THE CITY OF NEW YORK

DEPARTMENT OF FINANCE

NOTICE OF RULEMAKING

Pursuant to the power vested in me as Acting Commissioner of Finance by sections 389(b) and

1043 of the New York City Charter and section 11-2112.1 of the Administrative Code of the City of

New York, I hereby promulgate the within amendments to the Rules Relating to the Real Property

Transfer Tax.

Joseph J. Lhota /S/

Acting Commissioner of Finance

2

Section 1. The last paragraph of the definition of "Controlling interest" in section 23-02 of Title 19 of

the Compilation of the Rules of the City of New York (Rules Relating to the Real Property Transfer

Tax), promulgated May, 1985, and last amended December 24, 1993, is amended to read as follows:

(For rules on consideration in the cases of transfers of controlling economic interests, see §23-02

"Consideration"(3). For rules relating to the impact of the exemption for transactions constituting a

mere change of identity or form of organization or ownership on transfers of controlling economic

interests, see §23-05(b)(8).)

§2. Examples (i) and (ii) of paragraph 5 of subdivision (d) of section 23-02 of such rules are amended

to read as follows:

Example (i): A, B, C and D are equal shareholders of X Corporation. X owns two buildings in

New York City. In 1990, X redeems A's shares in exchange for one of the

buildings, which is unencumbered and valued at $250,000 (Parcel 1). X's

other building is also unencumbered and valued at $750,000 (Parcel 2). X

has no other assets. The value of A's shares is $250,000. The

consideration for this transfer is the X stock owned by A. Therefore, the

amount of tax due is [$2,500] $3,562.50 ([1%] 1.425% X $250,000). If

the redemption occurs on or after June 9, 1994, the transfer would be

exempt as a mere change of identity or form of ownership or organization

to the extent the beneficial ownership of the real property remained the

same. Because A had a 25% beneficial ownership interest in Parcel 1

before the redemption and a 100% beneficial interest afterwards, the

transfer of Parcel 1 to A is exempt as a mere change of identity or form of

ownership or organization to the extent of 25%. Therefore only 75% of

the consideration or $187,500 ($250,000 x 75%) is subject to tax. The

tax is calculated by multiplying $187,500 by the applicable tax rate of

1.425% for a tax due of $2,671.88. See §23-05(b)(8) of these rules.

Example (ii): Assume the same facts as in example (i) above, except that, in 1990, instead of

redeeming A's shares in exchange for Parcel 1, X redeems the shares of B,

C, and D in exchange for Parcel 2. In this case, there are two taxable

transfers. The first is the transfer by X of [parcel]Parcel 2 to B, C, and D

in exchange for consideration consisting of the X stock owned by B, C

and D. The value of B, C, and D's shares is $750,000. The amount of tax

due is [$15,000] $19,687.50 ([2%] 2.625% X $750,000). If the

transaction occurred on or after June 9, 1994, the transfer of Parcel 2 to

B, C, and D in exchange for consideration consisting of the X stock

owned by B, C and D would be exempt as a mere change of identity or

form of ownership or organization to the extent the beneficial ownership

of the real property remained the same. Because B, C and D collectively

3

had a 75% beneficial ownership interest in Parcel 2 before the redemption

(25% each) and 100% afterwards, the distribution of Parcel 2 is exempt

from tax as a mere change of identity or form of ownership or

organization to the extent of 75%. Therefore, only 25% of the $750,000

consideration is subject to the tax. The tax due is calculated by

multiplying the taxable consideration of $187,500 (25% x $750,000) by

the applicable tax rate (2.625%) for a tax due of $4,921.88. See §23-

05(b)(8) of these rules. The second taxable transfer is the transfer by B,

C, and D of a 75% interest in Parcel 1 to A, the remaining shareholder.

Since this constitutes a transfer of a controlling economic interest in

Parcel 1, it is also taxable. The consideration for the transfer is a

proportionate part of Parcel 2 received by B, C, and D in exchange for

their X stock. B, C, and D's stock represented their 75% interest in all of

the assets of X prior to the redemption. Since Parcel 1 constituted 25% of

the assets of X, 25% of the consideration, or $187,500, must be

apportioned to B, C, and D's interest in Parcel 1. Thus, the tax due is

[$1,875] $2,671.88 ([1%] 1.425% X $187,500).

§3. The first paragraph of subdivision (e) of section 23-03 of such rules is amended to read as follows:

(e) Conveyances to corporations and partnerships. (Any reference made to realty or property

includes an economic interest in realty. For transfers on or after June 9, 1994, see section 23-05(b)(8)

of these rules for rules relating to the exemption for transactions constituting a mere change of identity

or form of ownership or organization.)

§4. Paragraph 1 of subdivision (e) of section 23-03 of such rules is amended by adding a new

subparagraph (iv) to read as follows:

(iv) On or after June 9, 1994, a conveyance of realty or an economic interest in realty to

a corporation is exempt as a mere change of identity or form of ownership or organization to

the extent the beneficial ownership of the real property remains the same, whether or not

shares of stock are issued in exchange. See §23-05(b)(8) of these rules.

