1

U.S. Department of the Treasury

State Small Business Credit Initiative

Capital Program Policy Guidelines

Revised December 4, 2023

1

Table of Contents

Section I. Overview ........................................................................................................................ 4

Section II. Eligible Programs .......................................................................................................... 4

Section III. Main Capital Allocation – 12 U.S.C. § 5702(b) and (c) .............................................. 5

a. Allocation Formula – 12 U.S.C. § 5702(b) ......................................................................... 5

b. Tranching and Deployment – 12 U.S.C. § 5702(c)(1) ........................................................ 6

c. Termination of Amounts Not Transferred; Reallocations – 12 U.S.C. § 5702(c)(4) ......... 7

Section IV. SEDI-Owned Business Allocations ............................................................................. 8

a. $1.5 billion Allocation for SEDI-Owned Businesses – 12 U.S.C. § 5702(d) ..................... 8

Allocation Methodology and Disbursement Schedule ................................................ 8

“Expended For” Requirement .................................................................................... 9

b. $1.0 billion Incentive Allocation for SEDI-Owned Businesses – 12 U.S.C. § 5702(e) ... 11

Section V. Allocation for VSBs – 12 U.S.C. § 5702(f) ................................................................ 12

Section VI. Approving Jurisdictions for Participation .................................................................. 13

a. Designation of Administrative Responsibility – 12 U.S.C. §§ 5703(b)(1) and (b)(2) ...... 13

b. Applications, Generally – 12 U.S.C. § 5703(b) ................................................................ 13

c. Contractual Arrangements – 12 U.S.C. § 5703(c) ............................................................ 14

d. Tribal Governments – 12 U.S.C. §§ 5701(10)(E), 5702(b)(2)(C), 5703(b)-(c)................ 14

e. Municipalities – 12 U.S.C. § 5703(d) ............................................................................... 15

Section VII. Approving CAPs ...................................................................................................... 15

a. In General.......................................................................................................................... 15

b. Federal Contribution – 12 U.S.C. § 5704(d) ..................................................................... 15

c. CAP Experience and Capacity Program Requirement – 12 U.S.C. § 5704(e)(1) ............ 16

d. Lender Capital at Risk – 12 U.S.C. § 5704(e)(4).............................................................. 17

e. Borrower and Loan Size Requirements – 12 U.S.C. § 5704(c)(4) ................................... 18

1

The Capital Program Policy Guidelines were initially released on November 10, 2021 and were revised on

October 7, 2022, December 15, 2022, June 15, 2023, August 16, 2023, and December 4, 2023. Appendix 1

summarizes the substantive revisions.

2

f. Loan Purpose Requirements and Prohibitions – 12 U.S.C. § 5704(e)(7) ......................... 18

Business Purpose Generally – 12 U.S.C. § 5704(e)(7)(A)(i)(I) ................................ 18

Business Purpose: Passive Real Estate Investment Guidance – 12 U.S.C.

§ 5704(e)(7)(A)(i)(I).................................................................................................. 19

Prohibited Loan Purposes – 12 U.S.C. § 5704(e)(7)(A)(i)(II) ................................. 21

Borrower Restrictions – 12 U.S.C. § 5704(e)(7)(A)(i)(III) ....................................... 21

Additional Borrower Restrictions – 12 U.S.C. § 5704(e)(7)(A)(iv) .......................... 22

Lender Assurances – 12 U.S.C. § 5704(e)(7)(A)(ii) and (iii) ................................... 23

Lender Assurances: Refinancing and New Extensions of Credit – 12 U.S.C.

§ 5704(e)(7)(A)(ii) .................................................................................................... 24

g. Monitoring the Annual Claims Rate ................................................................................. 25

Section VIII. Approving OCSPs ................................................................................................... 25

a. In General.......................................................................................................................... 25

b. 10:1 Financing – 12 U.S.C. § 5705(c)(2).......................................................................... 26

c. 1:1 Financing – 12 U.S.C. § 5705(c)(1) ............................................................................ 27

d. Lender or Investor Capital at Risk – 12 U.S.C. § 5705(c)(3) ........................................... 28

Lenders ...................................................................................................................... 28

Debt Investors ........................................................................................................... 29

Equity Investors ........................................................................................................ 29

e. Borrower/Investee and Loan/Investment Size Requirements – 12 U.S.C. § 5705(c)(4) .. 30

f. Loan/Investment Purpose Requirements and Prohibitions – 12 U.S.C. § 5705(f) ........... 30

Generally................................................................................................................... 30

Equity/Venture Capital Programs: Conflict-of-Interest Standards .......................... 31

Equity/Venture Capital Programs: Certification Relating to Sex Offenses ............. 33

Tribal Programs: Conflict-of-Interest Standards ..................................................... 34

g. Additional Considerations for Approving OCSPs ............................................................ 34

Anticipated Benefits to the Jurisdiction – 12 U.S.C. § 5705(d)(1) ........................... 34

OCSP Experience and Capacity – 12 U.S.C. § 5705(d)(2) ...................................... 35

OCSP Capacity to Manage Increases – 12 U.S.C. § 5705(d)(3) .............................. 36

OCSP Accounting and Administrative Controls – 12 U.S.C. § 5705(d)(4) .............. 36

OCSP Program Design and Implementation Plan – 12 U.S.C. § 5705(d)(5) .......... 36

h. Relationship to Tax Credit Programs ................................................................................ 37

i. Additional Guidance Regarding Equity/Venture Capital Programs ................................. 37

Multi-Jurisdiction Funds .......................................................................................... 37

3

Services to Portfolio Companies ............................................................................... 37

Incubation and Early-Stage Investment Models ....................................................... 38

Reporting................................................................................................................... 39

Section IX. Other SSBCI Program Requirements ........................................................................ 40

a. Capital Access in Underserved Communities................................................................... 40

b. Compliance with Civil Rights Requirements ................................................................... 41

c. In-Jurisdiction and Out-of-Jurisdiction Loans and Investments ....................................... 41

d. Enrollment of Loans in Loan-Related SSBCI Programs .................................................. 42

e. Relationship to SBA Lending Programs and Other Federal Loans .................................. 43

f. Minimum National Customer Protection Standards ......................................................... 43

g. Disclosure of Terms .......................................................................................................... 45

Section X. Reporting ..................................................................................................................... 46

Section XI. Administrative Costs – 12 U.S.C. § 5702(c)(3)(C)-(D) ............................................ 47

Section XII. Un-enrollment – 12 U.S.C. § 5702(c)(1)(C) ............................................................ 47

a. Requesting Approval to Replenish and Un-enroll ............................................................ 47

b. Documentation for the Replenishment of Loans and Investments ................................... 48

4

Section I. Overview

The American Rescue Plan Act of 2021 (ARPA) reauthorized and amended the Small

Business Jobs Act of 2010 (SBJA) to provide $10 billion to fund the State Small Business Credit

Initiative (SSBCI) as a response to the economic effects of the COVID-19 pandemic. SSBCI is a

federal program administered by the Department of the Treasury (Treasury) that was created to

strengthen state programs that support private financing to small businesses.

2

SSBCI is expected

to, in conjunction with new small business financing, create billions of dollars in lending and

investments to small businesses that are not getting the support they need to expand and create

jobs. SSBCI allows states of the United States, the District of Columbia, territories, eligible

municipalities, and Tribal governments (collectively, “jurisdictions”

3

) the opportunity to build

upon or create successful models of small business programs. ARPA provided for a $6.5 billion

main capital allocation, $1.5 billion allocation for business enterprises owned and controlled by

socially and economically disadvantaged individuals (SEDI-owned businesses), $1.0 billion

incentive allocation for SEDI-owned businesses, $500 million allocation for very small

businesses (VSBs), and $500 million allocation for technical assistance funding.

