Page 1 of 13

TIME DEPOSIT AGREEMENT | APAC

for Time Deposits in Australia, China, Hong Kong, India, Indonesia, Japan, Malaysia, New Zealand, the Philippines, Singapore, Taiwan,

Thailand, Vietnam

V2.7_09_25_15

This time deposit agreement which shall include the Appendices herein and applicable Confirmation Advice(s) (as each is hereinafter defined) (the

“Agreement”) set out the agreed terms between __________________________ (the “Customer”) and JPMorgan Chase Bank, N.A., and/or its

affiliates or subsidiaries, as applicable (the “Bank”) governing the Customer’s time deposit(s) and related transactions from time to time (“Time

Deposits”) with the Bank in the jurisdiction(s) as set out above.

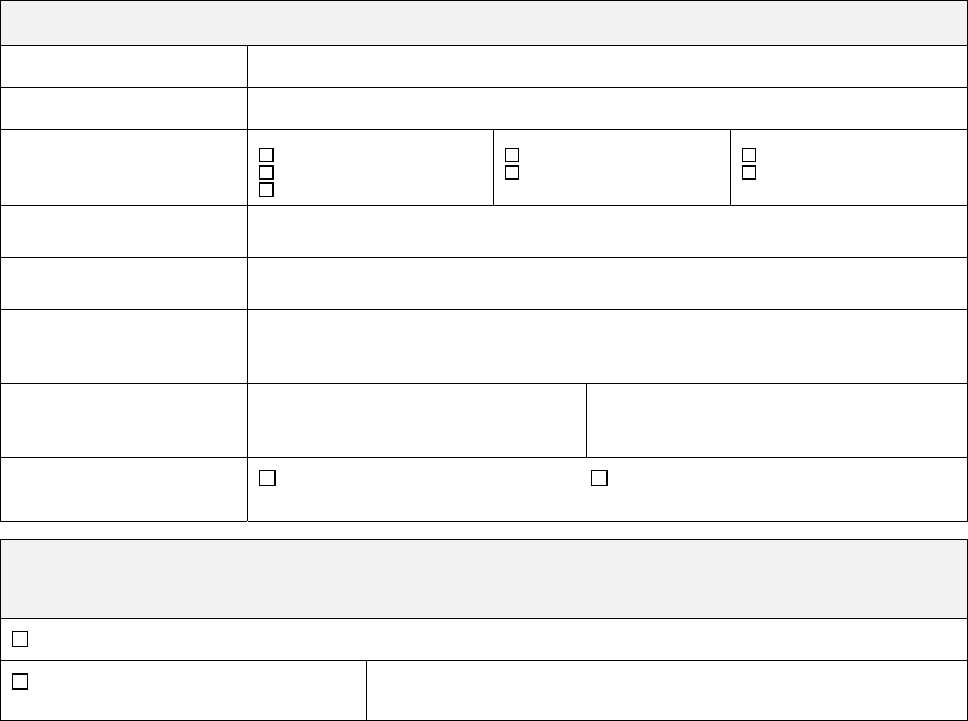

Customer Information

Entity Name

Time Deposit Name

(if applicable)

Entity Type

Corporation

Unincorporated Association

Other

Limited Liability Company

Trust

Partnership

Sole Proprietorship

Registered Legal Address

Mailing Address

Additional Information

Registered Company or Business No:

Other (PAN, for clients in India):

Tax Identification Number (TIN for clients in Philippines):

Customer Contact Information

Name:

Telephone:

Fax:

Title:

Email:

Mode of Communication

(for TD advices and reports)

Post (Physical Mail) Fax

Settlement Instructions

Notes: (i) If no selection is made, at maturity, the time deposit (principal & interest) will be rolled over for the same tenor. (ii) For any changes to Settlement

Instructions, the Customer will need to provide an Instruction at least one business day prior to applicable date of maturity and such Instruction shall be subject to

receipt and acceptance by the Bank.

Auto-rollover (Principal & Interest)

Transfer to Client Account

(Principal & Interest)

Refer to Appendix 3 of this Time Deposit Agreement for account details.

The Customer hereby authorizes the Bank to accept and/or confirm, written, facsimile, telephone and electronic “Instructions” (as defined in

Appendix 1), as applicable, and as per the terms of this Agreement.

