Revenue

.......................................................................... 195

Calculating Contract Liability and Contract Asset.....................................196

Distributing Contract Liability and Asset (Unbilled Receivable and Deferred Revenue) to

Performance Obligation Level.................................................. 198

11.4 Start a Revenue Posting Run..................................................... 200

11.5 Job Monitor................................................................. 204

11.6 Reversing a Revenue Posting.....................................................206

11.7 Account Determination......................................................... 207

11.8 Revenue-Related Events and Postings...............................................211

11.9 Revenue Accounting Close.......................................................216

11.10 Shifting Contracts with Failed Postings to the Next Period.................................217

11.11 Integration with the Financial Closing Cockpit..........................................218

12 Reconciliation...............................................................219

12.1 Reconciliation: Revenue Accounting Subledger and General Ledger..........................219

12.2 Reconciliation: Revenue Accounting Items and Revenue Accounting..........................221

13 Reporting.................................................................. 226

13.1 Reconciliation for Accountants....................................................226

13.2 Sample Reports...............................................................229

Sample Reports: Disaggregation of Revenue and Posted Amounts........................230

Sample Report: Contract Balance............................................... 230

How to Create a Report for Transaction Price Allocated to the Remaining Performance

Obligations................................................................231

SAP Revenue Accounting and Reporting

Content

P U B LI C 5

13.3 DataSources.................................................................236

Revenue Analysis by Posting Item............................................... 239

Allocated Price Change of Performance Obligation................................... 242

Revenue Forecast...........................................................244

Revenue Object Attribute..................................................... 246

Revenue Contract...........................................................247

Performance Obligation...................................................... 249

Reconciliation Key...........................................................251

Contract Status Text.........................................................253

Reconciliation Key Status Text..................................................254

Contract Category Text.......................................................255

Event Type Text............................................................256

Performance Obligation Type text............................................... 257

Fulfill Type Text............................................................ 258

Performance Obligation Role Text...............................................259

Performance Obligation Status Text..............................................260

Post Category Text..........................................................261

Start Date Type Text.........................................................262

Distinct Type Text...........................................................263

Performance Obligation Special Indicator Text......................................264

Review Reason Text.........................................................265

Validation Result Text........................................................266

14 Administration and Maintenance................................................ 268

14.1 Roles......................................................................268

Revenue Accountant.........................................................268

Revenue Accounting Administrator..............................................268

Revenue Accounting Auditor...................................................269

Revenue Accounting RFC User..................................................269

14.2 Migration from a Legacy System...................................................270

15 Extensibility.................................................................271

15.1 Field Extensibility..............................................................271

Field Extensibility in Revenue Accounting Item Processing..............................273

Field Extensibility for Revenue Accounting Contracts..................................274

Field Extensibility for Revenue Reporting.......................................... 276

15.2 Business Add-Ins..............................................................278

Validation of Status Change....................................................278

Enhance Revenue Accounting Items (Raw Items).................................... 279

Enhance Revenue Accounting Items (Processable Items).............................. 280

Combination of Contracts.....................................................281

Price Allocation............................................................ 282

6

P U B LI C

SAP Revenue Accounting and Reporting

Content

Deferral Method............................................................282

Account Assignment Derivation.................................................283

Custom Validations..........................................................283

Posting Enhancements.......................................................284

Compound Fulfillments.......................................................284

Review Worklist Enhancements.................................................284

Change Mode Determination of Performance Obligations...............................285

RAI Reconciliation with non-SAP Sender Components.................................285

Add Customer Fields for Comparative Report of Transition............................. 286

Distributing Contract Liability/Asset and Unbilled Receivable/Deferred Revenue into POB Level

........................................................................287

Deriving Duration of Performance Obligation for Capitalized.............................288

Distribute Invoice to Performance Obligation Level...................................288

Check if table FARR_D_DELDEFITM should be cleared.................................289

16 Migration.................................................................. 290

16.1 Overall Approach..............................................................290

Data Migration Overview......................................................290

Details Regarding the Migration Steps............................................294

16.2 Supported Scenarios...........................................................303

Sales and Distribution........................................................303

Customer Relationship Management, Service Application..............................305

Hybris Billing..............................................................309

Hybris Billing with Sales and Distribution...........................................312

Third Party Sender..........................................................314

16.3 Migration for Integration with Cost Object Controlling....................................314

17 Transition.................................................................. 316

17.1 Transition Process for IFRS 15.....................................................316

Date of Initial Adoption....................................................... 316

Full Retrospective and Modified Retrospective Transition...............................317

Comparative Period......................................................... 319

Cumulative Catch-Up........................................................320

17.2 Transition with SAP Revenue Accounting.............................................321

Supported Capabilities for Data Transfer to Transition.................................321

Parallel Accounting - Overview..................................................324

Assign Company Codes to Accounting Principles.................................... 328

Authorization..............................................................329

17.3 Transition Process.............................................................330

Operational Load...........................................................330

Initial Load Processing........................................................331

Reprocess Revenue Accounting Items for new Accounting Principle....................... 331

SAP Revenue Accounting and Reporting

Content

P U B LI C 7

Clean-up Transition data......................................................333

Contracts Created after Migration or Reprocessing of Revenue Accounting Items............. 333

Calculate Deferred and Unbilled Amount Under Status Migration.........................335

Change to Transition under New Accounting Standard.................................336

Reverse Migrated Unbilled Receivable and Deferred Revenue............................336

Cumulative Catch-Up........................................................337

Prepare and Analyze Comparative Report..........................................339

Calculate Time-Based Revenues................................................340

Calculate Contract Liability and Contract Asset......................................340

Post Revenues.............................................................340

Integration with Cost Object Controlling...........................................341

17.4 Use Case Example.............................................................342

18 Archiving...................................................................349

18.1 Archiving of Revenue Accounting Contracts (FARR_CONTR)...............................349

Checks (FARR_CONTR).......................................................351

Application-Specific Customizing (FARR_CONTR)....................................351

Variant Settings for Archiving (FARR_CONTR).......................................351

Displaying Archived Revenue Accounting Contracts (FARR_CONTR)...................... 352

18.2 Archiving of Revenue Accounting Items (FARR_RAI).....................................353

Checks (FARR_RAI)......................................................... 355

Application-Specific Customizing (FARR_RAI).......................................355

Variant Settings for Archiving (FARR_RAI)......................................... 355

Displaying Archived Revenue Accounting Items (FARR_RAI)............................ 356