§5. Paragraph 2 of subdivision (e) of section 23-03 of such rules is amended to read as follows:

(2) Corporate mergers. A transfer of real property in a statutory merger or consolidation

from a constituent corporation to the continuing or new corporation is not subject to tax.

However, the related transfer of shares of stock in a statutory merger or consolidation may be

subject to tax. For statutory mergers or consolidations occurring on or after June 9, 1994, the

related transfer of shares of stock is exempt from tax to the extent the beneficial ownership in the

4

real property or economic interest in real property remains the same. See §23-05(b)(8) of these

rules.

To illustrate:

Illustration (i) X Corporation owns real property in New York City with a fair market value

of $300,000 and has cash of $100,000. X is to be merged into Y

Corporation under Article 9 of the New York Business Corporation

Law. Prior to the merger, Y Corporation owns no real property in

New York City. Under the plan of merger, shareholders of X will

receive consideration valued at $400,000 consisting of 25% of the

stock of Y and[,] cash [and securities of Y (which stock does not

constitute a controlling economic interest in real property) valued at

$400,000]. [The transfer tax applies to this transaction.] The shares of

X exchanged or converted under the merger plan for the cash[,] and

stock [or securities] of Y represent a controlling economic interest in

real property and the transfer of such shares constitutes a taxable

transfer. The shareholders of X, therefore, are subject to tax as a

result of the statutory merger. If the transaction occurs prior to June

9, 1994, [The] the tax [will]would be measured by that portion of the

value of X's stock which is attributable to the real property

($300,000). A deed confirming title to property vested in the

surviving Y Corporation pursuant to section 906(b)(2) of the New

York Business Corporation Law will not be subject to the transfer

tax. If the transaction occurs on or after June 9, 1994, the tax on the

transfer of a controlling economic interest in X would be exempt to

the extent that the beneficial ownership in the real property remains

the same. In that event, because the X shareholders receive 25% of

the stock of Y and therefore retain a 25% beneficial interest in the

real property previously owned by X, the transaction would be

exempt to the extent of 25% and the tax would be imposed on 75%

of the value of the consideration attributable to the real property

(75% of $300,000 or $225,000). See §23-05(b)(8) of these rules.

Illustration (ii) X Corporation owns 100% of the stock of Y Corporation. Y owns real

property in New York City. Pursuant to the statutory merger

provisions of state law, Y is [to be] merged into X on January 1,

1995. Because X was the 100% beneficial owner of the property

before the transaction and remains the 100% beneficial owner of the

property afterwards, the transaction is exempt as a mere change of

identity or form of ownership or organization. [This transaction is

not subject to the transfer tax because there is no transfer of an

5

economic interest in real property.] Because the issuance of shares of

X in exchange for the Y shares would not affect X's beneficial interest

in Y's real property, the result would be the same regardless of

whether under applicable state law the Y shares are deemed

exchanged for X shares pursuant to the merger. [The vesting of Y's

assets in X, by operation of law, is also not subject to tax.]

Illustration (iii) X Corporation owns 100% of the stock of corporations Y and Z. Y owns real

property in New York City. Pursuant to the statutory merger

provisions of [the] state law, Y is to be merged into Z on January

1, 1995. Because X was the 100% beneficial owner of the

property before the transaction and remains the 100% beneficial

owner of the property afterwards, the transaction is exempt as a

mere change of identity or form of ownership or organization.

[This transaction is not subject to the transfer tax because there

is no transfer of an economic interest in real property.] Because

the issuance of Z shares in exchange for the Y shares would not

affect X's beneficial interest in Y's real property, the result would

be the same regardless of whether under applicable state law the

Y shares are deemed exchanged for Z shares pursuant to the

merger. [The vesting of Y's assets in Z, by operation of law, is

also not subject to tax.]

Illustration (iv) X Corporation owns unencumbered real property in New York City with a fair

market value of $300,000 and has cash of $150,000. Z Corporation

owns real property in New York City with a fair market value of

$450,000 and has no other assets. On January 1, 1995, X is merged

into Z pursuant to the statutory merger provisions of state law. The

shareholders of X Corporation will receive a 40% interest in Z and

the $150,000 cash. Because the exchange or conversion of 100% of

the X stock into shares of Z by the shareholders of X is effected

pursuant to the plan of merger approved by them, the exchanges by

the X shareholders are aggregated. Therefore, the merger results in a

taxable transfer of a controlling economic interest in the real property

owned by X. The tax will be measured by the consideration for that

portion of X's stock attributable to the real property ($300,000). The

transfer is exempt as a mere change of identity or form of ownership

or organization to the extent the beneficial ownership of the real

property remains the same. Because the former shareholders of X will

receive a 40% interest in Z Corporation, each receiving a

proportionate share of Z stock and cash, the beneficial ownership of

the property owned by X will remain the same to the extent of 40%

6

Therefore, $180,000 (60% x $300,000) of the consideration is

subject to tax. The tax due as a result of the merger is $2,565

(1.425% x $180,000). The transfer of the 40% interest in Z

Corporation to the former shareholders of X Corporation is not a

transfer of a controlling economic interest in Z Corporation and is not

subject to tax. A deed confirming title to property vested in Z

Corporation pursuant to the merger will not be subject to the transfer

tax.

