DE 2501 Rev. 81.1 (2-24) INTERNET Instruction & Information A

The State Disability Insurance (SDI) program provides benefits to eligible workers who have a

full or partial loss of wages due to disabilities that are not work related.

A disability is any illness or injury, either physical or mental, that prevents you from doing your

regular work. This includes elective surgery and disabilities related to pregnancy or childbirth.

Please read instruction and information pages (A through D) before completing the enclosed

forms.

For faster processing, apply using SDI Online at edd.ca.gov/SDI_Online instead of this form.

Do not complete this form if you are:

• Insured by a Voluntary Plan. Ask your employer for those forms.

• Filing for Non-Industrial Disability Insurance benefits. State government employees refer to your

personnel office.

If you cannot complete this form due to your disability, or if you are an authorized representative applying

for benefits on behalf of an incapacitated or deceased person, call 1-800-480-3287 or send us a message

using Ask EDD at askedd.edd.ca.gov.

How to Complete This Form

• Use black ink only.

• Type or write clearly within the boxes provided.

• Enter your Social Security number on all pages of the claim form including attachments.

• Do not fax the form.

Mail the completed form to us in the envelope provided. Submit your claim no earlier than nine days after

the first day your disability begins, but no later than 49 days after your disability begins.

1. Complete all items in “Part A – Claimant’s Statement” and sign box A40. For box A13, the United

States Postal Service will not deliver mail to a private mailbox unless it is preceded by the initials

“PMB.”

2. Have your physician/practitioner complete and sign “Part B – Physician/Practitioner’s Certificate.”

Certification can be made by a licensed physician or practitioner authorized to certify to a patient’s

disability or serious health condition (CUIC, section 2708).

If you are under the care of an accredited religious practitioner, obtain a Claim for Disability Insurance

Benefits - Religious Practitioner’s Certificate (DE 2502) by calling 1-800-480-3287 and ask your

religious practitioner to complete and sign it. Rubber stamped signatures are not accepted.

3. Decide the date you want your claim to begin. See “Your Benefit Amounts” on page B for information.

4. If you have a work-related disability, complete questions A31 to A38. If your workers’ compensation

claim has been accepted, denied, or delayed, include the status letter from the carrier.

Place the completed, signed form in the envelope provided. Claims are generally processed within

14 days when we receive “Part A – Claimant’s Statement” and “Part B – Physician/Practitioner’s

Certificate.”

5. Keep these instructions and information pages for future reference.

Note: You may lose or delay benefits if your claim is late, has errors or missing information.

The EDD is an equal opportunity employer/program. Auxiliary aids and services are available upon

request to individuals with disabilities. Requests for services, aids, or alternate formats need to be

made by calling 1-866-490-8879 (voice). TTY users, please call the California Relay Service at 711.

Claim for Disability Benefits

Page 1 of 13

DE 2501 Rev. 81.1 (2-24) INTERNET Instruction & Information B

Basic Eligibility Disability benefits can be paid only after you meet

all of the following requirements:

• You must be unable to do your regular work for at least eight

consecutive days.

• You must be employed or actively looking for work at the time you

become disabled.

• You must have lost wages because of your disability or, if

unemployed, have been actively looking for work.

• You must have earned at least $300 in wages from which SDI

deductions were withheld during your established base period.

See “Your Benefit Amounts” in the next column.

• You must be under the care and treatment of a licensed physician/

practitioner or accredited religious practitioner during the first

eight days of your disability. The beginning date of a claim can be

adjusted to meet this requirement. You must remain under care

and treatment to continue receiving benefits.

• You must complete and submit a claim form within 49 days of the

date you became disabled or you may lose benefits.

• Your physician/practitioner must complete the medical certification

of your disability. A licensed midwife or nurse-midwife can complete

the medical certification for disabilities related to normal pregnancy

or childbirth. If you are under the care of a religious practitioner,

request a Claim for Disability Insurance Benefits –Religious

Practitioner’s Certificate (DE 2502) from an SDI office. Certification

by a religious practitioner is acceptable only if the practitioner has

been accredited by the EDD.

We may require an independent medical examination to determine

your initial or continuing eligibility.

Ineligibility You may apply for benefits even if you are not sure you

are eligible. If you are found to be ineligible for all or part of a period

claimed, you will be notified of the ineligible period and the reason.

You may not be eligible for DI benefits if you:

• are claiming or receiving unemployment or Paid Family Leave

benefits.

• became disabled while committing a crime resulting in a felony

conviction.

• are receiving Workers’ Compensation benefits at a weekly rate

equal to or greater than the SDI rate.

• are in jail or prison because you were convicted of a crime.

• are a resident in an alcoholic recovery home or drug-free

residential facility that is not licensed and certified by the state in

which the facility is located.

• fail to submit to an independent medical examination when

requested to do so.

Fraud It is a violation to willfully make a false statement or knowingly

conceal a material fact in order to obtain the payment of any

benefits, such violation being punishable by imprisonment or by a

fine not exceeding $20,000 or both. To detect and discourage fraud,

SDI continually monitors claim payments, vigorously investigates

suspicious activity, and will seek restitution and conviction through

prosecution (CUIC, sections 2101, 2116, and 2122).

Your Responsibilities

• File your claim and other forms completely, accurately, and in a

timely manner. If a form is late, attach a written explanation of the

reasons to the form.

• Thoroughly read the instructions on this and all other forms you

receive from SDI. If you are not sure what is required, contact an

SDI office.

• Report to SDI in writing, electronically, or by telephone any:

Keep an appointment for an independent medical examination, if

requested.

●

Include your name and Social Security number or Claim ID

number on all correspondence.

Your Rights Information about your claim will be kept confidential,

except for the purposes allowed by law. You have the right to

inspect any personal records maintained about you by the EDD and

request that our records be corrected if you believe they are not

accurate, relevant, timely, or complete (Civil Code, section 1798.34,

and 1798.35).

Certain types of information that would generally be considered

personal are exempt from disclosure to you: medical or psychological

records where knowledge of the contents might be harmful to

the subject; records of active criminal, civil, or administrative

investigations. If you are denied access to records which you believe

you have a right to inspect or if your request to amend your records is

refused, you may file an appeal with an SDI office. You may request

a copy of your file by calling SDI at 1-800-480-3287 (Civil Code,

section 1798.40).

You also have the right to appeal any disqualification, overpayment,

or penalty. Specific instructions on how to appeal will be provided

on any appealable document you receive. If you file an appeal and

you remain disabled, you must continue to complete and return

continued claim certifications.

Your Benefit Amounts Your claim begins on the date your disability

began. SDI calculates your weekly benefit amount using your base

period. The date your disability began determines your base period,

unless the claim effective date is adjusted by SDI. If you want your

claim to begin later so that you will have a different base period, call

SDI at 1-800-480-3287 before you file your claim.

