Measuring the Macroeconomic Impact of

Monetary Policy at the Zero Lower Bound

Jing Cynthia Wu

Chicago Booth and NBER

Fan Dora Xia

Merrill Lynch

Paper presented at the 16th Jacques Polak Annual Research Conference

Hosted by the International Monetary Fund

Washington, DC─November 5–6, 2015

The views expressed in this paper are those of the author(s) only, and the presence

of the

m, or of links to them, on the IMF website does not imply that the IMF, its

Executive Board, or its management endorses or shares the views expressed in the

paper.

1

1

6

6

T

T

H

H

J

J

A

A

C

C

Q

Q

U

U

E

E

S

S

P

P

O

O

L

L

A

A

K

K

A

A

N

N

N

N

U

U

A

A

L

L

R

R

E

E

S

S

E

E

A

A

R

R

C

C

H

H

C

C

O

O

N

N

F

F

E

E

R

R

E

E

N

N

C

C

E

E

N

N

O

O

V

V

E

E

M

M

B

B

E

E

R

R

5

5

–

–

6

6

,

,

2

2

0

0

1

1

5

5

Working Paper No. 13-77

Measuring the Macroeconomic Impact of Monetary

Policy at the Zero Lower Bound

Jing Cynthia Wu

University of Chicago Booth School of Business

Fan Dora Xia

University of California, San Diego

All rights reserved. Short sections of text, not to exceed two paragraphs. May be quoted without

Explicit permission, provided that full credit including notice is given to the source.

This paper also can be downloaded without charge from the

Social Science Research Network Electronic Paper Collection:

http://ssrn.com/abstract=2321323

Measuring the Macroeconomic Impact of Monetary

Policy at the Zero Lower Bound

∗

Jing Cynthia Wu

Chicago Booth and NBER

Fan Dora Xia

Merrill Lynch

First draft: August 19, 2013

This draft: May 18, 2015

Abstract

This paper employs an approximation that makes a nonlinear term structure model

extremely tractable for analysis of an economy operating near the zero lower bound for

interest rates. We show that such a model offers an excellent description of the data

compared to the benchmark model and can be used to summarize the macroeconomic

effects of unconventional monetary policy. Our estimates imply that the efforts by the

Federal Reserve to stimulate the economy since July 2009 succeeded in making the

unemployment rate in December 2013 1% lower, which is 0.13% more compared to the

historical behavior of the Fed.

Keywords: monetary policy, zero lower bound, unemployment, shadow rate, dynamic

term structure model

JEL classification codes: E43, E44, E52, E58

∗

We have benefited from extensive discussions with Jim Hamilton and Drew Creal. We also thank

Jim Bullard, John Cochrane, Greg Duffee, Benjamin Friedman, Refet Gurkaynak, Kinda Hachem, Anil

Kashyap, Leo Krippner, Randy Kroszner, Jun Ma, David Romer, Glenn Rudebusch, Jeff Russell, Frank

Schorfheide, Matthew Shapiro, Eric Swanson, Ruey Tsay, Ken West, Johannes Wieland, John Williams,

three anonymous referees, and seminar and conference participants at Chicago Booth, UCSD, NBER Summer

Institute Monetary Economics Workshop, St. Louis Fed Applied Time Series Econometrics Workshop,

FRBSF ZLB workshop, Second BIS Research Network meeting, Atlanta Fed, Boston Fed, Chicago Fed,

Dallas Fed, and Kansas City Fed for helpful suggestions. Cynthia Wu gratefully acknowledges financial

support from the IBM Faculty Research Fund at the University of Chicago Booth School of Business.

1

1 Introduction

Historically the Federal Reserve has used the federal funds rate as the primary instrument of

monetary policy, lowering the rate to provide more stimulus and raising it to slow economic

activity and control inflation. But since December 2008, the federal funds rate has been near

zero, so that lowering it further to produce more stimulus has not been an option. Conse-

quently, the Fed has relied on unconventional policy tools such as large-scale asset purchases

(commonly known as quantitative easing) and forward guidance to try to affect long-term

interest rates and influence the economy. Assessing the impact of these measures or sum-

marizing the overall stance of monetary policy in the new environment has proven to be a

big challenge. Previous efforts include Gagnon, Raskin, Remache, and Sack(2011), Hamil-

ton and Wu(2012), Krishnamurthy and Vissing-Jorgensen(2011), D’Amico and King(2013),

Wright(2012), Bauer and Rudebusch(forthcoming), and Swanson and Williams(forthcoming).

However, these papers only focused on measuring the effects on the yield curve. In contrast,

the goal of this paper is to assess the overall effects on the economy.

A related challenge has been to describe the relations between the yields on assets of

different maturities in the new environment. The workhorse model in the term structure

literature has been the Gaussian affine term structure model (GATSM); for surveys, see

Piazzesi(2010), Duffee(forthcoming), G¨urkaynak and Wright(2012), and Diebold and Rude-

busch(2013). However, because this model is linear in Gaussian factors, it potentially allows

nominal interest rates to go negative and faces real difficulties in the zero lower bound (ZLB)

environment. One approach that could potentially prove helpful for both measuring the ef-

fects of policy and describing the relations between different yields is the shadow rate term

structure model (SRTSM) first proposed by Black(1995). This model posits the existence

of a shadow interest rate that is linear in Gaussian factors, with the actual short-term in-

terest rate the maximum of the shadow rate and zero. However, the fact that an analytical

solution to this model is known only in the case of a one-factor model makes using it more

challenging.

2

In this paper we propose a simple analytical representation for bond prices in the multi-

factor SRTSM that provides an excellent approximation and is extremely tractable for anal-

ysis and empirical implementation. It can be applied directly to discrete-time data to gain

immediate insights into the nature of the SRTSM’s predictions. We demonstrate that this

model offers an excellent empirical description of the recent behavior of interest rates, as

compared to the benchmark GATSM.

More importantly, we show using a simple factor-augmented vector autoregression (FAVAR)

that the shadow rate calculated by our model exhibits similar dynamic correlations with

macro variables of interest in the period since July 2009 as the fed funds rate did in data

prior to the Great Recession. This result gives us a tool for measuring the effects of mon-

etary policy at the ZLB, and offers an important insight to the empirical macro literature

where people use the effective federal funds rate in vector autoregressive (VAR) models to

study the relationship between monetary policy and the macroeconomy. Examples of this

literature include Christiano, Eichenbaum, and Evans(1999), Stock and Watson(2001), and

Bernanke, Boivin, and Eliasz(2005). The evident structural break in the effective fed funds

rate prevents researchers from extracting meaningful information out of a VAR once the data

covers the ZLB period. In contrast, the continuity of our shadow rate allows researchers to

update their favorite VAR during and post the ZLB period.

1

We show that the Fed has used unconventional policy measures to successfully lower the

shadow rate, and these measures have been more stimulative than a historical version of the

Taylor rule. Our estimates imply that the Fed’s efforts to stimulate the economy since July

2009 have succeeded in lowering the unemployment rate by 1% in December 2013, which is

0.13% more compared to the historical behavior of the Fed.

The SRTSM has been used to describe the recent behavior of interest rates and mone-

tary policy by Kim and Singleton(2012) and Bauer and Rudebusch(2013), but these authors

1

Our shadow rate data with monthly update is available at the Atlanta Fed (https://www.frbatlanta.

org/cqer/researchcq/shadow_rate.cfm) or our webpage (http://faculty.chicagobooth.edu/jing.

wu/research/data/WX.html).

3

relied on simulation methods to estimate and study the model. Krippner(2013) proposed a

continuous-time analog to our solution, where he added a call option feature to derive the so-

lution. Ichiue and Ueno(2013) derived similar approximate bond prices by ignoring Jensen’s

inequality. Both derivations are in continuous time, which requires numerical integration

when applied to discrete-time data.

Our paper also contributes to the recent discussion on the usefulness of the shadow rate as

a measure for the stance of monetary policy. Christensen and Rudebusch(2014) and Bauer

and Rudebusch(2013) pointed out that the estimated shadow rate varied across different

models. We confirm that different model choices do influence the level of the shadow rate.