§6. Paragraph 3 of subdivision (e) of section 23-03 of such Rules is amended to add a new

subparagraph (iv) and a new subparagraph (v) to read as follows:

(iv) On or after June 9, 1994, a conveyance of realty or an economic interest in realty to

a partnership, regardless of whether the partnership is an existing partnership or whether

interests in the partnership are issued in exchange for the realty or economic interest therein,

is exempt as a mere change of identity or form of ownership or organization to the extent the

beneficial ownership of the real property remains the same. See §23-05(b)(8) of these rules.

(v) The term "partnership" shall include a subchapter k limited liability company, as

defined in section 11-126 of the Administrative Code and the term "partner" or the term

"member" when used in relation to a limited liability company shall include a member of a

subchapter k limited liability company, unless the context requires otherwise.

§7. Paragraph 4 of subdivision (e) of section 23-03 of such Rules is amended to read as follows:

(4) Limited Partnership Mergers. A conveyance of real property or a transfer of a

controlling economic interest in real property in a merger or consolidation of two or more limited

partnerships from a constituent limited partnership to the continuing or new limited partnership is

not subject to tax if the merger or consolidation is pursuant to Article 8-A of the New York

Partnership Law or pursuant to comparable provisions of the partnership laws of another state,

territory, possession of the United States, the District of Columbia, or the Commonwealth of

Puerto Rico. However, the related transfer of partnership interests in the merger or consolidation

may be subject to tax.

To illustrate: A owns a 90% limited partnership interest in capital and profits in each of

limited partnerships X and Y. B is a general partner of both partnerships and owns the remaining

10% partnership interest in capital and profits in each limited partnership. X owns real property in

New York City. Pursuant to Article 8-A of the New York Partnership Law, X will merge into Y.

Following the merger A will have a 90% limited partnership interest in capital and profits in Y,

and B will be the general partner with a 10% partnership interest in capital and profits in Y. [The

7

related transfers of partnership interests in this transaction are not subject to tax because there is

no transfer of an economic interest in real property.] Because A and B were the 100% beneficial

owners of the property before the transaction and retain the same beneficial ownership interests in

the property afterwards, the transaction is exempt as a mere change of identity or form of

ownership or organization. The vesting of X's assets in Y, by operation of law, is also not subject

to tax.

§8. Subdivision (f) of section 23-03 of such rules is amended to read as follows:

(f) Multi-step conveyances. For transactions occurring prior to June 9, 1994, a series of transfers

pursuant to a plan to reorganize an ownership network of real property in New York City will be

treated as a direct transfer from the entity originally owning the real property or economic interest

therein to the entity ultimately owning the real property or economic interest therein, and the tax will

apply to the deemed direct transfer if the following factors are present:

(1) the series of transfers under the plan has a fixed beginning and end;

(2) the final transfer under the plan is completed within thirty days of the first transfer under

the plan;

(3) the plan will not result in a change in the respective percentage interests of the individuals

or entities which were the owners of the network at the beginning of the plan (for this purpose,

changes in the ownership of the owners themselves will not be taken into account, although such

changes may be subject to tax on their own facts); and

(4) the plan requires each interim holder of the real property or economic interest therein to

hold such interest solely to pass on to another individual or entity.

Under such a plan, each of the interim transfers will be presumed to be transfers to or from

conduits. The determination of whether a conveyance falls within this subdivision (e) will be made by

the Commissioner of Finance on a case by case basis after a review of all the documentation supporting

such treatment.

To illustrate: X Corporation owns unencumbered real property in New York City. X is owned

50% by A and 50% by B. Pursuant to a plan to be completed within 10

days, X is liquidated and its realty is distributed to A and B on January 1,

1990. The realty is then immediately conveyed to newly formed Y

Partnership, in which A and B each take a 50% partnership interest. The

two steps will be treated as a direct transfer of the realty from X to Y. The

consideration for the realty (the partnership interests received by A and B)

is presumed to be equal to the fair market value of the realty conveyed.

8

See §23-05(b)(8) of these rules for rules governing the exemption from tax of transactions on or after

June 9, 1994 qualifying as mere changes of identity or form of ownership or organization.

§9. Subparagraph (i) of paragraph 1 of subdivision (g) of section 23-03 of such rules is amended to

read as follows:

(i) A conveyance or transfer of real property or any economic interest therein in

complete or partial liquidation of a corporation, partnership, association, trust or other entity

prior to June 9, 1994, is subject to tax. (For liquidations on or after June 9, 1994, see

subparagraph (iii) of this paragraph.) The tax imposed shall be measured by

(A) the consideration for each such conveyance or transfer, or

(B) the value of the real property or economic interest therein, whichever is greater.

The consideration is the amount of any outstanding mortgage debt or other lien upon the

realty conveyed (or upon the underlying realty if an economic interest is being

transferred) and the amount of other liabilities assumed, [cancelled] canceled or forgiven

as a result of the liquidation or dissolution which are attributable to the realty or

economic interest therein. The value of the real property or economic interest therein is

its fair market value at the time of the conveyance or transfer, without reduction due to

any mortgage, lien or other encumbrance thereon.