Page 2 of 13

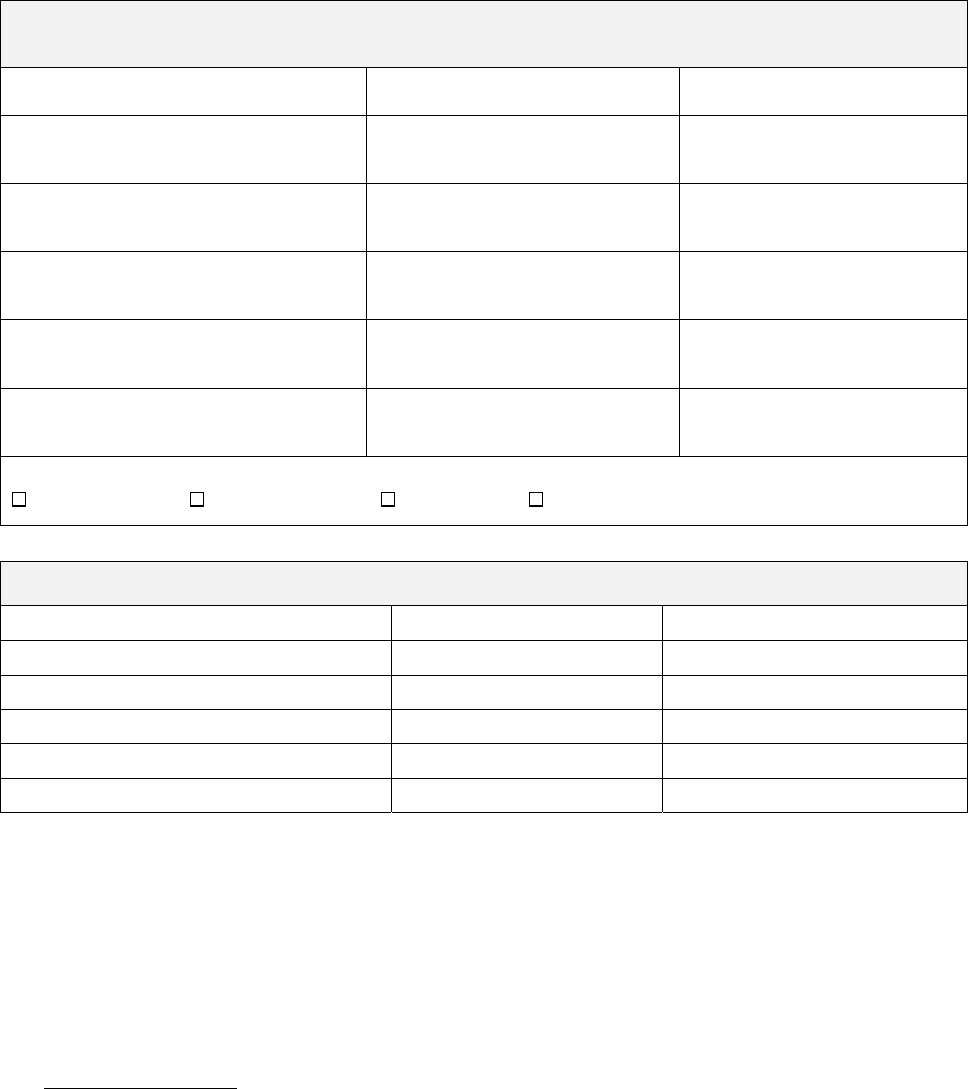

List of Authorized Persons authorized to issue, as applicable, written, telephone, electronic, or facsimile

Instructions

Authorized Person

Specimen Signature

(For Philippines – 3 Specimen signatures for

each signatory required)

Special Instructions

Method of Operation

–

for written and facsimile Instructions (to be consistent with authorization documents)

Any One Signatory Any Two Signatories All Signatories Other (please specify):

List of Authorized Persons authorized to confirm written, telephone, electronic, or facsimile Instructions

Authorized Person Telephone Number Facsimile Number

The Customer agrees that the Bank may but shall not be obliged to perform any call-back confirmation or confirmation by electronic means or

otherwise, or conduct any investigation into or verification supporting the same of any Instructions, or to inquire into the circumstances of any Time

Deposit transaction, and shall have a right to accept Instructions which it believes in good faith to have been given by (i) any of the above authorized

individuals (as the same may be amended from time to time, provided the Bank has a reasonable opportunity to act on such amendments), or (ii) the

Customer, where the Instruction is submitted to the Bank by electronic means pursuant to the terms of this Agreement.

The Customer hereby represents and warrants to the Bank that this Agreement and the transactions herein contemplated (i) have been duly

authorized by the Customer, and (ii) represent the valid and binding obligations of the Customer enforceable in accordance with its terms.

For clients placing Time Deposits in Malaysia: please select the information sharing options as appropriate as set out in Appendix 2 | Jurisdiction

Specific Terms for Malaysia.

For clients placing SGD Time Deposits in Singapore:

Deposit Insurance Scheme

Singapore dollar deposits of non-bank depositors are insured by the Singapore Deposit Insurance Corporation, for up to S$50,000 in aggregate

per depositor per Scheme member by law. Foreign currency deposits, dual currency investments, structured deposits and other investment

products are not insured. For more information, please refer to Singapore Deposit Insurance Corporation website at www.sdic.org.sg

Page 3 of 13

FOR AND ON BEHALF OF THE CUSTOMER:

Signature of Authorized Person Signature of Authorized Person

Name: Name:

Title: Title:

Date: Date

FOR AND ON BEHALF OF THE BANK

Signature of Authorized Person

Name:

Title:

Date:

Page 4 of 13

APPENDIX 1 | GENERAL TERMS AND CONDITIONS

Each Time Deposit is subject to the terms and conditions set out herein:

1. Instructions.

(i) Instructions for time deposits will be accepted at the discretion of the Bank. Except as otherwise agreed or provided herein, the Bank may

accept instructions for, and in relation to, the placement, maintenance, roll-over, withdrawals and other instructions regarding Time

Deposits (“Instruction”) received from time to time in writing, by fax, telephone or electronically (where permitted), which purport to be from

person(s) authorized on behalf of the Customer. In addition, the Bank may, at its discretion (and subject to the Customer’s completion of

any additional documentation the Bank may require), allow the Customer an option to complete Instruction and submit the same for the

Bank’s acceptance by electronic means.

(ii) Where an Instruction has been effected by means of a facsimile signature, personal seal or chop, the Bank is authorized to act on such

Instruction, regardless of by whom the facsimile signature, personal seal or chop was actually affixed.

(iii) If any Instruction is received by the Bank after its cut-off times (as the same are advised by the Bank from time to time), the Bank may

process the Instruction on the next day on which it is open for such business. An Instruction once given may be reversed, amended,

cancelled or revoked by the Customer upon a further Instruction to the Bank in writing or by electronic means where the same is permitted

by the Bank and only with the consent of the Bank.

(iv) Where permitted by applicable law, the Bank may, and the Customer hereby authorizes the Bank to, record telephone conversations in

connection with any Instruction. At the Customer’s request and cost the Bank may supply a copy or transcript of any such recording to the

Customer. The recording or transcript may be used in resolving any dispute between the Bank and the Customer. Recordings and any

transcript shall be the property of the Bank.

2. Confirmation. Upon its receipt of any Instruction the Bank may, but is not required to, send a confirmation advice at the facsimile number

indicated above (or as may be amended from time to time with the due acknowledgement of the Bank),or by such other means as mutually

agreed by the Bank and Customer, including, without limitation, through any electronic channel made available by the Bank (“Confirmation

Advice”) to the Customer containing the particulars of the Time Deposit and any additional terms pertaining thereto.

3. Early Redemption Prior to Stated Maturity / Fees and Charges.

(i) Subject to applicable law, a Time Deposit may not be redeemed, cancelled or withdrawn (each, a “withdrawal”) prior to its stated maturity

without the express prior consent of the Bank. The Customer understands and agrees that any such withdrawal consented to by the Bank

may, at the Bank’s discretion, be subject to withdrawal fees, charges and/or adjustment of interest (or principal, if permitted by law) as may

be determined by the Bank, as may be disclosed by the Bank to the Customer on or before the acceptance of this Agreement or at any

time thereafter subject to the Bank’s right of variation under this Agreement

(ii) The Bank may impose, charge, and adjust fees associated with any Time Deposit, including but not limited to, the applicable maintenance

fees, as may be disclosed by the Bank to the Customer on or before the acceptance of this Agreement or at any time thereafter subject to

the Bank’s right of variation under this Agreement. The Customer will pay all fees and charges applicable to any Time Deposit. All

payments to the Bank shall be in full, without set-off or counterclaim and free of any deduction or withholdings related to any tax or other

claim.

4. Interest/Roll-over/Payments. Calculation of interest, payment of interest and procedures relating to roll-over shall be as per the

Bank’s practice for each jurisdiction, as may be disclosed by the Bank to the Customer on or before the acceptance of this Agreement or at any

time thereafter subject to the Bank’s right of variation under this Agreement. Upon a Time Deposit maturity or permitted withdrawal, payments

will be made by the Bank to the Customer as per the settlement instructions, if applicable, or by any other means acceptable to the Bank.

