August 2024

S&P Dow Jones Indices: Index Methodology

Equity Indices Policies & Practices

Methodology

S&P Dow Jones Indices: Equity Indices Policies & Practices 1

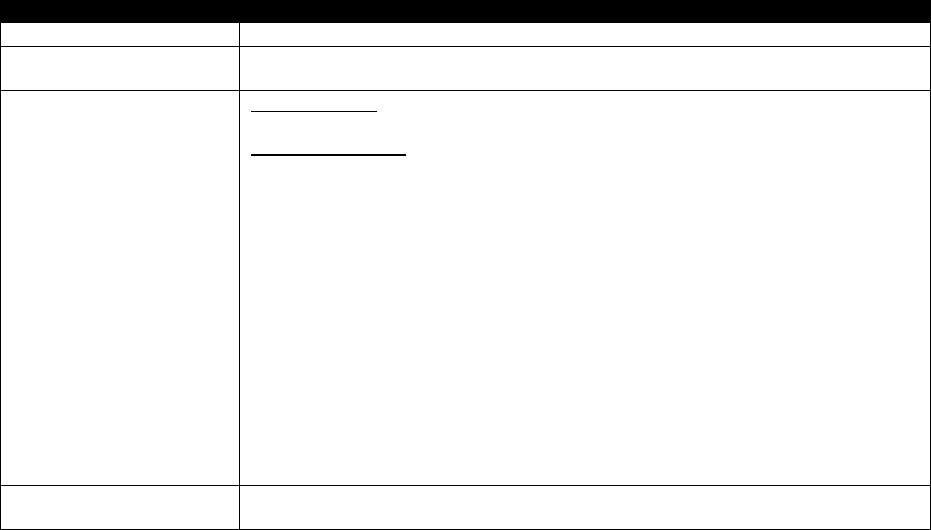

Table of Contents

Introduction 4

Overview 4

Corporate Action Treatment by Index Categorization 4

Additions and Deletions 5

Mandatory Events 6

Mergers & Acquisitions 6

Reverse Mergers/Takeovers 7

Tendered Shares 8

Spin-Offs 8

Treatment of Spin-Offs in Market Capitalization Indices 8

Treatment of Spin-Offs in Certain Non-Market Capitalization Indices 9

Rights Offerings (or “Rights Issues”) 10

S&P DJI’s Calculation of Rights Offerings 10

Non-Market Capitalization Weighted Indices 12

Warrants, Options, Partly Paid Shares, Convertible Bonds, Contingent Value

Rights, and Other Ineligible Securities & Share Types 12

Non-Mandatory Share and IWF Updates 14

Material Share/IWF Changes - Accelerated Implementation Rule 14

Market Specific Accelerated Implementation Rules 15

Announcement Policy 15

Non-Material Share/IWF Changes – Quarterly Implementation 15

Rebalancing Guidelines – Share/IWF Reference Date & Freeze Period 16

Certain Share Types and Designations 17

Multiple Share Classes 17

Designated Listings 17

Depositary Receipt Shares 18

Brazil Units 18

Dividends, Stock Splits, and Consolidations 19

Dividends 19

Regional Variations in the Treatment of Cash Dividends 20

Post Ex-date Dividend Adjustment 22

Foreign Exchange Conversions for Dividends 23

Multiple Dividend Distributions on a Single Day 23

S&P Dow Jones Indices: Equity Indices Policies & Practices 2

Dividend Not Quoted Ex by the Exchange 23

Bonus Issues of Shares Not Entitled To Cash Dividend 23

Total Return and Net Return Indices 23

Stock Split and Consolidation 24

Certain Eligibility Criteria for Dividend Focused Indices 24

Monthly Review for Ongoing Eligibility in Dividend Focused Indices 25

Summary of Corporate Action Treatment by Index Weighting Type 27

Market Capitalization Indices 27

Non-Market Capitalization Indices (Excluding Price & Equal Weighted Indices) 28

Price Weighted Indices 29

Equal Weighted Indices 30

Regulatory Capping Requirements 31

Treatment of Corporate Actions on Exchange Holidays 33

Price Adjusting Corporate Actions 33

Non-Price Adjusting Corporate Actions 33

Bankruptcies & Stock Suspensions 34

Bankruptcies 34

Long-Term Stock Suspensions 34

Short-Term Stock Suspensions 35

Sanctions 35

Domiciles 37

Policy 37

Controls on the Repatriation of Foreign Capital 39

Unexpected Exchange Closures 40

U.S. Securities 40

International Securities 40

Treatment of Corporate Actions 41

Rebalancing 42

Index Recalculation Policy 44

End-of-Month Global Fundamental Data – Recalculation Policy 45

Index Governance 47

Index Committee 47

Quality Assurance 47

Internal Reviews of Methodology 47

Index Policy 49

Announcements 49

Pro-forma Files 49

S&P Dow Jones Indices: Equity Indices Policies & Practices 3

Holiday Schedule 49

Exchange Rate 49

Corporate Actions Applicable to Domestic Investors Only 49

Special Index Variations 49

Child Indices 50

Index Cessations 50

Calculations and Pricing Disruptions 50

Other Adjustments 52

Expert Judgment 52

Discretion 52

Data Hierarchy and Data Sources 52

Contact Information 52

Appendix A – Definitions and Terms 53

Rights Offering Terms and Definitions 53

Appendix B – Methodology Changes 60

Disclaimer 71

Performance Disclosure/Back-Tested Data 71

Intellectual Property Notices/Disclaimer 72

ESG Indices Disclaimer 74

S&P Dow Jones Indices: Equity Indices Policies & Practices 4

Introduction

Overview

S&P Dow Jones Indices’ (S&P DJI) equity indices adhere to the general policies and practices covering

corporate action treatment, index applications, pricing guidelines, market disruptions, recalculations, and

other policies outlined below.

However, please note that local market practices may take precedence over general S&P DJI policies &

practices in some instances, so there are exceptions and/or special rules pertaining to those markets. If

an index methodology specifies a different approach than the general approach stated within this policy

document, the rules stated in the index methodology take precedence. To the extent possible, the

implementation and timing is the same across all S&P DJI’s branded equity indices. For specific

information on the policies and practices governing an index, please refer to the respective index

methodology.

Corporate Action Treatment by Index Categorization

S&P DJI’s index calculation and corporate action treatments vary according to the categorization of the

indices. At a broad level, indices are defined into two categorizations: Market Capitalization Weighted and

Non-Market Capitalization Weighted Indices.

A majority of S&P DJI’s equity indices are market capitalization weighted and float-adjusted, where each

stock’s weight in the index is proportional to its float-adjusted market value. S&P DJI also offers capped

versions of market capitalization weighted indices, where single index constituents or defined groups of

index constituents, such as sector or geographical groups, are confined to a maximum weight. The default

treatment in this document assumes a market capitalization weighted index.

Non-market capitalization weighted indices include those that are not weighted by float-adjusted market

capitalization and generally are not affected by notional market capitalization changes resulting from

corporate actions. Examples include indices that apply equal weighting, factor weighting such as dividend

yield or volatility, strategic tilts, thematic weighting, price weighting, or other alternative weighting

schemes.

S&P Dow Jones Indices: Equity Indices Policies & Practices 5

Additions and Deletions

Additions and deletions of securities to indices can occur for a number of reasons. For indices that do not

have a fixed number of constituents, additions and deletions are not linked to one another. For certain

indices with a fixed number of constituents, whenever there is a deletion from an index, a replacement is

added to the index, preferably on the same day. In other instances, indices can have a fixed number of

constituents at each rebalancing with the constituent count fluctuating between rebalancings. In these

situations, if an index has a targeted constituent count of 30 or less and more than 10% of the constituent

count between rebalancing dates is removed from the index due to mergers, acquisitions, takeovers,

delistings, bankruptcies, or other reasons that warrant ineligibility, the index will be reviewed by the Index

Committee to determine when replacement securities will be added to the index.