8

P U B LI C

SAP Revenue Accounting and Reporting

Content

1 SAP Revenue Accounting and Reporting

Product Information

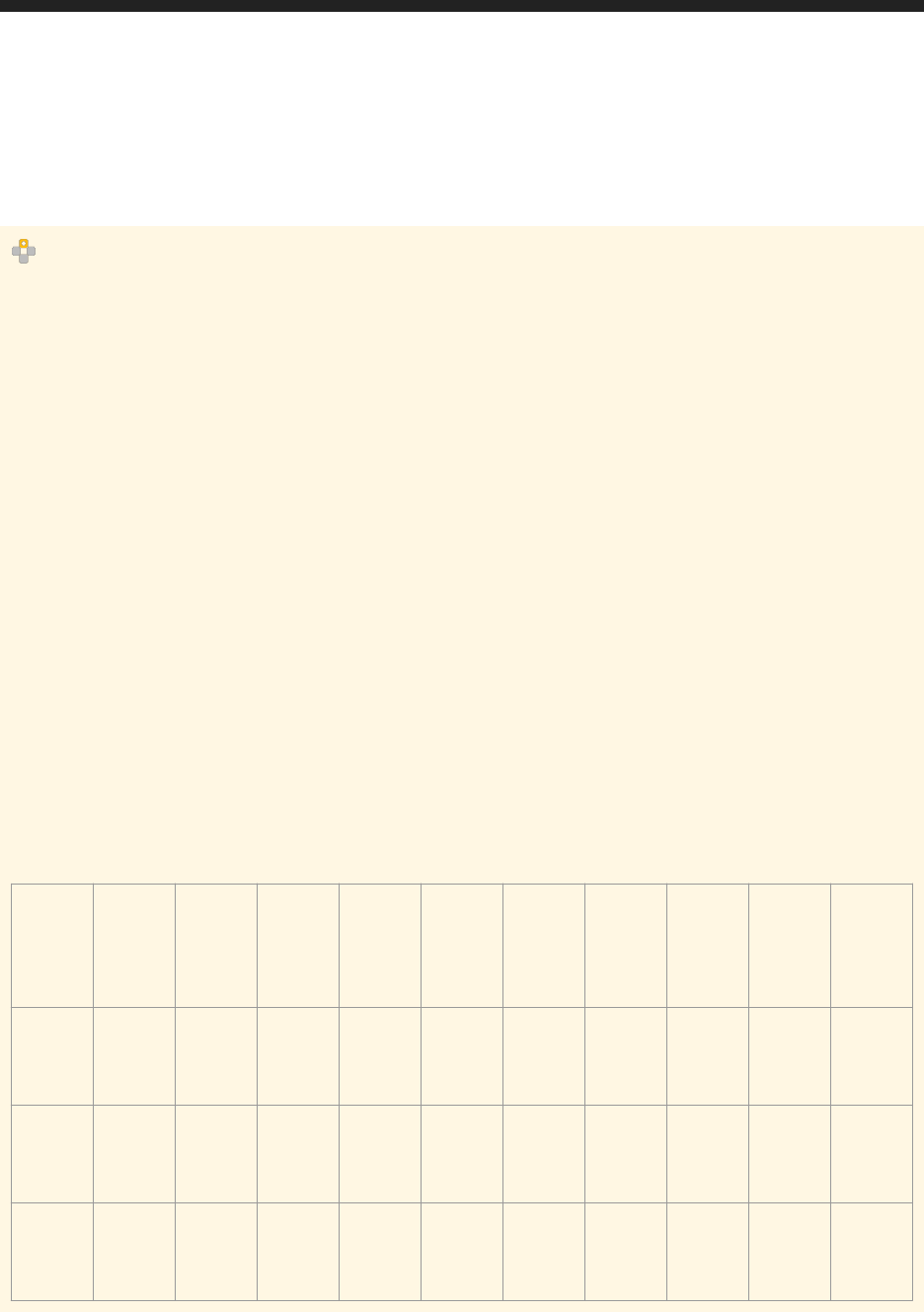

Table 1:

Product SAP Revenue Accounting and Reporting

Release 1.3 SP03

Based On SAP EHP 5 for SAP ERP 6.0

Documentation Published August 2017

Use

Revenue Accounting and Reporting enables you to manage revenue recognition in a process that involves the

following high-level steps:

● Identify contracts

In this step, you create revenue accounting contracts corresponding to operational documents that are

created on a back-end operational system.

● Identify performance obligations

In this step, you identify the performance obligations included in each contract. You create performance

obligations for items in the operational document and manage their relationships with one another.

● Allocate the transaction price

In this step, you determine the total price by aggregating the pricing conditions passed from the back-end

operational system, and then allocate the total price among the performance obligations.

● Manage fulfillment of performance obligations

In this step, you recognize revenue for performance obligations as they are fulfilled.

● Make revenue postings

In this step, you make postings to the general ledger regularly to reflect revenue-related transactions.

SAP Revenue Accounting and Reporting

SAP Revenue Accounting and Reporting

P U B LI C 9

2 What's New in Revenue Accounting and

Reporting

Use

This section contains all release notes. You can use the navigation structure on the left to find a specific release

note.

2.1 Release 1.1

Use

This section contains all release notes. You can use the navigation structure on the left to find a specific release

note.

2.1.1 Integration with SAP Billing and Revenue Innovation

Management

Use

You can connect SAP Billing and Revenue Innovation Management (BRIM) with Revenue Accounting.

Technical Details

Table 2:

Technical Name of Product Feature

FIRA_BRIM_INTEGRATION

Product Feature Is

New

Country Dependency

Valid for all countries

Software Component Version

REVREC 110

Application Component

FI-RA (Revenue Accounting)

10 P U B LI C

SAP Revenue Accounting and Reporting

What's New in Revenue Accounting and Reporting

Available As Of

Release 1.1

Required Business Functions

None

Additional Details

The prerequisites for this integration are:

● You are using Contract Accounts Receivable and Payable (FI-CA) as part of one of the following industry

components, and you are using SAP Convergent Invoicing and provider contracts:

○ Contract Accounts Receivable and Payable

○ Telecommunications

○ Utility industry

● If you are using SAP Customer Relationship Management, you have activated business function

CRM_PROVORDERINT_3_9 (Integration of SAP CC and SAP CI with Provider Order for EHP3 SP09).

● You have activated the business function FICA_EHP7_RA (Integration with Revenue Accounting) (in SAP

ERP).

If you have integrated SAP Customer Relationship Management (SAP CRM), SAP Convergent Invoicing (in SAP

ERP) and SAP Convergent Charging (SAP CC) in the Offer-to-Cash end-to-end process, the integration with

Revenue Accounting takes place solely by means of the ERP system. The ERP system transfers all necessary data

to Revenue Accounting.

Affects on Customizing Settings

SAP provides the sender component CA (SAP O2C) with Revenue Accounting.

You make the following system settings in Customizing for Revenue Accounting under Inbound Processing.

1. Under Revenue Accounting Item Management, define logical systems and assign them to sender component

CA (SAP O2C) in the Define Sender Components customizing activity.

2. Under Revenue Accounting Items create revenue accounting item classes CA01, CA02, and CA03, and

generate them.

The technical names are set by SAP. This ensures that the system automatically provides the required

settings for each class when it is generated.

The revenue accounting item class CA01 defines the technical properties of order items. Class CA02 defines

the technical properties of fulfillment items, and class

CA03 defines those of invoice items.

You activate the integration with Revenue Accounting and configure the RFC destination to the revenue

accounting system, meaning the system, in which SAP Revenue Accounting and Reporting is running, in

Customizing for Contract Accounts Receivable and Payable.

SAP Revenue Accounting and Reporting

What's New in Revenue Accounting and Reporting

P U B LI C 11

Additional Information

See the information about integration in the documentation for Contract Accounts Receivable and Payable under

Integration Revenue Accounting .

Also see the documentation of the business functions CRM_PROVORDERINT_3_9 and FICA_EHP7_RA.