5. Disclosure. The Customer authorizes the Bank to retain an agent to perform data processing, collection and other services that the Bank

considers necessary or desirable and to modify or terminate the Bank’s arrangements with the Bank’s agents at any time. The Customer

hereby consents to the disclosure of any information relating to the Customer or Time Deposits to (i) any bank examiner(s), the Bank's

head-office and other branch offices, its affiliates and associates, assignees or prospective assignees, and their employees (ii) the Bank's

auditors, counsel and other professional advisers (iii) the Bank’s sub-contractors or agents or any other third party, and their employees, in

each case, as the Bank may, in good faith, consider necessary or desirable including, without limitation:

(i) for the collation, synthesis, processing and management of data and the storing of data relating to any accounts or deposits held or

transactions undertaken by the Customer;

(ii) for the reporting of transaction details and other customer related information for global risk management, management information

system and regulatory reporting and monitoring;

(iii) for the monitoring of the Bank's global credit exposure to its clients and others;

(iv) for effecting any instruction by the Customer or any transaction for the benefit of the Customer, or effecting any disclosure which may be

required of the Bank by any such party;

Page 5 of 13

(v) enhanced operational, technology, finance and other support function efficiencies, or

(vi) as may be required by law, regulations or legal process.

The Bank shall take such measures as it considers reasonable to preserve the confidentiality of such information or documents.

6. Liability.

(i) To the maximum extent permitted by applicable law, the Bank shall not have any liability for any damage, loss, expense or liability of any

nature which may be suffered or incurred except to the extent of direct losses or expenses attributable to the Bank’s gross

negligence or wilful misconduct. The Bank shall not, in any event, be liable for indirect, special, consequential or punitive loss or damage

of any kind (including, but not limited to lost profits), whether or not foreseeable, even if the Bank has been advised of the likelihood of

such loss or damage, and regardless of whether the claim for loss or damage is made in negligence, gross negligence, for breach of

contract or otherwise; provided, however, that the foregoing shall not apply to the extent such loss or damage is caused by fraud on the

part of the Bank.

(ii) The Customer agrees to fully indemnify the Bank and hold the Bank harmless from and against any and all claims, damages, demands,

liabilities, losses, costs and expenses which may be incurred or suffered by the Bank in relation to the Bank acting pursuant to Instructions

issued in the name of the Customer and/or its authorized persons.

7. Taxes. The Customer will pay or reimburse the Bank for any taxes, levies, imposts, deductions, charges, stamp, transaction and other duties

and withholdings (together with any related interest, penalties, fines, and expenses) in connection with the Time Deposits except if imposed on

the overall net income of the Bank. The Customer will provide the Bank such documentation, declarations, certifications and information as the

Bank may require in connection with taxation, warrants that such information is true and correct in every respect and shall notify the Bank

immediately if any information requires updating or correction.

8. Notice. Subject to giving not less than 30 days notice in writing or an electronic notice through electronic channel, the Bank may change

these terms or impose other restrictions, as the Bank deems necessary in the course of its business, at any time.

9. Severability. The terms herein may vary applicable law or regulation to the maximum extent permitted under any such law or regulation.

Any provision of applicable law or regulation that cannot be varied shall supersede any conflicting term of this Agreement without invalidating

the remaining terms. If any provision herein shall be held to be illegal or unenforceable, the validity of the remaining portions herein shall not be

affected.

10. Miscellaneous.

(i) The Customer acknowledges that Time Deposits held in a branch of the Bank located outside of the U.S. are not insured by the Federal

Deposit Insurance Corporation; are subject to cross-border risks and may enjoy a lesser preference, as compared to deposits held in the

U.S. in the event the Bank should be liquidated, insolvent or placed into receivership or other proceeding for the benefit of creditors. A

Time Deposit held with the Bank is payable exclusively at the branch at which such deposit is held; however, payment may be suspended

from time to time in order to comply with any law, regulation, governmental decree or similar order for the time being affecting the Bank.

(ii) This Agreement shall be governed and interpreted under the laws of the jurisdiction where the Time Deposit is placed.

(iii) Any claim in connection with Time Deposits which are the subject of this Agreement, unless a shorter period of time is expressly provided,

must be brought against the Bank within two (2) years of the incurrence of the cause of action, except as prohibited by applicable law.

(iv) Where the Customer opens or maintains a current or demand deposit account with the Bank, and pursuant to the same agrees to terms

and conditions governing such accounts (“Account Terms”), such Account Terms shall be incorporated by reference in this Agreement

provided that to the extent there is a conflict between the Account Terms and this Agreement, the terms of this Agreement shall prevail.

(v) The Customer shall not transfer any of its rights and obligations in any Time Deposit, or create any form of security interest over such

rights and obligations, without the prior written consent of the Bank.

11. Expansion of Agreement To Other Jurisdictions. The Customer agrees to apply the terms of this Agreement to additional

jurisdiction(s) not covered by this Agreement (at the date an Instruction is sent by the Customer in relation to placing a Time Deposit in such

jurisdiction(s)), and the Bank shall provide the applicable jurisdiction specific terms (if any) for such jurisdiction(s) which the Customer will be

deemed to have accepted by the issuance of any Instruction with regard to such jurisdiction(s).

12. Use Of Electronic Channel For Giving Instructions And Other Actions. The Bank may, at its discretion, and subject to

completion of applicable documentation by the Customer, allow the Customer an option to submit certain requests/Instructions through an

electronic channel provided by the Bank. Where such electronic channel is used, the Customer agrees that all actions taken and Instructions

provided by the Customer shall bind the Customer and, as applicable, be subject to acceptance by the Bank (and the Bank may confirm such

acceptance electronically or by other means acceptable to it).

Page 6 of 13

APPENDIX 2 | JURISDICTIONAL SPECIFIC TERMS

The following are certain jurisdictional specific terms (forming part of the Agreement) which shall apply based on location of the Time Deposit (for

example, terms under the section for Australia shall apply to Time Deposits in Australia). If there is any conflict between these jurisdictional specific

terms and any other terms and conditions of this Agreement, the jurisdictional specific terms shall prevail.

A. Australia

1. The Bank advises the Customer, and the Customer hereby acknowledges, that Time Deposits on the books of JPMorgan Chase Bank,

N.A., Sydney, Australia (the “Australian Deposits”) are not covered by Division 2 of Part II of the Banking Act of the Commonwealth of

Australia. This means that the Australian Deposits do not have the benefit of the depositor protection provisions of the Banking Act.