§10. Paragraph 1 of subdivision (g) of section 23-03 of such rules is amended to add a new

subparagraph (iii) to read as follows:

(iii) For liquidations on or after June 9, 1994, the tax is measured by the greater of the

fair market value or the consideration as defined in subparagraph B of subparagraph (i) of this

paragraph. However, the liquidation may be wholly or partially exempt as a mere change of

identity or form of ownership or organization. See §23-05(b)(8) of these rules.

Illustration A: X Corporation owns real property in New York City with a fair market

value of $1,000,000, encumbered by a mortgage of $900,000. X

has no other assets. X is owned equally by two stockholders, A

and B. On January 1, 1995, X distributes all of its assets to its

stockholders in complete liquidation. A and B each receive a

50% interest in the property. Because A and B each had a 50%

beneficial ownership interest in the real property prior to the

liquidation and have retained the same interest after the

liquidation, the transfer is exempt from tax as a mere change of

identity or form of ownership or organization.

9

Illustration B: X Corporation is owned 60% by A and 40% by B. X owns an office

building in New York City with a value of $1,000,000 subject to

a mortgage of $700,000 and has cash of $500,000. X distributes

the real property, subject to the mortgage, and $180,000 of cash

to A and $320,000 of cash to B in complete liquidation on

January 1, 1995. The measure of tax for the distribution of the

real property is $1,000,000. However, because A had a 60%

interest in the real property prior to the distribution and a 100%

interest in the real property following the distribution, the

distribution is exempt from tax as a mere change of identity or

form of ownership or organization to the extent of 60%.

Therefore only 40% of the measure of tax, $400,000, is subject

to tax. The tax is $10,500 ($400,000 X .02625). The higher tax

rate applies because the total measure of tax for the distribution

exceeded $500,000.

§11. Paragraph 2 of subdivision (g) of section 23-03 of such rules is amended to read as follows:

(2) Economic interests.(i) When a liquidating entity transfers an economic interest in real

property, the tax on the transfer of that portion of the interest representing a given parcel is

measured by the greater of a proportionate share of the fair market value of the parcel or a

proportionate share of the amount of any mortgage, lien or other encumbrance upon the parcel.

This rule applies whether the total value of the economic interest in the entity owning the real

property is greater or less than the value of the realty. (For liquidations on or after June 9, 1994,

see subparagraph (ii) of this paragraph).

To illustrate:

Illustration [(i)]A: X Corporation transfers all of its assets to its stockholders in complete

liquidation. X owns 100% of the stock of Y Corporation. Y

owns real property in New York City with a fair market

value of $1,000,000. Y has other assets valued at $500,000.

Y's stock has a fair market value of $1,500,000. The

measure of the tax on the transfer of the stock in Y is the

fair market value of Y's real property ($1,000,000).

Illustration [(ii)]B: Assume the same facts as in illustration (i) above, except that Y has

liabilities of $850,000 and its stock has a fair market value

of $650,000. The measure of the tax on the transfer of the

stock in Y is $1,000,000.

10

Illustration [(iii)]C: Assume the same facts as in illustration (i) above, except that Y's real

property is encumbered by a mortgage [or] of $1,200,000

and the stock in Y has a fair market value of $300,000. The

measure of the tax on the transfer of the stock in Y is the

consideration for the real property ($1,200,000).

Illustration [(iv)]D: X Corporation owns real property in New York City (Parcel A) with a fair

market value of $1,000,000, encumbered by a mortgage of

$1,200,000. X also owns 100% of the stock in Y

Corporation. Y owns two parcels of realty in New York

City, Parcel B and Parcel C. Parcel B has a fair market value

of $1,000,000, and is encumbered by a mortgage of

$900,000. Parcel C has a fair market value of $500,000 and

is unencumbered. Y has other liabilities of $500,000. The

fair market value of the stock in Y is $100,000. X

liquidates. The tax on the transfer of Parcel A is measured

by consideration of $1,200,000. The tax on the transfer of

the stock in Y representing Parcel B is measured by the fair

market value of Parcel B ($1,000,000). The tax on the

transfer of the stock in Y representing Parcel C is measured

by the fair market value of parcel C ($500,000).

(ii) For liquidations on or after June 9, 1994, when a liquidating entity transfers an economic

interest in real property, the tax on the transfer of that portion of the interest representing a given

parcel is measured by the greater of a proportionate share of the fair market value of the parcel or

a proportionate share of the amount of any mortgage, lien or other encumbrance upon the parcel,

reduced to the extent the beneficial ownership of the real property remains the same after the

liquidation. See §23-05(b)8) of these rules.

Illustration A: The sole asset of X Corporation is 100% of the stock of Y Corporation. Y

owns unencumbered real property in New York City with a fair

market value of $1,000,000. On January 1, 1995, X Corporation

transfers all of its assets to its two stockholders, A and B, in complete

liquidation. A and B each own 50% of X Corporation stock and

receive equal shares of X's assets upon liquidation. The measure of

the tax on the distribution of the Y stock is the fair market value of

Y's real property ($1,000,000). However, because A and B each had

a 50% beneficial interest in the Y stock prior to the liquidation and

each retained that interest, the transfer of the stock is fully exempt

from tax as a mere change of identity or form of ownership or

organization.