2.1.2 Enhancements in the Revenue Accounting Item Monitor

Use

In the revenue accounting item monitor, you can now:

● Display legacy data

● Process data from the initial load

Technical Details

Table 3:

Technical Name of Product Feature

FIRA_RAI_MONITOR

Product Feature Is

New

Country Dependency

Valid for all countries

Software Component Version

REVREC 110

Application Component

FI-RA (Revenue Accounting)

Available As Of

Release 1.1

Required Business Functions

None

Additional Details

Displaying Legacy Data

On the initial screen of the revenue accounting item monitor (transaction FARR_RAI_MON), you can specify in your

personal settings that the monitor also displays legacy data (from previous systems). Choose the Personalize

pushbutton, and select one of the following settings:

● No Legacy Data

This is the default setting. The monitor does not select any legacy data, if you choose this setting.

12

P U B LI C

SAP Revenue Accounting and Reporting

What's New in Revenue Accounting and Reporting

● Allow Display of Legacy Data in Item Display

If you choose this setting, the monitor does not select legacy data automatically. However, if you choose the

(+) Legacy Data (Display Legacy Data) pushbutton in the item list, you can show legacy data.

● Always Display Legacy Data

If you choose this setting, the monitor always selects legacy data. You can hide the legacy data by choosing

the (-) Legacy Data (Hide Legacy Data) pushbutton in the item list.

The system saves your settings in the FARR_MON_SEL user parameter and uses them the next time you call the

monitor.

If you display legacy data, the monitor shows a new tab for each of the following: legacy data for main items,

legacy data for condition items, and legacy data for planned fulfillment items.

Processing Data from the Initial Load

Up to now you could only process items with field value 1 in INITIAL_LOAD (Initial Load Due to New Co. Code or

Migr. Package

) using transaction FARR_RAI_PROC_LOAD (Initial Load: Process Rev Acc Items).

Once you have selected items from the initial load, the Process Initial Load pushbutton now appears in the display

of processable items.

Items that were generated by an initial load due to a new company code or migration package can only be

processed if you choose the Process Initial Load pushbutton. All other items can be processed only by choosing

the Process pushbutton.

2.1.3 Processing of Return Orders

Use

Order items now have the following fields as references to their predecessor items:

● Predecessor Item Sender Component

● Logical System of the Predecessor Item

● Predecessor Item Type

● Predecessor Item ID

The fields are contained in interface component BASIC_MI01 and are therefore available in all order items.

If an order item is related to a predecessor item, the system does not treat the order item as a separate and

independent item. Instead the system aggregates its quantities and amounts with those of the predecessor item.

When the revenue is posted, the system treats the aggregated data as a change to the predecessor item.

Multiple revenue accounting items are allowed to refer to the same predecessor item. However, the total quantity

and total amount are not allowed to take on a negative value after all the items are aggregated.

Each of the items and its predecessor item must have the same company code, currencies, units of measure, and

setting for its value relevance.

SAP Revenue Accounting and Reporting

What's New in Revenue Accounting and Reporting

P U B LI C 13

Technical Details

Table 4:

Technical Name of Product Feature

FIRA_RETURN_ORDER_HNDLG

Product Feature Is

New

Country Dependency

Valid for all countries

Software Component Version

REVREC 110

Application Component

FI-RA (Revenue Accounting)

Available As Of

Release 1.1

Required Business Functions

None

Additional Details

The following example illustrates how the fields are used during processing of order items, based on a return in

Sales and Distribution (SD).

Example

1. A customer orders three televisions for 500 each.

2. Revenue Accounting creates a revenue accounting item for this order with a quantity of 3 and an amount of

1500, and generates the revenue postings.

3. One of the televisions is damaged in transport.

4. Revenue Accounting creates an additional order item with a quantity of -1 and an amount of -500. This item

refers to the original (predecessor) order item.

5. Revenue Accounting offsets the item for the return against the original order item.

6. When the revenue posting is made, the system takes the change of the original order item into account

with a newly calculated quantity of 2 and an amount of 1000.

2.1.4 Reconciliation of Revenue Accounting Items with

Contracts

Use

There is a program (transaction FARR_RAI_RECON) you can use to ensure data consistency between revenue

accounting items and revenue accounting contracts. You do so by reconciling the processed revenue accounting

items with the determined performance obligations. The system checks if the amounts and quantities are the

same in both. If the program determines there are differences in the quantity or amount, the system saves these

14

P U B LI C

SAP Revenue Accounting and Reporting

What's New in Revenue Accounting and Reporting

performance obligations. The next time a reconciliation is performed, the program checks these saved

performance obligations first.

Technical Details

Table 5:

Technical Name of Product Feature

FIRA_RAI_CONTR_RECONCILIATION

Product Feature Is

New

Country Dependency

Valid for all countries

Software Component Version

REVREC 110

Application Component

FI-RA (Revenue Accounting)

Available As Of

Release 1.1

Required Business Functions

None

Affects on Customizing Settings

The report parallelizes the selected data during processing. You specify the number of jobs that can be executed

in parallel in SAP Customizing under Cross-Application Components General Application Functions Parallel

Processing and Job Control Parallel Processing Maintain Job Distribution .

2.1.5 Enhancement of Account Determination

Use

You can completely move the determination of G/L accounts to Revenue Accounting. Then sender systems no

longer have to provide the accounts.

Revenue Accounting determines the G/L accounts to be posted for order items using Customizing rules from the

transferred revenue accounting items. The system derives the G/L accounts for fulfillment items and invoice

items using the reference to the order item.

SAP Revenue Accounting and Reporting

What's New in Revenue Accounting and Reporting

P U B LI C 15

Technical Details

Table 6:

Technical Name of Product Feature

FIRA_ACCT_DETERMINATION

Product Feature Is

New

Country Dependency

Valid for all countries

Software Component Version

REVREC 110

Application Component

FI-RA (Revenue Accounting)

Available As Of

Release 1.1

Required Business Functions

None

Additional Details

Up to now, you could determine the target accounts that are to be posted by using Customizing rules from

reference accounts that the sender system transfers in order items and invoice items. The target accounts are

used, for example, for posting recognized revenue or for adjusting receivables.

This function remains unchanged.

However, as a separate option, you can now determine G/L accounts completely within Revenue Accounting,

using characteristics of order items.

To derive the G/L accounts from characteristics of order items, the sender system has to set the Determine

Revenue Accounts with BRFplus indicator in main conditions. The sender system must also set the Determine P+L

Accounts with BRFplus indicator in condition records.

If these indicators are set, then the system derives the G/L accounts during the processing of order items in a

step that comes before the account determination used up to now. After that, the system processes the enriched

items exactly as if the sender system had transferred them with G/L accounts.

This ensures compatibility between the solution used until now and the new solution.

You define in Customizing for each revenue accounting item class which characteristics Revenue Accounting uses

to derive which G/L accounts.

The system derives the G/L accounts for fulfillment items and invoice items using the reference to the order item.

Affects on Customizing Settings

You make settings for deriving G/L accounts from reference accounts (provided by SAP) in Customizing for

Revenue Accounting under

Revenue Accounting Revenue Accounting Postings Configure Account

Determination for Specific Transactions .

16

P U B LI C

SAP Revenue Accounting and Reporting

What's New in Revenue Accounting and Reporting

To derive the G/L accounts from order items:

1. Enter the derivation rules for G/L accounts in Customizing for Revenue Accounting under Inbound

Processing Revenue Accounting Item Management Assign BRFplus Applications to Revenue Accounting

Item Classes

, by assigning BRFplus applications to the revenue accounting item class of the Order Item

class type.