2. The Customer acknowledges and agrees that the Bank (or its agents) may, in accordance with the Bank’s Australian Privacy Policy (which

can be accessed at https://www.jpmorgan.com/pages/privacy) collect ‘personal information’ (as that term is defined in the Privacy Act

1988) from the Customer (or any person connected with the Customer), use such personal information and disclose it to affiliated or

unaffiliated third parties, including recipients located in offshore jurisdictions, for the purpose of providing and administering the Accounts

and Services in accordance with the Account Terms and applicable Account Documentation and Services, and to the extent required or

permitted by applicable laws and regulations.

3. The Customer represents and warrants to the Bank that:

(a) it will comply with the collection notice requirements stipulated in the Privacy Act 1988;

(b) before the Customer collects and discloses to the Bank any personal information, it will obtain the necessary form of consent of each

individual the subject of the personal information to the Bank’s (or its agents’) collection, use and disclosure of their personal information

for the purpose of enabling the Bank to handle the personal information as contemplated under the Account Terms, Service Terms,

Account Documentation or in the Services; and

(c) before the Customer it obtains such consent from an individual, it will inform the individual that:

i. the Bank’s Australian Privacy Policy lists the countries where recipients to which the Bank is likely to disclose their personal

information may be located;

ii. by providing consent to the disclosure of their personal information outside Australia, the individual acknowledges that the Bank

is not required to ensure that overseas recipients handle their personal information in compliance with Australian privacy law

(but that where practicable in the circumstances, the Bank will take reasonable steps to ensure that overseas recipients use and

disclose such personal information in a manner consistent with the Bank's Australian Privacy Policy);

iii. such overseas recipients are subject to a foreign law that could, in certain circumstances, compel the disclosure of their

personal information to a third party such as an overseas authority; and

iv. the individual may complain about a breach of the Australian Privacy Principles made under the Privacy Act 1988 in the manner

set out in the Bank’s Australian Privacy Policy.

4. The Customer will notify the Bank as soon as practicable after it becomes aware of any complaint relating to personal information it has

disclosed to the Bank, and will cooperate with the Bank in the event of a suspected or actual breach of the Privacy Act 1988 or of an

investigation of the Bank or the Customer by the Australian Privacy Commissioner.

5. The Customer agrees that this agreement is not wholly or predominantly for personal, domestic or household use or consumption, or

otherwise a consumer contract within the meaning of that term under the Australian Securities and Investments Commission Act 2001

(Cth).

B. China

1. The Customer will supply the Bank with up-to-date copies of the Customer’s Articles of Association and Business License (and joint

venture agreement and approval certificate (if any) and all other documents required by the relevant regulators) and a copy of each

amendment or renewal thereof together with such supporting documentation (including any applicable governmental approval)

evidencing such amendment or renewal. In addition, the Customer will deliver to the Bank copies of all licenses, approvals and

registration certificates together with all amendments or renewals thereof, as soon as they have been made or issued.

2. Unless otherwise agreed between the Bank and the Customer, the Customer agrees that if Time Deposit is placed without any settlement

account opened in the same currency with the Bank branch where the Time Deposit is placed, the Customer shall provide to the Bank

branch its basic account number and the full name, address and bank code of the basic account bank in China, and notwithstanding

Clause 4 of Appendix 1, the Time Deposit fund will be remitted back to its basic account upon maturity or permitted withdrawal.

3. The Customer agrees to abide by and comply with all laws, rules and regulations (whether or not having the force of law including without

limitation rules from time to time made by the People’s Bank of China and all determinations made thereunder) from time to time applying

or relating to the Bank’s electronic banking platform, where applicable, any or all of the accounts and/or deposits the Customer may place

with or through the Bank. The Bank has the right, without prior notice to the Customer (or upon notice if a prior notice is required by law),

to do such acts, deeds and things and adopt such practices as the Bank may in its absolute discretion consider necessary or appropriate

to ensure due compliance with or implementation of any or all of such laws, rules, regulations and determinations, notwithstanding any

contrary provisions of this Agreement. The Customer further agrees to abide by and comply with such practices(s) as the Bank may from

time to time in its absolute discretion adopt in connection with such compliance or implementation.

4. If a maturity date falls on a day which is not a banking day at the Bank branch where the Time Deposit is placed, it shall be brought forward

to the banking day immediately preceding such maturity date.

Page 7 of 13

5. Any Chinese version of the Time Deposit Agreement shall be for reference only. In the event of discrepancy or inconsistency between this

English version and any Chinese version, the English version shall prevail.

6. The Customer undertakes to be bound by the Agreement, the terms of which have been read and accepted by the Customer. IN

PARTICULAR, THE CUSTOMER HAS READ, UNDERSTOOD, AND AGREED TO CLAUSE 6 OF THIS AGREEMENT.

7. The table of “List of Authorized Persons authorized to issue, as applicable, written, telephone, electronic or facsimile Instructions” and the

table of “List of Authorized Persons authorized to confirm written, telephone, electronic or facsimile Instructions” shall be deleted and

replaced by the following:

“Authorization:

The list of Signatories authorized to issue, as applicable, written, telephone or facsimile Instructions and the list of Signatories authorized

to confirm written, telephone or facsimile Instructions are set out in the Business Signature Card provided by the Bank to the Customer

separately, which is incorporated herein and made a part of this Agreement by reference.”

8. The following sentence is added immediately after “at the Bank’s discretion” in Clause 3(i) of the General Terms and Conditions:

“(and to the extent permitted by laws and regulations)”

9. The following sentences replace Clause 5 of the Time Deposit Agreement APAC in Appendix 1 General Terms and Conditions:

The Customer authorizes the Bank to retain an agent to perform data processing, collection and other services that the Bank considers

necessary or desirable and to modify or terminate the Bank’s arrangements with the Bank’s agents at any time. The Customer hereby

consents to the disclosure of any information relating to the Customer or Time Deposits, including all personal data of any individuals

disclosed by the Customer in connection with Time Deposits (the "Personal Data"), to (i) any bank examiner(s), the Bank's head-office and

other branch offices, its affiliates and associates, assignees or prospective assignees, and their employees (ii) the Bank's auditors,

counsel and other professional advisers (iii) the Bank’s sub-contractors or agents or any other third party, and their employees, in each

case, as the Bank may, in good faith, consider necessary or desirable. Insofar as the Personal Data is provided by the Customer, the

Customer represents and warrants that it has obtained sufficient informed consent from the relevant individuals and will promptly provide

the Bank with such consent as and when requested by the Bank.

C. Hong Kong

1. The Customer acknowledges and agrees that if an account is opened as a term/time deposit where the current term agreed to by the

Customer (at the most recent time it was negotiated) exceeds 5 years (and such other cases, as prescribed by the Deposit Protection

Scheme Ordinance of Hong Kong from time to time), its account is not a protected deposit and is not protected by the Deposit Protection

Scheme in Hong Kong

2. The Customer acknowledges that the Customer has received the notice and understands that in the case mentioned above, its account is

not a protected deposit and is not protected by the Deposit Protection Scheme in Hong Kong.