11

Illustration B: Same facts as above except that X Corporation also has cash of $500,000 and

A receives this cash and 25% of the Y stock in the liquidation. B

receives the other 75% interest in Y stock. The distribution of 100%

of the Y stock to A and B represents a transfer of a 100% economic

interest in real property. The measure of tax for the distribution of

100% of the Y stock is $1,000,000. Because A owned a 50%

interest in Y stock prior to the distribution and retains a 25% interest

while B owned a 50% interest in the Y stock prior to the distribution

and has a 75% interest following the distribution, the distribution of

the Y stock is exempt from tax as a mere change of identity or form

of ownership or organization to the extent of 75% (25% + 50%) and

only 25% of the measure of tax for the distribution, or $250,000, is

subject to tax. The tax due is $6,562.50 (2.625% x $250,000). The

higher tax rate applies because the total measure of tax for the

distribution exceeded $500,000.

§12. Paragraph 4 of subdivision (g) of section 23-03 of such rules is amended to read as follows:

(4) Credit. If a grantee(s) acquires a controlling economic interest in a corporation,

partnership, association, trust or other entity owning real property in a transaction which is taxable

under these regulations and, within 24 months of such acquisition, the entity owning the real

property is liquidated and the real property is conveyed to the grantee(s) of the controlling

economic interest, a credit is available against the transfer tax due on the liquidation in the amount

of the transfer tax paid with respect to the original acquisition of the controlling economic interest.

In no event shall this credit be greater than the tax payable upon the conveyance in liquidation.

To illustrate (assume that all transfers are made on or after August 1, 1989):

Example 1: A owns 100% of the stock of X Corporation. X owns unencumbered New York

City real property with a fair market value of $1,000,000. A sells all of the

stock of X to C on January 1, 1992. A $26,250 transfer tax is paid. One year

after the sale, C liquidates X and receives the real property. At that time, the

fair market value of X's real property is $1,200,000. The measure of the

transfer tax will be based on the fair market value of the real property

($1,200,000). The transfer tax, therefore, is 2.625% of $1,200,000, or

$31,500. Since this liquidation has occurred within 24 months of the transfer of

the stock of X to C, a credit will be available against the $31,500 tax. The

amount of the credit may not exceed the amount of tax paid upon the prior

transfer of the economic interest in X's real property. Accordingly, a credit of

$26,250 will be available against the $31,500 transfer tax due on the liquidation

of X. The transfer tax due is $31,500 minus $26,250, or $5,250.

12

Example 2: Assume the same facts as in illustration (1) above, except that C sells 40% of X to

D prior to the liquidation of X. Upon X's liquidation, C receives 60% of X's

realty and D receives the remaining 40%. The transfer tax due is $31,500. The

amount of credit available, however, is limited to the percentage of X's realty

received by C (60%). Thus, the credit available is $15,750 (60% x $26,250),

and the transfer tax due is $15,750 ($31,500 - $15,750).

Example 3: A owns 100% of the stock of X Corporation. X owns an unencumbered parcel of

New York City real property with a fair market value of $1,000,000. A sells all

of the stock of X to C on January 1, 1990. A $26,250 transfer tax is paid. One

year after the sale to C, X acquires a second unencumbered parcel of New

York City real property with a fair market value of $1,200,000. A $31,500

transfer tax is paid on this transfer. Eighteen months after the sale by A to C of

X stock, C decides to liquidate X and receives both parcels of real property. At

this time, X's first parcel of property is worth $800,000. The measure of the tax

on the transfer of each parcel will be based on the fair market value of each

parcel. Since the fair market value of the first parcel is $800,000, the tax on the

transfer of this parcel is $21,000. Since the fair market value of the second

parcel is $1,200,000, the tax on the transfer of this parcel is $31,500. A

$21,000 credit will be available against the tax on the transfer of the first parcel.

The tax on the transfer of the second parcel must be paid in full. No credit is

available for the prior tax of $31,500 paid when X acquired the second parcel.

Example 4: A Corporation owns an unencumbered office building in New York City with a

value of $1,000,000. On January 15, 1993, X and Y each purchase 50% of the

stock of A for $1,000,000. A transfer tax of $26,250 is paid. On July 1, 1994,

A liquidates. At that time the building is worth $1,200,000 and is subject to a

mortgage of $600,000 and A also has $400,000 of cash. A distributes a 25%

interest in the building and $350,000 of cash to X and a 75% interest in the

building and $50,000 in cash to Y. The measure of tax for the distribution of

the building is $1,200,000. Because X had a 50% interest in the building

before the distribution and retains a 25% interest afterwards while Y had a

50% interest in the building before the distribution and owns a 75% interest

afterwards, the distribution of the building is exempt as a mere change of

identity or form of ownership or organization to the extent of 75% (25% +

50%) of the measure of tax. The tax is $7,875 ($300,000 X .02625). A is

entitled to a credit against that tax of $7,875.

§13. Subdivision (b) of section 23-05 of such rules promulgated May, 1985 and last amended May 5,

1989, is amended by adding a new paragraph 8 to read as follows:

13

(8) A deed, instrument or transaction conveying or transferring real property or an economic

interest in real property to another person or entity, otherwise subject to tax, that effects a mere

change of identity or form of ownership or organization to the extent the beneficial ownership of

such real property or economic interest remains the same. A sale of real property or an economic

interest therein for cash or other valuable consideration will be exempt to the extent the beneficial

ownership remains the same, provided the transaction represents a mere change of identity or form

of ownership or organization.

