O R A C L E D A T A S H E E T

JD Edwards EnterpriseOne

India Localizations

JD Edwards EnterpriseOne is an ERP solution composed of three software

layers that together support companies' global business needs. The

underlying tools layer provides a technical foundation to configure different

global standards such as decimal and date formats, address formats, and

language preference by user. The base application software enables users to

configure global functionalities in areas such as payment and receipt

processing, tax processing, depreciation methods, hyperinflationary

accounting, fiscal reports, and statutory chart of accounts. The third layer of

software, localizations, addresses country-specific statutory and common

business practice requirements.

K E Y F E AT U RE S

• Goods and Services Tax (GST)

• Central Excise Tax

• Tax Collected at Source (TCS)

• Tax Deducted at Source (TDS)

• Work Contract Tax (WCT)

K E Y B E N EF IT S

• Addresses mandatory country-specific

legal and business requirements

• Is included with base software and fully

supported by Oracle

• Enables users to operate in their

respective local languages

• Supports global expansion without the

need for additional software

• Provides long-term value for a

company's investment through

frequent updates and migration path

• Reduces end user training and total

cost of ownership through same

standards, look and feel

• Supports single instance of the JD

Edwards EnterpriseOne solution

resulting in a more easily managed

software environment

The Issue: Why Do Companies Care About Localizations?

Many organizations are expanding operations outside their home country. They must

incorporate country-specific business practices into their companies' daily business

transactions and operations. It is mandatory to comply with country-specific legal

requirements. Requirements can exist at the city, state, and federal level depending on

the country. Nonadherence to these rules and regulations may lead to severe

consequences for a company.

The Solution: JD Edwards EnterpriseOne Supporting Current

and Future Global Business Needs

The JD Edwards EnterpriseOne localizations are part of the base software and fully

supported by Oracle. The localizations adhere to the Oracle software standards and

delivery methods and are covered by the Oracle support policies.

Legislative updates for localizations are release-independent and delivered on the

Oracle Update Center. These updates enable companies to comply with changing laws

and meet the legal effective dates specified by governments.

The JD Edwards EnterpriseOne localizations are fully integrated with the JD Edwards

EnterpriseOne base software. Such integration ensures that all Oracle-provided

localizations coexist. Companies can operate in multiple countries in a single instance.

The JD Edwards EnterpriseOne software is translated into 21 languages, so users can

operate in their respective local languages. Oracle-provided localizations enable

companies to use the JD Edwards EnterpriseOne software and comply with country-

specific laws and common business practices.

O R A C L E D AT A S H E E T

JD Edwards EnterpriseOne is a long-term investment. For companies expanding their

business operations around the globe, no additional software is required for operating in

most countries. Timely legislative updates are continuously provided. When companies

are ready to migrate to the most current release, upgrade paths are provided.

Feature Highlights for India

The JD Edwards EnterpriseOne localizations for India are included with the software

and supported for customers who have license version 9.0 or later.