Treasury has issued separate guidelines regarding technical assistance and instructions on

how to apply. Technical assistance funding is available for each jurisdiction that completes a

timely application for an SSBCI capital program in accordance with the deadlines and guidance

published by Treasury. Applications for technical assistance will be due in accordance with the

deadlines and guidance published by Treasury.

Treasury reserves the right to waive or modify any provision of these guidelines.

Section II. Eligible Programs

SSBCI provides funding for jurisdictions’ small business lending and investment

programs. There are two program categories: Capital Access Programs (CAPs) and Other Credit

Support Programs (OCSPs).

CAPs provide portfolio insurance to lenders that make small business loans. Portfolio

insurance is provided in the form of a separate loan loss

reserve

fund for each participating

financial institution. To enroll a loan in the CAP, both the lender and the borrower must make

insurance premium payments to the reserve fund. The jurisdiction must make a matching

insurance premium payment to the reserve fund. The jurisdiction’s matching payment to the

reserve fund may be made with the jurisdiction’s allocated SSBCI funds.

2

The SSBCI provisions are codified at 12 U.S.C. § 5701 et. seq.

3

The definition of “State” in the SBJA includes “a municipality of a State of the United States to which the

Secretary has given special permission to apply under section 3004(d) [of the SBJA].” Because all states submitted

complete applications by the applicable capital program deadline, municipalities are not eligible to apply for SSBCI.

Therefore, herein, unless indicated otherwise, a “jurisdiction” means (A) one of the fifty states of the United States;

(B) the District of Columbia, the Commonwealth of Puerto Rico, the Commonwealth of Northern Mariana Islands,

Guam, American Samoa, and the United States Virgin Islands; and (C) a Tribal government, or a group of Tribal

governments that jointly apply for an allocation. See 12 U.S.C. § 5701(10) and section VI.e of these Guidelines.

5

OCSPs include other programs that provide support for small business lending and

investment that are not CAPs. These programs include collateral support programs, loan

participation programs, loan guarantee programs, and other similar programs.

4

They also include

jurisdiction-sponsored equity/venture capital programs, which involve either (i) SSBCI

investments in venture capital funds that invest in small businesses or (ii) direct investments of

SSBCI funds in small businesses alongside co-investments.

5

OCSPs also include qualifying loan

or swap funding facilities, which are contractual arrangements between a jurisdiction and a

private financial entity. Under such facilities, the jurisdiction delivers funds to the private

financial entity as collateral; that entity, in turn, provides funding to the jurisdiction. The full

amount resulting from the arrangement, less any fees or other costs of the arrangement, is

contributed to, or for the account of, an approved program.

Section III. Main Capital Allocation – 12 U.S.C. § 5702(b) and (c)

a. Allocation Formula – 12 U.S.C. § 5702(b)

The SSBCI statute, 12 U.S.C. § 5702(b), sets out a formula for the amount of main

capital funds available to jurisdictions.

6

Pursuant to the statute, Treasury allocated funds to all

fifty states along with the District of Columbia, the Commonwealth of Puerto Rico, the

Commonwealth of Northern Mariana Islands, Guam, American Samoa, and the United States

Virgin Islands according to the formula, which takes into account a jurisdiction’s job losses in

proportion to the aggregate job losses of all jurisdictions. Each state of the United States, the

District of Columbia, and territory was guaranteed a minimum allocation of 0.9 percent of the

$6 billion allocation for states, the District of Columbia, and territories. Treasury made a

separate allocation to Tribal governments based on Tribal enrollment, with a preliminary

minimum allocation of approximately 0.09 percent of the total $500 million Tribal allocation.

7

4

Collateral support programs help viable businesses that are struggling to get credit because the value of the

collateral they hold has fallen and provide banks greater confidence in extending credit to these borrowers.

Loan participation programs entail risk sharing among financial institution lenders and the participating jurisdiction.

5

“Equity/venture capital programs” refer to the broad category of programs that meet this criteria.

Jurisdiction-sponsored equity/venture capital programs typically entail joint public-private investment programs

focused on “seeding” small businesses with high-growth-potential. For purposes of SSBCI, the references to the

term “venture capital fund” refer more specifically to an entity that meets the U.S. Securities and Exchange

Commission (SEC) definition of “venture capital fund” set out at 17 C.F.R. § 275.203(l)-1, as well as any entity that

would meet that definition but for the form of the investment of SSBCI funds in the entity, e.g., via a debt

instrument (in the latter case, this deviation from the regulatory definition may have implications for the ability of

program participants to rely on the SEC’s venture capital fund definition and any associated exemption from certain

requirements under the Investment Advisers Act of 1940). Co-investments in direct investment programs may come

from a venture capital fund or a wider group of investors or funds.

6

For ease of reference, the SSBCI website includes information about allocation amounts and allocation

methodology for each jurisdiction. Please visit http://www.treasury.gov/ssbci

for more details.

7

For more information on the Tribal allocation, please see the Tribal allocation methodology publication on

Treasury’s website.

6

b. Tranching and Deployment – 12 U.S.C. § 5702(c)(1)

Pursuant to 12 U.S.C. § 5702(c)(1), each jurisdiction that is approved for participation in

the SSBCI will receive its allocation of main capital funds in three disbursements as follows:

33 percent, 33 percent, and 34 percent. The transfer of the first 33 percent will occur promptly

following the receipt of the fully signed Allocation Agreement.

8

As a precondition to receipt of

the second and third disbursements, the jurisdiction must, among other things, certify to Treasury

that the jurisdiction has expended, transferred, or obligated 80 percent or more of the prior

disbursement of allocated funds to or for the account of one or more approved programs that

have delivered loans or investments to eligible businesses (i.e., it has deployed such funds).

9

The

certification must be signed by an official of the jurisdiction with oversight responsibility for the

approved program(s). The following is a description of these requirements.

Funds Expended, Transferred, or Obligated

For purposes of determining whether a jurisdiction has “expended” a prior disbursement

of SSBCI funds, Treasury will generally consider funds expended if the expenses have been paid

by or are for an approved program. Examples of expended funds include: SSBCI funds that have

been disbursed to a lender to cover the federal contribution to a CAP reserve fund; SSBCI funds

that have been disbursed to a specific borrower (or disbursed to a specific lender or set aside as

part of a commitment to a specific transaction) as part of a loan participation, loan guarantee,

collateral support, or direct lending program; SSBCI funds that have been invested in specific

small businesses pursuant to an equity/venture capital investment; and SSBCI funds that have

been spent for allowable administrative expenses.

For purposes of determining whether a jurisdiction has “transferred” a prior disbursement

of SSBCI funds, Treasury will generally consider funds transferred if they have been transferred

by the jurisdiction receiving SSBCI funds to the implementing entity, or the contracted entity,

that is charged with administering the day-to-day operations of the SSBCI program, as a

reimbursement for actual expenses or when there is a clearly documented actual and immediate

cash need to fund a loan or investment to an eligible small business or to pay for allowable

administrative expenses. The implementing entity is the specific department, agency, or political

subdivision of the jurisdiction that has been designated to implement a program under 12 U.S.C.

§ 5703(b)(1). The term “agency” includes government corporations and other entities authorized

or supervised by the jurisdiction. The contracted entity is the entity (i.e., an entity of another

jurisdiction, for-profit third-party, or nonprofit third-party) that contracts with the jurisdiction or

its implementing entity for the implementation and administration of the SSBCI program under

12 U.S.C. § 5703(c).

8

If the jurisdiction plans to use SSBCI funds as collateral for a qualifying loan or swap funding facility, the entire

allocation is available to be transferred in a single lump sum.

9

As part of this certification, the authorizing official for the participating jurisdiction will be required to certify to

Treasury that the participating jurisdiction is in compliance with all terms of the Allocation Agreement, SSBCI

Capital Program Policy Guidelines, and the representations and warranties made in the Allocation Agreement. Upon

receipt, Treasury will review the request and accompanying certification for completeness. Treasury may ask for

records or further information that substantiates any aspect of the participating jurisdiction’s certification.