(i) Applicable tax rate. Where this exemption applies, the consideration subject to tax is

reduced proportionately to the extent the beneficial ownership of the real property or

economic interest in the real property remains the same. However, for transfers or

transactions occurring on or after January 1, 1999, the determination of the applicable tax

rate will be made prior to the application of this exemption. The tax rate applicable to

transfers for consideration of more than $500,000 will apply even though the portion of the

consideration taxable after applying the exemption provided for in this paragraph is $500,000

or less.

(ii) Controlling interests. For transactions involving economic interests, the

determination of whether a controlling economic interest has been transferred is made prior to

the application of this exemption. Thus, the transfer of a controlling economic interest will be

taxable to the extent the beneficial ownership does not remain the same, even though the

portion of the interest subject to tax represents, in the case of a corporation, less than 50

percent of the total combined voting power of all classes of stock of such corporation; and, in

the case of a partnership, association, trust or other entity, less than 50 percent of the capital,

profits, or beneficial interest in such partnership, association, trust or other entity. The

exemption is not applicable to a conveyance to a cooperative housing corporation of the land

and building or buildings comprising the cooperative dwelling or dwellings. For purpose of

this paragraph a cooperative housing corporation does not include a housing company

organized and operating pursuant to the provision of article two, four, five or eleven of the

private housing finance law.

To illustrate:

Example A: A and B, two equal tenants-in-common of Parcel 1, transfer their interests in

Parcel 1 to X Corporation on January 1, 1995, each receiving 50% of the

outstanding stock of X. The transfer is wholly exempt from tax as a mere

change in identity or form of ownership or organization because the

beneficial ownership of the real property remains 100%, the same as

before the transfer.

Example B: A and B are equal partners in AB Partnership. AB Partnership owns two

14

properties. Parcel 1 is unencumbered commercial real property with a fair

market value of $1,000,000. Parcel 2 is unencumbered commercial real

property with a fair market value of $2,000,000. AB has other assets

valued at $1,000,000. On January 1, 1995, AB Partnership distributes all

of its assets to A and B in complete liquidation. B receives Parcel 2. A

receives Parcel 1 and all the other assets. The tax on the distribution of

Parcel 1 to A is measured by the fair market value of Parcel 1 of

$1,000,000 reduced by 50% because A had a 50% beneficial interest in

the parcel prior to the liquidation and has retained that interest after the

distribution. Therefore, $500,000 (50% x $1,000,000) of the measure of

the tax is subject to tax. The tax due on the distribution is $13,125

(2.625% x $500,000). Similarly, the distribution of Parcel 2 to B is

exempt from tax as a mere change of identity or form of ownership or

organization to the extent of 50% because B owned a 50% beneficial

interest in the property prior to the liquidation and has retained that

beneficial interest. Therefore, the taxable amount is $1,000,000 (50% x

$2,000,000) and the tax due on the distribution of Parcel 2 is $26,250

(2.625% x $1,000,000).

Example C: X Company is a New York general partnership composed of two equal

partners, A and B. X Company owns unencumbered real property located

in New York City with a fair market value of $1,000,000. On January 1,

1995, X Company is converted to a limited liability company through the

filing of articles of organization under applicable state law. After the

conversion, B sells a 49% interest in X Company to A so that A owns a

99% interest and B owns a 1% interest. If under the applicable state law,

X Company is considered to be the same entity as before the conversion,

the conversion will not be considered a transfer of real property or an

economic interest in real property. Immediately after the conversion, the

beneficial ownership of X Company is deemed identical to the beneficial

ownership of the old general partnership and no transfer of an economic

interest has occurred. B's transfer of a 49% interest in X Company to A

will not constitute a controlling economic interest transfer subject to tax.

However, the transfer of the 49% interest may be aggregated with a

subsequent related transfer within three years so as to constitute a transfer

of a controlling economic interest. See §23-02(2) definition of

"Controlling interest" governing aggregation of related transfers.

Example D: Limited Partnership X has four equal limited partners A, B, C, and D, each

with a 24% interest and one general partner, E with a 4% partnership

interest. X owns an unencumbered office building with a fair market value

of $1,000,000 and $100,000 of other assets. A, B, C, D and E form a

15

new limited partnership, Y, in which A, B, C, and D have respective

interests in capital and profits as follows: A owns 29%, B owns 29%, C

owns 24% and D owns 14%. E is the general partner and has a 4%

interest in capital and profits. Pursuant to an agreement of merger

approved on January 4, 1999, under Article 8-A of the New York

Partnership Law, the partners merge Limited Partnership X into Y. The

transfer of the assets of X to Y is not a taxable transfer of real property,

however, the resulting transfers of interests in X may be. See §23-03(e)(4)

of these rules. Pursuant to the merger, 100% of the interests in X are

deemed exchanged for interests in Y. The transaction is exempt as a mere

change of identity or form of ownership or organization to the extent the

partners retain the same beneficial interest in the property following the

merger as they held before the merger. In this case, A, B and C each

retain a 24% interest in the property, D retains a 14% interest in the

property and E retains a 4% interest in the property. Therefore, the

merger is exempt as a mere change of identity or form of ownership or

organization to the extent of 90%. The tax is imposed on $100,000 (10%

x $1,000,000). The tax due is $2,625 ($100,000 x 2.625%). The tax rate

is based on the full value of the consideration, $1,000,000, rather than the

amount subject to tax.