This base period covers 12 months and is divided into four

consecutive quarters. Your base period includes wages subject to

SDI tax which you were paid approximately 5 to 17 months before

your disability claim begins. Your base period does not include

wages being paid at the time the disability begins. For a disability

claim to be valid, you must have at least $300 in wages in the base

period. Using the following, you may determine the base period for

your claim.

• If your claim begins in January, February, or March, your base

period is the 12 months ending last September 30.

• If your claim begins in April, May, or June, your base period is the

12 months ending last December 31.

• If your claim begins in July, August, or September, your base

period is the 12 months ending last March 31.

• If your claim begins in October, November, or December, your

base period is the 12 months ending last June 30.

The quarter of your base period in which you were paid the highest

wages determines your weekly benefit amount. You may not

change the beginning date of your claim or adjust your base

period after you have established a valid claim.

Your daily benefit amount is your weekly benefit amount divided

by seven. Your maximum benefit amount is 52 times your weekly

benefit amount or the total wages subject to SDI tax paid in your

base period, whichever is less. Exceptions are as follows:

• For employers and self-employ who elect SDI coverage, the

maximum benefit amount is 39 times the weekly rate.

• For residents in a state licensed and certified alcoholic recovery

home or drug-free residential facility, the maximum payable

period is 90 days. However, disabilities related to or caused by

acute or chronic alcoholism or drug abuse which are being

medically treated do not have this limitation.

Contact an SDI office to inquire and provide additional information

if your situation fits any of these circumstances: If you do not have

sufficient base period wages and you remain disabled, you may

be able to apply by using a later beginning date. If you do not have

enough base period wages and you were actively seeking work for

60 days or more in any quarter of the base period, you may be able

to substitute wages paid in prior quarters. Additionally, you may be

entitled to substitute wages paid in prior quarters either to make

your claim valid or to increase your benefit amount if during your

base period you were in the U.S. military service, received Workers’

Compensation benefits, or did not work because of a labor dispute.

Page 2 of 13

− change of address or telephone number.

− return to part-time or full-time work.

− recovery from your disability.

− income you receive.

DE 2501 Rev. 81.1 (2-24) INTERNET Instruction & Information C

How Benefits Are Paid When your completed “Part A – Claimant’s

Statement” and “Part B – Physician/Practitioner’s Certificate” are

received, the SDI office will notify you by mail of your weekly and

maximum benefit amounts and may request additional information

to determine your eligibility. If you are eligible to receive benefits,

you have an option in how you receive your benefit payments. We

issue benefit payments by debit card or by check. The debit card

is the fastest and most secure way to receive benefits. Select your

preferred payment method in field A39.

You do not have to accept the debit card. To receive your benefits by

check, allow 7-10 days for delivery by US mail. The majority of claims

are processed, and payments are issued within 14 days of receipt of

both the claimant’s and the physician/practitioner’s portions of the

claim.

The first seven days of your claim is a non-payable

waiting period.

If you are eligible for further benefits, payments will be sent

automatically or a continued claim certification form for the next

period will be enclosed. Usually, the certification periods are for two

weeks; however, the period will vary under certain circumstances.

You will be paid 1/7 of your weekly benefit amount for each calendar

day you are eligible unless benefits are reduced for some reason.

(See “Benefit Reductions” below.) If you receive DI benefits in

place of unemployment or Paid Family Leave benefits, the amounts

paid will be reported to the Internal Revenue Service. Contact the

Internal Revenue Service for more specific tax information.

Benefit Reductions Under certain circumstances, you may not be

eligible for benefits for a period of your claim or you may be entitled

only to partial benefits. SDI will determine whether or not benefits

must be reduced. The types of income shown in the following list

should be reported to SDI even though they may not always affect

your benefits. Failure to report your income could result in an

overpayment, penalties, and a false statement disqualification.

●

Sick leave pay

●

Self-employment income

●

Military pay

●

Commissions

●

Wages, including modified duty wages

●

Residuals

●

Part-time work income

●

Bonuses

●

Workers’ Compensation benefits

●

Insurance settlements

●

Holiday pay

In addition, your benefits may be reduced because of a prior

unemployment, Paid Family Leave, or disability overpayment or for

delinquent court-ordered support payments.

Benefit Interruption and Termination A Notice of Final Payment

will be sent when records show you have:

●

been paid to your physician/practitioner’s estimated date

of recovery. If you are still disabled, ask your physician/

practitioner to complete and return the Physician/Practitioner’s

Supplementary Certificate (DE 2525XX) enclosed with the

Notice of Final Payment.

●

recovered or returned to work. If you return to work and become

disabled again, immediately submit a new claim form and report

the dates you worked.

Overpayment An overpayment results when you receive DI

benefits you were not entitled to receive. Once SDI determines

that you were overpaid, the SDI office will contact you to explain

the reason for your overpayment. It is important that you complete

and return all information requests, as there are some instances

when an overpayment can be waived. If it is determined that

you were overpaid and the overpayment cannot be waived, you

must repay this money. Benefits issued after an overpayment is

established may be reduced by 25 to 100 percent to collect your

overpayment. You will receive a Notice of Overpayment Offset (DE

826) if a reduction is taken for either a DI, Paid Family Leave, or

unemployment overpayment.

Disqualification All available information will be considered

before paying or disqualifying your claim. Benefits will be paid

only for the days you are eligible. If payment of benefits is denied

or reduced, you will be issued a Notice of Determination (DE

2517) stating the reason for the disqualification and the time-

period.

If you deliberately report incorrect information or if you willfully

omit or withhold information, false statement disqualifications

of up to 92 days are assessed. This can apply if you accept

disability benefit payments you know include days you should not

be paid, such as days after you returned to work. In addition, any

overpayment will be increased by a 30 percent penalty.

Special Circumstances

●

If you have suffered a work-related injury or illness, report it to

your employer and have your physician/ practitioner submit a

report to your employer’s Workers’ Compensation insurance

carrier. If the Workers’ Compensation insurance carrier delays or

refuses payments, SDI may pay you benefits while your case is

pending. However, SDI will pay benefits only for the period you

are disabled and will file a lien to recover benefits paid.

Note: SDI and Workers’ Compensation are two separate

programs. You cannot legally be paid full benefits from both

programs for the same period. However, if your Workers’

Compensation benefit rate is less than your SDI rate, SDI can

pay you the difference between the two rates.

For Workers’ Compensation information and assistance, contact

your local Workers’ Compensation Appeals Board office. You

will find their information at dir.ca.gov.

● For pregnancy, as with any medical condition, the disability period

begins on the first day you are unable to do your regular work. DI

benefits will be paid for the period-of-time reported on your

physician/practitioner’s certification. Pregnancy-related disability

claims should NOT be submitted until after the eighth day

following the date your physician/practitioner certifies you are

disabled.

