Louis Armstrong New Orleans International Airport (MSY)

Airline Competition Plan Update No. 1

_____________________________________________

Submitted to:

Federal Aviation Administration

As required by:

The Wendell H. Ford Aviation Investment & Reform Act for the 21st Century

Pub. L. 106-181, Section 155

Submitted:

December 24, 2014

Page | 2

TABLE OF CONTENTS

OVERVIEW ................................................................................................................................................. 3

AVAILABILITY OF GATES AND RELATED FACILITIES ................................................................... 5

LEASING AND SUBLEASING ARRANGEMENTS .............................................................................. 10

PATTERNS OF AIR SERVICE ................................................................................................................. 11

GATE ASSIGNMENT POLICY ................................................................................................................ 12

GATE USE REQUIREMENTS.................................................................................................................. 13

FINANCIAL CONSTRAINTS................................................................................................................... 14

AIRPORT CONTROLS OVER AIRSIDE AND GROUNDSIDE CAPACITY…………..……………..14

AIRPORT INTENTIONS TO BUILD OR ACQUIRE GATES TO BE USED AS COMMON

FACILITIES ............................................................................................................................................... 15

AIRFARE COMPARISON ........................................................................................................................ 16

SUMMARY ................................................................................................................................................ 28

Page | 3

OVERVIEW

On February 15, 2013, Louis Armstrong New Orleans International Airport (“MSY”) submitted

its Airline Competition Plan (“Plan”) in accordance with the Wendell H. Ford Aviation

Investment and Reform Act for the 21st Century (“AR-21”), Section 155, and applicable Federal

Aviation Administration (“FAA”) Program Guidance. MSY received approval for the initial Plan

on June 28, 2013 from the FAA. In accordance with 49 USC § 47107(a)(15), the Plan was made

available to the public by posting on MSY’s website under “Public Notice Advertisement.”

Below is a direct link to the posting:

http://www.flymsy.com/Files/Publications/MSY_Airline_Competition_Plan_2013.pdf

MSY prepared this first update to its approved Plan to provide updated information about MSY,

its physical properties, use of facilities and explains how airport management continues its

commitment and actions to provide new entrant access and expansion by incumbent carriers.

MSY is identified by the FAA as a medium hub airport. MSY now hosts thirteen (13) air carriers

and two (2) all-cargo carriers (December 2014). There are currently 45 nonstop destinations

available for booking from MSY. MSY fosters and strongly encourages airline competition and

accommodates new entrant carriers. No one carrier dominates the market; however, Southwest

Airlines and Delta Air Lines enplanements accounted for 62.9% in 2013. In the past four years,

MSY has seen eight (8) new carriers announce service.

MSY has approximately 1.2 million square feet of terminal space, with four (4) concourses.

There are a total of forty-two (42) gates, including six (6) on Concourse C with direct Federal

Inspection Service (FIS) access. In 2010, Concourse A closed, but the concourse has been

maintained and can be reactivated for commercial air service. The following is a breakdown of

the number of gates and airlines operating in each concourse:

Concourse A

Concourse B

Concourse C

Concourse D

6 gates

10 gates

14 gates

12 gates

(currently vacant)

AirTran

American

Delta

Southwest

Frontier

United

JetBlue

Air Canada

Spirit

US Airways

Alaska

Allegiant

(2/2015)

Page | 4

The average number of daily departures (1H2014) is approximately 137. There are no slot

restrictions, curfews or other constraints on air operations.

MSY policies provide a fertile environment for airline competition. Since 2010, MSY has

significantly decreased its cost per enplanement (CPE) paid by the airlines. Just as other

airports, MSY offers incentives consistent with Federal law and FAA policies to attract new

airlines and to encourage incumbent airline growth to new destinations.

The following factors demonstrate the lack of barriers to new entrant and incumbent airlines

desiring growth at MSY:

A. The lack of barriers:

No slot restrictions.

No significant aircraft delays.

Declining airline costs per enplanement.

B. Airport space available:

Thirty-two (32) agent positions and multiple options for offices.

Thirteen (13) jet bridges and hold rooms are non-preferential, available for lease by

airlines, not including seven gates with no jet bridges currently in place.

C. Significant level of existing competition:

Approximately 46.5% (Year Ending December, 2013) of capacity operated by low-

cost carriers, projected to increase to 48.5% in 1Q2015.

Consistently lower fares than the national average (Compared to top 100 passenger

markets, BTS.gov).

D. No complaints received from incumbent or new entrant carriers regarding denial of space

prior to filing this Plan Update. Most recently, Spirit Airlines, Alaska Airlines,

PEOPLExpress and Allegiant Air were provided the option of several gates and hold

rooms with access to Federal Inspection Services (FIS), ticket counters, and office space.

Page | 5

AVAILABILITY OF GATES AND RELATED FACILITIES

A. Number of gates available at MSY by lease arrangement

MSY has four (4) concourses with a total of forty-two (42) gates. Thirty-five (35) gates

(Concourses B, C and D) have passenger jet bridges and six (6) gates on Concourse A and one

(1) gate on Concourse B do not have passenger jet bridges. While the seven gates do not have

jet bridges, MSY has an approved PFC project to acquire jet bridges; and, if so acquired for any

of these seven gates, they would only be leased on a preferential use or common use basis.

As of December 2014, the allocation of the gates is as follows:

1. Fifteen (15) gates with MSY-owned jet bridges are under preferential leases to

signatory airlines. Since approval of the Plan, the following changes in gate use has

occurred:

a. U.S. Airways has consolidated operations with American in Concourse C. The

new American (combined operations) now leases a total of five (5) gates.

b. Southwest Airlines has begun leasing one additional gate on Concourse B

(Gate B2), where they also RON.

2. Seven (7) gates are under preferential leases to signatory airlines that also own the

associated jet bridge on the particular leased gate(s).

3. Three (3) gates with MSY-owned jet bridges are under a common use (non-signatory)

lease with airlines. Since MSY’s approval of its Airline Competition Plan, C8 has

been recaptured and used on a common-use, per turn basis. In February 2015,

Allegiant Air will begin its operations at MSY using a common-use gate, raising this

to a total of four (4) gates used on a common use basis.

a. Frontier Airlines has been relying on a common use gate since June 2010,

averaging less than two average daily flights. The use of this common use

gate has not created an impediment to the Frontier Airlines schedule.

b. Air Canada has been relying on United’s leased gate since October 2010,

averaging one daily flight. The shared gate has not created an impediment to

the Air Canada schedule.

c. Spirit Airlines continues to use a common use gate, and has grown its

operations from one (1) daily flight to five (5) daily flights. Spirit Airlines

recently expressed interest in becoming a signatory airline and preferentially

leasing a gate.

4. Thirteen (13) gates with Airport-owned jet bridges are available for use or lease

(either on a common use or preferential use basis) by airlines. As noted in 3 above,

Page | 6

three (3) of these gates on Concourse C are being used on a common use basis by

non-signatory airlines (Spirit, Alaska and Frontier Airlines) and one is being used on

a “per turn” basis by American Airlines. Beginning February 2015, one gate on

Concourse C will be used on a common use basis by the non-signatory airline,

Allegiant Air. The two (2) common use gates on Concourse D are being used on a

“per turn” basis, one by Delta Air Lines and one by United Airlines.

5. Six (6) gates without jet bridges on Concourse A and one (1) on Concourse B are

available for use or lease by airlines.

Below is a depiction of the gates at MSY as of November 2014. The jet bridges highlighted in

green are MSY’s common-use gates. Those gates identified with MSY’s “fleur de lis” logo are

gates that are not leased or used by any airline.