7

For purposes of determining whether a jurisdiction has “obligated” a prior disbursement

of SSBCI funds, Treasury will generally consider funds obligated if they have been committed to

pay for the amounts of orders placed, contracts awarded, goods and services received, and

similar transactions during a given period that will require payment by the approved program

during the same or a future period. Examples of obligated funds include: SSBCI funds that have

been committed, pledged, or otherwise promised, in writing, to a specific borrower as part of a

loan participation, collateral support, or direct lending program; SSBCI funds that have been set

aside to cover obligations arising from loan guarantees; SSBCI funds that have been committed,

pledged, or otherwise promised, in writing, as part of an equity/venture capital investment

transaction; and SSBCI funds that have been committed, pledged, or promised, in writing, for

allowable administrative expenses (e.g., an executed contract for services).

Delivered Loans or Investments to Eligible Businesses

As noted above, for a jurisdiction to receive a subsequent disbursement, at least

80 percent of its prior disbursement of allocated funds must have been expended, transferred, or

obligated to or for the account of one or more approved programs that have delivered loans or

investments to eligible businesses. Treasury will consider the latter requirement for the prior

disbursement to be used for approved programs that have delivered loans or investments to

eligible businesses to be satisfied if at least two transactions with eligible small businesses are

completed during every 12-month period from such programs’ inception. This latter requirement

to receive a subsequent disbursement must be fulfilled in addition to the requirement that funds

are expended, transferred, or obligated.

c. Termination of Amounts Not Transferred; Reallocations – 12 U.S.C.

§ 5702(c)(4)

Any portion of a jurisdiction’s allocation that has not been transferred to the jurisdiction

under this section may be deemed to be no longer allocated to the jurisdiction and no longer

available to the jurisdiction if:

• The second 1/3 of the jurisdiction’s allocated amount has not been transferred to the

jurisdiction before the end of the 3-year period beginning on the date that the

jurisdiction is approved for participation in the SSBCI; or

• The last 1/3 of a jurisdiction’s allocated amount has not been transferred to the

jurisdiction before the end of the 6-year period beginning on the date that the

jurisdiction is approved for participation in the SSBCI.

Any amount that is deemed to be no longer allocated to the jurisdiction and no longer

available to the jurisdiction shall be either returned to the general fund of the Treasury or

reallocated to other jurisdictions.

8

Section IV. SEDI-Owned Business Allocations

a. $1.5 billion Allocation for SEDI-Owned Businesses – 12 U.S.C. § 5702(d)

Allocation Methodology and Disbursement Schedule

The SSBCI statute, 12 U.S.C. § 5702(d), provides that the Secretary shall allocate

$1.5 billion among the jurisdictions based on the needs of SEDI-owned businesses. Treasury will

divide the $1.5 billion into a portion for states of the United States, the District of Columbia, and

territories and a portion for Tribal governments in a manner that is consistent with the division of

funds under the main capital allocation, referenced in 12 U.S.C. § 5702(b). Treasury has

determined that these portions reasonably reflect the needs of SEDI-owned businesses in the

respective jurisdictions, because these portions, determined by statute for the main capital

allocation, generally reflect small business financing needs in these jurisdictions.

Each state of the United States, the District of Columbia, or territory’s share of these

jurisdictions’ portion of the $1.5 billion SEDI allocation will be based on the percentage of the

jurisdiction’s total population residing in Community Development Financial Institution (CDFI)

Investment Areas, as defined in 12 C.F.R. § 1805.201(b)(3)(ii), relative to the total population

residing in all CDFI Investment Areas.

10

The population in CDFI Investment Areas serves as a

proxy for the needs of SEDI-owned businesses because these areas are generally low-income,

high-poverty geographies that receive neither sufficient access to capital nor support for the

needs of small businesses, including minority-owned businesses. Each Tribal government’s share

of the Tribal government portion of the $1.5 billion SEDI allocation will be determined using the

same formula as the main capital allocation, based on enrollment data, except without the

minimums.

11

Treasury has determined that the use of enrollment data reflects the needs of Tribal

SEDI-owned businesses, as Tribal members and communities have faced widespread and

long-standing lack of access to capital and investment, such that a population-based approach

provides a reasonable proxy for the extent of the needs of these businesses. The allocations are

posted on Treasury’s website.

Each jurisdiction’s SEDI allocation will be transferred in three approximately equal

tranches, with 33 percent for the first and second tranche and 34 percent for the third tranche.

The first allocation will be disbursed when the jurisdiction is approved for participation in the

SSBCI. The second and third disbursements will occur when the jurisdiction certifies that it has

deployed 80 percent of its prior tranche of SSBCI funds under the deployment standards set forth

in Section III.b above.

10

The CDFI Fund evaluates Puerto Rico, but not other territories, in identifying CDFI Investment Areas. For

purposes of the SSBCI, Treasury has also evaluated American Samoa, Guam, the Northern Mariana Islands, and the

U.S. Virgin Islands and has determined that these territories in their entirety constitute CDFI Investment Areas,

because each of these territories has a poverty rate of at least 20 percent. See 12 C.F.R. § 1805.201(b)(3)(ii)(D)(1).

11

More information about the Tribal SEDI allocation will be posted on Treasury’s website.

9

“Expended For” Requirement

A jurisdiction’s SEDI allocation must be expended for SEDI-owned businesses. A

jurisdiction is not required to establish a separate program for SEDI-owned businesses but must

maintain records of the total amount of its SSBCI funds that are expended for SEDI-owned

businesses. In light of the fungibility of SSBCI funds, Treasury will deem this “expended for”

requirement to be satisfied if an amount of the jurisdiction’s SSBCI funds equivalent to its SEDI

allocation is expended for SEDI-owned businesses. For this purpose, SSBCI funds means all

SSBCI funds disbursed to the jurisdiction—including the main capital allocation funds, VSB

allocation funds, SEDI allocation funds, and SEDI incentive allocation funds—other than

technical assistance funds.

Treasury will consider SSBCI funds to have been expended for SEDI-owned businesses

if the jurisdiction expends (as defined in Section III.b above) the funds for meeting the needs of

SEDI-owned businesses. “Meeting the needs of SEDI-owned businesses” means that the SSBCI

funds are expended for loans, investments, or other credit or equity support to:

(1) business enterprises that certify that they are owned and controlled by individuals who

have had their access to credit on reasonable terms diminished as compared to others in

comparable economic circumstances, due to their:

• membership of a group that has been subjected to racial or ethnic prejudice or

cultural bias within American society;

• gender;

• veteran status;

• limited English proficiency;

• disability;

• long-term residence in an environment isolated from the mainstream of American

society;

• membership of a federally or state-recognized Indian Tribe;

• long-term residence in a rural community;

• residence in a U.S. territory;

• residence in a community undergoing economic transitions (including

communities impacted by the shift towards a net-zero economy or

deindustrialization); or

• membership of an underserved community (see Executive Order 13985, under

which “underserved communities” are populations sharing a particular

characteristic, as well as geographic communities, that have been systematically

denied a full opportunity to participate in aspects of economic, social, and civic

life, as exemplified by the list in the definition of “equity,” and “equity” is

consistent and systematic fair, just, and impartial treatment of all individuals,

including individuals who belong to underserved communities that have been

denied such treatment, such as Black, Latino, and Indigenous and Native

American persons, Asian Americans and Pacific Islanders and other persons of

color; members of religious minorities; lesbian, gay, bisexual, transgender, and

10

queer (LGBTQ+) persons; persons with disabilities; persons who live in rural

areas; and persons otherwise adversely affected by persistent poverty or

inequality);

(2) business enterprises that certify that they are owned and controlled by individuals whose

residences are in CDFI Investment Areas, as defined in 12 C.F.R. § 1805.201(b)(3)(ii);

12

(3) business enterprises that certify that they will operate a location in a CDFI Investment

Area, as defined in 12 C.F.R. § 1805.201(b)(3)(ii); or

(4) business enterprises that are located in CDFI Investment Areas, as defined in 12 C.F.R.