● Contact the our Paid Family Leave program at 1-877-238-4373

about bonding with a new child. With the final disability benefit

payment issued to a new mother, a transition bonding claim form,

Claim for Paid Family Leave (PFL) Benefits – New Mother

(DE

2501FP) will be sent automatically by mail or electronically to your

online SDI Online service account if established.

● Child Support Questions. Contact the Department of Child

Support Services at 1-866-249-0773.

● For spousal or parental support questions, contact the District

Attorney’s office administering the court order.

● If a family member must stop work to care for you, or if you stop

work to care for a seriously ill family member, visit edd.ca.gov/

PaidFamilyLeave or contact the program at 1-877-238-4373 for

more information.

● If you expect your disability to be long-term or permanent, contact

the Social Security Administration well before you exhaust your DI

benefits. For information, call the Social Security Administration

toll-free at 1-800-772-1213.

● If you have a disability which prevents you from getting or keeping

a job, the Department of Rehabilitation may be

able to assist you with vocational training, education, career

opportunities, independent living, and use of assistive technology.

● If a person receiving DI benefits dies, an heir or legal

representative should report the death to SDI. Benefits are

payable through date of death.

Page 3 of 13

DE 2501 Rev. 81.1 (2-24) INTERNET Instruction & Information D

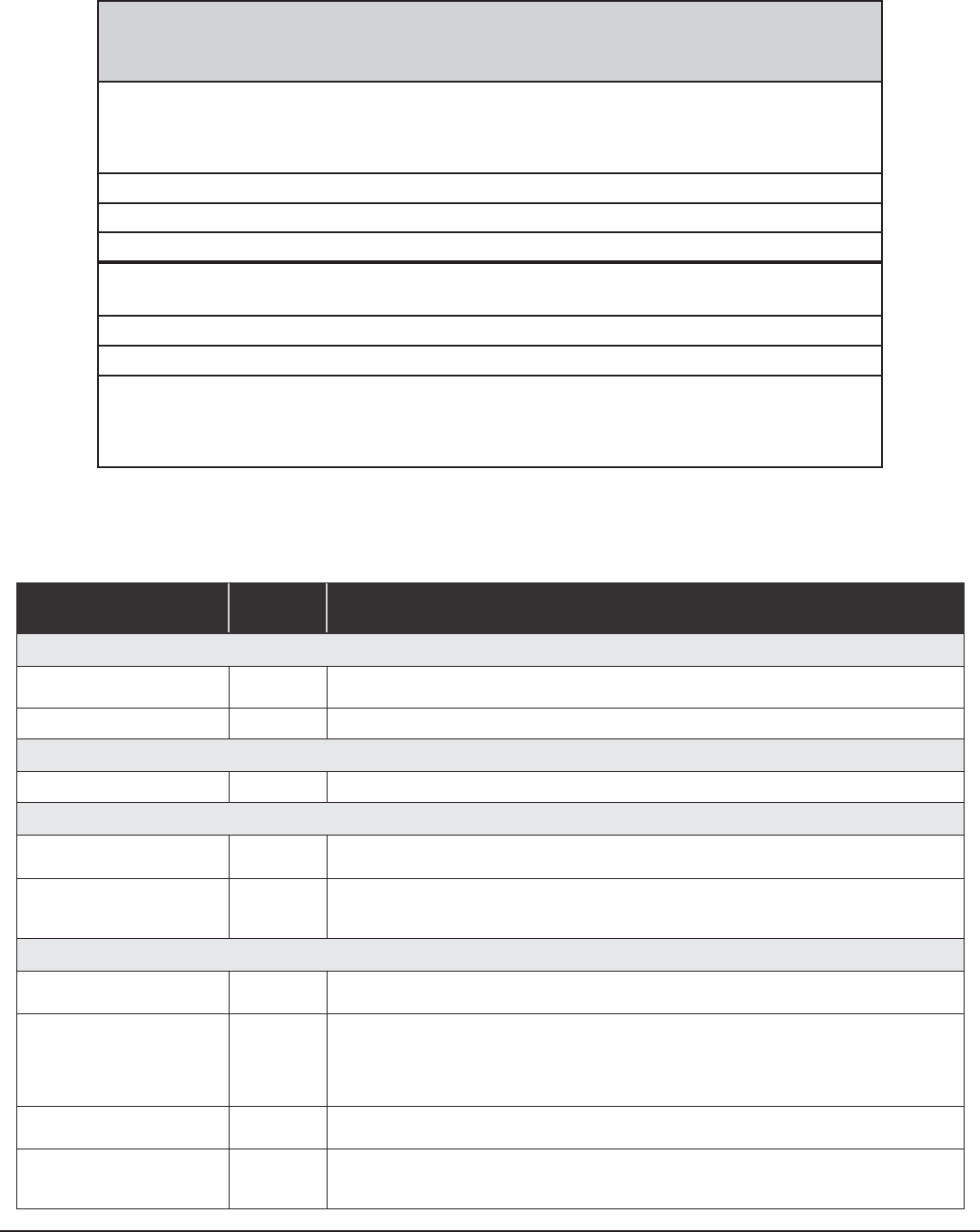

PREPAID DEBIT CARD DISCLOSURES

Money Network State Government Disbursement Program Short Form

You do not have to accept this benefits card.

Ask about other ways to receive your benefits.

Monthly fee

$0

Per purchase

$0

ATM withdrawal

$0 in-network

$1.00 out-of-network

Cash reload

N/A

ATM balance inquiry (in-network or out-of-network) $0

Customer service $0

per call

Inactivity $0

We charge 5 other types of fees. Here are two of them:

ATM Withdrawal Int. $1.00

Priority Shipping $8.00

No overdraft/credit feature

Your funds are eligible for FDIC insurance.

For general information about prepaid accounts, visit cfpb.gov/prepaid.

Find details and conditions for all fees and services in the Cardholder Agreement.

Money Network State Government Disbursement Program. The Mastercard Card is issued by My Banking Direct, a service of Flagstar

N.A., Member FDIC, pursuant to a license from Mastercard U.S.A. Inc. Incorporated. Card is serviced by Money Network Financial, LLC

List of all fees (Long Form) for the Money Network

®

State Government Disbursement Program

All Fees

Program

Fees

Details

Monthly Usage

Account Opening

and Card Receipt

$0.00

No fee for Account Opening and initial Card.

Monthly Maintenance Fee

$0.00

We do not assess a monthly maintenance fee.

Add Money

Payer Deposit

$0.00

Funds are loaded only by your Payer.

Spend Money

Signature Debit Transactions

$0.00

Select “Credit” or sign at point-of-sale (POS). International Service Assessment or Cross

Border Assessment may also apply to International Transactions.

PIN Debit Transactions

$0.00

Select “Debit” and enter PIN at POS; cash back option at participating merchants.

International Service Assessment or Cross Border Assessment may also apply to International

Transactions.