However, the common dynamics among different shadow rates point to the same economic

conclusion. We also demonstrate that the shadow rate is a powerful tool to summarize

useful information at the ZLB. Therefore, our evidence further supports the view expressed

by Bullard(2012) and Krippner(2012), who advocated the potential of the shadow rate to

describe the monetary policy stance. Recent work by Lombardi and Zhu(2014) shares the

same view with a shadow rate constructed from a factor model with a large information set.

The rest of the paper proceeds as follows. Section 2 describes the SRTSM. Section 3

proposes to use the shadow rate to measure the monetary policy at the ZLB. Section 4

summarizes the implication of unconventional monetary policy on the macroeconomy using

historical data from 1960 to 2013, and Section 5 zooms in on the ZLB period, and analyses

forward guidance and quantitative easing. Section 6 extends the robustness of our results to

different model specifications, and Section 7 concludes.

4

2 Shadow rate term structure model

2.1 Shadow rate

Similar to Black(1995), we assume that the short term interest rate is the maximum of the

shadow rate s

t

and a lower bound r:

r

t

= max(r, s

t

). (1)

If the shadow rate s

t

is greater than the lower bound, then s

t

is the short rate. Note that

when the lower bound is binding, the shadow rate contains more information about the

current state of the economy than does the short rate itself. Since the end of 2008, the

Federal Reserve has paid interest on reserves at an annual interest rate of 0.25%, proposing

the choice of r = 0.25%.

2

2.2 Factor dynamics and stochastic discount factor

We assume that the shadow rate s

t

is an affine function of some state variables X

t

,

s

t

= δ

0

+ δ

0

1

X

t

. (2)

The state variables follow a first order vector autoregressive process (VAR(1)) under the

physical measure (P):

X

t+1

= µ + ρX

t

+ Σε

t+1

, ε

t+1

∼ N(0, I). (3)

The log stochastic discount factor is essentially affine as in Duffee(2002)

M

t+1

= exp

−r

t

−

1

2

λ

0

t

λ

t

− λ

0

t

ε

t+1

, (4)

2

Our main results are robust if we estimate r as a free parameter, see Section 6 for detailed discussion.

5

where the price of risk λ

t

is linear in the factors

λ

t

= λ

0

+ λ

1

X

t

.

This implies that the risk neutral measure (Q) dynamics for the factors are also a VAR(1):

X

t+1

= µ

Q

+ ρ

Q

X

t

+ Σε

Q

t+1

, ε

Q

t+1

Q

∼ N(0, I). (5)

The parameters under the P and Q measures are related as follows:

µ −µ

Q

= Σλ

0

,

ρ −ρ

Q

= Σλ

1

.

2.3 Forward rates

Equation (1) introduces non-linearity into an otherwise linear system. A closed-form pricing

formula for the SRTSM described in Sections 2.1 - 2.2 is not available beyond one factor.

In this section, we propose an analytical approximation for the forward rate in the SRTSM,

making the otherwise complicated model extremely tractable. Our formula is simple and

intuitive, and we will compare it to the solution from a Gaussian model in Section 2.4. A sim-

ulation study in Section 2.6 demonstrates that the error associated with our approximation

is only a few basis points.

Define f

n,n+1,t

as the forward rate at time t for a loan starting at t + n and maturing at

t + n + 1,

f

n,n+1,t

= (n + 1)y

n+1,t

− ny

nt

, (6)

which is a linear function of yields on risk-free n and n + 1 period pure discount bonds. The

6

forward rate in the SRTSM described in equations (1) to (5) can be approximated by

f

SRT SM

n,n+1,t

= r + σ

Q

n

g

a

n

+ b

0

n

X

t

− r

σ

Q

n

, (7)

where (σ

Q

n

)

2

≡ Var

Q

t

(s

t+n

). The function g(z) ≡ zΦ(z)+φ(z) consists of a normal cumulative

distribution function Φ(.) and a normal probability density function φ(.). Its non-linearity

comes from moments of the truncated normal distribution. The expressions for a

n

, b

n

and

σ

Q

n

as well as the derivation are in Appendix A.

To our knowledge, we are the first in the literature to propose an analytical approxima-

tion for the forward rate in the SRTSM that can be applied to discrete-time data directly.

For example, Bauer and Rudebusch(2013) used a simulation-based method. Krippner(2013)

proposed an approximation for the instantaneous forward rate in continuous-time. To ap-

ply his formula to the one-month ahead forward rate in the data, a researcher needs to

numerically integrate the instantaneous forward rate over that month, see Christensen and

Rudebusch(2014) for example. Conversely, our discrete-time formula can be applied directly

to the data. In summary, our analytical approximation is free of any numerical error asso-

ciated with simulation methods and numerical integration.

2.4 Relation to Gaussian Affine Term Structure Models

If we replace equation (1) with

r

t

= s

t

,

the SRTSM becomes a GATSM, the benchmark model in the term structure literature. The

forward rate in the GATSM is an affine function of the factors:

f

GAT SM

n,n+1,t

= a

n

+ b

0

n

X

t

, (8)

7

where a

n

and b

n

are the same as in equation (7), and the detailed expressions are in Appendix

A.

The difference between (7) and (8) is the function g(.). We plot it in Figure 1 together

with the 45 degree line. It is a non-linear and increasing function. The function value is

indistinguishable from the 45 degree line for inputs greater than 2, and is practically zero

for z less than −2. The limiting behavior demonstrates that the GATSM is a simple and

close approximation for the SRTSM, when the economy is away from the ZLB.

2.5 Estimation

State space representation for the SRTSM We write the SRTSM as a nonlinear state

space model. The transition equation for the state variables is equation (3). From equation

(7), the measurement equation relates the observed forward rate f

o

n,n+1,t

to the factors as

follows:

f

o

n,n+1,t

= r + σ

Q

n

g

a

n

+ b

0

n

X

t

− r

σ

Q

n

+ η

nt

, (9)

where the measurement error η

nt

is i.i.d. normal, η

nt

∼ N (0, ω). The observation equation

is not linear in the factors. We use the extended Kalman filter for estimation, which applies

the Kalman filter by linearizing the nonlinear function g(.) around the current estimates.

See Appendix B for details.

The extended Kalman filter is extremely easy to apply due to the closed-form formula

in equation (7). We take the observation equation (9) directly to the data without any fur-

ther numerical approximation, which is necessary for pricing formulas derived in continuous

time. The likelihood surface behaves similarly to a GATSM, because the function g(.) is

monotonically increasing. These features together make our formula appealing.

8

State space representation for the GATSM For the GATSM described in Section 2.4,

equation (3) is still the transition equation. Equation (8) implies the measurement equation:

f

o

n,n+1,t

= a

n

+ b

0

n

X

t

+ η

nt

, (10)

with η

nt

∼ N (0, ω). We apply the Kalman filter for the GATSM, because it is a linear

Gaussian state space model. See Appendix B for details.

Data We construct one-month forward rates for maturities of 3 and 6 months, 1, 2, 5, 7

and 10 years from the G¨urkaynak, Sack, and Wright(2007) dataset, using observations at

the end of the month.

3

Our sample spans from January 1990 to December 2013.

4

We plot

the time series of these forward rates in Figure 2. In December 2008, the Federal Open

Market Committee (FOMC) lowered the target range for the federal funds rate to 0 to 25

basis points. We refer to the period from January 2009 to the end of the sample as the ZLB

period, and highlight with shaded area. For this period, forward rates of shorter maturities

are essentially stuck at zero, and do not display meaningful variation. Those with longer

maturities are still far away from the lower bound, and display significant variation.

Normalization The consensus in the term structure literature is that three factors are

sufficient to account for almost all of the cross-sectional variation in yields. Therefore, we

focus our discussion on three factor models.

5

The collection of parameters we estimate

include (µ, µ

Q

, ρ, ρ

Q

, Σ, δ

0

, δ

1

). For identification, we impose normalizing restrictions on the

Q parameters similar to Joslin, Singleton, and Zhu(2011) and Hamilton and Wu(2014): (i)

δ

1

= [1, 1, 0]

0

; (ii) µ

Q

= 0; (iii) ρ

Q

is in real Jordan form with eigenvalues in descending order;

3

As a robustness check, we also estimate the SRTSM and extract the shadow rate with Fama and

Bliss(1987) zero coupon bond data from CRSP, and we get similar results. See Section 6 for detailed

discussion.