§ 1805.201(b)(3)(ii).

13

The term “owned and controlled” means, if privately owned, 51 percent is owned by such

individuals; if publicly owned, 51 percent of the stock is owned by such individuals; and in the

case of a mutual institution, a majority of the board of directors, account holders, and the

community which the institution services is predominantly comprised of such individuals.

Certification will be required with regard to items (1) to (3) above. Item (3) is intended to

cover a business taking out a loan or investment to build a location in a CDFI Investment Area

that the business will operate in the future. With regard to item (4), a jurisdiction may reasonably

identify businesses located in CDFI Investment Areas based on the businesses’ addresses from

the relevant loan, investment, and credit/equity support applications without additional

certification.

Jurisdictions must use their SSBCI funds only for the purposes and activities specified in

these guidelines and other SSBCI guidance issued by Treasury, which will be incorporated by

reference into the Allocation Agreement. If the amount of a jurisdiction’s SEDI allocation is not

expended for SEDI-owned businesses, Treasury may find that the jurisdiction is non-compliant

with the Allocation Agreement, in which case Treasury may, in its sole discretion, withhold or

reduce the amount of future SSBCI disbursements to the jurisdiction or seek other available

remedies specified in the Allocation Agreement, such as the recoupment of previously disbursed

funds.

12

For each calendar year, Treasury will use the list of CDFI Investment Areas identified by the CDFI Fund as of

January 1 of that calendar year. If the CDFI Fund’s list is updated during that calendar year, the new list will not be

adopted for purposes of SSBCI until the next calendar year, in order to provide advance notice to jurisdictions.

Further, Treasury has determined that American Samoa, Guam, the Northern Mariana Islands, and the U.S. Virgin

Islands in their entirety constitute CDFI Investment Areas for purposes of the SSBCI, because each of these

territories has a poverty rate of at least 20 percent. Treasury has provided a mapping tool for the borrower or

investee to use to identify whether the relevant address is in a CDFI Investment Area, available at

https://home.treasury.gov/policy-issues/small-business-programs/state-small-business-credit-initiative-ssbci/2021-

ssbci/cdfi-fund-investment-areas.

13

See footnote 10.

11

b. $1.0 billion Incentive Allocation for SEDI-Owned Businesses – 12 U.S.C.

§ 5702(e)

Under 12 U.S.C. § 5702(e), Treasury must set aside $1 billion to increase the amount of

SSBCI funds that jurisdictions can obtain, beyond jurisdictions’ allocated amounts for the second

and third tranches of main capital, for jurisdictions that demonstrate “robust support” for

SEDI-owned businesses in the deployment of prior allocation amounts. Of this amount, Treasury

will use $500 million to provide jurisdictions additional funds for each of the second and third

tranches of main capital.

Jurisdictions demonstrate “robust support” for SEDI-owned businesses by expending

their previously disbursed SSBCI funds for meeting the needs of SEDI-owned businesses. For

this purpose, the terms “SSBCI funds,” “expend,” and “meeting the needs of SEDI-owned

businesses” have the same definitions as in Section IV.a above.

For each of the second and third tranches of main capital, Treasury will increase the

amount of SSBCI funds that a jurisdiction can obtain using a two-step process:

Step 1:

Each jurisdiction should aspire to expend a certain percentage (the SEDI Objective) of its

SSBCI funds that have been expended since the jurisdiction’s prior disbursement of main

capital allocation, SEDI allocation, and VSB allocation funds for meeting the needs of

the SEDI-owned businesses within its jurisdiction. For states of the United States, the

District of Columbia, and territories, the SEDI Objective equals the population of the

jurisdiction that are residents in CDFI Investment Areas, as defined in 12 C.F.R.

§ 1805.201(b)(3)(ii), divided by the total population of the jurisdiction.

14

For Tribal

governments, the SEDI Objective is 100 percent. These SEDI Objectives have been

established to reflect the needs of SEDI-owned businesses within each type of

jurisdiction in a manner that is consistent with the reasons described above regarding

these needs with respect to the SEDI allocation.

For each of the second and third tranches of main capital, $400 million of the

$500 million of additional funds will be available as initial eligible amounts. Each

jurisdiction’s initial eligible amount will be determined in the same manner as the

$1.5 billion SEDI allocation methodology described above, as that methodology reflects

the needs of SEDI-owned businesses. The initial eligible amounts are available on

Treasury’s website.

When a jurisdiction certifies that it has deployed 80 percent of its prior tranche of

disbursed SSBCI funds under Section III.b above, Treasury will calculate the percentage

of the jurisdiction’s SEDI Objective that the jurisdiction has achieved. The jurisdiction

will receive an additional disbursement in an amount equal to such achieved percentage

14

See footnote 10.

12

(subject to a limit of 100 percent) multiplied by the jurisdiction’s initial eligible amount.

Step 2:

For each of the second and third tranches of main capital, Treasury will make a second

disbursement from these additional funds, totaling $100 million in the aggregate plus any

other residual funds, to jurisdictions that have requested their Step 1 disbursement by the

date that Treasury sets for the second disbursement. For the second tranche of main

capital, the residual funds will include only initial eligible amounts unachieved by the

jurisdictions that have requested their Step 1 disbursement. For the third tranche of main

capital, the residual funds will include any remaining (unachieved and un-drawn) amount

of the $400 million for the second tranche of main capital and any remaining (unachieved

and un-drawn) amount of the $400 million for the third tranche of main capital.

Treasury will disburse these funds based on the aforementioned jurisdictions’ relative

performance in Step 1. Treasury will provide additional details regarding the

methodology and timing for allocating the second disbursements from these additional

funds at a later date. The second disbursements within each tranche are not expected to

occur before most jurisdictions have requested their first disbursement for such tranche.

Section V. Allocation for VSBs – 12 U.S.C. § 5702(f)

The SSBCI statute requires Treasury to allocate $500 million to jurisdictions to be

expended for VSBs. The allocations for VSBs will be determined according to the same formula

as the jurisdiction’s main capital allocation, except without the minimums for the Tribal

government portion. Each jurisdiction’s VSB allocation will be transferred in three

approximately equal tranches, with 33 percent for the first and second tranche and 34 percent for

the third tranche. The first tranche will be disbursed when the jurisdiction is approved for

participation in the SSBCI. The second and third tranches will be disbursed when the jurisdiction

certifies that it has deployed 80 percent of its prior tranche of disbursed SSBCI funds under

Section III.b above.

A jurisdiction’s VSB allocation must be expended for VSBs. A VSB means a business

with fewer than 10 employees at the time of the loan, investment, or other credit/equity support

and includes independent contractors and sole proprietors. A business that has 10 or more

employees following an SSBCI transaction will not be considered a VSB for purposes of

subsequent loans or investments.

A jurisdiction is not required to establish a separate program for VSBs but must maintain

records of the total amounts of its SSBCI funds expended for VSBs. In light of the fungibility of

SSBCI funds, Treasury will deem this “expended for” requirement to be satisfied if an amount of

the jurisdiction’s SSBCI funds equivalent to its VSB allocation is expended for VSBs. The term

“expended” has the same definition as in Section III.b above. For this purpose, SSBCI funds

means all SSBCI funds disbursed to the jurisdiction—including the main capital allocation funds,

VSB allocation funds, SEDI allocation funds, and SEDI incentive allocation funds—other than

13

technical assistance funds.

Jurisdictions must use their SSBCI funds only for the purposes and activities specified in

these guidelines and other SSBCI guidance issued by Treasury, which will be incorporated by

reference into the Allocation Agreement. If a jurisdiction’s VSB allocation is not expended for

VSBs, Treasury may find that the jurisdiction is non-compliant with the Allocation Agreement,

in which case Treasury may, in its sole discretion, withhold or reduce the amount of future

SSBCI disbursements to the jurisdiction, or seek other available remedies specified in the

Allocation Agreement, such as the recoupment of previously disbursed funds.