Get Cash or Send Cash

ATM Withdrawal Fee or ATM

Decline Fee | In-Network

$0.00

Withdrawal or Decline from ATM that is a part of our network. To find in-network ATMs, use the

locator on our Mobile App (data rates may apply) or on our Website, or call Customer Service.

ATM Withdrawal Fee |

Out-of-Network

$1.00

This is our fee. You will receive two (2) free withdrawals after each deposit made to your

account. You may also be charged a fee by the ATM operator, even if you do not complete a

transaction. “Out-of-Network” means ATMs that are not in-network ATMs. To find in-network

ATMs, use the locator on our Mobile App (data rates may apply) or on our Website, or call

Customer Service.

ATM Decline Fee |

Out-of-Network

$0.00

We do not charge a fee for this service. You may be charged a fee by the ATM operator.

Bank Teller Over the

Counter Cash Withdrawal

$1.00

At banks displaying the card association logo on your Card’s front side. This is our fee. You will

receive one (1) free per deposit made to your account. International Service Assessment or

Cross Border Assessment may also apply to International Transactions.

Page 4 of 13

DE 2501 Rev. 81.1 (2-24) INTERNET Instruction & Information E

All Fees

Program

Fees

Details

Transfer to Customer

Bank Fee

$0.00

Domestic ACH transactions are subject to additional terms that are disclosed when transaction

is initiated.

International ACH

Withdrawal Fee

$0.00

plus

0%

of the

exchange

rate

This transaction allows you to transfer funds via ACH to an international bank account.

We charge transfer fees consisting of a flat fee of up to $7.00 plus a mark-up on the exchange

rate of up to 3.5%. The transfer fees may be less depending on the amount transferred

and market conditions. Applicable transfer taxes will also be charged. The exact amount of

transfer fees and transfer taxes charged by us will be disclosed to you before you complete

the transaction. Your transaction is subject to an exchange rate conversion, and may be

subject to additional fees and taxes from 3rd parties. Recipient’s financial institution may also

charge fees and taxes. We do not monitor exchange rates or fees established by 3rd parties,

and these amounts are subject to change. These transactions are subject to additional terms

that are disclosed when a transaction is initiated. See Website for more information. You may

call Customer Service for assistance.

Information

Monthly Paper Statement

$0.00

You may also obtain Account activity without a fee via Mobile App (data rates may apply), our

Website, or by contacting Customer Service.

Customer Service

$0.00

24/7 toll free Account access, including account balance inquiries.

ATM Balance Inquiry

Fee | In-Network

$0.00

To find in-network ATMs, use the locator on our Mobile App (data rates may apply) or at our

Website, or call Customer Service.

ATM Balance Inquiry

Fee | Out-of-Network

$0.00

This is our fee. You may also be charged a fee by the ATM operator, even if you do not

complete a transaction.

Using Your Card Outside the U.S. (International Transactions)

ATM Withdrawal INT

Fee (Non-U.S.)

$1.00

This is our fee. You may also be charged a fee by the ATM operator, even if you do not

complete a transaction. Currency Conversion Assessment Fee, International Service

Assessment, and/or Cross Border Assessment may also apply to these transactions.

ATM Decline INT

Fee (Non-U.S.)

$0.00

ATM Balance Inquiry

INT Fee (Non-U.S.)

$0.00

Mastercard International

Service Assessment

2.0%

This fee applies if a transaction is initiated in a currency other than U.S. dollars and a currency

conversion rate applies. Fee is assessed as a percentage of the U.S. dollar amount of

each International Transaction made with your Card. See the section labeled “International

Transactions” in your Cardholder Agreement for additional information. If this fee applies to

your transaction, it will be included in the transaction amount on your statement.

Mastercard Cross

Border Assessment

0.0%

This fee applies if a transaction is initiated in U.S. dollars by a merchant with a non-U.S.

country code. Fee is assessed as a percentage of the U.S. dollar amount of each International

Transaction made with your Card. See the section labeled “International Transactions” in your

Cardholder Agreement for additional information. If this fee applies to your transaction, it will

be included in the transaction amount on your statement.

Other

Reissuance of Lost/

Stolen Card

$0.00

Reissued Card shipped via U.S. mail 7-10 business days after order placed. One replacement

Card provided at no charge each calendar year.

Priority Shipping Fee

$8.00

Additional fee to ship replacement Card 4-7 business days after order placed. Reissuance of

Card Fee also applies.

Additional Disclosures

Your funds are eligible for deposit insurance up to the applicable limits by the Federal Deposit Insurance Corporation (“FDIC”).

Your funds will be held at My Banking Direct, a service of New York Community Bank, an FDIC-insured institution. Once

there, your funds are insured up to $250,000 by the FDIC in the event New York Community Bank fails, if specific deposit

insurance requirements are met and your card is registered. See fdic.gov/deposit/deposits/prepaid.html fo

r details.

No overdraft/credit feature.

Contact Customer Service by calling 1-800-684-7051, by mail at 2900 Westside Parkway, Alpharetta, GA 30004, or visit our Website at

moneynetwork.com/EDD.

For general information about prepaid accounts, visit cfpb.gov/prepaid.

If you have a complaint about a prepaid account, call the Consumer Financial Protection Bureau at 1-855-411-2372 or visit cfpb.gov/complaint.

©2023 Money Network Financial, LLC. Cards issued by My Banking Direct, a service of Flagstar N.A., Member FDIC.

All trademarks, service marks and trade names referenced in these materials are the property of their respective owners. FSB ST GOV D 23/03

List of all fees (Long Form) for the Money Network

®

State Government Disbursement Program

(continued)

Page 5 of 13

DE 2501 Rev. 81.1 (2-24) INTERNET Instruction & Information F

FEDERAL PRIVACY ACT.

The EDD requires disclosure of Social Security numbers to comply with California Unemployment Insurance Code,

sections 1253 and 2627; with California Code of Regulations, Title 22, sections 1085, 1088, and 1326; with Code of

Federal Regulations, Title 20, Part 604; and with U.S. Code, Title 8, sections 1621, 1641, and 1642.

INFORMATION COLLECTION AND ACCESS.

State law requires the following information to be provided when collecting information from individuals:

Agency Name:

Employment Development Department (EDD)

Title of Ocial Responsible for Information Maintenance:

Manager, EDD State Disability Insurance Office

Local Contact Person:

Manager,

EDD State Disability Insurance Office

Contact Information:

You may contact State Disability Insurance by calling 1-800-480-3287.

A list of State Disability Insurance local office locations can be found on the

Internet at edd.ca.gov/disability/Contact_DI.htm.

The address and phone number of State Disability Insurance will also appear

on the “Notice of Computation,” DE 429D, issued at the time your benefit

determination is made.

Maintenance of the information is authorized by:

California Unemployment Insurance Code, sections 2601 through 3272.

California Code of Regulations, Title 22, sections 2706-1, 2706-3, 2708-1, and 2710-1.