B. Gate-use monitoring policy

MSY Operations Department is staffed with no less than one (1) Operations Supervisor

24-hours a day / 365-days a year. The Operations Supervisors monitor use of the thirteen

(13) gates with jet bridges that are not leased to any airline as well as the common use

gates leased to non-signatory airlines. The Operations Supervisors have the authority to

permit use of any of these available gates at the request of any carrier on a first come,

first serve basis. In addition, Operations Supervisors are charged with implementation of

the US Department of Transportation approved MSY Emergency Contingency Plan for

Page | 7

irregular operations. As of the submission of this Plan Update, MSY has been able to

accommodate all airline requests for additional gates, including charters, airline RONs

and diverted aircraft. In addition, MSY is able to accommodate any request by a potential

new entrant airline seeking gate space. MSY will consider a plan to monitor leased gates

in the event that MSY gate capacity becomes constrained.

C. Differences, if any, between gate-use monitoring policy at PFC-financed facilities,

facilities subject to PFC assurance #7, and other gates.

No change since the last Plan approval.

D. Description of the process for accommodating new service and for service by a new

entrant.

New service through an incumbent carrier is accommodated through a gate already leased

or assigned on a common-use basis. If an additional gate is required then one will be

assigned on a vacant gate of their choice. A new entrant carrier is provided a walk-

through of the terminal and any vacant space may be chosen accordingly, including

ticketing, office, and gate space. Incentives are also available for new non-stops and new

entrant carriers. The Airport uses objective standards by recognizing the flight

requirements of any requesting Airline. There are thirteen (13) vacant gates with jet

bridges available for lease (common use or preferential use) or use on a per turn basis,

five (5) of which can accommodate International flights, including three (3) capable of

wide-body aircraft. If in the unlikely event the Airport has no available gates for the

requesting Airline, the following objective standards used include, but are not limited to:

international flight requirements and Customs, TSA screening, aircraft wing span and

height requirements, fueling requirements, scheduling, ground equipment required for

specific aircraft type, personnel training, and alliance and code sharing synergies. The

Airport Operations Department will identify these and allocate a gate accordingly.

E. Has the PFC competitive assurance #7 operated to convert previously exclusive

gates to preferential-use gates or has it caused such gates to become available to

other users?

No change since the last Plan approval.

F. Gate Utilization (departures/gate) per week and month

In December 2014, approximately 1,046 flights per week were scheduled to depart from

MSY. With 28 of the available 42 gates being used on a daily basis, airport-wide

utilization per gate in December 2014 was 37 flights per week and 149 per month. The

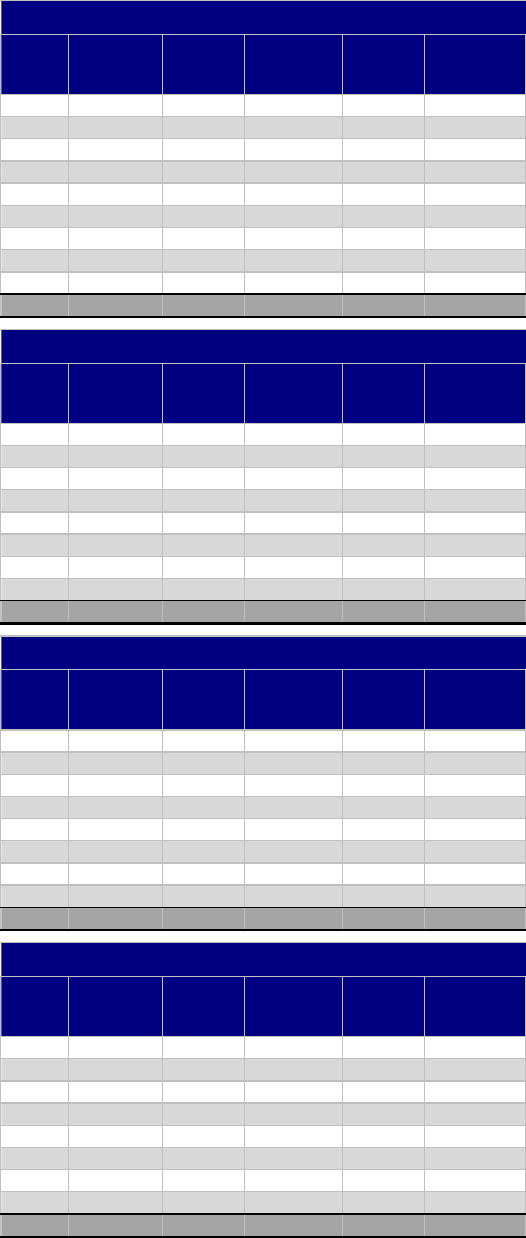

following table below shows the full year average for gate utilization by operating carrier

in 2013.

Page | 8

Full Year Ending December 2013 Gate Utilization

Airline

Number of

Departures

Number of

Gates

1

Daily Turns

per gate

Endeavor Air 1,257

Compass Airlines Inc. 294

Delta Air Lines 6,628

ExpressJet Airlines 530

SkyWest Airlines 194

Chautauqua Airlines Inc. 69

Shuttle America 5

Combined Operations 8,977 6 4.1

Frontier Airlines 372

Republic Airline 1

Combined Operations 373 1 1.0

ExpressJet Airlines 1,719

GoJet Airlines LLC 687

SkyWest Airlines 457

Chautauqua Airlines Inc. 198

Shuttle America 886

United Airlines 5,059

Mesa Airlines 4

Jazz Air 339

Combined Operations 9,349 6 4.3

PSA 3

US Airways 2,416

Mesa Airlines 247

Republic Airline 2,507

Air Wisconsin Airlines 4

American Airlines 3,696

Envoy Air Inc 635

Republic Airline 455

Combined Operations 9,963 6 4.5

AirTran Airways 1,833

Southwest Airlines 16,867

Combined Operations 18,700 6 9

JetBlue Airways 1,437 1 3.94

Spirit Airlines 342 1 0.94

TOTAL MSY 49,480

27

2

5

1

American

,

Delta, and United utilize one gate on a per turn basis

2

Alaska Airlines began service June 2014, not included in Full Year 2013 statistics

Source: Diio Mi, New Orleans Aviation Board

Page | 9

G. Number of carriers in the past year that have requested access or sought to expand,

how they were accommodated, and the length of time between any requests and

access

Since FAA approval of the Plan, Alaska Airlines has begun nonstop service to Seattle,

WA, the longest transcontinental nonstop currently scheduled from MSY. Southwest has

expanded options to include new non-stops to Austin, TX, San Diego, CA, San Antonio,

TX, Oakland, CA and Washington, D.C. Spirit Airlines expanded service to include

nonstop service to Chicago, IL, Dallas, TX, Detroit, MI, Ft. Lauderdale, FL and Houston,

TX. A startup airline, PEOPLExpress began the first nonstop service between MSY and

Newport News/Williamsburg, VA in August 2014. VacationExpress has added an

international nonstop to Punta Cana, Dominican Republic and expanded the frequency of

Cancun, Mexico from one weekly to three weekly for the upcoming year. Delta Air Lines

has also implemented a weekly nonstop to Cancun, Mexico with once weekly service

starting in February 2015. Similarly, United Airlines will be launching a weekly nonstop

route to Cancun, Mexico starting in May 2015. Ultra low-cost carrier Allegiant Air had a

major announcement in November 2014 announcing nonstop service to four destinations,

including Indianapolis, IN, Columbus-Rickenbacker, OH, Orlando-Sanford, FL and

Cincinnati, OH. We have been able to immediately accommodate each airline that has

requested terminal space and gates upon their request.

H. Description of process to resolve any access complaints by a new entrant or an air

carrier seeking to expand service

No change since the last Plan approval.

I. Use/lose or use/share policies for gates and other facilities

No change since the last Plan approval.