3. The Customer acknowledges that a deposit account opened or used as cash collateral (to secure any obligations of the Customer and/or

any other parties towards the Bank) does qualify for protection by the Deposit Protection Scheme in Hong Kong.

4. Without limiting any other right the Bank may have, the Customer agrees that the Bank may disclose customer information and data in and

outside Hong Kong to the persons listed in the Notice relating to Personal Data (Privacy) Ordinance or such other notice or document that

the Bank may provide to the Customer from time to time (the “Notice”) for the purposes of marketing the services of the Bank and/or other

parties.

5. Without limiting any other right the Bank may have, the Customer consents to the use, transfer and disclosure of data relating to it in the

manner described in the Notice.

6. The Customer agrees and undertakes to provide such information as requested by the Bank which the Bank may require in order for the

Bank to make disclosure under any law or regulation binding on the Bank or pursuant to any applicable direction, request or requirement

(whether or not having the force of law) of any competent government or authority.

7. The “Bank” shall refer to JP Morgan Chase Bank, N.A.

D. India

1. The Bank shall issue cheques, drafts, bills of exchange, notes and other financial instruments to the Customer for amounts of Rs. 50,000

and above only by way of debit to the Customer’s accounts or against cheques, and not against cash.

2. Any deposit or placement shall be the liability of and shall be payable and can be collected only at a branch of the Bank in India, and only

in the national currency of India or subject to any Governmental regulations, in the currency of deposit. It is expressly, understood and

agreed by the Customer that such deposit or placement shall not be payable at, or collectible against the assets of the head office of the

Bank or any other office or branch of the Bank outside India.

Page 8 of 13

3. This Agreement is subject to rules and regulations of the RBI or any other regulatory authority, and any directions issued by, and any

modifications that may be made to such rules, regulations and directions from time to time.

Time Deposits shall mean a deposit received by the Bank for a fixed period and which can be withdrawn only after the expiry of the said

fixed period. The nature of deposits can be, for example, recurring, cumulative, re-investing.

4. Maturity Date

(a) If the maturity date falls on a day which is not a banking day, it shall be postponed to the next banking day unless it would thereby fall

into the next calendar month in which case it shall be the banking day immediately preceding the maturity date.

5. Renewal

(a) In the case of Indian Rupee deposits, all deposits placed with the Bank in open accounts will be renewed only on Instructions by the

Customer to the Bank in writing or any other means acceptable to the Bank.

(b) In the absence of any specific instruction from the Customer as mentioned in (a) above, on the maturity date, the Bank shall credit,

the amount payable on maturity of the deposit, to the Account of the Customer maintained with the Bank. If the Customer does not

maintain any Account with the Bank as on the maturity date, the Bank shall send the amount payable on maturity of the deposit by

means of a cheque made payable to the Customer or any other means acceptable to the Bank.

(c) In the case of Indian Rupee deposits, if any Customer requests withdrawal of a deposit before maturity date, terms of such payment

would be determined by the Bank at its absolute discretion and such determination will be binding on the Customer. The above is

subject to change from time to time as determined by the Bank at its sole discretion.

6. Payment of Interest

(a) Interest on Time Deposits will be effected as per the scheme, it was issued under. If the Time Deposit is of a recurring/cumulative

nature, interest will be paid on maturity of the deposit, along with the principal sum.

(b) If the Time Deposit is withdrawn before its maturity, interest will be paid as per the interest rate applicable for the period it was

maintained with the Bank less penalty (as determined by the Bank) for a premature withdrawal which shall be communicated to the

Customer at the time of placing the Time Deposit.

7. Deposit Insurance

Deposit protection coverage provided under the Deposit Insurance and Credit Guarantee Corporation Act, 1961 as amended from time to

time (the “Act”) shall, subject to the eligibility of Account(s) under the provisions of the Act, apply to Account(s) held with JPMorgan Chase

Bank, N.A., Mumbai Branch.

E. Indonesia

1. Where a foreign currency account is closed, the Bank is entitled to convert the balance of the account into local currency at the rate of

exchange effective on the day of the account closure so that the Customer will be credited with or paid the rupiah equivalent of the credit

balance in the relevant foreign currency. The Customer agrees that account liquidations such as this shall fully discharge the Bank.

2. The termination of this Agreement shall not require a court pronouncement thereto and the Bank and the Customer for this purpose each

waive the provision in article 1266 Indonesian Civil Code, 2nd and 3rd sentence.

3. For the purpose of settling any affairs with the Bank, the Customer chooses general and permanent domicile at the Registrar’s office of the

District Court in South Jakarta in Jakarta (Kantor Pengadilan Negeri Jakarta Selatan di Jakarta), however, this shall not prejudice to the

Bank’s rights to proceed against the Customer under these terms and conditions to any other courts of justice in the Republic of Indonesia.

4. The Customer is prohibited from fulfilling their obligation to the Bank by set off or in any other way calculating amounts due against the

amounts of the claim(s) (if any) from the Customer or any third party to the Bank. The Customer hereby waives the provisions of Articles

1425 and 1426 of the Indonesian Civil Code or other prevailing provisions authorizing any such debt set off.

5. Time Deposit(s) held in an Indonesia branch of the Bank is insured as per the coverage provided by the "Lembaga Penjamin Simpanan

(LPS)" or Indonesia Deposit Insurance Corporation.

F. Japan

1. The Customer may place Time Deposits if any of Item (1), Item (2)(a) through (g), Item (3)(a) through (e) or Item (4)(a) through (e) of

Clause 6(a) of these Japan specific terms shall not apply to such Customer. If any of Item (1), Item (2)(a) through (g), Item (3)(a) through

(e) or Item (4)(a) through (e) of Clause 6(a) of these Japan specific terms applies to the Customer, the Bank may reject Customer's the

Instruction to place Time Deposits.

2. A time deposit in Japan shall only become effective or be established on the day the Bank actually receives full amount of the funds from

the Customer for the placement of such time deposit. Notwithstanding the above, a time deposit shall be invalid unless procedures

Page 9 of 13

required by the Law for Prevention of Transfer of Criminal Proceeds and Financial Instruments and Exchange Act (in case of currencies

other than yen) are complied with, even if the Bank has already received funds from the Customer. In such an event, the Customer shall

be responsible for any damages, losses, expenses incurred by the Bank.