Consequences of not providing all or any part of the requested information:

• Failure to supply any or all information may cause delay in issuing benefit payments or may cause you to be denied

benefits to which you are entitled.

• If you willfully make a false statement or representation or knowingly withhold a material fact to obtain or increase

any benefit or payment, the EDD will disqualify you from receiving benefits and/or services and may initiate criminal

prosecution against you.

Principal purpose(s) for which the information is to be used:

• To determine eligibility for Disability Insurance benefits.

• To be summarized and published in statistical form for the use and information of government agencies and the public

(your name and identification will not appear in publications).

• To be used to locate persons who are being sought for failure to provide child, spousal, or other court-ordered support.

• To be used by other governmental agencies to determine eligibility for public social services under the provisions of

California Welfar

e and

Institutions

Code,

Division

9.

• To be used by the EDD to carry out its responsibilities under the California Unemployment Insurance Code.

• To be exchanged pursuant to California Unemployment Insurance Code, section 322, and California Civil Code, section

1798.24, with other governmental departments and agencies, both federal and state, which are concerned with

any of

the

following:

(1) Administration of an Unemployment Insurance program.

(2) Collection of taxes which may be used to finance Unemployment Insurance or State Disability Insurance.

(3) Relief of unemployed or destitute individuals.

(4) Investigation of labor law violations or allegations of unlawful employment discrimination.

(5) The hearing of workers’ compensation appeals.

(6) Whenever

necessary to permit a state agency to carry out

its mandated responsibilities where the use to which

the information will be put is compatible with the purpose for which it was gathered.

(7) When mandated by state or federal law. Disclosures under California Unemployment Insurance Code, section 322,

will be

made only in those instances in which it furthers the administration of the programs mandated by that Code.

• Pursuant to California Unemployment Insurance Code, sections 1095 and 2714: (1) Information may be revealed

to

the extent necessary for the administration of public social services, to the Director of Social Services or his/her

representatives, or to the Director of Child Support Services or his/her representatives; (2) Claimant identity may be

released to the Department of Rehabilitation.

• Information shall be disclosed to authorized

agencies in accordance with California Unemployment Insurance Code,

sections 1095 and 2714.

Page 6

of 1

3

Claim for Disability Insurance (DI) Benefits

Health Insurance Portability and Accountability Act (HIPAA) Authorization

(Person/Organization providing the information) to furnish and disclose all my health

information and to allow inspection of and provide copies of any medical, vocational

rehabilitation, and billing records concerning my disability for which this claim is filed

that are within their knowledge to the following employees of the California Employment

Development Department (EDD): Disability Insurance Branch examiners, their direct

supervisors/managers and any other EDD employee who may have a need to access

this information in order to process my claim and/or determine eligibility for State

Disability Insurance benefits.

I understand that EDD is not a health plan or health care provider, so the information

released to EDD may no longer be protected by federal privacy regulations.

(45 CFR Section 164.508(c)(2)(iii)). EDD may disclose information as authorized by

the California Unemployment Insurance Code.

I agree that photocopies of this authorization shall be as valid as the original.

I understand I have the right to revoke this authorization by sending written notification

stopping this authorization to EDD, DI Branch MIC 29, PO Box 826880, Sacramento,

CA 94280. The authorization will stop on the date my request is received. I understand

that the consequences for my revoking this authorization may result in denial of further

State Disability Insurance benefits.

I understand that, unless revoked by me in writing, this authorization is valid for fifteen

years from the date received by EDD or the effective date of the claim, whichever is

later. I understand that I may not revoke this authorization to avoid prosecution or to

prevent EDD’s recovery of monies to which it is legally entitled.

I understand that I am signing this authorization voluntarily and that payment or

eligibility for my benefits will be affected if I do not sign this authorization. The

consequences for my refusal to sign this authorization may result in an incomplete

claim form that cannot be processed for payment of State Disability Insurance benefits.

I understand I have the right to receive a copy of this authorization.

I authorize

Claimant Signature (Do Not Print)

Date Signed

Claimant Social Security Number

Claimant Name

(First) (MI) (Last)

M

M D D Y Y Y Y

DE 2501 Rev. 81.1 (2-24) (INTERNET) Page 7 of 13

SAMPLE, this page for reference only

Sample Claimant

Geoff Booker

12252015

000000000

Sample Claimant

A1. YOUR SOCIAL SECURITY

NUMBER

A5. IF YOU EVER USED OTHER SOCIAL SECURITY NUMBERS,

ENTER THOSE NUMBERS BELOW

A12. LANGUAGE YOU PREFER TO USE

A13. YOUR MAILING ADDRESS, PO BOX OR NUMBER/STREET/APARTMENT, SUITE, SPACE#, OR PMB#

(PRIVATE MAIL BOX)

A15. YOUR LAST OR CURRENT EMPLOYER - IF YOUR LAST OR CURRENT EMPLOYMENT WAS SELF-EMPLOYMENT, ENTER “SELF” AND FILL-IN THIS OPTION.

CITY

CITY

CITY

NUMBER/STREET/SUITE# (STATE GOVERNMENT EMPLOYEES: PLEASE PROVIDE THE ADDRESS OF YOUR PERSONNEL OFFICE)

A8. YOUR LEGAL NAME (FIRST) SUFFIX

SUFFIX

SUFFIX

ENGLISH

A10. YOUR HOME AREA CODE AND TELEPHONE NUMBER

A11. YOUR CELL AREA CODE AND TELEPHONE NUMBER

A2. IF YOU HAVE PREVIOUSLY BEEN ASSIGNED AN EDD

CUSTOMER ACCOUNT NUMBER, ENTER THAT NUMBER HERE

A4. GENDER

MALE

A3. CALIFORNIA DRIVER

LICENSE OR ID NUMBER

A7. YOUR DATE OF BIRTH

A6. STATE GOVERNMENT EMPLOYEE

(IF “YES” INDICATE BARGAINING UNIT#)

YES

M

M D D Y Y Y Y

NO UNIT#

PART A - CLAIMANT’S STATEMENT

Your disability claim can also be filed online at www.edd.ca.gov

PLEASE PRINT WITH BLACK INK.

SELF

A14. YOUR RESIDENCE ADDRESS, REQUIRED IF DIFFERENT FROM YOUR MAILING ADDRESS

NUMBER/STREET/APARTMENT OR SPACE#

A9. OTHER NAMES, IF ANY, UNDER WHICH YOU HAVE WORKED

(FIRST) (MI) (LAST)

(FIRST)

(MI) (LAST)

A17. BEFORE YOUR DISABILITY BEGAN, WHAT

WAS THE LAST DAY YOU WORKED?

M

M D D Y Y Y Y

A18. WHEN DID YOUR DISABILITY BEGIN?