4

Starting the sample from 1990 is standard in the GATSM literature, see Wright(2011) and Bauer,

Rudebusch, and Wu(2012) for examples.

5

All of our main results relating to the macroeconomy, from Section 3 onward, are robust to two-factor

models, see Section 6 for further discussion. But for the term structure models themselves, two-factor models

perform worse than three-factor models in terms of fitting the data.

9

and (iv) Σ is lower triangular. Note that these restrictions are for statistical identification

only, i.e. they prevent the latent factors from shifting, rotating and scaling. Imposing this

or other sets of restrictions does not change economic implications of the model.

Repeated eigenvalues Estimation assuming that ρ

Q

has three distinct eigenvalues pro-

duces two smaller eigenvalues almost identical to each other, with the difference in the order

of 10

−3

. This evidence points to repeated eigenvalues. Creal and Wu(2015) have docu-

mented a similar observation using a different dataset and a different model. With repeated

eigenvalues, the real Jordan form becomes

ρ

Q

=

ρ

Q

1

0 0

0 ρ

Q

2

1

0 0 ρ

Q

2

.

Model comparison Maximum likelihood estimates, and robust standard errors (See Hamil-

ton(1994) p. 145) are reported in Table 1. The log likelihood value is 755.46 for the GATSM,

and 855.57 for the SRTSM. The superior performance of the SRTSM comes from its ability

to fit the short end of the forward curve when the lower bound binds. In Figure 3, we plot

average observed (red dots) and fitted (blue curves) forward curves in 2012. The left panel

illustrates that the SRTSM fitted forward curve flattens at the short end, because the g(.)

function is very close to zero when the input is sufficiently negative. This is consistent with

the feature of the data. In contrast, the GATSM in the right panel has trouble fitting the

short end. Instead of having a flat short end as the data suggest, the GATSM generates too

much curvature. That is the only way it can approximate the yield curve at the ZLB.

As demonstrated in Section 2.4, the GATSM is a good approximation for the SRTSM

when forward rates are sufficiently higher than the lower bound. We illustrate this property

using the following numerical example. When both models are estimated over the period

of January 1990 to December 1999, the maximum log likelihood is 475.71 for the SRTSM,

10

and 476.69 for the GATSM. The slight difference in the likelihood comes from the linear

approximation of the extended Kalman filter.

2.6 Approximation error

An alternative to equation (7) to compute forward rates or yields is simulation. We compare

forward rates and yields implied by equation (7) and by an average of 10 million simulated

paths to measure the size of the approximation error.

6

The approximation errors grow

with the time to maturity for both forward rates and yields. We focus on the longest end to

report the worst case scenario. The average absolute approximation error of the 24 Januaries

between 1990 and 2013 for the 10-year ahead forward rate is 2.3 basis points, about 0.36%

of the average forward rate for this period (6.37%). The number is 0.78 basis points for the

10 year yield with an average level of 5.29%, yielding a ratio of 0.14%. The approximation

errors for long term forward rates are larger than those for yields, because yields factor in

the smaller approximation errors of short term and medium term forward rates. Regardless,

the approximation errors are at most a few basis points, orders of magnitude smaller than

the level of interest rates. Although these numbers contain simulation errors, with the large

number of draws (10 million), the simulation error is negligible. To show that, we compare

the analytical solution in equation (8) for the GATSM with simulation. The average absolute

simulation errors are 0.1 basis points for the 10 year ahead forward rate and 0.04 for the 10

year yield.

3 Policy rate

The federal funds rate has been the primary measure for the Fed’s monetary policy stance,

and has provided the basis for most empirical studies of the interaction between monetary

6

At time t, we simulate 10 million paths of s

t+j

for j = 1, ..., 120 with the estimated factors X

t

and

Q parameters, and compute r

t+j

based on equation (1). Then we compute the corresponding 10 million

y

nt

= −

1

n

log

E

Q

t

[exp(−r

t

− r

t+1

− ... − r

t+n−1

)]

and then f

n,n+1,t

using (6). We take the average of the

10 million draws as the simulated yield or forward rate.

11

policy and the economy. However, since 2009, it has been stuck at the lower bound, and no

longer conveys any information. How do we summarize the effects of monetary policy in this

situation? Most research has focused on the ZLB sub-period. The issue with this approach

is that it throws out half a century of valuable historical data. Moreover, how do we move

forward after the economy exits the ZLB and the short rate regains its role as the summary

for monetary policy? Is there a way economists can keep using the long historical data, with

the presence of the ZLB period? The shadow rate from the SRTSM is a potential solution.

Section 3.2 demonstrates that the shadow rate interacts with macro variables similarly as

the fed funds rate did historically. Section 5.1 reinforces this key result.

We construct the new policy rate s

o

t

by splicing together the effective federal funds rate

before 2009 and the estimated shadow rate since 2009. This combination makes the most use

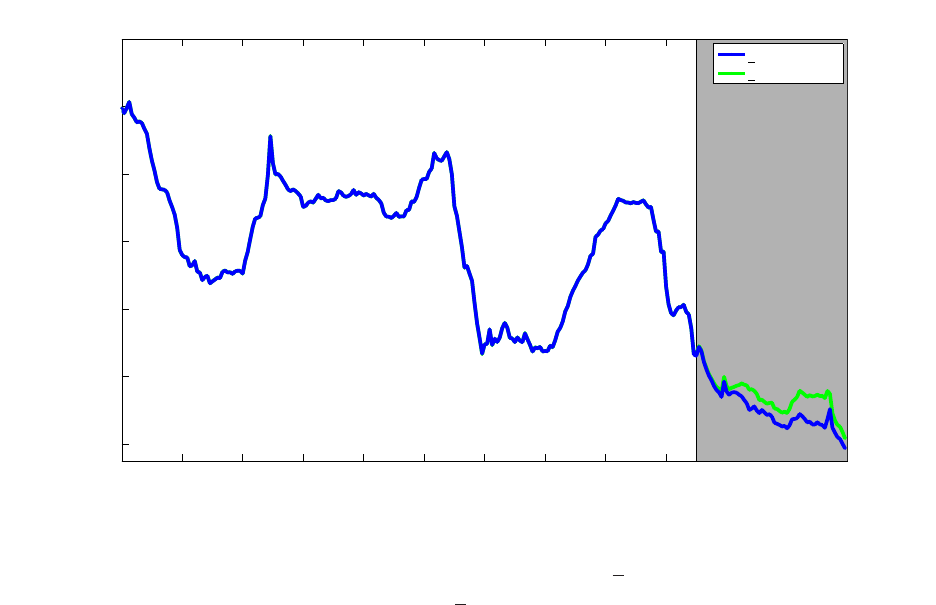

out of both series. We plot the model implied shadow rate (in blue) and the effective federal

funds rate (in green) in Figure 4. Before 2009, the ZLB was not binding, the model implied

short rate was equal to the shadow rate. The difference between the two lines in Figure 4

reflects measurement error, in units of basis points. The two rates have diverged since 2009.

The effective federal funds rate has been stuck at the ZLB. In contrast, the shadow rate

has become negative and still displays meaningful variation. We update our shadow rate

monthly at http://faculty.chicagobooth.edu/jing.wu/research/data/WX.html.

3.1 Factor augmented vector autoregression

We use the FAVAR model proposed by Bernanke, Boivin, and Eliasz(2005) to study the

effects of monetary policy. The basic idea of the FAVAR is to compactly summarize the rich

information contained in a large set of economic variables Y

m

t

using a low-dimensional vector

of factors x

m

t

. This model allows us to study monetary policy’s impact on any macroeconomic

variable of interest. The factor structure also ensures that the number of parameters does

not explode.

12

Model Following Bernanke, Boivin, and Eliasz(2005), we use 3 factors, and assume that

the factors x

m

t

and the policy rate s

o

t

jointly follow a VAR(13):

7

x

m

t

s

o

t

=

µ

x

µ

s

+ ρ

m

X

m

t−1

S

o

t−1

+ Σ

m

ε

m

t

ε

MP

t

,

ε

m

t

ε

MP

t

∼ N(0, I), (11)

where we summarize the current value of x

m

t

(and s

o

t

) and its 12 lags using a capital letter to

capture the state of the economy, X

m

t

= [x

m0

t

, x

m0

t−1

, ..., x

m0

t−12

]

0

(and S

o

t

= [s

o

t

, s

o

t−1

, ..., s

o

t−12

]

0

).