Initial Public Offerings (IPOs) and Direct Listings. IPO and direct listing additions to indices typically

take place on the rebalancing dates. In general, IPOs and direct listings must meet the index eligibility

criteria, and in certain cases, large offerings may qualify for fast track entry.

Data Availability. IPOs and direct listings for which S&P Dow Jones Indices is unable to confirm the

number of shares and/or calculate an accurate Investable Weight Factors (“IWFs”) based on available

information are not considered for fast track entry, and in instances where this information is not available

before a rebalancing cut-off reference date, may not be eligible for inclusion during the rebalancing.

Delistings. A security is generally dropped from all the indices it is a constituent of on or around its

expected delisting date. Securities removed from an index due to voluntary delisting or failure to meet the

exchange listing requirements, are removed at the primary exchange price, if available, or at a zero price

if no primary exchange price is available. In some cases, where a stock’s listing changes to an exchange

not maintained by S&P DJI, the stock is removed using the last traded price on the prior exchange. For

U.S. listed securities, non-bankrupt securities are removed at the OTC or pink sheet price if no primary

exchange price is available. If no OTC or pink sheet price is available, the security can be removed at a

zero price at the discretion of the Index Committee.

Please refer to Mergers & Acquisitions for information on delistings due to M&A events.

Note: Every index methodology has its own guidelines and thresholds for determining additions and

deletions, and the timing of these actions. Please refer to the respective individual index methodology for

further clarity on the timing of changes to the given index.

S&P Dow Jones Indices: Equity Indices Policies & Practices 6

Mandatory Events

Mergers & Acquisitions

Merger & Acquisition (M&A) corporate action events often result in changes to index membership, shares

outstanding, and IWFs for index constituents. S&P DJI attempts, on a best-efforts basis, to mimic index

clients’ real-world experiences when processing M&A events. S&P DJI’s index analysts track and review

all M&A events on an individual, case-by-case basis.

Event Finalization. S&P DJI’s branded indices generally implement (“finalize”) M&A driven changes

according to the below, with any action taken based on the publicly available information related to the

event:

• at least one (1) business days’ notice for all non-Depository Receipts (DR) U.S. listed stocks

• at least two (2) business days’ notice for all non-U.S. listed stocks, U.S. listed DRs, and inter-

listed stocks.

For mergers involving shareholder elections, S&P DJI generally recognizes the event based on the

default election terms. In certain cases, and with the defined advance notice to clients, S&P DJI may

decide to recognize an event using alternative election terms.

Any share issuance for the acquirer is implemented to coincide with the drop event for the target. To

minimize turnover, there is no minimum threshold requirement for implementation of an M&A driven

share/IWF change.

S&P DJI may, in certain cases, exercise discretion to accumulate and implement de minimis M&A share

changes with the quarterly share rebalancing. M&A share/IWF changes for an index company acquiring a

privately held company, or a company not part of any S&P DJI-maintained indices, are implemented at

the next quarterly rebalancing.

Target Deletion. S&P DJI generally removes an M&A target company from all indices on or around the

expected delisting, or last trading, date. In certain scenarios a target company may be removed before its

delisting date, according to the below:

• The M&A event is deemed unconditional, i.e., all required approvals are received and all

conditions for the acquisition to complete are met.

• For Tender offers:

o All conditions are met, and there is an announced settlement date.

o The remaining free float is less than 15% (except where pre-event free float is less than

15%) as based on publicly available information, even if the tender offer is still open.

Where these conditions are met, the deletion is generally effective prior to the open of the business day

following the last day of the tender period, subject to the notice periods specified above.

Any stock removed from an index due to the above rule is ineligible for re-inclusion in any S&P DJI

branded index for at least 12 months following the stock’s removal date, even if the stock continues to

trade on an eligible exchange.

Deletion Price. Generally, S&P DJI implements deletions using the security’s closing price on the

deletion date. If the primary exchange suspends or halts an M&A target security prior to S&P DJI’s

announced effective deletion date, the removal is implemented as follows:

S&P Dow Jones Indices: Equity Indices Policies & Practices 7

• Cash Consideration Events: S&P DJI removes the security at the market close price or the deal

price, whichever is lower.

• Stock Consideration Events: S&P DJI synthetically derives a price for the suspended security

using the deal ratio terms, provided the acquirer is issuing stock as part of the merger. The

synthetically derived price is used in index calculations until S&P DJI’s deletion date.

If any other pricing mechanism is used, the final decision regarding the pricing method is at the discretion

of S&P DJI and is announced to clients with sufficient notice.

Target Security Float Change. For events where conditions for the removal of a security are not met, or

where the intention is a partial acquisition, S&P DJI may decide to update the IWF of the target security

with at least two (2) business days’ notice. Such a decision is based on publicly available information in

the following circumstances:

1. The Offer Period is over, and the Acquiring company does not announce an extension or re-

opening. The following conditions must be met:

a. All required approvals have been received and conditions for the offer are met.

b. Public information is available to calculate the new IWF.

c. Settlement date of the tendered shares is known.

d. Size of the change is at least 5% and US$ 150 million or US$ 1 billion.

2. The Offer Period is extended, or an additional offer period is opened/announced, and the

following conditions are met:

a. All required approvals have been received and conditions for the offer are met.

b. Public information is available to calculate the new IWF.

c. Settlement date of the tendered shares is known.

d. Size of the change is at least US$ 1 billion or IWF changes by at least 15%.

If an IWF change does not meet any of the above conditions, the IWF updates at the subsequent

quarterly rebalancing, subject to all required information being publicly available. If the stock is

suspended, the event is recognized once trading resumes and follows the above process.

For more information on the timing of share changes, please refer to the Non-Mandatory Share and

Investable Weight Factor (IWF) Updates chapter.

S&P DJI believes turnover in index membership should be avoided when possible. An otherwise eligible

addition is generally not added to indices at a rebalancing if the company is the target of a confirmed

M&A event. Current index constituents are generally not deleted at a rebalancing solely for the reason of

being the target of a pending acquisition.

At the discretion of S&P DJI, constituents with shareholder ownership restrictions defined in company

bylaws may be deemed ineligible for inclusion in an index. Ownership restrictions preventing entities from

replicating the index weight of a stock may be excluded from the eligible universe or removed from the

index.

Reverse Mergers/Takeovers

Acquisitions for shares of a public company by a private company or by a subsidiary of a public company

that will then list, also known as reverse takeovers, will generally be implemented via a change of the

company/stock name, and all other identifiers of the target of the acquisition and current index

constituent. These events are generally triggered by a reorganization of the acquiring company’s

capitalization. In order to align all attributes of the newly listed company to the former entity, S&P DJI

S&P Dow Jones Indices: Equity Indices Policies & Practices 8

might apply a split event to the number of shares and share price of the parent according to the terms of

the takeover.

In instances where a price adjusting corporate action with a cash component becomes non-replicable for

clients due to late information, SP DJI may decide to use a temporary placeholder security to ensure

clients have at least one day’s notice.

Tendered Shares

Generally, index changes due to tender offers are only implemented after the final results of the tender

offer are publicly announced and verified by S&P DJI.

In certain markets, tendered shares may be replaced with a tradable tendered share class on the same

stock exchange. S&P DJI will consider replacing the common share line with the tendered share class in

indices once a minimum acceptance ratio of 75% has been reached and subject to the announcement of

a further acceptance period.

If S&P DJI decides to replace the common share line with the tendered line, an announcement will be

issued with one to five business days’ notice with a replacement effective date timed to occur during the

subsequent acceptance period. No changes will be made to the tendered shares outstanding, IWF,

divisor, or index weighting. Identifiers are updated if necessary.