3. The following sentences shall be added at the end of Clause 4 Interest / Roll-over / Payments of the General Terms and Conditions:

‘The Bank shall be entitled to choose which bank will act as an intermediary to make the Time Deposit payment. The Bank shall not be

responsible after sending payment Instructions to the account(s) listed in Appendix 3 hereto. The Customer shall bear any and all

remittance fees.’

4. The Customer hereby acknowledges that its Time Deposit(s) placed with the Bank in Japan are not covered by any deposit

protection/insurance scheme.

5. The Bank may issue a certificate(s) for Time Deposit(s) upon receipt of the relevant funds. In such a case where the Bank issues a

certificate, the Customer is required to submit the certificate with a registered stamp and seal (or signature) in the receipt column on the

back of the certificate when the Time Deposit is closed and payments shall be made to the Customer’s account as per the terms herein, or

renewed with any applicable additional conditions.

6. (a) If the Customer constitutes any of the categories in any of the following items, the Bank may, after serving the notice to the customer,

terminate the Time Deposits and the Time Deposit Agreement:

1) In case the representations and covenants made by the Customer at the time of application for the opening of the Time Deposits

have proved false.

2) In case that the Customer has become known to constitute any of the following:

a) An organized crime group (“Boryokudan”);

b) A member of a Boryokudan (“Boryokudanin”);

c) A person for whom five (5) years have not passed since ceasing to be a Boryokudanin;

d) A sub-member of a Boryokudan (“Boryokudan jyunkoseiin”);

e) A corporation related to a Boryokudan (“Boryokudan kankei kigyou”);

f) A racketeer attempting to extort money from a company by threatening to cause trouble at the general stockholders’ meeting

(“Soukaiya”) or advocating social causes (“Shakai undou nado hyoubou goro”), or a special intelligence organized crime group

(“Tokusyu chinou boryoku syudan”), etc.; or

g) A person or organisation equivalent to any of the above howsoever described (items (1) through (7), collectively, “Boryokudan,

Etc.”).

3) In case that the Customer has become know to have any of the following:

a) Relationships by which its management is considered to be controlled by Boryokudan, Etc.;

b) Relationships by which Boryokudan, Etc. are considered to be involved substantially in its management;

c) Relationships by which it is considered to unlawfully utilize Boryokudan, Etc. for the purpose of securing unjust advantage for

itself or any third party or of causing damage to any third party;

d) Relationships by which it is considered to offer funds or provide benefits to Boryokudan, Etc.; or

e) Officers or persons involved substantially in its management having socially condemnable relationships with Boryokudan, Etc.

4) In case that the Customer has, either in person or engaging a third party, engaged in any activity that corresponds to any of the

following :

a) Claims made with forceful behavior and acts of violence;

b) Unjust claims exceeding legal responsibilities;

c) Use of threatening action or statements, or violent acts and behaviors in connection with any transaction between the parties;

d) Acts and behaviors which may damage the credit or obstruct the business of the Bank by spreading false rumors or the use of

fraudulent means or by force; or

e) Other acts and behavior equivalent to the above howsoever described.

(b) The Customer agrees to indemnify and hold the Bank, and its agents, employees, officers and directors, harmless from and against

any and all claims, damages, demands, judgments, liabilities, losses, costs and expenses (including attorneys’ fees) resulting

directly or indirectly from termination of the Time Deposits and the Time Deposit Agreement in accordance with Clause 6(a) of these

Japan specific terms.

7. The Customer acknowledges that (i) Time Deposits are not covered by any deposit protection/insurance scheme in Japan; (ii) in the case

of bankruptcy of JPMorgan Chase Bank, N.A., even if there is a withdrawal of the deposit to the Customer, there may be cases where the

Customer may not be able to withdraw the deposit promptly; and (iii) the ultimate source of JPMorgan Chase Bank, N.A., Tokyo branch’s

solvency is dependent upon solvency of entire JPMorgan Chase Bank, N.A., and the governmental authority outside Japan having

jurisdiction over JPMorgan Chase Bank, N.A., supervises the soundness of entire JPMorgan Chase Bank, N.A.

Page 10 of 13

G. Labuan

1. The Customer declares and certifies that the information given in or pursuant to this Agreement is true and correct and that it will advise

J.P. Morgan Chase Bank N.A., Labuan (the “Bank” in the context of Time Deposits in Labuan) of any changes promptly. The Customer

further declares and certifies for the purposes of the Anti-Money Laundering and Anti-Terrorism Financing Act 2001 that it is not commonly

known by any other name than that given on this Agreement, or that if it is known by one or more other names, that it has fully disclosed

such name or names to the Bank in writing. The Customer will provide the Bank with such documentation, declarations, certifications and

information as the Bank may require in connection with the provision of any service to the Customer or the carrying out of any transaction

for the Customer’s benefit, and warrants that all such information shall be true and accurate in every respect.

2. For the avoidance of doubt, the Customer hereby irrevocably authorizes the Bank to disclose information concerning the Customer and/or

any of the Customer’s accounts or transactions to the Central Credit Reference Information System, Bank Negara Malaysia (“BNM”), the

Labuan Financial Services Authority (“LFSA”), the Controller of Foreign Exchange, the competent authority under the Anti-Money

Laundering and Anti-Terrorism Financing Act 2001, any court, tribunal or other authority or body having authority or jurisdiction over the

Bank and/or any other body or authority established by the foregoing or approved by the Association of Labuan Banks, Malaysia. The

Customer hereby expressly confirms that the Bank shall be under no liability whatsoever in respect of any such disclosure whether before,

on or after the establishment of account(s)/Time Deposits with the Bank.

3. The Customer acknowledges that any moneys standing to the credit of an Account that has not been operated in whatever manner by the

Customer for a period of not less than seven (7) years will constitute “unclaimed moneys” for the purposes of the Unclaimed Moneys Act

1965, and shall be dealt with by the Bank in accordance with the Unclaimed Moneys Act 1965. In addition, where the Bank has transferred

balances into an unclaimed moneys account, the Bank shall deal with such unclaimed moneys in accordance with the provisions of the

Unclaimed Moneys Act 1965.

4. The Customer acknowledges and agrees that the Customer’s foreign currency deposits are subject to the prevailing Malaysian Exchange

Control regulations and the Bank may convert the foreign currency deposits into local currency where the Bank deems necessary to

comply with such regulations, and that this Agreement and the Time Deposits shall be subject to all applicable rules, regulations, policies,

circulars and guidelines as may be issued by the Ministry of Finance, the Controller of Foreign Exchange, BNM, LFSA and/or any other

governmental, statutory or other authority, body or department from time to time.