Constants µ

x

and µ

s

are the intercepts, and ρ

m

is the autoregressive matrix. The matrix

Σ

m

is the cholesky decomposition of the covariance matrix. The monetary policy shock is

ε

MP

t

. We identify the monetary policy shock through the recursiveness assumption as in

Bernanke, Boivin, and Eliasz(2005); for details see Appendix C. Observed macroeconomic

variables load on the macroeconomic factors and policy rate as follows:

Y

m

t

= a

m

+ b

x

x

m

t

+ b

s

s

o

t

+ η

m

t

, η

m

t

∼ N(0, Ω), (12)

where a

m

is the intercept, and b

x

and b

s

are factor loadings.

Data Similar to Bernanke, Boivin, and Eliasz(2005), Y

m

t

consists of a balanced panel of

97 macroeconomic time series from the Global Insight Basic Economics, and our data spans

from January 1960 to December 2013.

8

We have a total of T = 635 observations. We apply

the same data transformations as in the original paper to ensure stationarity. Detailed data

description can be found in the Online Appendix.

7

Our results hold with different numbers of factors (3 or 5) and with different lag lengths (6, 7, 12 or 13),

see Section 6 for further discussion.

8

Global Insight Basic Economics does not maintain all 120 series used in Bernanke, Boivin, and

Eliasz(2005). Only 97 series are available from January 1960 to December 2013. The main results from

Bernanke, Boivin, and Eliasz(2005) can be replicated by using the 97 series in our paper for the same sample

period.

13

Estimation First, we extract the first three principal components of the observed macroe-

conomic variables over the period of January 1960 to December 2013, and take the part

that is orthogonal to the policy rate as the macroeconomic factors. Then, we estimate equa-

tion (12) by ordinary least squares (OLS). See Appendix C for details. Next, we estimate

equation (11) by OLS.

Macroeconomic variables and factors The loadings of the 97 macro variables on the

factors are plotted in Figure 5. Real activity measures load heavily on factor 1, price level

indexes load more on factor 2, and factor 3 contributes primarily to employment and prices.

For the contemporaneous regression in equation (12), more than one third of the variables

have an R

2

above 60%, which confirms the three-factor structure. Besides the policy rate,

we focus on the following five macroeconomic variables: industrial production, consumer

price index, capacity utilization, unemployment rate and housing starts. They represent the

three factors, and cover both real activity and price levels. The R

2

s for these macroeconomic

variables are 73%, 89%, 64%, 64% and 67% respectively.

3.2 Measures of monetary policy

The natural question is whether the shadow rate could be used in place of the fed funds rate

to describe the stance and effects of monetary policy under the ZLB. We first approach this

using a formal hypothesis test - can we reject the hypothesis that the parameters relating

the shadow rate to macroeconomic variables of interest under the ZLB are the same as those

that related the fed funds rate to those variables in normal times?

We begin this exercise by acknowledging that we do not attempt to model the Great

Recession in our paper, because it was associated with some extreme financial events and

monetary policy responses. For example, Ng and Wright(2013) provided some empirical

evidence that the Great Recession is different in nature from other post-war recessions.

Instead, we are interested in the behavior of monetary policy and the economy in the period

14

following the Great Recession, when policy returned to a new normal that ended up being

implemented through the traditional 6-week FOMC calendar but using the unconventional

tools of large scale asset purchases and forward guidance. We investigate whether a summary

of this new normal based on our derived shadow rate shows similar dynamic correlations as

did the fed funds rate in the period prior to the Great Recession.

We rewrite the first block for x

m

t

in (11)

x

m

t

= µ

x

+ ρ

xx

X

m

t−1

+ 1

(t<December 2007)

ρ

xs

1

S

o

t−1

+ 1

(December 2007≤t≤June 2009)

ρ

xs

2

S

o

t−1

+ 1

(t>June 2009)

ρ

xs

3

S

o

t−1

+ Σ

xx

ε

m

t

, (13)

The null hypothesis is that the matrix ρ

xs

is the same before and after the Great Recession:

H

0

: ρ

xs

1

= ρ

xs

3

.

We construct the likelihood ratio statistic as follows (see Hamilton(1994) p. 297):

(T − k)(log|

\

Σ

xx

R

Σ

xx0

R

| − log|

\

Σ

xx

U

Σ

xx0

U

|),

where T is the sample size, k is the number of regressors on the right hand side of equation

(13),

\

Σ

xx

U

Σ

xx0

U

is the estimated covariance matrix, and

\

Σ

xx

R

Σ

xx0

R

is the estimated covariance

matrix with the restriction imposed by the null hypothesis.

The likelihood ratio statistic has an asymptotic χ

2

distribution with 39 degrees of free-

dom. The p-value is 0.29 for our policy rate s

o

t

(see the first row of Table 2). We fail to

reject the null hypothesis at any conventional significance level. This is consistent with the

claim that our proposed policy rate impacts the macroeconomy the same way at the ZLB

15

as before. If we use the effective federal funds rate instead, the p-value is 0.0007, and we

would reject the null hypothesis at any conventional significance level. Our results show that

there is a structural break if one tries to use the conventional monetary policy rate. Using

a similar procedure for the coefficients relating lagged macro factors to the policy rate, the

p-values are 1 for both our policy rate and the effective fed funds rate. In summary, our

policy rate exhibits similar dynamic relations to key macroeconomic variables before and

after the Great Recession, and captures meaningful information missing from the effective

federal funds rate after the economy reached the ZLB. The immediate implication of this

result is that researchers can use the shadow rate to update earlier studies that had been

based on the historical fed funds rate.

4 Macroeconomic implications

After the Great Recession the Federal Reserve implemented a sequence of unconventional

monetary policy measures including large-scale asset purchases and forward guidance. The

literature has thus far focused on large-scale asset purchases or quantitative easing, and

its effects on the yield curve. In contrast to previous studies, here we attempt to answer

some more fundamental questions: what is the overall impact of these new unconventional

policy tools on the real economy? Is the Fed able to achieve its stated goal of lowering the

unemployment rate?

4.1 Effects of unconventional monetary policy

In this section, we attempt to assess the effect of the various unconventional policy measures

adopted by the Federal Reserve after the Great Recession with a historical decomposition.

The basic idea is that we can write each variable in equation (11) as a sum of past shocks

and its initial condition. Specifically, the contribution of monetary policy shocks after the

Great Recession (between [t

1

= July 2009, t

2

= December 2013]) to an individual economic

16

variable Y

m,i

t

can be summarized by

max(t,t

2

)

X

τ=t

1

Ψ

MP,i

t−τ

ε

MP

τ

, (14)

where Ψ

MP,i

j

is the impulse response

Ψ

MP,i

j

=

∂Y

m,i

t+j

∂ε

MP

t

= b

x,i

∂x

m

t+j

∂ε

MP

t

+ b

s,i

∂s

o

t+j

∂ε

MP

t

, (15)

for variable i after j periods in response to a one unit shock in ε

MP

t

, and the derivatives on

the right hand side are the impulse responses from a standard VAR.

In Figure 6, we plot the observed time series for the six variables in blue, and counterfac-

tual paths in red dashed lines for an alternative world where all the monetary policy shocks

at the ZLB were zero. In the top left panel, we show the difference between the realized and

counterfactual policy rates. Without any deviation from the traditional monetary policy

rule, the shadow rate would have been about -1% in December 2013, whereas the actual

shadow rate then was about -2%. On average, the shadow rate would have been 0.4% higher

between 2011 and 2013 if the monetary policy shocks were set to zero. These results indi-

cate that unconventional monetary policy has been actively lowering the policy rate, and

the Federal Reserve has employed an expansionary monetary policy since 2011.

Next consider implications for the real economy. In the absence of expansionary monetary

policy, in December 2013, the unemployment rate would be 0.13% higher at the 6.83% level

rather than 6.7% in the data. The industrial production index would have been 101.0

rather than 101.8, and capacity utilization would be 0.3% lower than what we observe.