Spin-Offs

Treatment of Spin-Offs in Market Capitalization Indices

As a general policy, a spin-off security is added to all indices where the parent security is a constituent, at

a zero price at the market close of the day before the ex-date (with no divisor adjustment). The spin-off

security will remain in the parent’s indices if it meets the eligibility criteria.

If a spin-off security is determined to be ineligible to remain in the index, it will be removed after at

least one day of regular way trading (with a divisor adjustment). In certain instances, S&P DJI may

decide to add the spin-off security to indices using a non-zero price and applying a price adjustment to

the parent.

S&P DJI may determine not to add an ineligible spin-off security to the parent’s indices due to de minimis

value, lack of information on value of the spin-off security, or tradability issues. Generally, if a spin-off

security is anticipated to trade on an exchange, it is at least temporarily added to indices to discover value

and then removed if it is determined to be ineligible for continued index inclusion. If S&P DJI is unable to

determine whether the spin-off security will trade on an exchange, or is unable to obtain information to

value the spin-off security, S&P DJI may choose not to recognize the event.

If there is a gap between the ex-date and distribution date (or payable date), or if the spin-off security

does not trade regular way on the ex-date, the spin-off security is kept in all indices in which the parent

is a constituent until the spin-off security begins trading regular way. An indicative or estimated price

may be used for the spin-off entity in place of a zero price until the spin-off security begins trading to

represent the value of the spin-off received. The indicative or estimated price for the spin-off security is

usually calculated using the difference between the parent’s close price the night before the ex-date and

the opening price of the parent on the ex-date. Any difference in calculation due to subsequent corporate

actions on the parent or spin-off security will be communicated to clients through the usual channels. If

the spin-off entity does not trade for 20 consecutive trading days after the ex-date and there is no

guidance issued for when trading may begin, S&P DJI may decide to remove the spin-off security at a

zero price with advance notice given to clients.

Index composition changes involving the parent or spin-off company, including attribute changes, such

as a change in its Global Industry Classification Standard (GICS

®

) classification, are implemented after the

spin-off entity has traded regular way for at least one day.

S&P Dow Jones Indices: Equity Indices Policies & Practices 9

1. Spin-off Security is a New Entity. The spin-off security will be added to all parent indices on the

ex-date.

2. Spin-off Security is an Existing Publicly Traded Entity (In Specie Distribution). S&P DJI will

add the in specie distribution to all indices in which the parent is a constituent on the ex-date at

a zero price and will mimic the price of the existing publicly traded entity on the close of the ex-

date. The distribution will be represented by a temporary non-tradeable placeholder constituent

created by S&P DJI to hold the place (weight) of the assets distributed, but not yet received by

index clients. A placeholder may be used by S&P DJI to enhance an index client’s ability to

replicate an index. The placeholder will be added to indices in which the parent is a constituent

using the parent’s IWF and using shares equal to the distribution ratio times the parent’s total

shares outstanding. The placeholder will be priced to match the price of the existing publicly

traded security. The placeholder will generally remain in indices until the distribution date. The

existing publicly traded security will be added and/or upweighted to reflect the distribution on the

same date that the placeholder is removed from indices, if applicable. In certain instances, S&P

DJI may decide to apply a price adjustment to the parent and not add a placeholder.

3. South Korea. In South Korea holding companies often have a reverse split accompany a spin-

off of its operating entity. As a general index implementation policy for spin-offs accompanied by

reverse splits in South Korea, a spin-off is effective on the day the spun-off company starts to

trade. The valuation of the spun-off company is calculated as the market capitalization of the

parent company before the spin-off event multiplied by the spin-off ratio.

4. India. Indian spin-offs often list several weeks, and in some cases months, after the ex-date. In

such cases, S&P DJI will apply an indicative or estimated price for the spin-off entity based on the

difference between the parent’s closing price the night before the ex-date and the opening price

of the parent on the ex-date until the spin-off security lists and begins trading. If the spin-off entity

does not trade for 20 consecutive trading days after listing, S&P DJI may decide to remove the

spin-off security at a zero price.

Treatment of Spin-Offs in Certain Non-Market Capitalization Indices

For most non-market capitalization weighted indices, both the parent and spin-off company generally

remain in the index until the next index rebalancing. The spin-off company is added to the index at a zero

price at the close of the day before the ex-date. No price adjustment is applied to the parent and there is

no divisor change. All indices undergo a full review with the next rebalancing.

However, if

(i) the next index rebalancing is more than three months away, and

(ii) either the parent company or the spin-off company is clearly not eligible for the particular index

then, the spin-off company is reviewed on a case-by-case basis and the appropriate treatment will be

announced to clients in advance. In such cases, and when achievable, clients are provided with one to

five business days advance notice to drop either the parent or child company (as applicable in the

situation) in a market situation where regular-way trading is available for both the parent and child.

• If a decision is made to keep the spun-off company and drop the parent, because of a

determination that the spun-off company is within the objective of the index while the parent no

longer meets such requirements, the weight of the parent stock is (1) distributed proportionately

across the rest of the index for a non-market capitalization weighted index or (2) the spun-off

stock inherits the weight of the parent in an non-market capitalization equal weighted index.

• Alternately, if a decision is made to drop the spun-off company and keep the parent, because it

has been determined that the parent company is within the objective of the index while the spun-

off does not meet such requirements, the weight of the spun-off company is added back to the

parent stock’s weight in a non-market capitalization equal weighted index.

S&P Dow Jones Indices: Equity Indices Policies & Practices 10

Non-market capitalization weighted indices based on another fixed count index whose adds and drops

follow the parent index exactly (for example, the S&P 500 Equal Weighted Index) will continue to follow

the add/drop policy of the parent as outlined in the following section.

Non-Market Capitalization Weighted Indices Based on a Fixed Count Parent Index. The spun-off

company is added to the index at a zero price at the market close of the day before the ex-date with no

divisor adjustment. If the spun-off company is replacing a dropped company in the parent index, on the

effective date of the deletion, first the weight of the spun-off company is redistributed to the parent

company, and then the weight of the deleted company is redistributed to the spun-off company. If the

spun-off company is replacing the parent company, the weight of the parent is redistributed to the spun-

off company on the effective date of the deletion. If the spun-off company will be dropped from the parent

index, the weight of the spun-off company is redistributed back to the parent company.

Refer to the respective individual index methodology documents for more information on the specific

treatment for a particular index.

Return Calculation for a Spun-off Stock on the Close of the Ex-Date. Where a stock is included at a

zero price and then trades, its return on the day is mathematically infinite. S&P DJI adjusts the % returns

field in the constituent (.SDC) files to make it zero for the day. Similarly, since the closing price of the

parent is not being adjusted downward as of the next day’s market open to account for the spin-off, the

return on the parent for that day could be understated. S&P DJI calculates the return on the parent stock

on that day by dividing the sum of the total closing index market cap of the parent stock and the spin-off

stock(s) by the closing index market cap of the parent stock on the day prior to spin-off. Using this method

to calculate the return of the parent stock yields a return on the combined position of the parent and spin-

off stock, and, since the return on the spin-off stock is treated as zero for the day, ensures that the single

stock returns presented can be aggregated into the total index return.

Rights Offerings (or “Rights Issues”)

A rights issue is an event in which existing shareholders are given the right to buy a specified number of

additional shares from a company, at a specified price (‘rights’ or ‘subscription’ price), within a specified

time (‘subscription period’). Only rights available to all shareholders are recognized.

For all markets (Developed, Emerging, and Frontier), irrespective of whether the rights are renounceable

and/or fully underwritten, S&P DJI implements the following treatment:

• Price adjustments are applied at the opening of the rights ex-date as per the calculations shown

below.

• Share changes are also applied at the full rights ratio at the opening of the rights ex-date.