Section VI. Approving Jurisdictions for Participation

a. Designation of Administrative Responsibility – 12 U.S.C. §§ 5703(b)(1) and

(b)(2)

Before Treasury approves a jurisdiction for participation in the SSBCI, the applicant must

demonstrate that all actions required under the jurisdiction’s laws have been taken to delegate

administrative responsibility for the program to a designated department, agency, or political

subdivision of the jurisdiction (i.e., the implementing entity). The term “agency” includes

government corporations and other entities authorized or supervised by the jurisdiction. The

applicant is required to submit a letter from the governor of the state or a governing official of

the territory, the District of Columbia, or Tribal government designating an implementing entity.

The applicant also will be required to submit a short narrative statement describing the legal

actions that have been taken to delegate responsibility for the program and attaching any relevant

documentation in support of that statement. The documents should describe the authority upon

which the designated implementing entity is able to enter into binding agreements on behalf of

the jurisdiction with Treasury. This will typically involve discussion of the entity’s charter and

express authorizations from the jurisdiction to act on its behalf through a state resolution or other

instrument. The narrative should discuss the jurisdiction’s budget process and any necessary

steps for SSBCI funds to be deployed for the uses in the application. In some states, this requires

the passage of a budget resolution by the state legislature. An application will not be approved

until all legal actions necessary to enable the designated implementing entity to implement the

program and participate in the SSBCI have been accomplished and the jurisdiction has provided

Treasury with a description of such actions.

b. Applications, Generally – 12 U.S.C. § 5703(b)

Any jurisdiction that establishes a new, or has an existing, CAP or OCSP that meets the

SSBCI eligibility criteria may apply for SSBCI funds by accessing the application portal from

the SSBCI website at http://www.treasury.gov/ssbci. Treasury is available to provide technical

assistance to applicants that are in the process of creating or starting programs. The SSBCI

statute requires that a CAP or OCSP be fully positioned, within 90 days of the execution of the

Allocation Agreement, to act on providing the kind of credit support that the CAP or OCSP was

established to provide. Complete applications from states, the District of Columbia, territories,

14

and Tribal governments must be submitted to Treasury in accordance with the deadlines

published by Treasury.

An application for SSBCI funding is not a competitive award process. Treasury will

approve applications that satisfy the requirements under the SSBCI statute and applicable

program requirements. To expedite processing, applicants should make every effort to ensure

that their applications include all applicable supporting documentation.

c. Contractual Arrangements – 12 U.S.C. § 5703(c)

A jurisdiction may have contractual arrangements for the implementation or

administration of its capital program with an authorized agent of the jurisdiction, or with an

entity selected and supervised by the jurisdiction, including for-profit and non-profit entities

(e.g., investment funds, loan funds). To help support the efficacy of small business credit support

and investment programs, and to ensure compliance with all applicable legal requirements,

Treasury expects participating jurisdictions to promote a fair, competitive, and open selection

and contracting process.

The SSBCI application will ask jurisdictions to explain the steps they will take to

promote a fair, competitive, and open selection and contracting process. These steps could

include application and enforcement of existing procurement and ethics policies of the

jurisdiction and new measures the jurisdiction chooses to implement specifically for the SSBCI

program. Examples of such policies include limitations on or disclosure of political contributions

to officials with authority to select SSBCI contractors; reporting requirements regarding

lobbying activity, including lobbying related to the SSBCI contractor selection process or

program implementation; and request-for-proposal policies to govern the process for evaluating

bids for SSBCI-related contracts.

d. Tribal Governments – 12 U.S.C. §§ 5701(10)(E), 5702(b)(2)(C), 5703(b)-(c)

Under 12 U.S.C. § 5702(b)(2)(C), Tribal governments may apply jointly for funding

under the SSBCI. Tribal governments may apply jointly through an organization or other Tribal

government representative if each Tribal government applying jointly authorizes the organization

or other Tribal government representative to represent the Tribal government for purposes of

SSBCI. Any joint application by a third party or Tribal government representative must include

documentation that the applicant has been authorized to represent each of the participating Tribal

governments. Such documentation must include Tribal resolutions or other actions taken by each

participating Tribal government to delegate authority to the applicant. The same approval criteria

and program requirements that are applicable to Tribal governments will apply to each joint

application by Tribal governments.

A Tribal enterprise may implement and administer SSBCI programs as long as it is an

authorized agent of, or entity supervised by, the Tribal government. A “Tribal enterprise” is an

entity: (1) that is wholly owned by one or more Tribal governments, or by a corporation that is

wholly owned by one or more Tribal governments; or (2) that is owned in part by one or more

15

Tribal governments, or by a corporation that is wholly owned by one or more Tribal

governments, if all other owners are either United States citizens or small business concerns.

This definition is consistent with the Small Business Administration (SBA) HUBZone definition

of a “small business concern” relating to Tribal governments in 15 U.S.C. § 657a(b)(2)(C).

e. Municipalities – 12 U.S.C. § 5703(d)

As noted above, the SSBCI statute allows municipalities to apply directly for SSBCI

funding in certain circumstances if the state of the United States does not apply directly.

Specifically, the Act provides that Treasury may grant municipalities of a state special

permission to apply directly for funding under the SSBCI if: (1) that state did not submit an

SSBCI notice of intent to Treasury by May 10, 2021; or (2) that state filed a notice of intent by

May 10, 2021 but does not submit a complete application for approval of a state program by

11:59 PM ET on February 11, 2022. Because all states submitted complete applications by the

deadline, municipalities are not eligible to apply.

Section VII. Approving CAPs

a. In General

CAPs provide portfolio insurance to lenders that are financial institutions as defined in

12 U.S.C. § 5701(5)

15

and that make small business loans. Portfolio insurance is provided in the

form of a separate loan loss reserve fund for each participating financial institution. CAPs are

established and administered by each jurisdiction, individually.

Jurisdictions may work together and standardize several program characteristics,

consistent with applicable SSBCI program requirements, which would increase uniformity

across jurisdictions. For example, jurisdictions could use similar enrollment forms for financial

institutions to participate in the program; use similar enrollment forms for each loan; set the

same rules for eligible borrowers and uses of loan proceeds; standardize the amount of borrower

and lender payments to the CAP reserve fund; establish a uniform form and frequency of

reporting from lenders; and use similar forms to document the recovery of any loan losses from

the CAP reserve fund. Such standardization could result in savings for financial institutions on

staff training, loan operations, recordkeeping, and management expenses. If the programs are

standardized across large and small jurisdictions, financial institutions could offer CAPs in all

locations with relatively little extra administrative cost.

b. Federal Contribution – 12 U.S.C. § 5704(d)

Under the SSBCI statute, approved CAPs are eligible for federal contributions in an

amount equal to the premiums paid by the borrower and the financial institution lender to the

15

The statutory definition of “financial institution” is any insured depository institution, insured credit union, or

CDFI, as each of those terms is defined in section 103 of the Riegle Community Development and Regulatory

Improvement Act of 1994, 12 U.S.C. § 4702.

16

reserve fund. This amount is calculated on a loan-by-loan basis. A participating jurisdiction may

use the federal contribution to make its contribution to the reserve fund. Accordingly, the federal

contribution may be used to match the aggregate borrower/lender contribution at a level of 1:1.

The jurisdiction may supplement the federal contribution with jurisdiction funds or private funds,

but the federal contribution cannot be used to match any amount in excess of the sum of the

borrower and financial institution lender contributions. Federal contributions to CAPs may only

be used to pay losses on loans originated and enrolled after the effective date of the jurisdiction’s

Allocation Agreement. The jurisdiction may allow lenders to use premiums from loans

subsequently enrolled in the jurisdiction’s SSBCI CAP portfolio to pay prior losses on loans

enrolled in the SSBCI CAP portfolio.