2. For each order item class, enter an ABAP structure that references the BRFplus application. In Customizing

for Revenue Accounting, choose Inbound Processing Revenue Accounting Item Management Maintain

BRFplus Structure

.

In this way, you can derive the G/L accounts from any characteristics of order items.

Note

If you want to derive G/L accounts based on customer fields, you have to define the BRFplus structure first in

Customizing. Then you can add the fields to the revenue accounting item class and generate the class. Once

this is done, the fields are available when you define your BRFplus application.

2.1.6 Planned Invoices for Billing Plans

Use

During processing of revenue accounting items, you can automatically generate invoices for items of a billing plan.

For this to take place, the sender system has to fill the Invoice Category attribute on the invoice items accordingly.

Technical Details

Table 7:

Technical Name of Product Feature

FIRA_PLANNED_INVOICES

Product Feature Is

New

Country Dependency

Valid for all countries

Software Component Version

REVREC 110

Application Component

FI-RA (Revenue Accounting)

Available As Of

Release 1.1

Required Business Functions

None

SAP Revenue Accounting and Reporting

What's New in Revenue Accounting and Reporting

P U B LI C 17

Additional Details

In Revenue Accounting, the total amount and total quantity of billing plans are represented by an order item that

is valid for the entire duration of the payment plan. In addition to this, information about the due dates and

amounts of the billing plan is stored in invoice items. If a payment plan date is invoiced, then the sender system

has to forward an additional invoice item with the billing document data to Revenue Accounting.

You can now also generate the actual invoice items in Revenue Accounting. This is to support scenarios in which

actual invoicing usually corresponds to the billing plan, and therefore you do not want to connect the billing

system to Revenue Accounting (or it might not be possible).

If you want the system to generate an actual invoice from a planned invoice item of a billing plan on the posting

date, then the invoice must have invoice category 2. In addition, the Invoice Corrections from Billing Plan

(BILLING_PLAN_INV) indicator has to be set on the order item of the billing plan.

Invoice items of invoice category 2 keep the status Processable until their posting date is reached. If they are

processed after their posting date has been reached, then actual invoices are created from them. These invoices

then result in postings. When the actual invoice items are generated, the values in foreign currency are updated.

You can change invoice items of invoice category 2 until their posting date is reached. After the posting date is

reached, changes are no longer possible, since it could be the case that postings were already made based on this

data. Therefore, after the posting date is reached, you have to reverse these invoices and create new ones to

make a change, the same as you would for actual invoices.

2.1.7 Archiving Revenue Accounting Contracts and Items

Use

You can archive revenue accounting items and revenue accounting contracts.

Technical Details

Table 8:

Technical Name of Product Feature

FIRA_ARCHIVING

Product Feature Is

New

Country Dependency

Valid for all countries

Software Component Version

REVREC 110

Application Component

FI-RA (Revenue Accounting)

Available As Of

Release 1.1

18 P U B L I C

SAP Revenue Accounting and Reporting

What's New in Revenue Accounting and Reporting

Required Business Functions

None

Additional Details

Archiving of revenue accounting contracts takes place using the archiving object FARR_CONTR. You can archive

revenue accounting contracts if the following applies for the revenue accounting contracts to be archived:

● They have the contract status Closed.

● The date on which they were closed is entered in the contract.

● They are updated.

In addition, the date on which the contract was closed must be further in the past than the amount of time

specified by the residence time.

Archiving of revenue accounting items takes place using the archiving object FARR_RAI. You can archive a

revenue accounting item, if the revenue accounting contract, to which the revenue accounting item relates, is

deleted.

Effects on Customizing Settings

You define the residence time for revenue accounting contracts and activate the archive information structure in

Customizing for Revenue Accounting under

Revenue Accounting Revenue Accounting Contracts

Archiving .

You activate the archive information structure for revenue accounting items in Customizing for Revenue

Accounting under Revenue Accounting Inbound Processing Archiving .

2.1.8 Determining Quantities and Amounts in Revenue

Accounting

Use

Sender systems can transfer revenue accounting items that do not contain a quantity and do not contain an

amount. Revenue Accounting determines quantities and amounts when it processes revenue accounting items.

SAP Revenue Accounting and Reporting

What's New in Revenue Accounting and Reporting

P U B LI C 19

Technical Details

Table 9:

Technical Name of Product Feature

FIRA_ESTIMATED_QUANTITIES

Product Feature Is

New

Country Dependency

Valid for all countries

Software Component Version

REVREC 110

Application Component

FI-RA (Revenue Accounting)

Available As Of

Release 1.1

Required Business Functions

None

Additional Details

For determining quantities and amounts (prices) per unit, SAP provides the BRFplus function

FC_RAI_EST_QUAN_DET.

Example

You provide services to customers.

The performance obligation is consumption-based.

The price of the performance obligation depends on how many units the customer consumes until the duration

of the performance obligation ends.

Based on the data transferred in the revenue accounting items, you use the BRFplus function

FC_RAI_EST_QUAN_DET to estimate the amount consumed and to determine the average price per unit of

measure.

The amount of the performance obligation is determined by multiplying the estimated quantity by the average

price per unit.

2.1.9 Migration by Package

Use

Up to now, it was only possible to perform initial load for a complete company code.

Now you can load revenue accounting items to Revenue Accounting with finer granularity than an entire company

code and already use the company code productively.

20

P U B LI C

SAP Revenue Accounting and Reporting

What's New in Revenue Accounting and Reporting

To load data to already productive company codes, you define migration packages.

Technical Details

Table 10:

Technical Name of Product Feature

FIRA_PACKAGE_MIGRATION

Product Feature Is

New

Country Dependency

Valid for all countries

Software Component Version

REVREC 110

Application Component

FI-RA (Revenue Accounting)

Available As Of

Release 1.1

Required Business Functions

None

Additional Details

Example

You want to migrate a very large company code to Revenue Accounting.

As the first step, you transfer the data of a particular customer group to Revenue Accounting and set the

company code to productive. Later, you gradually transfer additional customer groups of the company code

and thereby set the company to productive over time.

A migration package contains all data for a certain customer group in a company code.

You set the status of an individual migration package in a company code to Migration or Productive. The

prerequisite for this is that the combination of company code and accounting principle without a migration

package is already productive, and that the transfer date of the new migration package is after the transfer date of

the already productive migration packages.

During the transfer of revenue accounting items, the sender system transfers the migration package in the

MIG_PACKAGE field to the main items of order items.

In transaction FARR_RAI_PROC_LOAD, you can start the processing of revenue accounting items from the initial

load for individual migration packages. The system only processes revenue accounting items from migration

packages that have the status

Migration and that have a posting date (event date) before the transfer date of the

migration package.

If problems occur during the migration of a package, you can delete the data transferred in the package. To do so,

you use transaction FARR_IL_CLEANUP. This is only possible as long as the package has the status Migration and

no postings have been made.

SAP Revenue Accounting and Reporting

What's New in Revenue Accounting and Reporting

P U B LI C 21

Effects on Customizing Settings

You define migration packages in Customizing for Revenue Accounting under Revenue Accounting Contracts

Define Migration Packages .

You set the status of migration packages in Customizing for Revenue Accounting under Revenue Accounting

Contracts Assign Company Codes to Accounting Principles in the Assignment of Migration Packages group

box.