• If the rights are undersubscribed or oversubscribed, the corresponding share adjustments are

made at the next quarterly share rebalancing.

• If the new shares are not entitled to a future dividend, which has been announced and where the

amount is known, the price adjustment calculation will reflect the dividend (the dividend amount

will be added to the subscription price). This applies to both ordinary and special dividends.

Please see the example calculations below.

S&P DJI’s Calculation of Rights Offerings

Step 1: In/Out-of-the-Money Determination:

If the subscription price < the stock closing price on the day before the ex-date, then the rights offering is

in-the-money.

If the subscription price ≥ the stock closing price on the day before the ex-date, then the rights offering is

out-of-the-money.

S&P Dow Jones Indices: Equity Indices Policies & Practices 11

Note: In several cases with rights offerings, the new shares are not entitled to a future dividend. If a future

dividend is announced by the day before the ex-date of the rights, the dividend amount has been

confirmed and S&P DJI is certain that the newly created shares as a result of the rights offering are not

entitled to the dividend, the following rule is used to determine whether a rights offering is or is not in-the-

money:

If the subscription price + dividend < the stock closing price on the day before the ex-date, then the rights

offering is in-the-money.

If the subscription price + dividend ≥ the stock closing price on the day before the ex-date, then the rights

offering is out-of-the-money.

Step 2: Application of Price & Share Adjustment on the Ex-Date for in-the-money Rights

Offerings:

S&P DJI’s practice is to only recognize rights that are in-the-money. The assumption is that main clients

are long-only indexers and, as rational investors, they will exercise any rights that are in-the-money to

mimic the index and keep tracking error minimized. Indexers will not exercise issues that are out-of-the-

money, as they are trading at a premium to the current market price.

For rights offering in-the-money, the share adjustment is made irrespective of whether it is greater or

less than 5% (since it is a corporate action driven event). The price adjustment is always applied on the

ex-date using the following calculation:

Price adjustment calculation:

Value of the Rights = {Market Value of the Stock – (Subscription Price + Dividend

1

)}/ (Number of Rights

required to purchase 1 share + 1)

Price Adjustment Factor = (Market Value of the Stock - Value of the Rights)/ Market Value of the Stock

Adjusted Price or Theoretical Ex-Rights Price (TERP) = Market Value of the Stock * Price Adjustment

Factor = Market Value of the Stock – Value of the Rights

Note > that the Market Value of the Stock is the previous day’s closing price (previous day to the rights

ex-date). This is also referred to as Cum Rights Price in some markets.

Examples:

Example 1: SP AUSNET (SPN.AX). For SPN.AX’s (May 2009) rights offer, the full AU$ 0.05927

distribution (AU$0.04603 cash dividend + AU$ 0.01324 capital return) was used in the TERP calculation

of SPN.AX. This amount was added to the SPN.AX rights subscription price of AU$ 0.78. The cash

dividend and capital return on the dividend ex-distribution date was not diluted.

Example 2: A 7:5 rights offering (i.e., the right to buy seven new shares for every five shares owned) at a

subscription price GBP 1.50 and the market value of the stock on previous day’s close is GBP 3.34; no

future dividend has been announced.

Value of Rights = {3.34 – (1.5 + 0)}/ {(5/7) + 1} = GBP 1.07333333

Price Adjustment Factor = (3.34 – 1.07333)/ 3.34 = 0.67864271

Adjusted Price or TERP = 3.34 * 0.67864271 = GBP 2.26666667

1

If there is no upcoming dividend or newly added shares are entitled to a future dividend, the “Dividend” amount in the formula is

zero. If the new shares are not entitled to the dividend, the dividend amount is added to the subscription price. This applies to

regular and special dividends.

S&P Dow Jones Indices: Equity Indices Policies & Practices 12

OR

Adjusted Price or TERP = 3.34 – 1.07333333 = GBP 2.26666667

Example 3: A 7:5 rights offering at a subscription price of GBP 1.50 and the market value of the stock on

previous day’s close is GBP 3.34; a future dividend for the amount GBP 0.50 is declared, but the new

shares are not entitled to this dividend.

Value of Rights = {3.34 – (1.5 + 0.5)}/ {(5/7) + 1} = GBP 0.78166667

Price Adjustment Factor = (3.34 – 0.78166667)/ 3.34 = 0.76596806

Adjusted Price or TERP = 3.34 * 0.76596806= GBP 2.5583333

OR

Adjusted Price or TERP = 3.34 – 0.78166667 = GBP 2.5583333

If the rights offering is out-of-the-money, then no action is undertaken to match the corporate action

for index purposes, as a rational investor would not subscribe to the rights issue. This is valid even if the

issue is underwritten or guaranteed rights offering. Any subsequent shares issued are made at the

quarterly rebalancing.

Non-Market Capitalization Weighted Indices

When a stock in an equal weighted non-market capitalization weighted index has a rights or open

offering, there are no market cap changes between the close and adjusted close files (i.e., the weight of

the company stays the same, per the index methodology). The AWF will be adjusted to offset any

potential market cap changes, bringing the security back to its weight before the rights offering. Certain

Strategy indices also follow the non-market capitalization weighted methodology. For such indices, in the

event of a rights offering, the treatment is exactly the same as the one for equal weighted non-market

capitalization weighted indices. The price adjustment is accompanied by an index share change so that

the company’s weight remains the same as its weight before the rights offering. No divisor adjustment is

made.

Refer to the respective individual index methodology for more information on the specific treatment for a

particular index.

Warrants, Options, Partly Paid Shares, Convertible Bonds, Contingent Value Rights, and Other

Ineligible Securities & Share Types

Securities such as warrants, options, partly paid shares, convertible bonds, or contingent value rights are

ineligible for equity indices. In certain instances, if a derivative security is anticipated to trade on a local

exchange, it may, temporarily, be added to indices to discover value and then later removed. S&P DJI

may choose to implement a price adjustment to the parent on the ex-date if all the information to calculate

the price adjustment for the derivative security is available. If S&P DJI is unable to determine whether a

derivative security will trade on a local exchange or is unable to obtain information to value an ineligible

security, S&P DJI may choose not to recognize the event. Any share increase associated with the

derivative security, where applicable, is implemented when the information is available, following a review

by S&P DJI.

If S&P DJI decides to temporarily add the ineligible security to indices and the ineligible security does not

trade for 20 consecutive trading days after the ex-date, S&P DJI may decide to remove the security at a

zero price with advance notice given to clients.

In instances where the terms specify that the type of shares or financial instruments being offered are of a

different nature than the current shares outstanding for a particular company’s stock, a price adjustment

S&P Dow Jones Indices: Equity Indices Policies & Practices 13

may be implemented on the rights ex-date with a share increase at a later time, in line with the treatment

detailed above. Clients will be notified of such treatment in advance.

Exceptions:

Subscription Price is unknown until after the Ex-Date. In certain markets, the subscription price is not

known on the ex-date and is sometimes provided well after the ex-date. In Singapore, in some instances,

a subscription price range is provided instead of a fixed subscription price, and there is no definite

subscription price at the market close of the day before the rights ex-date. Similar cases have come up in

Chile and other emerging markets. In the U.S., there have been instances where the subscription price

and ratio were not known until the ex-date had passed. In all such cases, these are treated as a book

build/placement issue and a share change is applied to the full extent of the rights ratio at the opening of

the first business day following the expiration date. The share change is applied only if the rights are in

the money when the terms are disclosed. No price adjustment is made.

Other. In instances where high profile banks or companies are involved, or the Government is

underwriting shares, S&P DJI reserves the right to alter the general treatment with sufficient notice to

clients.