5. Information Sharing Options (Customer to select as appropriate)

The Customer does not agree to the Bank sharing any information relating to the Customer with related companies of the Bank

for the purposes of cross-selling products or services or for marketing or promotional purposes (it being understood that if the

Customer does not select this option, the Customer shall be deemed for all intents and purposes to have agreed to such sharing

of information). The Customer hereby confirms that no further permission or consent from the Customer is/are necessary or

required in relation thereto and this shall constitute the consent required pursuant to Section 178(1)(e) of the Labuan Financial

Services and Securities Act (2010) and/or pursuant to any other applicable law, regulation or statute, and any other contractual

consent for such disclosure of information.

The Customer expressly authorizes the Bank to share information relating to the Customer with third parties which are not

related companies of the Bank for the purposes of cross-selling products or services or for marketing and promotional

purposes. The Customer hereby confirms that no further permission or consent from the Customer is/are necessary or required

in relation thereto and this shall constitute the consent required pursuant to Section 178(1)(e) of the Labuan Financial Services

and Securities Act (2010) and/or pursuant to any other applicable law, regulation or statute, and any other contractual consent

for such disclosure of information.

6. The Customer confirms, represents, warrants, covenants and undertakes that the funds to be placed by it with the Bank are not and will

not at any time derive from or be export proceeds or foreign currency receivables. The Customer will, at all times in its dealings with the

Bank and in respect of the Account, Time Deposits and its utilization of the services provided by the Bank, (i) fully comply with all prevailing

Malaysian Exchange Control regulations and all applicable laws, as well as all rules, policies, circulars and guidelines as may be issued by

the Ministry of Finance, the Controller of Foreign Exchange, BNM and/or any other governmental, statutory or other authority, body or

department from time to time and (ii) obtain and maintain all such approvals and effect all such registrations as may be required

thereunder. The Customer undertakes to (i) update the Bank of the Customer’s status prior to each and every Time Deposit placement

and/or placement in the Account hereafter, and (ii) whenever BNM’s and/or any other authority’s’ written approval or registration with BNM

and/or any other authority is at any time required for any placement or dealings, provide the Bank with a true and complete copy of such

written approval or confirmation of registration (as the case may be).

7. The Customer agrees to indemnify and hold the Bank and its agents, employees, officers and directors harmless from and against any

and all claims, damages, demands, judgments, liabilities, losses, costs and expenses (including attorney’s fees) resulting directly or

indirectly from any failure by the Customer to perform or observe any of the Customer’s obligations under these terms or any breach by

the Customer of any of its covenants or undertakings or any warranty, representation or confirmation of the Customer being untrue,

incorrect, misleading or inaccurate in any manner whatsoever.

H. Malaysia

1. The Customer declares and certifies that the information given in or pursuant to this Agreement is true and correct and that it will advise

J.P. Morgan Chase Bank Berhad (the “Bank” in the context of time deposits in Malaysia) of any changes promptly. The Customer further

declares and certifies for the purposes of the Anti-Money Laundering and Anti-Terrorism Financing Act 2001 that it is not commonly known

by any other name than that given on this Agreement, or that if it is known by one or more other names, that it has fully disclosed such

name or names to the Bank in writing. The Customer will provide the Bank with such documentation, declarations, certifications and

Page 11 of 13

information as the Bank may require in connection with the provision of any Service to the Customer or the carrying out of any transaction

for the Customer’s benefit, and warrants that all such information shall be true and accurate in every respect.

2. For the avoidance of doubt, the Customer hereby irrevocably authorizes the Bank to disclose information concerning the Customer and/or

any of the Customer’s accounts or transactions to the Central Credit Reference Information System, the Dishonoured Cheques

Information System (DCHEQS), Bank Negara Malaysia (“BNM”), the Controller of Foreign Exchange, the competent authority under the

Anti-Money Laundering and Anti-Terrorism Financing Act 2001, or any other authority or body having authority or jurisdiction over the

Bank or any other body or authority established by the foregoing or approved by the Association of Banks in Malaysia. The Customer

hereby expressly confirms that the Bank shall be under no liability whatsoever in respect of any such disclosure whether before, on or after

the establishment of account(s)/time deposits with the Bank.

3. The Customer acknowledges that any moneys standing to the credit of an Account that has not been operated in whatever manner by the

Customer for a period of not less than seven (7) years will constitute “unclaimed moneys” for the purposes of the Unclaimed Moneys Act

1965, and shall be dealt with by the Bank in accordance with the Unclaimed Moneys Act 1965. In addition, where the Bank has transferred

balances into an unclaimed moneys account, the Bank shall deal with such unclaimed moneys in accordance with the provisions of the

Unclaimed Moneys Act 1965.

4. The Customer acknowledges and agrees that the Customer’s foreign currency deposits are subject to the prevailing Malaysian Exchange

Control regulations and the Bank may convert the foreign currency deposits into local currency where the Bank deems necessary to

comply with such regulations.

5. The Customer acknowledges that it has been informed that the time deposits are insured by Perbadanan Insurans Deposit Malaysia and

it has received a copy of the brochure supplied by Perbadanan Insurans Deposit Malaysia.

6. Information Sharing Options (Customer to select as appropriate)

The Customer does not agree to the Bank sharing any information relating to the Customer with related companies of the Bank

for the purposes of cross-selling products or services or for marketing or promotional purposes (it being understood that if the

Customer does not select this option, the Customer shall be deemed for all intents and purposes to have agreed to such sharing

of information). The Customer hereby confirms that no further permission or consent from the Customer is/are necessary or

required in relation thereto and this shall constitute the consent required pursuant to Section 99(1)(a) of the Banking and

Financial Institutions Act (1989) and any other contractual consent for such disclosure of information.

The Customer expressly authorizes the Bank to share information relating to the Customer with third parties which are not

related companies of the Bank for the purposes of cross-selling products or services or for marketing and promotional

purposes. The Customer hereby confirms that no further permission or consent from the Customer is/are necessary or required

in relation thereto and this shall constitute the consent required pursuant to Section 99(1)(a) of the Banking and Financial

Institutions Act (1989) and any other contractual consent for such disclosure of information.

7. The Customer may lodge a complaint in respect of the Service in the manner set out in

http://www.jpmorganaccess.com.my/client_charter.html or in such other manner as the Bank may otherwise notify the Customer from

time to time. Subject to all relevant information having been provided to the Bank’s satisfaction, the Bank may conduct its investigations

accordingly.

I. New Zealand

1. JPMorgan Chase Bank, N.A. is the “Bank” in the context of Time Deposits in New Zealand.

2. JPMorgan Chase Bank, N.A. is a registered bank in New Zealand under the Reserve Bank of New Zealand Act 1989. In accordance with

that Act, the Bank provides a Key Information Summary and a General Disclosure Statement. The Bank will provide a copy of the Bank's

most recent Key Information Summary and most recent General Disclosure Statement at no charge immediately to any person requesting

a copy.