2.1.10 Improvement in Closing Activities

Use

We enhance revenue accounting close for granular posting and add new check logic for revenue accounting close.

Revenue accounting period (RA period) has a new status In Closing. In this status, new business will result in the

next RA period while the accountant can still conduct accrual run for the current RA period.

You can shift an error contract to the next period and close the current RA period in order to process your

businesses. We enhance three granular posting transactions, namely Calculate Liability and Asset, Calculate

Time-based Revenue, and Revenue Posting, to support SAP Financial Closing Cockpit.

Technical Details

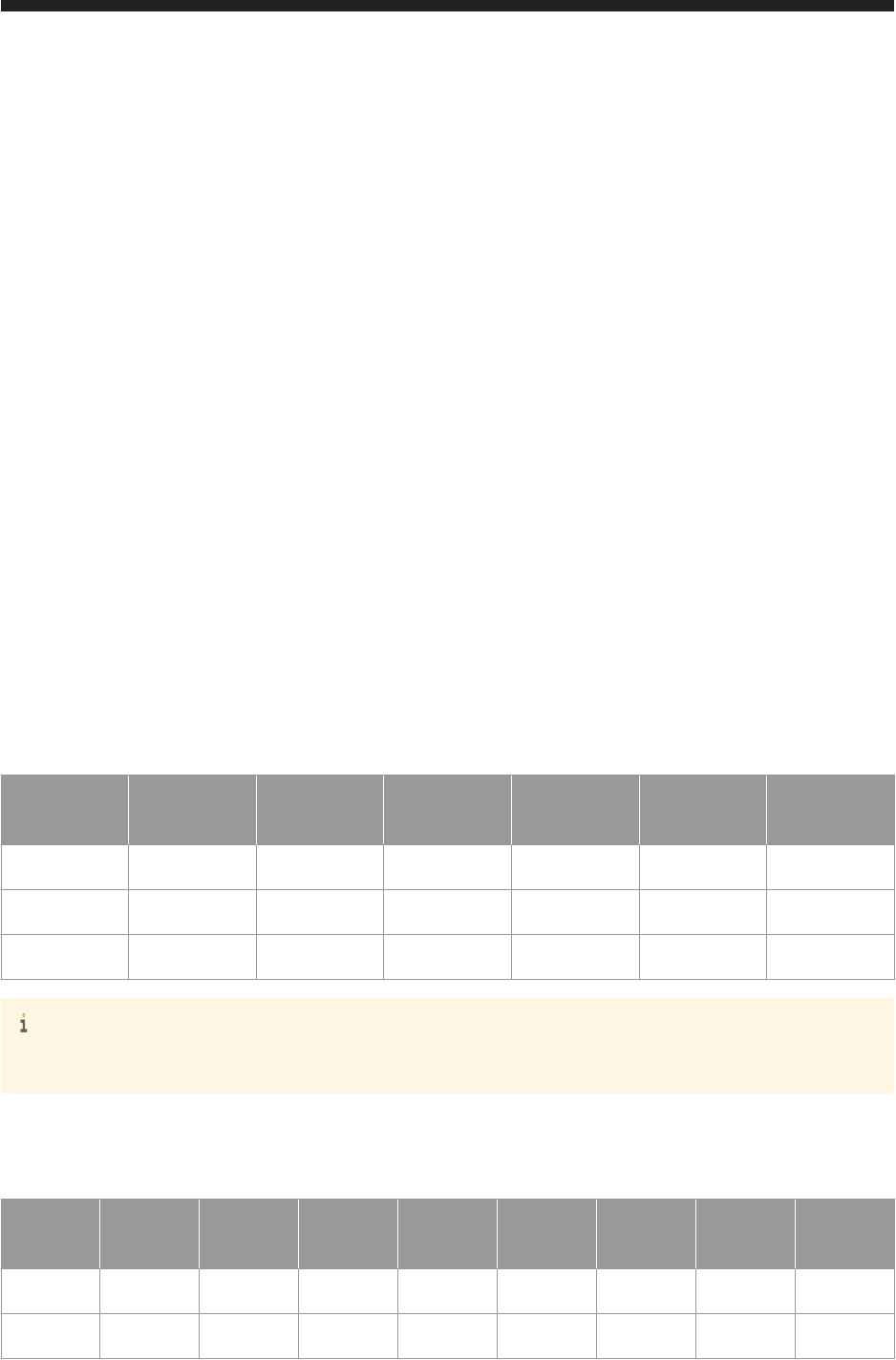

Table 11:

Technical Name of the Product Feature

FIRA_CLOSING

The product feature is Enhanced

Country Dependency Valid for all countries

Software Component Version REVREC 110

Application Component FI-RA

Availability SAP Revenue Accounting and Reporting 1.1

Prerequisite Business Functions N.A.

Additional Details

In Revenue Accounting 1.0, you can set two statuses in a revenue accounting period, that is, Open and Close,

controlled by period. In Revenue Accounting 1.1, we have a new status.

22

P U B LI C

SAP Revenue Accounting and Reporting

What's New in Revenue Accounting and Reporting

● Open: Events can still request a reconciliation key in a certain period and are included in revenue posting in

the period.

● Close: When events request a reconciliation key in a certain period, if you set the Close status, the system

provides an open key in the next period. You cannot run revenue posting when the revenue accounting period

is closed.

● In Closing: When events request a reconciliation key in a certain period, the system provides an open key in

the next period, but you can still run revenue posting in this certain period.

To close the RA period, you can choose close revenue accounting period when conducting revenue posting. Then

you can shift contracts to the next period only when the current RA period is in the In Closing status. Once the

contracts have been shifted to next RA period, you are not able to re-open the closed period unless you register

the three revenue accounting programs in SAP Financial Closing Cockpit.

2.1.11 Further Flexibility in Posting Process

Use

The Revenue Accounting system manages revenue recognition using objects such as revenue accounting

contracts and performance obligations. The system receives events that relate to revenue recognition and tracks

the fulfillment of performance obligations. However, revenue postings do not occur at the times of those events.

The accountant performs revenue posting jobs regularly to post FI documents to the general ledger. For example,

the accountant may run a revenue posting job at the end of each accounting period to transfer revenue

recognition transactions to the general ledger.

Technical Details

Table 12:

Technical Name of the Product Feature

FIRA_POSTING_IMPROVE

The product feature is New

Country Dependency Valid for all countries

Software Component Version REVREC 110

Application Component FI-RA

Availability SAP Revenue Accounting and Reporting 1.1

Prerequisite Business Functions N.A.

SAP Revenue Accounting and Reporting

What's New in Revenue Accounting and Reporting

P U B LI C 23

Additional Details

The general task of revenue posting is divided into three steps. The accountant runs three separate programs to

complete these steps: calculating time-based revenue, calculating contract liability and asset, and performing the

revenue posting run.

In Revenue Accounting and Reporting 1.1, you can post revenue using a single revenue posting run instead of

reconciliation keys.

Effects on Existing Data

Compared to Revenue Accounting and Reporting 1.0, the purpose of the reconciliation key in Revenue Accounting

and Reporting 1.1 has changed. In Revenue Accounting and Reporting 1.0, the reconciliation key works as a

posting bucket for one company code and one accounting principle. It also connects revenue accounting and FI. In

Revenue Accounting and Reporting 1.1, on the other hand, to achieve postings with the same granularity (that is,

postings on the contract level), the reconciliation key works as an event counter for each contract. The length of

the reconciliation key has been extended from 10 digits to 14.