Accelerated Rights Offering: Accelerated Rights may come in two parts “institutional” (accelerated) and

“retail” (traditional). For all purposes, the index is adjusted on the ex-date at the full rights ratio. If the

stock is suspended during the accelerated stage of the offer, the ex-date is taken as the date that trading

resumes. If there is an over allocation in the index, a share adjustment is made to bring shares back into

line at the next quarterly share rebalancing. Current treatment is as follows:

• Known Price: If the subscription price is known in advance, price and shares are adjusted on the

ex-date.

• Unknown Price: If the price is determined in a bookbuild or some other facility and released after

the ex-date, this is treated as a placement (secondary offering). Shares increase at the full ratio,

with one to five business days’ notice, with no price adjustment.

UK Open Offers. Open Offers are a type of UK equity placing where existing shareholders are offered

the opportunity to buy shares at a discounted rate to the market price. These rights are non-

renounceable. Open offers are often accompanied by an equity placing available to all investors at the

same discounted price preferentially available to existing shareholders. Both events are normally

announced on the ex-date of the open offer.

S&P DJI recognizes that there is no additional value to being a shareholder prior to the offer, as there is

equal value available to other market participants.

The treatment of UK Open Offers is to not apply a price adjustment for such transactions. The share

change is considered a non-mandatory event and is applied after the end of the subscription period

where the event meets the requirements for accelerated implementation. Share changes that do not meet

the criteria for accelerated implementation are implemented at the quarterly rebalancing.

For more information, please refer to the Non-Mandatory Share & Investable Weight Factor (IWF)

Updates section.

S&P Dow Jones Indices: Equity Indices Policies & Practices 14

Non-Mandatory Share and IWF Updates

Certain mandatory actions, such as M&A driven share/IWF changes, stock splits, and mandatory

distributions, are not subject to a minimum threshold for implementation. Material share/IWF changes

resulting from certain non-mandatory corporate actions follow the accelerated implementation rule

defined below with sufficient advance notification. Non-material share/IWF changes are implemented

quarterly. The accelerated implementation rule is intended to reduce turnover intra-quarter while also

enhancing opportunities for index trackers to take advantage of non-mandatory material liquidity events.

In certain instances, local market practices may relax these rules, so please refer to the respective

individual index methodology for any deviations from this policy.

Material Share/IWF Changes - Accelerated Implementation Rule

1. Public offerings. Public offerings of new company-issued shares and/or existing shares offered

by selling shareholders, including block sales and spot secondaries, will be eligible for

accelerated implementation treatment if the size of the event meets the materiality threshold

criteria:

a. At least US $150 million

2

, and

b. At least 5%

3

of the pre-event total shares.

In addition to the materiality threshold, public offerings must satisfy the following conditions:

• Be underwritten.

• Have a publicly available prospectus, offering document, or prospectus summary filed with

the relevant authorities.

• Have a publicly available confirmation from an official source that the offering has been

completed.

For public offerings that involve a concurrent combination of new company shares and existing

shares offered by selling shareholders, both events are implemented if either of the public

offerings or the total underwritten public offering represents at least 5% of total shares and US

$150 million. Any concurrent share repurchase by the affected company will also be included

in the implementation.

2. Dutch Auctions, Self-tender offer buybacks, and Split-off exchange offers. These non-

mandatory corporate action types will be eligible for accelerated implementation treatment

regardless of size once the final results are publicly announced and verified by S&P DJI.

For companies with multiple share class lines, the criteria specified above applies to each individual

multiple share class line rather than total company shares.

Accelerated implementation for events less than US $1 billion includes an adjustment to the company’s

IWF only to the extent that such an IWF change helps the new float share total mimic the shares available

in the offering. To minimize unnecessary turnover, these IWF changes do not need to meet any minimum

2

Calculated using the offering (subscription) price per share and the number of shares offered (excluding any overallotment).

When the offering price is announced in a non-US currency, it is converted into USD using the WMR 4PM spot rate on the

day prior to the pricing date. If the offering price, total shares offered, and total offering value cannot reasonably be determined to

meet the minimum threshold criteria based on the public information available, S&P DJI may decide not to use accelerated

implementation treatment, or may wait until more information becomes available before determining if accelerated implementation

treatment will be used.

3

Measured as the pre-event total share outstanding for that share class.

S&P Dow Jones Indices: Equity Indices Policies & Practices 15

threshold requirement for implementation. Any IWF change resulting in an IWF of 0.96 or greater is

rounded up to 1.00 at the subsequent annual IWF review.

For accelerated implementation of at least US $1 billion

4

, S&P DJI applies the share change, and any

resulting IWF change, using the latest share and ownership information publicly available at the time

of the announcement, even if the offering size is below the 5% threshold. This exception ensures that

very large events are recognized in a timely manner using the latest available information. Any IWF

change resulting in an IWF of 0.96 or greater is rounded up to 1.00.

Market Specific Accelerated Implementation Rules

U.S. and Canada. Non-fully paid or non-fully settled offerings, such as subscription receipts in Canada

and forward sales agreements in the U.S., are ineligible for accelerated implementation. Share updates

resulting from completion of subscription receipts terms, or the settlement of forward sale agreements,

are updated at a future quarterly rebalancing.

India. Non-mandatory events that otherwise qualify for accelerated implementation are not

implemented until the updated shareholder information is available, due to the tendency for such

events to be made known to strategic holders ahead of time.

Announcement Policy

For accelerated implementation, S&P DJI provides two (2) business days’ notice for all non-U.S. listed

stocks, U.S. listed Depositary Receipts (DRs), and interlisted stocks

5

, and one (1) business days’

notice for all non-DR U.S. listed stocks.

6

For non-DR U.S. listed stocks, to provide additional notification, S&P DJI announces accelerated

implementation events with a size of at least US$ 1 billion intraday, once S&P DJI confirms the event

details.

Non-Material Share/IWF Changes – Quarterly Implementation

All non-mandatory events not covered or implemented via the accelerated implementation rule

(including but not limited to private placements, acquisition of private companies, and conversion of

non-index share lines) are reviewed quarterly, effective after the close of the third Friday of the third

month in each calendar quarter and as per below.

Share Updates. At each quarterly review, shares outstanding are updated to the latest available

information as of the rebalancing reference date.

For more information, please refer to ‘Rebalancing Guidelines – Share/IWF Reference Date & Freeze

Period’.

IWF Updates. At the quarterly review, IWF changes are only made if there is a share change of at least

5% of total current shares outstanding and if the adjusted IWF absolute change is at least 5, with IWF

adjustments limited to the extent necessary to help reflect the corresponding share change.

4

Calculated using the offering (subscription) price per share and the number of shares offered (excluding any overallotment).

When the offering price is announced in a non-US currency, it will be converted into USD using the WMR 4PM spot rate on

the day prior to the pricing date. If the offering price, total shares offered, and total offering value cannot reasonably be

determined to meet the minimum threshold criteria based on the public information available, S&P DJI may decide not to use

accelerated implementation treatment, or may wait until more information becomes available before determining if accelerated

implementation treatment will be used.

5

Includes interlisted stocks where the designated listing trades on a non-U.S. exchange. For interlisted stocks where the designated

listing trades on a U.S. exchange, S&P DJI provides one business days’ notice.

6

For Australian stocks S&P DJI provides two (2) business days’ notice from the day the Appendix 2A (formerly Appendix 3B) is

filed. If the Appendix 2A is filed at or after the end of the day, accelerated changes are implemented at the earliest on the next

trading day.

S&P Dow Jones Indices: Equity Indices Policies & Practices 16

For quarterly share change events, unless there is explicit information stating that the new shares are not

available to the market, shares are generally considered to be available to all investors and reflected in

the IWF. Events such as conversion of derivative securities, acquisitions of private companies, or

acquisitions of non-index companies that do not trade on a major exchange are generally implemented as

described above.

In certain markets such as India and Thailand, foreign ownership limit adjustments that result in IWF

changes are implemented with the quarterly rebalancing even if there is no change in shares outstanding.