J. Policy regarding “recapturing” gates that are not being fully used

No change since the last Plan approval.

K. Plans to make gates and related facilities available to new entrant air carriers that

want to expand service at MSY; methods of accommodating new gate demand by

air carriers at MSY (common-use, preferential-use, or exclusive-use gates); and

length of time between when an air carrier initially contacts MSY and could begin

operations

MSY actively pursues new entrant airlines and can adequately accommodate the needs of

new and existing carriers. In February 2014, Alaska Airlines was a new entrant carrier

seeking a common-use gate for their daily flight to Seattle, WA. Alaska was provided

several options for gate, ticketing counters, and office spaces for their operation.

PEOPLExpress was offered multiple options. Allegiant Air will take advantage of an

office and common-use ticket counters when they commence operations in February

2015.

Page | 10

L. Availability of an airport competitive access liaison to assist requesting carriers,

including new entrants

MSY has dedicated staff to market and promote air service and present business cases to

key airline planners, including familiarizing new carriers with MSY, terminal space

availability and ensuring incumbent and new entrants are aware of promotional

incentives. Any concerns regarding access should be reported to the Air Service

Manager, Business Development Officer or the Deputy Director and Chief Operations

Officer.

M. Number of aircraft remain overnight (RON) positions available at the airport by

lease arrangement, i.e. exclusive, preferential, common-use or unassigned, and

distribution by carrier. Describe procedures for monitoring and assigning RON

positions and for communicating availability of RON positions to users.

No change since the last Plan approval.

1.) Procedures for Assigning and Communicating Available RON Positions

No change since the last Plan approval.

2.) Monitoring Procedures

No change since the last Plan approval.

LEASING AND SUBLEASING ARRANGEMENTS

A. Is a subleasing agreement with an incumbent carrier necessary to obtain access?

No change since the last Plan approval.

B. How MSY assists requesting airlines obtain a sublease?

No change since the last Plan approval.

C. Airport policies regarding sublease fees (e.g., no more than 15 percent above the

standard airport-determined fee).

No change since the last Plan approval.

D. Airport oversight policies for sublease fees and ground handling arrangements.

Under the Airline-Airport Use and Lease Agreement, Airlines must request permission

from the Director of Aviation to sublease their preferential areas. Included in the request,

a copy of the proposed sublease agreement and rental fees are sent for review by MSY.

Page | 11

MSY will use best efforts to negotiate inclusion of fee limitation language in its next

Airline Airport Use and Lease Agreement. To date, we have not had an airline raise

concerns about sublease fees. If we were to receive such notification, we would review

the fees being charged and interject accordingly, if necessary, to amicably resolve the

matter.

E. Are formal arrangements in place to resolve disputes among air carriers regarding

the use of airport facilities?

In addition to direct one-on-one communication with the airlines, MSY sponsors an

Airport-Airline Affairs Committee (“AAAC”) as a primary vehicle for airlines to resolve

any disputes in regard to airport facilities. MSY hosts airline station managers meetings

as an additional means to identify any issues or concerns in regard to use of MSY

facilities. MSY is considering development of a formal procedure to resolve disputes

among air carriers, as we are committed to eliminating any impediments to competition.

F. How complaints by subtenants about excessive sublease fees or unneeded bundling

of services are resolved?

No change since the last Plan approval.

G. How independent contractors who want to provide ground handling, maintenance,

fueling, catering or other support services but have been unable to establish a

presence at MSY are accommodated?

Signatory air carriers may perform aircraft handling and servicing with their own

employees or by contracting for their services directly with a ground handling company

of their choice. In addition, MSY has eight independent and contractible companies on-

site to provide on-call ground handling. Alaska Airlines and PEOPLExpress expressed

interest in ground handlers not currently providing services at MSY. The Airport worked

with Menzie’s Aviation and QuickFlight Services to obtain Board approval for ground

handling permits so they may conduct business at MSY. A ground handler wishing to

conduct business at the Airport will contact the Manager of Properties to obtain

information on insurance requirements and vacant terminal spaces.

H. Copies of lease and use agreements in effect.

No change since the last Plan approval.

PATTERNS OF AIR SERVICE

A. Number of Markets Served

As of December 2014, MSY has nonstop service to 42 domestic and 3 international

destinations.

B. Nonstop Markets and Flight frequency

Page | 12

CY 2013-2014 (including announcements for 2015 service)

GATE ASSIGNMENT POLICY

A. Gate assignment policy and method of informing existing carriers and new entrants

of this policy. This would include standards and guidelines for gate usage and

leasing, such as security deposits, minimum usage, if any, fees, terms, master

agreements, signatory and non-signatory requirements.

Each airline considering service at MSY is provided a presentation, including a hard copy

entailing general airport information, gates available preferential or common use,

contacts for on-site ground handlers, rates and charges, and signage requirements.

Incumbent carriers have either preferential or common use gates. With thirteen available

common-use gates with jet bridges, requests are accommodated on a first come, first

serve basis.

B. Methods for announcing to tenant carriers when gates become available.

No change since the last Plan approval.

C. How announcements are made to tenant air carriers when gates become available.

Do all tenant air carriers receive information on gate availability and terms and

conditions by the same process at the same time?

No change since the last Plan approval.

D. New policies that have been adopted or actions that have been taken to ensure that

new entrant carriers have reasonable access to MSY and that incumbent carriers

can expand their operations.

There are currently thirteen (13) available gates with jet bridges available for incumbent

or new entrant carriers. There are seven (7) available gates on Concourse A with no jet

bridges that can be activated if additional space is needed by any carrier, new or existing.

Domestic International

Number of markets served nonstop 42 3

Average number of flights per day 134 1

Number of markets served by low-cost carriers 27

Number of markets served by one carrier 25 1

Number of new markets in 2013-2014 12 2

Number of previously served markets dropped since filing 5 1

Page | 13

Airport staff closely monitors gate utilization and availability in order to accommodate all

requests.

GATE USE REQUIREMENTS

A. Gate use monitoring policy, including schedules for monitoring, basis for

monitoring activity (i.e., airline schedules flight information display systems, etc.),

and the process for distributing the product to interested carriers.

MSY Operations staff monitors gates on a daily basis with information from the airline

station managers, handlers and their daily observations. If capacity were to become

constrained, Operations staff would also utilize daily flight schedules. Tenants must

request permission prior to use and staff assigns gates accordingly on a first come first

serve basis.

B. Requirements for signatory status and identity of signatory carriers.

No change since the last Plan approval.

C. Where applicable, minimum use requirements for leases (i.e., frequency of

operations, number of seats, etc.).

Currently, to become Signatory an Air Transportation Company must provide passenger

service with at least two daily departures, lease at least 2,500 square feet of terminal

space, and execute an agreement with MSY. MSY is negotiating the terms of a new Use

and Lease Agreement with the airlines. In principal, MSY and the airlines have agreed to

include an increased utilization requirement provision (as recommended by the FAA in

its 2013 Plan approval) to a minimum of four (4) scheduled turns per day for each

preferential gate.

D. The priorities, if any, employed to determine carriers that will be accommodated

through forced sharing or sub-leasing arrangements. Describe how these priorities

are communicated to interested carriers.

No change since the last Plan approval.

E. Justifications for any differences in gate use requirements among tenants.

No change since the last Plan approval.

F. Usage policies for common-use gates, including where applicable, a description of

priorities for use of common-use gates. Explain how these priorities are

communicated to interested carriers.

No change since the last Plan approval.

Page | 14

G. Methods for calculating rental rates or fees for leased and common-use space.

Where applicable, provide an explanation of the basis for disparities in rental fees

for common-use versus leased gates.

No change since the last Plan approval.