Housing starts would be 11,000 lower (988,000 vs. 999,000). These numbers suggest that

unconventional monetary policy achieved its goal of stimulating the economy. Interestingly,

the accommodative monetary policy during this period has not boosted real activity at the

cost of high inflation. Instead, monetary policy shocks have contributed to decreasing the

17

consumer price index by 1. Our result exhibits the same price puzzle that has been discussed

in earlier macro studies.

9

The historical decomposition exercise calculates the contribution of monetary policy

shocks defined as deviations of the realized shadow rate from the policy rate implied by

the historical monetary policy rule. Another question of interest is what would happen if

the Fed had adopted no unconventional monetary policy at all. This question is more diffi-

cult to answer, because it is not clear what the counterfactual shadow rate would be. One

possible counterfactual to consider would be what would have happened if the shadow rate

had never fallen below the lower bound r. Specifically, we replace the realized monetary

policy shock (ε

MP

τ

) in equation (14) with the counterfactual shocks, ε

MP,II

τ

, such that these

shocks would have kept the shadow rate at the lower bound. One might view the difference

between the actual shadow rate and this counterfactual as an upper bound on the contri-

bution of unconventional monetary policy measures. If instead of the realized shadow rate,

monetary policy had been such that the shadow rate never fell below 0.25%, the result would

have been an unemployment rate 1% higher than observed.

Our estimated effect of unconventional monetary policy on the unemployment rate is

smaller than the ones found in Chung, Laforte, Reifschneider, and Williams(2012) and

Baumeister and Benati(2013). This is primarily because they assumed that unconventional

monetary policy had a big impact on the yield curve. For example, Chung, Laforte, Reif-

schneider, and Williams(2012) assumed that the large-scale asset purchases reduced the long

term interest rates by 50 basis points, and then translated this number into a 1.5% decrease

in the unemployment rate. If we were to use Hamilton and Wu(2012)’s estimate of 13 basis-

point decrease in the 10 year rate, a simple linear calculation would translate this number

into a 0.39% reduction in the unemployment rate. This is comparable to our estimate.

9

Examples include Sims(1992) and Eichenbaum(1992).

18

4.2 Impulse responses

What would happen to the unemployment rate one year later if the Fed decreases the policy

rate by 25 basis points now? An impulse response function offers a way to think about

questions like this by describing monetary policy’s dynamic impact on the economy.

We compute the impulse responses using equation (15) and plot them in Figure 7 for six

economic variables (the policy rate, industrial production, consumer price index, capacity

utilization, unemployment rate and housing starts) to a loosening monetary policy shock

with a size of 25 basis points (Σ

ss

ε

MP

t

= −25 bps). The 90% confidence intervals are in

the shaded areas.

10

With an expansionary monetary policy shock, real activity increases as

expected: industrial production, capacity utilization and housing starts increase while the

unemployment rate decreases. The impacts peak after about a year. Specifically, one year

after a -25 basis-point shock to the policy rate, industrial production is 0.5% higher than its

steady state level, capacity utilization increases by 0.2% , the unemployment rate decreases

by 0.06% , and housing starts is 1.3% above its steady state level. After the peak, the effects

die off slowly, and they are eventually gone in about 8 years.

5 Macroeconomic impact at the ZLB

Our main results in Section 3 and 4 are based on a constant structure before and after the

Great Recession. Despite a much smaller sample, the ZLB period provides an alternative

angle, complementing the results we have so far. Section 5.1 serves as a robustness check – we

compare the full sample impulse responses with those from the ZLB period, demonstrating

the usefulness of the shadow rate. Section 5.2 studies forward guidance. With a sample size

of 53 months at the ZLB, we replace the 13-lag FAVAR with a 1-lag FAVAR. In Section

5.3, we connect our shadow rate with the three rounds of quantitative easing and operation

twist.

10

Confidence intervals are constructed by bootstrapping.

19

5.1 New vs. conventional policy rates

Consider first an attempt to estimate a first-order FAVAR for data at the ZLB period in

which the effective fed funds rate is used as the policy rate. We plot impulse responses

to an expansionary policy shock of 25 basis points in Figure 8. The turquoise lines are

median responses, and 90% confidence intervals are in the turquoise areas. For comparison,

we also plot the impulse responses for the full sample with our policy rate in blue. These

are identical to the impulse responses presented in Figure 7. For the ZLB subsample, the

impulse responses to a shock to the effective federal funds rate are associated with huge

uncertainty, with the confidence intervals orders of magnitude bigger than those for the full

sample. This indicates that the effective federal funds rate does not carry much information

at the ZLB. The reason is simple: it is bounded by the lower bound, and does not display

any meaningful variation. We can also see this from Figure 4.

By contrast, Figure 9 plots the ZLB impulse-response functions in turquoise with our

policy rate introduced in Section 3. Again, we compare them with full sample impulse

responses in blue. Overall, the sub-sample impulse responses are qualitatively the same

as those for the full sample. Specifically, an expansionary monetary policy shock boosts

real economic activity. The impulse responses for the sub-sample and full sample also look

quantitatively similar, especially for medium and long horizons, despite some differences in

the short horizon for several variables, potentially due to different model specifications. The

point estimates and confidence intervals have the same orders of magnitude. Therefore, at

the ZLB, our new policy rate conveys important and economically meaningful information;

while the conventional policy rate gets stuck around zero.

5.2 Forward guidance

Since December 2008, the federal funds rate has been restricted by the ZLB. The conventional

monetary policy is no longer effective, because the Federal Reserve cannot further decrease

the federal funds rate below zero to boost the economy. Consequently, the central bank has

20

resorted to a sequence of unconventional monetary policy tools. One prominent example is

forward guidance, or central bank communications with the public about the future federal

funds rate. In particular, forward guidance aims to lower the market’s expectation regarding

the future short rate. Market expectations about future short rates feed back through the

financial market to affect the current yield curve, especially at the longer end. Lower long

term interest rates in turn stimulate aggregate demand. The Federal Reserve has made

considerable use of forward guidance since the federal funds rate first hit the ZLB. In Table

3, we summarize a list of forward guidance quotes, when the Fed expected a different liftoff

date. Some of these dates overlap with Woodford(2012). The wording focuses either on

(i) the length of the ZLB, or (ii) the target unemployment rate. Section 5.2.1 compares the

length of the ZLB prescribed by forward guidance and the market’s expectation from our

model. Section 5.2.2 studies the impact of forward guidance on the unemployment rate.

5.2.1 Liftoff date

One focus of forward guidance is for the Federal Reserve to implicitly or explicitly commu-

nicate with the general public about how long it intends to keep the federal funds rate near

zero, as demonstrated in Table 3. For example, in the earlier FOMC statements in late 2008

and early 2009, they used phrases such as “some time” and “an extended period”. Later

on, starting from late 2011, the Federal Reserve decided to be more transparent and specific

about forward guidance. In each statement, they unambiguously revised the date, on which

they expected the ZLB to end, according to the development of the overall economy.

Our model implies a closely related concept: the ZLB duration. It measures the market’s

perception of when the economy will finally escape from the ZLB. This is a random variable

defined as

τ

t

≡ inf{τ

t

≥ 0|s

t+τ

≥ r}.

Thus τ

t

represents how much time passes before the shadow rate first crosses the lower bound

from below. At time t, s

t+τ

is unknown. We simulate out N = 10000 paths of the future

21

shadow rate given the information at time t.

11

Every simulated path generates an estimate

of τ

t

. Therefore, we have a distribution of τ

t

, and we take the median across N simulations

as our measure of the market’s expected ZLB duration.

We summarize the history of the market’s expected ZLB duration in terms of the liftoff

date in Figure 10. The market’s expectation of the liftoff date kept extending until early 2013,

when the market believed the ZLB would continue until sometime in 2016. Then the market

revised its expectation of liftoff to 2015 in mid 2013. Since then, the market’s expectations

have fluctuated between 2015 and 2016. We highlight four announcements in August 2011,

January 2012, September 2012 and June 2013 when the Fed explicitly spelled out the ZLB

liftoff date (see Table 3). Between early 2011 and the first announcement, the market kept

revising the liftoff date forward. On August 9, 2011, the Federal Reserve promised to keep

the rate low “at least through mid-2013”, whereas the market anticipated the ZLB to last

until early 2015. Then the market made some downward adjustment to mid 2014 in the

following months. When the lift-off date was postponed to “at least through late 2014” on

January 25, 2012, the market revised its expectation to early 2015. The two expectations

overlap each other. On September 13, 2012, the forward guidance further extended the

liftoff date to “at least through mid-2015”, the market expected the ZLB to last until early

2016. On June 19, 2013, Federal Reserve Board Chairman Ben Bernanke expressed in a

press conference the Federal Reserve’s plan to maintain accommodative monetary policy

until 2015 based on the economic outlook at that time. Following his remarks, the market’s

expected lift-off date jumped to coincide with Bernanke’s statement.