The general task of posting revenue is divided into three steps. The accountant runs three separate programs to

complete these steps:

1. Calculating time-based revenue

2. Calculating contract liabilities and assets

3. Performing the revenue posting run

Revenue Accounting and Reporting 1.1 offers two new UIs for calculating time-based revenue and calculating

contract liabilities and assets.

The system allows you to simulate a revenue posting run in simulation mode. You can use the simulated results to

verify account determination, account assignments, debit/credit side, and posting amounts. Additionally, the

simulation mode allows you to select specific contracts and performance obligations to simulate postings. The

simulation mode provides three views for simulation: You can simulate the results by accounts, by performance

obligations, and by postings.

In a revenue posting run, you can simulate postings using transaction RWIN (General Ledger Posting) to check

whether errors occur in this transaction, such as when the posting period is closed or an account number is not

valid. You can check the result of a test run in the job monitor.

When the posting check is selected in revenue posting run, the program checks the contracts one by one to verify

the possibility of making a revenue posting for that contract. If any contract fails the check, the contract is rolled

back in the actual postings.

Effects on Data Transfer

In Revenue Accounting and Reporting 1.1, postings with greater granularity is supported, which leads to changes

in the data structure and the business process model. Data created in Revenue Recognition 1.0 is supported in the

new version.

24

P U B LI C

SAP Revenue Accounting and Reporting

What's New in Revenue Accounting and Reporting

Effects on System Administration

The revenue posting user interfaces do not provide options for you to schedule a recurring job. However, the three

programs for revenue posting are all available as ABAP programs. The ABAP programs provide more flexibility,

and you can schedule recurring jobs by using the ABAP built-in scheduling framework.

2.1.12 Prospective Change

Use

Contract modifications that have resulted from changes to scope or price (or both) lead to either a prospective

change or a retrospective change.

Retrospective changes apply the modification to both fulfilled and unfulfilled parts in a revenue accounting

contract. Prospective changes only apply the modification to unfulfilled parts.

Technical Details

Table 13:

Technical Name of the Product Feature N.A.

The product feature is New

Country Dependency Valid for all countries

Software Component Version REVREC 110

Application Component FI-RA

Availability SAP Revenue Accounting and Reporting 1.1

Prerequisite Business Functions N.A.

Additional Details

By default, the system uses standard rules to determine whether a change is prospective or retrospective. You

can enhance the BAdI ( FARR_CHANGE_MODE_DETERMINATION) by defining your own rules.

To define your rules, go to Customizing and choose Financial Accounting Revenue Accounting Revenue

Accounting Contracts Business Add-Ins BAdI: Determination of Contract Modification for Performance

Obligations

SAP Revenue Accounting and Reporting

What's New in Revenue Accounting and Reporting

P U B LI C 25

2.1.13 Enhanced Reconciliation Functions

Use

Revenue Accounting receives data from different components, such as SD or CRM, and then posts documents

into General Ledger Accounting (FI-GL) and Profitability Analysis (CO-PA). The system logs any errors that occur

in the communication between the components and processing in the Adapter Reuse Layer (ARL).

Consequently, you need to reconcile data until the data processed in ARL and data finalized in the revenue

accounting engine are consistent. You still need a summary report to reconcile data between revenue accounting

items and the revenue accounting engine. You need to perform the reconciliation regularly.

Technical Details

Table 14:

Technical Name of the Product Feature

FIRA_RECONC_ENHANCE

The product feature is New

Country Dependency Valid for all countries

Software Component Version REVREC 110

Application Component FI-RA

Availability SAP Revenue Accounting and Reporting 1.1

Prerequisite Business Functions N.A.

Additional Details

In Revenue Accounting and Reporting 1.1, we have enhanced reconciliation for performance obligations with bills

of material.

2.2 Release 1.2

Use

This section contains all release notes. You can use the navigation structure on the left to find a specific release

note.

26

P U B LI C

SAP Revenue Accounting and Reporting

What's New in Revenue Accounting and Reporting

2.2.1 Integration with CRM

Use

You can connect SAP Customer and Relationship Management (CRM) to Revenue Accounting.

Technical Details

Table 15:

Technical Name of Product Feature

CRM_SRV_REVACC_4 in CRM

CRM_SRV_REVACC_ERP_8 in ERP

Product Feature Is

New

Country Dependency

Valid for all countries

Software Component Version

BBPCRM Enhancement Package 4

SAP_APPL Enhancement Package 8

REVREC 120

REVRECSD (in case of billing in ERP SD)

Application Component

CRM-BTX (Business Transaction)

Available As Of

CRM 7.14 SP02

ERP 6.18 SP02

REVREC 1.20

REVRECSD 1.00 SP 06

Required Business Functions

None

Additional Details

The prerequisites for this integration are:

● You utilize the CRM Service Application and use business transactions of the following types:

○ Service contract

○ Service order and service confirmation

○ Product bundle service order quotation

● See documentation of busniess functions CRM_SRV_REVACC_4 (CRM Service: Revenue Accounting in

enhancement package 4) in the CRM system and

CRM_SRV_REVACC_ERP_8 (CRM Service: Revenue

SAP Revenue Accounting and Reporting

What's New in Revenue Accounting and Reporting

P U B LI C 27

Accounting in Enhancement Package 4) in the ERP system. (CRM Service: Revenue Accounting Integration)

activiated in the ERP system.

● You have set up accounting integration for CRM service business transactions in ERP.

● You bill CRM service business transactions (by means of the Billing Engine) and have set up the

corresponding accounting interface in ERP.

Or you bill CRM service business transactions in ERP SD and set up this interface in ERP.

The integration takes place from CRM via ERP to Revenue Accounting.

If you bill the CRM service business transaction in ERP SD, the SD integration components must then be installed

for revenue accounting (add on component REVRECSD) in the ERP system.

Effects on Customizing Settings

SAP provides the sender component CRS (SAP CRM Service) with Revenue Accounting. You make the following

system settings in Customizing for Revenue Accounting under

Inbound Processing.

1. Under Revenue Accounting Item Management, define logical systems and assign them to sender component

CRS (SAP CRM Service) in the Define Sender Components IMG activity.

2. Under Revenue Accounting Items create revenue accounting item classes CS01, CS03 and generate them.

The technical names are set by SAP. This ensures that the system automatically provides the required

settings for each class when it is generated.

The revenue accounting item class CS01 defines the technical characteristics of the order items and the class

CS03 those of the invoice items of CRM billing.

The class SD03 defines the technical properties of the invoice items from ERP SD.

You activate the integration with Revenue Accounting in Customizing for CRM Service Business Processes in the

CRM system. Choose the following path in SAP Customizing for Customer Relationship Management

Transactions Settings for Service Transactions Integration Revenue Accounting Integration .

You configure the RFC destination to the Revenue Accounting system, which is the system that runs the SAP

Revenue Accounting and Reporting, in SAP Customizing in the ERP System under

Integration with Other SAP

Components CRM Settings for Service Processing .

More Information

See documentation of busniess functions CRM_SRV_REVACC_4 (CRM Service: Revenue Accounting in

enhancement package 4) in the CRM system and CRM_SRV_REVACC_ERP_8 (CRM Service: Revenue Accounting

Integration) in the ERP system.