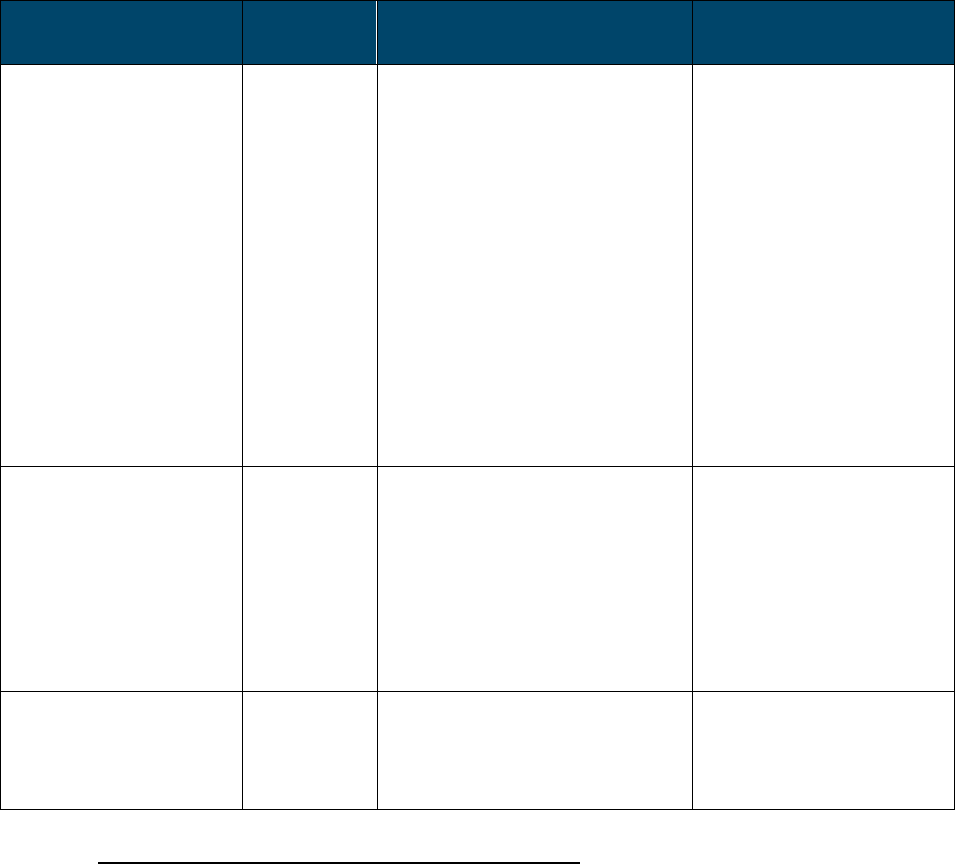

c. CAP Experience and Capacity Program Requirement – 12 U.S.C. § 5704(e)(1)

Each jurisdiction should exercise due care to determine that financial institutions

participating in the SSBCI possess sufficient commercial lending experience, financial and

managerial capacity, and operational skills to meet the objectives of the SSBCI statute. To ensure

the federal funds are made broadly available to small businesses, including VSBs and

SEDI-owned businesses, each jurisdiction must apply the same standards for participation in its

SSBCI programs to all classes of lenders and not restrict any class of financial institutions from

participating in the program. In addition, if a CAP allows financial institution lenders to partner

with third-party providers (e.g., non-depository CDFIs), the jurisdiction must apply the same

standards applicable to the financial institutions to third-party providers. In all cases, loans

should comply with the minimum national customer protection standards under Section IX.f

below and be offered in a manner that ensures fair access to financial services, fair treatment of

customers, and compliance with applicable laws and regulations, including fair lending and

consumer protection laws. As required by the SSBCI statute, jurisdictions must consult with the

appropriate federal banking agency or, as appropriate, the CDFI Fund, to determine for each

financial institution that participates in a CAP that the financial institution has sufficient

commercial lending experience and financial and managerial capacity to participate in the CAP.

Jurisdictions may also consult with state regulatory or supervisory authorities regarding

participating financial institutions, if applicable. The following table lists examples of

documents and certifications jurisdictions may use to determine adequacy of a financial

institution’s lending experience and financial and managerial capacity.

17

TYPE OF

IN

ST

ITU

TION

RATINGS

PERFORMANCE REPORTS

CER

T

IFICA

T

I

ONS

Insured depository

institutions

(including

depository

CDFIs)

•

Uniform Banking

Performance Report (UBP

R)

showing that commercial

loans and leases comprise a

significant part of the

institution’s assets.

•

A UBPR peer group analy

sis

showing that the institution

’s

percentage of non-current

loans and leases does not

exceed its peer group

average (UBPR reports may

be obtained at

www.ffiec.gov/UBPR.htm).

Self-certification that the

ins

titution is not operating

under

any formal

e

nforcement action with

its primary

federal

regulator that addresses

unsafe or unsound lending

practices

.

Federally-insured credit

u

nions

(

including CDFI credit

u

nions)

Financial Performance Reports

(FPRs) from the NCUA.

Self-certification that the

ins

t

i

t

ution is not operating

under

any formal

e

nforcement action with

its primary

federal

regulator that addresses

unsafe or unsound lending

practices.

CDFIs (excluding

insured depositories

and

credit u

nions)

AERIS rating

• Annual report with audited

financial statements.

•

State supervisory or

regulatory information.

d. Lender Capital at Risk – 12 U.S.C. § 5704(e)(4)

The SSBCI statute, 12 U.S.C. § 5704(e), requires that for any loan enrolled in a CAP, the

financial institution lender must have a meaningful amount of its own capital at risk in the loan.

Treasury has determined that because of how CAPs operate, each lender has a meaningful

amount of its own capital resources at risk. As required by 12 U.S.C. § 5704(e)(5), the borrower

and lender together can only contribute up to 7 percent of the loan amount to a reserve fund, and

the jurisdiction matches that same contribution with SSBCI funds. At maximum contribution, the

reserve fund only has 14 percent of each loan (7 percent from the borrower and lender together,

and 7 percent from SSBCI funds), leaving the lender at risk for 86 percent of the loan.

18

e. Borrower and Loan Size Requirements – 12 U.S.C. § 5704(c)(4)

For a loan to be eligible for enrollment in the CAP, the borrower must have

500 employees or less at the time that the loan is enrolled in the program, and the loan cannot

exceed $5 million.

For purposes of determining a borrower’s eligibility for CAPs, Treasury’s calculation of

borrower size is consistent with the SBA’s methodology for calculating the number of

employees under 13 C.F.R. § 121.106. In determining a borrower’s number of employees,

Treasury counts all individuals employed on a full-time, part-time, or other basis. This includes

employees obtained from a temporary employee agency, professional employee organization, or

leasing concern. Volunteers (i.e., individuals who receive no compensation, including no in-kind

compensation, for work performed) are not considered employees. A borrower’s number of

employees includes the employees of its affiliates, as defined in 13 C.F.R. § 121.103. In regard

to counting employees, businesses owned and controlled by a Tribal government are not

considered affiliates of the Tribal government and are not considered affiliates of other

businesses owned by the Tribal government because of their common ownership by the Tribal

government or common management, as described in 13 C.F.R. § 121.103(b)(2).

f. Loan Purpose Requirements and Prohibitions – 12 U.S.C. § 5704(e)(7)

As required by 12 U.S.C. § 5704(e)(7), for each loan enrolled in a CAP, the participating

jurisdiction must require the financial institution lender to obtain an assurance from each

borrower stating that the loan proceeds will not be used for an impermissible loan purpose under

the SSBCI program.