12

Overall, evidence suggests that when time goes on, forward guidance and the market’s

expectation align better. For the later events, the two expectations overlapped each other.

In the next section, we will use the expected ZLB duration as a proxy for forward guidance,

and study its impact on the real economy, especially the unemployment rate.

11

Note that we use the P parameters for simulation to capture real life expectations.

12

The results look very similar if we use real time duration instead, i.e., compute the ZLB duration at

time t using only data up to t.

22

5.2.2 Impact on unemployment

We have demonstrated that forward guidance is consistent with the market’s expectation.

The ultimate question central bankers and economists care about is whether forward guid-

ance is as successful in terms of its impact on the real economy, especially unemployment.

We phrase this question in a FAVAR(1) framework with the expected ZLB duration measur-

ing the monetary policy, and use this tool to study the transmission mechanism of forward

guidance. For the macroeconomic factors, we keep them as they were. Figure 11 shows the

impulse responses to a shock to the expected ZLB duration of one year for the same set

of variables. Overall, in response to an easing of monetary policy, the economy starts to

expand. Most interestingly, a one year increase in the expected ZLB duration translates into

a 0.1% decrease in the unemployment rate, although the impulse response is not statistically

significant at 10% level.

A simple calculation suggests that a one year increase in the expected ZLB duration has

roughly the same effect on the macroeconomy as a 15 basis-point decrease in the policy rate.

The visual comparison is in Figure 12, where the blue part is identical to Figure 11, and

the turquoise portion is 15/25 times the turquoise in figure 9. Figure 12 suggests that in

response to a one year shock to the expected ZLB duration, or a negative 15 basis-point

shock to the policy rate, capacity utilization goes up by 0.2%, unemployment rate decreases

by 0.1% and housing starts is about 2% over its steady state.

5.3 Quantitative easing

In this section, we relate the Federal Reserves’ quantitative easing (QE) and operation twist

(OT) to our shadow rate in an informal event study setting.

Lasting from November 2008 to March 2010, QE1 purchased about $1.7 trillion of

mortgage-backed securities, agency debt as well as Treasury securities. During this pe-

riod, the policy rate dropped from 97 basis points in October 2008 to negative 48 basis

points in March 2010, totaling 1.45%, see Figure 13. Overall, we observe sizable downward

23

movement in the policy rate associated with a substantial operation. QE2 was implemented

from November 2010 to June 2011 with $600 billion purchases of longer maturity US Trea-

suries. In the meantime, the shadow rate moved from -1% to -1.12%, with a net change of

12 basis points. The decrease in the shadow rate was smaller due to two reasons. First,

the scale of QE2 was smaller than QE1. Second, QE2 was well anticipated by the market,

and much of the adjustment was already made prior to when it was announced due to the

forward looking nature of market participants. Operation Twist, between September 2011

and December 2012, swapped the shorter term bonds the Fed held with longer term bonds.

There was no net purchase, and the nominal amount exchanged was $667 billion. There was

not much action in the shadow rate, moving only 5 basis points lower. Between September

2012 and October 2014

13

, QE3 made another round of bigger purchases with $1.7 trillion of

longer-term Treasuries and mortgage-backed securities (Figure 13). In the meantime, we see

the biggest drop for the shadow rate of 1.54% from -1.26% in August 2012 to -2.8% in Oc-

tober 2014

14

. Among these events, the larger purchases of QE1 and QE3 were accompanied

with bigger drops of the shadow rate, around 1.5% each time.

These numbers give a rough overall mapping between the QE and OT programs to our

shadow rate. We need to interpret these numbers with a grain of salt. Although during these

periods unconventional monetary policy constituted major events, the yield curve, hence the

shadow rate, could still have potentially reacted to other macroeconomic news. To better

single out QE’s effects on the shadow rate, we narrow down the window size below.

In Figure 14, we document responses of interest rates to two announcements, which

surprised the market the most. On November 25, 2008, The Federal Reserve announced

its first quantitative easing program to purchase the direct obligations of housing-related

government-sponsored enterprises and mortgage-backed securities (top row of Figure 14).

On May 22, 2013, Ben Bernanke mentioned to taper the Federal Reserve’s QE program,

13

Note, there are several months overlap between OT and QE3.

14

We use the extended shadow rate from our website: http://faculty.chicagobooth.edu/jing.wu/

research/data/WX.html.

24

referred by the popular media as the “taper tantrum” (bottom row of Figure 14). In the

first column of Figure 14, we plot the one day change of the yield curve corresponding to these

events. In response to the accommodative announcement about QE1, we observe the longer

end of the yield curve shifted down, while the shorter end remained unchanged. During the

taper tantrum, a tightening event, longer yields shifted up without moving short yields. The

second column describes the same movements in terms of monthly changes of the forward

curve, which is a simple linear function of the yield curve, see (6). Again, long rates moved

in the right directions, whereas short rates did not react to the taper tantrum due to the

ZLB. The forward curve approximately captures the expected future short term interest rate

under the risk neutral measure. Given that agents do not expect the short term interest rate

to move away from the lower bound anytime soon, we do not see any movement at the short

end. To contrast this lack of movement, we plot the expected future shadow rate curves

in the third column. The longer end mimicked the movements in the second column. The

difference is that as the shadow rate still displays variation at the ZLB, we see the whole

curve, including the short end, shifted in response to these events. In response to the QE1

announcement, the shadow rate dropped 42 basis points. The taper tantrum increased the

shadow rate by 25 basis points.

Overall, we have illustrated that the shadow rate can adequately summarize changes in

long term interest rates (or forward rates) due to QE announcements. Some researchers

have suggested that QE lowers long term interest rates through the term premium channel.

If this is the case, even at the very short end of the yield curve, our shadow rate can also

capture movements in the term premium component.

6 Robustness

Lower bound Our benchmark SRTSM in Section 2 sets r = 0.25% at the interest the

Federal Reserve has paid on reserves. This parameter is potentially estimable. As a robust-

25

ness, we estimate it as an additional parameter. The estimated lower bound ˆr = 0.20% is

fairly close to the 25 basis points chosen by economic intuition.

As a result, the dynamics of the shadow rates implied by the two versions resemble each

other, see Figure 15. There is some difference between the blue line (our original shadow

rate) and the green line (the new shadow rate with estimated r) in levels, similar to what

Bauer and Rudebusch(2013) found. However, the dynamics of the two series exhibit a strong

comovement, with a correlation of 1.00 for the full sample and 0.93 for the ZLB subsample.

The comovement rather than the difference in levels between the shadow rates is what drives

the key results. For example, the liftoff dates produced by them resemble each other as well,

see Figure 16.

More importantly, they produce the same economic implications. Our key result in

Section 3 holds. The second row of Table 2 reports the p value for the test H

0

: ρ

xs

1

= ρ

xs

3

on

the left. Similar to the benchmark case in the first row, we cannot reject the null hypothesis

at any conventional level, again supporting the conclusion that the shadow rate is a natural

extension of the fed funds rate at the ZLB. The second number illustrates that we cannot

reject the null hypothesis H

0

: ρ

sx

1

= ρ

sx

3

either. The impulse responses produced with the

new shadow rate have an identical economic meaning as those in Figure 7.

15

Overall, whether

we fix the r at 25 basis points as in our benchmark or estimate it at 20 basis points does not

alter any conclusion, especially our main macro conclusions.

Macro implications One of the key macro results is based on the structural break tests

in Section 3. We demonstrated the robustness of this result against an alternative lower

bound. Next, we vary some other specifications of the SRTSM to show a broader set of

robustness. First, although it is well established in the GATSM literature that we need 3

factors to capture the cross sectional variation of the term structure, some researchers in the

SRTSM use 2 factors instead. Examples are Kim and Singleton(2012), Krippner(2013) and

Christensen and Rudebusch(2014). Therefore, the second set of robustness (A2) uses a 2

15

For brevity, figures are not included in the paper.