28

P U B LI C

SAP Revenue Accounting and Reporting

What's New in Revenue Accounting and Reporting

2.2.2 Cancellation of Performance Obligation

Use

The operational system may pass the finalization date as a sign to terminate performance obligations in Revenue

Accounting, and to lock the operational order with the “Rejection” status. An unblocked delivery or invoice can still

be processed and then passed down to Revenue Accounting.

Revenue Accounting processes performance obligations with a finalization date and an “In Process” status. After

this process, these performance obligations are set to “Complete.” Meanwhile their cumulative amount and

quantity are changed according to the invoice amount. If the finalization date is earlier than the system date, the

performance obligation fulfillment will be adjusted to 100%. The system otherwise submits a report to scan and

process such performance obligations with a finalization date and an “In Process” status, and sets these

performance obligations to “Complete” on the finalization date.

If the operational system changes the order and removes the “Rejection” status afterwards, the operational

system passes an empty “Finalization date” to Revenue Accounting. The system changes the performance

obligation back to “In Process” and adjusts the cumulative amount and quantity accordingly.

Technical Details

Table 16:

Technical Name of the Product Feature

FIRA_POB_CANCEL

Content of the product feature New

Country Dependency Valid for all countries

Software Component Version REVREC 120

Application Component FI-RA

Availability SAP Revenue Accounting and Reporting 1.2

Prerequisite Business Functions N.A.

2.2.3 Cost Recognition

Use

Cost of sold goods (COGS) is now managed in revenue accounting. Cost is recognized together with revenue, at

the same time as when the performance obligation is fulfilled and then transferred to COPA.

SAP Revenue Accounting and Reporting

What's New in Revenue Accounting and Reporting

P U B LI C 29

Technical Details

Table 17:

Technical Name of the Product Feature

FIRA_POB_CANCEL

Content of the Product Feature New

Country Dependency Valid for all countries

Software Component Version REVREC 120

Application Component FI-RA

Availability SAP Revenue Accounting and Reporting 1.2

Prerequisite Business Functions N.A.

2.2.4 Enhanced CO Account Assignments

Use

Additional account assignments are supported by Revenue Accounting.

Additional Details

The following account assignments can be forwarded to revenue accounting:

● an internal order

● a sales order item with make-to-order production

● a work breakdown structure element

● a cost center

You can’t change the account assignment if revenue is posted in revenue accounting. Otherwise values on the

controlling object would be inconsistent. As a result, the new account assignments can‘t be added to performance

obligations created in Revenue Accounting 1.1 or 1.0

The cost center can only be a statistical account assignment, as it doesn’t manage revenues.

30

P U B LI C

SAP Revenue Accounting and Reporting

What's New in Revenue Accounting and Reporting

Technical Details

Table 18:

Technical Name of the Product Feature

FIRA_CO_ASSIGN

Content of the Product Feature New

Country Dependency Valid for all countries

Software Component Version REVREC 120

Application Component FI-RA

Availability SAP Revenue Accounting and Reporting 1.2

Prerequisite Business Functions N.A.

2.2.5 Enhanced Capabilities for Contract Combination

Use

In Revenue Accounting 1.2, revenue contracts can be combined even if their revenue has already been recognized

or invoiced. Performance obligations can also be reassigned from one revenue contract to another when revenue

has been recognized and an invoice has been issued.

When performing the combination or reassignment, you can specify whether this change is a Change of

Estimates or Contract Modification. If a change of estimates is specified, cumulative catch-up will be calculated

from the earliest period and posted to the current open period. If a contract modification is specified, the change

will only affect revenues that will be recognized in the future. Meanwhile you need to specify a date for revenue

accounting contract change. The date is used to determine unfulfilled revenue and to reallocate prices.

Note: Historical information relating to combined contracts is available for reporting.

Technical Details:

Table 19:

Technical Name of the Product Feature

FIRA_CONTRACT_COMB

Content of the Product Feature Changed

Country Dependency Valid for all countries

Software Component Version REVREC 120

SAP Revenue Accounting and Reporting

What's New in Revenue Accounting and Reporting

P U B LI C 31

Application Component FI-RA

Availability SAP Revenue Accounting and Reporting 1.2

Prerequisite Business Functions N.A.

2.2.6 Enhanced Conflict Handling in SAP Revenue Accounting

Use

In Revenue Accounting 1.2, conflict handling of revenue accounting contracts has been enhanced in the following

ways:

● The manually changed performance obligation attribute is always preserved, even if the operational

document is updated. Any manual changes to the spreading of a performance obligation will therefore always

be maintained, even if the allocated price of the performance obligation is changed. Users can correct the

revenue schedule manually based on the previous manual change.

● There are three update modes for the performance obligation attributes: Always Check Conflict, Always

Update from Operational Documents, and Always Keep Manually Changed Value. You can choose any mode. If

you choose the first mode, the conflicts always go to the conflict worklist. If you choose the second mode, the

system always maintains values from the operational documents. If you choose the third mode, the system

always maintains manually changed values. The change mode of each attribute can be configured at

company code level in Customizing.

● It is no longer regarded as a conflict if you add or remove a performance obligation manually. This change

reduces unnecessary conflicts.

Technical Details

Table 20:

Technical Name of the Product Feature

FIRA_CONFLICT_HANDLING

Content of the Product Feature New

Country Dependency Valid for all countries

Software Component Version REVREC 120

Application Component FI-RA

Availability Revenue Accounting and Reporting 1.2

Prerequisite Business Functions N.A.

32 P U B L I C

SAP Revenue Accounting and Reporting

What's New in Revenue Accounting and Reporting

Effects on existing data

The table FARR_C_CONFLI_EX is extended using column UPDATE_MODE, as well as maintenance view

FARR_C_CONFLI_EX.

If you already have customized entries in table FARR_C_CONFLI_EX, you need to maintain the entries that already

exist and then set the update mode to Always Update from Operational Documents.

Effects on existing Customizing

If the performance obligation attributes are not defined in this Customizing, they will have the default update

mode Always Check Conflict. You can switch to another mode according to your needs.

You can find the description of the Customizing activity under Revenue Accounting Revenue Accounting

Contracts Define default value for Update Mode of POB attributes .

Note

The title of the Customizing activity has been changed from “Configure Automatic Overriding for Conflict

Resolution is changed to Revenue Accounting” to “Define default value for Update Mode of POB attributes”.

2.2.7 Further Support for Disclosures

Use

The data source has been optimized: posting table FARR_D_POSTING has been extended with a new field GJAHR/

POPER. This change enables you to aggregate the posted data by period in the posting table which results in faster

data aggregation than in the memory.

Technical Details

Table 21:

Technical Name of the Product Feature

FIRA_DISCLOSURES_2

Content of the Product Feature New

Country Dependency Valid for all countries

Software Component Version REVREC 120

SAP Revenue Accounting and Reporting

What's New in Revenue Accounting and Reporting

P U B LI C 33

Application Component FI-RA

Availability SAP Revenue Accounting and Reporting 1.2

Prerequisite Business Functions N.A.

2.2.8 Improvements in Contract Management

Use

The improvements allow you to:

● Change the fulfillment type after posting.

● Check and report warning messages when you suspend revenue posting.

● Have a BAdI to validate contracts and performance obligations.

● Have an application interface for manual allocation.

● Add a new authorization object in status management.

● Set a status and review the reason for performance obligations.