MM

MM DD DD YY YY YY YY

A21 A. IF YOU RECOVERED, ENTER DATE: A21 B. IF YOU RETURNED TO WORK,

ENTER DATE:

M

M

M

M

D

D

D

D

Y

Y

Y

Y

Y

Y

Y

Y

A20. SINCE YOUR DISABILITY BEGAN, HAVE YOU WORKED OR

ARE YOU WORKING ANY FULL OR PARTIAL DAYS?

YES NO

A16. AT ANY TIME DURING YOUR DISABILITY, WERE YOU IN THE CUSTODY OF LAW ENFORCEMENT

AUTHORITIES BECAUSE YOU WERE CONVICTED OF

VIOLATING A LAW OR ORDINANCE?

YES NO

EMPLOYER’S TELEPHONE NUMBER

FEMALE

(MI) (LAST)

SPANISH CANTONESE VIETNAMESE ARMENIAN PUNJABI TAGALOG OTHER

STATE

STATE

STATE

ZIP OR POSTAL CODE

ZIP OR POSTAL CODE

ZIP OR POSTAL CODE

COUNTRY

(IF NOT U.S.A.)

COUNTRY (IF NOT U.S.A.)

COUNTRY (IF NOT U.S.A.)

NAME OF YOUR EMPLOYER [STATE GOVERNMENT EMPLOYEES: PROVIDE THE AGENCY NAME (FOR EXAMPLE: CALTRANS)]

A19. DATE YOU WANT YOUR CLAIM TO BEGIN IF DIFFERENT THAN THE DATE ENTERED IN A18

DE 2501 Rev. 81.1 (2-24) (INTERNET) Page 8 of 13

SAMPLE, this page for reference only

000000000

999 0236789

499 3111111

123 Any Street

Roadrunner Pastries

647 Armistice Way

Anywhere 66222CA

Anytown CA 12345

111 0020047

Z1234567

01011900

No X

X

X

Sample

X

X

12012015

12162015

Claimant

A34. WORKERS’ COMPENSATION INSURANCE COMPANY NAME AREA CODE AND TELEPHONE NUMBER EXTENSION (IF ANY)

NUMBER/STREET/SUITE#

CITY STATE ZIP CODE WORKERS’ COMPENSATION CLAIM NUMBER

A25. HOW WOULD YOU DESCRIBE OR CLASSIFY YOUR JOB?

Mostly sit; occasionally stand or walk; occasionally lift, carry, push, pull, or otherwise move objects that weigh 10 lbs. or less.

Mostly walk/stand; occasionally lift, carry, push, pull, or otherwise move objects that weigh up to 20 lbs.

Constantly lift, carry, push, pull, or otherwise move objects that weigh up to 10 lbs.; frequently up to 20 lbs.; occasionally up to 50 lbs.

A33. DATE(S) OF INJURY SHOWN ON YOUR WORKERS’ COMPENSATION CLAIM

M

M M M

M

M M M

D

D D D

D

D D D

Y

Y Y Y

Y

Y Y Y

Y

Y Y Y

Y

Y Y Y

A26. IF YOUR EMPLOYER(S) CONTINUED OR WILL CONTINUE TO PAY YOU DURING YOUR DISABILITY, INDICATE

TYPE OF PAY:

A27. MAY WE DISCLOSE BENEFIT PAYMENT

INFORMATION TO YOUR EMPLOYER(S)?

YES NO

OTHER (EXPLAIN)

A28. SECOND EMPLOYER NAME (IF YOU HAVE MORE THAN ONE EMPLOYER)

NUMBER/STREET/SUITE#

CITY

BEFORE YOUR DISABILITY BEGAN, WHAT WAS THE LAST DAY YOU WORKED FOR THIS EMPLOYER?

M

M D D Y Y Y Y

A30. IF YOU ARE A RESIDENT OF AN ALCOHOLIC RECOVERY HOME OR A DRUG-FREE RESIDENTIAL FACILITY, PROVIDE THE FOLLOWING:

NAME OF FACILITY

NUMBER/STREET/SUITE#

CITY

A24. WHY DID YOU STOP WORKING? (SELECT ONLY ONE BOX)

LAYOFF UNPAID LEAVE OF ABSENCE VOLUNTARILY QUIT OR RETIRED TERMINATED OTHER REASON

ILLNESS, INJURY, OR PREGNANCY

A29. IF YOU HAVE MORE THAN 2 EMPLOYERS CHECK HERE.

PART A - CLAIMANT’S STATEMENT - CONTINUED

A22. PLEASE RE-ENTER YOUR SOCIAL SECURITY NUMBER

A31. HAVE YOU FILED OR DO YOU INTEND TO FILE FOR WORKERS’ COMPENSATION BENEFITS?

YES - COMPLETE ITEMS A32 THROUGH A38 NO - SKIP ITEMS A33 THROUGH A38

A32. WAS THIS DISABILITY CAUSED BY YOUR JOB?

YES NO

A23. WHAT IS YOUR REGULAR OR CUSTOMARY OCCUPATION?

Constantly lift, carry, push, pull, or otherwise move objects that weigh over 20 lbs.; frequently over 50 lbs.; occasionally over 100 lbs.

Constantly lift, carry, push, pull, or otherwise move objects that weigh up to 20 lbs.; frequently up to 50 lbs.; occasionally up to 100 lbs.

ANNUALSICK VACATION

Paid Time Off

(PTO)

STATE

STATE

ZIP OR POSTAL CODE

ZIP OR POSTAL CODE AREA CODE AND TELEPHONE NUMBER

COUNTRY (IF NOT U.S.A.)

EMPLOYER’S TELEPHONE NUMBER

DE 2501 Rev. 81.1 (2-24) (INTERNET) Page 9 of 13

SAMPLE, this page for reference only

000000000

Pastry Chef

X

X

Cosmic Cookies

469 Thrifty Way

Bluebell 84369

12162015

CA

ATTORNEY’S ADDRESS NUMBER/STREET/SUITE#

CITY STATE ZIP CODE

WORKERS’ COMPENSATION APPEALS

BOARD/ADJ CASE NUMBER

A38. YOUR ATTORNEY’S NAME (IF ANY) FOR YOUR WORKERS’ COMPENSATION CASE AREA CODE AND TELEPHONE NUMBER EXTENSION (IF ANY)

A36. WORKERS’ COMPENSATION ADJUSTER’S NAME AREA CODE AND TELEPHONE NUMBER EXTENSION (IF ANY)

A37. EMPLOYER’S NAME SHOWN ON YOUR WORKERS’ COMPENSATION CLAIM AREA CODE AND TELEPHONE NUMBER EXTENSION (IF ANY)

A39. SELECT YOUR PREFERRED PAYMENT METHOD

o

EDD DEBIT CARD

SM

o

CHECK

A41. IF YOUR SIGNATURE IS MADE BY MARK (X), CHECK THE BOX AND IT MUST BE ATTESTED BY TWO WITNESSES WITH THEIR ADDRESSES.