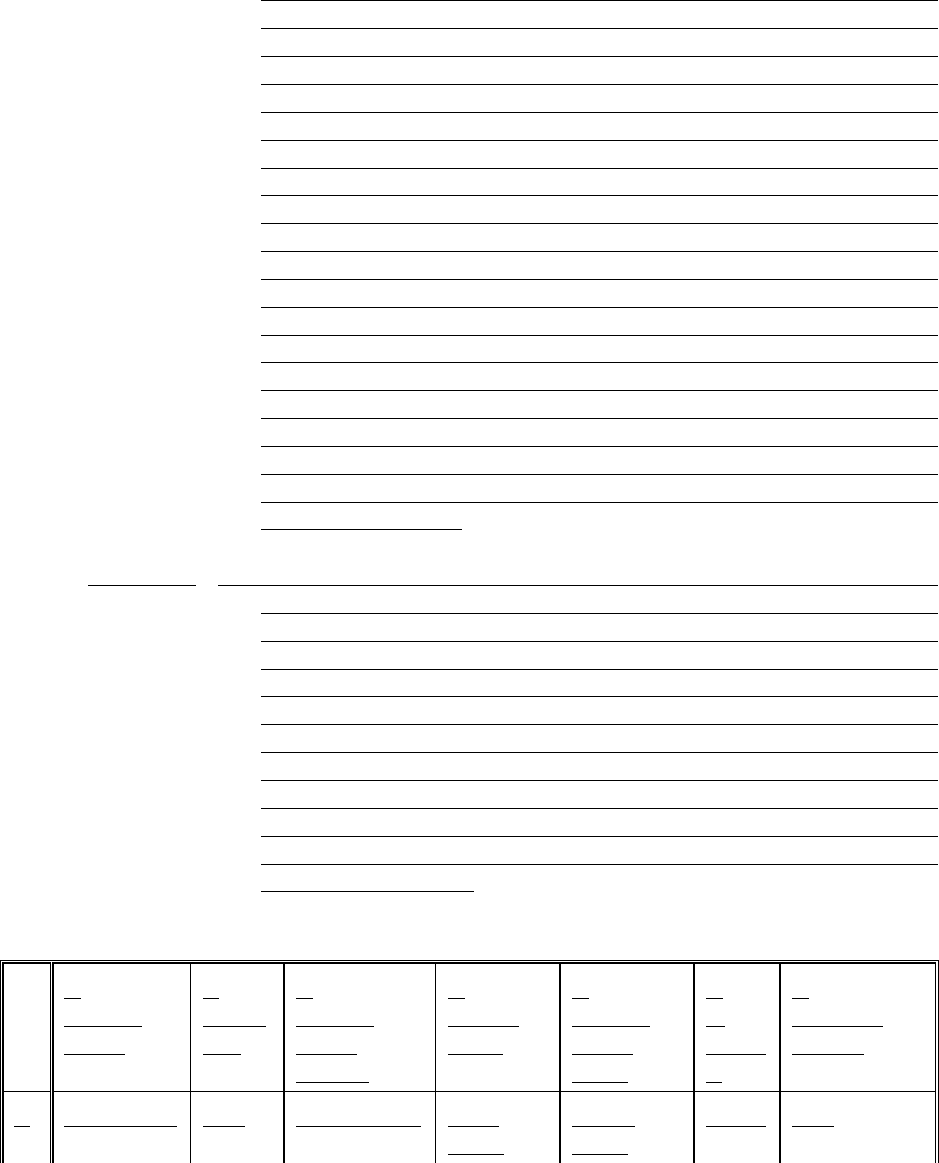

Example E: Corporation X has five shareholders (col. 1 of table below) and owns real

property in New York City. Pursuant to a plan of merger agreed upon

and adopted by shareholders of Corporation X on January 4, 1999,

Corporation X is to be merged under Article 9 of the New York Business

Corporation Law into Corporation Y, which owns no real property in

New York City. Four of the five shareholders of Corporation X also own

stock in Corporation Y prior to the merger (col. 3 of table below).

Corporation Y has 30,000 outstanding shares but will increase that

number to 50,000. Pursuant to the merger, the Corporation X shares will

be converted into Corporation Y shares in a ratio of four Corporation Y

shares for every five Corporation X shares. The mere change exemption

is computed as follows:

1.

X shares

owned

2.

% held

in X

3.

Y shares

owned

(before)

4.

Y stock

issued

5.

Y shares

owned

(after)

6.

%

held in

Y

7.