Business Purpose Generally – 12 U.S.C. § 5704(e)(7)(A)(i)(I)

Each financial institution lender must obtain an assurance from the borrower affirming

that the loan proceeds will be used for a business purpose. A business purpose includes, but is

not limited to, start-up costs; working capital; franchise fees; and acquisition of equipment,

inventory, or services used in the production, manufacturing, or delivery of a business’s goods or

services, or in the purchase, construction, renovation, or tenant improvements of an eligible place

of business that is not for passive real estate investment purposes. SSBCI funds may be used to

purchase any tangible or intangible assets except goodwill. The term “business purpose” excludes

acquiring or holding passive investments in real estate, the purchase of securities, and lobbying

activities (as defined in Section 3(7) of the Lobbying Disclosure Act of 1995, P.L. 104-65, as

amended).

16

16

The Act defines “lobbying activities” as “lobbying contacts and efforts in support of such contacts, including

preparation and planning activities, research and other background work that is intended, at the time it is performed,

for use in contacts, and coordination with the lobbying activities of others.”

19

Business Purpose: Passive Real Estate Investment Guidance – 12 U.S.C. § 5704(e)(7)(A)(i)(I)

Each financial institution lender must obtain an assurance from the borrower affirming

that the loan proceeds will be used for a business purpose. As noted above under “Business

Purpose Generally,” an eligible business purpose under SSBCI includes the purchase,

construction, renovation, or tenant improvements of an eligible place of business that is not for

passive real estate investment purposes. However, an eligible business purpose excludes

acquiring or holding passive investments in real estate. Loan proceeds are used for passive real

estate investment purposes when the proceeds of the loan are used to invest in real estate

acquired and held primarily for sale, lease, or investment. Passive real estate investment includes

most real estate development (including construction) in which the developer does not intend to

occupy or actively use the resulting real property.

A small business borrower can deliver the assurance that the loan is not being used for

passive real estate if the small business borrower occupies and uses at least a specific percentage

of the building; the percentage varies depending on whether the project involves the construction

of a new building or renovation of an existing building:

• Construction of a new building. If SSBCI-supported loan proceeds are used in the

construction of a new building, the small business must occupy and use at least

60 percent of the total rentable property following issuance of an occupancy permit or

other similar authorization.

• Renovation of an existing building. If SSBCI-supported loan proceeds are used in the

acquisition, renovation, or reconstruction of an existing building, the borrower may

permanently lease up to 49 percent of the rentable property to one or more tenants, if the

small business occupies and uses at least 51 percent of the total rentable property within

12 months following the acquisition, renovation, or reconstruction.

If a small business chooses to lease an allowable portion of the rentable square footage to

a tenant, the jurisdiction may rely on lease agreements, blueprints, or similar documentation in

assuring the lease of an allowable portion of the rentable square footage is consistent with these

guidelines.

SSBCI-supported loan proceeds may not be used to improve or renovate any portion of

rentable property that the small business borrower leases to a third party. “Rentable property”

means the total square footage of all buildings or facilities used for business operations, which

(1) excludes vertical penetrations (e.g., stairways, elevators, and mechanical areas that are

designed to transfer people or services vertically between floors) and all outside areas and

(2) includes common areas (e.g., lobbies, passageways, vestibules, and bathrooms).

There are two exceptions to the general prohibition on the use of SSBCI-supported loan

proceeds for passive real estate investment. An eligible business purpose may include the

financing of real estate investments in either one of the following limited circumstances.

(1) Passive company leasing to operating company. A passive company such as a

holding company that acquires real property using an SSBCI-supported loan may

20

have an eligible business purpose where 100 percent of the rentable property is leased

to the passive company’s affiliated operating companies that are actively involved in

conducting business operations. To meet this exception, the following criteria must

also be met:

• The passive company must be an eligible small business using the affiliate and

employee definitions described above;

• The operating company must be subject to the same sublease restrictions as the

owner affiliate;

• The operating company must be a guarantor or co-borrower on the

SSBCI-supported loan to the eligible passive company;

• Both the passive company and the operating company must execute SSBCI

borrower use-of-proceeds certifications and sex-offender certifications covering

all principals;

• Each natural person holding an ownership interest constituting at least 20 percent

of either the passive company or the operating company must provide a personal

guarantee for the SSBCI-supported loan; and

• The passive company and the operating company have a written lease with a term

at least equal to the term of the SSBCI-supported loan (which may include

options to renew exercisable solely by the operating company).

(2) Construction loan of $500,000 or less. A construction loan with an original principal

amount of $500,000 or less may have an eligible business purpose if:

• the building will not serve as a residence for the owner, their relatives, or

affiliates;

• the building will be put into service immediately;

• the loan is underwritten and made for the purpose of constructing or refurbishing

a structure; and

• the building has not been and will not be financed by another SSBCI-supported

loan.

Under this exception, loans that automatically convert into permanent financing are

excluded from the definition of “eligible business purpose,” unless the converted

loans would no longer rely on SSBCI support. The term “construction loan” means a

loan secured by real estate made to finance (1) land development (e.g., the process of

21

improving land, such as laying sewers or water pipes) preparatory to erecting new

structures or (2) the on-site construction of industrial, commercial, residential, or farm

buildings. For purposes of this paragraph, “construction” includes not only

construction of new structures, but also additions or alterations to existing structures

and the demolition of existing structures to make way for new structures.

Prohibited Loan Purposes – 12 U.S.C. § 5704(e)(7)(A)(i)(II)

Each financial institution lender must obtain an assurance from the borrower affirming

that the loan proceeds will not be used to:

• Repay delinquent federal or jurisdiction income taxes unless the borrower has a

payment plan in place with the relevant taxing authority;

• Repay taxes held in trust or escrow (e.g., payroll or sales taxes);

• Reimburse funds owed to any owner, including any equity investment or investment

of capital for the business’s continuance; or

• Purchase any portion of the ownership interest of any owner of the business,

17

except

for the purchase of an interest in an employee stock ownership plan qualifying under

section 401 of Internal Revenue Code, worker cooperative, employee ownership trust,

or related vehicle, provided that the transaction results in broad-based employee

ownership for employees in the business and the employee stock ownership plan or

other employee-owned entity holds a majority interest (on a fully diluted basis) in the

business.

Borrower Restrictions – 12 U.S.C. § 5704(e)(7)(A)(i)(III)

Each financial institution lender must obtain an assurance from the borrower affirming

that the borrower is not:

• An executive officer, director, or principal shareholder of the financial institution

lender;

• A member of the immediate family of an executive officer, director, or principal

shareholder of the financial institution lender; or

• A related interest or immediate family member of such an executive officer, director,

or principal shareholder of the financial institution lender.

For purposes of these three borrower restrictions, the terms “executive officer,”

17

This prohibition applies to the acquisition of shares of a company or the partnership interest of a partner when the

proceeds of the loan directly supported by SSBCI funds will go to any existing owner or partner.

22

“director,” “principal shareholder,” “immediate family,” and “related interest” refer to the same

relationship to a financial institution lender as the relationships described in 12 C.F.R. part 215.

Permissible borrowers may include jurisdiction-designated charitable, religious, or other

non-profit or philanthropic institutions; government-owned corporations; consumer and

marketing cooperatives; and faith-based organizations, provided the loan is for a “business

purpose” as defined above. Permissible borrowers may also include sole proprietors, independent

contractors, worker cooperatives, and other employee-owned entities, as well as Tribal

enterprises, provided that all applicable program requirements are satisfied.

Additional Borrower Restrictions – 12 U.S.C. § 5704(e)(7)(A)(iv)

Each financial institution lender must obtain an assurance from the borrower affirming

that the borrower is not:

• A business engaged in speculative activities that profit from fluctuations in price,

such as wildcatting for oil and dealing in commodities futures, unless those activities

are incidental to the regular activities of the business and part of a legitimate risk

management strategy to guard against price fluctuations related to the regular

activities of the business or through the normal course of trade;

18

• A business that earns more than half of its annual net revenue from lending activities,

unless the business is (1) a CDFI that is not a depository institution or a bank holding

company, or (2) a Tribal enterprise lender that is not a depository institution or a bank

holding company

;

19

• A business engaged in pyramid sales, where a participant’s primary incentive is based

on the sales made by an ever-increasing number of participants;

• A business engaged in activities that are prohibited by federal law or, if permitted by

federal law, applicable law in the jurisdiction where the business is located or

conducted (this includes businesses that make, sell, service, or distribute products or

services used in connection with illegal activity, unless such use can be shown to be

completely outside of the business’s intended market); this category of businesses

includes direct and indirect marijuana businesses, as defined in SBA Standard

18

A construction loan permitted under Business Purpose: Passive Real Estate Investment Guidance – 12 U.S.C.