26

factor SRTSM instead of a 3 factor model. There is also some concern about the G¨urkaynak,

Sack, and Wright(2007) dataset due to its smoothing nature. As a third alternative (A3),

we use the Fama and Bliss(1987) unsmoothed zero coupon bond yields from CRSP, with

maturities of 3 months and 1 through 5 years. The results for these alternatives are in row

3-4 of Table 2. Again, all the p values are larger than 10%, as opposed to 0.0007 for the fed

funds rate, supporting our conclusion.

Another important macro result are the impulse responses in Section 4.2. The impulse

responses using alternative shadow rates look economically identical to the benchmark re-

sponses in Figure 7. The literature argues that different aspects of the SRTSM – including the

lower bound, number of factors and dataset – might have implications for the term structure

itself. However, our evidence suggests that for the more important economic implications,

they do not play such a role.

To further extend the reliance of our key macro results, we vary the specifications for

the FAVAR as well. We first change the number of macro factors from 3 to 5 in A4. Then,

we also check for 6, 7 and 12 lags (A5) as opposed to 13 lags in the benchmark. These are

all plausible alternatives analyzed in Bernanke, Boivin, and Eliasz(2005). Row 5-8 of Table

2 summarize the results. We cannot reject either of the null hypotheses at 5% level for all

the specifications, with all but one p values greater than 0.1. Thus, our key results are not

subject to the specific model choices for the FAVAR either.

Overall, neither changes in the SRTSM hence the shadow rate, nor changes in the FAVAR

alter the key macroeconomic results of this paper, and our results are robust to a wide range

of alternatives.

7 Conclusion

We have developed an analytical approximation for the forward rate in the SRTSM, making

the otherwise complicated model extremely tractable, with the approximation error being

27

only a couple of basis points. The SRTSM offers an excellent description of the data especially

when the economy is at the ZLB. We used the shadow rate from the SRTSM to construct a

new measure for the monetary policy stance when the effective federal funds rate is bounded

below by zero, and employed this measure to study unconventional monetary policy’s impact

on the real economy. We have found that our policy rate impacts the real economy since July

2009 in a similar fashion as the effective federal funds rate did before the Great Recession.

An expansionary monetary policy shock boosts the real economy. More specifically, at the

ZLB, in response to a negative 15 basis-point shock to the policy rate, the unemployment

rate decreases by 0.1%. This quantity is equivalent to a one year extension of the expected

ZLB period, prescribed by forward guidance. Our historical decomposition has found that

the efforts by the Federal Reserve to stimulate the economy since July 2009 succeeded in

making the unemployment rate in December 2013 0.13% lower than it otherwise would have

been.

The continuity in our policy rate series provides empirical researchers – who used the

effective federal funds rate in a VAR to study monetary policy in the macroeconomy – a

tool to update their historical analysis. It also has potential applications in other areas in

macroeconomics, such as dynamic stochastic general equilibrium models.

Researchers introduced new modeling ingredients into New Keynesian models specifi-

cally for the ZLB period, Eggertsson and Woodford(2003) and Wieland(2014) are examples,

although empirically Wieland(2014) found a constant relationship between economic quan-

tities during normal times and the ZLB, which is a similar observation as ours.

16

How to

map the empirical evidence of ours and Wieland’s (2014) into a coherent structural model

and map the shadow rate into an equilibrium quantity are still open to future work.

16

He found that both the sign and size of supply shock’s impact on the economy are similar during normal

times and the ZLB.

28

References

Bauer, Michael D., and Glenn D. Rudebusch (2013) “Monetary Policy Expectations at

the Zero Lower Bound” Federal Reserve Bank of San Francisco Working Paper.

Bauer, Michael D., and Glenn D. Rudebusch (forthcoming) “The Signaling Channel for

Federal Reserve Bond Purchases” International Journal of Central Banking.

Bauer, Michael D., Glenn D. Rudebusch, and Jing Cynthia Wu (2012) “Correcting Es-

timation Bias in Dynamic Term Structure Models” Journal of Business & Economic

Statistics 30, 454–467.

Baumeister, Christiane, and Luca Benati (2013) “Unconventional Monetary Policy and

the Great Recession: Estimating the Macroeconomic Effects of a Spread Compres-

sion at the Zero Lower Bound” International Journal of Central Banking 9, 165–212.

Bernanke, Ben S., Jean Boivin, and Piotr Eliasz (2005) “Measuring the Effects of Mone-

tary Policy: a Factor-Augmented Vector Autoregressive (FAVAR) Approach” Quar-

terly Journal of Economics 120, 387–422.

Black, Fischer (1995) “Interest Rates as Options” Journal of Finance 50, 1371–1376.

Bullard, James. (2012) “Shadow Interest Rates and the Stance of US Monetary Policy”

Presentation at the Center for Finance and Accounting Research Annual Corporate

Finance Conference, Washington University in St. Louis.

Christensen, J. H. E., and Glenn D. Rudebusch (2014) “Estimating shadow-rate term

structure models with near-zero yields” Journal of Financial Econometrics 0, 1–34.

Christiano, Lawrence J., Martin Eichenbaum, and Charles L. Evans (1999) “Monetary

policy shocks: What have we learned and to what end?” in Handbook of macroeco-

nomics Elsevier.

Chung, Hess, Jean-philippe Laforte, David Reifschneider, and John C. Williams (2012)

“Have We Underestimated the Likelihood and Severity of Zero Lower Bound

29

Events?” Journal of Money, Credit and Banking 44, 47–82.

Creal, Drew D., and Jing Cynthia Wu (2015) “Estimation of Affine Term Structure

Models with Spanned or Unspanned Stochastic Volatility.” Journal of Econometrics

185, 60–81.

D’Amico, Stefania, and Thomas King (2013) “Flow and Stock Effects of Large-Scale

Treasury Purchases: Evidence on the Importance of Local Supply” Journal of Fi-

nancial Economics 108, 425–448.

Diebold, Francis X., and Glenn D. Rudebusch (2013) Yield Curve Modeling and Fore-

casting. Princeton University Press, Princeton, NJ.

Duffee, Gregory R. (2002) “Term Premia and Interest Rate Forecasts in Affine Models”

Journal of Finance 57, 405–443.

Duffee, Gregory R. (forthcoming) “Bond Pricing and the Macroeconomy” in Handbook

of the Economics of Finance.

Eggertsson, Gauti B, and Michael Woodford (2003) “The Zero Bound on Interest Rates

and Optimal Monetary Policy” Brookings Papers on Economic Activity, 139–211.

Eichenbaum, Martin (1992) “Comment on Interpreting the Macroeconomic Time Series

Facts: the Effects of Monetary Policy” European Economic Review 36, 1001–1011.

Fama, Eugene F., and Robert R. Bliss (1987) “The Information in Long-Maturity For-

ward Rates” American Economic Review, 680–692.

Gagnon, Joseph, Mattew Raskin, Julie Remache, and Brian Sack (2011) “The Financial

Market Effects of the Federal Reserve’s Large-Scale Asseet Purchase” International

Journal of Central Banking 7, 3–43.

G¨urkaynak, Refet S., Brian Sack, and Jonathan H. Wright (2007) “The U.S. Treasury

Yield Curve: 1961 to the Present” Journal of Monetary Economics 54, 2291–2304.

30

G¨urkaynak, Refet S., and Jonathan H. Wright (2012) “Macroeconomics and the Term

Structure” Journal of Economic Literature 50, 331–367.

Hamilton, James D. (1994) Time Series Analysis Princeton University Press, Princeton,

New Jersey.

Hamilton, James D., and Jing Cynthia Wu (2012) “The Effectiveness of Alternative

Monetary Policy Tools in a Zero Lower Bound Environment” Journal of Money,

Credit, and Banking 44 (s1), 3–46.

Hamilton, James D., and Jing Cynthia Wu (2014) “Testable Implications of Affine Term

Structure Models” Journal of Econometrics 178, 231–242.

Ichiue, Hibiki, and Yoichi Ueno (2013) “Estimating Term Premia at the Zero Bound :

an Analysis of Japanese, US, and UK Yields” Bank of Japan Working Paper.