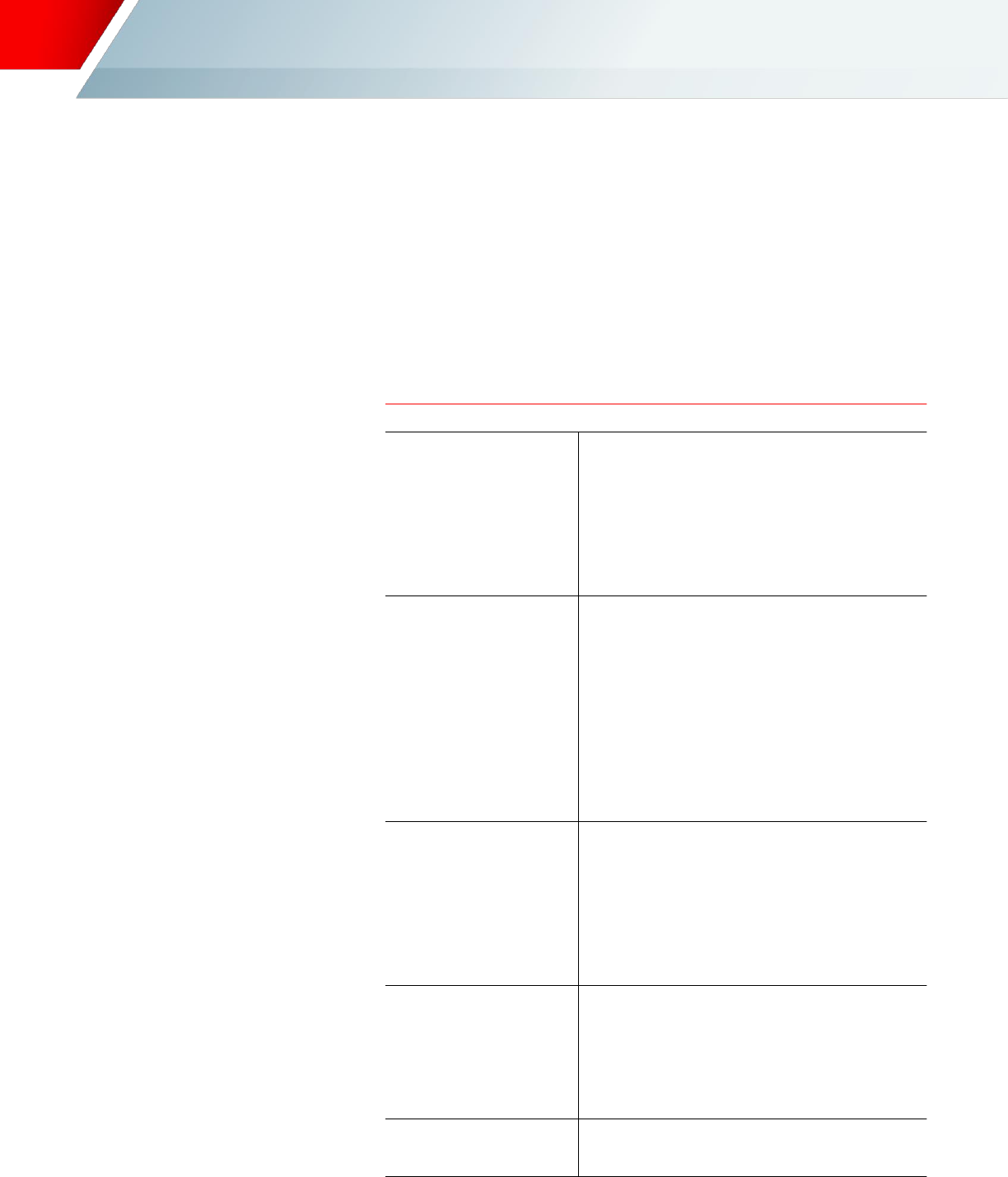

The following table provides a sample of the functionalities included with the JD

Edwards EnterpriseOne localizations for India.

Feature Highlights

Functionalities

Common Features

•

Configurable Tax Types

•

Tax on Tax Calculation

•

India-Specific Invoice Print

•

30 New Localized Category Codes

•

Rounding

•

Supplementary Invoice

•

Abatement, Exception, Exemption, MRP Calculation

•

Item Attributes or Cat. Codes

•

Common Registration Details Form

•

Regulatory Report

Goods and Services Tax (GST)—

Procure to Pay Features

•

Purchase Order with Stock Item

•

Purchase Order with Non-Stock Items

•

Purchase—Reverse Charge

•

Purchase Order Print with GST Details

•

Purchase Returns

•

Account Payable Transactions

•

Advance Payments for Goods and Services

•

Self-Invoice for Reverse Charge Transactions

•

Claim Input Tax Credit (ITC)