% interest

retained

A 4,000 shares 16% 10,000 shares 3,200

shares

13,200

shares

26.4% 16%

16

B 2,000 shares 8% 1,000 shares 1,600

shares

2,600

shares

5.2% 5.2%

C 3,000 shares 12% 1,000 shares 2,400

shares

3,400

shares

6.8% 6.8%

D 5,000 shares 20% 3,000 shares 4,000

shares

7,000

shares

14% 14%

E 11,000

shares

44% 0 shares 8,800

shares

8,800

shares

17.6% 17.6%

T

ot

al

25,000

shares

100% 15,000 shares

(out of

30,000)

20,000

shares

35,000

shares (out

of 50,000)

70% 59.6%

The transfer of the City real property from Corporation X to Corporation Y

pursuant to the merger would be exempt from tax. See section 23-03(e)(2) of

these rules. Pursuant to the merger, 100 percent of the Corporation X shares

are deemed exchanged for Corporation Y stock, which constitutes a transfer of

a controlling economic interest in New York City real property. Because the

transfers by the shareholders were made pursuant to the approved plan of

merger they are aggregated in determining whether the transaction constitutes

a transfer of a controlling economic interest. However, the transaction is

exempt to the extent that each of the Corporation X shareholders retains its

beneficial interest in the real property formerly held by Corporation X. Column

7 reflects the percentage interest in the property retained by each shareholder,

which is the lesser of the amounts in Columns 2 and 6. The transfer is exempt

as a mere change of identity or form of ownership or organization to that

extent, i.e., 59.6 percent. Shareholders A, B, C, D and E are the grantors and

pursuant to the merger, are considered to have transferred their shares in X to

Corporation Yin exchange for Y shares.

Example F: T, an individual, owns 20 shares in a cooperative housing corporation attributable to

an apartment in the building. The apartment is leased to a tenant for residential

use. T transfers the shares attributable to the apartment to Y Corporation, her

wholly owned corporation . Because T retains a 100% beneficial ownership of

the apartment, the transfer is exempt from tax as a mere change of identity or

form of ownership or organization.

Example G: J owns 70% of the stock of X Corp, whose sole asset is 80% of the stock of Y

Corp. Y Corp's sole asset is an unencumbered parcel of commercial real

property in New York City with a fair market value of $1,000,000. On

17

February 1, 1999, J transfers all of her stock in X Corp to a newly formed

corporation, Z Corp in return for 60% of Z Corp's stock. (The other 40% of Z

Corp's stock is owned by shareholders who have no independent interest in X

Corp, Y Corp or Y Corp's parcel of real property.) J's transfer of the X stock

is a transfer of a 56% interest (70% x 80%) in the real property and is,

therefore, subject to tax as a transfer of a controlling economic interest. The

value of the consideration received in exchange, the Z Corp stock, is $560,000

($1,000,000 x 56%). The transaction is exempt as a mere change of identity or

form of ownership or organization to the extent that A retains a beneficial

interest in the property following the merger . In this case, J retains a 33.6%

interest in the property (56% x 60%). Therefore, the merger is exempt as a

mere change of identity or form of ownership or organization to that extent.

The tax is imposed on $224,000 (.224/.56 X $560,000). The tax due is $5,936

($224,000 x 2.625%). The tax rate is based on the full value of the

consideration, $560,000, rather than the amount subject to tax.

(iii) Transfers to and from trusts. - RESERVED

(iv) For purposes of determining whether and to what extent the mere change of identity

or form of ownership or organization exemption applies, the determination of the beneficial

ownership of the real property or economic interest therein prior to a transaction and the

extent to which the beneficial interest therein remains the same following the transaction will

be based on the facts and circumstances.

§14. These rules shall be effective immediately and shall apply to all open years, except as otherwise

provided herein. Although subparagraph (ii) of paragraph 8 of subdivision (b) of section 23-05 of

these rules added by section 13 hereof does not reflect a change in the Department's policy or

interpretation of Ad. Code section 11-2106.b(8), that subparagraph will be controlling only with

respect to transactions occurring on or after May 19, 1998, pursuant to binding written contracts

entered into on or after that date .

18

BASIS AND PURPOSE OF AMENDMENTS

These amendments to the Rules Relating to the New York City Real Property Transfer Tax are

intended to reflect the enactment of Administrative Code section 11-2106.b(8) by Chapter 170, Laws

of 1994, section 308, which provides for an exemption from the tax for transfers on or after June 9,

1994, that effect a mere change of identity or form of ownership or organization to the extent the

beneficial ownership remains the same. While these amendments are effective immediately and apply

to all open years for transactions occurring on or after June 9, 1994, except as otherwise specifically

provided, new subparagraph (ii) of paragraph (8) of subdivision (b) of section 23-05 of the rules will be

controlling only with respect to transactions occurring on or after May 19, 1998, pursuant to binding

written contracts entered into on or after that date. However, the prospective application of that

subparagraph does not reflect a change in Department of Finance policy. Since June 4, 1994,

Department policy has been that for all transactions occurring on or after that date, the determination

of whether a transaction constitutes a transfer of a controlling economic interest is made prior to the

application of the mere change exemption. Section 23-05(b)(8)(iii) is reserved for rules governing

transfers to and from trusts to be promulgated at a later date. A task force of Department of Finance

and outside experts is being assembled to draft those rules.

Joseph J. Lhota /S/

Acting Commissioner of Finance

Signed April 16, 1999

Published April 28, 1999

Effective May 28, 1999