FINANCIAL CONSTRAINTS

A. The major source of revenue at MSY for terminal projects.

No change since the last Plan approval.

B. Rates and charges methodology (residual, compensatory, or hybrid).

No change since the last Plan approval.

C. Past use, if any, of PFC’s for gates and related terminal projects.

No change since the last Plan approval.

D. Availability of discretionary income for airport capital improvements.

No change since the last Plan approval.

AIRPORT CONTROLS OVER AIRSIDE AND GROUNDSIDE

CAPACITY

A. Majority-in-interest (MII) or “no further rates and charges” clauses covering

groundside and airside projects

The current Airport-Airline Use and Lease Agreements contain a Majority-in-interest

(MII) provision.

B. List capital construction projects that have been delayed or prevented because an

MII was invoked

None.

C. Plans to modify existing MII agreements

The existing Use and Lease Agreement with the airlines will be extended for a period of

one year to expire December 31, 2015. This extension is necessary to complete the

negotiations of the terms of a new Use and Lease Agreement with the airlines. In

Page | 15

principal, MSY and the airlines have agreed to a modified MII provision that will not

interfere with MSY’s approved Plan and will be consistent with the FAA’s intent and

guidance provided to MSY in connection with the 2013 approval of the Plan. Further, it

was agreed in principal that MII will not be required for any airport project less than $3

million in any one year and not to exceed a total $10 million for projects over any five

year period.

AIRPORT INTENTIONS TO BUILD OR ACQUIRE GATES TO

BE USED AS COMMON FACILITIES

A. The number of common-use gates available at MSY today.

Thirteen gates with jet bridges are available for common-use or preferential leasing.

B. The number of common-use gates MSY intends to build or acquire and timeline.

Intended financing.

The New Orleans Aviation Board is in the “design development” phase for a new

terminal replacement facility that is planned to open in 2018. The new “North Terminal”

is a $650 million project that will include an approximate 650,000 square foot terminal

containing two (2) concourses, Federal Inspection Service (FIS) and thirty (30) gates, and

such other associated terminal facilities. As part of the planning efforts, there is identified

space to allow for an expansion of the terminal to accommodate twelve (12) additional

gates (for a total of forty-two (42) gates). All aspects of this project have been

thoroughly coordinated with all stakeholders, including the airlines, FAA, U.S.

Transportation Security Administration, U.S. Customs and Border Patrol. The sources of

funding include FAA Airport Improvement Program grants, TSA grants, Louisiana State

Aviation Trust Fund grants, PFC collections, and General Airport Revenue Bonds.

C. Are any air carriers that have been serving MSY for more than three years relying

exclusively on common use gates?

Frontier has been using a common-use gate since 2010 with their low frequency seasonal

nonstop flight to Denver, Colorado. The use of this gate has not impeded growth plans

and allows for MSY to maintain service by Frontier by using a common use gate for their

seasonal service.

D. Whether common-use gates will be constructed in conjunction with gates leased

through exclusive or preferential-use arrangements.

The North Terminal will have 30 gates in 2018. There will be a combination of common

use and airline preferential leased gates, with the exact numbers determined when the

design is complete.

Page | 16

E. Whether gates being used for international service are available for domestic

service.

No change since the last Plan approval.

F. Do air carriers that only serve domestic markets now operate from international

gates?

No change since the last Plan approval.

AIRFARE COMPARISON

Average airfares cannot be directly compared to each other at a single airport due to the

differences in stage length, or miles flown, by each passenger. Therefore, it is appropriate to

compare the airfare on a miles flown basis in order to truly understand the differences between

the carrier fares at MSY.

When compared on a per mile basis, it is clear that there is an excellent competitive balance at

MSY among the incumbent air carriers. The range, between 8.49 – 20.69 cents for Calendar

Year (“CY”) 2013, is an acceptable range which encourages healthy competition among the

carriers. For example, United Airlines captured approximately 16% of the passenger share at

MSY in CY 2013, but its average ticket yield is in the middle of the range at 18.83 cents.

Southwest Airlines, whose average fare is among the lowest of the incumbent carriers at MSY at

$173.31, has the highest ticket yield of 20.69 cents. This is due to the fact that the average ticket

miles flown for a Southwest passenger at MSY are the lowest of all carriers, at 838 miles.

Therefore, when the fare is adjusted on a per mile basis the result is the highest ticket yield, but

still quite competitive.

MSY welcomed the entrance of Spirit Airlines into the air service picture in January 2013. This

is another positive development for competitive balance at MSY, as Spirit Airlines “ultra-low

cost carrier” strategy is one that stimulates demand based on low fares, thereby forcing other

legacy and low cost carriers to compete for these price conscious passengers. As the table

indicates, Spirit’s ticket yield, 8.49 cents, was indeed the lowest during CY 2013 at MSY. In CY

2015, MSY will welcome another ultra-low cost carrier, Allegiant Air, which will further

enhance the competitive balance at MSY.

MSY Ticket Yield by Carrier Comparison

CY 2013

Page | 17

Source: Aviation DataMiner™ analysis of DOT/BTS O&D Survey

MSY Airfares vs. Comparison Airports

MSY ranked #37 in overall enplanements during CY 2013, a 6.6% increase over CY 2012.

Based on the current ranking of MSY, airports that generated similar levels of enplanements for

CY 2013 have been compared to MSY for the purposes of the airfare comparison. The airports

chosen for this comparison are as follows:

Kansas City International Airport (MCI)

Raleigh-Durham International Airport (RDU)

Pittsburgh International Airport (PIT)

Source: http://www.faa.gov/airports/planning_capacity/passenger_allcargo_stats/passenger/

When comparing the ticket yield trends at MSY to its similar sized peer airports over the last

three years, it is evident that the air carriers at MSY operate in a very competitive and fair

environment. When compared to similar sized airports (MCI, RDU, and PIT), MSY had the

lowest percent increase in year-over-year yield increase between 2013 and 2012. Furthermore,

the average yield of 19.39 cents in CY 2013 is very competitive with the peer airports.

8.49¢

12.73¢

16.74¢

17.59¢

18.72¢

18.83¢

19.35¢

20.29¢

20.69¢

0.00¢

5.00¢

10.00¢

15.00¢

20.00¢

25.00¢

NK

F9

B6

FL

AA

UA

DL

US

WN

Ticket Yield

Rank

FAA

Region

State Locid City Airport Name

Arpt

Category

Hub

CY 13

Enplanements

CY 12

Enplanements

%

Change

35 CE MO MCI Kansas City Kansas City International P M 4,836,221 4,866,850 -0.6%

37 SW LA MSY Metairie Louis Armstrong New Orleans International P M 4,576,539 4,293,624 6.6%

39 SO NC RDU Raleigh Raleigh-Durham International P M 4,482,016 4,490,374 -0.2%

46 EA PA PIT Pittsburgh Pittsburgh International P M 3,812,460 3,892,338 -2.1%

Page | 18

MSY vs. Similar Sized Airports Ticket Yield Trend

Three Year Trend: 2011 – 2013

Source: Aviation DataMiner™ analysis of DOT/BTS O&D Survey

MSY Top 25 O&D Markets: Yield/Airfare Comparison

In addition to analyzing the overall yields at MSY versus the similar sized airports, it is

instructive to examine the yields in the MSY Top 25 Origination and Destination (“O&D”)

markets as compared to the same markets at the comparison airports. As is shown in the table

below, MSY has very competitive yields to its Top 25 O&D markets compared to MCI, RDU,

and PIT.