Technical Details

Table 22:

Technical Name of the Product Feature

FIRA_CONTRACT_MMGT

The product feature is New

Country Dependency Valid for all countries

Software Component Version REVREC 120

Application Component FI-RA

Availability SAP Revenue Accounting and Reporting 1.2

Prerequisite Business Functions N.A.

2.2.9 Improvements in Revenue Posting

Use

Revenue Accounting 1.2 provides new Customizing activities which allow you to select different aggregation levels

for revenue posting. To improve posting performance, the system also supports parallel processing. The contract

34

P U B LI C

SAP Revenue Accounting and Reporting

What's New in Revenue Accounting and Reporting

liability and contract asset can also be calculated and posted to performance obligation level. By using a Business

Add-In (BAdI), you can define rules for distributing the contract liability and contract asset to performance

obligation level. You need to enter the following:

● Contract liability and contract asset balance, as per IFRS 15, provided by a standard logic

● Information of performance obligations

Technical Details

Table 23:

Technical Name of the Product Feature

FIRA_REV_POSTING

Content of the Product Feature is New

Country Dependency Valid for all countries

Software Component Version REVREC 120

Application Component FI-RA

Availability SAP Revenue Accounting and Reporting 1.2

Prerequisite Business Functions N.A.

Additional Details

To enable posting optimization, go to Customizing and choose Financial Accounting (New) Revenue

Accounting Revenue Accounting Postings Switch on Posting Optimization .

To change standard fields during posting to financial accounting, go to Customizing and choose Financial

Accounting (New)

Revenue Accounting Revenue Accounting Postings Business Add-Ins BAdI: Changing

Standard Fields during Posting to Financial Accounting .

To assign an additional revenue posting aggregation dimension, go to Customizing and choose Financial

Accounting (New) Revenue Accounting Revenue Accounting Postings Business Add-Ins BAdI: Assigning

Additional Revenue Posting Aggregation Dimensions

.

To check revenue contracts with your own logic, go to Customizing and choose Financial Accounting (New)

Revenue Accounting Revenue Accounting Postings Business Add-Ins BAdI: Validation and Filter of Revenue

Posting Programs

.

SAP Revenue Accounting and Reporting

What's New in Revenue Accounting and Reporting

P U B LI C 35

2.2.10 Integration with Cost Object Controlling

Use

Cost object controlling is integrated with revenue accounting.

Additional Details

Integrated cost objects are either a work breakdown structure element, a sales order item with make-to-order or

an internal order.

Effects on Customizing settings

The related sales order item is marked as relevant for revenue accounting. The results analysis version and

currency type are assigned to the company code and accounting principle. The results analysis key and results

analysis version are marked as relevant for revenue accounting.

Line IDs can be defined, as follows:

For percentage of completion methods: the cost elements (accounts), which are used for the revenue correction

postings (revenue adjustments), must be assigned to a separate line ID using category ‘R’.

For revenue-based methods: all cost elements for revenues must be assigned to line IDs using category ‘E’.

Technical Details

Table 24:

Technical Name of the Product Feature

FIRA_COSTOBJECTCONTROLLING

Content of the Product Feature New

Country Dependency Valid for all countries

Software Component Version REVREC 120

Application Component FI-RA

Availability SAP Revenue Accounting and Reporting 1.2

Prerequisite Business Functions N.A.

36 P U B L I C

SAP Revenue Accounting and Reporting

What's New in Revenue Accounting and Reporting

2.2.11 Contract Change

Use

Contract change will result in either a change of estimates or a contract modification. A change of estimates

applies from the inception date, which leads to cumulative catch-up. Contract modification applies to the open

part of a contract depending on whether its performance obligation is unit-distinct. For detailed rules, refer to

Contract Modification [page 148].

Technical Details

Table 25:

Technical Name of the Product Feature

FIRA_PROSPECTIVE

Content of the Product Feature New

Country Dependency Valid for all countries

Software Component Version REVREC 120

Application Component FI-RA

Availability SAP Revenue Accounting and Reporting 1.2

Prerequisite Business Functions N.A.

Additional Details

The system has default rules to determine whether a change is a contract modification or a change of estimates.

You can also apply your own rules in the following activity:

Choose Financial Accounting Revenue Accounting Revenue Accounting Contracts Business Add-Ins

BAdI: Determination of Contract Modification for Performance Obligations .

2.2.12 Transition to the new Revenue Standard

Use

In Revenue Accounting 1.2, the system supports the transition process from a source accounting principle to a

target accounting principle with the new revenue recognition standard.

SAP Revenue Accounting and Reporting

What's New in Revenue Accounting and Reporting

P U B LI C 37

The process is as follows:

1. Create a new accounting principle from an existing accounting principle.

2. Adjust the performance obligation attributes according to the rules, or manually for:

○ A combination of contracts

○ Linked performance obligations

○ Additional performance obligations

○ An historic standalone selling price (SSP) in case there are differences between the old and new

standards

○ A fulfillment event type changed from invoice to goods issue

○ Other performance obligation attributes similar to creating new performance obligations

3. Calculate the cumulative catch-up of the historic values according to the new attributes.

4. Make a comparative report between the accounting principles for the old and new standard.

Technical Details

Table 26:

Technical Name of the Product Feature

FIRA_TRANSITION

Content of the Product Feature is New

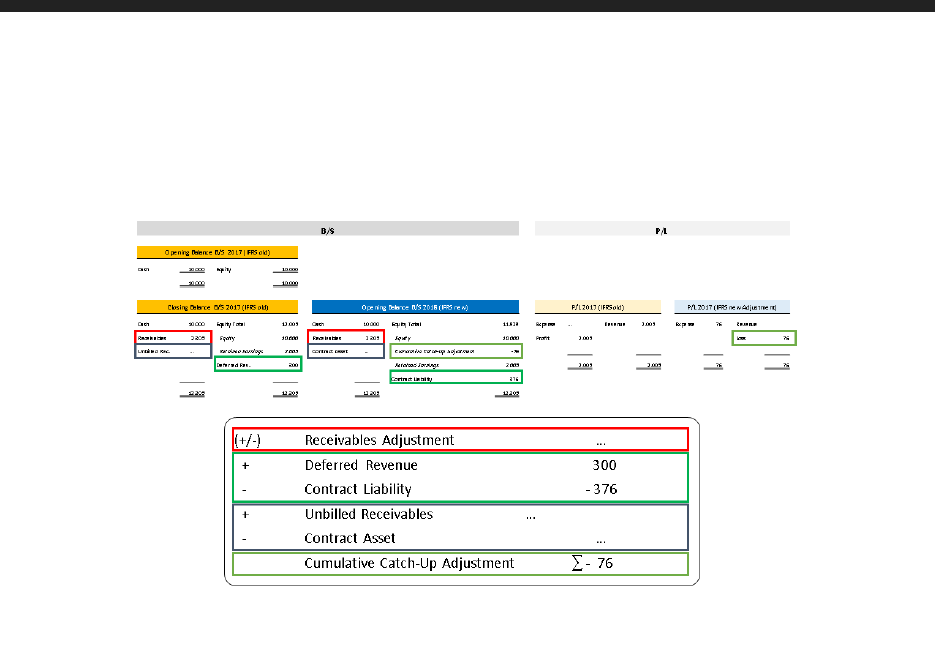

Country Dependency Valid for all countries

Software Component Version REVREC 120