•

Payments to Tax Authority

•

Matching Purchase Tax Data with GSTR2A

•

ITC Credit Distribution

•

Personal Consumption

•

Matching Purchase Tax Data with ANX2

Goods and Services Tax (GST)—

Order to Cash Features

•

Sales—Goods

•

Sales—Returns

•

Sales—Reverse Charge

•

Sales—Stock Transfer

•

Sales—Exports

•

GST Invoice Templates for Domestic and Export Transactions

•

Advance Payments for Goods and Services

•

Accounts Receivables Transactions—Services

•

Accounts Receivables—Modifications

•

Electronic Invoice Templates for Domestic Transactions

Goods and Services Tax (GST)

for Freight

•

Configure GST Against Routing Numbers

•

Compute GST and Store the Tax Amounts in the Freight Update

(R4981) Process

•

Print GST on Freight in India GST Invoice

•

Update the GST Ledger for the Freight Lines during the Sales

Update (R42800) Process

•

Matching the Freight with the Voucher

•

Tax Liability Reverse Charge Report for GST on Freight

Goods and Services Tax (GST)—

Returns

•

Print ANX-1 and RET-1 Information Extract

•

Print GSTR3B Information Extract

•

Print GSTR1 Information Extract

O R A C L E D AT A S H E E T

Excise

•

Relation Between Excise Unit and BU or Branch Plant

•

Identify Entity as Manufacturer or Dealer or 100% EOU

•

Manufacturer Transaction Processing through Sales Order or

Purchase Order

•

Dealer Transaction Support Through Sales Order or Purchase

Order Processing

•

Dealer-Specific Calculations which Allow Transfer of Duties from

Purchase to Sales Transactions

•

100% EOU Setups and Export Transaction Processing (ARE1 –

Bond (LOU) ARE3 or CT2-CT3 Transaction Processing)

•

Regulatory Reports and Business Reports

▪

RG1 Excise Manufacturer Register, Dealer Register

RG23D

▪

Input Registers, Capital Registers

▪

Annexure 8, Annexure 10

▪

Form ER1 or ER3 or ER5 or ER6

▪

ARE1 or ARE3 Form Printing

▪

CT2 or CT3 Annexure Certificate

•

Sub-Contracting Transaction or Report Support Through Work

Order

•

Consignment Print Challan—57F4

•

Credit Distribution Excise and Service Credits or Debits

•

Recording of Items for Personal Consumption

Tax Collected at Source (TCS)

•

TCS Transaction Processing

•

TCS Tax Reporting

▪

Form 27D

▪

eTCS Reporting

Tax Deducted at Source (TDS) or

Works Contract Tax (WCTDS)

•

TDS or WCTDS Withholding Calculation Through Voucher

Processing (AP)

•

TDS or WCTDS Tax Reporting

▪

Form 16A

▪

eTDS Reporting

C O N T A C T U S

For more information about JD Edwards EnterpriseOne, visit oracle.com or call +1.800.ORACLE1 to

speak to an Oracle representative.

C O N N E C T WI T H U S

blogs.oracle.com/oracle

facebook.com/oracle

twitter.com/oracle

oracle.com

Copyright © 2023, Oracle and/or its affiliates. All rights reserved. This document is provided for information purposes only, and the

contents hereof are subject to change without notice. This document is not warranted to be error-free, nor subject to any other

warranties or conditions, whether expressed orally or implied in law, including implied warranties and conditions of merchantability or

fitness for a particular purpose. We specifically disclaim any liability with respect to this document, and no contractual obligations are

formed either directly or indirectly by this document. This document may not be reproduced or transmitted in any form or by any means,

electronic or mechanical, for any purpose, without our prior written permission.

Oracle and Java are registered trademarks of Oracle and/or its affiliates. Other names may be trademarks of their respective owners.

Intel and Intel Xeon are trademarks or registered trademarks of Intel Corporation. All SPARC trademarks are used under license and

are trademarks or registered trademarks of SPARC International, Inc. AMD, Opteron, the AMD logo, and the AMD Opteron logo are

trademarks or registered trademarks of Advanced Micro Devices. UNIX is a registered trademark of The Open Group. 0117