Airport CY 2011 CY 2012 CY 2013

12 vs '11

YOY %

Increase

13 vs '12

YOY %

Increase

MSY

17.29¢ 18.96¢ 19.39¢

9.7% 2.3%

MCI

17.15¢ 17.97¢ 19.08¢

4.8% 6.2%

RDU

18.05¢ 19.02¢ 19.54¢

5.4% 2.7%

PIT

16.83¢ 18.24¢ 19.20¢

8.4% 5.3%

Page | 19

Rank M arket P sgr

Net OW

Fare

Ticket

Yield

M arket P sgr

Net OW

Fare

Ticket

Yield

M arket P sgr

Net OW

Fare

Ticket

Yield

M arket P sgr

Net OW

Fare

Ticket

Yield

1 HOU 380,032 $153.81 50.82¢ HOU 130,239 $197.22 28.93¢ HOU 65,307 $208.18 19.27¢ HOU 56,584 $201.72 16.66¢

2 ATL 341,364 $139.77 32.23¢ ATL 289,661 $170.59 23.71¢ ATL 398,605 $135.03 37.75¢ ATL 292,677 $160.89 29.81¢

3 LAX 320,047 $258.98 14.95¢ LAX 265,393 $200.37 14.17¢ LAX 239,823 $221.18 9.76¢ LAX 165,449 $270.79 12.08¢

4 LGA 293,444 $189.07 15.36¢ LGA 189,049 $268.87 23.02¢ LGA 479,321 $143.25 32.29¢ LGA 281,173 $211.04 62.80¢

5 DAL 284,734 $138.76 31.45¢ DAL 240,242 $151.95 32.80¢ DAL 29,694 $174.11 14.14¢ DAL 12,380 $202.94 15.99¢

6 DEN 247,740 $159.43 14.47¢ DEN 462,776 $113.69 21.11¢ DEN 183,843 $200.02 12.92¢ DEN 163,900 $235.05 17.16¢

7 IAH 238,987 $173.68 56.79¢ IAH 80,719 $251.59 37.50¢ IAH 87,536 $245.88 23.13¢ IAH 178,849 $291.08 25.03¢

8 MCO 237,250 $157.10 25.76¢ MCO 271,731 $177.60 15.66¢ MCO 271,373 $131.21 23.35¢ MCO 419,985 $140.95 16.45¢

9 BWI 235,675 $190.88 18.32¢ BWI 160,455 $189.52 18.69¢ BWI 206,336 $130.32 50.77¢ BWI 68,608 $125.30 57.46¢

10 JFK 233,321 $199.70 16.80¢ JFK 20,527 $244.38 20.09¢ JFK 237,007 $130.81 30.20¢ JFK 63,191 $170.32 48.39¢

11 EWR 218,137 $207.17 17.08¢ EWR 125,091 $281.27 24.83¢ EWR 153,589 $221.35 47.83¢ EWR 112,464 $260.04 79.11¢

12 DFW 210,156 $110.06 24.24¢ DFW 182,158 $148.66 31.81¢ DFW 191,942 $230.64 21.40¢ DFW 194,427 $232.96 20.61¢

13 DCA 198,993 $226.96 22.75¢ DCA 202,687 $163.19 16.51¢ DCA 120,050 $215.12 93.84¢ DCA 50,245 $161.62 78.04¢

14 PHL 192,994 $202.26 17.40¢ PHL 160,330 $188.08 16.86¢ PHL 236,807 $175.82 51.47¢ PHL 163,593 $242.62 87.74¢

15 TPA 181,137 $142.18 26.22¢ TPA 140,581 $195.45 17.27¢ TPA 178,325 $149.99 24.24¢ TPA 269,540 $142.07 15.72¢

16 BOS 179,528 $199.25 13.68¢ BOS 146,818 $202.48 15.34¢ BOS 417,898 $140.00 22.50¢ BOS 332,086 $125.43 24.84¢

17 SFO 177,310 $283.11 14.06¢ SFO 135,528 $238.28 15.17¢ SFO 188,893 $286.39 11.60¢ SFO 147,095 $287.25 12.02¢

18 LAS 158,561 $210.55 13.27¢ LA S 285,298 $178.68 14.96¢ LAS 148,718 $222.73 10.53¢ LA S 255,797 $189.09 9.43¢

19 ORD 154,904 $230.39 24.52¢ ORD 232,355 $158.06 38.67¢ ORD 276,047 $177.24 26.33¢ O RD 228, 174 $161.41 37.87¢

20 MDW 151,430 $190.76 22.27¢ MDW 337,962 $141.65 34.63¢ MDW 166,136 $147.85 22.31¢ MDW 187,476 $132.72 32.92¢

21 BNA 148,807 $138.15 27.78¢ BNA 144,860 $135.17 25.60¢ BNA 193,887 $121.76 26.38¢ BNA 60,474 $160.60 23.46¢

22 FLL 131,711 $173.60 22.58¢ FLL 166,118 $163.31 12.23¢ FLL 184,700 $127.29 16.56¢ FLL 192,090 $153.86 14.80¢

23 MIA 126,069 $178.38 24.85¢ MIA 37,340 $201.80 13.87¢ MIA 147,707 $134.89 18.41¢ MIA 77,704 $162.52 15.10¢

24 DTW 120,684 $194.65 19.63¢ DTW 120,360 $264.55 38.05¢ DTW 118,623 $210.94 36.60¢ DTW 26,061 $319.96 156.90¢

25 PHX 110,975 $204.33 13.96¢ PHX 279,098 $182.71 16.58¢ PHX 118,815 $218.04 11.15¢ PHX 163,936 $223.12 11.85¢

MCI

RDU

PIT

MSY

Page | 20

CY 2013 Comparison

Car r ier

CY 2 0 1 3

O& D P ax

CY 2 0 1 3

P ax Share

%

CY 2 0 1 3

A vg. Net O ne

Way Fare

CY 2 0 1 3

T icket

Yield

CY 2 0 1 3

A vg. T icket

Miles

AA 682,582 8.3% $198.54 18.72¢ 1,061

B6 241,148 2.9% $207.75 16.74¢ 1,241

DL 1,645,161 20.1% $211.00 19.35¢ 1,090

F9 131,972 1.6% $170.72 12.73¢ 1, 341

FL 125,760 1.5% $149.35 17.59¢ 849

NK 72, 341 0.9% $57.57 8.49¢ 678

UA 1,303,738 15.9% $228.32 18.83¢ 1,213

US 784,514 9.6% $222.13 20.29¢ 1,095

WN 3,193,554 39.0% $173.31 20.69¢ 838

Total 8,181,002 100.0% $196.45 19.39¢ 1,013

Car r ier

CY 2 0 1 3

O& D P ax

CY 2 0 1 3

P ax Share

%

CY 2 0 1 3

A vg. Net O ne

Way Fare

CY 2 0 1 3

T icket

Yield

CY 2 0 1 3

A vg. T icket

Miles

AA 696,590 8.2% $174.45 19.28¢ 905

AS 95,933 1.1% $218.53 12.39¢ 1,764

DL 1,528,169 17.9% $214.24 20.94¢ 1,023

F9 515,276 6.0% $133.34 14.21¢ 938

FL 112,272 1.3% $163.64 15.52¢ 1,054

UA 928,016 10.9% $217.00 20.60¢ 1,053

US 713,109 8.4% $213.78 17.16¢ 1,246

WN 3,947,660 46.2% $171.62 19.37¢ 886

Total 8,537,373 100.0% $186.59 19.08¢ 978

Car r ier

CY 2 0 1 3

O& D P ax

CY 2 0 1 3

P ax Share

%

CY 2 0 1 3

A vg. Net O ne

Way Fare

CY 2 0 1 3

T icket

Yield

CY 2 0 1 3

A vg. T icket

Miles

AA 1,194,370 15.0% $197.05 17.94¢ 1,098

B6 417,288 5.3% $137.92 20.66¢ 668

DL 2,220,830 28.0% $187.89 20.31¢ 925

F9 86,638 1.1% $118.66 26.57¢ 447

FL 157,006 2.0% $138.27 17.54¢ 788

UA 752,852 9.5% $236.94 18.90¢ 1,253

US 1,166,402 14.7% $193.73 24.64¢ 786