1st WITNESS SIGNATURE (PRINT AND SIGN)

2nd WITNESS SIGNATURE (PRINT AND SIGN)

NUMBER/STREET/APARTMENT OR SPACE#, PO BOX OR PRIVATE MAIL BOX ADDRESSES NOT ACCEPTABLE.

NUMBER/STREET/APARTMENT OR SPACE#, PO BOX OR PRIVATE MAIL BOX ADDRESSES NOT ACCEPTABLE.

(FIRST) (MI) (LAST)

CITY STATE ZIP CODE

CITY STATE ZIP CODE

A40. Declaration and Signature. By my signature on this claim statement, I claim benefits and certify that for the period covered by

this claim I was unemployed and disabled. I understand that willfully making a false statement or concealing a material fact in order to

obtain payment of benefits is a violation of California law and that such violation is punishable by imprisonment or fine or both. I declare

under penalty of perjury that the foregoing statement, including any accompanying statements, is to the best of my knowledge and

belief true, correct, and complete. By my signature on this claim statement, I authorize the California Department of Industrial Relations

and my employer to furnish and disclose to State Disability Insurance all facts concerning my disability, wages or earnings, and benefit

payments that are within their knowledge. By my signature on this claim statement, I authorize release and use of information as stated

in the “Information Collection and Access” portion of this form (see Informational Instructions, page D). I agree that photocopies of this

authorization shall be as valid as the original, and I understand that authorizations contained in this claim statement are granted for a

period of fifteen years from the date of my signature or the effective date of the claim, whichever is later.

CLAIMANT’S SIGNATURE (DO NOT PRINT) OR SIGNATURE MADE BY MARK (X)

DATE SIGNED

DATE SIGNED

DATE SIGNED

A42. CHECK THIS BOX IF YOU ARE THE PERSONAL REPRESENTATIVE SIGNING ON BEHALF OF CLAIMANT AND COMPLETE THE FOLLOWING:

THIS MATTER AS AUTHORIZED BY DECLARATION OF INDIVIDUAL CLAIMING DISABILITY INSURANCE BENEFITS DUE AN INCAPACITATED OR DECEASED

CLAIMANT, DE

2522 (SEE INSTRUCTION & INFORMATION A, UNDER HOW TO APPLY #4) POWER OF ATTORNEY (ATTACH COPY)

, REPRESENT THE CLAIMANT IN

M

M

M

M

M

M

D

D

D

D

D

D

Y

Y

Y

Y

Y

Y

Y

Y

Y

Y

Y

Y

PERSONAL REPRESENTATIVE’S SIGNATURE (DO NOT PRINT)

DATE SIGNED

M

M D D Y Y Y Y

I,

PART A - CLAIMANT’S STATEMENT - CONTINUED

A35. PLEASE RE-ENTER YOUR SOCIAL SECURITY NUMBER

DE 2501 Rev. 81.1 (2-24) (INTERNET) Page 10 of 13

SAMPLE, this page for reference only

000000000

12162015

Sample Claimant

MAILING ADDRESS, PO BOX OR NUMBER/STREET/SUITE#

FACILITY ADDRESS, NUMBER/STREET/SUITE#

FACILITY NAME

(IF APPLICABLE)

B11. PHYSICIAN/PRACTITIONER’S ADDRESS

COUNTY HOSPITAL/GOVERNMENT FACILITY ADDRESS

B13. AT ANY TIME DURING YOUR ATTENDANCE FOR THIS MEDICAL PROBLEM, HAS THE PATIENT BEEN INCAPABLE OF PERFORMING HIS/HER REGULAR

OR CUSTOMARY WORK?

B5. PATIENT’S NAME (FIRST) (MI) (LAST)

(MI) (LAST)

(FIRST) SUFFIX

B10. PHYSICIAN/PRACTITIONER’S NAME AS SHOWN ON LICENSE

B12. THIS PATIENT HAS BEEN UNDER MY CARE AND TREATMENT FOR THIS MEDICAL PROBLEM

AT INTERVALS OF:

DAILY WEEKLY MONTHLY AS NEEDED OTHER

FROM

TO

B6. PHYSICIAN/PRACTITIONER’S LICENSE NUMBER

B7. STATE OR COUNTRY (IF NOT U.S.A.) THAT ISSUED LICENSE NUMBER ENTERED IN B6

STATE COUNTRY

B3. IF YOU KNOW THE PATIENT’S ELECTRONIC RECEIPT NUMBER, ENTER IT HERE: B4. PATIENT’S DATE OF BIRTH

M

M

M

M

M

M

M

M

D

D

D

D

D

D

D

D

Y

Y

Y

Y

Y

Y

Y

Y

Y

Y

Y

Y

Y

Y

Y

Y

Claim for Disability Insurance (DI) Benefits -

Physician/Practitioner’s Certificate

PLEASE PRINT WITH BLACK INK.

B1. PATIENT’S SOCIAL SECURITY NUMBER

PART B - PHYSICIAN/PRACTITIONER’S CERTIFICATE

CITY

CITY STATE ZIP OR POSTAL CODE COUNTRY (IF NOT U.S.A.)

M

M D D Y Y Y Y

CHECK HERE TO INDICATE YOU ARE STILL TREATING THE PATIENT

YES - ENTER DATE DISABILITY BEGAN

WAS THE DISABILITY CAUSED BY AN ACCIDENT OR TRAUMA?

IF YES, INDICATE THE DATE THE ACCIDENT OR TRAUMA OCCURRED.

NO - SKIP TO B33

YES

R

NO

B15. IF PATIENT IS NOW PREGNANT OR HAS BEEN PREGNANT, PLEASE CHECK THE APPROPRIATE BOX AND ENTER THE FOLLOWING:

ESTIMATED DELIVERY DATE: DATE PREGNANCY ENDED:

M

M

M

M

D

D

D

D

Y

Y

Y

Y

Y

Y

Y

Y

TYPE OF DELIVERY, IF PATIENT HAS DELIVERED: VAGINAL CESAREAN

M

M D D Y Y Y Y

B14. DATE YOU RELEASED OR ANTICIPATE RELEASING PATIENT TO RETURN TO HIS/HER REGULAR OR CUSTOMARY WORK

(“UNKNOWN”, “INDEFINITE”, ETC., NOT ACCEPTABLE.)

CHECK HERE TO INDICATE PATIENT’S DISABILITY IS PERMANENT AND YOU NEVER ANTICIPATE RELEASING PATIENT TO RETURN TO HIS/HER

REGULAR OR CUSTOMARY WORK

B8. PHYSICIAN/PRACTITIONER LICENSE TYPE B9. SPECIALTY (IF ANY)

B2. PATIENT’S FILE NUMBER

STATE ZIP OR POSTAL CODE COUNTRY

(IF NOT U.S.A.)