Joslin, Scott, Kenneth J. Singleton, and Haoxiang Zhu (2011) “A New Perspective On

Gaussian Dynamic Term Structure Models” Review of Financial Studies 27, 926–

970.

Kim, Don H., and Kenneth J. Singleton (2012) “Term Structure Models and the Zero

Bound: an Empirical Investigation of Japanese Yields” Journal of Econometrics

170, 32–49.

Krippner, Leo (2012) “Modifying Gaussian Term Structure Models When Interest Rates

are Near the Zero Lower Bound” Reserve Bank of New Zealand Discussion Paper

2012/02.

Krippner, Leo (2013) “A Tractable Framework for Zero Lower Bound Gaussian Term

Structure Models” Australian National University CAMA Working Paper 49/2013.

Krishnamurthy, Arvind, and Annette Vissing-Jorgensen (2011) “The Effects of Quanti-

tative Easing on Interest Rates” Brooking Papers on Economic Activity 43, 215–287.

Lombardi, Marco J., and Feng Zhu (2014) “A shadow policy rate to calibrate US mon-

31

etary policy at the zero lower bound” Working paper, BIS.

Ng, Serena, and Jonathan H. Wright (2013) “Facts and Challenges from the Great

Recession for Forecasting and Macroeconomic Modeling” NBER Working Paper

19469.

Piazzesi, Monika (2010) “Affine Term Structure Models” in Handbook of Financial

Econometrics, edited by Y. Ait-Sahalia and L. P. Hansen Elsevier, New York pages

691–766.

Sims, Christopher A (1992) “Interpreting the Macroeconomic Time Series Facts: the

Effects of Monetary Policy” European Economic Review 36, 975–1000.

Stock, James H., and Mark W. Watson (2001) “Vector Autoregression” Journal of

Economic Perspectives 15, 101–115.

Swanson, Eric T., and John C. Williams (forthcoming) “Measuring the Effect of the Zero

Lower Bound on Medium- and Longer-Term Interest Rates” American Economic

Review.

Wieland, Johannes (2014) “Are negative supply shocks expansionary at the zero lower

bound?” Working paper, University of California, San Diego.

Woodford, Michael (2012) “Methods of Policy Accommodation at the Interest-rate

Lower Bound” Jackson Hole symposium, August, Federal Reserve Bank of Kansas

City.

Wright, J. H. (2011) “Term Premia and Inflation Uncertainty: Empirical Evidence from

an International Panel Dataset” American Economic Review 101, 1514–1534.

Wright, Jonathan H. (2012) “What does Monetary Policy do to Long-term Interest

Rates at the Zero Lower Bound?” Economic Journal 122, F447–F466.

32

Appendix A Approximation to Forward rates

Define

¯a

n

≡ δ

0

+ δ

0

1

n−1

X

j=0

ρ

Q

j

µ

Q

,

a

n

≡ ¯a

n

−

1

2

δ

0

1

n−1

X

j=0

ρ

Q

j

ΣΣ

0

n−1

X

j=0

ρ

Q

j

0

δ

1

,

b

0

n

≡ δ

0

1

ρ

Q

n

.

Shadow rate The shadow rate is affine in the state variables. Under the risk neutral measure,

it is conditionally normally distributed. The conditional mean is

E

Q

t

[s

t+n

] = ¯a

n

+ b

0

n

X

t

,

the conditional variance is

Var

Q

t

[s

t+n

] ≡

σ

Q

n

2

=

n−1

X

j=0

δ

0

1

ρ

Q

j

ΣΣ

0

ρ

Q0

j

δ

1

,

and

1

2

Var

Q

t

n

X

j=1

s

t+j

− Var

Q

t

n−1

X

j=1

s

t+j

= ¯a

n

− a

n

.

SRTSM We start the derivation of equation (7) with the following approximation: log

E

e

Z

≈

E [Z] +

1

2

Var [Z] for any random variable Z. This approximation uses Taylor series expansions for

the exponential and natural logarithm functions. For the special case of a Gaussian random vari-

able Z, this approximation is exact. Then the forward rate between t + n and t + n + 1 can be

approximated as follows:

f

SRT SM

n,n+1,t

= (n + 1)y

n+1,t

− ny

nt

= −log

e

−r

t

E

Q

t

h

e

−

P

n

j=1

r

t+j

i

+ log

e

−r

t

E

Q

t

h

e

−

P

n−1

j=1

r

t+j

i

≈ E

Q

t

n

X

j=1

r

t+j

−

1

2

Var

Q

t

n

X

j=1

r

t+j

− E

Q

t

n−1

X

j=1

r

t+j

+

1

2

Var

Q

t

n−1

X

j=1

r

t+j

= E

Q

t

[r

t+n

] −

1

2

Var

Q

t

n

X

j=1

r

t+j

− Var

Q

t

n−1

X

j=1

r

t+j

. (A.1)

33

We calculate the first term E

Q

t

[r

t+n

] analytically:

E

Q

t

[r

t+n

] = E

Q

t

[max (r, s

t+n

)]

= Pr

Q

t

[s

t+n

< r] × r + Pr

Q

t

[s

t+n

≥ r] × E

Q

t

[s

t+n

|s

t+n

≥ r]

= r + σ

Q

n

¯a

n

+ b

0

n

X

t

− r

σ

Q

n

Φ

¯a

n

+ b

0

n

X

t

− r

σ

Q

n

+ φ

¯a

n

+ b

0

n

X

t

− r

σ

Q

n

= r + σ

Q

n

g

¯a

n

+ b

0

n

X

t

− r

σ

Q

n

. (A.2)

Using the second moments for the truncated normal distribution, we have the following approxi-

mations for the conditional variance and covariance (see details in Appendix A.1):

Var

Q

t

[r

t+n

] ≈ Pr

Q

t

[s

t+n

≥ r] Var

Q

t

[s

t+n

] , (A.3)

Cov

Q

t

[r

t+n−j

, r

t+n

] ≈ Pr

Q

t

[s

t+n−j

≥ r, s

t+n

≥ r] Cov

Q

t

[s

t+n−j

, s

t+n

] , ∀j = 1, ..., n − 1.(A.4)

Next, we take the approximation

Pr

Q

t

[s

t+n−j

≥ r|s

t+n

≥ r] ≈ 1,

using the fact that the shadow rate is very persistent. Equation (A.4) becomes

Cov

Q

t

[r

t+n−j

, r

t+n

] ≈ Pr

Q

t

[s

t+n

≥ r] Cov

Q

t

[s

t+n−j

, s

t+n

] .

Then, the second term in equation (A.1) is

1

2

Var

Q

t

n

X

j=1

r

t+j

− Var

Q

t

n−1

X

j=1

r

t+j

≈ Pr

Q

t

(s

t+n

≥ r) ×

1

2

Var

Q

t

n

X

j=1

s

t+j

− Var

Q

t

n−1

X

j=1

s

t+j

= Φ

¯a

n

+ b

0

n

X

t

− r

σ

Q

n

× (¯a

n

− a

n

). (A.5)

Plug equations (A.2) and (A.5) to (A.1), we conclude our derivation for equation (7) with another

first-order Taylor approximation:

f

SRT SM

n,n+1,t

≈ r + σ

Q

n

g

¯a

n

+ b

0

n

X

t

− r

σ

Q

n

+ Φ

¯a

n

+ b

0

n

X

t

− r

σ

Q

n

× (a

n

− ¯a

n

)

= r + σ

Q

n

g

¯a

n

+ b

0

n

X

t

− r

σ

Q

n

+ σ

Q

n

∂g

¯a

n

+b

0

n

X

t

−r

σ

Q

n

∂¯a

n

× (a

n

− ¯a

n

)

≈ r + σ

Q

n

g

a

n

+ b

0

n

X

t

− r

σ

Q

n

. (A.6)

34

GATSM In the GATSM, the forward rate between t + n and t + n + 1 is priced as follows

f

GAT SM

n,n+1,t

= (n + 1)y

n+1,t

− ny

nt

= −log

e

−s

t

E

Q

t

h

e

−

P

n

j=1

s

t+j

i

+ log

e

−s

t

E

Q

t

h

e

−

P

n−1

j=1

s

t+j

i

= E

Q

t

n

X

j=1

s

t+j

−

1

2

Var

Q

t

n

X