WN 1,941,357 24.5% $164.77 17.20¢ 958

Total 7,937,663 100.0% $185.03 19.54¢ 947

Car r ier

CY 2 0 1 3

O& D P ax

CY 2 0 1 3

P ax Share

%

CY 2 0 1 3

A vg. Net O ne

Way Fare

CY 2 0 1 3

T icket

Yield

CY 2 0 1 3

A vg. T icket

Miles

AA 523,958 7.6% $222.13 16.92¢ 1,313

B6 190,095 2.8% $119.29 20.81¢ 573

DL 1,196,345 17.5% $214.03 23.47¢ 912

F9 177,836 2.6% $167.73 29.13¢ 576

FL 268,723 3.9% $149.91 16.01¢ 937

UA 1,120,451 16.3% $244.93 18.57¢ 1,319

US 1,558,078 22.7% $208.97 23.16¢ 902

WN 1,817,699 26.5% $163.96 14.94¢ 1,098

Total 6,854,516 100.0% $199.29 19.20¢ 1,038

MSY

MCI

RDU

PIT

Page | 21

CY 2012 Comparison

Car rier

CY 2 0 1 2

O& D P ax

CY 2 0 1 2

P ax Shar e

%

CY 2 0 1 2

A vg. Net O ne

Way Far e

CY 2 0 1 2

T icket

Yield

CY 2 0 1 2

A vg. T icket

Miles

AA 685,117 8.8% $201.51 19.10¢ 1,055

B6 247,964 3.2% $201.27 16.22¢ 1,241

DL 1,660,709 21.3% $201.04 18.41¢ 1,092

F9 129,460 1.7% $180.42 14.65¢ 1,231

FL 327,795 4.2% $138.50 15.89¢ 872

UA 1,339,950 17.2% $221.04 17.45¢ 1,266

US 702,065 9.0% $219.93 20.52¢ 1,072

WN 2,717,035 34.8% $174.51 21.12¢ 826

Total 7,810,266 100.0% $194.15 18.96¢ 1,024

Car rier

CY 2 0 1 2

O& D P ax

CY 2 0 1 2

P ax Shar e

%

CY 2 0 1 2

A vg. Net O ne

Way Far e

CY 2 0 1 2

T icket

Yield

CY 2 0 1 2

A vg. T icket

Miles

AA 757,824 8.7% $171.08 18.62¢ 919

AS 77,193 0.9% $209.26 11.93¢ 1,754

DL 1,627,174 18.6% $202.07 19.12¢ 1,057

F9 792,208 9.1% $134.89 13.88¢ 972

FL 174,789 2.0% $135.82 13.67¢ 993

UA 1,062,666 12.2% $205.95 19.19¢ 1,073

US 670,782 7.7% $204.50 16.52¢ 1,238

WN 3,573,083 40.9% $163.89 18.70¢ 876

Total 8,735,805 100.0% $177.36 17.97¢ 987

Car rier

CY 2 0 1 2

O& D P ax

CY 2 0 1 2

P ax Shar e

%

CY 2 0 1 2

A vg. Net O ne

Way Far e

CY 2 0 1 2

T icket

Yield

CY 2 0 1 2

A vg. T icket

Miles

AA 1,129,566 14.2% $195.84 18.29¢ 1,071

B6 424,662 5.3% $129.88 20.49¢ 634

DL 2,124,170 26.6% $179.62 19.22¢ 935

F9 74,476 0.9% $154.81 27.45¢ 564

FL 223,384 2.8% $121.21 14.80¢ 819

UA 843,722 10.6% $227.40 18.44¢ 1,233

US 1,239,118 15.5% $178.85 22.20¢ 805

WN 1,922,574 24.1% $160.66 17.69¢ 908

Total 7,982,325 100.0% $177.64 19.02¢ 934

Car rier

CY 2 0 1 2

O& D P ax

CY 2 0 1 2

P ax Shar e

%

CY 2 0 1 2

A vg. Net O ne

Way Far e

CY 2 0 1 2

T icket

Yield

CY 2 0 1 2

A vg. T icket

Miles

AA 531,256 7.5% $219.10 17.22¢ 1,272

B6 264,598 3.7% $113.76 20.48¢ 555

DL 1,260,174 17.7% $191.14 20.48¢ 933

F9 163,365 2.3% $135.68 27.74¢ 489

FL 679,913 9.5% $134.74 14.71¢ 916

UA 1,200,836 16.8% $235.86 17.38¢ 1,357

US 1,616,820 22.7% $196.02 22.67¢ 865

WN 1,404,043 19.7% $167.23 14.52¢ 1,152

Total 7,130,543 100.0% $187.80 18.24¢ 1,030

MSY

MCI

RDU

PIT

Page | 22

CY 2011 Comparison

Car rier

CY 2 0 1 1

O& D P ax

CY 2 0 1 1

P ax Shar e

%

CY 2 0 1 1

A v g. Net O ne

Way Far e

CY 2 0 1 1

T icket

Yield

CY 2 0 1 1

A v g. T icket

Miles

AA 752,457 9.7% $180.12 17.40¢ 1,035

B6 254,493 3.3% $173.16 13.96¢ 1,240

CO 857,489 11.0% $192.06 17.72¢ 1,084

DL 1,627,805 20.9% $180.57 16.59¢ 1,088

F9 278,213 3.6% $176.79 16.06¢ 1,101

FL 356,242 4.6% $128.74 14.39¢ 895

UA 542,536 7.0% $214.50 14.61¢ 1,468

US 515,586 6.6% $197.32 18.58¢ 1,062

WN 2,604,844 33.44% $161.93 19.42¢

834

Total 7,790,158 100.0% $176.26 17.29¢ 1,019

Car rier

CY 2 0 1 1

O& D P ax

CY 2 0 1 1

P ax Shar e

%

CY 2 0 1 1

A v g. Net O ne

Way Far e

CY 2 0 1 1

T icket

Yield

CY 2 0 1 1

A v g. T icket

Miles

AA 773,752 8.7% $164.77 17.79¢ 926

CO 453,713 5.1% $207.34 19.58¢ 1,059

DL 1,608,543 18.0% $180.02 17.93¢ 1,004

F9 1, 197,231 13.4% $132.84 13.83¢ 960

FL 202,393 2.3% $133.92 13.76¢ 973

UA 640,199 7.2% $199.32 19.19¢ 1,038

US 620,507 6.9% $199.87 15.87¢ 1,259

WN 3,430,438 38.4% $156.11 17.57¢ 888

Total 8,928,621 100.0% $166.60 17.15¢ 971

Car rier

CY 2 0 1 1

O& D P ax

CY 2 0 1 1

P ax Shar e

%

CY 2 0 1 1

A v g. Net O ne

Way Far e

CY 2 0 1 1

T icket

Yield

CY 2 0 1 1

A v g. T icket

Miles

AA 1,151,300 14.4% $184. 91 17.06¢ 1,084

B6 437,876 5.5% $115.12 18.82¢ 612

CO 499,243 6.3% $211.85 17.58¢ 1,205

DL 2,073,873 26.0% $170.57 17.89¢ 953

F9 114,698 1.4% $147.19 21.28¢ 692

FL 220,497 2.8% $127.69 15.07¢ 847

UA 366,736 4.6% $211.33 17.62¢ 1,199

US 1,258,970 15.8% $167.03 22.37¢ 747

WN 1,844,617 23.14% $154.58 16.74¢

923

Total 7,971,385 100.0% $168.16 18.05¢ 932

Car rier

CY 2 0 1 1

O& D P ax

CY 2 0 1 1

P ax Shar e

%

CY 2 0 1 1

A v g. Net O ne

Way Far e

CY 2 0 1 1

T icket

Yield

CY 2 0 1 1

A v g. T icket

Miles

AA 525,023 7.0% $198.45 15.64¢ 1,269

B6 247,083 3.3% $98.28 18.74¢ 525

CO 548,661 7.4% $218.31 16.73¢ 1,305

DL 1,212,222 16.3% $181.19 18.71¢ 968

F9 211,205 2.8% $129.13 19.93¢ 648