DE 2501 Rev. 81.1 (2-24) (INTERNET) Page 11 of 13

SAMPLE, this page for reference only

000000000

69-642-38

01011900

Sample

634-027930

MD

Geoff

269 Commerce

Anywhere

12162015

12162015

X

X

X

72694

Booker

CA

CA

Claimant

PART B - PHYSICIAN/PRACTITIONER’S CERTIFICATE - CONTINUED

B16. PLEASE RE-ENTER PATIENT’S SOCIAL SECURITY NUMBER

B22. TYPE OF TREATMENT/MEDICATION RENDERED TO PATIENT

B21. FINDINGS - STATE NATURE, SEVERITY, AND EXTENT OF THE INCAPACITATING DISEASE OR INJURY, INCLUDE ANY OTHER DISABLING CONDITIONS

B24. CHECK HERE IF PATIENT IS DECEASED, PLEASE PROVIDE DATE OF DEATH

M

M D D Y Y Y Y

B23. IF PATIENT WAS HOSPITALIZED, PROVIDE DATES OF ENTRY AND DISCHARGE

MM

MM DD DD YY YY YY YY

TO

CHECK HERE TO INDICATE THE PATIENT IS STILL HOSPITALIZED

B20. DIAGNOSIS (REQUIRED) - IF NO DIAGNOSIS HAS BEEN DETERMINED, ENTER A DETAILED STATEMENT OF SYMPTOMS

CITY COUNTY STATE

B18. IN CASE OF AN ABNORMAL PREGNANCY AND/OR DELIVERY, STATE THE COMPLICATION(S) CAUSING MATERNAL DISABILITY

B17. IF THE PATIENT HAS NOT DELIVERED AND YOU DO NOT ANTICIPATE RELEASING THE PATIENT TO RETURN TO REGULAR OR CUSTOMARY WORK PRIOR

TO THE ESTIMATED DELIVERY DATE, ENTER THE NUMBER OF DAYS THAT THE PATIENT WILL BE DISABLED POSTPARTUM, FOR EACH DELIVERY TYPE:

VAGINAL DELIVERY CESAREAN DELIVERY

B19. ICD DIAGNOSIS CODE(S) FOR DISABLING CONDITION THAT PREVENT THE PATIENT FROM

PERFORMING HIS/HER REGULAR OR CUSTOMARY WORK (REQUIRED)

ICD-9

ICD-10

EXAMPLE OF HOW TO

COMPLETE ICD CODES

.

.

..

.

(Check only one box)

ICD-9 3 2 0

1

ICD-10 G 0 0

1

PRIMARY

SECONDARY

SECONDARY

SECONDARY

DE 2501 Rev. 81.1 (2-24) (INTERNET) Page 12 of 13

SAMPLE, this page for reference only

000000000

552 92XA

Broken left forearm closed fracture

Unable to use left arm and hand

Cast immobilize arm

X

PART B - PHYSICIAN/PRACTITIONER’S CERTIFICATE - CONTINUED

UNDER SECTIONS 2116 AND 2122 OF THE CALIFORNIA UNEMPLOYMENT INSURANCE CODE, IT IS A VIOLATION FOR ANY INDIVIDUAL

WHO, WITH INTENT TO DEFRAUD, FALSELY CERTIFIES THE MEDICAL CONDITION OF ANY PERSON IN ORDER TO OBTAIN DISABILITY

INSURANCE BENEFITS, WHETHER FOR THE MAKER OR FOR ANY OTHER PERSON, AND IS PUNISHABLE BY IMPRISONMENT AND/OR A

FINE NOT EXCEEDING $20,000. SECTION 1143 REQUIRES ADDITIONAL ADMINISTRATIVE PENALTIES.

B33.

PHYSICIAN/PRACTITIONER’S: I CERTIFY UNDER PENALTY OF PERJURY THAT THE PATIENT IS UNABLE TO PERFORM HIS/HER REGULAR OR

CUSTOMARY WORK BECAUSE OF THE LISTED DISABLING CONDITION(S). I HAVE PERFORMED A PHYSICAL EXAMINATION AND/OR TREATED THE

PATIENT. I AM AUTHORIZED TO CERTIFY A PATIENT DISABILITY OR SERIOUS HEALTH CONDITION PURSUANT TO CALIFORNIA UNEMPLOYMENT

INSURANCE CODE SECTION 2708.

PHYSICIAN/PRACTITIONER’S ORIGINAL SIGNATURE - RUBBER STAMP

IS NOT ACCEPTABLE

M

M D D Y Y Y Y

AREA CODE/PHONE NUMBER DATE SIGNED

B31. DATE YOUR PATIENT BECAME A RESIDENT OF A DRUG OR ALCOHOL FACILITY (IF KNOWN)

B32. WOULD DISCLOSURE OF THE INFORMATION ON THIS FORM BE MEDICALLY OR PSYCHOLOGICALLY DETRIMENTAL TO YOUR PATIENT?

M

M D D Y Y Y Y

YES NO

B25. PLEASE RE-ENTER PATIENT’S SOCIAL SECURITY NUMBER

B30. ARE YOU COMPLETING THIS FORM FOR THE SOLE PURPOSE OF REFERRAL/RECOMMENDATION TO AN ALCOHOLIC RECOVERY HOME OR DRUG-FREE

RESIDENTIAL FACILITY AS INDICATED BY THE PATIENT IN QUESTION A30?

B29. WAS THIS DISABLING CONDITION CAUSED AND/OR AGGRAVATED BY THE PATIENT’S REGULAR OR CUSTOMARY WORK? YES

YES

B28. ICD PROCEDURE CODE(S)

CPT CODE(S) (DO NOT INCLUDE MODIFIERS)

B27. DATE AND TYPE OF SURGERY/PROCEDURE MOST RECENTLY PERFORMED OR TO BE PERFORMED

WAS THE PATIENT UNABLE TO WORK IMMEDIATELY PRIOR TO THE SURGERY OR PROCEDURE?

IF YES, PLEASE PROVIDE THE FIRST DATE THE PATIENT WAS UNABLE TO WORK BEFORE THE SURGERY OR PROCEDURE

M

M

M

M

D

D

D

D

Y

Y

. . . .

Y

Y

Y

Y

Y

Y

YES NO

ICD-9 ICD-10

B26. WAS THE PATIENT SEEN PREVIOUSLY BY ANOTHER PHYSICIAN/PRACTITIONER OR MEDICAL FACILITY FOR THE CURRENT DISABILITY/ILLNESS/INJURY?

M

M D D Y Y Y Y

YES NO UNKNOWN IF YES, WHAT WAS THE DATE OF FIRST TREATMENT?

NO

NO

DE 2501 Rev. 81.1 (2-24) (INTERNET) Page 13 of 13

SAMPLE, this page for reference only

000000000

X

X

X

12172015 423 0024693Geoff Booker