Other than the situations described above, please note that IWF changes are only made at the annual

IWF review.

For more information on IWF updates, please refer to S&P Dow Jones Indices’ Float Adjustment

Methodology.

Note: For indices using equal weighted, price weighted, or non-market capitalization weighted corporate

action treatments, shares and/or IWF updates are only effective for the underlying shares or IWF. The

stocks’ Additional Weight Factor (AWF) is generally modified to counteract the underlying shares/IWF

change, so that index shares remain unchanged until the index is fully updated at the next scheduled

rebalancing.

Please refer to the respective individual index methodologies to confirm if an index follows this rule.

Rebalancing Guidelines – Share/IWF Reference Date & Freeze Period

A reference date, after the market close five weeks prior to the third Friday in March, June, September,

and December, is the cutoff for publicly available information used for quarterly shares outstanding and

IWF changes. All shares outstanding and ownership information contained in public filings and/or official

sources dated on or before the reference date are included in that quarter’s update. In addition, there is a

freeze period on a quarterly basis for any changes that result from the accelerated implementation rules.

The freeze period begins after the market close on the Tuesday prior to the second Friday of each

rebalancing month (i.e., March, June, September, and December) and ends after the market close on the

third Friday of the rebalancing month.

Pro-forma files for float-adjusted market capitalization indices are generally released after the market

close on the first Friday, two weeks prior to the rebalancing effective date. Pro-forma files for capped and

alternatively weighted indices are generally released after the market close on the second Friday, one

week prior to the rebalancing effective date. For illustration purposes, if rebalancing pro-forma files are

scheduled to be released on Friday, March 5, the share/IWF freeze period will begin after the close of

trading on Tuesday, March 9, and will end after the close of trading the following Friday, March 19 (i.e.,

the third Friday of the rebalancing month).

During the share/IWF freeze period shares and IWFs are not changed, and the accelerated

implementation rule is suspended, except for mandatory corporate action events (such as merger activity,

stock splits, and rights offerings). The suspension includes all changes that qualify for accelerated

implementation and would typically be announced or effective during the share/IWF freeze period. At the

end of the freeze period all suspended changes will be announced on the third Friday of the rebalancing

month and implemented five business days after the quarterly rebalancing effective date. For these non-

mandatory events, S&P DJI uses shares and IWF data as of the upcoming rebalancing effective date to

calculate the size of the event and in turn assess if the event qualifies the Accelerated Implementation

rule.

Companies that are the target of cash M&A events, and publicly available guidance indicates the event is

expected to close by quarter end, may have their share count frozen at their current level for rebalancing

purposes.

S&P Dow Jones Indices: Equity Indices Policies & Practices 17

Certain Share Types and Designations

Multiple Share Classes

Companies issue multiple share classes in some instances. The treatment of multiple share classes of

stock varies across S&P DJI’s indices depending on local market custom and conditions. S&P DJI

includes all publicly listed multiple share class lines separately in its float-adjusted market capitalization

(FMC) weighted indices, subject to liquidity and float criteria currently in place for each index. Index

membership eligibility for a company with multiple share class lines is based on the total market

capitalization of the company. The decision to include each publicly listed line is evaluated line by line; the

weight of each line will only reflect its own float, not the combined float of all company lines. It is possible

that one listed share class line may be included in an index while a second listed share class line of the

same company is excluded. Unlisted share class lines are not combined with any other listed share class

lines, but these unlisted share class lines are included in the calculation of the company’s total market

capitalization. A company’s total market capitalization is used to determine its assignment to either large-

cap, mid-cap, or small-cap indices.

Once a listed share class line is added to an index, it may be retained in the index even though it may

appear to violate certain addition criteria. Listed share class line deletions are at the discretion of the

governing Index Committee.

For companies that issue a second publicly traded share class to index share class holders, the newly

issued share class line will be considered for inclusion if the event is mandatory, and the market

capitalization of the distributed class is not considered to be de minimis.

Exception:

Berkshire Hathaway Inc. Due to turnover and liquidity concerns, Berkshire Hathaway Inc.

(NYSE:BRK.B) is an exception to the Multiple Share Classes rule. S&P DJI will continue to consolidate

the share count for this company under the B share class line.

Designated Listings

For companies with multiple share classes of common stock, S&P DJI determines the share class with

both the highest one-year trading liquidity (as defined by Median Daily Value Traded) and largest float-

adjusted market capitalization as the Designated Listing. All other share classes are referred to as

Secondary Listings. When the liquidity and market capitalization indicators are in conflict, S&P DJI

analyzes the relative differences between the two values placing a greater importance on liquidity.

Once established, the Designated Listing is only changed if both the liquidity and market capitalization of

a Secondary Listing exceed the liquidity and market capitalization of the Designated Listing by more than

20 percent. If only one measure exceeds 20 percent, S&P DJI analyzes the data as described above to

determine if the Designated Listing should be changed. Otherwise, the Designated Listing remains

unchanged.

For those companies having depository receipts or shares listed on an exchange outside of the country of

domicile (including inter-listed stocks), the Designated Listing is generally the one listed on the exchange

in the country of domicile. Non-voting depositary receipts (NVDR) are generally designated as Secondary

Listings.

S&P DJI reviews Designated Listings on an annual basis and any changes are implemented after the

close of the third Friday of September. The last trading day in July is used as the reference date for the

S&P Dow Jones Indices: Equity Indices Policies & Practices 18

liquidity and market capitalization data. If less than one year of trading data is available as of the

reference date, then all available data is used. S&P DJI reserves the right to review and update the

Designated Listing more frequently based on market conditions.

For purposes of index selection, S&P DJI utilizes one of the following approaches when more than one

listing of equity stock outstanding is available. Changes to a Designated Listing within a given index are

only made at a regularly scheduled rebalancing as defined in the applicable Index Methodology. Any

deviations from the rules below are described in individual Index Methodology documents.

A. All publicly listed multiple share class lines are eligible for index inclusion, subject to meeting the

eligibility criteria detailed in the respective Index Methodology.

B. Each company is represented once by the Designated Listing.

C. Each company is represented once by the listing with the highest dividend yield, subject to

meeting the eligibility criteria detailed in the respective index methodology. In the event multiple

lines meet the eligibility criteria and have similar dividend yields, the Designated Listing is

selected.

Exception:

The class A shares of Chinese companies as well as the class A shares of Filipino companies will not be

selected as the Designated Listing due to foreign ownership restrictions. In these cases, an alternative

listing will be considered the Designated Listing.

Note: Non-market capitalization indices that follow the composition of an S&P Dow Jones FMC index

utilize the same composition as the parent index.

For information on the treatment of multiple share classes for non-market capitalization weighted indices,

please refer to the respective index’s methodology document available at www.spglobal.com/spdji/.

Depositary Receipt Shares

Depositary Receipt (DR) shares outstanding, including American Depositary Receipts (ADRs) and Global

Depositary Receipts (GDRs), are derived by multiplying the DR ratio by the underlying shares

represented by the DR.

Brazil Units

Brazil units are securities issued and traded on the São Paulo Stock Exchange representing a

combination of Ordinary and Preferred shares issued by companies in Brazil. For index purposes, shares

outstanding for Units are derived by dividing the total number of outstanding ordinary and preferred

shares by the Units ratio, which is the total number of securities that the Unit contains. The IWF for Units

is calculated using float figures at the company level, based on the total holdings of ordinary and

preferred shares per shareholder. For companies in Brazil that have listed Units, the Units are normally

used for index inclusion rather than its Ordinary or Preferred listed stocks.