FL 765,237 10.3% $128.88 13.94¢ 925

UA 688,539 9.2% $226.97 15.47¢ 1,468

US 1,741,948 23.4% $172.49 20.03¢ 861

WN 1,504,935 20.18% $150.34 14.54¢

1,034

Total 7,456,027 100.0% $171.32 16.83¢ 1,018

MSY

MCI

RDU

PIT

Page | 23

MSY City Pair Comparison with Similar Sized Airports

The following tables indicate the nonstop domestic city pair comparison at MSY with airports of

similar size, which for this analysis are MCI, RDU, and PIT. The data that is summarized

includes the local passengers, average passenger trip length, average passenger yield, and the city

pairs portioned off between markets of 750 miles or less and markets over 750 miles.

Furthermore, it is indicated which of these city pairs has a low fare carrier present. For this

analysis, low fare carrier has been defined as JetBlue, Frontier, Southwest/AirTran, Spirit, and

Allegiant. The following data is based on CY 2013 data.

Page | 24

O& D

Market

Rank

Market P sgr

Net O W

Far e

T icket

Yield

A vg.

Passenger

T r ip L ength

Nonstop

Ser vice

< 7 5 0

Miles

> 7 5 0

Miles

Low Fare

Car rier

Pr esent

1 HOU 380,032 $153.81 50.82¢ 303 Y X WN

7 IAH 238,987 $173.68 56.79¢ 306 Y X -

59 BHM 29,175 $135.46 32.79¢ 413 Y X WN

2 ATL 341,364 $139.77 32.23¢ 434 Y X WN

5 DAL 284,734 $138.76 31.45¢ 441 Y X WN

66 MEM 19,363 $284.28 63.74¢ 446 Y X -

12 DFW 210,156 $110.06 24.24¢ 454 Y X NK

21 BNA 148,807 $138.15 27.78¢ 497 Y X WN

31 AUS 94,415 $184.96 37.13¢ 498 Y X WN

15 TPA 181,137 $142.18 26.22¢ 542 Y X WN

8 MCO 237,250 $157.10 25.76¢ 610 Y X WN

61 EYW 24,205 $156.87 22.98¢ 683 Y X WN

28 CLT 107,355 $184.78 26.50¢ 697 Y X -

26 STL 109,711 $179.55 25.56¢ 703 Y X WN

23 MIA 126,069 $178.38 24.85¢ 718 Y X -

22 FLL 131,711 $173.60 22.58¢ 769 Y X WN

29 MCI 101,591 $145.11 17.75¢ 818 Y X WN

53 CVG 34,812 $222.45 26.71¢ 833 Y X -

20 MDW 151,430 $190.76 22.27¢ 856 Y X WN

19 ORD 154,904 $230.39 24.52¢ 939 Y X -

24 DTW 120,684 $194.65 19.63¢ 992 Y X -

13 DCA 198,993 $226.96 22.75¢ 997 Y X -

34 MKE 68,465 $141.24 14.14¢ 999 Y X WN

38 IAD 51,313 $264.98 26.00¢ 1,019 Y X -

9 BWI 235,675 $190.88 18.32¢ 1,042 Y X WN

41 CLE 46,547 $216.85 20.62¢ 1,052 Y X -

6 DEN 247,740 $159.43 14.47¢ 1,102 Y X F9/WN

80 TTN 14,335 $91.81 8.17¢ 1,123 Y X F9

14 PHL 192,994 $202.26 17.40¢ 1,163 Y X -

30 MSP 101,395 $214.95 18.49¢ 1,163 Y X -

10 JFK 233,321 $199.70 16.80¢ 1,189 Y X B6

11 EWR 218,137 $207.17 17.08¢ 1,213 Y X WN

4 LGA 293,444 $189.07 15.36¢ 1,231 Y X -

16 BOS 179,528 $199.25 13.68¢ 1,456 Y X B6

25 PHX 110,975 $204.33 13.96¢ 1,464 Y X WN

39 SLC 50,320 $259.07 16.51¢ 1,569 Y X -

18 LAS 158,561 $210.55 13.27¢ 1,587 Y X WN

3 LAX 320,047 $258.98 14.95¢ 1,732 Y X WN

17 SFO 177,310 $283.11 14.06¢ 2,014 Y X -

MSY

Page | 25

O& D

Market

Rank

Market Psgr

Net O W

Far e

T icket

Yield

A vg.

Passenger

T r ip Length

Nonstop

Ser vice

< 7 5 0

Miles

> 7 5 0

Miles

Low Far e

Carr ier

Pr esent

30 STL 101,490 $121.57 51.24¢ 237 Y X WN

9 ORD 232,355 $158.06 38.67¢ 409 Y X -

2 MDW 337,962 $141.65 34.63¢ 409 Y X WN

13 MSP 170,496 $184.70 45.13¢ 409 Y X WN

52 OKC 33,201 $137.22 33.09¢ 415 Y X WN

8 DAL 240,242 $151.95 32.80¢ 463 Y X WN

12 DFW 182,158 $148.66 31.81¢ 467 Y X -

28 MKE 102,328 $133.77 27.99¢ 478 Y X WN

84 MEM 14,201 $270.34 52.92¢ 511 Y X -

31 IND 100,708 $131.82 25.79¢ 511 Y X WN

20 BNA 144,860 $135.17 25.60¢ 528 Y X WN

1 DEN 462,776 $113.69 21.11¢ 538 Y X F9/WN

47 CVG 42,325 $215.49 36.00¢ 599 Y X -

38 IAH 80,719 $251.59 37.50¢ 671 Y X -

23 HOU 130,239 $197.22 28.93¢ 682 Y X WN

25 DTW 120,360 $264.55 38.05¢ 695 Y X -

3 ATL 289,661 $170.59 23.71¢ 719 Y X WN

43 CLE 61,678 $238.34 31.46¢ 758 Y X -

29 MSY 101,591 $145.11 17.75¢ 818 Y X WN

44 ABQ 56,991 $171.77 20.10¢ 855 Y X WN

27 CLT 109,135 $181.75 20.09¢ 905 Y X -

37 IAD 86,718 $194.88 20.11¢ 969 Y X -

10 DCA 202,687 $163.19 16.51¢ 988 Y X F9

34 SLC 91,187 $192.31 19.39¢ 992 Y X -

17 BWI 160,455 $189.52 18.69¢ 1,014 Y X WN

5 PHX 279,098 $182.71 16.58¢ 1,102 Y X WN

18 PHL 160,330 $188.08 16.86¢ 1,116 Y X -

21 TPA 140,581 $195.45 17.27¢ 1,132 Y X WN

24 EWR 125,091 $281.27 24.83¢ 1,133 Y X -

6 MCO 271,731 $177.60 15.66¢ 1,134 Y X WN

11 LGA 189,049 $268.87 23.02¢ 1,168 Y X -

4 LAS 285,298 $178.68 14.96¢ 1,194 Y X WN

71 JFK 20,527 $244.38 20.09¢ 1,217 Y X -

19 BOS 146,818 $202.48 15.34¢ 1,320 Y X WN

14 FLL 166,118 $163.31 12.23¢ 1,335 Y X WN

7 LAX 265,393 $200.37 14.17¢ 1,414 Y X WN

16 SAN 160,524 $195.16 13.63¢ 1,431 Y X WN

32 OAK 100,684 $193.14 12.45¢ 1,552 Y X WN

22 SFO 135,528 $238.28 15.17¢ 1,571 Y X -

15 SEA 163,235 $196.22 12.23¢ 1,605 Y X WN

26 PDX 113,525 $183.29 11.26¢ 1,627 Y X WN

MCI

Page | 26

O& D

Mar ket

Rank

Mar ket P sgr

Net O W

Far e

T icket

Yield

A vg.