3. The Bank advises the Customer, and the Customer hereby acknowledges, that Time Deposits on the books of JPMorgan Chase Bank,

N.A., New Zealand branch do not have the benefit of any depositor protection in New Zealand.

4. In the course of a Customer’s dealings with the Bank, a Customer may disclose to the Bank, and the Bank may collect, personal

information that is subject to privacy regulation. The Bank will use that personal information for the purpose of providing its services to the

Customer. If, at any time, a Customer supplies the Bank with personal information about another person, that Customer must ensure that

the Customer is authorised to do so and the Customer must agree to inform that person who the Bank is, that the Bank may use and

disclose that personal information and that that person may gain access to it should the Bank hold that information. Each Customer

authorizes the Bank to disclose personal information to related companies, affiliates, and any agents or contractors who provide services

to the Bank in connection with the provision of the Time Deposits. Each Customer has a right to gain access to and correct any personal

information about the Customer that is held by the Bank.

5. To the extent that any supply made by the Bank under this Agreement is a taxable supply for the purposes of the New Zealand Goods and

Services Tax Act 1985, the fees payable in respect of that taxable supply (“original amount”) will be increased by the amount of goods and

services tax payable in respect of that taxable supply. Customer must pay the increased amount at the same time and in the same

manner as the original amount.

Page 12 of 13

J. The Philippines

The Customer, if a non-resident, acknowledges and agrees that deposits in a currency other than the Philippine Peso are payable solely from

the assets of the Philippine Branch of the Bank.

K. Singapore

Deposit Insurance Scheme

Singapore dollar deposits of non-bank depositors are insured by the Singapore Deposit Insurance Corporation for up to S$50,000 in aggregate

per depositor per Scheme member by law. Foreign currency deposits, dual currency investments, structured deposits and other investment

products are not insured. For more information, please refer to Singapore Deposit Insurance Corporation website at www.sdic.org.sg

L. Taiwan

1. The Customer hereby consents to the Bank’s collection, processing by computer and use of any and all personal data of any third party

and/or any employees, officers, directors and/or supervisors of the Customer provided or to be provided by the Customer to the Bank or

otherwise acquired by the Bank for the purposes of (i) handling the Bank’s transactions with the Customer; and/or (ii) such other purposes

as may be permitted by applicable laws and regulations. Moreover, the Customer warrants and represents that third party’s prior consent

has been obtained for the Bank’s processing by computer and use of any third party’s personal data for above purposes.

2. With respect to demand deposits in New Taiwan Dollar (“NTD”) and time deposits in NTD (collectively, the “NTD Deposits”), the Customer

acknowledges and agrees that (i) interest on the NTD Deposits will be calculated on the basis of a year of three hundred sixty five (365)

days, and (ii) if any interest payment date is not a day on which the Bank is generally open for business in the city of Taipei (“Taipei

Business Day”), the relevant interest will be paid on the day falling on Taipei Business Day immediately preceding such interest payment

date.

3. With respect to non negotiable time deposits in NTD, notwithstanding Clause 3 of the General Terms and Conditions, the customer may

early terminate without Bank consent, and, in the event of any early termination of such deposit, interest shall be adjusted to a rate which

is 80% of the prevailing time deposit prescribed by the Bank at the time of making such deposit.

4. The reference to “bank examiners” in Clause 5 of the Generals Terms and Conditions shall include all bank examiners and regulators with

regulatory authority over the Bank in any jurisdiction.

M. Vietnam

1. The Customer agrees that if required by law or by a competent State body, the Bank may investigate, freeze, withhold or make deductions

from deposits of the Customer.

2. The Bank may refuse to: (i) make payments with respect to or allow withdrawals from Time Deposits; or (ii) convert such amounts or

withdrawal proceeds into other currencies or remit those proceeds to non-residents or overseas, if this would result in a breach of

Vietnamese law.

3. In addition to the other methods stated in these terms by which these terms or the relevant rates, fees and time periods may be changed

from time to time, the Customer agrees that such changes will take effect from the date they are posted on the public notice board at the

bank's branch premises in Ho Chi Minh City. Any changes to these terms with respect to rates, fees and time periods with respect to time

deposits shall not alter the relevant terms of time deposits already accepted by the Bank.

4. The Customer confirms that the sources of any funds it wishes to place on Time Deposit with the Bank accord with the law and that those

funds may be retained by the Customer in the currency of the Time Deposit for the term of the Time Deposit without breach of the law.

Page 13 of 13

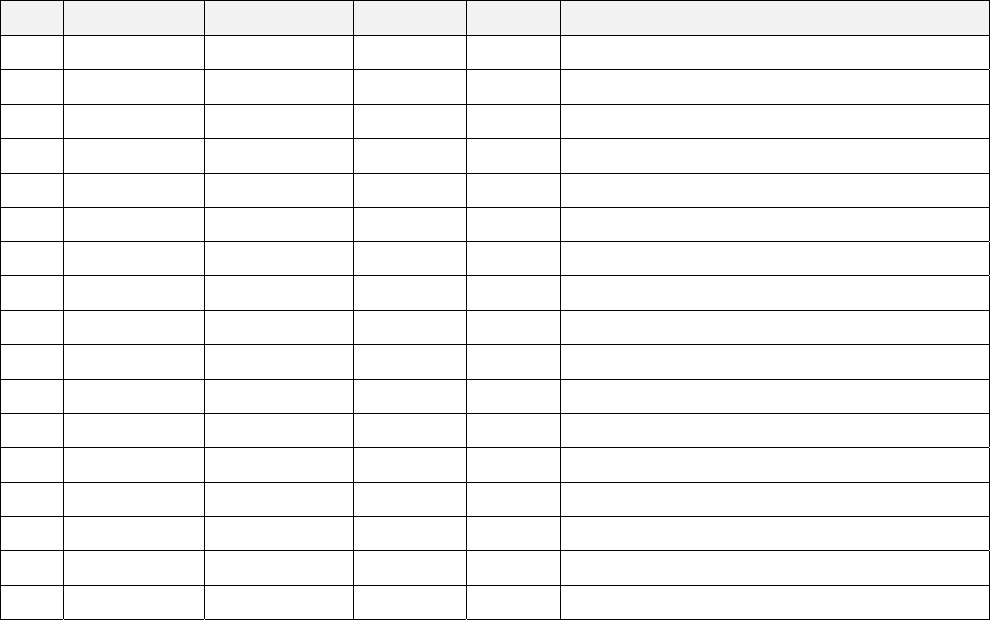

APPENDIX 3

In accordance with Clause 4 of Appendix 1, the Bank shall deposit Time Deposit funds into the following account(s):

S/N Account Owner Account Name

Account

Number

Currency Bank Name, Branch And Address