S&P Dow Jones Indices: Equity Indices Policies & Practices 19

Dividends, Stock Splits, and Consolidations

Dividends

Ordinary Dividend. An ordinary dividend is a distribution of a portion of a company's earnings to its

shareholders. Ordinary dividends typically follow a quarterly, semi-annual, or annual cycle and are most

often quoted in terms of the payment amount each share receives (dividends per share). For index

calculation purposes, an ordinary dividend will only have an effect on the Total Return (TR) and Net Total

Return (NTR) indices and not on Price Return indices.

Variable Dividends. To be considered a variable dividend, a company must pay a base dividend and

pay an additional variable dividend amount that fluctuates based on company earnings or another metric

explicitly stated in the dividend policy. Variable dividends differ from special dividends in that variable

dividends are part of the normal dividend policy of the company. For index purposes, variable dividends

are treated as ordinary dividends for companies with a variable dividend policy and only effect the Total

Return (TR) and Net Total Return (NTR) indices, excluding Price Return indices.

Special Dividends. Special dividends are defined as those dividends that are outside of the normal

payment pattern established historically by the corporation. Whether a dividend is funded from operating

earnings or from other sources of cash does not affect the determination of whether it is a special

dividend. Special dividends are typically larger than ordinary dividends and are quoted in terms of the

payment amount each share receives (dividends per share). Generally, there are no patterns for these

events, and they may be one-time payments. Special dividends are treated as corporate actions with

price and divisor adjustments. For index calculation purposes, a special dividend results in a stock’s price

being adjusted (reduced) by the payment amount at the opening of the effective date.

S&P DJI generally considers the third consecutive instance of a non-ordinary dividend (in terms of timing

[i.e., ex-date], not amount) to be ordinary for index purposes as the third consecutive payment is

generally be considered to be part of the normal payment pattern established by the company.

Special dividends usually have the following characteristics: The company describes it as a “special,”

“extra,” “irregular,” “return of capital” “distribution from reserves”, or some other similar term in the

dividend announcement. Dividend payments not subject to a withholding tax are usually an indication that

the dividend should be treated as special; however, large and out-of- pattern payments are still

considered as “special” even if they are subject to a withholding tax.

When an ordinary dividend is increased or decreased, it is still ordinary, not special.

When a return of capital is declared in lieu of an ordinary cash dividend and fits the historical pattern of an

ordinary dividend in amount and frequency, it is treated as an ordinary cash dividend. For example, many

Swiss companies distribute a return of capital in lieu of ordinary dividends.

When a dividend is paid the first time, it is ordinary unless the company’s release specifically states

otherwise.

Return of Capital. A return of capital is a cash distribution of a portion of a company’s share capital or

capital surplus. As it is not paid out of net income or retained earnings, it is generally not subject to

withholding tax. For index calculation purposes, a return of capital is considered a special dividend.

However, when a return of capital is declared in lieu of an ordinary cash dividend and fits the historical

pattern of an ordinary dividend in amount and frequency, it is treated as an ordinary cash dividend.

S&P Dow Jones Indices: Equity Indices Policies & Practices 20

Hybrid Dividends. Hybrid dividends, payable in cash & stock, can be considered as regular or special

dividends by S&P DJI. Treatment is as follows:

• Hybrid Dividends Considered Ordinary Dividends. S&P DJI applies the full amount of the

dividend on the ex-date (using the cash equivalent amount), and then increases the shares either

on the payable date (if the final distribution ratio is announced by the company at least one

business day prior to the payable date) or at the next quarterly share rebalancing, regardless of

whether the share increase is at least 5%.

• Hybrid Dividends Considered Special Dividends. A price adjustment is applied for the full

amount of the dividend after the close of trading on the day before the ex-date, and a share

increase is made either on the payable date (if the final distribution ratio is announced by the

company at least one business day prior to the payable date) or at the next quarterly share

rebalancing, regardless of whether the share increase is at least 5%.

In certain instances, S&P DJI may decide to add a temporary placeholder security to represent the stock

portion of the hybrid dividend when deemed necessary to enhance the replicability of the index and to

reduce unnecessary turnover. In such cases, S&P DJI will announce the treatment details with one to five

business days’ notice.

Scrip Dividend. A scrip dividend is a dividend paid by the issue of new shares in lieu of cash. A

company may offer its shareholders the choice of receiving a dividend in shares (scrip dividend) rather

than cash. The share option is typically listed as the default option for the shareholders who do not make

an election. Only the distribution received under the cash option is subject to dividend withholding tax.

S&P DJI treats scrip dividends as cash dividends on the ex-date. Any share changes made due to a

shareholder’s election to receive shares are accumulated for quarterly implementation.

Dividend Treatments for ADRs and GDRs. For most American Depository Receipts (ADRs) and Global

Depository Receipts (GDRs), cash dividends are declared in the local currency. While the dividend ex-

date for an ADR/GDR is known ahead of time, the depositary bank usually provides only an estimated

dividend amount in the trading currency of the ADR/GDR based on the foreign exchange rates at that

time. The final dividend amount calculated using the latest forex rates is not available until closer to the

payable date. S&P DJI’s branded indices use the dividend treatment outlined below:

(i) If the dividend is quoted ex by the exchange, this amount is used on the dividend ex-date.

(ii) If the dividend is not quoted ex by the exchange, the dividend is not generally recognized for

index purposes. An exception is Japanese and Korean ADR dividends which are generally not

quoted ex by the exchange but are recognized on a future date if the depository bank issues a

final dividend notice.

For more information, please refer to the Post Ex-date Dividend Adjustment section.

(iii) For certain Russian GDRs, the information regarding the dividend amount and ex-date is

available only after the ex-date has passed. In these instances, S&P DJI may choose to

recognize the dividend on the date S&P DJI becomes aware of the amount. S&P DJI does not

wait for the payable date, which could be months away in some instances.

Regional Variations in the Treatment of Cash Dividends

UK. Cash dividends reported in the UK are net dividends, which is the amount used for index calculation

purposes. UK dividends are taxed at the source – from company profits after corporation tax has already

been paid.

Property Income Distributions (PIDs): PIDs are a special kind of dividend related to Real Estate

Investment Trusts (REITs) and are taxed at a rate of 20%. REITs might declare dividends that are solely

PIDs, solely ordinary dividends or a combination of the two.

Example:

S&P Dow Jones Indices: Equity Indices Policies & Practices 21

Company A declares a dividend consisting of two components: an ordinary dividend of GBP 0.031 and a

PID component of GBP 0.015 taxed at a rate of 20%. So, for index calculation purposes, the dividend

amount for Company A is GBP 0.043.

Dividend = GBP 0.031 + GBP {0.015 * (1-0.2)} = GBP 0.043

Taiwan. When there is a suspension in trading that S&P DJI is aware of, the event is recognized on the

date trading resumes.

Examples:

(1) The reverse split for 2887.TW was recognized on February 3, 2010, the pay date after the stock

came out of its trading suspension instead of January 19, 2010, which was the ex-date.

(2) The return of capital with the reverse split for 2412.TW was recognized on February 8, 2010, the

pay date, after the stock resumed trading instead of its ex-date January 21, 2010.

Japan. The majority of dividends in Japan are provided in estimated amounts on their ex-date. If an

estimated dividend is provided, the estimated dividend is reinvested into the index on the ex-date. For

companies that do not provide estimates but have a historical pattern of paying dividends, the estimate is

calculated as the previous year’s dividend amount adjusted for any split/bonus issues. If no dividend was

paid in the same period the prior year and an estimated dividend is not available, no dividend amount is

reinvested on the ex-date. Once the company announces the actual dividend amount, S&P DJI reinvests

the difference between the estimated and confirmed dividend amount using the Post Ex-Date Dividend

calculation methodology (see below).

Irregular distributions declared by Japanese companies, including memorial dividends, returns of capital

and special dividends are generally treated as ordinary dividends.