Passenger

T r ip Length

Nonstop

Ser vice

< 7 50

Miles

> 7 50

Miles

Low Far e

Car rier

Pr esent

81 CLT 12,694 $143.21 109.64¢ 131 Y X -

21 DCA 120,050 $215.12 93.84¢ 229 Y X -

51 IAD 33,232 $266.17 115.21¢ 231 Y X -

9 BWI 206,336 $130.32 50.77¢ 257 Y X WN

8 PHL 236,807 $175.82 51.47¢ 342 Y X WN

3 ATL 398,605 $135.03 37.75¢ 358 Y X WN

49 TTN 39,117 $61.75 16.55¢ 373 Y X F9

29 PIT 75,495 $116.32 31.06¢ 375 Y X -

7 JFK 237,007 $130.81 30.20¢ 433 Y X B6

1 LGA 479,321 $143.25 32.29¢ 444 Y X -

45 CVG 44,690 $222.97 48.74¢ 457 Y X -

10 BNA 193,887 $121.76 26.38¢ 462 Y X WN

17 EWR 153,589 $221.35 47.83¢ 463 Y X -

39 CMH 51,582 $184.93 37.65¢ 491 Y X -

36 CLE 63,398 $197.00 37.85¢ 520 Y X -

5 MCO 271,373 $131.21 23.35¢ 562 Y X WN

23 DTW 118,623 $210.94 36.60¢ 576 Y X -

30 IND 74,322 $193.79 32.56¢ 595 Y X -

35 BDL 63,592 $179.18 29.65¢ 604 Y X -

15 TPA 178,325 $149.99 24.24¢ 619 Y X WN

2 BOS 417,898 $140.00 22.50¢ 622 Y X B6

16 MDW 166,136 $147.85 22.31¢ 663 Y X WN

4 ORD 276,047 $177.24 26.33¢ 673 Y X -

43 MEM 47,743 $204.44 30.24¢ 676 Y X -

19 MIA 147,707 $134.89 18.41¢ 733 Y X -

24 STL 109,654 $168.82 22.28¢ 758 Y X WN

13 FLL 184,700 $127.29 16.56¢ 769 Y X B6/WN

20 MSP 144,505 $204.23 19.61¢ 1,041 Y X -

27 IAH 87,536 $245.88 23.13¢ 1,063 Y X -

11 DFW 191,942 $230.64 21.40¢ 1,078 Y X -

33 HOU 65,307 $208.18 19.27¢ 1,081 Y X WN

14 DEN 183,843 $200.02 12.92¢ 1,548 Y X WN

22 PHX 118,815 $218.04 11.15¢ 1,956 Y X WN

34 SLC 65,132 $243.39 12.18¢ 1,998 Y X -

18 LAS 148,718 $222.73 10.53¢ 2,115 Y X WN

6 LAX 239,823 $221.18 9.76¢ 2,266 Y X -

12 SFO 188,893 $286.39 11.60¢ 2,470 Y X -

RDU

Page | 27

O& D

Mar ket

Rank

Mar ket P sgr

Net O W

Far e

T icket

Yield

A vg.

Passenger

T r ip Length

Nonstop

Ser vice

< 7 5 0

Miles

> 7 5 0

Miles

Low Far e

Car rier

Present

285 CLE 152 $91.05 75.84¢ 120 Y X F9

67 IAD 15,887 $287.82 157.67¢ 183 Y X

51 DTW 26,061 $319.96 156.90¢ 204 Y X

38 DCA 50,245 $161.62 78.04¢ 207 Y X

27 BWI 68,608 $125.30 57.46¢ 218 Y X WN

68 CVG 15,743 $284.94 107.31¢ 266 Y X

16 PHL 163,593 $242.62 87.74¢ 277 Y X

19 EWR 112,464 $260.04 79.11¢ 329 Y X

4 LGA 281,173 $211.04 62.80¢ 336 Y X

30 JFK 63,191 $170.32 48.39¢ 352 Y X B6

25 RDU 75,495 $116.32 31.06¢ 375 Y X

10 MDW 187,476 $132.72 32.92¢ 403 Y X WN

7 ORD 228,174 $161.41 37.87¢ 426 Y X

26 BDL 72,640 $140.65 32.22¢ 437 Y X

18 CLT 120,849 $199.64 45.45¢ 439 Y X

2 BOS 332,086 $125.43 24.84¢ 505 Y X B6

3 ATL 292,677 $160.89 29.81¢ 540 Y X WN

21 STL 85,290 $157.42 24.02¢ 655 Y X

32 BNA 60,474 $160.60 23.46¢ 685 Y X WN

41 MEM 38,975 $202.65 26.15¢ 775 Y X

20 MSP 107,990 $233.25 28.25¢ 826 Y X

1 MCO 419,985 $140.95 16.45¢ 857 Y X WN

5 TPA 269,540 $142.07 15.72¢ 904 Y X WN

12 RSW 169,434 $150.35 15.12¢ 994 Y X WN

28 PBI 65,612 $157.99 15.43¢ 1,024 Y X WN

9 FLL 192,090 $153.86 14.80¢ 1,039 Y X WN

23 MIA 77,704 $162.52 15.10¢ 1,076 Y X

8 DFW 194,427 $232.96 20.61¢ 1,131 Y X

11 IAH 178,849 $291.08 25.03¢ 1,163 Y X

34 HOU 56,584 $201.72 16.66¢ 1,211 Y X WN

15 DEN 163,900 $235.05 17.16¢ 1,370 Y X WN

14 PHX 163,936 $223.12 11.85¢ 1,882 Y X WN

6 LAS 255,797 $189.09 9.43¢ 2,004 Y X WN

13 LAX 165,449 $270.79 12.08¢ 2,241 Y X

17 SFO 147,095 $287.25 12.02¢ 2,391 Y X

PIT

Page | 28

SUMMARY

MSY is committed to encouraging and facilitating airline competition. MSY staff strategically

identifies markets that currently or potentially support nonstop service. Once those markets are

identified, MSY begins negotiations with carriers who might have an interest in entering one of

the individual markets with competitive service and fares.

Similarly, MSY identifies markets with potentially higher average fares and brings it to a low-

cost carrier’s attention, such as Dallas/Fort Worth and Newark which were added in 2013 by

Spirit Airlines and Southwest Airlines respectively. Chicago, Detroit and Ft. Lauderdale were

also added by Spirit Airlines in 2014 to compete with legacy carriers and another low-cost

carrier, Southwest Airlines. Allegiant Air, also known for their ultra-low cost model will begin

nonstop service to Orlando-Sanford, Columbus-Rickenbacker, Indianapolis and Cincinnati in the

first quarter of 2015.

As opportunities unfold and opportunities to increase service and improve competition further

arise, MSY is dedicated to maximizing the use of its facilities for existing and potential new

entrant carriers. At this time, MSY ticket and gate areas are not at maximum capacity, and able

to accommodate expanded or new service as needed.