§ 5704(e)(7)(A)(i)(I) will not be considered a speculative business for purposes of SSBCI.

19

When a participating jurisdiction makes a loan to an eligible CDFI, the CDFI may re-lend the funds to other

entities. Each CDFI re-lending transaction must be eligible and meet all SSBCI program requirements, including

obtaining all required assurances and certifications. The participating jurisdiction may include private financing

caused by and resulting from the re-lending transaction in the jurisdiction’s private leverage ratio. Similarly, Tribal

enterprise lenders may also be permissible borrowers for the purpose of relending, if the re-lending transactions are

eligible and meet all SSBCI program requirements, including obtaining all required assurances and certifications.

23

Operating Procedure 50 10 6;

20

or

• A business deriving more than one-third of gross annual revenue from legal gambling

activities, unless the business is a Tribal SSBCI participant, in which case the Tribal

SSBCI participant is prohibited from using SSBCI funds for gaming activities, but is

not restricted from using SSBCI funds for non-gaming activities merely due to an

organizational tie to a gaming business

21

; “gaming activities” for purposes of Tribal

SSBCI programs is defined as Class II and Class III gaming under the Indian Gaming

Regulatory Act (IGRA), 25 U.S.C. § 2703.

Each financial institution lender must also obtain an assurance from the borrower

affirming that no principal of the borrowing entity has been convicted of a sex offense against a

minor (as such terms are defined in section 111 of the Sex Offender Registration and Notification

Act (42 U.S.C. § 16911)). For purposes of this certification, “principal” is defined as if a sole

proprietorship, the proprietor; if a partnership, each partner; if a corporation, limited liability

company, association, development company, or other entity, each director, each of the five most

highly compensated executives, officers, or employees of the entity, and each direct or indirect

holder of

20

percent

or more

of the ownership

stock

or

stock

equivalent

of the

entity.

Lender Assurances – 12 U.S.C. § 5704(e)(7)(A)(ii) and (iii)

Each participating jurisdiction must obtain an assurance from the financial institution

lender affirming:

• The SSBCI-supported loan is not being made in order to place under the protection of

the approved program prior debt that is not covered under the approved program and

that is or was owed by the borrower to the financial institution lender or to an affiliate

of the financial institution lender.

• If the SSBCI-supported loan is a refinancing, it complies with all applicable SSBCI

restrictions and requirements regarding refinancing and new extensions of credit,

including that the SSBCI-supported loan is not a refinancing of a loan previously

made to the borrower by the lender or an affiliate of the lender.

• No principal of the financial institution lender has been convicted of a sex offense

against a minor (as such terms are defined in section 111 of the Sex Offender

Registration and Notification Act (42 U.S.C. § 16911)). For the purposes of this

certification, “principal” is defined as if a sole proprietorship, the proprietor; if a

20

SBA Standard Operating Procedure 50 10 6, Lender and Development Company Loan Programs (effective

October 1, 2020) (“Because federal law prohibits the distribution and sale of marijuana, financial transactions

involving a marijuana-related business would generally involve funds derived from illegal activity. Therefore,

businesses that derive revenue from marijuana-related activities or that support the end-use of marijuana may be

ineligible for SBA financial assistance.”).

21

Under this standard, a gaming Tribal enterprise could apply for SSBCI funds for its new gas station, for example,

even if the Tribal enterprise’s revenues from gaming were greater than 33 percent.

24

partnership, each partner; if a corporation, limited liability company, association,

development company, or other entity, each director, each of the five most highly

compensated executives, officers, or employees of the entity, and each direct or

indirect holder of 20 percent or more of the ownership stock or stock equivalent of

the entity.

Lender Assurances: Refinancing and New Extensions of Credit – 12 U.S.C.

§ 5704(e)(7)(A)(ii)

New Lenders. Under the SSBCI statute, a lender is not prohibited from enrolling or

refinancing loans previously made by another, non-affiliated financial institution. Accordingly, a

lender may refinance a borrower’s existing loan, line of credit, extension of credit, or other debt

originally made by an unaffiliated lender so long as the proceeds of the transaction are not used

to finance an extraordinary dividend or other distribution.

When a participating jurisdiction uses SSBCI funds to support the purchase of a loan from

another, non-affiliated financial institution, the jurisdiction must make a determination that the

transaction is beneficial to the small business borrower. For purposes of the eligible business

purpose and certification requirements, the eligible business purpose of the new loan is generally

determined by the purpose of the underlying funding being refinanced.

New Extensions of Credit by Existing Lenders. Financial institution lenders are generally

prohibited from refinancing an existing outstanding balance or previously made loan, line of

credit, extension of credit, or other debt owed by a small business borrower already on the books

of the same financial institution (or an affiliate) into the SSBCI-supported program. However, a

financial institution lender may use SSBCI funds to support a new extension of credit that repays

the amount due on a matured

22

loan or other debt that was previously used for an eligible

business purpose when all the following conditions are met:

• The amount of the new loan or other debt is at least 150 percent of the outstanding

amount of the matured loan or other debt;

• The new credit supported with SSBCI funding is based on a new underwriting of the

small business’s ability to repay the loan and a new approval by the lender;

• The prior loan or other debt has been paid as agreed and the borrower was not in

default of any financial covenants under the loan or debt for at least the previous

36 months (or since origination, if shorter); and

• Proceeds of the transaction are not used to finance an extraordinary dividend or other

distribution.

22

A matured loan or line of credit only includes such that have matured according to their terms and does not

include a loan or line of credit that has been accelerated to maturity. Transferring an accelerated loan into an SSBCI

program does not promote the purpose of expanding small business access to capital and would primarily benefit

lenders rather than small businesses.

25

If a participating jurisdiction enrolls a loan that is used to repay principal under a loan previously

made by the same financial institution or its affiliate, the participating jurisdiction or the

financial institution lender must maintain records showing that these criteria were met. The

limitation on refinancing does not prohibit a financial institution lender from originating a new

loan under an SSBCI approved program and subsequently refinancing the same loan under any

approved program.

g. Monitoring the Annual Claims Rate

The claims rate for a CAP reflects the compensation a lender may seek for borrower

defaults and, accordingly, the amount of SSBCI subsidy the lender may receive. CAPs are

intended to support responsible lending that is beneficial to small businesses and are not intended

to subsidize high default rate business models. To ensure CAPs continue to be used consistent

with these objectives, jurisdictions must monitor annual CAP claims rates and review lenders

whose annual claims rates exceed 6 percent. The claims rate may be measured by either total

capital or number of loans in a 12-month period. The jurisdiction may determine to disallow a

lender from enrolling any additional CAP loans if the jurisdiction determines the lender’s

practices do not meet program standards or is using the CAP to offset the costs of high default

rate lending.

23

Treasury will monitor CAP annual claims rates annually.

Section VIII. Approving OCSPs

a. In General

Under 12 U.S.C. § 5701(12), an OCSP is a program that is not a CAP, that uses public

resources to promote private access to credit, and that meets certain eligibility criteria. OCSPs

may include loan programs, investment programs, or other credit or equity support programs.

OCSPs may include programs that provide support for small business lending and investment

such as collateral support programs, loan participation programs, jurisdiction

-sponsored

equity/

venture

capital

programs,

loan

guarantee

programs,

or

other similar programs. Unlike

CAP lenders, OCSP lenders and investors need not be financial institutions as defined above.

In an SSBCI equity/venture capital program, the “investor” can be an entity of the