Korea. The majority of dividends in Korea are not announced prior to their ex-date. If an estimated

dividend is provided, the estimated dividend is reinvested into the index on the ex-date. For companies

that do not provide estimates but have a historical pattern of paying interim dividends or dividends with a

record date at fiscal year-end, the estimate is calculated as the previous year’s dividend amount in the

same period adjusted for any split/bonus issues. If no dividend was paid in the same period of the prior

year and an estimated dividend is not available, no dividend amount is reinvested on the ex-date. Once

the company announces and pays the actual dividend amount, S&P DJI reinvests the difference between

the estimated and confirmed dividend amount using the Post Ex-Date Dividend calculation methodology

(see below). A negative dividend adjustment will be applied if the estimated dividend has not been

confirmed by the company six months after the ex-date.

Brazil. Interest on Capital is generally recognized as an ordinary dividend subject to a different

withholding tax rate.

Turkey. Distributions from REIT companies are treated as ordinary dividends but are not subject to

withholding tax.

Australia.

• Franking. Australia has a tax structure where profits are only taxed once at either the company

level or shareholder level (i.e., Australian companies pay out profits as dividends either before or

after tax). The “franking rate” is what tracks whether or not the tax was already paid on the cash

dividend. If the tax was already paid at the company level, then the dividend amount is fully

franked (100% franked). If taxes were not paid on the cash distribution, then the dividend is 0%

franked. Note that the franking rate can also be in between 0% and 100%.

Note S&P DJI does not backfill franking rates announced after a dividend ex date.

S&P Dow Jones Indices: Equity Indices Policies & Practices 22

• Conduit Foreign Income (CFI). CFI is foreign income received by a foreign resident via an

Australian corporate tax entity. The tax relief for CFI ensures that those amounts are not taxed in

Australia when distributed by the Australian corporate tax entity to its foreign owners. The Conduit

Foreign Income removes any withholding tax liability for non-resident shareholders in relation to

the CFI component of dividends received.

China.

• Offshore A-Shares. These are shares issued by companies in mainland China and are listed on

the Shanghai - Hong Kong Stock Connect or Shenzhen - Hong Kong Stock Connect exchanges,

and available to foreign investors. S&P DJI uses the offshore CNH exchange rate for the

calculation and maintenance of China A-Shares using the Stock Connect listings.

Franking Credit Adjusted Total Return Indices. Additional total return indices are available for a

number of S&P/ASX Indices that adjust for the tax effect of franking credits attached to cash dividends.

The indices utilize tax rates relevant to two segments of investors: one version incorporates a 0% tax rate

relevant for tax-exempt investors and a second version uses a 15% tax rate relevant for superannuation

funds. The franking credits attached to both regular and special cash dividends are included in the

respective calculations.

Post Ex-date Dividend Adjustment

S&P DJI may apply an adjustment to a dividend post ex-date due to a revision of the original amount or

due to certain market conventions.

Companies in Japan and South Korea do not typically confirm cash dividend amounts prior to the ex-

dates. Estimated dividends are usually available for Japanese companies ahead of the dividend ex-date,

and it is generally accepted to recognize the estimated amount on the ex-date. Korean companies do not

usually provide an estimate for dividends. For both countries, actual dividend amounts are confirmed by

the companies several weeks after the ex-date.

For South Korea, S&P DJI applies the adjustment after the pay date. This dividend adjustment is

applicable to Japanese and South Korean companies listed in their home markets and overseas as

depositary receipts (ADR/GDR). For Japanese and Korean depositary receipts (ADR/GDR), S&P DJI

uses the final confirmed dividend amount announced by the depositary bank.

S&P DJI determines the difference between the dividend amount recognized on the original ex-date and

the confirmed dividend amount announced by the company. An adjustment in terms of dividend points is

applied to the affected indices weekly at the close of the following Friday without restatement to past

index levels. Any dividend adjustment applied on Friday is announced one day in advance. If the following

Friday is not a trading day, the dividend adjustment is applied on the next trading day. The dividend point

adjustment for a particular index is calculated using the following formula:

Index Dividend Point Adjustment = (D

dt

* S

at

) / Divisor

t

where:

D

dt

= Difference between the original and the confirmed dividend amount; foreign exchange

conversion, if applicable, is based on the exchange rate on the ex-date.

S

at

= Index shares on the ex-date.

Divisor

t

= Index divisor on the ex-date.

The gross total return (TR) and net total return (NTR) versions of the dividend point adjustment are

calculated. The TR index dividend point adjustment, which may be positive or negative, is added to the

price index level on Friday for the calculation of the total return index that day. Similarly, the NTR index

dividend point adjustment is used for the calculation of net total return. If there are multiple dividend

adjustments to implement in an index, a separate index dividend point is calculated for each dividend

adjustment. The index dividend points are then aggregated for the calculation of return index levels. In the

S&P Dow Jones Indices: Equity Indices Policies & Practices 23

event that a negative dividend adjustment results in an overall negative index dividend for the day, the

gross and net total return series underperform the price return on the effective date that the dividend

adjustment is applied.

Exception: If a stock is not part of an index on the original dividend ex-date or the dividend adjustment

implementation date, there is no dividend adjustment for that stock in that index. For indices formed by

attributes applied to the headline composition, if a stock has an attribute change between the original ex-

date and the dividend adjustment effective date but remains in the headline index throughout the period,

any dividend adjustment attributable to that stock would be applied to the headline index but not to the

attribute indices.

Foreign Exchange Conversions for Dividends

When companies declare dividends in currencies other than their stock trading currency, the following

rules are used for the dividend currency conversion:

• The dividend is converted using the forex rate on the ex-date for regular cash dividends. Special

dividends are converted using the forex rate on the day prior to the ex-date (or two days prior for

Asia Pacific). Please refer to individual index methodology documents to check which foreign

exchange rates are used for index calculation purposes.

• For ADRs and GDRs, the dividend amount and currency provided by the depositary banks are

generally used for index calculation.

S&P DJI reserve the right to make exceptions to this policy and apply a dividend amount in an alternative

currency announced by the company.

Multiple Dividend Distributions on a Single Day

When there are multiple regular cash dividends on a single day, S&P DJI will combine them into a single

amount for implementation. If the different dividends or multiple components of a single dividend are

subject to different dividend withholding taxes, the standard withholding tax rate for the country will be

used and the gross dividend amount may be adjusted accordingly.

Dividend Not Quoted Ex by the Exchange

At times, when companies declare a conditional dividend (contingent upon some event taking place (e.g.,

a merger, Board approval, etc.), S&P DJI might still decide to recognize it. In such cases, clients will be

notified in advance.

Bonus Issues of Shares Not Entitled To Cash Dividend

In certain global markets there have been cases where bonus issues of shares are not entitled to a

dividend effective at a later date.

Treatment is as follows:

• Apply the bonus issue on the ex-date

• Adjust the dividend effective at a later date accordingly (i.e., decrease the dividend amount in order

to adjust it over the new number of shares including those resulting from the bonus issue).

Total Return and Net Return Indices

Gross and net total return indices are calculated for most S&P DJI branded indices. Cash dividends are

generally applied on the ex-date of the dividend (market exceptions are noted in this document).

Net return indices reflect the return to an investor where dividends are reinvested after the deduction of a

withholding tax.

S&P Dow Jones Indices: Equity Indices Policies & Practices 24

Withholding Tax. This is the amount withheld by the company making a dividend payment, to be paid to

the taxation authorities. In the context of S&P DJI’s branded indices, this refers to the tax that non-

residents are subject to, when the country in which the company paying the dividends is incorporated is

not where the shareholder resides. In most countries, domestic shareholders are not required to pay this

tax. Tax treaties between countries may reduce the amount of withholding tax required. The withholding

tax rates used by S&P DJI do not reflect any such reduction from tax treaties. Tax rate data is reviewed

annually by S&P DJI. Tax rates are sourced and verified with independent data sources, including but not